Carmila Announces the Launch of a Tender Offer on Its Existing Notes Maturing in May 2027, March 2028, October 2028 and April 2029, and Announces Its Intention to Issue New Notes

September 16 2024 - 3:47AM

Business Wire

Regulatory News:

Carmila (Paris:CARM) announces today the launch of a tender

offer on the following series of existing notes:

- €300,000,000 1.625 per cent. Notes due 30 May 2027 (ISIN

FR0014000T33);

- €350,000,000 2.125 per cent. Notes due 7 March 2028 (ISIN

FR0013321536);

- €500,000,000 5.500 per cent. Notes due 9 October 2028 (ISIN

FR001400L1E0); and

- €325,000,000 1.625 per cent. Notes due 1 April 2029 (ISIN

FR0014002QG3).

In parallel, the Company announces its intention to issue Euro

denominated fixed rate notes (the "New Notes"), subject to

market conditions.

The tender offer is subject to the terms and conditions set out

in the Tender Offer Memorandum dated 16 September 2024. In

particular, the offer is subject to a maximum acceptance amount of

€150,000,000, which the Company may increase or decrease in its

sole and absolute discretion, and to the pricing of the New

Notes.

These operations will enable the Company to proactively manage

and further extend the Company's debt maturity profile and optimise

its balance sheet structure.

The tender offer will run from 16 September 2024 to 4:00 p.m.

(Paris time) on 23 September 2024. The results of the offer are

intended to be announced on 24 September 2024.

INVESTOR AGENDA

17 October 2024 (after market close): Financial

information for the third quarter 2024

ABOUT CARMILA

As the third-largest listed owner of commercial property in

Europe, Carmila was founded by Carrefour and large institutional

investors in order to enhance the value of shopping centres

adjoining Carrefour hypermarkets in France, Spain and Italy. At 31

December 2023, its portfolio was valued at €5.9 billion and is made

up of 201 shopping centres, with leading positions in their

catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila has been a member of the SBF

120 since 20 June 2022.

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management’s beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Funding” section of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/funding/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916937496/en/

INVESTOR AND ANALYST CONTACT Pierre-Yves Thirion - CFO

pierre_yves_thirion@carmila.com +33 6

47 21 60 49

PRESS CONTACT Elodie Arcayna – Corporate Communications

Director elodie_arcayna@carmila.com

+33 7 86 54 40 10

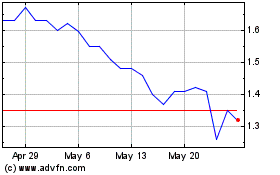

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Carisma Therapeutics (NASDAQ:CARM)

Historical Stock Chart

From Nov 2023 to Nov 2024