CFO Josh Siegel to step down and Deputy CFO

Erica Smith to be named CFO

CyberArk (NASDAQ: CYBR), the global leader in identity security,

today announced that Chief Financial Officer (CFO) Josh Siegel will

step down on January 1, 2025 and transition into an advisory role.

As part of a planned succession, Erica Smith, CyberArk's Deputy

Chief Financial Officer, will become Chief Financial Officer and

join the executive team.

Smith joined CyberArk in 2015 and was appointed Deputy Chief

Financial Officer in 2024 after serving as Senior Vice President of

Finance and Investor Relations, leading FP&A, investor

relations and ESG. She was a part of the leadership team driving a

successful business model transition in 2021 and 2022 and

CyberArk’s $1.6 billion acquisition of Venafi in 2024. Smith will

draw on her more than 25 years of finance leadership experience at

CyberArk and other public companies to support CyberArk’s continued

innovation and growth.

During his 13-year tenure as CFO, Siegel built a robust, highly

disciplined finance organization that enabled essential investments

and helped CyberArk scale from less than $40 million in revenue to

nearly $1 billion in ARR, with a strong track record of profitable

growth. As an advisor to the company, Siegel will help ensure a

smooth transition and will work on key company initiatives and

special projects.

“For more than a decade, Josh has been an instrumental member of

the executive team,” said Matt Cohen, CyberArk's Chief Executive

Officer. “His laser focus on growth, balanced with profitability

and strong cash generation, has been key to our operating rhythm

and has set the tone for the entire executive team and our

long-term strategy. His contribution has been immeasurable, and

we’re fortunate that he will stay on as an advisor, so we can

continue to benefit from his insight and leadership.

“Erica has been a strong leader since day one. She has built an

impeccable investor relations program and expanded her role to

include FP&A, treasury and ESG. She also played an integral

part in our subscription transition and currently has the key role

of leading Venafi’s finance organization during the integration

process. She knows the company inside and out and is a trusted

partner to the Board and our executive leadership team. Her

intellect, deep financial knowledge and sound judgment make her the

perfect choice to be CyberArk’s next CFO,” continued Cohen.

“It’s been a privilege to have been part of CyberArk’s

remarkable journey and to work alongside so many talented people.

CyberArk has a bright future ahead as it continues to extend its

leadership position in identity security. We have a strong finance

team, and I am confident that under Erica’s leadership, they will

continue to excel as they support the company’s growth, scale and

profitability,” said Josh Siegel.

“I am honored by the trust Matt, Josh, the executive leadership

team and Board are placing in me as the next CFO of CyberArk,” said

Erica Smith. “CyberArk is truly a special company, and I am excited

to build on the strong foundation Josh has established to help

drive further growth and scale. I am also extremely grateful for

the opportunity to work even more closely with our talented finance

team around the world, who has demonstrated an unwavering

commitment to professionalism and results-driven execution.”

Prior to joining CyberArk, Smith was Vice President of Investor

Relations for Demandware from 2011 to 2015. Demandware completed an

initial public offering and listing on Nasdaq in 2012 and was

acquired by Salesforce in 2016. As a member of the finance

leadership team at Demandware, Smith was deeply involved in

establishing and tracking financial metrics, as well as finance and

M&A activities. Previously, Smith held various investor

relations, corporate communications and finance positions at

leading companies including Boston Private Financial Holdings,

Network Engines, StorageNetworks, Sharon Merrill Associates and

Lehman Brothers. Smith holds a B.A. in Economics from the College

of the Holy Cross.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security. Centered on Intelligent Privilege Controls™, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud environments and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit cyberark.com, read the CyberArk blogs or follow on LinkedIn,

X, Facebook or YouTube.

Copyright © 2024 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating, but not limited to: risks

related to the Company’s acquisition of Venafi Holdings, Inc.

(“Venafi”), including impacts of the acquisition on the Company’s

or Venafi’s operating results and business generally; the ability

of the Company or Venafi to retain and hire key personnel and

maintain relationships with customers, suppliers and others with

whom the Company or Venafi do business; risks that Venafi’s

business will not be integrated successfully into the Company’s

operations; risks relating to the Company’s ability to realize

anticipated benefits of the combined operations after the Venafi

acquisition; changes to the drivers of the Company’s growth and the

Company’s ability to adapt its solutions to the information

security market changes and demands, including artificial

intelligence (“AI”); the Company’s ability to acquire new customers

and maintain and expand the Company’s revenues from existing

customers; intense competition within the information security

market; real or perceived security vulnerabilities, gaps, or

cybersecurity breaches of the Company, or the Company’s customers’

or partners’ systems, solutions or services; risks related to the

Company’s compliance with privacy, data protection and AI laws and

regulations; the Company’s ability to successfully operate its

business as a subscription company and fluctuation in the quarterly

results of operations; the Company’s reliance on third-party cloud

providers for its operations and software-as-a-service (“SaaS”)

solutions; the Company’s ability to hire, train, retain and

motivate qualified personnel; the Company’s ability to effectively

execute its sales and marketing strategies; the Company’s ability

to find, complete, fully integrate or achieve the expected benefits

of additional strategic acquisitions; the Company’s ability to

maintain successful relationships with channel partners, or if the

Company’s channel partners fail to perform; risks related to sales

made to government entities; prolonged economic uncertainties or

downturns; the Company’s history of incurring net losses, the

Company’s ability to generate sufficient revenue to achieve and

sustain profitability and the Company’s ability to generate cash

flow from operating activities; regulatory and geopolitical risks

associated with the Company’s global sales and operations; risks

related to intellectual property claims; fluctuations in currency

exchange rates; the ability of the Company’s products to help

customers achieve and maintain compliance with government

regulations or industry standards; the Company’s ability to protect

its proprietary technology and intellectual property rights; risks

related to using third-party software, such as open-source

software; risks related to stock price volatility or activist

shareholders; any failure to retain the Company’s “foreign private

issuer” status or the risk that the Company may be classified, for

U.S. federal income tax purposes, as a “passive foreign investment

company”; risks related to the Company’s Convertible Senior Notes

due 2024 (the “Convertible Notes”), including the potential

dilution to existing shareholders and the Company’s ability to

raise the funds necessary to repurchase the Convertible Notes;

changes in tax laws; the Company’s expectation to not pay dividends

on the Company’s ordinary shares for the foreseeable future; risks

related to the Company’s incorporation and location in Israel,

including the ongoing war between Israel and Hamas and conflict in

the region; and other factors discussed under the heading “Risk

Factors” in the Company’s most recent annual report on Form 20-F

filed with the Securities and Exchange Commission. Forward-looking

statements in this release are made pursuant to the safe harbor

provisions contained in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113780536/en/

Investor Relations: Srinivas Anantha, CFA CyberArk

617-558-2132 ir@cyberark.com

Media: Nick Bowman CyberArk +44 (0) 7841 673378

press@cyberark.com

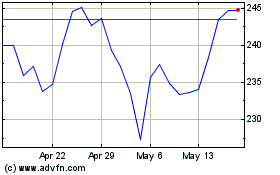

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

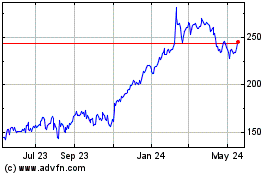

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024