Form 8-K - Current report

July 31 2024 - 4:00PM

Edgar (US Regulatory)

false

0001759186

0001759186

2024-07-30

2024-07-30

0001759186

us-gaap:CommonStockMember

2024-07-30

2024-07-30

0001759186

us-gaap:WarrantMember

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

July 30, 2024

_____________________

COEPTIS THERAPEUTICS HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39669 |

98-1465952 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

105 Bradford Rd, Suite 420

Wexford, Pennsylvania |

|

15090 |

| (Address of principal executive offices) |

|

(Zip Code) |

724-934-6467

(Registrant’s telephone number, including area code)

____________________________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

|

Common Stock, par value $0.0001 per share |

|

COEP

|

|

Nasdaq

Capital Market |

| Warrants,

each whole warrant exercisable for one-half of one share of Common Stock for $11.50 per whole share |

|

COEPW |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As

previously disclosed, on January 29, 2024, Coeptis Therapeutics Holdings, Inc. (the “Company”) received a letter from the

Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of

the Company’s common stock, par value $0.0001 per share (“Common Stock”), for the last 30 consecutive business days,

the Company was not in compliance with the requirement to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price

Requirement”) for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Original

Notice”). At that time, the Company was provided a compliance period of 180 calendar days from the date of the Original Notice,

or until July 29, 2024, to regain compliance with the Minimum Bid Price Requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A).

As

the Company did not regain compliance with the Minimum Bid Price Requirement by July 29, 2024, and it was determined that the Company

is not eligible for another 180 calendar-day extension because it did not meet the minimum stockholders’ equity initial listing

requirements of $5,000,000 for Nasdaq, as set forth under Nasdaq Listing Rule 5505(b), the Company received a delisting determination

letter on July 30, 2024 (the “Delisting Determination Letter”).

The Delisting Determination Letter states that

unless the Company requests a hearing before a Nasdaq Hearing Panel (“Panel”) to appeal Nasdaq’s delisting determination

by August 6, 2024, trading of the Common Stock will be suspended at the opening of business on August 8, 2024, and the Common Stock will

be delisted from Nasdaq.

The Company intends to request a hearing before

the Panel at which it will request a suspension of delisting pending its return to compliance. Pursuant to Nasdaq Listing Rule 5815(a)(1)(B),

the Company expects that its hearing request will stay the suspension of trading and delisting of the Common Stock pending the conclusion

of the hearing process. Consequently, the Company expects the Common Stock to remain listed on Nasdaq at least until the Panel renders

a decision following the hearing.

The Company intends to provide a plan to regain

compliance to the Panel, including, subject to approval of the Company’s Board of Directors and its stockholders, implementing a

reverse stock split, should it be necessary.

There can be no assurance that the Company will

be able to regain compliance with the Minimum Bid Price Requirement or will otherwise be in compliance with other applicable Nasdaq listing

rules, that the Company will be able to successfully implement a reverse stock split if it decides to pursue one, that the Panel will

grant the Company’s request for a suspension of delisting on Nasdaq, or that the Company’s appeal of the delisting determination

will be successful.

Forward-Looking Statements

This Current Report contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can be identified

by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,”

“estimates,” “projects,” “forecasts,” “expects,” “plans,” “proposes”

and similar expressions. Forward-looking statements contained in this Current Report include statements regarding its intent and ability

to regain compliance with the Minimum Bid Price Requirement or will otherwise be in compliance with other applicable Nasdaq listing rules,

successfully implement a reverse stock split, or successfully appeal the delisting determination, and regarding the Panel’s grant

of the Company’s request for a suspension of delisting on Nasdaq. Although the Company believes that the expectations reflected

in these forward-looking statements are based on reasonable assumptions, there are a number of risks, uncertainties and other important

factors that could cause actual results to differ materially from such forward-looking statements, including the risk that the Company

may not be successful in its appeal to a Panel, the risk that the Company may not otherwise meet the requirements for continued listing

under the Nasdaq Listing Rules, the risk that Nasdaq may not grant the Company relief from delisting if necessary, and the risk that the

Company may not ultimately meet applicable Nasdaq requirements if any such relief is necessary, among other risks, uncertainties, and

important factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, as updated by its other filings with the Securities and Exchange Commission. Forward-looking statements speak

only as of the date of the document in which they are contained, and the Company does not undertake any duty to update any forward-looking

statements, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Coeptis Therapeutics Holdings, Inc. |

| |

|

|

| Date: July 31, 2024 |

By: |

/s/ David Mehalick |

| |

|

David Mehalick

Chief Executive Officer |

v3.24.2

Cover

|

Jul. 30, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity File Number |

001-39669

|

| Entity Registrant Name |

COEPTIS THERAPEUTICS HOLDINGS, INC.

|

| Entity Central Index Key |

0001759186

|

| Entity Tax Identification Number |

98-1465952

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

105 Bradford Rd

|

| Entity Address, Address Line Two |

Suite 420

|

| Entity Address, City or Town |

Wexford

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

15090

|

| City Area Code |

724

|

| Local Phone Number |

934-6467

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

COEP

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Title of 12(b) Security |

Warrants,

each whole warrant exercisable for one-half of one share of Common Stock for $11.50 per whole share

|

| Trading Symbol |

COEPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

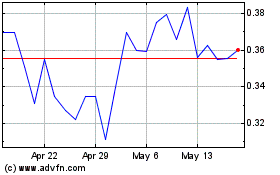

Coeptis Therapeutics (NASDAQ:COEP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Coeptis Therapeutics (NASDAQ:COEP)

Historical Stock Chart

From Dec 2023 to Dec 2024