Current Report Filing (8-k)

June 11 2019 - 3:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 6, 2019

Citi Trends, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51315

|

|

52-2150697

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

104 Coleman Boulevard, Savannah, Georgia

|

|

31408

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(912) 236-1561

Former name or former address, if changed since last report

:

Not applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre- commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

|

CTRN

|

|

Nasdaq Stock Market

|

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 10, 2019, Bruce D. Smith and the Board of Directors (the “Board”) of Citi Trends, Inc. (the “Company”) mutually agreed that he would resign as the President, Chief Executive Officer and Secretary of the Company and a member of the Board, effective on the earlier of (i) 30 days following the date on which the Company hires a new Chief Executive Officer or (ii) February 1, 2020. In connection with his resignation, on June 11, 2019, the Company and Mr. Smith entered into a Separation Agreement (the “Separation Agreement”). Pursuant to the Separation Agreement, Mr. Smith will receive severance payments and benefits as provided in his Severance Agreement with the Company, dated March 15, 2018. In addition, the Company agreed to accelerate the vesting of time-based restricted stock held by Mr. Smith as of his separation date.

The summary of the Separation Agreement above does not purport to be complete and is qualified in its entirety by reference to such agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 5.02.

The press release dated June 11, 2019 announcing Mr. Smith’s resignation is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 5.02.

Additionally, on June 6, 2019, the Company terminated the services of Brian Lattman, a Senior Vice President and General Merchandise Manager of the Company. In accordance with the terms of Mr. Lattman’s previously disclosed Severance Agreement, dated March 30, 2018, since Mr. Lattman’s employment was terminated without cause, he is entitled to separation payments of twelve (12) months base salary, to be paid in twenty-six (26) regular bi-weekly pay periods. He will also be entitled to an amount, minus all applicable taxes and withholdings, equal to the full monthly cost (including any portion of the cost previously paid by the employee) to provide the same level of group health benefits that he maintained as of his separation from service. The separation payments described above are conditioned on Mr. Lattman executing and not revoking a Separation and General Release Agreement, which releases and waives any and all claims against the Company and its affiliated persons and companies.

Item 5.07

Submission of Matters to a Vote of Security Holders.

At the 2019 annual meeting of stockholders (the “Annual Meeting”) of Citi Trends, Inc. (the “Company”) held on June 6, 2019 (the “Annual Meeting”), the holders of the Company’s common stock entitled to vote at the meeting (1) elected three director nominees whose terms will expire at the 2020 annual meeting of stockholders, (2) adopted, on a non-binding, advisory basis, the resolution approving the compensation of the Company’s named executive officers as set forth in the proxy statement, and (3) ratified the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 1, 2020.

The voting results were as follows:

(1) The election of three directors:

|

Board of Directors Nominee

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

Brian P. Carney

|

|

8,023,693

|

|

1,246,617

|

|

1,815

|

|

562,006

|

|

Barbara Levy

|

|

8,087,130

|

|

1,183,922

|

|

1,073

|

|

562,006

|

|

Peter R. Sachse

|

|

8,949,546

|

|

311,536

|

|

11,043

|

|

562,006

|

(2) A proposal to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers as set forth in the proxy statement:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

8,247,948

|

|

983,876

|

|

40,301

|

|

562,006

|

2

(3) Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for

the fiscal year ending February 1, 2020:

|

For

|

|

Against

|

|

Abstain

|

|

9,670,230

|

|

161,820

|

|

2,081

|

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

CITI TRENDS, INC.

|

|

Date: June 11, 2019

|

|

|

|

|

|

|

By:

|

/s/ Bruce D. Smith

|

|

|

Name:

|

Bruce D. Smith

|

|

|

Title:

|

President and Chief Executive Officer

|

4

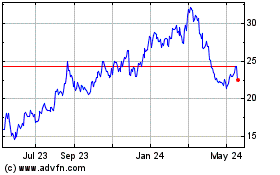

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

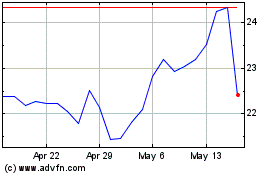

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024