0001108205falseNasdaq00011082052024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): November 14, 2024

Curis, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 000-30347 | 04-3505116 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | |

128 Spring Street, Building C - Suite 500, Lexington, MA 02421 |

| (Address of Principal Executive Offices) (Zip Code) |

(617) 503-6500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 per share | | CRIS | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 14, 2024, Curis, Inc. announced its financial results for the three- and nine-month periods ended September 30, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and the Exhibit attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the InLine XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Curis, Inc. |

| | | |

| | | |

| Date: | November 14, 2024 | By: | /S/ JAMES E. DENTZER |

| | | James E. Dentzer |

| | | President and Chief Executive Officer |

| | | |

PRESS RELEASE

Curis Provides Third Quarter 2024 Business Update

Management to host conference call today at 8:30 a.m. ET

LEXINGTON, Mass., Nov. 14, 2024 /PRNewswire/ -- Curis, Inc. (“Curis”) (NASDAQ: CRIS), a biotechnology company focused on the development of emavusertib (CA-4948), an orally available, small molecule IRAK4 inhibitor, today reported its business update and financial results for the quarter ended September 30, 2024.

“We continue to make excellent progress across our clinical programs. We are especially excited about the recent R/R PCNSL data released in September which continue to demonstrate the activity of emavusertib in combination with ibrutinib in salvage-line patients and that the CR/CRu responses appear to be durable,” said James Dentzer, Curis Chief Executive Officer. “We are also excited to present additional clinical data in our TakeAim Leukemia study next month at ASH. We believe the positive momentum as we finish the year sets us up well for 2025.”

Third Quarter 2024 and Recent Operational Highlights

Emavusertib (IRAK4 Inhibitor)

TakeAim Lymphoma

•In September, at the 3rd Annual IRAK4 Symposium in Cancer, the Company released preliminary efficacy data in 10 response-evaluable patients who had progressed on treatment with a BTKi. The data showed 3 complete responses (CR), 1 unconfirmed complete response (CRu) and 2 partial responses (PR). The duration of response for 3 of the 4 patients with a CR/CRu was greater than 6 months.

•The Company is actively engaged in discussions with regulatory authorities to gain alignment on the registrational path in PCNSL.

TakeAim Leukemia

The Company will have both an oral presentation and a poster presentation at the 66th American Society of Hematology (ASH) annual meeting in December.

•Oral Presentation:

Session Name: 616. Acute Myeloid Leukemias: Investigational Drug and Cellular Therapies: New Treatment Approaches for AML

Session Date: Monday, December 9, 2024

Presentation Time: 11:30 AM

Room: Manchester Grand Hyatt San Diego, Grand Hall B

Publication Number: 737

Title: Preliminary Safety, Efficacy, and Molecular Characterization of Emavusertib (CA-4948) in Relapsed/Refractory Acute Myeloid Leukemia Patients

•Poster:

Session Name: 637. Myelodysplastic Syndromes: Clinical and Epidemiological: Poster II

Session Date: Sunday, December 8, 2024

Presentation Time: 6:00 PM - 8:00 PM

Location: San Diego Convention Center, Halls G-H

Publication Number: 3225

Title: Preliminary Safety, Efficacy and Molecular Characterization in Patients with Higher-Risk Myelodysplastic Syndrome Treated with Single Agent Emavusertib (CA-4948)

Corporate

In October 2024, Curis completed a registered direct offering and concurrent private placement of unregistered warrants (“October 2024 Offerings”) with net proceeds of approximately $10.8 million.

Third Quarter 2024 Financial Results

For the third quarter of 2024, Curis reported a net loss of $10.1 million or $1.70 per share on both a basic and diluted basis as compared to $12.2 million or $2.13 per share on both a basic and diluted basis, for the same period in 2023. Curis reported a net loss of $33.8 million or $5.77 per share on both a basic and diluted basis, for the nine months ended September 30, 2024 as compared to a net loss of $35.7 million or $6.96 per share on both a basic and diluted basis for the same period in 2023.

Revenues for the third quarter of 2024 were $2.9 million as compared to $2.8 million for the same period in 2023. Revenues for both periods consist of royalty revenues from Genentech and Roche's sales of Erivedge®. Revenues for the nine months ended September 30, 2024 and 2023 were $7.6 million and $7.3 million, respectively.

Research and development expenses were $9.7 million for the third quarter of 2024, as compared to $10.4 million for the same period in 2023. The decrease was primarily attributable to lower consulting and employee related costs. Research and development expenses were $29.6 million for the nine months ended September 30, 2024, as compared to $29.5 million for the same period in 2023.

General and administrative expenses were $3.8 million for the third quarter of 2024, as compared to $4.8 million for the same period in 2023. The decrease was primarily attributable to lower legal and employee related costs. General and administrative expenses were $13.4 million for the nine months ended September 30, 2024, as compared to $13.8 million for the same period in 2023.

Other income, net was $0.5 million for the third quarter of 2024, as compared to $0.2 million for the same period in 2023. The increase was primarily attributable to a decrease in the non-cash expense related to the sale of future royalties. Other income, net was $1.8 million for the nine months ended September 30, 2024, as compared to $0.4 million for the same period in 2023.

Including the impact of the October 2024 Offerings, Curis's cash and cash equivalents totaled $31.6 million, and the Company had approximately 8.5 million shares of common stock outstanding. Curis expects its existing cash and cash equivalents will enable its planned operations into mid-2025.

Conference Call Information

Curis management will host a conference call today, November 14, 2024, at 8:30 a.m. ET, to discuss the business update and these financial results.

To access the live conference call, please dial 800-836-8184 from the United States or 1-646-357-8785 from other locations, to access the webcast login to https://app.webinar.net/jG81a9Deb0V shortly before 8:30 a.m. ET. The webcast can also be accessed via the Curis website in the 'Investors' section.

About Curis, Inc.

Curis is a biotechnology company focused on the development of emavusertib, an orally available, small molecule IRAK4 inhibitor. Emavusertib is currently undergoing testing in the Phase 1/2 TakeAim Lymphoma study (CA-4948-101) in patients with relapsed/refractory primary central nervous system lymphoma (PCNSL) in combination with the BTK inhibitor ibrutinib, as a monotherapy in the Phase 1/2 TakeAim Leukemia study (CA-4948-102) in patients with relapsed/refractory acute myeloid leukemia (AML) and relapsed/refractory high risk myelodysplastic syndrome (hrMDS) with either a FLT3 mutation or a splicing factor mutation (U2AF1 or SF3B2), and as a frontline combination therapy with azacitidine and venetoclax in patents with AML (CA-4948-104). Emavusertib has received Orphan Drug Designation from the U.S. Food and Drug Administration for the treatment of AML and MDS and from the European Commission for the treatment of PCNSL. Curis, through its 2015 collaboration with Aurigene, has the exclusive license to emavusertib (CA-4948). Curis licensed its rights to Erivedge® to Genentech, a member of the Roche Group, under which they are commercializing Erivedge® for the treatment of advanced basal cell carcinoma. For more information, visit Curis's website at www.curis.com.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including, without limitation, any statements with respect to Curis's cash runway, plans, strategies and objectives; statements concerning research, development, clinical trials and commercialization plans, timelines, anticipated results or the therapeutic potential of emavusertib including the progression, expansion, use, safety, efficacy, rates and duration of responses, mutations or potential biomarkers, and potential benefits of emavusertib in clinical trials as a monotherapy and/or as a combination therapy; statements regarding Curis's plans and timelines to provide preliminary, interim and/or additional data from its ongoing or planned clinical trials; any statements concerning Curis's expectations regarding its interactions with the FDA and/or health authorities on the potential development path for emavusertib in PCNSL or the potential benefits of having received orphan drug designation from the EC for emavusertib in PCNSL; and statements of assumptions underlying any of the foregoing. Forward-looking statements may contain the words "believes," "expects," "anticipates," "plans," "intends," "seeks," "estimates," "assumes," "predicts," "projects," "targets," "will," "may," "would," "could," "should," "continue," "potential," "focus," "strategy," "mission," or similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other important factors that may cause actual results to be materially different from those indicated by such forward-looking statements. Curis may experience adverse results, delays and/or failures in its drug development programs and may not be able to successfully advance the development of its drug candidates in the time frames it projects, if at all. Curis's drug candidates may cause unexpected toxicities, fail to demonstrate sufficient safety and efficacy in clinical studies and/or may never achieve the requisite regulatory approvals needed for commercialization. Favorable results seen in preclinical studies and early clinical trials of Curis's drug candidates may not be replicated in later trials. Curis is dependent on the success of emavusertib and any delays in the development of emavusertib could have a material adverse effect on its business. There can be no guarantee that the collaboration agreement with Aurigene will continue for its full term, or the CRADA with NCI, that Curis or its collaborators will each maintain the financial and other resources necessary to continue financing its portion of the research, development and commercialization costs, or that the parties will successfully discover, develop or commercialize drug candidates under the collaboration. Regulatory authorities may determine to delay or restrict Genentech's and/or Roche's ability to continue to commercialize Erivedge in basal cell carcinoma. Competing drugs may be developed that are superior to Erivedge. In connection with its agreement with Oberland Capital, Curis faces risks relating to the transfer and encumbrance of certain royalty and royalty-related payments on commercial sales of Erivedge, including the risk that, in the event of a default by Curis or its wholly-owned subsidiary, Curis could lose all retained rights to future

royalty and royalty-related payments, Curis could be required to repurchase such future royalty and royalty-related payments at a price that is a multiple of the payments it has received, and its ability to enter into future arrangements may be inhibited, all of which could have a material adverse effect on its business, financial condition and stock price. Curis will require substantial additional capital to fund its business. Based on its available cash resources, it does not have sufficient cash on hand to support current operations within the next 12 months from the date of this press release. If it is not able to obtain sufficient funding, it will be forced to delay, reduce in scope or eliminate the development emavusertib, including related clinical trials and operating expenses, potentially delaying the time to market for, or preventing the marketing of, emavusertib, which could adversely affect its business prospects and its ability to continue operations, and would have a negative impact on its financial condition and its ability to pursue its business strategies. Curis faces substantial competition. Curis and its collaborators face the risk of potential adverse decisions made by the FDA and other regulatory authorities, investigational review boards, and publication review bodies. Curis may not obtain or maintain necessary patent protection and could become involved in expensive and time-consuming patent litigation and interference proceedings. Unstable market and economic conditions, natural disasters, public health crises, political crises and other events outside of Curis's control could significantly disrupt its operations or the operations of third parties on which Curis depends and could adversely impact Curis's operating results and its ability to raise capital. Other important factors that may cause or contribute to actual results being materially different from those indicated by forward-looking statements include the factors set forth under the captions "Risk Factor Summary" and "Risk Factors" in our most recent Form 10-K and Form 10-Q, and the factors that are discussed in other filings that we periodically make with the Securities and Exchange Commission. In addition, any forward-looking statements represent the views of Curis only as of today and should not be relied upon as representing Curis's views as of any subsequent date. Curis disclaims any intention or obligation to update any of the forward-looking statements after the date of this press release whether as a result of new information, future events or otherwise, except as may be required by law.

CURIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues, net | $ | 2,931 | | | $ | 2,833 | | | $ | 7,563 | | | $ | 7,327 | |

| Operating expenses: | | | | | | | |

| Cost of royalties | 22 | | | 60 | | | 81 | | | 158 | |

| Research and development | 9,723 | | | 10,380 | | | 29,594 | | | 29,532 | |

| General and administrative | 3,753 | | | 4,761 | | | 13,436 | | | 13,770 | |

| Total operating expenses | 13,498 | | | 15,201 | | | 43,111 | | | 43,460 | |

| Loss from operations | (10,567) | | | (12,368) | | | (35,548) | | | (36,133) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total other income | 475 | | | 187 | | | 1,777 | | | 432 | |

| Net loss | $ | (10,092) | | | $ | (12,181) | | | $ | (33,771) | | | $ | (35,701) | |

| Net loss per common share (basic and diluted) | $ | (1.70) | | | $ | (2.13) | | | $ | (5.77) | | | $ | (6.96) | |

| Weighted average common shares (basic and diluted) | 5,940,924 | | | 5,720,789 | | | 5,847,982 | | | 5,131,904 | |

CURIS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| ASSETS | | | | |

Cash, cash equivalents and investments | | $ | 20,854 | | | $ | 56,334 | |

| Restricted cash | | 544 | | | 544 | |

| Accounts receivable | | 2,978 | | | 2,794 | |

| Prepaid expenses and other assets | | 5,408 | | | 5,138 | |

| Property and equipment, net | | 246 | | | 434 | |

| Operating lease right-of-use asset | | 3,461 | | | 3,056 | |

| Goodwill | | 8,982 | | | 8,982 | |

| Total assets | | $ | 42,473 | | | $ | 77,282 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

| Accounts payable and accrued liabilities | | $ | 11,959 | | | $ | 12,212 | |

| Operating lease liability | | 3,260 | | | 2,794 | |

| Liability related to the sale of future royalties, net | | 35,989 | | | 42,606 | |

| Total liabilities | | 51,208 | | | 57,612 | |

| Total stockholders' equity (deficit) | | (8,735) | | | 19,670 | |

| Total liabilities and stockholders' equity (deficit) | | $ | 42,473 | | | | $ | 77,282 | |

For further information:

Investor Relations

IR@curis.com

v3.24.3

Cover Page

|

Nov. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

Curis, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-30347

|

| Entity Tax Identification Number |

04-3505116

|

| Entity Address, Address Line One |

128 Spring Street

|

| Entity Address, Address Line Two |

Building C - Suite 500

|

| Entity Address, City or Town |

Lexington

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02421

|

| City Area Code |

(617)

|

| Local Phone Number |

503-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

CRIS

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001108205

|

| Amendment Flag |

false

|

| Security Exchange Name |

NASDAQ

|

| Document Period End Date |

Nov. 14, 2024

|

| Entity Listings [Line Items] |

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

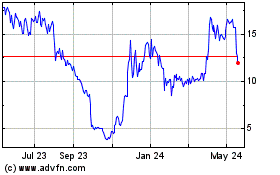

Curis (NASDAQ:CRIS)

Historical Stock Chart

From Feb 2025 to Mar 2025

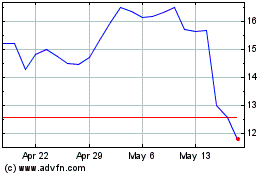

Curis (NASDAQ:CRIS)

Historical Stock Chart

From Mar 2024 to Mar 2025