Rafael Holdings, Inc. (NYSE: RFL), today reported its financial

results for the fourth quarter and the full fiscal year ended July

31, 2024.

“During fiscal 2024, we made significant

progress on our strategy to advance our existing portfolio and to

invest in, develop and commercialize clinical stage assets in areas

of high unmet medical need. Specifically, we are extremely pleased

to have entered into a merger agreement with Cyclo Therapeutics

(Nasdaq: CYTH),” said Bill Conkling, CEO of Rafael Holdings. Bill

added, “We are encouraged that Cyclo Therapeutics has fully

enrolled its pivotal Phase 3 study evaluating Trappsol® Cyclo™ for

the treatment of Niemann-Pick Disease Type C1, a rare and fatal

genetic disease, and results from the 48-week interim analysis are

expected in the middle of 2025. Despite recent FDA approvals, we

believe that Trappsol® Cyclo™ has the potential to be a market

leader. We anticipate a shareholder vote and closing the merger

with Cyclo Therapeutics in the coming months.”

Rafael Holdings, Inc. Fourth Quarter Fiscal Year 2024

Financial Results

As of July 31, 2024, we had cash, cash

equivalents and marketable securities of $65.9 million.

For the three months ended July 31, 2024, we

recorded a net loss from continuing operations attributable to

Rafael Holdings of $4.5 million, or $0.19 per diluted share, versus

a net gain from continuing operations of $1.3 million, or $0.06 per

diluted share, in the year ago period.

Research and development expenses were $1.5

million for the three months ended July 31, 2024, compared to $1.3

million in the year ago period. The year over year increase relates

to activity at Cornerstone and Day Three Labs, which were

consolidated with Rafael Holdings during fiscal 2024.

For the three months ended July 31, 2024,

general and administrative expenses were $2.3 million. For the same

period in the prior year, general and administrative expenses were

$1.4 million. The increase was primarily due to additional expenses

from Cornerstone and Day Three Labs, which were consolidated with

Rafael Holdings during fiscal 2024, as well as increased

professional fees related to the Cornerstone and Day Three Labs

acquisitions.

Rafael Holdings, Inc. Full Fiscal Year 2024 Financial

Results

For the twelve months ended July 31, 2024, we

recorded a net loss from continuing operations attributable to

Rafael Holdings of $34.4 million, or $1.45 per diluted share,

versus a net loss from continuing operations of $8.4 million, or

$0.36 per diluted share, in the year ago period. The net loss

recorded during fiscal year 2024 was driven by an in-process

research and development expense of $89.9 million related to the

Cornerstone acquisition, a loss of $1.6 million on our initial

investment in Day Three Labs, offset by a recovery of receivables

from Cornerstone of $31.3 million and realized and unrealized gains

on our investment in Cyclo Therapeutics. During the second quarter

of 2024, we increased our investment in Day Three Labs and now hold

a majority interest in the company with 84% of the shares

outstanding. We began reporting consolidated financial results for

Day Three Labs in January 2024 and Cornerstone Pharmaceuticals in

March 2024.

Research and development expenses were $4.2

million for the fiscal year ended July 31, 2024, compared to $6.3

million in the year ago period. The year over year reduction is due

to the winding down of early-stage programs, including at Barer

Institute.

For the fiscal year ended July 31, 2024, general

and administrative expenses were $8.9 million versus $8.9 million

in the same period in the prior year. The decrease in general and

administrative expenses at Rafael Holdings was offset by additional

G&A expenses from Cornerstone and Day Three Labs as well as

increased professional fees related to the two acquisitions in

Fiscal 2024.

About Rafael Holdings, Inc.

Rafael Holdings, Inc. is a holding company with

interests in clinical and early-stage pharmaceutical companies

including an investment in (and planned merger with) Cyclo

Therapeutics Inc. (Nasdaq: CYTH), a biotechnology company dedicated

to developing Trappsol® Cyclo™, which is being evaluated in

clinical trials, including an ongoing Phase 3 trial for the

potential treatment of Niemann-Pick Disease Type C1 (“NPC1”),

a rare, fatal, and progressive genetic disorder. Rafael also

holds a majority equity interest in LipoMedix Pharmaceuticals Ltd.

a clinical stage pharmaceutical company, Barer Institute Inc., a

wholly owned preclinical cancer metabolism research operation, and

a majority interest in Cornerstone Pharmaceuticals, Inc., formerly

known as Rafael Pharmaceuticals Inc., a cancer metabolism-based

therapeutics company. Rafael also holds a majority interest in

Rafael Medical Devices, LLC., an orthopedic-focused medical device

company developing instruments to advance minimally invasive

surgeries, and a majority interest in Day Three Labs, Inc., a

company which empowers third-party manufacturers to reimagine their

existing cannabis offerings enabling them to bring to market

better, cleaner, more precise and predictable versions by utilizing

Day Three’s pharmaceutical-grade technology and innovation like

Unlokt™. The Company’s primary focus is to expand our

investment portfolio through opportunistic and strategic

investments including therapeutics, which address high unmet

medical needs. Upon closing of the planned merger with Cyclo, the

Company intends to focus its efforts on making

Trappsol® Cyclo™ its lead clinical program.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking statements, including without limitation

statements regarding our expectations surrounding the potential,

safety, efficacy, and regulatory and clinical progress of our

product candidates; plans regarding the further evaluation of

clinical data; and the potential of our pipeline, including our

internal cancer metabolism research programs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to, those disclosed under the caption “Risk

Factors” in our Annual Report on Form 10-K for the year ended July

31, 2024, and our other filings with the SEC. These factors could

cause actual results to differ materially from those indicated by

the forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change.

Contact:Barbara

RyanBarbara.ryan@rafaelholdings.com(203) 274-2825

| |

| RAFAEL

HOLDINGS, INC. |

| CONSOLIDATED

BALANCE SHEETS |

| (in

thousands, except share and per share data) |

|

|

|

|

|

|

| |

|

|

|

|

| |

|

July 31, 2024 |

|

July 31, 2023 |

|

ASSETS |

|

|

|

|

| |

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,675 |

|

|

$ |

21,498 |

|

|

Available-for-sale securities |

|

|

63,265 |

|

|

|

57,714 |

|

|

Interest receivable |

|

|

515 |

|

|

|

387 |

|

|

Convertible note receivable, related party |

|

|

5,191 |

|

|

|

— |

|

|

Accounts receivable, net of allowance for doubtful accounts of $245

at July 31, 2024 and July 31, 2023 |

|

|

426 |

|

|

|

213 |

|

|

Prepaid expenses and other current assets |

|

|

430 |

|

|

|

914 |

|

|

Convertible note receivable, related party |

|

|

0 |

|

|

|

1,921 |

|

|

Investment in equity securities |

|

|

— |

|

|

|

294 |

|

|

Total current assets |

|

|

72,502 |

|

|

|

82,941 |

|

| |

|

|

|

|

|

Property and equipment, net |

|

|

2,120 |

|

|

|

1,695 |

|

|

Investments – Cyclo |

|

|

12,010 |

|

|

|

4,763 |

|

|

Investments – Hedge Funds |

|

|

2,547 |

|

|

|

4,984 |

|

|

Investment – Day Three |

|

|

— |

|

|

|

2,797 |

|

|

Investments – Other Pharmaceuticals |

|

|

— |

|

|

|

65 |

|

|

Convertible note receivable |

|

|

1,146 |

|

|

|

— |

|

|

Goodwill |

|

|

3,050 |

|

|

|

— |

|

|

Intangible assets, net |

|

|

1,847 |

|

|

|

— |

|

|

In-process research and development |

|

|

1,575 |

|

|

|

1,575 |

|

|

Other assets |

|

|

35 |

|

|

|

9 |

|

|

TOTAL ASSETS |

|

$ |

96,832 |

|

|

$ |

98,829 |

|

| |

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

Accounts payable |

|

$ |

2,556 |

|

|

$ |

333 |

|

|

Accrued expenses |

|

|

1,798 |

|

|

|

763 |

|

|

Convertible notes payable |

|

|

614 |

|

|

|

— |

|

|

Other current liabilities |

|

|

113 |

|

|

|

1,023 |

|

|

Due to related parties |

|

|

733 |

|

|

|

26 |

|

|

Installment note payable |

|

|

1,700 |

|

|

|

— |

|

|

Total current liabilities |

|

|

7,514 |

|

|

|

2,145 |

|

| |

|

|

|

|

|

Accrued expenses, noncurrent |

|

|

2,982 |

|

|

|

— |

|

|

Convertible notes payable, noncurrent |

|

|

73 |

|

|

|

— |

|

|

Other liabilities |

|

|

5 |

|

|

|

55 |

|

|

TOTAL LIABILITIES |

|

|

10,574 |

|

|

|

2,200 |

|

| |

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

| |

|

|

|

|

|

EQUITY |

|

|

|

|

| Class A

common stock, $0.01 par value; 35,000,000 shares authorized,

787,163 shares issued and outstanding as of July 31, 2024 and July

31, 2023 |

|

|

8 |

|

|

|

8 |

|

| Class B

common stock, $0.01 par value; 200,000,000 shares authorized,

24,142,535 issued and 23,819,948 outstanding (excluding treasury

shares of 101,487) as of July 31, 2024, and 23,635,709 shares

issued and 23,490,527 shares outstanding as of July 31, 2023 |

|

|

238 |

|

|

|

236 |

|

|

Additional paid-in capital |

|

|

280,048 |

|

|

|

264,010 |

|

|

Accumulated deficit |

|

|

(201,743 |

) |

|

|

(167,333 |

) |

|

Treasury stock, at cost; 101,487 and 0 Class B shares as of July

31, 2024 and July 31, 2023, respectively |

|

|

(168 |

) |

|

|

— |

|

| Accumulated

other comprehensive income (loss) related to unrealized income on

available-for-sale securities |

|

|

111 |

|

|

|

(353 |

) |

| Accumulated

other comprehensive income related to foreign currency translation

adjustment |

|

|

3,691 |

|

|

|

3,725 |

|

| Total equity

attributable to Rafael Holdings, Inc. |

|

|

82,185 |

|

|

|

100,293 |

|

|

Noncontrolling interests |

|

|

4,073 |

|

|

|

(3,664 |

) |

|

TOTAL EQUITY |

|

|

86,258 |

|

|

|

96,629 |

|

| |

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

96,832 |

|

|

$ |

98,829 |

|

|

|

|

|

|

|

| |

| RAFAEL

HOLDINGS, INC. |

| CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(LOSS) |

| (in

thousands, except share and per share data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended July 31, |

|

Year Ended July 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues |

$ |

165 |

|

|

$ |

68 |

|

|

$ |

637 |

|

|

$ |

279 |

|

| |

|

|

|

|

|

|

|

| Cost of

infusion Technology revenue |

|

69 |

|

|

|

- |

|

|

|

154 |

|

|

|

- |

|

| G&A

Expenses |

|

2,330 |

|

|

|

1,395 |

|

|

|

8,854 |

|

|

|

8,932 |

|

| R&D

Expenses |

|

1,543 |

|

|

|

1,266 |

|

|

|

4,170 |

|

|

|

6,312 |

|

| In-process

research and development expense |

|

- |

|

|

|

0 |

|

|

|

89,861 |

|

|

|

- |

|

| Depreciation

and amortization |

|

68 |

|

|

|

18 |

|

|

|

225 |

|

|

|

78 |

|

| Operating

Loss |

|

(3,845 |

) |

|

|

(2,611 |

) |

|

|

(102,627 |

) |

|

|

(15,043 |

) |

| Interest

income |

|

606 |

|

|

|

- |

|

|

|

2,383 |

|

|

|

3,253 |

|

| Impairment

of investments - Other Pharmaceuticals |

|

- |

|

|

|

17 |

|

|

|

- |

|

|

|

(334 |

) |

| Loss on

initial investment in Day Three upon acquisition |

|

- |

|

|

|

- |

|

|

|

(1,633 |

) |

|

|

- |

|

| Realized

gain on available-for-sale securities |

|

251 |

|

|

|

- |

|

|

|

1,772 |

|

|

|

154 |

|

| Realized

gain (loss) on investment in equity securities |

|

- |

|

|

|

- |

|

|

|

(46 |

) |

|

|

309 |

|

| Unrealized

gain on investment in equity securities |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

33 |

|

| Realized

gain on investment - Cyclo |

|

- |

|

|

|

- |

|

|

|

424 |

|

|

|

- |

|

| Unrealized

gain on investment - Cyclo |

|

(3,162 |

) |

|

|

2,663 |

|

|

|

37 |

|

|

|

2,663 |

|

| Unrealized

gain on convertible notes receivable, due from Cyclo |

|

1,191 |

|

|

|

- |

|

|

|

1,191 |

|

|

|

- |

|

| Unrealized

(loss) gain on investment - Hedge Funds |

|

181 |

|

|

|

100 |

|

|

|

63 |

|

|

|

220 |

|

| Recovery of

receivables from Cornerstone |

|

- |

|

|

|

- |

|

|

|

31,305 |

|

|

|

- |

|

| Interest

expense |

|

(163 |

) |

|

|

- |

|

|

|

(248 |

) |

|

|

- |

|

| Other

income |

|

- |

|

|

|

1,294 |

|

|

|

118 |

|

|

|

- |

|

| Income

(loss) before incomes taxes from continuing operations |

|

(4,941 |

) |

|

|

1,463 |

|

|

|

(67,261 |

) |

|

|

(8,745 |

) |

| Benefit from

taxes |

|

87 |

|

|

|

(4 |

) |

|

|

2,680 |

|

|

|

255 |

|

| Equity in

loss of Day Three |

|

- |

|

|

|

(203 |

) |

|

|

(422 |

) |

|

|

(203 |

) |

| Consolidated

net loss from continuing operations |

|

(4,854 |

) |

|

|

1,256 |

|

|

|

(65,003 |

) |

|

|

(8,693 |

) |

| |

|

|

|

|

|

|

|

| Discontinued

Operations |

|

|

|

|

|

|

|

| Loss from

discontinued operations related to 520 Property |

|

|

|

(65 |

) |

|

|

- |

|

|

|

(306 |

) |

| Gain on

disposal of 520 Property |

|

|

|

0 |

|

|

|

- |

|

|

|

6,784 |

|

| Income from

discontinued operations |

|

- |

|

|

|

(65 |

) |

|

|

- |

|

|

|

6,478 |

|

| |

|

|

|

|

|

|

|

| Consolidated

net loss |

|

(4,854 |

) |

|

|

1,191 |

|

|

|

(65,003 |

) |

|

|

(2,215 |

) |

| Net loss

attributable to noncontrolling interests |

|

(386 |

) |

|

|

(28 |

) |

|

|

(30,593 |

) |

|

|

(339 |

) |

| Net loss

attributable to Rafael Holdings, Inc. |

$ |

(4,468 |

) |

|

$ |

1,163 |

|

|

$ |

(34,410 |

) |

|

$ |

(1,876 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Continuing

operations earnings (loss) per share |

|

|

|

|

|

|

|

| Net loss

from continuing operations |

$ |

(4,854 |

) |

|

$ |

1,256 |

|

|

$ |

(65,003 |

) |

|

$ |

(8,693 |

) |

| Net loss

attributable to noncontrolling interests |

|

(386 |

) |

|

|

-28 |

|

|

|

(30,593 |

) |

|

|

(339 |

) |

| Numerator

for loss per share from continuing operations |

$ |

(4,468 |

) |

|

$ |

1,284 |

|

|

$ |

(34,410 |

) |

|

$ |

(8,354 |

) |

| |

|

|

|

|

|

|

|

| Discontinued

operations earnings income per share |

|

|

|

|

|

|

|

| Numerator

for income from discontinued operations |

$ |

- |

|

|

$ |

(65 |

) |

|

$ |

- |

|

|

$ |

6,478 |

|

| |

|

|

|

|

|

|

|

| Earnings

(loss) per share - Basic and Diluted |

|

|

|

|

|

|

|

| Continuing

operations |

$ |

(0.19 |

) |

|

$ |

0.06 |

|

|

$ |

(1.45 |

) |

|

$ |

(0.36 |

) |

| Discontinued

operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.28 |

|

|

Total basic earnings (loss) per common share |

$ |

(0.19 |

) |

|

$ |

0.06 |

|

|

$ |

(1.45 |

) |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

| Weighted

average number of shares used in calculation of earnings (loss) per

share - basic and diluted |

|

23,916,839 |

|

|

|

22,263,211 |

|

|

|

23,745,516 |

|

|

|

23,263,211 |

|

| |

|

|

|

|

|

|

|

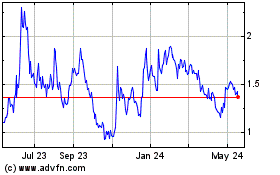

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From Dec 2024 to Jan 2025

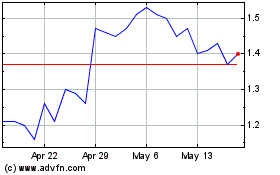

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From Jan 2024 to Jan 2025