Total ARR Reaches $1.169 billion; Surpasses $1

billion ARR Organically Subscription Portion of Annual Recurring

Revenue (ARR) Reaches $977 million Record Total Revenue of $1.001

billion for the Full Year 2024 Non-GAAP Operating Income of $151

million, or 15% operating margin, for the Full Year 2024 Record

Free Cash Flow of $221 million, or a 22% FCF margin, for the Full

Year 2024 Returns to Rule of 40 for the Full Year 2024; A Year

Ahead of Target

CyberArk (NASDAQ: CYBR), the global leader in identity security,

today announced strong financial results for the fourth quarter and

full year ended December 31, 2024.

“2024 was a milestone year for CyberArk. Our record performance

in the fourth quarter and the year reflects the strength of demand

for our identity security solutions and the consistent execution of

our strategy,” said Matt Cohen, CyberArk’s Chief Executive Officer.

“Total ARR reached $1.169 billion, driven by organic ARR crossing

$1 billion and the outperformance from Venafi. With our strong

revenue growth and free cash flow margin, we returned to Rule of 40

on a full year basis – beating our long-term guidance framework by

a full year. With our leading identity security platform,

innovation engine, and persona-based solutions uniquely

differentiated with best-in-class security controls, we are well

positioned to go after our massive market opportunity. We enter

2025 in a position of strength and we are set up to deliver durable

growth.”

Financial Summary for the Fourth Quarter Ended December 31,

2024

The financial results for the fourth quarter of 2024 include the

financial contributions from the acquisition of Venafi, which

closed on October 1, 2024.

- Total revenue was $314.4 million in the fourth quarter of 2024,

up 41 percent from $223.1 million in the fourth quarter of

2023.

- Subscription revenue was $243.0 million in the fourth quarter

of 2024, an increase of 62 percent from $150.3 million in the

fourth quarter of 2023.

- Maintenance and professional services revenue was $66.4 million

in the fourth quarter of 2024, compared to $64.8 million in the

fourth quarter of 2023.

- Perpetual license revenue was $5.0 million in the fourth

quarter of 2024, compared to $8.0 million in the fourth quarter of

2023.

- GAAP operating loss was $(31.4) million compared to GAAP

operating loss of $(4.7) million in the same period last year.

Non-GAAP operating income was $58.7 million, or 19 percent margin,

compared to non-GAAP operating income of $34.7 million, or 16

percent margin, in the same period last year.

- GAAP net loss was $(97.1) million, or $(2.02) per basic and

diluted share, compared to GAAP net income of $8.9 million, or

$0.20 per diluted share, in the same period last year. Non-GAAP net

income was $40.4 million, or $0.80 per diluted share, compared to

non-GAAP net income of $38.1 million, or $0.81 per diluted share,

in the same period last year.

Financial Summary for the Full Year Ended December 31,

2024

The financial results for the full year 2024 include financial

contribution in the fourth quarter from the acquisition of Venafi,

which closed on October 1, 2024.

- Total revenue was $1.001 billion in the full year 2024, growing

33 percent year-over-year from $751.9 million in the full year

2023.

- Subscription revenue was $733.3 million in the full year 2024,

an increase of 55 percent from $472.0 million in the full year

2023.

- Maintenance and professional services revenue was $253.0

million in the full year 2024, compared to $258.8 million in the

full year 2023.

- Perpetual license revenue was $14.4 million in the full year

2024, compared to $21.0 million in the full year 2023.

- GAAP operating loss was $(72.8) million, and non-GAAP operating

income was $150.9 million in the full year 2024, or a margin of 15

percent, compared to $33.5 million, or a margin of 4 percent, in

the full year 2023.

- GAAP net loss was $(93.5) million, or $(2.12) per basic and

diluted share, in the full year 2024. Non-GAAP net income was

$147.5 million, or $3.03 per diluted share, in the full year 2024,

compared to $52.0 million, or $1.12 per diluted share, in the full

year 2023.

Balance Sheet and Net Cash Provided by Operating

Activities

- As of December 31, 2024, cash, cash equivalents, short-term

deposits, and marketable securities were $841.1 million. The

changes in CyberArk’s cash balance reflect the approximately $1

billion in cash as part of the consideration paid for the

acquisition of Venafi.

- On November 15, 2024, the Company settled $535 million of

outstanding senior convertible notes with our ordinary shares,

consistent with the terms of the senior convertible notes.

- During the full year 2024, the Company’s net cash provided by

operating activities was $231.9 million, compared to $56.2 million

in the year ended December 31, 2023.

Key Business Highlights

- Annual Recurring Revenue (ARR) was $1.169 billion, an increase

of 51 percent from $774 million at December 31, 2023. On a CyberArk

standalone basis, ARR grew 30 percent year-over-year.

- The Subscription portion of ARR was $977 million, or 84 percent

of total ARR at December 31, 2024. This represents an increase of

68 percent from $582 million, or 75 percent of total ARR, at

December 31, 2023.

- The Maintenance portion of ARR was $192 million at December 31,

2024, compared to $192 million at December 31, 2023.

- Recurring revenue in the fourth quarter was $292.2 million, an

increase of 45 percent from $201.5 million for the fourth quarter

of 2023. For the full year 2024, recurring revenue was $930.3

million, an increase of 37 percent from $679.6 million in the full

year 2023.

Recent Developments

- CyberArk announced a New Integration with SentinelOne®,

bringing together SentinelOne’s market-leading Singularity™

Endpoint solution and CyberArk Endpoint Privilege Manager.

- CyberArk announced a New Integration between CyberArk

Privileged Access Manager (PAM) and Microsoft Defender for

Identity.

- CyberArk Announced the Launch of FuzzyAI, a breakthrough

open-source tool that helps organizations safeguard against AI

model jailbreaks.

- CyberArk announced that CyberArk Workforce Identity Achieved

FIDO2 certification from the FIDO Alliance.

Zilla Security Acquisition

In a separate announcement, CyberArk announced it has completed

the acquisition of Zilla Security, a leader in modern Identity

Governance and Administration (IGA), for an enterprise value of

$165 million in cash and a $10 million earn-out tied to the

achievement of certain milestones.

Zilla’s innovative, AI-powered IGA capabilities will expand

CyberArk’s industry-leading Identity Security Platform with

scalable automation that enables accelerated identity compliance

and provisioning across digital environments, while maximizing

security and operational efficiency. This acquisition further

advances CyberArk’s strategy to deliver the industry’s most

powerful, comprehensive identity security platform to secure every

identity – human and machine – with the right level of privilege

controls.

Business Outlook

Based on information available as of February 13, 2025, CyberArk

is issuing guidance for the first quarter and full year 2025 as

indicated below. Venafi contributed to CyberArk’s results in the

fourth quarter of 2024 and did not contribute to the first, second

and third quarter periods. The guidance for the first quarter and

full year 2025 includes the expected contribution from the

acquisition of Zilla Security, which closed on February 12,

2025.

First Quarter 2025:

- Total revenue is expected to be in the range of $301.0 million

and $307.0 million, representing growth of 36 percent to 39 percent

compared to the first quarter of 2024.

- Non-GAAP operating income is expected to be in the range of

$42.5 million to $47.5 million.

- Non-GAAP net income per share is expected to be in the range of

$0.74 to $0.81 per diluted share.

- Assumes 51.3 million weighted average diluted shares.

Full Year 2025:

- Total revenue is expected to be in the range of $1.308 billion

to $1.318 billion, representing growth of 31 percent to 32 percent

compared to the full year 2024.

- Non-GAAP operating income is expected to be in the range of

$215.0 million to $225.0 million.

- Non-GAAP net income per share is expected to be in the range of

$3.55 to $3.70 per diluted share.

- Assumes 51.5 million weighted average diluted shares.

- ARR as of December 31, 2025 is expected to be in the range of

$1.410 billion to $1.420 billion, representing growth of 21 percent

from December 31, 2024.

- Adjusted free cash flow is expected to be in the range of

$300.0 million to $310.0 million for the full year 2025. Adjusted

free cash flow guidance normalizes for a one-time payment of $70

million as discussed below.

Tax Payment Related to Transfer of Venafi IP

CyberArk's forward-looking guidance for adjusted free cash flow

for the full year 2025 excludes the estimated impact of an

approximately $70 million one-time tax payment related to the

capital gain associated with the intercompany migration of

intellectual property related to the Venafi acquisition. We expect

this to occur in the first half of 2025.

Conference Call Information

In conjunction with this announcement, CyberArk will host a

conference call on Thursday, February 13, 2025 at 8:30 a.m. Eastern

Time (ET) to discuss the Company’s fourth quarter and full year

2024 financial results and its business outlook. To access this

call, dial +1 (888) 330-2455 (U.S.) or +1 (240) 789-2717

(international). The conference ID is 6515982. Additionally, a live

webcast of the conference call will be available via the “Investor

Relations” section of the company’s website at

www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 (800) 770-2030 (U.S.) or +1 (609) 800-9909

(international). The replay pass code is 6515982. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security, trusted by organizations around the world to secure human

and machine identities in the modern enterprise. CyberArk’s

AI-powered Identity Security Platform applies intelligent privilege

controls to every identity with continuous threat prevention,

detection and response across the identity lifecycle. With

CyberArk, organizations can reduce operational and security risks

by enabling zero trust and least privilege with complete

visibility, empowering all users and identities, including

workforce, IT, developers and machines, to securely access any

resource, located anywhere, from everywhere. Learn more at

cyberark.com.

Copyright © 2025 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Key Performance Indicators and Non-GAAP Financial

Measures

Recurring Revenue

- Recurring Revenue is defined as revenue derived from SaaS and

self-hosted subscription contracts, and maintenance contracts

related to perpetual licenses during the reported period.

Annual Recurring Revenue (ARR)

- ARR is defined as the annualized value of active SaaS,

self-hosted subscriptions and their associated maintenance and

support services, and maintenance contracts related to the

perpetual licenses in effect at the end of the reported

period.

Subscription Portion of Annual Recurring Revenue

- Subscription portion of ARR is defined as the annualized value

of active SaaS and self-hosted subscription contracts in effect at

the end of the reported period. The subscription portion of ARR

excludes maintenance contracts related to perpetual licenses.

Maintenance Portion of Annual Recurring Revenue

- Maintenance portion of ARR is defined as the annualized value

of active maintenance contracts related to perpetual licenses. The

Maintenance portion of ARR excludes SaaS and self-hosted

subscription contracts in effect at the end of the reported

period.

Net New ARR

- Net new ARR refers to the difference between ARR as of December

31, 2024 and ARR as of September 30, 2024.

Annual Recurring Revenue (ARR), Subscription portion of ARR and

Maintenance portion of ARR are performance indicators that provide

more visibility into the growth of our recurring business in the

upcoming year. This visibility allows us to make informed decisions

about our capital allocation and level of investment. Each of these

measures should be viewed independently of revenues and total

deferred revenue as each is an operating measure and is not

intended to be combined with or to replace either of those

measures. ARR, Subscription portion of ARR and Maintenance portion

of ARR are not forecasts of future revenues and can be impacted by

contract start and end dates and renewal rates.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating expense, non-GAAP operating income, non-GAAP net

income, free cash flow and adjusted free cash flow is helpful to

our investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to gross profit, operating loss, net

income (loss) or net cash provided by operating activities or any

other performance measures derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as GAAP gross profit

excluding share-based compensation expense, amortization of

intangible assets related to acquisitions, and impairment of

capitalized software development costs.

- Non-GAAP operating expense is calculated as GAAP operating

expenses excluding share-based compensation expense, acquisition

related expenses, and amortization of intangible assets related to

acquisitions.

- Non-GAAP operating income is calculated as GAAP operating loss

excluding share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, and impairment of capitalized software development

costs.

- Non-GAAP net income is calculated as GAAP net income (loss)

excluding share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, amortization of debt discount and issuance costs,

change in fair value of derivative assets, impairment of

capitalized software development costs, gain from investment in

privately held companies, the tax effect of non-GAAP adjustments,

the establishment of valuation allowance on deferred tax assets and

the tax impact of intra-entity transactions.

- Free cash flow is calculated as net cash provided by operating

activities less purchase of property and equipment and other

assets.

- Adjusted free cash flow is calculated as free cash flow plus

one-time tax payment on the capital gain from the intercompany

migration of intellectual property (IP) related to the Venafi

acquisition.

The Company believes that providing non-GAAP financial measures

that are adjusted by, as applicable, share-based compensation

expense, acquisition related expenses, amortization of intangible

assets related to acquisitions, non-cash interest expense related

to the amortization of debt discount and issuance cost, change in

fair value of derivative assets, impairment of capitalized software

development costs, gain from investment in privately held

companies, the tax effect of the non-GAAP adjustments, the

establishment of valuation allowance on deferred tax assets and the

tax impact of intra-entity transactions, purchase of property and

equipment and other assets, and one-time tax payment on the capital

gain from the intercompany migration of intellectual property

allows for more meaningful comparisons of its period to period

operating results. Share-based compensation expense has been, and

will continue to be for the foreseeable future, a significant

recurring expense in the Company’s business and an important part

of the compensation provided to its employees. Share-based

compensation expense has varying available valuation methodologies,

subjective assumptions and a variety of equity instruments that can

impact a company’s non-cash expense. The Company believes that

expenses related to its acquisitions, amortization of intangible

assets related to acquisitions, impairment of capitalized software

development costs, change in fair value of derivative assets, gain

from investment in privately held companies, and non-cash interest

expense related to the amortization of debt discount and issuance

costs do not reflect the performance of its core business and

impact period-to-period comparability. The Company believes free

cash flow and adjusted free cash flow are liquidity measures that,

after the purchase of property and equipment and other assets, and

one-time tax payment on the capital gain from the intercompany

migration of intellectual property provide useful information about

the amount of cash generated by the business.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, non-cash interest expense related to the amortization

of debt discount and issuance costs, the tax effect of the non-GAAP

adjustments and other tax adjustments, the establishment of

valuation allowance on deferred tax assets and the tax impact of

intra-entity transactions, purchase of property and equipment and

other assets, and one-time tax payment on the capital gain from the

intercompany migration of intellectual property. A reconciliation

of the non-GAAP financial measures guidance to the corresponding

GAAP measures is not available on a forward-looking basis due to

the uncertainty regarding, and the potential variability and

significance of, the amounts of share-based compensation expense,

amortization of intangible assets related to acquisitions, and the

non-recurring expenses that are excluded from the guidance, as well

as changes in interest rates and foreign exchange rates, which

impact other GAAP performance metrics or liquidity measures.

Accordingly, a reconciliation of the non-GAAP financial measures

guidance to the corresponding GAAP measures for future periods is

not available without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include, but are not limited to: risks related to

the Company’s acquisitions of Venafi Holdings, Inc. (“Venafi”) and

Zilla Security Inc. (“Zilla”), including potential impacts on

operating results; challenges in retaining and hiring key personnel

and maintaining business; risks related to the successful

integration of Venafi’s or Zilla’s operations and the ability to

realize anticipated benefits of the combined operations; disruption

of the current plans and operations of the Company and/or Zilla as

a result of the announcement of the transaction, including risks of

cyberattacks; changes to the drivers of the Company’s growth and

the Company’s ability to adapt its solutions to the information

security market changes and demands, including artificial

intelligence (“AI”); the Company’s ability to acquire new customers

and maintain and expand the Company’s revenues from existing

customers; intense competition within the information security

market; real or perceived security vulnerabilities, gaps, or

cybersecurity breaches of the Company, or the Company’s customers’

or partners’ systems, solutions or services; risks related to the

Company’s compliance with privacy, data protection and AI laws and

regulations; the Company’s ability to successfully operate its

business as a subscription company and fluctuation in its quarterly

results of operations; the Company’s reliance on third-party cloud

providers for its operations and software-as-a-service (“SaaS”)

solutions; the Company’s ability to hire, train, retain and

motivate qualified personnel; the Company’s ability to effectively

execute its sales and marketing strategies; the Company’s ability

to find, complete, fully integrate or achieve the expected benefits

of additional strategic acquisitions; the Company’s ability to

maintain successful relationships with channel partners, or if the

Company’s channel partners fail to perform; risks related to sales

made to government entities; prolonged economic uncertainties or

downturns; the Company’s history of incurring net losses, the

Company’s ability to generate sufficient revenue to achieve and

sustain profitability and the Company’s ability to generate cash

flow from operating activities; regulatory and geopolitical risks

associated with the Company’s global sales and operations; risks

related to intellectual property claims; fluctuations in currency

exchange rates; the ability of the Company’s products to help

customers achieve and maintain compliance with government

regulations or industry standards; the Company’s ability to protect

its proprietary technology and intellectual property rights; risks

related to using third-party software, such as open-source

software; risks related to stock price volatility or activist

shareholders; any failure to retain the Company’s “foreign private

issuer” status or the risk that the Company may be classified, for

U.S. federal income tax purposes, as a “passive foreign investment

company”; changes in tax laws; the Company’s expectation to not pay

dividends on the Company’s ordinary shares for the foreseeable

future; risks related to the Company’s incorporation and location

in Israel, including wars and other hostilities in the Middle East;

and other factors discussed under the heading “Risk Factors” in the

Company’s most recent annual report on Form 20-F filed with the

Securities and Exchange Commission. Forward-looking statements in

this release are made pursuant to the safe harbor provisions

contained in the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements are made only as of the date

hereof, and the Company undertakes no obligation to update or

revise the forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

CYBERARK SOFTWARE LTD. Consolidated Statements of

Operations U.S. dollars in thousands (except per share

data) (Unaudited) Three Months Ended

Twelve Months Ended December 31, December 31,

2023

2024

2023

2024

Revenues: Subscription

$

150,257

$

243,045

$

472,023

$

733,275

Perpetual license

8,009

4,965

21,037

14,449

Maintenance and professional services

64,838

66,374

258,828

253,018

Total revenues

223,104

314,384

751,888

1,000,742

Cost of revenues: Subscription

19,764

47,720

74,623

115,852

Perpetual license

700

346

1,873

1,594

Maintenance and professional services

19,189

25,700

79,635

90,931

Total cost of revenues

39,653

73,766

156,131

208,377

Gross profit

183,451

240,618

595,757

792,365

Operating expenses: Research and development

53,792

73,282

211,445

243,058

Sales and marketing

106,607

146,984

405,983

480,977

General and administrative

27,763

51,712

94,801

141,134

Total operating expenses

188,162

271,978

712,229

865,169

Operating loss

(4,711

)

(31,360

)

(116,472

)

(72,804

)

Financial income, net

19,302

5,997

53,214

56,838

Income (loss) before taxes on income

14,591

(25,363

)

(63,258

)

(15,966

)

Taxes on income

(5,680

)

(71,755

)

(3,246

)

(77,495

)

Net income (loss)

$

8,911

$

(97,118

)

$

(66,504

)

$

(93,461

)

Basic income (loss) per ordinary share

$

0.21

$

(2.02

)

$

(1.60

)

$

(2.12

)

Diluted income (loss) per ordinary share

$

0.20

$

(2.02

)

$

(1.60

)

$

(2.12

)

Shares used in computing net income (loss) per ordinary

shares, basic

42,069,678

48,116,242

41,658,424

44,182,071

Shares used in computing net income (loss) per ordinary shares,

diluted

47,107,294

48,116,242

41,658,424

44,182,071

CYBERARK SOFTWARE LTD.

Consolidated Balance

Sheets

U.S. dollars in

thousands

(Unaudited)

December 31, December 31,

2023

2024

ASSETS CURRENT ASSETS: Cash and cash

equivalents

$

355,933

$

526,467

Short-term bank deposits

354,472

256,953

Marketable securities

283,016

36,356

Trade receivables

186,472

328,465

Prepaid expenses and other current assets

31,550

45,292

Total current assets

1,211,443

1,193,533

LONG-TERM ASSETS: Marketable securities

324,548

21,345

Property and equipment, net

16,494

19,581

Intangible assets, net

20,202

534,726

Goodwill

153,241

1,317,374

Other long-term assets

214,816

258,531

Deferred tax asset

81,464

3,305

Total long-term assets

810,765

2,154,862

TOTAL ASSETS

$

2,022,208

$

3,348,395

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

10,971

$

23,671

Employees and payroll accruals

95,538

133,400

Accrued expenses and other current liabilities

36,562

53,486

Convertible senior notes, net

572,340

-

Deferred revenues

409,219

596,874

Total current liabilities

1,124,630

807,431

LONG-TERM LIABILITIES: Deferred revenues

71,413

95,190

Other long-term liabilities

33,839

75,970

Total long-term liabilities

105,252

171,160

TOTAL LIABILITIES

1,229,882

978,591

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value

111

130

Additional paid-in capital

827,260

2,494,158

Accumulated other comprehensive income (loss)

(1,849

)

2,173

Accumulated deficit

(33,196

)

(126,657

)

Total shareholders' equity

792,326

2,369,804

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

2,022,208

$

3,348,395

CYBERARK SOFTWARE LTD.

Consolidated Statements of

Cash Flows

U.S. dollars in

thousands

(Unaudited)

Twelve Months Ended December 31,

2023

2024

Cash flows from operating activities: Net loss

$

(66,504

)

$

(93,461

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

19,250

41,983

Amortization of premium and accretion of discount on marketable

securities, net and other

(4,570

)

(3,537

)

Share-based compensation

140,101

168,766

Deferred income taxes, net

(7,879

)

66,293

Increase in trade receivables

(65,655

)

(93,303

)

Amortization of debt discount and issuance costs

2,996

2,660

Change in fair value of derivative assets

-

(4,618

)

Increase in prepaid expenses, other current and long-term assets

and others

(45,016

)

(47,456

)

Changes in operating lease right-of-use assets

6,566

8,544

Increase (decrease) in trade payables

(2,669

)

11,000

Increase in short-term and long-term deferred revenues

72,190

150,780

Increase in employees and payroll accruals

6,981

22,001

Increase in accrued expenses and other current and long-term

liabilities

7,507

10,965

Changes in operating lease liabilities

(7,094

)

(8,730

)

Net cash provided by operating activities

56,204

231,887

Cash flows from investing activities: Investment in

short and long term deposits

(337,835

)

(368,577

)

Proceeds from short and long term deposits

319,542

460,077

Investment in marketable securities and other

(406,633

)

(143,391

)

Proceeds from maturities of marketable securities

340,657

218,061

Proceeds from sales of marketable securities and other

3,389

483,296

Purchase of property and equipment and other assets

(4,948

)

(11,059

)

Payments for business acquisitions, net of cash acquired

-

(984,669

)

Net cash used in investing activities

(85,828

)

(346,262

)

Cash flows from financing activities: Payment of

equity issuance costs

-

(190

)

Proceeds from withholding tax related to employee stock plans

11,188

273

Proceeds from exercise of stock options

11,065

8,309

Proceeds in connection with employees stock purchase plan

15,831

19,598

Payment of convertible notes

-

(542

)

Proceeds from settlement of capped call transactions

-

261,358

Net cash provided by financing activities

38,084

288,806

Increase in cash and cash equivalents

8,460

174,431

Effect of exchange rate differences on cash and cash

equivalents

135

(3,897

)

Cash and cash equivalents at the beginning of the period

347,338

355,933

Cash and cash equivalents at the end of the period

$

355,933

$

526,467

CYBERARK SOFTWARE LTD. Reconciliation of GAAP

Measures to Non-GAAP Measures U.S. dollars in thousands

(except per share data) (Unaudited)

Reconciliation of Net cash provided by operating activities to

Free cash flow: Three Months Ended Twelve

Months Ended December 31, December 31,

2023

2024

2023

2024

Net cash provided by operating activities

$

46,898

$

64,736

$

56,204

$

231,887

Less: Purchase of property and equipment and other assets

(695

)

(3,969

)

(4,948

)

(11,059

)

Free cash flow

$

46,203

$

60,767

$

51,256

$

220,828

GAAP net cash used in investing activities

(84,140

)

(1,050,560

)

(85,828

)

(346,262

)

GAAP net cash provided by financing activities

18,889

276,355

38,084

288,806

Reconciliation of Gross Profit to Non-GAAP Gross

Profit: Three Months Ended Twelve Months

Ended December 31, December 31,

2023

2024

2023

2024

Gross profit

$

183,451

$

240,618

$

595,757

$

792,365

Plus: Share-based compensation (1)

4,500

5,867

17,612

21,724

Amortization of share-based compensation capitalized in software

development costs (3)

84

94

393

328

Amortization of intangible assets (2)

1,704

20,563

6,817

25,676

Impairment of capitalized software development costs

-

-

2,067

-

Non-GAAP gross profit

$

189,739

$

267,142

$

622,646

$

840,093

Reconciliation of Operating Expenses to Non-GAAP

Operating Expenses: Three Months Ended Twelve

Months Ended December 31, December 31,

2023

2024

2023

2024

Operating expenses

$

188,162

$

271,978

$

712,229

$

865,169

Less: Share-based compensation (1)

33,035

41,478

122,489

147,042

Amortization of intangible assets (2)

137

6,725

547

7,101

Acquisition related expenses

-

15,375

-

21,800

Non-GAAP operating expenses

$

154,990

$

208,400

$

589,193

$

689,226

Reconciliation of Operating Loss to Non-GAAP Operating

Income: Three Months Ended Twelve Months

Ended December 31, December 31,

2023

2024

2023

2024

Operating loss

$

(4,711

)

$

(31,360

)

$

(116,472

)

$

(72,804

)

Plus: Share-based compensation (1)

37,535

47,345

140,101

168,766

Amortization of share-based compensation capitalized in software

development costs (3)

84

94

393

328

Amortization of intangible assets (2)

1,841

27,288

7,364

32,777

Acquisition related expenses

-

15,375

-

21,800

Impairment of capitalized software development costs

-

-

2,067

-

Non-GAAP operating income

$

34,749

$

58,742

$

33,453

$

150,867

Reconciliation of Net Income (Loss) to Non-GAAP Net

Income: Three Months Ended Twelve Months

Ended December 31, December 31,

2023

2024

2023

2024

Net income (loss)

$

8,911

$

(97,118

)

$

(66,504

)

$

(93,461

)

Plus: Share-based compensation (1)

37,535

47,345

140,101

168,766

Amortization of share-based compensation capitalized in software

development costs (3)

84

94

393

328

Amortization of intangible assets (2)

1,841

27,288

7,364

32,777

Acquisition related expenses

-

15,375

-

21,800

Amortization of debt discount and issuance costs

752

403

2,996

2,660

Change in fair value of derivative assets

-

(2,027

)

-

(4,618

)

Gain from investment in privately held companies

(2,213

)

-

(2,757

)

-

Impairment of capitalized software development costs

-

-

2,067

-

Taxes on income related to non-GAAP adjustments and other tax

adjustments (4)

(8,848

)

49,084

(31,656

)

19,297

Non-GAAP net income

$

38,062

$

40,444

$

52,004

$

147,549

Non-GAAP net income per share Basic

$

0.90

$

0.84

$

1.25

$

3.34

Diluted

$

0.81

$

0.80

$

1.12

$

3.03

Weighted average number of shares Basic

42,069,678

48,116,242

41,658,424

44,182,071

Diluted

47,107,294

50,853,179

46,375,198

48,641,292

(1) Share-based Compensation : Three Months

Ended Twelve Months Ended December 31,

December 31,

2023

2024

2023

2024

Cost of revenues - Subscription

$

1,219

$

1,794

$

4,178

$

6,525

Cost of revenues - Perpetual license

15

5

45

22

Cost of revenues - Maintenance and Professional services

3,266

4,068

13,389

15,177

Research and development

7,661

10,695

29,458

34,953

Sales and marketing

14,800

18,647

58,790

67,924

General and administrative

10,574

12,136

34,241

44,165

Total share-based compensation

$

37,535

$

47,345

$

140,101

$

168,766

(2) Amortization of intangible assets : Three Months

Ended Twelve Months Ended December 31,

December 31,

2023

2024

2023

2024

Cost of revenues - Subscription

$

1,704

$

20,563

$

6,817

$

25,676

Sales and marketing

137

6,725

547

7,101

Total amortization of intangible assets

$

1,841

$

27,288

$

7,364

$

32,777

(3) Classified as Cost of revenues - Subscription.

(4) Includes income tax adjustments related to

non-GAAP items. For the three and twelve months ended December 31,

2024, includes the establishment of a valuation allowance on

deferred tax assets, primarily for CyberArk Software Ltd., and the

tax impact of intra-entity transactions related to the Venafi

acquisition.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213398855/en/

Investor Relations: Srinivas Anantha, CFA CyberArk

617-558-2132 ir@cyberark.com

Media: Rachel Gardner CyberArk 603-531-7229

press@cyberark.com

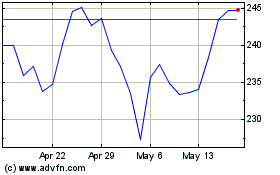

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Jan 2025 to Feb 2025

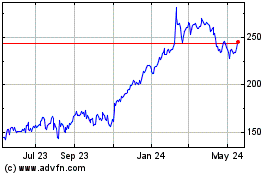

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Feb 2024 to Feb 2025