Sluggish 2Q for Central Garden - Analyst Blog

May 07 2012 - 3:45AM

Zacks

Central Garden & Pet

Company (CENT) recently reported sluggish second-quarter

2012 results. The company’s quarterly earnings of 45 cents a share

were down 16.7% from the prior-year quarter’s earnings of 54 cents

due to short-term execution issues on account of transformational

initiatives undertaken. The analyst covered by Zacks had expected

the company to deliver earnings of 54 cents per share in the

reported quarter.

Moreover, total revenue for the

quarter decreased 4% to $466.9 million, reflecting sales decline in

garden and pet products segment. Moreover, the company’s reported

net sales fell well short of the Zacks Consensus Estimate of $503

million.

During the reported quarter, gross

profit shrinked 9.5% to $147.7 million, whereas gross margin

contracted approximately 200 basis points to 31.6%. The decline

reflected a rise in raw material costs and lower sales of high

margin products. Operating profit for the quarter was $45.2

million, indicating a decline of 24.2% from the year-ago

quarter.

Central Garden & Pet, one of

the leading producers and marketers of premium and value-oriented

products, focuses on the lawn & garden and pet supplies markets

in the U.S.

Garden Products segment sales

declined 6% year over year to $244.4 million, reflecting lower

sales of grass seed and wild bird feed coupled with delay in

filling orders. The segment reported an operating profit of $36.6

million during the quarter, down 22% from the year-ago quarter.

According to the company, the

Garden Products segment’s branded product sales came in at $211.7

million, whereas sales of other manufacturers’ products came in at

$32.7 million during the quarter.

Pet Products segment sales inched

down 1% to $222.5 million, reflecting decreased sales of wild bird

feed. Moreover, the segment’s operating income decreased 10.3% year

over year to $21 million.

The segment’s branded product sales

came in at $179.8 million, whereas sales of other manufacturers’

products were $42.7 million during the quarter.

Central Garden & Pet, which

faces stiff competition from The Scotts Miracle-Gro

Company (SMG), ended the quarter with cash and cash

equivalents of $10.3 million, long-term debt of $566.6 million and

shareholders’ equity of $448.8 million, excluding non-controlling

interest of $173,000. The leverage ratio was 5.5x for the quarter.

Capital expenditures for the quarter were $8 million. Management

expects capital expenditure of $30 million for fiscal 2012.

Currently, we maintain a long-term

‘Neutral’ recommendation on the stock. However, Central Garden

& Pet has a Zacks #4 Rank, which translates into a short-term

‘Sell’ rating.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

SCOTTS MIRCL-GR (SMG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

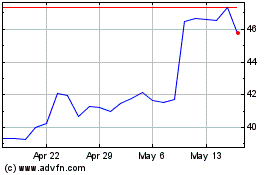

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

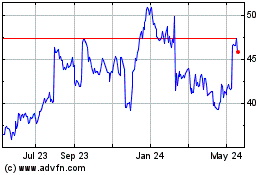

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024