Men's Wearhouse to Buy Back Shares - Analyst Blog

July 23 2013 - 6:10PM

Zacks

Yesterday, after the market closed, The Men's Wearhouse,

Inc. (MW) announced that it has entered into an agreement

with JPMorgan Chase Bank, NA to repurchase its $100 million worth

of common stock under an accelerated share repurchase program.

One of the largest specialty retailers of menswear in the United

States and Canada will buy these shares under its ongoing $200

million share repurchase program announced on Mar 13 this year.

Furthermore, Men’s Wearhouse expects to close the transaction by

the end of fourth-quarter

2013.

Under the accelerated share repurchase program, a company buys

back its shares from an investment bank. The investment bank sells

these shares to the company after borrowing from clients or share

lenders.

Thereafter, the bank returns the shares borrowed from clients or

share lenders by purchasing shares from the open market over a

certain time period. This type of share repurchase program allows

companies to acquire shares at a faster pace and immediately reduce

the shares outstanding.

Initially, the menswear retailer will get nearly 2,197,000

shares from JPMorgan, approximately 85% of the total number of

shares projected to be repurchased. The price at which Men’s

Wearhouse will acquire these shares will be calculated on the basis

of volume-weighted average share price.

The company intends to fund this accelerated share repurchase

program with cash in hand and/or by utilizing its existing credit

facility. Men’s Wearhouse’s strong balance sheet and cash flows

provide financial flexibility and facilitate shareholder friendly

moves.

During fiscal 2012, the company shelled out $41.3 million on

share repurchases and $37.1 million on cash dividends. Furthermore,

last week, the company signed an agreement to acquire JA Holding,

Inc. for a sum of $97.5 million in cash.

Men’s Wearhouse currently carries a Zacks Rank #4 (Sell). Other

well-performing stocks in the apparel industry that are worth a

look include The Gap, Inc. (GPS), Citi

Trends, inc. (CTRN) and Express Inc.

(EXPR). All of them have a Zacks Rank #2 (Buy).

CITI TRENDS INC (CTRN): Free Stock Analysis Report

EXPRESS INC (EXPR): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

MENS WEARHOUSE (MW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

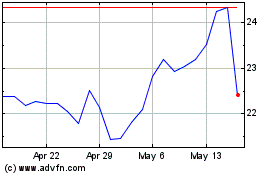

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

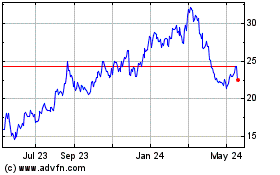

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024