Second Quarter Net Sales Increased 38.2% to $59.4 Million; Second

Quarter Comparable Store Sales Increased 11.5%; Second Quarter

Diluted Earnings per Share Increased to $0.03; Fiscal Year 2005 EPS

Guidance Range of $0.80 - $0.83 SAVANNAH, Ga., Aug. 24

/PRNewswire-FirstCall/ -- Citi Trends, Inc. (NASDAQ:CTRN) today

reported results for the thirteen and twenty-six weeks ended July

30, 2005. Quarter Ended July 30, 2005 Total net sales for the

thirteen weeks ended July 30, 2005 increased by 38.2% to $59.4

million from $43.0 million reported in the prior year. Comparable

store sales increased 11.5% for the thirteen weeks ended July 30,

2005 compared to 0.3% in the thirteen weeks ended July 31, 2004.

Total net sales for the twenty-six weeks ended July 30, 2005

increased by 35.1% to $123.1 million from $91.1 million reported in

the prior year. Comparable store sales increased 9.0% for the

twenty-six weeks ended July 30, 2005 compared to 2.0% in the

twenty-six weeks ended July 31, 2004. Relocated stores and expanded

stores are included in the comparable store sales results. The

Company reported net income for the thirteen weeks ended July 30,

2005 of approximately $381,000, or $0.03 per diluted share,

compared to net loss of approximately $41,000 or $0.00 per diluted

share in the thirteen weeks ended July 31, 2004. The Company

reported net income for the twenty-six weeks ended July 30, 2005 of

$3.6 million, or $0.30 per diluted share, compared to net income of

$2.2 million or $0.20 per diluted share in the twenty-six weeks

ended July 31, 2004. The Company paid a one-time fee in the second

quarter of $1.2 million pre- tax, or $0.05 per diluted share, to

Hampshire Equity Partners to terminate its management consulting

agreement with the Company, as previously disclosed by the Company

in the prospectus for its initial public offering. The fee is

included in the net income results reported above. For fiscal 2005,

the Company plan was to open 40 new stores. In the twenty-six weeks

ended July 30, 2005, the Company opened 21 new stores and is on

plan for store openings for the remainder of the year. Fiscal 2005

EPS Outlook The Company anticipates full year diluted earnings per

share of between $0.80 and $0.83 based on 13.4 million diluted

shares outstanding. The Company reminds investors of the complexity

of accurately assessing future growth given the difficulty in

predicting fashion trends, consumer preferences and general

economic conditions and the impact of other business variables. A

one-hour conference call will be held on August 25, 2005 at 10:00

am EST to discuss second quarter results and answer questions. To

access the conference call, listeners should dial 800-218-8862.

International callers should dial 303-262-2211. For those unable to

listen at that time, a replay of the call will be available through

September 1, 2005 at 800-405-2236 for domestic callers or

303-590-3000 for international callers. The pass code for the

replay is 11037385. The call will be broadcast live over the

Internet via http://ir.cititrends.com/medialist.cfm. For those who

are unavailable to listen to the live broadcast, a replay will be

available shortly after the call on the above web site for 60 days.

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company

currently operates 221 stores located in 12 states in the South,

Southeast and Mid-Atlantic region, and our website address is

http://www.cititrends.com/. Forward-Looking Statements All

statements other than historical facts contained in this news

release, including statements regarding our future financial

position, business policy and plans and objectives of management

for future operations, are forward- looking statements that are

subject to material risks and uncertainties. The words "believe,"

"may," "could," "estimate," "continue," "anticipate," "intend,"

"expect" and similar expressions, as they relate to Citi Trends,

are intended to identify forward-looking statements. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance or results and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified, and that actual results or developments

may differ materially from those in the forward-looking statements

as a result of various factors which are discussed in Citi Trends,

Inc. filings with the Securities and Exchange Commission. These

risks and uncertainties include, but are not limited to,

uncertainties relating to economic conditions, growth and expansion

risks, consumer spending patterns, competition within the industry,

competition in our markets and the ability to anticipate and

respond to fashion trends. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, Citi

Trends does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise. CTRN - E CITI TRENDS, INC. CONDENSED

STATEMENT OF INCOME (unaudited) in $000's, except share and per

share data) Thirteen Weeks Ended July 30, 2005 July 31, 2004

(unaudited) (unaudited) Net sales 59,449 43,011 Gross profit 21,767

14,916 Selling, general and administrative expenses 21,271 14,806

Income from operations 496 110 Net income 381 (41) Net income per

share, basic 0.03 0.00 Net income per share, diluted 0.03 0.00

Weighted average shares used to compute net income per share, basic

11,925,307 9,310,600 Weighted average shares used to compute net

income per share, diluted 13,587,400 10,952,838 CITI TRENDS, INC.

CONDENSED STATEMENT OF INCOME (unaudited) in $000's, except share

and per share data) Twenty-six Weeks Ended July 30, 2005 July 31,

2004 (unaudited) (unaudited) Net sales 123,066 91,080 Gross profit

46,900 33,950 Selling, general and administrative expenses 41,029

30,026 Income from operations 5,871 3,924 Net income 3,646 2,198

Net income per share, basic 0.34 0.24 Net income per share, diluted

0.30 0.20 Weighted average shares used to compute net income per

share, basic 10,610,154 9,308,000 Weighted average shares used to

compute net income per share, diluted 12,230,180 10,928,216 CITI

TRENDS, INC. CONDENSED BALANCE SHEETS (in $000's) July 30, 2005

July 31, 2004 (unaudited) (unaudited) Assets Cash and cash

equivalents 30,760 5,894 Marketable securities 12,013 -- Inventory

50,064 36,936 Other assets 7,279 5,715 Property and equipment, net

20,129 15,276 Total assets 120,245 63,821 Liabilities and

stockholders' equity Borrowings under line of credit -- 5,660

Accounts payable and accrued liabilities 43,713 29,661 Other

liabilities 7,414 9,769 Total stockholders' equity 69,118 18,731

Total liabilities and stockholders' equity 120,245 63,821

DATASOURCE: Citi Trends, Inc. CONTACT: Tom Stoltz, Chief Financial

Officer, +1-912-443-2075, , or Ed Anderson, Chief Executive

Officer, +1-912-443-3075, , both of Citi Trends, Inc.; or General:

Marilynn Meek, +1-212-827-3773, or Analysts: Susan Garland,

+1-212-827-3775, both of Financial Relations Board for Citi Trends,

Inc. Web site: http://www.cititrends.com/

http://ir.cititrends.com/medialist.cfm

Copyright

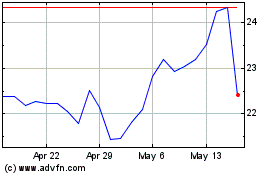

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

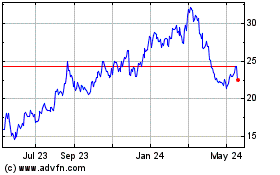

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024