Leading embedded security offerings will

complement Cadence’s expanding IP portfolio, unlocking a growing

multi-hundred-million incremental TAM opportunity

Cadence (Nasdaq: CDNS) today announced it has entered into a

definitive agreement to acquire Secure-IC, a leading embedded

security IP platform provider. The addition of Secure-IC’s talent

and highly complementary, proven portfolio of embedded security IP,

security solutions, security evaluation tools and services will

augment Cadence’s rapidly expanding portfolio of leading-edge,

silicon-proven IP, including interface, memory, AI/ML and DSP

solutions.

“In our increasingly interconnected world, every semiconductor,

chiplet and electronic system will require embedded security.

Whether for consumer, data center, automotive, drone, robotics, or

aerospace and defense applications, security is a foundational

element of any design,” said Boyd Phelps, senior vice president and

general manager of the Silicon Solutions Group at Cadence. “We

continue to invest in our comprehensive IP and design services

portfolio to provide more complete system solutions for our

customers. The anticipated addition of Secure-IC’s proven embedded

security IP and solutions is yet another example of our commitment

to being our customers’ SoC design partner and delivering optimal

value as they navigate the complexities of bringing AI-enabled SoCs

and disaggregated designs to market faster and with greater

impact.”

“Over the past 15 years, Secure-IC has been dedicated to

safeguarding the digital future with cutting-edge technologies,

multi-certified and compliant to worldwide cybersecurity

regulations, that protect assets from manufacturing phases to

mission mode and enable data protection at rest, in transmission

and in computation. By joining Cadence, we will secure the

sustainability and operational strength necessary to continue our

mission while creating a powerful synergy that accelerates

innovation. Together, we are poised to scale globally, deliver

enhanced value to our customers and pioneer the next generation of

embedded cybersecurity solutions for complex silicon systems and

chiplets following the closing of the transaction,” said Hassan

Triqui, co-founder and CEO of Secure-IC.

Secure-IC’s customer base includes top-tier customers such as SK

Hynix Memory Solutions America, Synaptics, Silicon Labs and Faraday

Technology, which span key verticals worldwide, including

automotive, data center, mobile, aerospace and defense, mobile,

networking, IoT and consumer electronics. This will offer

reciprocal synergistic go-to-market opportunities with Cadence’s

existing IP offerings, from protocol controllers and AI

accelerators to supporting customers utilizing various processor

architectures.

Cadence technologies, coupled with Secure-IC’s security

solutions, will be fully equipped to address the growing

complexities of embedded cybersecurity, ensuring robust solutions

for the ever-evolving challenges of connected systems. Secure-IC

has consistently delivered comprehensive security solutions to

partners and customers across industries, completing over 500

successful projects worldwide. This acquisition will combine

Cadence’s decades of expertise in IP and subsystem design with

Secure-IC’s leading embedded cybersecurity solutions, ensuring

Cadence is better able to meet the needs of its customers in the

evolving world of SoCs.

For Secure-IC’s customers, this alignment will enhance global

reach, ensuring long-term stability and accelerating roadmap

execution while maintaining the highest standards of support and

quality. The integration of Secure-IC’s complementary solutions

(Securyzr™, Laboryzr™ and Expertyzr™) into Cadence’s portfolio will

empower Cadence to accelerate innovation, broaden its capabilities

and strengthen support for diverse industries and businesses.

Cadence solutions will feature comprehensive end-to-end integrated

security, easily provisionable, deployable and versatile to

customer use cases.

Secure-IC’s addition to Cadence expertise will be especially

impactful in the context of chiplet systems and complex silicon

solutions, building on the companies’ proven success together in

the flagship chiplet project recently unveiled by Cadence.

Headquartered in Rennes, France, Secure-IC has eight additional

offices and research centers worldwide.

The transaction is expected to close in the first half of 2025,

subject to receipt of regulatory approvals and other customary

closing conditions. The acquisition is expected to be immaterial to

revenue and earnings this year.

About Cadence

Cadence is a pivotal leader in electronic systems design,

building upon more than 30 years of computational software

expertise. The company applies its underlying Intelligent System

Design strategy to deliver software, hardware and IP that turn

design concepts into reality. Cadence customers are the world’s

most innovative companies, delivering extraordinary electronic

products from chips to boards to complete systems for the most

dynamic market applications, including hyperscale computing, 5G

communications, automotive, mobile, aerospace, consumer, industrial

and healthcare. For 10 years in a row, Fortune magazine has named

Cadence one of the 100 Best Companies to Work For. Learn more at

cadence.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding Cadence’s proposed acquisition of

Secure-IC, the anticipated timeline and closing of the proposed

transaction, Secure-IC’s and Cadence’s talent, technologies and

product offerings, business strategy, plans and opportunities,

industry and market trends including TAM estimates and the expected

benefits and impact of the proposed transaction and combined

business on Cadence’s growth. Forward-looking statements are based

on current expectations, estimates, forecasts and projections.

Words such as “expect,” “anticipate,” “should,” “believe,” “hope,”

“target,” “project,” “goals,” “estimate,” “potential,” “predict,”

“may,” “will,” “might,” “could,” “intend,” “shall” and variations

of these terms and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Forward-looking

statements are subject to a number of risks, uncertainties and

other factors, many of which are outside Cadence’s control. For

example, the markets for Secure-IC’s or Cadence’s products and

services may develop more slowly than expected or than they have in

the past; operating results and cash flows may fluctuate more than

expected; Secure-IC or Cadence may fail to satisfy the closing

conditions, including obtaining required regulatory approvals, in a

timely manner or at all; Cadence may fail to successfully acquire

and integrate Secure-IC; Cadence may fail to realize the

anticipated benefits of the proposed acquisition; Cadence may incur

unanticipated costs or other liabilities in connection with

acquiring or integrating Secure-IC; the potential impact of the

announcement or consummation of the proposed acquisition on

relationships with third parties, including employees, customers,

partners and competitors; Cadence may be unable to motivate and

retain key personnel; changes in or failure to comply with

legislation or government regulations could affect the closing of

the proposed transaction or post-closing operations and results of

operations; and macroeconomic and geopolitical conditions could

deteriorate. Further information on potential factors that could

affect Cadence’s ability to successfully acquire and integrate

Secure-IC or otherwise realize the anticipated benefits of the

proposed acquisition is included in Cadence’s most recent report on

Form 10-K and its other filings with the Securities and Exchange

Commission. The forward-looking statements included in this press

release represent Cadence’s views as of the date of this press

release, and Cadence disclaims any obligation to update any of them

publicly in light of new information or future events.

© 2025 Cadence Design Systems, Inc. All rights reserved

worldwide. Cadence, the Cadence logo and the other Cadence marks

found at www.cadence.com/go/trademarks are trademarks or registered

trademarks of Cadence Design Systems, Inc. All other trademarks are

the property of their respective owners.

Category: Featured

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121792961/en/

For more information, please contact: Cadence Newsroom

408-944-7039 newsroom@cadence.com

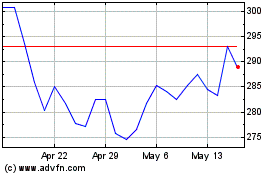

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

From Jan 2024 to Jan 2025