UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024

Commission File Number: 001-40712

Cardiol Therapeutics

Inc.

(Translation of registrant's name into English)

602-2265 Upper Middle Road East, Oakville,

Ontario, Canada L6H 0G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

x Form 20-F ¨

Form 40-F

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CARDIOL THERAPEUTICS INC. |

| |

(Registrant) |

| |

|

|

|

| Date: August 12, 2024 |

By: |

/s/ Chris Waddick |

| |

|

Name: |

Chris Waddick |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

CARDIOL THERAPEUTICS

INC.

CONDENSED INTERIM

CONSOLIDATED

FINANCIAL STATEMENTS

THREE AND SIX

MONTHS ENDED

JUNE 30, 2024

(EXPRESSED IN

CANADIAN DOLLARS)

(UNAUDITED)

Cardiol Therapeutics Inc.

Condensed Interim

Consolidated Statements of Financial Position

(Expressed

in Canadian Dollars)

Unaudited

| | |

As

at

June 30,

2024 | | |

As at

December 31,

2023 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents

(note 3) | |

$ | 24,021,237 | | |

$ | 34,931,778 | |

| Accounts receivable | |

| 93,651 | | |

| 142,745 | |

| Other receivables | |

| 148,773 | | |

| 137,127 | |

| Prepaid expenses | |

| 1,617,854 | | |

| 941,442 | |

| Total current assets | |

| 25,881,515 | | |

| 36,153,092 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Property and equipment (note 4) | |

| 263,009 | | |

| 337,058 | |

| Intangible assets

(note 5) | |

| 168,136 | | |

| 210,358 | |

| Total assets | |

$ | 26,312,660 | | |

$ | 36,700,508 | |

| | |

| | | |

| | |

EQUITY

AND LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities

(note 14) | |

$ | 9,431,457 | | |

$ | 8,041,485 | |

| Current portion of lease liability

(note 6) | |

| 21,719 | | |

| 15,808 | |

| Derivative liability

(note 7) | |

| 1,355,732 | | |

| 238,176 | |

| Total current liabilities | |

| 10,808,908 | | |

| 8,295,469 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Lease liability

(note 6) | |

| 142,554 | | |

| 158,532 | |

| Total liabilities | |

| 10,951,462 | | |

| 8,454,001 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

Share

capital (note 8) | |

| 152,349,535 | | |

| 148,519,136 | |

| Warrants (note 10) | |

| - | | |

| 3,517,867 | |

| Contributed surplus | |

| 21,358,970 | | |

| 18,786,306 | |

| Deficit | |

| (158,347,307 | ) | |

| (142,576,802 | ) |

| Total equity | |

| 15,361,198 | | |

| 28,246,507 | |

| Total equity

and liabilities | |

$ | 26,312,660 | | |

$ | 36,700,508 | |

The accompanying

notes to the unaudited condensed interim consolidated financial statements are an integral part of these consolidated financial statements.

Commitments (notes 5 and 12)

Subsequent events (note 9)

Approved on behalf of the Board:

| "David Elsley",

Director |

|

"Guillermo Torre-Amione",

Director |

Cardiol Therapeutics Inc.

Condensed Interim Consolidated Statements

of Loss and Comprehensive Loss

(Expressed in Canadian Dollars)

Unaudited

| | |

Three

Months Ended | | |

Three

Months Ended | | |

Six

Months Ended | | |

Six

Months Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses (notes 9, 13,

14) | |

| | |

| | |

| | |

| |

| General and administration | |

| 5,031,702 | | |

| 2,835,264 | | |

| 10,114,254 | | |

| 6,493,704 | |

| Research and development | |

| 2,709,644 | | |

| 3,479,385 | | |

| 6,032,573 | | |

| 7,607,081 | |

| Loss before other income | |

| (7,741,346 | ) | |

| (6,314,649 | ) | |

| (16,146,827 | ) | |

| (14,100,785 | ) |

| Interest income | |

| 307,409 | | |

| 528,697 | | |

| 684,703 | | |

| 1,074,624 | |

| Gain (loss) on foreign exchange | |

| 152,017 | | |

| (828,909 | ) | |

| 780,952 | | |

| (752,117 | ) |

| Change in derivative liability (note

7) | |

| 691,047 | | |

| (856,893 | ) | |

| (1,117,556 | ) | |

| (782,812 | ) |

| Other income | |

| - | | |

| - | | |

| 28,223 | | |

| - | |

| Net loss and

comprehensive loss for the period | |

$ | (6,590,873 | ) | |

$ | (7,471,754 | ) | |

$ | (15,770,505 | ) | |

$ | (14,561,090 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Basic

and diluted net loss per share (note 11) | |

$ | (0.10 | ) | |

$ | (0.12 | ) | |

$ | (0.23 | ) | |

$ | (0.23 | ) |

| Weighted

average number of common shares outstanding | |

| 68,751,105 | | |

| 64,105,448 | | |

| 68,005,224 | | |

| 64,098,586 | |

The accompanying

notes to the unaudited condensed interim consolidated financial statements are an integral part of these consolidated financial statements.

Cardiol Therapeutics Inc.

Condensed Interim

Consolidated Statements of Cash Flows

(Expressed

in Canadian Dollars)

Unaudited

| | |

Six Months | | |

Six Months | |

| | |

Ended | | |

Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | |

| Operating activities | |

| | | |

| | |

| Net loss and comprehensive loss for the period | |

$ | (15,770,505 | ) | |

$ | (14,561,090 | ) |

| Adjustments for: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 81,309 | | |

| 74,479 | |

| Amortization of intangible assets | |

| 42,222 | | |

| 42,222 | |

| Share-based compensation | |

| 2,707,686 | | |

| 1,093,223 | |

| Change in derivative liability | |

| 1,117,556 | | |

| 782,812 | |

| Unrealized foreign exchange gain on

cash | |

| (640,778 | ) | |

| (849,290 | ) |

| Accretion on lease liability | |

| 13,006 | | |

| 3,011 | |

| Shares for services | |

| - | | |

| 16,449 | |

| Changes in non-cash working capital items: | |

| | | |

| | |

| Accounts receivable | |

| 49,094 | | |

| 21,579 | |

| Other receivables | |

| (11,646 | ) | |

| 153,549 | |

| Prepaid expenses | |

| (676,412 | ) | |

| 87,864 | |

| Accounts payable and accrued liabilities | |

| 1,389,972 | | |

| (2,165,963 | ) |

| Net cash used in operating activities | |

| (11,698,496 | ) | |

| (15,301,155 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (7,260 | ) | |

| (48,029 | ) |

| Net cash used in investing activities | |

| (7,260 | ) | |

| (48,029 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Proceeds from stock options exercised | |

| 177,510 | | |

| - | |

| Payment of lease liability | |

| (23,073 | ) | |

| (27,688 | ) |

| Net cash provided by (used in) financing activities | |

| 154,437 | | |

| (27,688 | ) |

| Net change in cash and cash equivalents | |

| (11,551,319 | ) | |

| (15,376,872 | ) |

| Cash and cash equivalents, beginning of period | |

| 34,931,778 | | |

| 59,469,868 | |

| Impact of foreign exchange on cash and cash equivalents | |

| 640,778 | | |

| 849,290 | |

| Cash and cash equivalents, end

of period | |

$ | 24,021,237 | | |

$ | 44,942,286 | |

The accompanying notes to the unaudited

condensed interim consolidated financial statements are an integral part of these consolidated financial statements.

Cardiol

Therapeutics Inc.

Condensed

Interim Consolidated Statements of Changes in Equity

(Expressed

in Canadian Dollars)

Unaudited

| |

|

Share capital | | |

| | |

Contributed | | |

| | |

| |

| |

|

Number |

| |

Amount | | |

Warrants | | |

surplus | | |

Deficit | | |

Total | |

| Balance, December 31, 2022 | |

64,042,536 | | |

$ | 147,545,399 | | |

$ | 3,517,867 | | |

$ | 15,586,832 | | |

$ | (114,448,510 | ) | |

$ | 52,201,588 | |

| Restricted share units exercised | |

80,000 | | |

| 112,800 | | |

| - | | |

| (112,800 | ) | |

| - | | |

| - | |

| Shares for services | |

5,000 | | |

| 16,449 | | |

| - | | |

| - | | |

| - | | |

| 16,449 | |

| Share-based compensation (note 9) | |

- | | |

| - | | |

| - | | |

| 1,093,223 | | |

| - | | |

| 1,093,223 | |

| Net loss and comprehensive loss for

the period | |

- | | |

| - | | |

| - | | |

| - | | |

| (14,561,090 | ) | |

| (14,561,090 | ) |

| Balance, June 30, 2023 | |

64,127,536 | | |

$ | 147,674,648 | | |

$ | 3,517,867 | | |

$ | 16,567,255 | | |

$ | (129,009,600 | ) | |

$ | 38,750,170 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

65,352,279 | | |

$ | 148,519,136 | | |

$ | 3,517,867 | | |

$ | 18,786,306 | | |

$ | (142,576,802 | ) | |

$ | 28,246,507 | |

| Fair value of expired warrants | |

- | | |

| - | | |

| (3,517,867 | ) | |

| 3,517,867 | | |

| - | | |

| - | |

| Restricted share units exercised | |

1,596,034 | | |

| 1,919,588 | | |

| - | | |

| (1,919,588 | ) | |

| - | | |

| - | |

| Stock options exercised | |

175,000 | | |

| 177,510 | | |

| - | | |

| - | | |

| - | | |

| 177,510 | |

| Fair value of stock options exercised | |

- | | |

| 99,263 | | |

| - | | |

| (99,263 | ) | |

| - | | |

| - | |

| Share-based compensation (note 9) | |

- | | |

| - | | |

| - | | |

| 2,707,686 | | |

| - | | |

| 2,707,686 | |

| Performance share units exercised | |

2,200,000 | | |

| 1,634,038 | | |

| - | | |

| (1,634,038 | ) | |

| - | | |

| - | |

| Net loss and comprehensive loss for

the period | |

- | | |

| - | | |

| - | | |

| - | | |

| (15,770,505 | ) | |

| (15,770,505 | ) |

| Balance, June 30, 2024 | |

69,323,313 | | |

$ | 152,349,535 | | |

$ | - | | |

$ | 21,358,970 | | |

$ | (158,347,307 | ) | |

$ | 15,361,198 | |

The accompanying

notes to the unaudited condensed interim consolidated financial statements are an integral part of these consolidated financial statements.

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated

Financial Statements

Three and Six Months Ended June 30,

2024

(Expressed in Canadian Dollars)

Unaudited

Cardiol Therapeutics

Inc. was incorporated under the laws of the Province of Ontario on January 19, 2017. The Corporation's registered and legal office

is located at 2265 Upper Middle Rd. E., Suite 602, Oakville, Ontario, L6H 0G5, Canada.

Cardiol Therapeutics

Inc. and its subsidiary (the "Corporation" or "Cardiol") is a clinical-stage life sciences company focused on the

research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease. The Corporation's

lead drug candidate, CardiolRx™ (cannabidiol) oral solution, is pharmaceutically manufactured and in clinical development for use

in the treatment of heart disease.

On December 20,

2018, the Corporation completed its initial public offering on the Toronto Stock Exchange (the "TSX"). As a result, the Corporation's

common shares commenced trading on that date on the TSX under the symbol "CRDL". On August 10, 2021, the Corporation's

common shares commenced trading on The Nasdaq Capital Market under the symbol "CRDL".

| 2. | Material

accounting policy information |

Statement of

compliance

The Corporation

applies International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”)

and Interpretations issued by the International Financial Reporting Interpretations Committee (“IFRIC”). These unaudited

condensed interim consolidated financial statements have been prepared in accordance with International Accounting Standard 34, Interim

Financial Reporting. Accordingly, they do not include all of the information required for full annual financial statements required by

IFRS as issued by IASB and interpretations issued by IFRIC.

The policies applied

in these unaudited condensed interim consolidated financial statements are based on IFRSs issued and outstanding as of August 12,

2024, the date the Board of Directors approved the statements. The same accounting policies and methods of computation are followed in

these unaudited condensed interim consolidated financial statements as compared with the most recent annual consolidated financial statements

as at and for the year ended December 31, 2023.

Any subsequent

changes to IFRS that are given effect in the Corporation’s annual consolidated financial statements for the year ending December 31,

2024, could result in restatement of these unaudited condensed interim consolidated financial statements.

| 3. | Cash

and cash equivalents |

Interest earned

on cash and cash equivalents for the three and six months ended June 30, 2024 amounted to $307,409 and $684,703 (three and six months

ended June 30, 2023 - $528,697 and $1,074,624).

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated

Financial Statements

Three and Six Months Ended June 30,

2024

(Expressed in Canadian Dollars)

Unaudited

| Cost | |

Right-of-

use asset | | |

Equipment | | |

Leasehold

improvements | | |

Office

equipment | | |

Computer

equipment | | |

Total | |

| Balance, December 31, 2022 | |

$ | 200,319 | | |

$ | 171,864 | | |

$ | 237,248 | | |

$ | 66,864 | | |

$ | 112,290 | | |

$ | 788,585 | |

| Additions | |

| 140,919 | | |

| 47,945 | | |

| - | | |

| - | | |

| 16,367 | | |

| 205,231 | |

| Balance, December 31, 2023 | |

| 341,238 | | |

| 219,809 | | |

| 237,248 | | |

$ | 66,864 | | |

$ | 128,657 | | |

$ | 993,816 | |

| Additions | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,260 | | |

| 7,260 | |

| Balance, June 30, 2024 | |

$ | 341,238 | | |

$ | 219,809 | | |

$ | 237,248 | | |

$ | 66,864 | | |

$ | 135,917 | | |

$ | 1,001,076 | |

| Accumulated

Depreciation | |

| Right-of-

use asset | | |

| Equipment | | |

| Leasehold

improvements | | |

| Office

equipment | | |

| Computer

equipment | | |

| Total | |

| Balance, December 31, 2022 | |

$ | 143,577 | | |

$ | 94,961 | | |

$ | 156,712 | | |

$ | 33,728 | | |

$ | 63,869 | | |

$ | 492,847 | |

| Depreciation for the year | |

| 53,091 | | |

| 36,761 | | |

| 50,840 | | |

| 6,627 | | |

| 16,592 | | |

| 163,911 | |

| Balance, December 31, 2023 | |

$ | 196,668 | | |

$ | 131,722 | | |

$ | 207,552 | | |

$ | 40,355 | | |

$ | 80,461 | | |

$ | 656,758 | |

| Depreciation for the period | |

| 31,992 | | |

| 13,213 | | |

| 25,420 | | |

| 2,651 | | |

| 8,033 | | |

| 81,309 | |

| Balance, June 30, 2024 | |

$ | 228,660 | | |

$ | 144,935 | | |

$ | 232,972 | | |

$ | 43,006 | | |

$ | 88,494 | | |

$ | 738,067 | |

| Carrying

value | |

| Right-of-

use asset | | |

| Equipment | | |

| Leasehold

improvements | | |

| Office

equipment | | |

| Computer

equipment | | |

| Total | |

| Balance, December 31, 2023 | |

$ | 144,570 | | |

$ | 88,087 | | |

$ | 29,696 | | |

$ | 26,509 | | |

$ | 48,196 | | |

$ | 337,058 | |

| Balance, June 30, 2024 | |

$ | 112,578 | | |

$ | 74,874 | | |

$ | 4,276 | | |

$ | 23,858 | | |

$ | 47,423 | | |

$ | 263,009 | |

| Cost | |

Exclusive global

license agreement | |

| Balance, December 31, 2022, December 31,

2023, and June 30, 2024 | |

$ | 767,228 | |

| Accumulated Amortization | |

Exclusive global

license agreement | |

| Balance, December 31, 2022 | |

$ | 472,426 | |

| Amortization for the year | |

| 84,444 | |

| Balance, December 31, 2023 | |

$ | 556,870 | |

| Amortization for the period | |

| 42,222 | |

| Balance, June 30, 2024 | |

$ | 599,092 | |

| Carrying Value | |

Exclusive global

license agreement | |

| Balance, December 31, 2023 | |

$ | 210,358 | |

| Balance, June 30, 2024 | |

$ | 168,136 | |

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated

Financial Statements

Three and Six Months Ended June 30,

2024

(Expressed in Canadian Dollars)

Unaudited

| 5. | Intangible

assets (continued) |

Exclusive global agreement ("Meros

License Agreement")

In 2017, the Corporation

was granted by Meros Polymers Inc. (“Meros”) the sole, exclusive, irrevocable license to patented nanotechnologies for use

with any drugs to diagnose, or treat, cardiovascular disease, cardiopulmonary disease, and cardiac arrhythmias. Meros is focused on the

advancement of nanotechnologies developed at the University of Alberta.

Under the Meros

License Agreement, Cardiol agreed to certain milestones and milestone payments, including the following: (i) payment of $100,000

upon enrolling the first patient in a Phase IIB clinical trial designed to investigate the safety and indications of efficacy of one

of the licensed technologies; (ii) payment of $500,000 upon enrolling the first patient in a Pivotal Phase III clinical trial designed

to investigate the safety and efficacy of one of the licensed technologies; (iii) $1,000,000 upon receiving regulatory approval

from the FDA for any therapeutic and/or prophylactic treatment incorporating the licensed technologies. No milestone payments have been

earned or made to date. Cardiol also agreed to pay Meros the following royalties:

(a) 5% of

worldwide proceeds of net sales of the licensed technologies containing cannabinoids, excluding non-royalty sub-license income in (b) below,

that Cardiol receives from human and animal disease indications and derivatives as outlined in the Meros License Agreement;

(b) 7% of

any non-royalty sub-license income that Cardiol receives from human and animal disease indications and derivatives for licensed technologies

containing cannabinoids as outlined in the Meros License Agreement;

(c) 3.7%

of worldwide proceeds of net sales that Cardiol receives from the licensed technology in relation to human and animal cardiovascular

and/or cardiopulmonary disease, heart failure, and/or cardiac arrhythmia diagnosis and/or treatments using the drugs, excluding cannabinoids

included in (a) above, outlined in the Meros License Agreement; and

(d) 5% of

any non-royalty sub-license income that Cardiol receives in relation to any human and animal heart disease, heart failure and/or arrhythmias

indications, excluding cannabinoids included in (b) above, as outlined in the Meros License Agreement.

In addition, as

part of the consideration under the Meros License Agreement, Cardiol (i) issued to Meros 1,020,000 common shares; and (ii) issued

to Meros 1,020,000 special warrants convertible automatically into common shares for no additional consideration upon the first patient

being enrolled in a Phase 1 clinical trial using the licensed technologies as described in the Meros License Agreement. As of June 30,

2024, and the date of these financial statements, this condition has not been met.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| | |

Carrying

Value | |

| Balance, December 31, 2022 | |

$ | 72,871 | |

| Additions (i) | |

| 140,919 | |

| Repayments | |

| (55,376 | ) |

| Accretion | |

| 15,926 | |

| Balance, December 31, 2023 | |

$ | 174,340 | |

| Repayments | |

| (23,073 | ) |

| Accretion | |

| 13,006 | |

| Balance, June 30, 2024 | |

$ | 164,273 | |

| Current portion | |

| 21,719 | |

| Long-term portion | |

$ | 142,554 | |

(i) When measuring the lease liability for

the property lease that was classified as an operating lease, the Corporation discounted the lease payments using its incremental borrowing

rate. The original property lease expires on May 31, 2024, and the lease payments were discounted with a 9% interest rate. During

the year ended December 31, 2023, the property lease was extended to October 30, 2028. The lease liability was revalued as

of the extension date with lease payments discounted with a 15% interest rate.

On November 5, 2021, the Corporation issued

8,175,000 warrants as part of a unit financing. Each warrant is exercisable into one common share at the price of USD$3.75 per share

for a period of three years from closing. The original estimated fair value of $11,577,426 was assigned to the 8,175,000 warrants issued

by using a fair value market technique incorporating the Black-Scholes option pricing model, with the following assumptions: a risk-free

interest rate of 1.01%; an expected volatility factor of 81%; an expected dividend yield of 0%; and an expected life of 3 years. The

only significant unobservable input is the volatility, which could cause an increase or decrease in fair value. The warrants have been

classified as a derivative liability on the statement of financial position and are re-valued at each reporting date, as the warrants

were issued in a currency other than the Corporation's functional currency. As at June 30, 2024, the fair value of the derivative

liability was $1,355,732 (December 31, 2023 - $238,176), resulting in an (increase)/decrease in the value of the derivative liability

for the three and six months ended June 30, 2024 of $691,047 and $(1,117,556) (three and six months ended June 30, 2023 - $(856,893)

and $(782,812)).

Significant assumptions used in determining the

fair value of the derivative warrant liabilities are as follows:

| | |

Six Months

Ended | | |

Six Months

Ended | |

| | |

June 30,

2024 | | |

June 30,

2023 | |

| Share price | |

USD$ |

2.02 | | |

USD$ |

0.89 | |

| Exercise price | |

USD$ |

3.75 | | |

USD$ |

3.75 | |

| Risk-free interest rate | |

| 4.63 | % | |

| 4.54 | % |

| Expected volatility | |

| 99 | % | |

| 101 | % |

| Expected life in years | |

| 0.35 | | |

| 1.35 | |

| Expected dividend yield | |

| Nil | | |

| Nil | |

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

a) Authorized share capital

The authorized share capital consists of an unlimited

number of common shares. The common shares do not have a par value. All issued shares are fully paid.

b)

Common shares issued

| | |

Number of | | |

| |

| | |

common

shares | | |

Amount | |

| Balance, December 31, 2022 | |

| 64,042,536 | | |

$ | 147,545,399 | |

| Shares for services (i) | |

| 5,000 | | |

| 16,449 | |

| Restricted share units exercised (note 9) | |

| 80,000 | | |

| 112,800 | |

| Balance, June 30, 2023 | |

| 64,127,536 | | |

$ | 147,674,648 | |

| | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 65,352,279 | | |

$ | 148,519,136 | |

| Restricted share units exercised (note 9) | |

| 1,596,034 | | |

| 1,919,588 | |

| Stock options exercised (note 9) | |

| 175,000 | | |

| 177,510 | |

| Fair value of stock options exercised (note 9) | |

| - | | |

| 99,263 | |

| Performance share units exercised (note 9) | |

| 2,200,000 | | |

| 1,634,038 | |

| Balance, June 30, 2024 | |

| 69,323,313 | | |

$ | 152,349,535 | |

(i) During the six months ended June 30, 2023, the

Corporation issued 5,000 common shares with a fair value of $3,550. The fair value of the shares was determined to be equal to the

value of the services rendered. Included in shares for services is $12,899 related to vesting of previously issued shares.

The Corporation has adopted an Omnibus Equity

Incentive Plan in accordance with the policies of the TSX, which permits the grant or issuance of options, Restricted Share Units ("RSUs"),

Performance Share Units ("PSUs") and Deferred Share Units ("DSUs"), as well as other share-based payment arrangements.

The maximum number of shares that may be issued upon the exercise or settlement of awards granted under the plan may not exceed 15% of

the Corporation's issued and outstanding shares from time to time. The Board of Directors determines the price per common share and the

number of common shares which may be allotted to directors, officers, employees, and consultants, and all other terms and conditions

of the option, subject to the rules of the TSX.

During the three and six months ended June 30,

2024, the total expenses related to share-based compensation amounted to $1,805,586 and $2,707,686 (three and six months ended June 30,

2023 - $666,400 and $1,093,223). All outstanding awards are settleable with common shares and not cash.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| 9. | Share-based payments (continued) |

(a) Stock

Options

| | |

Number of | | |

Weighted average | |

| | |

stock options | | |

exercise price ($) | |

| Balance, December 31, 2022 | |

| 1,968,476 | | |

$ | 3.52 | |

| Issued | |

| 500,000 | | |

| 1.20 | |

| Expired | |

| (780,976 | ) | |

| 4.65 | |

| Balance, June 30, 2023 | |

| 1,687,500 | | |

$ | 2.32 | |

| | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 1,732,500 | | |

$ | 2.44 | |

| Issued | |

| 455,000 | | |

| 2.56 | |

| Expired | |

| (185,000 | ) | |

| 1.84 | |

| Exercised (i) | |

| (175,000 | ) | |

| 1.01 | |

| Balance, June 30, 2024 | |

| 1,827,500 | | |

$ | 2.68 | |

(i) The weighted average share price on date of exercise

was $2.62.

At the grant date, the fair value of stock options issued was estimated

using the Black-Scholes option pricing model based on the following weighted average assumptions:

| |

|

Six Months

Ended

June 30,

2024 |

|

|

Six Months

Ended

June 30,

2023 |

|

| Fair value of stock options at grant date |

|

$ |

1.79 |

|

|

$ |

0.65 |

|

| Share price |

|

$ |

2.83 |

|

|

$ |

1.00 |

|

| Exercise price |

|

$ |

2.56 |

|

|

$ |

1.20 |

|

| Risk-free interest rate |

|

|

3.83 |

% |

|

|

3.74 |

% |

| Expected volatility |

|

|

93 |

% |

|

|

89 |

% |

| Expected life in years |

|

|

3.13 |

|

|

|

4.40 |

|

| Expected dividend yield |

|

|

Nil |

|

|

|

Nil |

|

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| 9. | Share-based payments (continued) |

The following table reflects the actual stock options issued and outstanding

as of June 30, 2024:

| Expiry date | |

Exercise

price ($) | | |

Weighted average

remaining

contractual

life (years) | | |

Number of

options

outstanding | | |

Number of

options

vested

(exercisable) | |

| February 23, 2025 | |

| 3.54 | | |

| 0.65 | | |

| 20,000 | | |

| 20,000 | |

| August 19, 2025 | |

| 2.12 | | |

| 1.14 | | |

| 100,000 | | |

| 100,000 | |

| August 30, 2025 | |

| 5.00 | | |

| 1.17 | | |

| 80,000 | | |

| 80,000 | |

| April 1, 2026 | |

| 5.77 | | |

| 1.75 | | |

| 60,000 | | |

| 60,000 | |

| September 10, 2026 | |

| 1.37 | | |

| 2.20 | | |

| 25,000 | | |

| - | |

| November 29, 2026 | |

| 2.46 | | |

| 2.42 | | |

| 250,000 | | |

| - | |

| December 8, 2026 | |

| 3.59 | | |

| 2.44 | | |

| 325,000 | | |

| 216,667 | |

| January 11, 2027 | |

| 2.18 | | |

| 2.53 | | |

| 220,000 | | |

| 146,667 | |

| March 1, 2027 | |

| 2.56 | | |

| 2.67 | | |

| 350,000 | | |

| 87,500 | |

| March 14, 2027 | |

| 2.07 | | |

| 2.70 | | |

| 60,000 | | |

| 40,000 | |

| May 12, 2027 | |

| 1.46 | | |

| 2.87 | | |

| 70,000 | | |

| 46,667 | |

| September 12, 2027 | |

| 1.61 | | |

| 3.20 | | |

| 207,500 | | |

| 69,168 | |

| October 23, 2028 | |

| 1.20 | | |

| 4.32 | | |

| 30,000 | | |

| - | |

| January 29, 2029 | |

| 2.56 | | |

| 4.59 | | |

| 30,000 | | |

| - | |

| | |

| 2.68 | | |

| 2.50 | | |

| 1,827,500 | | |

| 866,669 | |

(b) Performance Share Units

| | |

Number of

PSUs | |

| Balance, December 31, 2022 and June 30, 2023 | |

| 600,000 | |

| | |

| | |

| Balance, December 31, 2023 | |

| 2,000,000 | |

| Issued (i) | |

| 300,000 | |

| Redeemed (ii) | |

| (2,200,000 | ) |

| Balance, June 30, 2024 | |

| 100,000 | |

(i) Grants

of PSUs require completion of certain performance criteria specific to each grant. As the fair value of the services for all PSUs issued

cannot be reliably measured, the fair value was determined on the basis of the equity issued. The fair value of PSUs granted was determined

based on the Corporation's share price, adjusted by the estimated likelihood of the performance conditions being met.

(ii) The weighted average share price on date of exercise was $2.04.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| 9. | Share-based payments (continued) |

(b) Performance Share Units (continued)

The following table reflects the actual PSUs issued and outstanding

as of June 30, 2024:

| Expiry date | |

Weighted average

remaining

contractual

life (years) | | |

Number of

PSUs

outstanding | | |

Number of

PSUs

vested

(exercisable) | |

| December 31, 2024 | |

| 0.50 | | |

| 100,000 | | |

| - | |

(i) Subsequent to

June 30, 2024, 700,000 PSUs were issued.

(ii) Subsequent to

June 30, 2024, 450,000 PSUs were redeemed.

(c) Restricted Share Units

| | |

Number of

RSUs | |

| Balance, December 31, 2022 | |

| 2,312,963 | |

| Issued (i) | |

| 1,125,000 | |

| Redeemed (ii) | |

| (80,000 | ) |

| Balance, June 30, 2023 | |

| 3,357,963 | |

| | |

| | |

| Balance, December 31, 2023 | |

| 3,544,887 | |

| Redeemed (iii) | |

| (1,596,034 | ) |

| Balance, June 30, 2024 | |

| 1,948,853 | |

(i) The fair value of

RSUs granted was determined based on the Corporation's share price.

(ii) The weighted average

share price on date of exercise was $0.80.

(iii) The weighted

average share price on date of exercise was $1.57.

The following table reflects the actual RSUs issued and outstanding as of June 30, 2024:

| | |

Weighted average

remaining | | |

Number of | | |

Number of

RSUs | |

| Expiry date | |

contractual

life (years) | | |

RSUs

outstanding | | |

vested

(exercisable) | |

| July 31, 2025 | |

| 1.08 | | |

| 1,914,639 | | |

| 1,452,727 | |

| October 31, 2025 | |

| 1.34 | | |

| 34,214 | | |

| 34,214 | |

| | |

| 1.09 | | |

| 1,948,853 | | |

| 1,486,941 | |

(i) Subsequent to June 30, 2024,

3,626,000 RSUs were issued.

(ii) Subsequent to June 30, 2024,

108,407 RSUs were redeemed.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| | |

Number of

warrants | | |

Amount | |

| Balance, December 31, 2022 and June 30, 2023 | |

| 11,628,178 | | |

$ | 3,517,867 | |

| | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 11,628,178 | | |

$ | 3,517,867 | |

| Expired | |

| (3,453,178 | ) | |

| (3,517,867 | ) |

| Balance, June 30, 2024 | |

| 8,175,000 | | |

$ | - | |

The following table reflects the actual warrants

issued and outstanding as of June 30, 2024, excluding 1,020,000 special warrants convertible automatically into common shares for

no additional consideration in accordance with the original escrow release terms as described in the Meros License Agreement (see note

5):

| | |

Exercise | | |

Remaining

contractual | | |

Warrants | |

| Expiry date | |

price ($) | | |

life (years) | | |

exercisable | |

| November 5, 2024(1) | |

| 5.13 | | |

| 0.35 | | |

| 8,175,000 | |

(1) Warrants carry an exercise price of

USD$3.75. This amount was translated to CAD for presentation purposes at the June 30, 2024 rate of 1.37. These warrants are classified

as a derivative liability on the statement of financial position (see note 7).

For the three and six months ended June 30,

2024, basic and diluted loss per share has been calculated based on the loss attributable to common shareholders of $6,590,873 and $15,770,505,

respectively (three and six months ended June 30, 2023 - $7,471,754 and $14,561,090, respectively) and the weighted average number

of common shares outstanding of 68,751,105 and 68,005,224, respectively (three and six months ended June 30, 2023 - 64,105,448 and

64,098,586, respectively). Diluted loss per share did not include the effect of stock options, PSUs, RSUs, and warrants as they are anti-dilutive.

(i) The

Corporation has leased premises with third parties. The minimum committed lease payments, which include the lease liability payments

shown as base rent, are approximately as follows:

| | |

Base rent | | |

Variable rent | | |

Total | |

| 2024 | |

$ | 18,459 | | |

$ | 17,282 | | |

$ | 35,741 | |

| 2025 | |

| 55,376 | | |

| 51,846 | | |

| 107,222 | |

| 2026 | |

| 55,376 | | |

| 51,846 | | |

| 107,222 | |

| 2027 | |

| 55,376 | | |

| 51,846 | | |

| 107,222 | |

| 2028 | |

| 46,146 | | |

| 43,205 | | |

| 89,351 | |

| | |

$ | 230,733 | | |

$ | 216,025 | | |

$ | 446,758 | |

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| 12. | Commitments (continued) |

(ii) The

Corporation has signed various agreements with consultants to provide services. Under the agreements, the Corporation has the following

remaining commitments.

(iii) Pursuant

to the terms of agreements with various other contract research organizations, the Corporation is committed for the following contract

research services:

| 2024 | |

$ | 303,888 | |

| 2025 | |

| 1,176,824 | |

| 2026 | |

| 12,708 | |

| Total | |

$ | 1,493,420 | |

The following details highlight certain components

of the research and development and general and administration expenses classified by nature. Remaining research and development and

operating expenses include personnel costs and expenses paid to third parties:

| | |

Three Months

Ended | | |

Three Months

Ended | | |

Six Months

Ended | | |

Six Months

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Research and development expenses | |

| | | |

| | | |

| | | |

| | |

| Non-cash share-based compensation | |

$ | 26,229 | | |

$ | 98,487 | | |

$ | 79,573 | | |

$ | 195,892 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administration expenses | |

| | | |

| | | |

| | | |

| | |

| Depreciation of property and equipment | |

$ | 40,797 | | |

$ | 37,385 | | |

$ | 81,309 | | |

$ | 74,479 | |

| Amortization of intangible assets | |

$ | 21,111 | | |

$ | 21,111 | | |

$ | 42,222 | | |

$ | 42,222 | |

| Non-cash share-based compensation | |

$ | 1,779,357 | | |

$ | 567,913 | | |

$ | 2,628,113 | | |

$ | 897,331 | |

| 14. |

Related party transactions |

(a) The Corporation entered into the

following transactions with related parties:

(i) Included in research and development

expense is $109,129 and $737,809 for the three and six months ended June 30, 2023 paid to a company previously related to a director.

As at December 31, 2023, $416,792 was owed to this company and this amount was included in accounts payable and accrued liabilities.

|

Cardiol Therapeutics Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three

and Six Months Ended June 30, 2024

(Expressed in Canadian Dollars)

Unaudited |

| 14. | Related party transactions (continued) |

(b) Key

management personnel are those persons having authority and responsibility for planning, directing, and controlling the activities of

the Corporation directly or indirectly, including any directors (executive and non-executive) of the Corporation. Remuneration of directors

and key management personnel of the Corporation, except as noted in (a) above, was as follows:

| | |

Three

Months

Ended | | |

Three

Months

Ended | | |

Six

Months

Ended | | |

Six

Months

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Salaries and benefits | |

$ | 540,335 | | |

$ | 534,446 | | |

$ | 1,804,739 | | |

$ | 1,704,476 | |

| Share-based payments | |

| 154,291 | | |

| 262,128 | | |

| 275,731 | | |

| 531,010 | |

| | |

$ | 694,626 | | |

$ | 796,574 | | |

$ | 2,080,470 | | |

$ | 2,235,486 | |

As at June 30, 2024, $nil (December 31, 2023 - $nil) was

owed to key management personnel and this amount was included in accounts payable and accrued liabilities.

Exhibit 99.2

CARDIOL THERAPEUTICS

INC.

MANAGEMENT'S DISCUSSION AND ANALYSIS

THREE AND SIX MONTHS ENDED

JUNE 30, 2024

MANAGEMENT’S

DISCUSSION AND ANALYSIS

Introduction

The following management’s

discussion and analysis (“MD&A”) of the financial condition and results of the operations of Cardiol Therapeutics Inc.

and its subsidiary (the “Corporation” or “Cardiol”) constitutes management of the Corporation's ("Management")

review of the factors that affected the Corporation’s financial and operating performance for the three and six months ended June 30,

2024 (the “2024 Fiscal Period”). This discussion should be read in conjunction with the consolidated financial statements

for the years ended December 31, 2023, 2022, and 2021 and the unaudited condensed interim consolidated financial statements for

the three and six months ended June 30, 2024 (“Financial Statements”), together with the respective notes thereto. Results

are reported in Canadian dollars, unless otherwise noted. The Financial Statements and the financial information contained in this MD&A

are derived from the Financial Statements prepared in accordance with International Accounting Standard 34, Interim Financial Reporting.

Accordingly, they do not include all of the information required for full annual financial statements required by International Financial

Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and Interpretations

issued by the International Financial Reporting Interpretations Committee (“IFRIC”). In the opinion of Management, all adjustments

(which consist only of normal recurring adjustments) considered necessary for a fair presentation have been included.

This MD&A is

dated August 12, 2024. All dollar amounts in this MD&A are reported in Canadian dollars, unless otherwise stated. Unless otherwise

noted or the context indicates otherwise, the terms “we”, “us”, “our”, “Cardiol”, the

"Company" or the “Corporation” refer to Cardiol Therapeutics Inc. and its subsidiary.

This MD&A is

presented current to August 12, 2024 unless otherwise stated. The financial information presented in this MD&A is derived from

the Financial Statements. This MD&A contains forward-looking statements that involve risks, uncertainties, and assumptions, including

statements regarding anticipated developments in future financial periods and our plans and objectives. There can be no assurance that

such information will prove to be accurate, and readers are cautioned not to place undue reliance on such forward-looking statements.

See “Forward-Looking Statements” and “Risk Factors”.

Forward-Looking

Information

This MD&A contains

forward-looking information that relates to the Corporation’s current expectations and views of future events. In some cases, this

forward-looking information can be identified by words or phrases such as “may”, “might”, "could",

“will”, “expect”, “anticipate”, “estimate”, “intend”, “plan”,

“indicate”, “seek”, “believe”, “predict”, or “likely”, or the negative of

these terms, or other similar expressions intended to identify forward-looking information. Statements containing forward-looking information

are not historical facts. The Corporation has based this forward-looking information on its current expectations and projections about

future events and financial trends that it believes might affect its financial condition, results of operations, business strategy, and

financial needs. The forward-looking information includes, among other things, statements relating to:

| · | our

anticipated cash needs, and the need for additional financing; |

| · | our

development of our product candidates for use in testing, research, preclinical studies,

clinical studies, and commercialization; |

| · | our

ability to develop new routes of administration of our product candidates, including parenteral,

for use in testing, research, preclinical studies, clinical studies, and commercialization; |

| · | our

ability to develop new formulations of our product candidates for use in testing, research,

preclinical studies, clinical studies, and commercialization; |

| · | the

successful development and commercialization of our current product candidates and the addition

of future products and product candidates; |

| · | the

ability of our product delivery technologies to deliver our product candidates to inflamed

and/or fibrotic tissue; |

| · | our

intention to build a pharmaceutical brand and our products focused on addressing inflammation

and fibrosis in heart disease, including acute myocarditis, recurrent pericarditis, and heart

failure; |

| · | the

expected medical benefits, viability, safety, efficacy, effectiveness, and dosing of our

product candidates; |

| · | patents

and intellectual property, including, but not limited to, our (a) ability to procure,

defend, and/or enforce our intellectual property relating to our products, product formulations,

routes of administration, product candidates, and associated uses, methods, and/or processes,

and (b) freedom to operate; |

| · | our

competitive position and the regulatory environment in which we operate; |

| · | the

molecular targets and mechanism of action of our product candidates; |

| · | our

financial position; our business strategy; our growth strategies; our operations; our financial

results; our dividend policy; our plans and objectives; and |

| · | expectations

of future results, performance, achievements, prospects, opportunities, or the market in

which we operate. |

In addition, any

statements that refer to expectations, intentions, projections, or other characterizations of future events or circumstances contain

forward-looking information. Forward-looking information is based on certain assumptions and analyses made by the Corporation in light

of the experience and perception of historical trends, current conditions, and expected future developments and other factors we believe

are appropriate and are subject to risks and uncertainties. The preceding list is not intended to be an exhaustive list of all of our

forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance,

taking into account the information currently available to us. These statements are only predictions based upon our current expectations

and projections about future events. Although we believe that the assumptions underlying these statements are reasonable, they may prove

to be incorrect, and we cannot assure that actual results will be consistent with this forward-looking information. Given these risks,

uncertainties, and assumptions, prospective investors should not place undue reliance on this forward-looking information. Whether actual

results, performance, or achievements will conform to the Corporation’s expectations and predictions is subject to a number of

known and unknown risks, uncertainties, assumptions, and other factors, including those listed under “Risk Factors”, which

include:

| · | the

inherent uncertainty of product development including testing, research, preclinical studies,

and clinical trials; |

| · | our

requirement for additional financing; |

| · | our

negative cash flow from operations; |

| · | dependence

on the success of our early-stage product candidates which may not generate revenue, if approved; |

| · | reliance

on Management, loss of members of Management or other key personnel, or an inability to attract

new Management team members; |

| · | our

ability to successfully design, initiate, execute, and complete clinical trials, including

the high cost, uncertainty, and delay of clinical trials and additional costs associated

with any failed clinical trials; |

| · | the

uncertainty our investigational products will have a therapeutic benefit in the clinical

indications we are pursuing; |

| · | potential

equivocal or negative results from clinical trials and their adverse impacts on our future

commercialization efforts; |

| · | our

ability to receive and maintain regulatory exclusivities in multiple jurisdictions, including

Orphan Drug Designations/Approvals, for our product candidates; |

| · | delays

in achievement of projected development goals; |

| · | management

of additional regulatory burdens; |

| · | volatility

in the market price for our securities; |

| · | failure

to protect and maintain and the consequential loss of intellectual property rights; |

| · | third-party

claims relating to misappropriation by the Corporation of their intellectual property; |

| · | reliance

on third parties to conduct and monitor our pre-clinical studies and clinical trials; |

| · | our

product candidates being subject to controlled substance laws which may vary from jurisdiction

to jurisdiction; |

| · | changes

in laws, regulations, and guidelines relating to our business, including tax and accounting

requirements; |

| · | our

reliance on early-stage research regarding the medical benefits, viability, safety, efficacy,

and dosing of our product candidates; |

| · | claims

for personal injury or death arising from the use of our future products and product candidates,

if approved; |

| · | uncertainty

relating to market acceptance of our product candidates; |

| · | our

lack of experience in commercializing any products, including selling, marketing, or distributing

pharmaceutical products; |

| · | securing

third-party payor reimbursement for our product candidates, if approved; |

| · | the

level of pricing and reimbursement for our product candidates, if approved; |

| · | our

dependence on contract manufacturers; |

| · | unsuccessful

collaborations with third parties; |

| · | business

disruptions affecting third-party suppliers and manufacturers; |

| · | lack

of control in future production and selling prices of our product candidates, if approved; |

| · | competition

in our industry; |

|

· |

our inability to develop new

technologies and products and the obsolescence of existing technologies and products; |

|

· |

unfavorable publicity or consumer

perception towards any products for which we receive marketing authorization; |

|

· |

product liability claims and

product recalls; |

|

· |

expansion of our business to

other jurisdictions; |

|

· |

fraudulent activities of employees,

contractors, and consultants; |

|

· |

our reliance on key inputs

and their related costs; |

|

· |

difficulty associated with

forecasting demand for products; |

|

· |

operating risk and insurance

coverage; |

|

· |

our inability to manage growth; |

|

· |

conflicts of interest among

the officers and directors ("Director") of the Corporation; |

|

· |

managing damage to our reputation

and third-party reputational risks; |

|

· |

relationships with customers

and third-party payors and consequential exposure to applicable anti-kickback, fraud, and abuse and other healthcare laws; |

|

· |

exposure to information systems

security threats; |

|

· |

no dividends for the foreseeable

future; |

|

· |

future sales of common shares

and warrants by existing shareholders causing the market price for the common shares and warrants to fluctuate; |

|

· |

the issuance of common shares

in the future causing dilution; |

|

· |

events outside of our control

could adversely affect our operations; |

|

· |

our ability to remediate any

material weakness in our internal control over financial reporting; |

|

· |

global geo-political events,

and the responses of governments having a significant effect on the world economy; and |

|

· |

failure to meet regulatory

or ethical expectations on environmental impact, including climate change. |

If any of these

risks or uncertainties materialize, or if assumptions underlying the forward-looking information prove incorrect, actual results may

vary materially from those anticipated in the forward-looking information.

Information contained

in forward-looking information in this MD&A is provided as of August 12, 2024, and we disclaim any obligation to update any

forward-looking information, whether as a result of new information or future events or results, except to the extent required by applicable

securities laws. Accordingly, potential investors should not place undue reliance on forward-looking information.

Overview

On December 20,

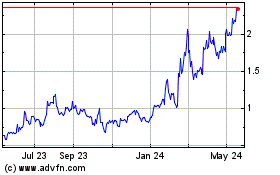

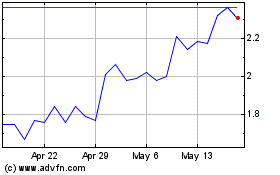

2018, the Corporation completed its initial public offering on the Toronto Stock Exchange (the "TSX"). As a result, the common

shares commenced trading on the TSX under the symbol "CRDL". On August 10, 2021, the Corporation's common shares commenced

trading on The Nasdaq Capital Market under the symbol "CRDL".

The Corporation

is a clinical-stage life sciences company focused on the research and clinical development of anti- inflammatory and anti-fibrotic therapies

for the treatment of heart diseases. The Corporation's lead drug candidate, CardiolRx™ (cannabidiol) oral solution, is pharmaceutically

manufactured and is currently in clinical development for use in the treatment of two heart diseases. It is recognized that cannabidiol

inhibits activation of the inflammasome pathway, an intracellular process known to play an important role in the development and progression

of inflammation and fibrosis associated with myocarditis, pericarditis, and heart failure.

Cardiol has received

Investigational New Drug Application ("IND") authorization from the United States Food and Drug Administration (“FDA”)

to conduct clinical studies to evaluate the efficacy and safety of CardiolRx in two rare diseases affecting the heart: (i) a Phase

II multi-center open-label pilot study in recurrent pericarditis (the "MAvERIC-Pilot" study; NCT05494788), an inflammatory

disease of the pericardium which is associated with symptoms including debilitating chest pain, shortness of breath, and fatigue, and

results in physical limitations, reduced quality of life, emergency department visits, and hospitalizations; and (ii) a Phase II

multi-national, randomized, double-blind, placebo-controlled trial (the "ARCHER" trial; NCT05180240) in acute myocarditis,

an important cause of acute and fulminant heart failure in young adults and a leading cause of sudden cardiac death in people less than

35 years of age.

The FDA has granted

Orphan Drug Designation to CardiolRx for the treatment of pericarditis, which includes recurrent pericarditis. The U.S. Orphan Drug Designation

program was created to provide the sponsor of a drug or biologic significant incentives, including seven-year marketing exclusivity and

exemptions from certain FDA fees, to develop treatments for diseases that affect fewer than 200,000 people in the U.S. Products with

Orphan Drug Designation also frequently qualify for accelerated regulatory review. The European Commission's European Medicines Agency

("EMA") has a similar orphan medicine product program for rare diseases.

Cardiol is also

developing a novel subcutaneously administered drug formulation of its lead small molecule drug candidate ("CRD-38") intended

for use in heart failure – a leading cause of death and hospitalization in the developed world, with associated healthcare costs

in the U.S. exceeding $30 billion annually1.

Operations Highlights

During the 2024

Fiscal Period

(i) In January 2024,

the Corporation announced it has exceeded 50% patient enrollment for ARCHER. See "Phase II Trial – Acute Myocarditis (ARCHER)".

(ii) In

January 2024, the Corporation announced that it received notice on January 23, 2024 from The Nasdaq Stock Market LLC stating

the Corporation had regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2) for continued

listing on The Nasdaq Capital Market.

(iii) In

February 2024, the Corporation announced that the FDA has granted Orphan Drug Designation to CardiolRx for the treatment of pericarditis,

which includes recurrent pericarditis.

(iv) In

February 2024, the Corporation announced completion of patient enrollment in MAvERIC-Pilot. See "Phase II Open Label Pilot

Study - Recurrent Pericarditis (MAvERIC-Pilot)".

(v) In

May 2024, the Corporation announced its Phase II ARCHER trial was the subject of an oral presentation at the World Congress on Acute

Heart Failure 2024 in Lisbon, Portugal at the annual congress of the Heart Failure Association of the European Society of Cardiology

(“ESC”).

The trial design,

rationale, and blinded baseline data on the first 50 patients randomized into ARCHER was presented by Univ.-Prof. Dr. med. Carsten

Tschöpe from the Berlin Institute of Health – Charité on behalf of the ARCHER Study Group, an independent steering

committee comprising distinguished thought leaders in heart failure and myocarditis from international centers of excellence who contributed

to the design and execution of ARCHER. Concurrent with the presentation the journal ESC Heart Failure, which is dedicated to advancing

knowledge about heart failure worldwide, accepted the manuscript describing the rationale and design of the ARCHER trial and it was published

in June 2024.

(vi) In

June 2024, the Corporation reported positive topline 8-week clinical data from its Phase II open-label MAvERIC- Pilot study investigating

the impact of CardiolRx™ administered to patients with symptomatic recurrent pericarditis. The data showed a marked reduction in

the primary efficacy endpoint of patient-reported pericarditis pain at the end of the 8-week treatment period (“TP”), as

well as normalization of inflammation – as measured by C-reactive protein (“CRP”) – in 80% of patients with elevated

CRP at baseline.

MAvERIC-Pilot study

enrolled 27 patients diagnosed with symptomatic recurrent pericarditis. Each patient had a high disease burden as reflected in the mean

baseline pericarditis pain score of 5.8 out of 10, and by the number of previous episodes of pericarditis: 9 patients (33%) with 2 previous

episodes; 9 (33%) with 3; 4 (15%) with 4; and 5 (19%) with >4.

Summary of topline

findings include:

| · | Primary

endpoint of patient-reported pericardial pain on an 11-point numerical rating scale (“NRS”)

showed a mean reduction of 3.7, from 5.8 at baseline (range of 4 to 10) to 2.1 (range of

0 to 6) at 8 weeks. NRS is a validated instrument used to assess patient-reported pericarditis

pain. Zero represents ‘no pain at all’, whereas the upper limit of 10 represents

‘the worst pain ever possible’. |

| · | Eight

of the ten patients (80%) with a baseline CRP =1mg/dL had a normalization of CRP (=0.5 mg/dL)

at 8 weeks. The mean CRP decreased from 5.7 mg/dL at baseline to 0.3 mg/dL at 8 weeks. CRP

is a commonly used clinical marker of inflammation, and in combination with the NRS score,

is used by clinicians to assess clinical response and determine a recurrence. |

| · | Eighty-nine

percent of patients (24/27) have progressed from the TP into the extension period (“EP”)

of the study, defined as the additional 18-week period of CardiolRx™ treatment that

follows the TP. |

| · | CardiolRx™

was shown to be generally well-tolerated. |

Phase II

Open Label Pilot Study – Recurrent Pericarditis (MAvERIC-Pilot)

Pericarditis refers

to inflammation of the pericardium (the membrane or sac that surrounds the heart), frequently resulting from a viral infection. Recurrent

pericarditis is the reappearance of symptoms after a symptom-free period of at least four to six weeks following the initial acute episode

of pericarditis. Patients may have multiple recurrences. Symptoms include debilitating chest pain, shortness of breath, and fatigue,

resulting in physical limitations, reduced quality of life, emergency department visits, and hospitalizations. Causes of pericarditis

can include infection (e.g., tuberculosis), systemic disorders such as autoimmune and inflammatory diseases, cancer, and post-cardiac

injury syndromes. Pericarditis (and its recurrences) are symptomatic events, the diagnosis of which is based on meeting two of four criteria:

chest pain; pericardial friction rub; electrocardiogram changes; and new or worsening pericardial swelling. Elevation of inflammatory

markers such as C-reactive protein ("CRP"), and evidence of pericardial inflammation by an imaging technique (computed tomography

scan or cardiac magnetic resonance) may help the diagnosis and the monitoring of disease activity. Although generally self-limited and

not life threatening, pericarditis is diagnosed in 0.2% of all cardiovascular in-hospital admissions and is responsible for 5% of emergency

room admissions for chest pain in North America and Western Europe2.

Recurrent pericarditis

appears in 15% to 30% of patients following the acute index episode and usually within 18 months. Furthermore, up to 50% of patients

with a recurrent episode of pericarditis experience more recurrences. Standard first-line medical therapy consists of non-steroidal anti-inflammatory

drugs or aspirin with or without colchicine. Corticosteroids such as prednisone are second-line therapy in patients with continued recurrence

and inadequate response to conventional therapy. The only FDA-approved therapy for recurrent pericarditis, launched in 2021, is a costly

and potent subcutaneously injected interleukin-1 inhibitor with immunosuppressive effects. It is generally used as a third-line intervention

in patients with persistent underlying disease, multiple recurrences, and an inadequate response to conventional therapy2.

On an annual basis,

the number of patients in the U.S. having experienced at least one recurrence is estimated at 38,000. Approximately 60% of patients with

multiple recurrences (>1) still suffer for longer than two years, and one third are still impacted at five years. Hospitalization

due to recurrent pericarditis is often associated with a 6-8-day length of stay and cost per stay is estimated to range between US$20,000

and US$30,000 in the U.S.2.

In May 2022,

the Corporation announced the FDA has authorized the Corporation's IND to commence a Phase II open- label pilot study designed to evaluate

the tolerance, safety, and efficacy of CardiolRx in patients with recurrent pericarditis. MAvERIC-Pilot will also assess the improvement

in objective measures of disease, and during an extension period, assess the feasibility of weaning concomitant background therapy including

corticosteroids, while taking CardiolRx. Recurrent pericarditis is a rare disease in the U.S., and in February 2024, the FDA granted

Orphan Drug Designation to CardiolRx for the treatment of pericarditis, which includes recurrent pericarditis.

The MAvERIC-Pilot

study, designed to enroll 25 patients, enrolled 27 patients at eight major clinical centers in the U.S. specializing in pericarditis.

The primary efficacy endpoint of the study is the change, from baseline to eight weeks, in patient-reported pericarditis pain using an

11-point numeric rating scale ("NRS"). The NRS is a validated clinical tool used across multiple conditions with acute and

chronic pain, including previous studies of recurrent pericarditis. Secondary endpoints include the pain score after 26 weeks of treatment,

and changes in high sensitivity CRP. Importantly, the study will also assess freedom from pericarditis recurrence.

The MAvERIC-Pilot

study was designed with the support of an independent Advisory Committee and key trial investigators, consisting of international thought

leaders in cardiovascular disease, including:

| · | Study

Chair: Allan Klein, MD, CM – Director, Center for the Diagnosis and Treatment of

Pericardial Diseases, and Professor of Medicine, Heart, Vascular and Thoracic Institute,

Cleveland Clinic; |

| · | Antonio

Abbate, MD – Ruth C. Heede Professor of Cardiology, School of Medicine, and Department

of Medicine, Division of Cardiovascular Medicine - Heart and Vascular Center, University

of Virginia; |

| · | Allen

Luis, MBBS, PhD – Co-Director of the Pericardial Diseases Clinic, Associate Professor

of Medicine, Department of Cardiovascular Medicine, at Mayo Clinic Rochester Minnesota; |

| · | Paul

Cremer, MD – Departments of Medicine and Radiology, Northwestern University, and

Multimodality Cardiac Imaging and Clinical Trials Unit, Bluhm Cardiovascular Institute; |

| · | Stephen

Nicholls – Program Director, Victorian Heart Hospital, Director, Monash Victorian

Heart Institute, and Professor of Cardiology, Monash University, Melbourne; and |

| · | Stefano

Toldo, PhD – Associate Professor of Medicine, Department of Medicine, Cardiovascular

Medicine at University of Virginia. |

In June 2024,

the Corporation reported positive topline 8-week clinical data from its MAvERIC-Pilot study. The data showed a marked reduction in the

primary efficacy endpoint of patient-reported pericarditis pain at the end of the 8- week treatment period (“TP”), as well

as normalization of inflammation – as measured by C-reactive protein (“CRP”) – in 80% of patients with elevated

CRP at baseline.

MAvERIC-Pilot study

enrolled 27 patients diagnosed with symptomatic recurrent pericarditis. Each patient had a high disease burden as reflected in the mean

baseline pericarditis pain score of 5.8 out of 10, and by the number of previous episodes of pericarditis: 9 patients (33%) with 2 previous

episodes; 9 (33%) with 3; 4 (15%) with 4; and 5 (19%) with >4.

Summary of topline

findings include:

| · | Primary

endpoint of patient-reported pericardial pain on an 11-point numerical rating scale (“NRS”)

showed a mean reduction of 3.7, from 5.8 at baseline (range of 4 to 10) to 2.1 (range of

0 to 6) at 8 weeks. NRS is a validated instrument used to assess patient-reported pericarditis

pain. Zero represents ‘no pain at all’, whereas the upper limit of 10 represents

‘the worst pain ever possible’. |

| · | Eight

of the ten patients (80%) with a baseline CRP =1mg/dL had a normalization of CRP (=0.5 mg/dL)

at 8 weeks. The mean CRP decreased from 5.7 mg/dL at baseline to 0.3 mg/dL at 8 weeks. CRP

is a commonly used clinical marker of inflammation, and in combination with the NRS score,

is used by clinicians to assess clinical response and determine a recurrence. |

| · | Eighty-nine

percent of patients (24/27) have progressed from the TP into the extension period (“EP”)

of the study, defined as the additional 18-week period of CardiolRx™ treatment that

follows the TP. |

| · | CardiolRx™

was shown to be generally well-tolerated. |

The Corporation

expects to report full results including extension period data during H2 2024. Cardiol has budgeted costs to complete this study to be

approximately $500,000. If Cardiol determines that the study has met its objectives, it currently expects to undertake the next steps

in its clinical development program, which would consist of a larger clinical study, the details of which will be determined in conjunction

with its external clinical advisors and regulatory agencies. The total cost and timeline to complete this clinical development program

cannot be determined at this stage as this will depend on a variety of factors. The Corporation may involve a commercial partner from

the pharmaceutical industry to fund the late-stage clinical development and commercialization of CardiolRx for the treatment of recurrent

pericarditis.

Phase II

Trial – Acute Myocarditis (ARCHER)

Myocarditis is

an acute inflammatory condition of the heart muscle (myocardium) characterized by chest pain, impaired cardiac function, atrial and ventricular

arrhythmias, and conduction disturbances. Although the symptoms are often mild, myocarditis remains an important cause of acute and fulminant

heart failure and is a leading cause of sudden cardiac death in people under 35 years of age. Although viral infection is the most common

cause of myocarditis, the condition can also result from administration of therapies used to treat several common cancers, including

chemo- therapeutic agents and immune checkpoint inhibitors3.

In a proportion

of patients, the inflammation in the heart persists and causes decreased heart function with symptoms and signs of heart failure, and

as such pharmacological treatment is based on conventional therapy for heart failure. This includes diuretics, ACE inhibitors, angiotensin

receptors blockers, beta blockers, and aldosterone inhibitors. For those with a fulminant presentation, intensive care is often required,

with the use of inotropic medications (to increase the force of the heart muscle contraction). Severe cases frequently require ventricular

assist devices or extracorporeal oxygenation and may necessitate heart transplantation. There are no FDA-approved therapies for acute

myocarditis. Patients hospitalized with acute myocarditis experience an average 7-day length of stay and a 4 - 6% risk of in-hospital

mortality, with average hospital charge per stay estimated at US$110,000 in the U.S.3.

Data from multiple

sources, including the ‘Global Burden of Disease Study’, reports that the number of cases per year of myocarditis range from

approximately 10 to 22/100,000 persons (estimated U.S. patient population of 33,000 to 73,000), qualifying the condition as a rare disease

in the U.S. and in European Union. Cardiol believes that there is a significant opportunity to develop a therapy for acute myocarditis

that may be eligible for designation as an orphan drug under the FDA's Orphan Drug Designation and the European Medicines Agency Orphan

Medicine programs3.

In August 2021,

Cardiol received IND authorization from the FDA to conduct a Phase II clinical trial of CardiolRx in acute myocarditis - the ARCHER trial.

ARCHER has also received regulatory clearance in other jurisdictions and is expected to enroll 100 patients at major cardiac centers

in North America, Europe, Latin America and Israel. In May 2024, the Corporation announced that the ARCHER trial had exceeded 85%

of its patient enrollment objective. ARCHER has been designed in collaboration with an independent steering committee comprising distinguished

thought leaders in heart failure and myocarditis from international centers of excellence. The primary endpoints of the trial, which

will be evaluated after 12 weeks of double-blind therapy, consist of the following cardiac magnetic resonance imaging measures: left

ventricular function (global longitudinal strain) and myocardial edema/fibrosis (extra-cellular volume), each of which has been shown

to predict long-term prognosis of patients with acute myocarditis.

Members of the

Steering Committee include:

| · | Chair:

Dennis M. McNamara, MD – Professor of Medicine at the University of Pittsburgh.

He is also the Director of the Heart Failure/Transplantation Program at the University of

Pittsburgh Medical Center; |

| · | Co-Chair:

Leslie T. Cooper, Jr., MD – General cardiologist and the Chair of the Mayo

Clinic Enterprise Department of Cardiovascular Medicine, as well as chair of the Department

of Cardiovascular Medicine at the Mayo Clinic in Florida; |

| · | Arvind

Bhimaraj, MD – Specialist in Heart Failure and Transplantation Cardiology and Associate

Professor of Cardiology, Institute for Academic Medicine at Houston Methodist and at

Weill Cornell Medical College, NYC; |

| · | Wai

Hong Wilson Tang, MD – Advanced Heart Failure and Transplant Cardiology specialist

at the Cleveland Clinic in Cleveland, Ohio. Dr. Tang is also the Director of the Cleveland

Clinic's Center for Clinical Genomics; Research Director, and staff cardiologist in the Section of

Heart Failure and Cardiac Transplantation Medicine in the Sydell and Arnold Miller Family

Heart & Vascular Institute at the Cleveland Clinic; |

| · | Peter

Liu, MD – Chief Scientific Officer and Vice President, Research, of the University

of Ottawa Heart Institute, and Professor of Medicine and Physiology at the University of

Toronto and University of Ottawa; |

| · | Carsten

Tschöpe, MD – Clinical Professor in Cardiology, Head of the Cardiomyopathy

Unit, Department of Cardiology, Angiology and Intensive Care, Campus Virchow, German Heart

Center (DHZC) at Charité, Berlin;. |

| · | Matthias