Clover Health Investments, Corp. (Nasdaq: CLOV) (“Clover,” “Clover

Health” or the “Company”), today reported financial results for the

third quarter 2024. Management will host a conference call today at

5:00 p.m. ET to discuss its operating results and other business

highlights.

"We delivered another strong quarter on all

metrics. This demonstrates the strength of our model during a

period where other approaches are facing significant headwinds,"

said Clover Health CEO Andrew Toy. "Underpinned by our ability to

use technology to empower any physician on a wide network, our

results position us to drive membership growth while maintaining

strong underlying financial performance. I am proud that, powered

by Clover Assistant, our health plans are anchored on identifying

and managing diseases as early as possible to better control the

total cost of care. This has also contributed to our market-leading

HEDIS performance and achievement of 4.0 Stars for our flagship PPO

plan for payment year 2026. We believe this validates our care

platform and positions us well to invest in growth in both our core

Insurance plans and Counterpart offering."

For the third quarter 2024, GAAP Net loss from

continuing operations improved to $8.8 million from $33.6 million

in the third quarter of 2023, and Adjusted EBITDA increased to

$19.3 million from $2.7 million in the third quarter of 2023. For

the year-to-date 2024 period, GAAP Net Loss from continuing

operations improved to $24.8 million from a loss of $142.2 million

year-to-date in 2023, and year-to-date Adjusted EBITDA increased to

$62.3 million in 2024 as compared to a loss of

$24.9 million in the 2023 comparable period. Insurance revenue

during the third quarter 2024 grew by 7% year-over-year to $322.6

million, and by 9% year-over-year to $1.0 billion on a year-to-date

basis, driven by strong member retention and continued intra-year

growth. Insurance BER in 2024 improved to 82.8% in the third

quarter and 80.6% year-to-date, as compared to 83.3% in the third

quarter and 86.2% in the year-to-date period of 2023.

"Our differentiated approach continues to drive

our underlying financial momentum," said Clover Health CFO Peter

Kuipers. "Strong execution during the third quarter drove

meaningful Adjusted EBITDA profitability improvement. As a result,

we have increased our full-year 2024 Adjusted EBITDA profitability

guidance. We believe that our strong financial profile and

momentum, combined with continued strong Stars performance for our

flagship PPO plan, sets us up well to invest in and return to

membership growth in 2025."

Key Company highlights are as follows:

|

Dollars in Millions |

|

3Q24 |

|

3Q23(1) |

|

Change Between (%) |

|

Insurance revenue |

|

$ |

322.6 |

|

|

$ |

301.2 |

|

|

7.1 |

% |

| Insurance net medical claims

incurred |

|

|

251.6 |

|

|

|

236.5 |

|

|

6.4 |

% |

| Total revenue |

|

|

331.0 |

|

|

|

306.0 |

|

|

8.2 |

% |

| Insurance MCR |

|

|

78.0 |

% |

|

|

78.5 |

% |

|

(50 bps) |

| Insurance BER(2) |

|

|

82.8 |

% |

|

|

83.3 |

% |

|

(50 bps) |

| Salaries and benefits plus

General and administrative expenses ("SG&A")(3) |

|

$ |

90.2 |

|

|

$ |

101.6 |

|

|

(11.2) |

% |

| Adjusted Salaries and benefits

plus General and administrative expenses ("Adjusted

SG&A")(4)(5) |

|

|

61.9 |

|

|

|

67.5 |

|

|

(8.3) |

% |

| Net loss from continuing

operations |

|

|

(8.8 |

) |

|

|

(33.6 |

) |

|

73.8 |

% |

| Adjusted EBITDA(5) |

|

|

19.3 |

|

|

|

2.7 |

|

|

614.8 |

% |

| Total restricted and

unrestricted cash, cash equivalents, and investments |

|

$ |

531.4 |

|

|

$ |

672.0 |

|

|

(20.9) |

% |

Financial Outlook

For full-year 2024, Clover Health is updating

its guidance as follows:

|

|

Current 2024 Guidance |

|

Previous 2024 Guidance |

| Insurance revenue |

$1.35 billion - $1.375 billion |

|

$1.35 billion - $1.375 billion |

| Insurance MCR |

76% - 77% |

|

77% - 79% |

| Insurance BER(5) |

81% - 82% |

|

81% - 83% |

| Adjusted SG&A(5) |

$290 million - $295 million |

|

$270 million - $280 million |

| Adjusted EBITDA(5) |

$55 million - $65 million |

|

$50 million - $65 million |

1 The results of operations for the Company's former

Non-Insurance segment have been reclassified as discontinued

operations for all periods presented due to the Company's decision

to not participate in the ACO Reach program for the 2024

performance year. Refer to Note 17 - Discontinued Operations within

the Company's most recent Form 10-Q for additional information.2

Insurance Benefits Expense Ratio (“BER”) is a Non-GAAP financial

measure. A reconciliation of BER to Insurance Net medical claims

incurred, net, the most directly comparable GAAP measure, is

provided in a table immediately following the consolidated

financial statements below. Additional information about the

Company's Non-GAAP financial measures can be found under the

caption "About Non-GAAP Financial Measures" below and in Appendix

A. Beginning in the second quarter 2024, the Company is presenting

Insurance BER. Management believes that by adding quality

improvement expenses into the Insurance BER calculation, this

offers a clearer and more accurate representation of our investment

in healthcare quality and member engagement, and more fully

captures the cost of maintaining and enhancing the quality of care

for our members.3 Salaries and benefits plus General and

administrative expenses ("SG&A") is the sum of Salaries and

benefits plus General and administrative expenses presented as the

GAAP measure in the condensed consolidated financial statements.4

Adjusted SG&A (Non-GAAP) and Adjusted EBITDA (Non-GAAP) are

Non-GAAP financial measures. Reconciliations of Adjusted SG&A

(Non-GAAP) to SG&A and Adjusted EBITDA (Non-GAAP) to Net loss

from continuing operations, respectively, the most directly

comparable GAAP measures, are provided in the tables immediately

following the consolidated financial statements below. Additional

information about the Company's Non-GAAP financial measures can be

found under the caption "About Non-GAAP Financial Measures" below

and in Appendix A.5 Reconciliations of projected Adjusted SG&A

(Non-GAAP) to projected SG&A, and projected Adjusted EBITDA

(Non-GAAP) to Net loss from continuing operations, the most

directly comparable GAAP measures, are not provided because

Stock-based compensation, which is excluded from Adjusted SG&A

(Non-GAAP) and Adjusted EBITDA (Non-GAAP), cannot be reasonably

calculated or predicted at this time without unreasonable efforts.

A reconciliation of projected Insurance BER (Non-GAAP) to projected

Net medical claims incurred, net, the most directly comparable GAAP

measure, is not provided because quality improvements, which are

included in Insurance BER (Non-GAAP), cannot be reasonably

calculated or predicted at this time without unreasonable efforts.

Additional information about the Company's Non-GAAP financial

measures can be found under the caption "About Non-GAAP Financial

Measures" below and in Appendix A.

Lives under Clover

Management

|

|

September 30, 2024 |

|

September 30, 2023 |

| Insurance members |

81,110 |

|

81,275 |

Earnings Conference Call Details

Clover Health’s management will host a

conference call to discuss its financial results on Wednesday,

November 6, at 5:00 PM Eastern Time. To access the call via

telephone please dial 800-579-2543 (for U.S. callers) or

785-424-1789 (for callers outside the U.S.) and enter the

conference ID: CLOVQ324. A live audio webcast will also be

available online at:

https://event.on24.com/wcc/r/4738366/21B4058D29B8D4F0F55BC3BAB4EA9B91

and related presentation materials will be available at Clover

Health’s Investor Relations website at investors.cloverhealth.com.

A replay of the call will be available via webcast for on-demand

listening shortly after the completion of the call, at the same web

link and at Clover Health’s Investor Relations website at

investors.cloverhealth.com, and will remain available for

approximately 12 months.

Upcoming Investor Events & Conferences

- 2024 UBS Global Healthcare Conference

at 5:00 p.m. Eastern Time, November 12, 2024

- Canaccord Genuity 2024 Medical Technology, Diagnostics, and

Digital Health Forum, November 21, 2024

- 2024 Virtual BTIG Digital Health Forum, November 25, 2024

- 2024 Citi Global Healthcare

Conference at 3:15 p.m. Eastern Time, December 3, 2024

Any live and archived webcasts and presentations associated with

the conferences listed above may be accessed on Clover Health’s

Investor Relations website at:

investors.cloverhealth.com/news-and-events/investor-events-presentations.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include statements

regarding future events and Clover Health's future results of

operations, financial condition, market size and opportunity,

business strategy and plans, and the factors affecting our

performance and our objectives for future operations.

Forward-looking statements are not guarantees of future performance

and you are cautioned not to place undue reliance on such

statements. In some cases, you can identify forward looking

statements because they contain words such as "may," "will,"

"should," "expects," "plans," "anticipates," "going to," "can,"

"could," "should," "would," "intends," "target," "projects,"

"contemplates," "believes," "estimates," "predicts," "potential,"

"outlook," "forecast," "guidance," "objective," "plan," "seek,"

"grow," "if," "continue" or the negative of these words or other

similar terms or expressions that concern Clover Health's

expectations, strategy, priorities, plans or intentions.

Forward-looking statements in this press release include, but are

not limited to, the following: statements under "Financial Outlook"

and statements regarding expectations relating to potential

improvements in Insurance MCR, operating expenses, Adjusted

SG&A, Insurance BER, and the number of Clover Health's

Insurance members, as well as the statements contained in the

quotations of our executive officers, future capital needs and

other expectations as to future performance, operations and results

(including our updated guidance for full-year 2024). Statements

regarding our Adjusted EBITDA profitability are also

forward-looking, and are based on our current targets which are

preliminary and are derived from our 2024 financial outlook. These

statements are subject to known and unknown risks, uncertainties

and other factors that may cause our actual results, levels of

activity, performance or achievements to differ materially from

results expressed or implied by forward-looking statements in this

press release. Forward-looking statements involve a number of

judgments, risks and uncertainties, including, without limitation,

risks related to: our expectations regarding results of operations,

financial condition, and cash flows; our expectations regarding the

development and management of our Insurance business; our ability

to successfully enter new service markets and manage our

operations; anticipated trends and challenges in our business and

in the markets in which we operate; our ability to effectively

manage our beneficiary base and provider network; our ability to

maintain and increase adoption and use of Clover Assistant,

including the expansion of Clover Assistant for external payors and

providers under the brand name Counterpart Assistant; the

anticipated benefits associated with the use of Clover Assistant,

including our ability to utilize the platform to manage our medical

care ratios; our ability to maintain or improve our Star Ratings or

otherwise continue to improve the financial performance of our

business; our ability to develop new features and functionality

that meet market needs and achieve market acceptance; our ability

to retain and hire necessary employees and staff our operations

appropriately; the timing and amount of certain investments in

growth; the outcome of any known and unknown litigation and

regulatory proceedings; any current, pending, or future

legislation, regulations or policies that could have a negative

effect on our revenue and businesses, including rules, regulations,

and policies relating to healthcare and Medicare; our ability to

maintain, protect, and enhance our intellectual property; general

economic conditions and uncertainty; persistent high inflation and

interest rates; and geopolitical uncertainty and instability.

Additional information concerning these and other risk factors is

contained under Item 1A. “Risk Factors” in our most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (the "SEC") on March 14, 2024, as such risks may be

updated in our subsequent filings with the SEC. The forward-looking

statements included in this press release are made as of the date

hereof. Except as required by law, Clover Health undertakes no

obligation to update any of these forward-looking statements after

the date of this press release or to conform these statements to

actual results or revised expectations.

About Non-GAAP Financial Measures

We use Non-GAAP measures including Insurance

BER, Adjusted EBITDA, Adjusted SG&A, and Adjusted SG&A as a

percentage of revenue. These Non-GAAP financial measures are

provided to enhance the reader's understanding of Clover Health's

past financial performance and our prospects for the future. Clover

Health's management team uses these Non-GAAP financial measures in

assessing Clover Health's performance, as well as in planning and

forecasting future periods. These Non-GAAP financial measures are

not computed according to GAAP, and the methods we use to compute

them may differ from the methods used by other companies. Non-GAAP

financial measures are supplemental to and should not be considered

a substitute for financial information presented in accordance with

generally accepted accounting principles in the United States

("GAAP") and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Readers are encouraged to review the reconciliations of these

Non-GAAP financial measures to the comparable GAAP measures, which

are attached to this release, together with other important

financial information, including our filings with the SEC, on the

Investor Relations page of our website at

investors.cloverhealth.com.

For a description of these Non-GAAP financial

measures, including the reasons management uses each measure,

please see Appendix A: "Explanation of Non-GAAP Financial

Measures."

The statements contained in this document are solely those of

the authors and do not necessarily reflect the views or policies of

CMS. The authors assume responsibility for the accuracy and

completeness of the information contained in this document.

About Clover Health:Clover

Health (Nasdaq: CLOV) is a physician enablement technology company

committed to bringing access to great healthcare to everyone on

Medicare. This includes a health equity-based focus on seniors who

have historically lacked access to affordable, high-quality

healthcare. Our strategy is powered by our software platform,

Clover Assistant, which is designed to aggregate patient data from

across the healthcare ecosystem to support clinical decision-making

and improve health outcomes through the early identification and

management of chronic disease. For our members, we provide PPO and

HMO Medicare Advantage plans in several states, with a

differentiated focus on our flagship wide-network, high-choice PPO

plans. For healthcare providers outside Clover Health's Medicare

Advantage plan, we aim to extend the benefits of our data-driven

technology platform to a wider audience via our subsidiary,

Counterpart Health, and to enable enhanced patient outcomes and

reduced healthcare costs on a nationwide scale. Clover Health has

published data demonstrating the technology’s impact on Medication

Adherence, as well as the earlier identification and management of

Diabetes and Chronic Kidney Disease.

Visit: www.cloverhealth.com

Investor Relations Contact:Ryan

Schmidtinvestors@cloverhealth.com

Press Contact:Andrew

Still-Baxterpress@cloverhealth.com

|

CLOVER HEALTH INVESTMENTS, CORP.CONDENSED CONSOLIDATED BALANCE

SHEETS(Dollars in thousands, except share amounts) |

|

|

|

|

September 30,

2024(Unaudited) |

|

December 31, 2023 |

|

Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

287,956 |

|

$ |

116,407 |

|

Short-term investments |

|

1,779 |

|

|

12,218 |

|

Investment securities, available-for-sale (Amortized cost: 2024:

$43,695; 2023: $101,412) |

|

43,302 |

|

|

100,702 |

|

Investment securities, held-to-maturity (Fair value: 2024: $15;

2023: $6,778) |

|

15 |

|

|

6,902 |

|

Accrued retrospective premiums |

|

20,963 |

|

|

22,076 |

|

Other receivables |

|

14,962 |

|

|

16,666 |

|

Healthcare receivables |

|

37,314 |

|

|

64,164 |

|

Surety bonds and deposits |

|

596 |

|

|

542 |

|

Prepaid expenses |

|

12,949 |

|

|

14,418 |

|

Other assets, current |

|

2,804 |

|

|

1,404 |

|

Assets related to discontinued operations |

|

10,087 |

|

|

72,471 |

|

Total current assets |

|

432,727 |

|

|

427,970 |

| |

|

|

|

|

Investment securities, available-for-sale (Amortized cost: 2024:

$182,840; 2023: $121,868) |

|

184,085 |

|

|

120,208 |

|

Investment securities, held-to-maturity (Fair value: 2024: $14,178;

2023: $692) |

|

14,294 |

|

|

793 |

|

Property and equipment, net |

|

5,336 |

|

|

5,082 |

|

Operating lease right-of-use assets |

|

2,585 |

|

|

3,382 |

|

Other intangible assets |

|

2,990 |

|

|

2,990 |

|

Other assets, non-current |

|

10,996 |

|

|

10,246 |

|

Total assets |

$ |

653,013 |

|

$ |

570,671 |

|

CLOVER HEALTH INVESTMENTS, CORP.CONDENSED CONSOLIDATED BALANCE

SHEETS(Dollars in thousands, except share amounts) |

|

|

|

|

September 30,

2024(Unaudited) |

|

December 31, 2023 |

|

Liabilities and Stockholders' Equity |

|

|

|

| Current liabilities |

|

|

|

|

Unpaid claims |

$ |

166,070 |

|

|

$ |

135,737 |

|

|

Due to related parties, net |

|

1,340 |

|

|

|

1,363 |

|

|

Accounts payable and accrued expenses |

|

25,746 |

|

|

|

37,184 |

|

|

Accrued salaries and benefits |

|

35,340 |

|

|

|

20,951 |

|

|

Deferred revenue |

|

17 |

|

|

|

3,099 |

|

|

Operating lease liabilities |

|

1,345 |

|

|

|

1,665 |

|

|

Other liabilities, current |

|

836 |

|

|

|

1,017 |

|

|

Liabilities related to discontinued operations |

|

48,941 |

|

|

|

60,099 |

|

|

Total current liabilities |

|

279,635 |

|

|

|

261,115 |

|

| |

|

|

|

|

Long-term operating lease liabilities |

|

2,321 |

|

|

|

2,998 |

|

|

Other liabilities, non-current |

|

28,891 |

|

|

|

20,164 |

|

|

Total liabilities |

|

310,847 |

|

|

|

284,277 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity |

|

|

|

|

Class A Common Stock, $0.0001 par value; 2,500,000,000 shares

authorized at September 30, 2024 and December 31, 2023;

411,256,965 and 401,183,882 issued and outstanding at

September 30, 2024 and December 31, 2023,

respectively |

|

41 |

|

|

|

40 |

|

|

Class B Common Stock, $0.0001 par value; 500,000,000 shares

authorized at September 30, 2024 and December 31, 2023;

89,032,305 and 87,867,732 issued and outstanding at

September 30, 2024 and December 31, 2023,

respectively |

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

2,546,167 |

|

|

|

2,461,238 |

|

|

Accumulated other comprehensive loss |

|

852 |

|

|

|

(2,370 |

) |

|

Accumulated deficit |

|

(2,180,711 |

) |

|

|

(2,159,794 |

) |

|

Less: Treasury stock, at cost; 16,817,010 and 7,912,750 shares held

at September 30, 2024 and December 31, 2023,

respectively |

|

(24,192 |

) |

|

|

(12,729 |

) |

|

Total stockholders' equity |

|

342,166 |

|

|

|

286,394 |

|

|

Total liabilities and stockholders' equity |

$ |

653,013 |

|

|

$ |

570,671 |

|

|

CLOVER HEALTH INVESTMENTS, CORP. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

(Unaudited) |

|

(Dollars in thousands, except per share and share amounts) |

|

|

|

|

|

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Premiums

earned, net (Net of ceded premiums of $97 and $106 for the three

months ended September 30, 2024 and 2023, respectively; net of

ceded premiums of $301 and $341 for the nine months ended September

30, 2024 and 2023, respectively) |

$ |

322,579 |

|

|

$ |

301,230 |

|

|

$ |

1,014,201 |

|

|

$ |

932,699 |

|

|

Other income |

|

8,407 |

|

|

|

4,798 |

|

|

|

19,967 |

|

|

|

15,459 |

|

|

Total revenues |

|

330,986 |

|

|

|

306,028 |

|

|

|

1,034,168 |

|

|

|

948,158 |

|

| |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Net medical claims incurred |

|

249,774 |

|

|

|

235,785 |

|

|

|

763,283 |

|

|

|

754,836 |

|

|

Salaries and benefits |

|

54,995 |

|

|

|

60,567 |

|

|

|

169,717 |

|

|

|

191,985 |

|

|

General and administrative expenses |

|

35,201 |

|

|

|

41,030 |

|

|

|

124,194 |

|

|

|

140,384 |

|

|

Premium deficiency reserve expense (benefit) |

|

— |

|

|

|

392 |

|

|

|

— |

|

|

|

(6,556 |

) |

|

Depreciation and amortization |

|

339 |

|

|

|

557 |

|

|

|

987 |

|

|

|

1,835 |

|

|

Restructuring (recoveries) costs |

|

(538 |

) |

|

|

1,313 |

|

|

|

288 |

|

|

|

7,870 |

|

|

Total operating expenses |

|

339,771 |

|

|

|

339,644 |

|

|

|

1,058,469 |

|

|

|

1,090,354 |

|

|

Loss from continuing operations |

|

(8,785 |

) |

|

|

(33,616 |

) |

|

|

(24,301 |

) |

|

|

(142,196 |

) |

| |

|

|

|

|

|

|

|

| Change

in fair value of warrants |

|

— |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

| Interest

expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7 |

|

| Loss on

investment |

|

— |

|

|

|

— |

|

|

|

467 |

|

|

|

— |

|

|

Net loss from continuing operations |

|

(8,785 |

) |

|

|

(33,616 |

) |

|

|

(24,785 |

) |

|

|

(142,203 |

) |

|

Net (loss) income from discontinued operations |

|

(370 |

) |

|

|

(7,853 |

) |

|

|

3,868 |

|

|

|

(686 |

) |

|

Net loss |

$ |

(9,155 |

) |

|

$ |

(41,469 |

) |

|

$ |

(20,917 |

) |

|

$ |

(142,889 |

) |

| |

|

|

|

|

|

|

|

| Per

share data: |

|

|

|

|

|

|

|

|

Basic weighted average number of Class A and Class B common shares

and common share equivalents outstanding |

|

490,180,103 |

|

|

|

480,770,283 |

|

|

|

488,501,812 |

|

|

|

480,921,520 |

|

|

Diluted weighted average number of Class A and Class B common

shares and common share equivalents outstanding |

|

490,180,103 |

|

|

|

480,770,283 |

|

|

|

488,501,812 |

|

|

|

480,921,520 |

|

|

Continuing operations: |

|

|

|

|

|

|

|

|

Basic loss per share |

$ |

(0.02 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.30 |

) |

|

Diluted loss per share |

|

(0.02 |

) |

|

|

(0.07 |

) |

|

|

(0.05 |

) |

|

|

(0.30 |

) |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

0.00 |

|

|

|

(0.02 |

) |

|

|

0.01 |

|

|

|

0.00 |

|

|

Diluted earnings (loss) per share |

|

0.00 |

|

|

|

(0.02 |

) |

|

|

0.01 |

|

|

|

0.00 |

|

| |

|

|

|

|

|

|

|

| Net

unrealized gain on available-for-sale investments |

|

3,111 |

|

|

|

1,643 |

|

|

|

3,222 |

|

|

|

4,302 |

|

|

Comprehensive loss |

$ |

(6,044 |

) |

|

$ |

(39,826 |

) |

|

$ |

(17,695 |

) |

|

$ |

(138,587 |

) |

|

Operating

Segments |

| |

| |

|

Insurance |

|

Corporate/Other |

|

Eliminations |

|

Consolidated Total |

| Three Months Ended

September 30, 2024 |

|

(in thousands) |

|

Premiums earned, net (Net of ceded premiums of $97) |

|

$ |

322,579 |

|

$ |

— |

|

$ |

— |

|

|

$ |

322,579 |

| Other income |

|

|

4,314 |

|

|

32,422 |

|

|

(28,329 |

) |

|

|

8,407 |

| Intersegment revenues |

|

|

— |

|

|

46,944 |

|

|

(46,944 |

) |

|

|

— |

| Net medical claims

incurred |

|

|

251,643 |

|

|

4,442 |

|

|

(6,311 |

) |

|

|

249,774 |

| Gross profit (loss) |

|

$ |

75,250 |

|

$ |

74,924 |

|

$ |

(68,962 |

) |

|

$ |

81,212 |

|

CLOVER HEALTH INVESTMENTS, CORP.CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS(Unaudited)(Dollars in thousands) |

|

|

|

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

Net loss |

$ |

(20,917 |

) |

|

$ |

(142,889 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization expense |

|

987 |

|

|

|

1,835 |

|

|

Stock-based compensation |

|

84,686 |

|

|

|

107,795 |

|

|

Change in fair value of warrants and amortization of warrants |

|

17 |

|

|

|

— |

|

|

Accretion, net of amortization |

|

(2,140 |

) |

|

|

(3,096 |

) |

|

Accrued interest earned |

|

(354 |

) |

|

|

— |

|

|

Net realized gains on investment securities |

|

(174 |

) |

|

|

(20 |

) |

|

Loss on investment |

|

467 |

|

|

|

— |

|

|

Premium deficiency reserve |

|

— |

|

|

|

(6,556 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Accrued retrospective premiums |

|

1,113 |

|

|

|

4,741 |

|

|

Other receivables |

|

1,704 |

|

|

|

8,836 |

|

|

Surety bonds and deposits |

|

(54 |

) |

|

|

(17 |

) |

|

Prepaid expenses |

|

1,469 |

|

|

|

2,920 |

|

|

Other assets |

|

(2,640 |

) |

|

|

5,244 |

|

|

Healthcare receivables |

|

26,850 |

|

|

|

18,534 |

|

|

Operating lease right-of-use assets |

|

797 |

|

|

|

405 |

|

|

Unpaid claims |

|

30,310 |

|

|

|

(24,164 |

) |

|

Accounts payable and accrued expenses |

|

(11,438 |

) |

|

|

2,851 |

|

|

Accrued salaries and benefits |

|

14,389 |

|

|

|

371 |

|

|

Deferred revenue |

|

(3,082 |

) |

|

|

103,295 |

|

|

Other liabilities |

|

8,546 |

|

|

|

179 |

|

|

Operating lease liabilities |

|

(997 |

) |

|

|

(900 |

) |

| Net cash provided by operating

activities from continuing operations |

|

129,539 |

|

|

|

79,364 |

|

| Net cash (used in) provided by

operating activities from discontinued operations |

|

(8,861 |

) |

|

|

34,060 |

|

| Net cash provided by operating

activities |

|

120,678 |

|

|

|

113,424 |

|

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Purchases of short-term investments, available-for-sale, and

held-to-maturity securities |

|

(153,347 |

) |

|

|

(142,359 |

) |

|

Proceeds from sales of short-term investments and

available-for-sale securities |

|

47,804 |

|

|

|

60,436 |

|

|

Proceeds from maturities of short-term investments,

available-for-sale, and held-to-maturity securities |

|

108,788 |

|

|

|

139,122 |

|

|

Purchases of property and equipment |

|

(1,241 |

) |

|

|

(848 |

) |

| Net cash provided by investing

activities |

|

2,004 |

|

|

|

56,351 |

|

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Issuance of common stock, net of early exercise liability |

|

243 |

|

|

|

1,149 |

|

|

Repurchases of common stock |

|

(1,772 |

) |

|

|

— |

|

|

Treasury stock acquired |

|

(9,691 |

) |

|

|

(5,393 |

) |

| Net cash used in financing

activities |

|

(11,220 |

) |

|

|

(4,244 |

) |

| |

|

|

|

| Net increase in cash, cash

equivalents, and restricted cash for discontinued and continuing

operations |

|

111,462 |

|

|

|

165,531 |

|

| Cash, cash equivalents, and

restricted cash, beginning of period for discontinued and

continuing operations |

|

176,494 |

|

|

|

186,213 |

|

| Cash, cash equivalents, and

restricted cash, end of period for discontinued and continuing

operations |

$ |

287,956 |

|

|

$ |

351,744 |

|

| |

|

|

|

| Reconciliation of cash and

cash equivalents and restricted cash for discontinued and

continuing operations |

|

|

|

|

Cash and cash equivalents |

$ |

287,956 |

|

|

$ |

299,014 |

|

|

Restricted cash |

|

— |

|

|

|

52,730 |

|

|

Total cash, cash equivalents, and restricted cash for discontinued

and continuing operations |

$ |

287,956 |

|

|

$ |

351,744 |

|

| Supplemental disclosure of

non-cash activities |

|

|

|

|

Performance year receivable |

$ |

— |

|

|

$ |

(185,404 |

) |

|

Performance year obligation |

|

— |

|

|

|

185,404 |

|

|

CLOVER HEALTH INVESTMENTS, CORP. |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

ADJUSTED EBITDA (NON-GAAP) RECONCILIATION |

|

(in thousands)(1) |

| |

|

|

|

| |

Three Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss

from continuing operations (GAAP): |

$ |

(8,785 |

) |

|

$ |

(33,616 |

) |

|

Adjustments |

|

|

|

|

Depreciation and amortization |

|

339 |

|

|

|

557 |

|

|

Stock-based compensation |

|

27,988 |

|

|

|

33,070 |

|

|

Premium deficiency reserve expense |

|

— |

|

|

|

392 |

|

|

Restructuring (recoveries) costs |

|

(538 |

) |

|

|

1,313 |

|

|

Non-recurring legal expenses and settlements |

|

259 |

|

|

|

1,007 |

|

|

Adjusted EBITDA (Non-GAAP) |

$ |

19,263 |

|

|

$ |

2,723 |

|

|

(1) |

The table

above includes Non-GAAP measures. Non-GAAP financial measures are

supplemental and should not be considered a substitute for

financial information presented in accordance with GAAP. For a

detailed explanation of these Non-GAAP measures, see Appendix

A. |

|

CLOVER HEALTH INVESTMENTS, CORP.RECONCILIATION OF NON-GAAP

FINANCIAL MEASURESADJUSTED SG&A (NON-GAAP) RECONCILIATION(in

thousands)(1) |

| |

|

| |

Three Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Salaries and benefits |

$ |

54,995 |

|

|

$ |

60,567 |

|

| General and administrative

expenses |

|

35,201 |

|

|

|

41,030 |

|

|

Total SG&A (GAAP) |

|

90,196 |

|

|

|

101,597 |

|

| Adjustments |

|

|

|

|

Stock-based compensation |

|

(27,988 |

) |

|

|

(33,070 |

) |

|

Non-recurring legal expenses and settlements |

|

(259 |

) |

|

|

(1,007 |

) |

|

Adjusted SG&A (Non-GAAP) |

$ |

61,949 |

|

|

$ |

67,520 |

|

| |

|

|

|

| Total revenues (GAAP) |

$ |

330,986 |

|

|

$ |

306,028 |

|

| Adjusted SG&A (Non-GAAP)

as a percentage of revenue |

|

19 |

% |

|

|

22 |

% |

|

(1) |

The table

above includes Non-GAAP measures. Non-GAAP financial measures are

supplemental and should not be considered a substitute for

financial information presented in accordance with GAAP. For a

detailed explanation of these Non-GAAP measures, see Appendix

A. |

|

CLOVER HEALTH INVESTMENTS, CORP. |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

INSURANCE BENEFITS EXPENSE RATIO (NON-GAAP) RECONCILIATION |

|

(in thousands)(1) |

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net medical claims incurred, net

(GAAP): |

$ |

251,643 |

|

|

$ |

236,533 |

|

| Adjustments |

|

|

|

|

Quality improvements |

|

15,445 |

|

|

|

14,363 |

|

|

Insurance benefits expense, net (Non-GAAP) |

$ |

267,088 |

|

|

$ |

250,896 |

|

| |

|

|

|

| Premiums earned, net (GAAP) |

$ |

322,579 |

|

|

$ |

301,230 |

|

| Insurance benefits expense ratio,

net (Non-GAAP) |

|

82.8 |

% |

|

|

83.3 |

% |

|

(1) |

The table

above includes Non-GAAP measures. Non-GAAP financial measures are

supplemental and should not be considered a substitute for

financial information presented in accordance with GAAP. For a

detailed explanation of these Non-GAAP measures, see Appendix

A. |

CLOVER HEALTH INVESTMENTS, CORP.Appendix

AExplanation of Non-GAAP Financial Measures

Non-GAAP Definitions

Adjusted EBITDA - A Non-GAAP financial measure

defined by us as net loss from continuing operations before

depreciation and amortization, loss on investment, stock-based

compensation, premium deficiency reserve expense (benefit),

restructuring (recoveries) costs, and non-recurring legal expenses

and settlements. Adjusted EBITDA is a key measure used by our

management team and the board of directors to understand and

evaluate our operating performance and trends, to prepare and

approve our annual budget and to develop short and long-term

operating plans. In particular, we believe that the exclusion of

the amounts eliminated in calculating Adjusted EBITDA provide

useful measures for period-to-period comparisons of our business.

Accordingly, we believe that Adjusted EBITDA provides investors and

others useful information to understand and evaluate our operating

results in the same manner as our management and our board of

directors.

Adjusted SG&A - A Non-GAAP financial measure

defined by us as total SG&A less stock-based compensation and

non-recurring legal expenses and settlements. We believe that

Adjusted SG&A provides management, investors, and others a

useful view of our operating spend as it excludes non-cash,

stock-based compensation and expenses related to investments that

management believes do not reflect the Company's core operating

expenses. We believe that Adjusted SG&A as a percentage of

revenue is useful to management, investors, and others because it

allows us to measure our operational leverage as revenue

scales.

Insurance Benefits Expense Ratio - A Non-GAAP

financial measure defined by us as benefits expense ratio ("BER").

We calculate our Insurance BER by taking the total of Insurance net

medical expenses incurred and quality improvements, and dividing

that total by premiums earned on a net basis, in a given period.

Quality improvements include expenses associated with activities

that improve health outcomes, as defined by the U.S. Department of

Health and Human Services ("HHS"), as well as those directly tied

to enhancing healthcare quality, such as the Company's spend on

health information technology, wellness and prevention programs,

initiatives to reduce hospital readmissions, and our clinically

focused Member Rewards program. We believe our Insurance BER is

useful to management, investors, and others because it offers a

clearer and more accurate representation of our investment in

healthcare quality and member engagement, and gives a comprehensive

view of costs related to maintaining and improving the quality of

care of our members, which is crucial for sustaining member

satisfaction and adherence to treatment regimens.

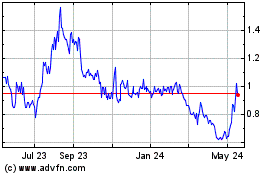

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Jan 2025 to Feb 2025

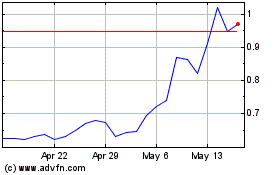

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Feb 2024 to Feb 2025