false

0001434524

0001434524

2024-08-21

2024-08-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 21, 2024

CLEARSIGN TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in charter)

| Delaware |

|

001-35521 |

|

26-2056298 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employee

Identification No.) |

8023 E. 63rd Place, Suite 101

Tulsa,

Oklahoma 74133

(Address of Principal Executive Offices)

(Zip Code)

(918) 236-6461

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13(e)-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock |

|

CLIR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth

company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

To

the extent required, the information set forth below in Item 7.01 of this Current Report on Form 8-K is incorporated herein by reference

in its entirety.

| Item 7.01 | Regulation FD Disclosure. |

On

August 21, 2024, ClearSign Technologies Corporation (the “Company”) issued a press release announcing the results of operations

for the quarter ended June 30, 2024 (the “Financial Results”). The press release is furnished as Exhibit 99.1 to this

Current Report on Form 8-K and is incorporated by reference in its entirety into this Item 7.01.

Also

on August 21, 2024, the Company held a conference call discussing the Financial Results and other business related information. A transcript

of this conference call is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference in

its entirety into this Item 7.01.

The

information furnished with this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

(d) Exhibits.

* Filed herewith.

** Furnished herewith.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated: August 23, 2024

| |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

|

| |

By: |

/s/ Colin James Deller |

| |

Name: |

Colin James Deller |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

ClearSign Technologies Corporation Provides

Second Quarter 2024 Update

TULSA, Okla., August 21, 2024 -- ClearSign Technologies Corporation

(Nasdaq: CLIR) (“ClearSign” or the “Company”), an emerging leader in industrial combustion and sensing technologies

that improve energy, operational efficiency and safety while dramatically reducing emissions, today provides an update on operations

for the quarter ended June 30, 2024.

“The ClearSign business has advanced on multiple fronts during

the past few months, including significant new orders, new product development and increased engagement with customers and industry stakeholders,”

said Jim Deller, Ph.D., Chief Executive Officer of ClearSign. “Our installation base continues to grow, and we are now receiving

orders from larger global collaborators and operators, as seen with our most recent initial engineering order relating to the first phase

of a 26 burner project. It is also encouraging that many of our orders are from third party intermediaries whom are sales conduits themselves.

As a strategic marketing initiative, we have just completed a large product demonstration to industry leaders at the facilities of our

partner Zeeco for our process burner line and we have an upcoming event in California next week to unveil independent data on emissions

performance and fuel savings, or CO2 reduction, from our boiler burner line. Lastly, we are seeing additional states like

Texas and Colorado in the process of reducing allowable NOx emissions,” concluded Dr. Deller.

Recent strategic and operational highlights during, and subsequent

to, the end of the second quarter 2024 include:

Announced Order for Multi Heater Project for Texas Petrochemical

Facility: The Company received the initial engineering order from engineering and heater manufacturer Birwelco USA Inc.

(a BIH Group company) as the first phase of a project to retrofit four process heaters with a total of 26 ClearSign Core™ burners

to be installed in the Gulf Coast facility of a Fortune 500 global chemical company.

Announced Order of Largest Burner Sold to Date: This is the

largest boiler burner ClearSign has sold to date, at close to 90 million BTU/hr, or almost two times the size of the previous largest

single burner sold. The burner was sold by Devco Process Heaters of Tulsa, OK and will be going into a new heater in a central Texas

gas processing facility. The Company expects to deliver the burner in the third quarter.

Announced Board Transitions: Separately, ClearSign announced

the appointment of both David Maley and G. Todd Silva to its Board of Directors. Mr. Silva replaced Robert T. Hoffman, Sr. as

the director designee of the Company’s largest stockholder, clirSPV LLC.

Announced Closing of Public Offering and Concurrent Private Placement

of Common Stock and Warrants as well as the Full Exercise of Participation Right Granted to clirSPV LLC: The offerings and participation

right resulted in gross proceeds of approximately $9.3 million and $4.3 million, respectively.

Announced Successful Start-Up of Second Multi-Burner Heater at

Kern Energy: The five-burner heater had a successful start-up with independent source testing confirming emissions levels

below guarantee. This follows the successful installation and start-up of the first eight-burner heater in January.

Received Orders for the Engineering of Burners for Two Additional

Heaters at Kern Energy: ClearSign received two additional purchase orders to complete the detailed engineering of burners for the

retrofitting of two more process heaters in the California refinery for a total of four burners. These orders follow the

recent successful installations of two multi burner heater orders at Kern Energy’s refinery site. Like previous orders, this initial

engineering is anticipated to be followed by purchase orders for the manufacture and supply of burners.

Cash and cash equivalents were approximately $16 million as of June

30, 2024.

There were 50,205,657shares of the Company’s common stock issued

and outstanding as of June 30, 2024.

The Company will be hosting a call at 5:00 PM ET today.

Investors interested in participating on the live call can dial 1-800-836-8184 within the U.S. or 1-646-357-8785 from abroad. Investors

can also access the call online through a listen-only webcast at https://app.webinar.net/KO7mz3MRoNZ or on the investor

relations section of the Company's website at http://ir.clearsign.com/overview.

The webcast will be archived on the Company's investor relations website

for at least 90 days and a telephonic playback of the conference call will be available by calling 1-888-660-6345 within the U.S. or

1-646-517-4150 from abroad. Conference ID #84206. The telephonic playback will be available for 7 days after the conference call.

About ClearSign Technologies Corporation

ClearSign Technologies Corporation designs and develops products and

technologies for the purpose of improving key performance characteristics of industrial and commercial systems, including operational

performance, energy efficiency, emission reduction, safety and overall cost-effectiveness. Our patented technologies, embedded in established

OEM products as ClearSign Core™ and ClearSign Eye™ and other sensing configurations, enhance the performance of combustion

systems and fuel safety systems in a broad range of markets, including the energy (upstream oil production and down-stream refining),

commercial/industrial boiler, chemical, petrochemical, transport and power industries. For more information, please visit www.clearsign.com.

Cautionary note on forward-looking statements

All statements in this press release that are not based on historical

fact are “forward-looking statements.” You can find many (but not all) of these statements by looking for words such as “approximates,”

“believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,”

“intends,” “plans,” “would,” “should,” “could,” “may,” “will”

or other similar expressions. While management has based any forward-looking statements included in this press release on its current

expectations on the Company’s strategy, plans, intentions, performance, or future occurrences or results, the information on which

such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and

are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, that could

cause actual results to materially differ from such statements. Such risks, uncertainties and other factors include, but are not limited

to, the Company’s ability to successfully deliver, install, and meet the performance obligations of the Company’s burners

in the California and Texas market, and any other markets the Company may sell products in; the Company’s ability to further

expand the sale of ultra-low NOx process and boiler burners; the Company’s ability to successfully perform engineering orders;

the Company’s ability to successfully develop the 100% hydrogen burner with the Phase 2 grant funding; general business and economic

conditions; the performance of management and the Company’s employees; the Company’s ability to obtain financing, when needed;

the Company’s ability to compete with competitors; whether the Company’s technology will be accepted and adopted and other

factors identified in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission and available

at www.sec.gov and other factors that are detailed in the Company’s periodic and current reports available for

review at www.sec.gov. Furthermore, the Company operates in a competitive environment where new and unanticipated risks may

arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. The Company

disclaims any intention to, and, except as may be required by law, undertakes no obligation to, update or revise forward-looking statements

to reflect events or circumstances that subsequently occur or of which the Company hereafter become aware.

ClearSign Technologies Corporation and Subsidiary

Condensed Consolidated Balance Sheets

(Unaudited)

| (in thousands, except share and per share data) | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 15,974 | | |

$ | 5,684 | |

| Accounts receivable | |

| 135 | | |

| 287 | |

| Contract assets | |

| 5 | | |

| 188 | |

| Prepaid expenses and other assets | |

| 588 | | |

| 350 | |

| Total current assets | |

| 16,702 | | |

| 6,509 | |

| | |

| | | |

| | |

| Fixed assets, net | |

| 271 | | |

| 275 | |

| Patents and other intangible assets, net | |

| 855 | | |

| 836 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 17,828 | | |

$ | 7,620 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 453 | | |

$ | 366 | |

| Current portion of lease liabilities | |

| 88 | | |

| 71 | |

| Accrued compensation and related taxes | |

| 430 | | |

| 703 | |

| Contract liabilities | |

| 825 | | |

| 1,116 | |

| Total current liabilities | |

| 1,796 | | |

| 2,256 | |

| Long Term Liabilities: | |

| | | |

| | |

| Long term lease liabilities | |

| 143 | | |

| 172 | |

| Total liabilities | |

| 1,939 | | |

| 2,428 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 9) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value, zero shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.0001 par value, 50,205,657 and 38,687,061 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| 5 | | |

| 4 | |

| Additional paid-in capital | |

| 112,602 | | |

| 98,922 | |

| Accumulated other comprehensive loss | |

| (21 | ) | |

| (17 | ) |

| Accumulated deficit | |

| (96,697 | ) | |

| (93,717 | ) |

| Total equity | |

| 15,889 | | |

| 5,192 | |

| | |

| | | |

| | |

| Total Liabilities and Equity | |

$ | 17,828 | | |

$ | 7,620 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

ClearSign Technologies Corporation and Subsidiary

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(Unaudited)

| (in thousands, except share and per share data) | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | 45 | | |

$ | 150 | | |

$ | 1,147 | | |

$ | 1,044 | |

| Cost of goods sold | |

| 3 | | |

| 21 | | |

| 668 | | |

| 809 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 42 | | |

| 129 | | |

| 479 | | |

| 235 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 402 | | |

| 187 | | |

| 683 | | |

| 347 | |

| General and administrative | |

| 1,777 | | |

| 1,571 | | |

| 3,185 | | |

| 3,221 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 2,179 | | |

| 1,758 | | |

| 3,868 | | |

| 3,568 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,137 | ) | |

| (1,629 | ) | |

| (3,389 | ) | |

| (3,333 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| | | |

| | | |

| | | |

| | |

| Interest | |

| 77 | | |

| 94 | | |

| 138 | | |

| 152 | |

| Government assistance | |

| 185 | | |

| 14 | | |

| 264 | | |

| 107 | |

| Gain from sale of assets | |

| — | | |

| — | | |

| — | | |

| 5 | |

| Other income, net | |

| 3 | | |

| 43 | | |

| 7 | | |

| 162 | |

| Total other income | |

| 265 | | |

| 151 | | |

| 409 | | |

| 426 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,872 | ) | |

$ | (1,478 | ) | |

$ | (2,980 | ) | |

$ | (2,907 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and fully diluted | |

$ | (0.04 | ) | |

$ | (0.04 | ) | |

$ | (0.07 | ) | |

$ | (0.08 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding - basic and fully diluted | |

| 47,312,810 | | |

| 38,549,810 | | |

| 43,080,454 | | |

| 38,407,053 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,872 | ) | |

$ | (1,478 | ) | |

$ | (2,980 | ) | |

$ | (2,907 | ) |

| Foreign-exchange translation adjustments | |

| (1 | ) | |

| (12 | ) | |

| (4 | ) | |

| (12 | ) |

| Comprehensive loss | |

$ | (1,873 | ) | |

$ | (1,490 | ) | |

$ | (2,984 | ) | |

$ | (2,919 | ) |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

For further information:

Investor Relations:

Matthew Selinger

Firm IR Group for ClearSign

+1 415-572-8152

mselinger@firmirgroup.com

Exhibit 99.2

Event Name: ClearSign Technologies Second Quarter 2024 Conference Call

Event Date: Wednesday, August 21, 2024, 5:00 p.m. Eastern Time

Officers and Speakers

Matthew Selinger; Firm IR Group

Brent Hinds; Chief Financial Officer

Jim Deller; Chief Executive Officer

Analysts

Amit Dayal; H.C. Wainwright

Presentation

Operator: Good afternoon, and welcome to the ClearSign Technologies

Second Quarter 2024 Conference Call.

[Operator Instructions]

Please note this event is being recorded.

I would now like to turn the conference over to Matthew Selinger of

Firm IR Group. Please go ahead.

Matthew Selinger: Good afternoon, and thank you, operator. Welcome,

everyone, to the ClearSign Technologies Corporation Second Quarter 2024 Results Conference Call.

During this conference call, the company will make forward-looking

statements. Any statement that is not a statement of historical fact is a forward-looking statement. This includes remarks about the company's

projections, expectations, plans, beliefs and prospects. These statements are based on judgments and analysis as of the date of this conference

call and are subject to numerous important risks and uncertainties that could cause actual results to differ materially from those described

in the forward-looking statements.

The risks and uncertainties associated with the forward-looking statements

made in this conference call include, but are not limited to, whether field testing and sales of ClearSign's products will be successfully

completed, whether ClearSign will be successful in expanding the markets for its products, and other risks that are described in ClearSign's

public periodic filings with the SEC, including the discussion in the Risk Factors section of the 2023 annual report on Form 10-K for

the period ended December 31, 2023.

Except as required by law, ClearSign assumes no responsibility to update

these forward-looking statements to reflect future events or actual outcomes, and does not intend to do so.

So on the call with me today are Jim Deller, ClearSign's Chief Executive

Officer; and Brent Hinds, ClearSign's Chief Financial Officer.

So with that, at this point in the call, I would like to turn the call

over to CFO Brent Hinds. So Brent, please go ahead.

Brent Hinds: Thank you, Matthew, and thank you to everyone joining

us here today.

Before I begin, I'd like to note that our financial results for the

second quarter of 2024 are included on the quarterly report on Form 10-Q that was filed with the SEC last Wednesday on August 14.

And with that, I would like to give an overview of the financials for

the second quarter of 2024. For the second quarter of 2024, the company recognized approximately $45,000 in revenues, compared to approximately

$150,000 for the same comparable period in 2023. This $105,000 decrease in revenues is driven by the natural lumpiness in our business,

as we continue to work to build our sales pipeline.

While we don't provide guidance, Jim will comment later on our project

pipeline, with shipping and delivery timeframes, which can give an indication of future revenues.

Looking at the income statement as a whole, our net loss for the second

quarter in 2024 was approximately $1.9 million, which is an unfavorable increase of approximately $400,000 compared to the same period

in 2023. This unfavorable year-over-year change was predominantly due to a one-time non-cash event for $260,000 related to the vesting

of restricted stock units in connection with the resignation of Mr. Hoffman from the Board of Directors.

Now I'd like to shift focus from our income statement to the balance

sheet; more specifically, cash. Our net cash used in operations for the second quarter of 2024 was approximately $1.5 million, compared

to a generation of cash of approximately $50,000 for the same period in 2023. This unfavorable year-over-year change was driven by the

prior year's operations. As you may recall, during the second quarter of 2023, we collected a significant amount of cash from customers

because we met billing milestones specified in our contracts.

Shifting gears but continuing our focus on cash, I would also like

to revisit an announcement we made on June 20, 2024, when we announced a full exercise of the clirSPV participation right. Pursuant to

the stock purchase agreement dated July 12, 2018, clirSPV can participate in equity offerings to maintain its 19.99% ownership. The full

exercise of the participation right added approximately $4.3 million in cash to the balance sheet. Couple this with the other recent equity

offerings, we added approximately $13 million in cash to our balance sheet in the second quarter of 2024. So therefore, as of June 30,

2024, we reported a balance of approximately $16 million in cash and cash equivalents. From a financial perspective, we believe this working

capital position instills greater confidence in our customers and suppliers when doing business with us.

And with that, I'd like to turn the call over to our CEO, Jim Deller.

Jim?

Jim Deller: Thank you, Brent, for the finance overview. As always,

I'd like to thank everyone for joining us on this call today and for your interest in ClearSign.

Before I start, on behalf of ClearSign and the board, I want to thank

our former chairman and board member Rob Hoffman for his years of service and for the continued financial support for ClearSign provided

by clirSPV. Rob's support was instrumental in fostering this company from a research and development technology company to the viable

commercial entity we are today.

On a similar note, I'd like to welcome Todd Silva to the ClearSign

Board of Directors to fill Rob's vacancy as clirSPV's designee. Todd brings over 30 years of leadership and financial experience in industries

spanning financial services, technology, healthcare and others. I think this is an exciting time for the company, and we look forward

to working with Todd and the other board members.

On the call today, I will review our product lines, starting with our

process burners, then move to boiler burners, and then discuss the outlook for the rest of the year.

So turning to our process burner line, in our last call, we discussed

our multiple installations and follow-on orders from Kern Energy in California. At that time, our two largest heater retrofit projects

had just been started up, and shortly afterward their emissions were verified by formal third-party measurements known as source tests.

These two heaters are side by side, one with five burners and the other with eight. Since those two projects, we have also received follow-on

orders for two additional heaters at Kern Energy. Our previous orders, the initial purchase order, is for engineering, and we anticipate

receiving the orders for the follow-on fabrication and delivery to complete these retrofits after our engineering scope is complete.

We continue to work with Kern Energy, obviously, on our existing projects,

but also in regard to discussions for the future. You may also have seen messaging from Kern Energy, particularly on LinkedIn, and also

new articles referencing our work together from their perspective, emphasizing their priorities and values, and why our projects are important

to Kern Energy. In their words, the supply of ClearSign's technology helps the refinery continue to meet California's clean air goals

and go beyond established emissions limits to further reduce their environmental footprint.

Since then, and most recently, we have made further significant progress

in our process burner product line. On July 17, we announced that we had received the engineering order from engineering company and heater

manufacturer Birwelco USA Inc., a Boustead International Heaters company, for the first phase of a project to retrofit four process heaters

with a total of 26 ClearSign Core burners to be installed in the Gulf Coast facility of a Fortune 500 global chemical company. This order

is important not just for the size and the anticipated revenue associated with it, as important as that is, but also because the order

is destined for a facility in Texas, which is part of the USA Gulf Coast region that we expect to ultimately be the largest market for

our current product lines, and one that is now in the process of revising their clear air regulations, and because of the prominence of

the engineering and heater manufacturer Birwelco, who were paramount in the selection of the equipment for this project, which ultimately

resulted in the order being placed with ClearSign.

For anyone looking to get insight into this industry, I encourage you

to look at Birwelco, and particularly to visit their website. They work with a distinguished list of major refiners, midstream and chemical

companies. They are based on Houston and part of Boustead International Heaters, or BIH, which includes sister companies in Europe, Malaysia

and Singapore. Birwelco's business is predominantly the supply of heaters to refineries and petrochemical plants, or engineering and managing

projects to upgrade them, including projects that require the change-out of the burners. We believe that having Birwelco express their

confidence in ClearSign's technology, allowing them to have firsthand experience of it and the exposure to what we do, makes us well positioned

to be part of the solutions they offer and may provide for future clients. As you would expect, we are engaged in other early-stage conversations

of this nature with them.

If you've participated in previous conference calls, we have mentioned

that we were working with a major global chemical company to become an approved vendor in their system. In fact, that was not a one-off,

but one of these was a precursor to this order I have just described.

Beyond this, we have a 20-burner order nearing completion. The final

witnessed test was completed some time ago, and these burners are now finishing fabrication by our partner Zeeco and are scheduled to

be shipped to our client in the Los Angeles area of California late in September. When up and running, there will be another two heaters,

this time with eight and twelve burners, which will provide a very significant reference for us, especially given their location in the

large refining hub in the Los Angeles area.

As previously noted, in accordance with the contract terms of this

project, we will collect revenue upon shipment of the burners, so referring back to Brent's comments earlier, our revenue flow is based

on the contractual milestones of our projects, so we anticipate that during the period in which we are establishing sales, our revenue

flow may be lumpy. While we have significant sales news in the second quarter of 2024, shipping orders like this are what show up in our

financial results.

Regarding our crossover product line, meaning our horizontally fired

burners for process heaters, on June 26 we announced the sale of our largest burners to date. The sale is meaningful for a couple of reasons:

First, the firing rate of this burner, at close to 19 million BTUs per hour, is almost two times the size of our previous largest single

burner sold. With this, we will have demonstrated products designed for our small, medium and large size ranges in the field. Secondly,

this burner was sold in collaboration with another heater manufacturer, Devco Process Heaters, or Devco, into the midstream market, which

will introduce our solutions to new customers and expand our sales channels. In that regard, we have received requests to provide quotes

for additional projects from Devco since the supply of this burner. The burner will be going into a heater in a Central Texas gas processing

facility. We expect the burner to be delivered during the third quarter this year.

This product line continues to gain traction. We believe this level

of interest and customer requests for quotes indicate that there is a ready market for these burners. We have proposals that are progressing

well and I hope to have further news on this progression in the near future.

We also have an update on our hydrogen burner technology. On the last

call, we reported that this new technology had worked very well and had exceeded our expectations at this stage of the project. We also

mentioned that we have shared some of those initial results on LinkedIn. While we still have some work to do before calling this product

line complete, the hydrogen burner performance is sufficiently robust and comprehensive that we are able to offer this new product for

sale and have already been doing so.

One of the attributes of this new technology is that it will perform

not only with 100% hydrogen as a fuel in the future, but also with the fuel gases currently in use today. And because of this, it is a

product that our customers can install to meet their NOx and other operational requirements today, and at the same time, have the technology

in place and ready to operate as they introduce additional hydrogen to their fuel gas streams or convert to 100% hydrogen when that fuel

source becomes available in the future.

Last week we hosted a process burner technology launch event at the

facilities of Zeeco. I have frequently emphasized that one of our priorities is to develop familiarity and confidence in our technology

and its capabilities to our customers and other industry stakeholders. Obviously, a key part of this is developing our installed base,

but we can also progress this by holding events such as this, in which we demonstrate our technology operating in the Zeeco test furnaces.

As you would expect, this was accompanied by a series of presentations and discussions about our technology, how it is installed and operated,

et cetera, including our introduction and presentation of our new hydrogen burners, which provided an opportunity for our customers to

literally see it in person for the first time.

This demonstration was well attended, including by senior technical

representatives of two global supermajor refineries and an equivalent global chemicals company; multiple global engineering procurement

and construction, or EPC, companies; multiple leading heater manufacturers and prominent engineering and consulting companies. The burner

demonstration went seamlessly, and from what we can tell, the presentations were well received, with active engagement and significant

discussion throughout the day. I'm also pleased to note that there was significant interest in the new 100% hydrogen-capable burner. What

was also particularly pleasing was the continuing active dialogue, and in particular, with our customers raising their needs and highlighting

how our technology can help them solve their respective challenges, and the value of these solutions for them, which is very helpful as

we prioritize our product development initiatives.

There have been some developments in clean air regulations in both

Texas and Colorado that are relevant to both our process and boiler burner product lines. First, in Texas, there was a final certification

by the United States EPA of Texas' reclassification of nonattainment status for compliance with the 2015 National Ambient Air Quality

Standards for ozone from moderate to serious for both the greater Houston and greater Dallas regions. This triggers many actions by the

Texas Commission on Environmental Quality, or TCEQ; most notably, a revision of the State Implementation Plans, or SIPs, for both regions,

and implementation of new Reasonable Available Control Technology, or RACT, rules for emissions sources.

We believe these developments are good news for the long-term ClearSign

business. I will tender that development with a reminder that government and regulatory processes take time to be implemented, if at all,

and the changes to the State Implementation Plans and RACT rules are not due until late next year into early 2026. Although on the positive

side, the customers in the affected areas and the regulators issuing permits know that these changes are on the horizon, so we should

expect NOx requirements for new permits and opportunities be pushed down ahead of the new regulations being formalized.

Secondly, in Colorado, following the recent reclassification of federal

ozone nonattainment zone severity for Denver and the North Front Range, Colorado Governor Polis sent a letter to the executive director

of the Colorado Department of Public Health and Environment dated March 16, 2024, directing action for ozone and NOx reductions. This

letter directs these agencies to reduce NOx in the affected regions by 30% by the end of 2025, and by 50% by the end of 2030. Following

this development, about two weeks ago, we met in person with the senior staff of both the Department of Public Health and Environment

and the Energy and Carbon Management Commission to introduce ClearSign technologies, to understand their planning process and to identify

how we can support their NOx reduction initiatives.

Now turning to boiler burners. The commissioning of our large 1,200-horsepower,

2.5-ppm NOx burner, branded Near Zero NOx, for a recycling plant in California is under way. This burner is installed, and as you would

expect with this being the first burner of this scale, there are some details to work through. However, we believe we are close to having

these worked out and look forward to having this plant in full operation and the formal source test completed. When in service, we believe

that this will be a prominent development in the industry and a great reference installation for us.

We also have the first article of our new horizontally fired burner

design being manufactured. If this burner performs as we expect it to, and as shown in our computer modeling, it will provide extremely

low NOx in short-length heaters and boilers. Bear in mind, our current boiler burner technology is optimized for firetube boilers in which

the space for flame is typically long and narrow. The first burner of this new design is for installation in a hot oil heater in Texas.

The reason I have included this in this section is that we anticipate that the biggest market for this new burner will be watertube boilers,

a segment of the market that we have not been able to effectively pursue at this point.

Our expectation is that we will be able to install this burner in the

fourth quarter this year, although this may be contingent on the coordination of the installation with the client's operations schedule.

We are pushing to arrange for this installation to be as early as we can because we already have several opportunities waiting for this

new design to be demonstrated in service, both in terms of repeat orders from existing customers and from potential new clients, and covering

both hot oil midstream-type processes or applications and watertube boilers.

Other upcoming events related to our boiler burner line include an

industry demonstration that will be held in Santa Ana, California, next week. The investor-owned California utility companies fund energy

efficiency research on available and near-future products and technologies. One of these programs is called the Statewide Gas Emerging

Technologies, or GET, program, which is administered by Southern California Gas Company through a contract awarded to ICF, a global consulting

and digital services company. The GET program's objective is to source and screen technologies, gather necessary technical information

and data on potential efficiency gains to identify key market barriers to the adoption of these technologies and develop strategies to

overcome such barriers. ClearSign is pleased to have been selected to participate in this important program.

We have completed a study of the formally tested and quantified operating

efficiency improvements that will basically translate into fuel savings of the ClearSign boiler burner technology compared to a typical

energy standard ultra-low-NOx burner. The test method was developed by independent third-party engineers and the testing was also overseen

by independent third-party engineers, all contracted directly by the GET program. We are not able to give results today as the work and

data is owned by the GET program and they have not released their report at this time. However, I can say that the results were pleasing,

both in terms of efficiency and the NOx emissions demonstrated. We plan to provide access to this report on our website when available

and also provide notification that it is issued and a link on LinkedIn.

The study results and a physical demonstration of the burner in operation

will be presented at the industry demonstration next week. We are expecting approximately 70 attendees, including many from the various

California air regulators; California refineries, both supermajor and local; national energy and infrastructure companies; engineering

companies; and national boiler operators.

One final project update on our boiler burner line: In February this

year we announced an order which was for the first of four burners for a California plant. That first burner is in production, but the

client's schedule has moved out a little and that burner is now scheduled to ship at the end of the year and to be installed by the end

of the first quarter of 2025. As usual, we will keep you informed as that project progresses and as we get dates for the remaining three

burners for that project.

And finally regarding boiler burners, on the last call I mentioned

our China certification project has seen some delays. While some progress has been made, I do not have any significant updates regarding

the project's schedule at this time.

In closing, it is worthwhile to look at what we are doing at a tactical

level, and also at a strategic or high level. The updates I have given here are mostly tactical, individual product updates, customer

demonstrations, et cetera. At a strategic level, there are areas of focus that are consistent, and it is useful to articulate these to

provide a framework to understand what we are doing and to gauge progress.

Our top line objective is to increase sales and profitability both

in the near term but also increasingly in the future. To do this, we need to continue developing products that provide value to our customers,

and because our technology is new, we need to develop our reputation and familiarity in the market.

In working toward this objective, we have discussed significant new

orders, especially the process burner order for a chemical company in Texas, likely in the most significant United States market for us

in the midterm, and also the engagement of a leading heating manufacturer and engineering firm, who is actually our direct customer for

this project and is now getting firsthand experience of our products and working with ClearSign. Under this general seeding-the-industry

objective, we also have carried out a largescale product demonstration in the Zeeco facility for our process burners last week and will

be doing another demonstration for our firetube boiler product line in California next week. We're also nurturing our relationship with

Kern Energy, as evidenced by press releases from both us and them regarding our installations there, and we will continue to publish news

and journal articles related to our installations with Kern Energy throughout the remainder of this year.

In support of our continued business growth, we are investing time

and energy in bringing new products to market and developing new markets themselves. The new products that are most advanced are our new

process burner, capable of burning fuel gas ranging from the fuel gases in use today up to 100% hydrogen while maintaining the same market-leading

NOx levels, enabling the burners to be installed now and our customers to be ready for new higher hydrogen fuels as those become available.

We are seeing a lot of interest in this new burner, as evidenced in the level of engagement during our demonstration last week, and as

mentioned, we are starting to provide sales proposals for this burner.

The second new product line is the new horizontally fired burner, with

the first of this new technology currently in fabrication and plans to be installed in the hot oil heater in Texas. When successfully

installed and commissioned, this burner is expected to open up to the watertube boiler market for us in addition to the midstream heaters

in the process burner market. We also already have interest in this burner, just waiting on the demonstrated operation of this first article

in Texas. We also maintain an ongoing portfolio of early-stage development projects and are receiving multiple customer requests for new

variations of our technology, some of which we continue to develop and some of which will get dropped as we work through the standard

technical, business and marketing assessments of these different opportunities.

In the same category of development for the future, we are also considering

the development of our resources, such as the recent investment in computer modeling capabilities. We are also engaged in developing market

access for the future. I talked briefly about our engagement with the regulatory leadership in Colorado, which we will continue to work

on. We are also in frequent contact with the California Air Resources Board, the body that oversees the air districts in California, and

also members of the TCEQ in Texas.

You will appreciate that to get all this done in addition to our ongoing

normal business operations will take a lot of time and effort. We are conscious of the costs of running ClearSign and we only add to our

headcount when absolutely needed. I greatly appreciate all the hard work and dedication of our team.

And with that, I'd like to open up the call for questions, please,

operator.

Questions & Answers

Operator: [Operator Instructions]

Your first question comes from the line of Amit Dayal from H.C. Wainwright.

Amit Dayal: So Jim, I mean, it's good to see all the progress you guys

are making, and it's almost now getting hard to track all the sales and your pipeline. Could you maybe help us a little bit and give us

a dollar sense of how much you have in hand as orders that you will be shipping out over the next few quarters and what is in the pipeline?

Jim Deller: Yes, thank you, Amit, and thank you for your question.

I think to start, I'll rephrase the -- well, I think the general numbers we had given for everyone, our products obviously cover boiler

burners and process burners in varying size, but to keep things simple, a good estimate of the sales price or revenue per burner is $100,000

per item. So I can then talk to the number of burners both we have in our existing projects and then certainly talk a little bit about

what we see in the future.

So as I think on the process burner line, the two big orders, I mentioned

the 20 burners, which we expect to ship to California late in September, so there's 20 burners there; we have the engineering order, which

we fully expect to progress, for the chemical facility down in Texas; that's 26 burners. That's 46 in total with just those two orders.

There's two heaters that we've mentioned for Kern Energy; the engineering for those is just about complete. There are a handful of boiler

burner and hot oil burner or hot oil heater burners in progress. We also have the four-burner plan with one single client in California.

So I think that's the majority of the standard burner orders. Obviously there's engineering and service and spare parts and other work

that we do, but that's, I think, a good framework to assess the revenue to be recognized based on the work that we have to date.

Going forward, I'm always conscious about a bird in the hand as opposed

to what's out there, but we are seeing a lot of interest in the hot oil heater line and are expecting that to progress. We have -- I mentioned

an ongoing relationship with Kern Energy, and there's certainly interest there.

I think some of the more exciting things for me, as I look further

out to the future, are the ongoing conversations with companies like Birwelco, the engineering company involved in the order we've just

announced down in Texas, but also that we are getting drawn or invited to enter discussions at the feed stage of some very large projects.

The feed stage is really the first financial and feasibility assessment that our customers go through when developing projects. These

are typically going to be two years out, something in that timeframe, sometimes even more. But the important thing is, that's how you

load the pipeline, and that's where the growth and the long-term growth of the company comes from, is by getting involved in these really

big projects early. For me, the reason that's encouraging, one is for that pipeline, but also it's an indication of the growing recognition

and trust of ClearSign's technology out there in the market.

Amit Dayal: Understood. Thank you. And just to clarify, the hot oil

heater opportunity is tied to the horizontal process burner offering that you are developing?

Jim Deller: That's correct. We've used several names, and we're actually

using that as more of a generic name. There are a number of different processes, but it's the -- there's a number of horizontally fired

heaters in the process industries, in gas processing industries: hot oil heaters, glycol heaters. There's a number of different processes.

We've used the term hot oil heaters generally to describe those horizontally fired single-burner forced-draft burner applications.

Amit Dayal: Okay, got it. You said you guys are probably getting a

little stretched with all of the activity in terms of business development and deployments going on; are you looking to add more people?

And how should we think about operating costs on a quarterly basis going forward?

Jim Deller: Yes. So we -- you may have seen -- we currently have one

-- and I'll use this as an advertisement as well -- we currently have one open job posting out. We are currently reviewing resumes for

an engineer to both assist with work with our test furnace and installation work out in the field with our clients. That is the only current

open position we have. Obviously as more orders come in, we will monitor the load on our project management team and maybe even on our

engineering team.

Part of the reason also that we are focused on that engineering team

is not only that we need to execute the orders that we have, but that I want to ensure that our senior engineers are also very effective

salespeople, maintain the time in their schedule to focus on sales and those customer conversations to bring orders in, and do not get

consumed in order execution and engineering because of a low staffing level. You'd appreciate we have to have people in-house and trained

up so that they're effectively able to do that work, so we do keep our work force to a low level; we also have to balance that to make

sure that we have the right people to do the job and not take our foot off the gas and focus on the outreach and the sales activities

that are so important to us.

But I think in terms of just looking at overhead costs, these positions

are positions that we add as part of the growing business. So they're not -- I wouldn't classify them as overhead-style costs. They are

very much a function of the increasing workflow.

Amit Dayal: Understood. And just last one from me: These demonstrations

with Zeeco that you are doing for clients, what kind of responses are you getting from that? And how is this helping sort of improve your

sales cycle? Just any color on how you're leveraging these demonstrations to get more visibility of your customers.

Jim Deller: Yes, absolutely. I mean, the whole purpose of doing these

is to show what we can do to the industry, to get people to see it in person, and seeing is believing, often. This demonstration last

week was a big demonstration; it was three burners firing in a test furnace. That is not normal. Most tests are done with just a single

furnace -- a single burner. The -- I think it's important to note that the people that came in made this trip, dedicated especially for

this purpose. They were not in town for other reasons. They'd flown across the country to be here with us.

There was a lot of engagement -- we had a full day of active conversations,

including the firing demonstration, that pursued in vigor through a dinner that evening. The burners ran well. We got to show the hydrogen

burner. There was a lot of conversation around the hydrogen burner and the hydrogen burner performance. It also -- we had a lot of ClearSign

staff among the customers, as you would expect, and a lot of one-on-one conversations, and we picked up and got engaged in a lot of conversations

with our customers where they were asking how it -- how could we help them with their problems, and I think we've picked up a lot of --

maybe not immediate opportunities, but I think a lot of initiatives that have a very good potential of turning into future opportunities

from those conversations. And just having that dialogue and ongoing conversations with your customers always keeps you at the front of

their mind, and so while there's no specific opportunities we're bidding immediately as a result of that converse, I am very confident

that we will get more engagement and opportunities as a result of that demonstration.

Operator: [Operator Instructions]

Matthew Selinger: Operator, I'm going to go ahead and read -- we've

got a couple via e-mail, so I'm going to read the first question. You've increasingly highlighted third parties like heater manufacturers

in your recent press releases about sales. Can you talk about how many of these relationships we may have and how many of these may exist?

Jim Deller: That's a good question. I will answer this, Matt, answer

the best I can. So it is probably good to -- just to step back a little for everyone and explain sort of how the heater manufacturers

and the engineering companies fit into the industry. So you think of a typical client; let's pick one, name a supermajor. Let's say Chevron

has a heater, and he doesn't want to buy a heater, or else he'd go to a heater manufacturer and that heater manufacturer would then buy

burners to put into that heater and supply as part of a package. Or, if they own that heater and require work on the heater to change

its purpose or to meet new emissions requirements, they would typically go to one of those heater manufacturers or heater engineering

companies and outsource the work to them, and that company would then have a very prominent role in redesigning the heater and selecting

the equipment.

During the -- our remarks a few minutes ago, I talked to some extent

about Birwelco. Birwelco is a really good example of a very prominent heater manufacturer. They supply heaters, they do the engineering,

and they were very influential in the 26-burner order that we announced in that role.

So we -- yes, I do talk about them a lot because effectively, they

act as a sales channel for us. And as we sell products and new heater companies get involved in a ClearSign project, that's another heater

company that's aware of what we do and then can use our burners as part of their solution that they are constantly trying to sell to their

customers to get business for themselves.

So I need to go back and look through details, but we're probably at

a handful or half a dozen heater companies that we've worked with to date. I might be off by one or two, but somewhere in that order.

That's the easy part of the question. I think the question as to how

many are out there is a lot more open-ended. There's probably 10 to 15 heater and heater engineering companies that frequently engaged

in the U.S. market, but depending on how big the companies you include are, and where they are, the number will actually be much more

than that. And there are a lot of smaller bespoke engineering and heater companies as well. So that last part is, to be honest, difficult

to put a number to.

Matthew Selinger: The second question: In your press release today,

you stated an event in California next week to unveil independent data. Can you give more color?

Jim Deller: Well, first of all, thank you for reading the press release.

So this project in some ways is similar to the demonstration we ran at Zeeco last week, with some very significant differences. First

of all, fundamentally for us, it's focused on our boiler burner technology rather than the process burner. We have a -- or been part of

an ongoing burner comparison study that's being run by the California GET program to look at technologies to reduce NOx emissions and

to increase burner efficiency. Essentially, increasing efficiency is decarbonization. It's the saver of fuel, and that means less carbon.

So their -- that is really the focus of this program, is how can you decarbonize the boilers and achieve or maintain these exceptionally

low NOx numbers.

The program is run by GET and funded by them. The engineers were paid

by GET. It was hosted at our partner California Boiler's site. The data is owned by GET. They will be releasing a report, we believe sometime

in early September, and please follow us on LinkedIn; we will put announcements of that out. We will host that -- put that report out

on our website.

Also, the demonstration next week is the ClearSign technology operating

in a boiler -- it's one of the concluding activities of this GET program. They have managed this. They have been the ones primarily distributing

the invitee list and maintaining the list. We have, I think last count today, we had up to 80 attendees registered for that. Some of them

were the senior global refinery engineers that came into our Zeeco demonstration. Some of those are actually going out to California because

they're also interested in the boiler burner technology, so we got to talk about that at the same time. But the -- this is a big deal,

and especially the results. I don't have the exact data to share today, but having a burner that aids in decarbonization, is shown to

be more efficient and has this world-leading NOx level for a burner is a really big deal, in my opinion.

Operator: Thank you. There are no further questions at this time. I

would like to turn the conference back over to ClearSign's CEO, Mr. Jim Deller, for any closing remarks.

Jim Deller: Thank you, operator, and thank you, everyone, for your

interest and taking the time to participate today. We look forward to updating you regarding our developments and speaking with you all

on our next call.

Operator: This concludes today's call. Thank you for participating.

You may all disconnect.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

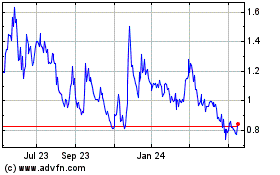

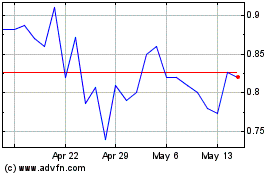

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Dec 2023 to Dec 2024