|

|

|

|

|

Before you invest, you may want to review the Fund’s

Prospectus, which contains more information about the Fund and

its risks. You can find the Fund’s Prospectus and other

information about the Fund online at

janus.com/info.

You can also get this information at no cost by calling a Janus

representative at

1-877-335-2687

or by sending an email request to

prospectusrequest@janus.com.

|

|

[PERKINS LOGO]

|

Summary

Prospectus dated October 26, 2012

As

Supplemented April 1, 2013

Perkins Select Value Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ticker:

|

|

JVSAX

|

|

Class A Shares

|

|

JSVSX

|

|

Class S Shares

|

|

JVSNX

|

|

Class N Shares

|

|

|

|

|

|

JVSCX

|

|

Class C Shares

|

|

JVSIX

|

|

Class I Shares

|

|

JSVTX

|

|

Class T Shares

|

|

|

INVESTMENT

OBJECTIVE

Perkins Select Value Fund

seeks capital appreciation.

FEES AND

EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if

you buy and hold Shares of the Fund. Each share class has

different expenses, but represents an investment in the same

Fund. For Class A Shares, you may qualify for sales charge

discounts if you and your family invest, or agree to invest in

the future, at least $50,000 in the Fund or in other Janus

mutual funds. More information about these and other discounts,

as well as eligibility requirements for each share class, is

available from your financial professional and in the

“Purchases” section on page 60 of the Fund’s

Prospectus and in the “Purchases” section on

page 83 of the Fund’s Statement of Additional

Information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDER FEES

(fees paid directly from your investment)

|

|

|

|

|

|

|

Class A

|

|

|

|

|

|

|

|

Class C

|

|

|

|

|

|

|

|

Class S

|

|

|

|

|

|

|

|

Class I

|

|

|

|

|

|

|

|

Class N

|

|

|

|

|

|

|

|

Class T

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum Sales Charge (load) Imposed on Purchases (as a

percentage of offering price)

|

|

|

|

|

|

|

5.75%

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (load) (as a percentage of the

lower of original purchase price or redemption proceeds)

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

1.00%

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the

value of your investment)

|

|

|

|

|

|

|

Class A

|

|

|

|

|

|

|

|

Class C

|

|

|

|

|

|

|

|

Class S

|

|

|

|

|

|

|

|

Class I

|

|

|

|

|

|

|

|

Class N

|

|

|

|

|

|

|

|

Class T

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Fees (may adjust up or down)

|

|

|

0.70%

|

|

|

|

|

|

|

|

0.70%

|

|

|

|

|

|

|

|

0.70%

|

|

|

|

|

|

|

|

0.70%

|

|

|

|

|

|

|

|

0.70%

|

|

|

|

|

|

|

|

0.70%

|

|

|

Distribution/Service (12b-1) Fees

|

|

|

0.25%

|

|

|

|

|

|

|

|

1.00%

|

|

|

|

|

|

|

|

0.25%

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

None

|

|

|

Other

Expenses

(1)

|

|

|

0.56%

|

|

|

|

|

|

|

|

0.73%

|

|

|

|

|

|

|

|

0.78%

|

|

|

|

|

|

|

|

0.56%

|

|

|

|

|

|

|

|

0.56%

|

|

|

|

|

|

|

|

0.74%

|

|

|

Total Annual Fund Operating

Expenses

(2)

|

|

|

1.51%

|

|

|

|

|

|

|

|

2.43%

|

|

|

|

|

|

|

|

1.73%

|

|

|

|

|

|

|

|

1.26%

|

|

|

|

|

|

|

|

1.26%

|

|

|

|

|

|

|

|

1.44%

|

|

|

Fee

Waiver

(2)

|

|

|

0.24%

|

|

|

|

|

|

|

|

0.41%

|

|

|

|

|

|

|

|

0.21%

|

|

|

|

|

|

|

|

0.24%

|

|

|

|

|

|

|

|

0.24%

|

|

|

|

|

|

|

|

0.17%

|

|

|

Total Annual Fund Operating Expenses After Fee

Waiver

(2)

|

|

|

1.27%

|

|

|

|

|

|

|

|

2.02%

|

|

|

|

|

|

|

|

1.52%

|

|

|

|

|

|

|

|

1.02%

|

|

|

|

|

|

|

|

1.02%

|

|

|

|

|

|

|

|

1.27%

|

|

|

|

|

|

(1)

|

Other Expenses for Class N Shares are based on the

estimated expenses that the Shares expect to incur during their

initial fiscal period.

|

|

(2)

|

Janus Capital has contractually agreed to waive the Fund’s

total annual fund operating expenses (excluding any performance

adjustments to management fees, the distribution and shareholder

servicing fees – applicable to Class A Shares,

Class C Shares, and Class S Shares; administrative

services fees payable pursuant to the Transfer Agency Agreement

(except for networking and omnibus fees for Class A Shares,

Class C Shares, and Class I Shares); brokerage

commissions; interest; dividends; taxes; acquired fund fees and

expenses; and extraordinary expenses) to 1.00% until at least

November 1, 2013. The contractual waiver may be terminated

or modified prior to this date only at the discretion of the

Board of Trustees.

|

EXAMPLE:

The following Example is based on expenses without

waivers.

The Example is intended to help you compare the

cost of investing in the Fund with the cost of investing in

other mutual funds. The Example assumes that you invest $10,000

in the Fund for the time periods indicated and reinvest all

dividends and distributions. The Example also assumes that your

investment has a 5% return each year and that the Fund’s

operating expenses without waivers remain the same. Although

your actual costs may be higher or lower, based on these

assumptions your costs would be:

1

ï

Perkins

Select Value Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Shares are

redeemed:

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Class A Shares

|

|

$

|

720

|

|

|

$

|

1,025

|

|

|

$

|

1,351

|

|

|

$

|

2,273

|

|

|

Class C Shares

|

|

$

|

346

|

|

|

$

|

758

|

|

|

$

|

1,296

|

|

|

$

|

2,766

|

|

|

Class S Shares

|

|

$

|

176

|

|

|

$

|

545

|

|

|

$

|

939

|

|

|

$

|

2,041

|

|

|

Class I Shares

|

|

$

|

128

|

|

|

$

|

400

|

|

|

$

|

692

|

|

|

$

|

1,523

|

|

|

Class N Shares

|

|

$

|

128

|

|

|

$

|

400

|

|

|

$

|

692

|

|

|

$

|

1,523

|

|

|

Class T Shares

|

|

$

|

147

|

|

|

$

|

456

|

|

|

$

|

787

|

|

|

$

|

1,724

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Shares are not

redeemed:

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Class A Shares

|

|

$

|

720

|

|

|

$

|

1,025

|

|

|

$

|

1,351

|

|

|

$

|

2,273

|

|

|

Class C Shares

|

|

$

|

246

|

|

|

$

|

758

|

|

|

$

|

1,296

|

|

|

$

|

2,766

|

|

|

Class S Shares

|

|

$

|

176

|

|

|

$

|

545

|

|

|

$

|

939

|

|

|

$

|

2,041

|

|

|

Class I Shares

|

|

$

|

128

|

|

|

$

|

400

|

|

|

$

|

692

|

|

|

$

|

1,523

|

|

|

Class N Shares

|

|

$

|

128

|

|

|

$

|

400

|

|

|

$

|

692

|

|

|

$

|

1,523

|

|

|

Class T Shares

|

|

$

|

147

|

|

|

$

|

456

|

|

|

$

|

787

|

|

|

$

|

1,724

|

|

Portfolio Turnover:

The Fund pays transaction costs,

such as commissions, when it buys and sells securities (or

“turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable

account. These costs, which are not reflected in annual fund

operating expenses or in the Example, affect the Fund’s

performance. During the period December 15, 2011 to

June 30, 2012, the Fund’s portfolio turnover rate was

80% of the average value of its portfolio.

PRINCIPAL

INVESTMENT STRATEGIES

The Fund pursues its investment objective by investing primarily

in common stocks selected for their capital appreciation

potential. The Fund primarily invests in the common stocks of

companies of any size whose stock prices the portfolio managers

believe to be undervalued. The Fund may also invest in foreign

equity and debt securities, which may include investments in

emerging markets. In addition, when the portfolio managers

believe that market conditions are unfavorable for investing, or

when they are otherwise unable to locate attractive investment

opportunities, the Fund’s cash or similar investments may

increase.

The Fund focuses on companies that have fallen out of favor with

the market or that appear to be temporarily misunderstood by the

investment community. The Fund’s portfolio managers

generally look for companies with:

|

|

|

|

•

|

strong balance sheets and solid recurring free cash flows

|

|

•

|

attractive relative and absolute valuation ratios or that have

underperformed recently

|

|

•

|

favorable reward to risk characteristics

|

The Fund may invest its assets in derivatives, which are

instruments that have a value derived from or directly linked to

an underlying asset, such as equity securities, bonds,

commodities, currencies, interest rates, or market indices, as

substitutes for securities in which the Fund invests. The Fund

may invest in derivative instruments (by taking long and/or

short positions) for different purposes, including hedging (to

offset risks associated with an investment, currency exposure,

or market conditions) and to earn income and enhance returns.

For more information on the Fund’s use of derivatives,

refer to the Fund’s shareholder reports and

Form N-Q

reports, which are filed with the Securities and Exchange

Commission.

PRINCIPAL

INVESTMENT RISKS

The biggest risk is that the Fund’s returns will vary, and

you could lose money. The Fund is designed for long-term

investors seeking an equity portfolio, including common stocks.

Common stocks tend to be more volatile than many other

investment choices.

Value Investing Risk.

Because different types

of stocks tend to shift in and out of favor depending on market

and economic conditions, “value” stocks may perform

differently than other types of stocks and from the market as a

whole, and can continue to be undervalued by the market for long

periods of time. It is also possible that a value stock will

never appreciate to the extent expected by the Fund’s

portfolio managers. When the Fund’s investments in cash or

similar investments increase

2

ï

Janus

Investment Fund

due to a lack of favorable investment opportunities or other

extraordinary factors, the Fund may not participate in market

advances or declines to the same extent that it would if the

Fund had been fully invested.

Market Risk.

The value of the Fund’s

portfolio may decrease if the value of an individual company or

security, or multiple companies or securities, in the portfolio

decreases or if the portfolio managers’ belief about a

company’s intrinsic worth is incorrect. Further, regardless

of how well individual companies or securities perform, the

value of the Fund’s portfolio could also decrease if there

are deteriorating economic or market conditions. It is important

to understand that the value of your investment may fall,

sometimes sharply, in response to changes in the market, and you

could lose money.

Foreign Exposure Risk.

The Fund may have

exposure to foreign markets as a result of its investments in

foreign securities, including investments in emerging markets,

which can be more volatile than the U.S. markets. As a

result, its returns and net asset value may be affected to a

large degree by fluctuations in currency exchange rates or

political or economic conditions in a particular country. In

some foreign markets, there may not be protection against

failure by other parties to complete transactions. It may not be

possible for the Fund to repatriate capital, dividends,

interest, and other income from a particular country or

governmental entity. In addition, a market swing in one or more

countries or regions where the Fund has invested a significant

amount of its assets may have a greater effect on the

Fund’s performance than it would in a more geographically

diversified portfolio. The Fund’s investments in emerging

market countries may involve risks greater than, or in addition

to, the risks of investing in more developed countries.

Real Estate Risk.

The Fund may be affected by

risks associated with investments in real estate-related

securities. The value of securities of issuers in the real

estate and real estate-related industries, including real estate

investment trusts, is sensitive to changes in real estate values

and rental income, property taxes, interest rates, tax and

regulatory requirements, supply and demand, and the management

skill and creditworthiness of the issuer. These factors may

impact the Fund’s investments in foreign real estate

markets differently than U.S. real estate markets.

Derivatives Risk.

Derivatives can be highly

volatile and involve risks in addition to the risks of the

underlying referenced securities. Gains or losses from a

derivative can be substantially greater than the

derivative’s original cost, and can therefore involve

leverage. Derivatives can be less liquid than other types of

investments and entail the risk that the counterparty will

default on its payment obligations.

An investment in the Fund is not a bank deposit and is not

insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency.

PERFORMANCE

INFORMATION

The Fund does not have a full calendar year of operations.

Performance information for certain periods is included in the

Fund’s first annual

and/or

semiannual report.

3

ï

Perkins

Select Value Fund

MANAGEMENT

Investment Adviser:

Janus Capital Management LLC

Investment Subadviser:

Perkins Investment Management

LLC

Portfolio Managers:

Robert H. Perkins

is

Co-Portfolio Manager of the Fund, which he has co-managed since

inception.

Alec Perkins

is

Co-Portfolio

Manager of the Fund, which he has

co-managed

since April 2013.

PURCHASE

AND SALE OF FUND SHARES

Minimum

Investment Requirements*

|

|

|

|

|

|

Class A Shares, Class C Shares**, Class S Shares, and Class T

Shares

|

|

Non-retirement accounts

|

|

$

|

2,500

|

|

|

|

|

|

|

Certain tax-deferred accounts or UGMA/UTMA accounts

|

|

$

|

500

|

|

|

|

|

|

|

Class I Shares

|

|

|

|

|

|

|

Institutional investors (investing directly with Janus)

|

|

$

|

1,000,000

|

|

|

|

|

|

|

Through an intermediary institution

|

|

|

|

|

• non-retirement accounts

|

|

$

|

2,500

|

|

• certain tax-deferred accounts or

UGMA/UTMA

accounts

|

|

$

|

500

|

|

|

|

|

|

|

Class N Shares

|

|

|

|

|

|

|

No minimum investment requirements imposed by the Fund

|

|

|

None

|

|

|

|

|

|

|

|

|

|

*

|

Exceptions to these minimums may apply for certain tax-deferred,

tax-qualified and retirement plans, and accounts held through

certain wrap programs.

|

|

**

|

The maximum purchase in Class C Shares is $500,000 for any

single purchase.

|

Purchases, exchanges, and redemptions can generally be made only

through institutional channels, such as financial intermediaries

and retirement platforms. Class I Shares may be purchased

directly by certain institutional investors. You should contact

your financial intermediary or refer to your plan documents for

information on how to invest in the Fund. Requests must be

received in good order by the Fund or its agents (financial

intermediary or plan sponsor, if applicable) prior to the close

of the regular trading session of the New York Stock Exchange in

order to receive that day’s net asset value. For additional

information, refer to “Purchases,”

“Exchanges,” and/or “Redemptions” in the

Prospectus.

TAX

INFORMATION

The Fund’s distributions are taxable, and will be taxed as

ordinary income or capital gains, unless you are investing

through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account.

PAYMENTS

TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Class A Shares, Class C Shares,

Class S Shares, Class I Shares, or Class T Shares

of the Fund through a broker-dealer or other financial

intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares

and related services. These payments may create a conflict of

interest by influencing the broker-dealer or other intermediary

and your salesperson to recommend the Fund over another

investment or to recommend one share class over another. Ask

your salesperson or visit your financial intermediary’s

website for more information.

4

ï

Janus

Investment Fund

|

|

|

|

|

Before you invest, you may want to review the Fund’s

Prospectus, which contains more information about the Fund and

its risks. You can find the Fund’s Prospectus and other

information about the Fund online at

janus.com/reports.

You can also get this information at no cost by calling a Janus

representative at

1-800-525-3713

or by sending an email request to

prospectusorder@janus.com.

|

|

[PERKINS LOGO]

|

Summary

Prospectus dated October 26, 2012

As

Supplemented April 1, 2013

Perkins Select Value Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ticker:

|

|

JSVDX

|

|

Class D Shares*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Class D Shares are closed to certain new investors.

|

INVESTMENT

OBJECTIVE

Perkins Select Value Fund

seeks capital appreciation.

FEES AND

EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if

you buy and hold Shares of the Fund.

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the

value of your investment)

|

|

|

|

|

|

|

Class D

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Fees (may adjust up or down)

|

|

|

0.70%

|

|

|

Other Expenses

|

|

|

1.04%

|

|

|

Total Annual Fund Operating

Expenses

(1)

|

|

|

1.74%

|

|

|

Fee

Waiver

(1)

|

|

|

0.55%

|

|

|

Total Annual Fund Operating Expenses After Fee

Waiver

(1)

|

|

|

1.19%

|

|

|

|

|

|

(1)

|

Janus Capital has contractually agreed to waive the Fund’s

total annual fund operating expenses (excluding any performance

adjustments to management fees, administrative services fees

payable pursuant to the Transfer Agency Agreement, brokerage

commissions, interest, dividends, taxes, acquired fund fees and

expenses, and extraordinary expenses) to 1.00% until at least

November 1, 2013. The contractual waiver may be terminated

or modified prior to this date only at the discretion of the

Board of Trustees.

|

EXAMPLE:

The following Example is based on expenses without waivers.

The Example is intended to help you compare the cost of

investing in the Fund with the cost of investing in other mutual

funds. The Example assumes that you invest $10,000 in the Fund

for the time periods indicated, reinvest all dividends and

distributions, and then redeem all of your Shares at the end of

each period. The Example also assumes that your investment has a

5% return each year and that the Fund’s operating expenses

without waivers remain the same. Although your actual costs may

be higher or lower, based on these assumptions your costs would

be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Class D Shares

|

|

$

|

177

|

|

|

$

|

548

|

|

|

$

|

944

|

|

|

$

|

2,052

|

|

Portfolio Turnover:

The Fund pays transaction costs,

such as commissions, when it buys and sells securities (or

“turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable

account. These costs, which are not reflected in annual fund

operating expenses or in the Example, affect the Fund’s

performance. During the period December 15, 2011 to

June 30, 2012, the Fund’s portfolio turnover rate was

80% of the average value of its portfolio.

PRINCIPAL

INVESTMENT STRATEGIES

The Fund pursues its investment objective by investing primarily

in common stocks selected for their capital appreciation

potential. The Fund primarily invests in the common stocks of

companies of any size whose stock prices the portfolio managers

believe to be undervalued. The Fund may also invest in foreign

equity and debt securities, which may include investments in

emerging markets. In addition, when the portfolio managers

believe that market conditions are unfavorable for investing, or

when they are otherwise unable to locate attractive investment

opportunities, the Fund’s cash or similar investments may

increase.

The Fund focuses on companies that have fallen out of favor with

the market or that appear to be temporarily misunderstood by the

investment community. The Fund’s portfolio managers

generally look for companies with:

|

|

|

|

•

|

strong balance sheets and solid recurring free cash flows

|

1

ï

Perkins

Select Value Fund

|

|

|

|

•

|

attractive relative and absolute valuation ratios or that have

underperformed recently

|

|

•

|

favorable reward to risk characteristics

|

The Fund may invest its assets in derivatives, which are

instruments that have a value derived from or directly linked to

an underlying asset, such as equity securities, bonds,

commodities, currencies, interest rates, or market indices, as

substitutes for securities in which the Fund invests. The Fund

may invest in derivative instruments (by taking long and/or

short positions) for different purposes, including hedging (to

offset risks associated with an investment, currency exposure,

or market conditions) and to earn income and enhance returns.

For more information on the Fund’s use of derivatives,

refer to the Fund’s shareholder reports and

Form N-Q

reports, which are filed with the Securities and Exchange

Commission.

PRINCIPAL

INVESTMENT RISKS

The biggest risk is that the Fund’s returns will vary, and

you could lose money. The Fund is designed for long-term

investors seeking an equity portfolio, including common stocks.

Common stocks tend to be more volatile than many other

investment choices.

Value Investing Risk.

Because different types

of stocks tend to shift in and out of favor depending on market

and economic conditions, “value” stocks may perform

differently than other types of stocks and from the market as a

whole, and can continue to be undervalued by the market for long

periods of time. It is also possible that a value stock will

never appreciate to the extent expected by the Fund’s

portfolio managers. When the Fund’s investments in cash or

similar investments increase due to a lack of favorable

investment opportunities or other extraordinary factors, the

Fund may not participate in market advances or declines to the

same extent that it would if the Fund had been fully invested.

Market Risk.

The value of the Fund’s

portfolio may decrease if the value of an individual company or

security, or multiple companies or securities, in the portfolio

decreases or if the portfolio managers’ belief about a

company’s intrinsic worth is incorrect. Further, regardless

of how well individual companies or securities perform, the

value of the Fund’s portfolio could also decrease if there

are deteriorating economic or market conditions. It is important

to understand that the value of your investment may fall,

sometimes sharply, in response to changes in the market, and you

could lose money.

Foreign Exposure Risk.

The Fund may have

exposure to foreign markets as a result of its investments in

foreign securities, including investments in emerging markets,

which can be more volatile than the U.S. markets. As a

result, its returns and net asset value may be affected to a

large degree by fluctuations in currency exchange rates or

political or economic conditions in a particular country. In

some foreign markets, there may not be protection against

failure by other parties to complete transactions. It may not be

possible for the Fund to repatriate capital, dividends,

interest, and other income from a particular country or

governmental entity. In addition, a market swing in one or more

countries or regions where the Fund has invested a significant

amount of its assets may have a greater effect on the

Fund’s performance than it would in a more geographically

diversified portfolio. The Fund’s investments in emerging

market countries may involve risks greater than, or in addition

to, the risks of investing in more developed countries.

Real Estate Risk.

The Fund may be affected by

risks associated with investments in real estate-related

securities. The value of securities of issuers in the real

estate and real estate-related industries, including real estate

investment trusts, is sensitive to changes in real estate values

and rental income, property taxes, interest rates, tax and

regulatory requirements, supply and demand, and the management

skill and creditworthiness of the issuer. These factors may

impact the Fund’s investments in foreign real estate

markets differently than U.S. real estate markets.

Derivatives Risk.

Derivatives can be highly

volatile and involve risks in addition to the risks of the

underlying referenced securities. Gains or losses from a

derivative can be substantially greater than the

derivative’s original cost, and can therefore involve

leverage. Derivatives can be less liquid than other types of

investments and entail the risk that the counterparty will

default on its payment obligations.

An investment in the Fund is not a bank deposit and is not

insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency.

PERFORMANCE

INFORMATION

The Fund does not have a full calendar year of operations.

Performance information for certain periods is included in the

Fund’s first annual

and/or

semiannual report.

2

ï

Janus

Investment Fund

MANAGEMENT

Investment Adviser:

Janus Capital Management LLC

Investment Subadviser:

Perkins Investment Management

LLC

Portfolio Managers:

Robert H. Perkins

is

Co-Portfolio Manager of the Fund, which he has co-managed since

inception.

Alec Perkins

is Co-Portfolio Manager of the

Fund, which he has co-managed since April 2013.

PURCHASE

AND SALE OF FUND SHARES

|

|

|

|

|

|

|

Minimum Investment Requirements

|

|

To open a new regular Fund account

|

|

$

|

2,500

|

|

|

|

|

|

|

|

|

To open a new UGMA/UTMA account, Coverdell Education Savings

Account, or a retirement Fund account

|

|

|

|

|

|

• without an automatic investment program

|

|

$

|

1,000

|

|

|

• with an automatic investment program of

$100 per month

|

|

$

|

500

|

|

|

|

|

|

|

|

|

To add to any existing type of Fund account

|

|

$

|

100

|

|

|

|

|

|

|

|

You may generally purchase, exchange, or redeem Fund Shares on

any business day by written request, wire transfer, telephone,

and in most cases, online at

janus.com/individual.

You may conduct transactions by mail (Janus,

P.O. Box 55932, Boston, MA

02205-5932),

or by telephone at

1-800-525-3713.

Purchase, exchange, or redemption requests must be received in

good order by the Fund or its agents prior to the close of the

regular trading session of the New York Stock Exchange in order

to receive that day’s net asset value. For additional

information, refer to “To Open an Account or Buy

Shares,” “To Exchange Shares,” and/or “To

Sell Shares” in the Prospectus.

TAX

INFORMATION

The Fund’s distributions are taxable, and will be taxed as

ordinary income or capital gains, unless you are investing

through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account.

PAYMENTS

TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

With respect to certain other classes of shares, the Fund and

its related companies may pay select broker-dealer firms or

other financial intermediaries for the sale of Fund shares and

related services. These payments may create a conflict of

interest by influencing a broker-dealer or other intermediary or

a salesperson to recommend the Fund over another investment or

to recommend one share class over another.

3

ï

Perkins

Select Value Fund

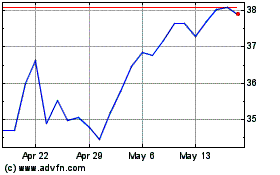

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jul 2023 to Jul 2024