Central Garden & Pet Company (NASDAQ:CENT)(NASDAQ:CENTA)

today announced fourth quarter and full year results for its fiscal

year ended September 26, 2009.

“During fiscal 2009, we began to show improved performance from

the implementation of our financial and operational priorities,”

noted William Brown, Chairman and Chief Executive Officer of

Central Garden & Pet Company. “We achieved these results by

maintaining a strict focus on our core operating objectives:

reducing investment in working capital, lowering expenses, and

improving gross margins. We believe these continuing initiatives

will strengthen Central’s foundation as we move forward to a new

phase of growth.”

In the fourth quarter, the Company reported net sales of $363

million, a decrease of 12 percent compared to $414 million in the

comparable fiscal 2008 period. For the quarter, the Company

reported operating income of $19.9 million compared to an operating

loss of $12.3 million in the year ago period. Net income for the

quarter was $8.0 million, or $0.12 per fully diluted share compared

to a net loss of $13.9 million, or $0.20 per fully diluted share in

the year ago period. Sales of branded products decreased 12 percent

to $311 million and sales of other manufacturers’ products

decreased 14 percent to $52 million. Depreciation and amortization

was $7.3 million compared to $8.1 million in the year ago period.

The quarter ending debt balance was $408 million compared to $523

million a year ago, a decrease of $115 million. The quarter ending

Leverage Ratio, as defined in the Company’s credit agreement, was

2.9x compared to the covenant level of 4.5x.

Net sales for the Garden Products segment in the quarter were

$160 million, a decrease of 15 percent compared to $188 million in

the comparable fiscal 2008 period. Garden Products segment

operating income was $4.7 million compared to a loss of $30.8

million in the year ago period, which includes the impairment of

goodwill, other intangibles and long-lived assets of $29.5 million.

Sales of garden branded products declined 15 percent to $142

million. Sales of other garden manufacturers’ products declined 14

percent to $18 million. Net sales for the Pet Products segment in

the quarter were $204 million, a decrease of 10 percent compared to

$226 million in the year ago period. Operating income for the Pet

Products segment was $27.6 million, a decrease of 13 percent,

compared to $31.6 million in the year ago period. Sales of pet

branded products declined nine percent to $169 million. Sales of

other pet manufacturers’ products decreased 13 percent to $35

million.

Included in the results for the fourth quarter of fiscal 2008 is

a non-cash, pre-tax charge of $27.8 million related to the

impairment of goodwill, other intangibles and long-lived assets.

Excluding goodwill impairment and other asset impairment charges

that are not representative of the on-going results of operations

of our business, operating income for the fourth quarter of fiscal

2008 was $13.8 million and the corresponding net income for the

quarter was $4.0 million, or $0.06 per fully diluted share.

For the fiscal year ended September 26, 2009, the Company

reported net sales of $1.61 billion compared to $1.70 billion in

fiscal 2008, a decline of five percent. Operating income for the

fiscal year was $126.0 million compared to an operating loss of

$324.4 million in fiscal 2008. Branded product sales declined five

percent and sales of other manufacturers’ products declined five

percent. Depreciation and amortization for the fiscal year was

$29.1 million compared to $32.5 million in the prior fiscal year.

Net income for the fiscal year ended September 26, 2009 was $65.9

million compared to a net loss of $267.3 million in fiscal 2008.

Earnings per diluted share were $0.94 compared to a loss of $3.76

per fully diluted share in fiscal 2008.

Included in the full year results for fiscal 2008 is a non-cash,

pre-tax charge of $430 million related to the impairment of

goodwill, other intangibles and long-lived assets. Also included in

the results for the prior fiscal year is a pre-tax gain of $11.1

million related to the sale of properties and legal settlement

proceeds. Fiscal 2008 operating income, excluding goodwill

impairment and other asset impairment charges and the gains related

to the sale of properties and legal settlement proceeds that are

not representative of the on-going results of operations of our

business, was $90.6 million, and the corresponding net income and

earnings per fully diluted share were $34.6 million and $0.49,

respectively.

The Company will discuss its fourth quarter and fiscal 2009

results on a conference call Thursday, November 19, 2009 at 4:30

p.m. EST / 1:30 p.m. PST. Individuals may access the call by

dialing 1-888-713-4213 and passcode 6032 1821 (domestic) or

1-617-213-4865 and passcode 6032 1821 (international). The

conference call will be simultaneously broadcast over the Internet

through Central’s website, http://www.central.com/. To listen to

the webcast, please log on to the website prior to the scheduled

call time to register and download any necessary audio

software.

Re-play dial-in numbers for the call will be available for three

weeks: 1-888-286-8010 and passcode 3022 0524 (domestic) and

1-617-801-6888 and passcode 3022 0524 (international).

Central Garden & Pet Company is a leading innovator,

marketer and producer of quality branded products for the lawn

& garden and pet supplies markets. We are committed to new

product innovation and our products are sold to specialty

independent and mass retailers in the following categories: In Lawn

& Garden: Grass seed including the brands PENNINGTON® and THE

REBELS™ wild bird feed and the brands PENNINGTON® and KAYTEE®weed

and insect control and the brands AMDRO®, SEVIN®, IRONITE® and Over

‘N Out®; and decorative outdoor patio products and the brands

NORCAL®, NEW ENGLAND POTTERY® and MATTHEWS FOUR SEASONS™. We also

provide a host of other regional and application-specific garden

brands and supplies. Pet categories include: Animal health and the

brands ADAMS™ and ZODIAC®; aquatics and reptile and the brands

OCEANIC®, AQUEON™ and ZILLA™; bird & small animal and the

brands KAYTEE®, SUPER PET® and CRITTER TRAIL®; dog & cat and

the brands TFH®, NYLABONE®, FOUR PAWS®, PINNACLE® and Avoderm®; and

equine and the brands FARNAM®, BRONCO® and SUPER MASK®. Central

Garden & Pet Company is based in Walnut Creek, California, and

has approximately 5,000 employees, primarily in North America and

Europe. For additional information on Central Garden & Pet

Company, including access to the Company's SEC filings, please

visit the Company’s website at http://www.central.com/.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts, including future growth expectations, and

margin improvements are forward-looking statements that are subject

to risks and uncertainties that could cause actual results to

differ materially from those set forth in or implied by

forward-looking statements. These risks are described in the

Company's Annual Report on Form 10-K, to be filed November 20,

2009, and other Securities and Exchange Commission filings. Central

undertakes no obligation to publicly update these forward-looking

statements to reflect new information, subsequent events or

otherwise.

Central Garden & Pet

Company

Condensed Consolidated Statements

of Operations

(In thousands, except per share

amounts)

Three Months Ended Fiscal Year Ended

September 26, September 27, September 26, September

27, 2009 2008 2009

2008 Net Sales $ 363,171 $ 413,976 $ 1,614,300 $

1,705,386 Cost of Goods Sold and Occupancy 246,933

299,727 1,086,974 1,184,058

Gross Profit 116,238 114,249 527,326 521,328

Selling, General and Administrative Expenses 96,312 98,803 401,340

415,978 Goodwill and other impairments

-

27,764

-

429,764 Income from Operations 19,926

(12,318 ) 125,986 (324,414 ) Interest Expense (4,864 )

(7,695 ) (22,710 ) (38,326 ) Interest Income 35 139 649 1,053 Other

Income (Expense) (28 ) (341 ) 52

2,116 Income (Loss) Before Income Taxes and Minority

Interest 15,069 (20,215 ) 103,977 (359,571 ) Income Tax

Expense (Benefit) 6,870 (6,232 ) 36,368 (93,069 ) Minority Interest

163 (73 ) 1,661 833

Net Income (Loss) 8,036 $ (13,910 )

65,948 (267,335 ) Basic Earnings (Loss)

Per Common Share $ 0.12 $ (0.20 ) $ 0.95 $ (3.76 ) Diluted

Earnings (Loss) Per Common Share $ 0.12 $ (0.20 ) $ 0.94 $ (3.76 )

Weighted Average Shares Outstanding Basic 68,502 70,330

69,499 71,117 Diluted 69,768 70,330 70,264 71,117

Central Garden & Pet

Company

Condensed Consolidated Balance

Sheets

(In thousands)

September 26,

2009

September 27,

2008

Assets Current Assets: Cash and Cash Equivalents $ 85,668 $ 26,929

Accounts Receivable - Net 206,565 260,639 Inventories 284,834

349,499 Other Current Assets 44,425 34,686

Total Current Assets 621,492 671,753 Property and Equipment

- Net 164,734 174,013 Goodwill 207,749 201,499 Other

Intangible Assets – Net 103,366 107,404 Deferred Income Taxes and

Other Assets 53,584 104,649 Total $ 1,150,925

$ 1,259,318 Liabilities and Shareholders’ Equity

Current Liabilities: Accounts Payable $ 108,836 $ 133,364 Accrued

Expenses 82,143 84,345 Current Portion of Long-Term Debt

3,270 3,340 Total Current Liabilities 194,249 221,049

Long-Term Debt 404,815 519,807 Other Long-Term Obligations

4,526 7,037 Minority Interest 2,250 2,667 Shareholders’ Equity

545,085 508,758 Total $ 1,150,925 $ 1,259,318

Non-GAAP Financial

Measures

This press release includes adjustments to GAAP net

loss for the fourth quarter and fiscal year ended

September 27, 2008. Adjusted net income and adjusted earnings per

share, are non-GAAP financial measures which exclude the impact

of the impairment of goodwill, other intangibles and

long-lived assets plus gains related to the sale of properties and

legal settlement proceeds. We believe that they are useful

as supplemental measures in assessing the operating

performance of our business. These measures are used by

our management, including our chief operating decision maker, to

evaluate business results. We exclude goodwill

impairment and other asset impairment charges which are not

representative of the on-going results of operations of our

business and are not used to determine compliance with the

financial covenants in our credit facility.

We provide this information to investors and other users of the

financial statements, such as lenders, to assist in comparisons of

past, present and future operating results and to assist in

highlighting the results of on-going operations. While management

believes adjusted earnings and adjusted earnings per share are

useful supplemental information, such adjusted results are not

intended to replace our GAAP financial results and should be used

in conjunction with those GAAP results.

Below is a reconciliation of this non-GAAP measure to net

loss for the fourth quarter and fiscal year ended September

27, 2008.

Fourth Quarter Fiscal 2008

Dollars EPS Dollars

EPS (in millions) (in millions) Reconciliation

of net loss to adjusted net income: Net loss, as reported $ (13.9 )

$ (0.20 ) $ (267.3 ) $ (3.76 ) Adjustment for goodwill impairment

and other asset impairment charges that are not representative of

the on-going results of operations of our business, net of taxes

17.9 0.26

308.9

4.35 Adjustment for building sales, legal settlement and sale of a

business, net of tax

-

-

(7.0 ) (0.10 ) Adjusted net income $ 4.0

$ 0.06 $ 34.6 $ 0.49

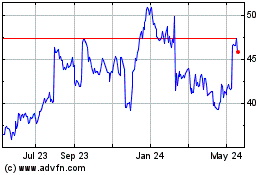

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

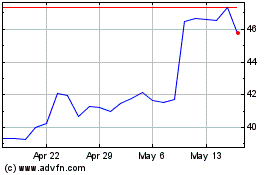

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024