Abercrombie Beats on EPS - Analyst Blog

February 22 2013 - 8:24AM

Zacks

Casual apparel retailer, Abercrombie & Fitch

Co. (ANF) reported an outstanding financial result for the

fourth quarter of fiscal 2012 with earnings surging over 97% year

over year to $2.21 per share, substantially beating the Zacks

Consensus Estimate of $1.93.

The robust quarterly performance was primarily driven by strong

top-line growth along with improved margins. The earnings included

the effect of change of inventory valuation method to cost method

from retail method.

Summary of the Quarter

Driven by robust sales performance in the international market,

total sales for the company escalated 11% to $1.469 billion from

$1.329 billion in the comparable prior-year period. However, the

quarterly revenue missed the Zacks Consensus Estimate of $1.481

billion.

The increase in total sales reflects robust growth of 34% in

international business (including direct-to-consumer sales) to

$392.2 million and total domestic sales (including

direct-to-consumer sales) increasing 1% to $976.4 million. Overall,

direct-to-consumer sales jumped 26% to $266.4 million in the

quarter under review, signifying continued strength in the online

business.

Including direct-to-consumer sales, the company’s total

comparable-store sales (comps) inched down 1%, primarily due to a

fall of 4% in comparable-store sales, partially offset by an

increase of 17% in comparable direct-to-consumer sales.

In the quarter, gross margin improved 390 basis points (bps) to

63.4%. The expansion in gross margin was primarily driven by

reduced average unit cost.

Stores and distribution expenses, as a percentage of sales,

increased 110 bps to 38.8% compared with 37.7% in the prior-year

period, primarily due to higher direct-to-consumer expenses.

Moreover, marketing, general and administrative expenses escalated

by $10.7 million to $122.3 million due to higher compensation

charges along with enhanced marketing, travelling and IT

expenses.

Balance Sheet

Abercrombie ended fiscal 2012 with cash and cash equivalents of

$645.7 million and shareholders’ equity of $1.818 billion. As of

Feb 2, 2013, inventories were approximately $427.0 million under

the cost method.

During the fiscal, the company spent approximately $321.7

million toward repurchasing 7.5 million shares of its common stock.

The company now has the total authorization to buyback 18.7 million

additional shares under its share repurchase program.

Further, on Feb 21, 2013, the company’s board of directors

announced a quarterly cash dividend of 20 cents per share payable

on Mar 19, 2013 to shareholders of record as of Mar 4, 2013. The

recently declared dividend represents an increase of 14.3% from

last paid dividend of 17.5 cents per share on Dec 11, 2012.

Store Update

During the fiscal, the company opened 3 new domestic and 40

international stores, while it shuttered 47 domestic stores at

different locations.

The company ended the fiscal with a total of 1,051 stores,

including 285 Abercrombie & Fitch stores, 150 abercrombie kids

stores, 589 Hollister Co. stores and 27 Gilly Hicks stores.

Sneak Peek into Fiscal 2013

Based on strong sales trends, Abercrombie expects its fiscal

2013 earnings to come in the range of $3.35–$3.45 per share, under

the cost method of inventory valuation. During the fiscal year,

Abercrombie intends to open nearly 20 international Hollister

stores and shut down 40–50 domestic stores. The company anticipates

a capital expenditure of approximately $200.0 million toward new

store openings and other planned expenditure in fiscal 2013.

Other Stocks to Consider

Currently, Abercrombie has a Zacks Rank #1 (Buy). Other stocks

worth considering in the apparel retail industry are Citi

Trends, Inc. (CTRN), Express Inc. (EXPR)

and American Eagle Outfitters, Inc. (AEO). While

Citi Trends and Express hold a Zacks Rank #1 (Strong Buy), American

Eagle has a Zacks Rank #2 (Buy).

AMER EAGLE OUTF (AEO): Free Stock Analysis Report

ABERCROMBIE (ANF): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

EXPRESS INC (EXPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

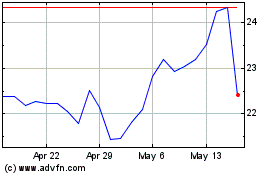

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

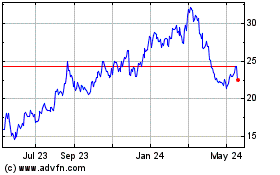

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024