Dada Nexus Limited (NASDAQ: DADA, “Dada” or the “Company”), China’s

leading local on-demand delivery and retail platform, today

announced its unaudited financial results for the fourth quarter

and fiscal year ended December 31, 2022.

Fourth Quarter and Fiscal Year 2022

Highlights

- Total

net revenues in the fourth quarter were RMB2,681.0

million, an increase of 31.9% year over year from RMB2,032.1

million in the same quarter of 2021. Total net

revenues in 2022 were RMB9,367.6 million,

an increase of 36.4% year over year from RMB6,866.3 million in

2021.

- Total

Gross Merchandise Volume (“GMV”) of JDDJ in 2022 was

RMB63.3 billion, an increase of 46.9% year over year from RMB43.1

billion in 2021.

- Number

of active consumers in 2022 was 78.6 million, as compared

with 62.3 million in 2021.

“We continued to execute well amid macro

challenges in the past quarter. Our team remained focused on

enriching product selection and improving user experience, and our

highly flexible rider network continued to serve consumers and our

merchant partners during COVID-19 resurgence,” said Mr. Jeff He,

President of Dada. “Looking ahead, we feel optimistic about what

the future holds. As on-demand penetration steadily progresses in

every single category, we believe our track record of enabling

retailers and synergies unleashed from our deepened collaboration

with JD.com will position us well to capture opportunities in the

coming years.”

“We are pleased to deliver another quarter of

robust top-line growth and remarkable bottom-line improvement,”

said Mr. Beck Chen, Chief Financial Officer of Dada. “Our revenue

grew by 32% year over year in the fourth quarter. Meanwhile, we

made further great strides toward profitability, with non-GAAP

operating margin1 improving by over 17 percentage points year over

year. Heading into 2023, we are confident in further improving

profitability while sustaining revenue growth momentum.”

Fourth Quarter 2022 Financial

Results

Total net revenues were

RMB2,681.0 million, an increase of 31.9% year over year from

RMB2,032.1 million in the same quarter of 2021.

|

|

|

For the three months ended December 31, |

|

|

|

|

2021 |

|

2022 |

|

|

|

|

(RMB in thousands) |

|

|

Net Revenue |

|

|

|

|

|

|

Dada Now |

|

|

|

|

|

|

Services |

|

701,175 |

|

863,116 |

|

|

Sales of goods |

|

17,253 |

|

19,879 |

|

|

Subtotal |

|

718,428 |

|

882,995 |

|

|

JDDJ |

|

|

|

|

|

|

Services note (1) |

|

1,313,698 |

|

1,798,041 |

|

|

Total |

|

2,032,126 |

|

2,681,036 |

|

Note: (1) Includes net revenues from (i)

commission fee, and online advertising and marketing services of

RMB726,447 and RMB1,090,437 for the three months ended December 31,

2021 and 2022, respectively; and (ii) fulfillment services and

others of RMB587,251 and RMB707,604 for the three months ended

December 31, 2021 and 2022, respectively.

- Net

revenues generated from Dada Now increased by 22.9% from

RMB718.4 million in the fourth quarter of 2021 to RMB883.0 million

in the fourth quarter of 2022, mainly driven by the increase in

order volume of intra-city delivery service to chain

merchants.

- Net

revenues generated from JDDJ increased by 36.9% from

RMB1,313.7 million in the fourth quarter of 2021 to RMB1,798.0

million in the fourth quarter of 2022, mainly due to the increase

in GMV from the same quarter last year, which was driven by

increases in the number of active consumers and average order size.

The increase in online marketing services revenue as a result of

the increasing promotional activities launched by brand owners and

retailers also contributed to the increment of the net revenues

generated from JDDJ.

Total costs and expenses were

RMB3,114.9 million, compared with RMB2,688.3 million in the same

quarter of 2021.

-

Operations and support costs were RMB1,574.6

million, compared with RMB1,371.9 million in the same quarter of

2021. The increase was primarily due to an increase in rider cost

as a result of increasing order volume for intra-city delivery

services provided to various chain merchants on the Dada Now

platform and retailers on the JDDJ platform.

- Selling

and marketing expenses were RMB1,293.5 million, compared

with RMB1,032.7 million in the same quarter of 2021. The increase

was primarily due to (i) growing incentives to JDDJ consumers, (ii)

an increase in advertising and marketing expenses to attract new

consumers to JDDJ platform, and (iii) amortization of the business

cooperation agreement in connection with the share subscription

transaction with JD.com in February 2022.

- General

and administrative expenses were RMB101.0 million,

compared with RMB99.0 million in the same quarter of 2021. The flat

growth was primarily due to efficient expense control

measures.

-

Research and development expenses were RMB125.7

million, compared with RMB169.4 million in the same quarter of

2021. The decrease was mainly attributable to lower research and

development personnel cost.

Loss from operations was

RMB399.6 million, compared with RMB605.7 million in the same

quarter of 2021.

Non-GAAP loss from operations1

was RMB207.0 million, compared with RMB505.4 million in the same

quarter of 2021.

Net loss was RMB370.6 million,

compared with RMB577.8 million in the same quarter of 2021.

Non-GAAP net loss2 was RMB179.2

million, compared with RMB485.4 million in the same quarter of

2021.

Net loss attributable to ordinary

shareholders of Dada was RMB370.6 million, compared with

RMB577.8 million in the same quarter of 2021.

Non-GAAP net loss attributable to

ordinary shareholders of Dada3 was RMB179.2 million,

compared with RMB485.4 million in the same quarter of 2021.

Basic and diluted net loss per

share was RMB0.36, compared with RMB0.61 for the fourth

quarter of 2021.

Non-GAAP basic and diluted net loss per

share4 was RMB0.18, compared with RMB0.51 for the fourth

quarter of 2021.

Fiscal Year 2022 Financial

Results

Total net revenues were

RMB9,367.6 million, an increase of 36.4% year over year from

RMB6,866.3 million in 2021.

|

|

|

For the year ended December 31, |

|

|

|

|

2021 |

|

2022 |

|

|

|

|

(RMB in thousands) |

|

|

Net Revenue |

|

|

|

|

|

|

Dada Now |

|

|

|

|

|

|

Services |

|

2,753,458 |

|

3,082,928 |

|

|

Sales of goods |

|

67,254 |

|

74,642 |

|

|

Subtotal |

|

2,820,712 |

|

3,157,570 |

|

|

JDDJ |

|

|

|

|

|

|

Services note (2) |

|

4,045,550 |

|

6,205,180 |

|

|

Sales of goods |

|

— |

|

4,845 |

|

|

Subtotal |

|

4,045,550 |

|

6,210,025 |

|

|

Total |

|

6,866,262 |

|

9,367,595 |

|

Note: (2) Includes net revenues from (i)

commission fee, and online advertising and marketing services of

RMB2,275,306 and RMB3,831,218 for fiscal year 2021 and 2022,

respectively; and (ii) fulfillment services and others of

RMB1,770,244 and RMB2,373,962 for fiscal year 2021 and 2022,

respectively.

- Net

revenues generated from Dada Now increased by 11.9% from

RMB2,820.7 million in 2021 to RMB3,157.6 million in 2022. The

growth was mainly driven by the increase in order volume of

intra-city delivery service to chain merchants, partially offset by

the business upgrade of last-mile delivery services.

- Net

revenues generated from JDDJ increased by 53.5% from

RMB4,045.6 million in 2021 to RMB6,210.0 million in 2022, mainly

due to the increase in GMV in 2022, which was driven by increases

in the number of active consumers and average order size. The

increase in online marketing services revenue as a result of the

increasing promotional activities launched by brand owners and

retailers also contributed to the increment of the net revenues

generated from JDDJ.

Total costs and expenses were

RMB11,608.0 million, compared with RMB9,601.7 million in 2021.

-

Operations and support costs were RMB5,743.0

million, compared with RMB5,139.1 million in 2021. The rise was

primarily due to an increase in rider cost as a result of

increasing order volume for intra-city delivery services provided

to various chain merchants on the Dada Now platform and retailers

on the JDDJ platform, partially offset by the decrease of

rider-related cost incurred by business upgrade of last-mile

delivery services.

- Selling

and marketing expenses were RMB4,747.9 million, compared

with RMB3,427.9 million in 2021. The increase was primarily due to

(i) growing incentives to JDDJ consumers, (ii) an increase in

advertising and marketing expenses to attract new consumers to JDDJ

platform, and (iii) amortization of the business cooperation

agreement in connection with the share subscription transaction

with JD.com in February 2022.

- General

and administrative expenses were RMB408.8 million,

compared with RMB400.4 million in 2021. The general and

administrative expenses remained flat, primarily due to efficient

expense control measures.

-

Research and development expenses were RMB630.9

million, compared with RMB573.9 million in 2021. The increase was

mainly attributable to the increase in research and development

personnel cost to strengthen the technological capabilities.

Loss from operations was

RMB2,119.5 million, compared with RMB2,578.7 million in 2021.

Non-GAAP loss from operations1

was RMB1,432.7 million, compared with RMB2,198.9 million in

2021.

Net loss was RMB2,008.0

million, compared with RMB2,471.1 million in 2021.

Non-GAAP net loss2 was

RMB1,326.2 million, compared with RMB2,102.9 million in 2021.

Net loss attributable to ordinary

shareholders of Dada was RMB2,008.0 million, compared with

RMB2,471.1 million in 2021.

Non-GAAP net loss attributable to

ordinary shareholders of Dada3 was RMB1,326.2 million,

compared with RMB2,102.9 million in 2021.

Basic and diluted net loss per

share was RMB1.98, compared with RMB2.60 in 2021.

Non-GAAP basic and diluted net loss per

share4 was RMB1.31, compared with RMB2.21 in 2021.

Pursuant to our US$70 million share repurchase

program announced in March 2022, as of December 31, 2022, we had

repurchased approximately US$60.1 million of ADSs under this

repurchase program.

As of December 31, 2022, the Company had

RMB4,370.4 million in cash, cash equivalents, restricted

cash and short-term investments, an increase from

RMB1,764.8 million as of December 31, 2021.

Environmental, Social and Corporate

Governance

The Company continued to devote in enhancing ESG

practices and was honored to receive external recognition in the

fourth quarter:

- In the fourth

quarter, Dada Group actively cooperated with local governmental

authorities to ensure the supply of daily necessities in

pandemic-affected communities by coordinating merchants’ offerings

and delivery capacity. In particular, when medicines are in short

supply as COVID-19 cases surged, JDDJ worked closely with tens of

thousands of offline pharmacies to facilitate the access to

essential anti-virus drugs and supplies, such as masks, antigen

test kits and ibuprofen. Our efforts were recognized by a number of

local authorities, including the governmental authorities of

Tianjin, Shijiazhuang and Guiyang.

- In December,

JDDJ launched a six-month commission-free initiative for community

fresh food stores, which substantially reduced merchants’ operating

costs and further enhanced the platform’s merchant ecosystem. In

addition, during Chinese New Year promotion period, Shop Now

launched marketing resource packages to support more than 35,000

newly onboarded stores.

- Starting in

November, Dada Now launched Winter Care program for the sixth

consecutive year, delivering tens of thousands of free winter care

and COVID prevention kits to riders nationwide. Moreover, Dada Now

actively applied for government subsidies on behalf of riders

engaged in delivering daily necessities during the Chinese New Year

holiday in cities including Shanghai, Guangzhou, Shenzhen, Tianjin,

Suzhou, Hangzhou, Nanjing and Xiamen, and distributed these

benefits to riders immediately. On top of government subsidies,

Dada Now also offered platform incentives to riders to improve

rider earnings and ensure smooth operations during winter and the

Chinese New Year holiday. As of early February, a total of nearly

RMB100 million of incentives and subsidies were distributed to Dada

Now riders.

- With

continuously improving ESG practices and disclosures, Dada’s ESG

ratings by leading third-party agencies have notably improved. In

November, MSCI upgraded Dada's ESG rating from BB to BBB, on the

strength of higher scores across all three dimensions of

environment, social and governance. Also in November, Dada improved

its ESG score in the S&P Corporate Sustainability Assessment

(CSA) to 32, a score that moves Dada up to top 15% among all peers

in the global retailing sector. There is still significant room for

improvement, and the Company will further integrate ESG philosophy

into its daily operations to enhance ESG practices.

Business Outlook

For the first quarter of 2023, Dada expects

total revenue to be between RMB2,570 million and RMB2,770 million,

representing year-over-year growth of 27% to 37%. This outlook is

based on information available as of the date of this press release

and reflects the Company's current and preliminary expectations,

which are subject to change.

______________________________

1 Non-GAAP loss from operations represents loss from operations

excluding the impact of share-based compensation expenses and

amortization of intangible assets resulting from business

acquisition. Non-GAAP operating margin equals non-GAAP loss from

operations divided by total net revenues.2 Non-GAAP net loss

represents net loss excluding the impact of share-based

compensation expenses, amortization of intangible assets resulting

from business acquisitions and tax benefit from amortization of

such intangible assets.3 Non-GAAP net loss attributable to ordinary

shareholders of Dada is net loss attributable to ordinary

shareholders of Dada excluding the impact of share-based

compensation expenses, amortization of intangible assets resulting

from business acquisition and tax benefit from amortization of such

intangible assets.4 Non-GAAP basic and diluted net loss per share

is non-GAAP net loss attributable to ordinary shareholders of Dada

divided by weighted average number of shares used in calculating

net loss per share.

Conference Call

The Company will host a conference call to

discuss the earnings at 8:30 p.m. Eastern Time on Tuesday, March 8,

2023 (9:30 a.m. Beijing time on Wednesday, March 9, 2023).

Please register in advance of the conference

using the link provided below and dial in 10 minutes prior to the

call.

PRE-REGISTER LINK:

https://s1.c-conf.com/diamondpass/10029031-str69d.html

Upon registration, each participant will receive details for the

conference call, including dial-in numbers, conference call

passcode and a unique access PIN. To join the conference, please

dial the number provided, enter the passcode followed by your PIN,

and you will join the conference.

A telephone replay of the call will be available

after the conclusion of the conference call through March 15,

2023.

Dial-in numbers for the replay are as

follows:

|

U.S./Canada |

1-855-883-1031 |

| Mainland China |

400-1209-216 |

| Hong Kong |

800-930-639 |

| Replay PIN |

10029031 |

A live and archived webcast of the conference

call will be available on the Investor Relations section of Dada’s

website at https://ir.imdada.cn/.

Use of Non-GAAP Financial Measures

The Company also uses certain non-GAAP financial

measures in evaluating its business. For example, the Company uses

non-GAAP income/(loss) from operations, non-GAAP operating margin,

non-GAAP net income/(loss), non-GAAP net margin, non-GAAP net

income/(loss) attributable to ordinary shareholders of Dada and

non-GAAP net income/(loss) attributable to ordinary shareholders of

Dada per share as supplemental measures to review and assess its

financial and operating performance. The presentation of these

non-GAAP financial measures is not intended to be considered in

isolation, or as a substitute for the financial information

prepared and presented in accordance with U.S. GAAP. Non-GAAP

income/(loss) from operations is income/(loss) from operations

excluding the impact of share-based compensation expenses and

amortization of intangible assets resulting from business

acquisition. Non-GAAP operating margin is non-GAAP income/(loss)

from operations as a percentage of total net revenues. Non-GAAP net

income/(loss) is net income/(loss) excluding the impact of

share-based compensation expenses, amortization of intangible

assets resulting from business acquisition and tax benefit from

amortization of such intangible assets. Non-GAAP net margin is

non-GAAP net income/(loss) as a percentage of total net revenues.

Non-GAAP net income/(loss) attributable to ordinary shareholders of

Dada is net income/(loss) attributable to ordinary shareholders of

Dada excluding the impact of share-based compensation expenses,

amortization of intangible assets resulting from business

acquisition and tax benefit from amortization of such intangible

assets. Non-GAAP net income/(loss) attributable to ordinary

shareholders of Dada per share is non-GAAP net income/(loss)

attributable to ordinary shareholders of Dada divided by weighted

average number of shares used in calculating net income/(loss) per

share.

The Company presents the non-GAAP financial

measures because they are used by the Company’s management to

evaluate the Company’s financial and operating performance and

formulate business plans. Non-GAAP income/(loss) from operations

and non-GAAP net income/(loss) enable the Company’s management to

assess the Company’s financial and operating results without

considering the impact of share-based compensation expenses,

amortization of intangible assets resulting from business

acquisition and tax benefit from amortization of such intangible

assets. The Company also believes that the use of the non-GAAP

measures facilitates investors’ assessment of the Company’s

financial and operating performance.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The non-GAAP financial measures have limitations as analytical

tools. One of the key limitations of using non-GAAP income/(loss)

from operations, non-GAAP net income/(loss), non-GAAP net

income/(loss) attributable to ordinary shareholders of Dada, and

non-GAAP net income/(loss) attributable to ordinary shareholders of

Dada per share is that they do not reflect all items of income and

expense that affect the Company’s operations. Share-based

compensation expenses, amortization of intangible assets resulting

from business acquisition and tax benefit from amortization of such

intangible assets have been and may continue to be incurred in the

Company’s business and is not reflected in the presentation of

non-GAAP income/(loss) from operations, non-GAAP net income/(loss),

non-GAAP net income/(loss) attributable to ordinary shareholders of

Dada, and non-GAAP net income/(loss) attributable to ordinary

shareholders of Dada per share. Further, the non-GAAP measures may

differ from the non-GAAP measures used by other companies,

including peer companies, potentially limiting the comparability of

their financial results to the Company’s. In light of the foregoing

limitations, the non-GAAP income/(loss) from operations, non-GAAP

operating margin, non-GAAP net income/(loss), non-GAAP net margin,

non-GAAP net income/(loss) attributable to ordinary shareholders of

Dada and non-GAAP net income/(loss) attributable to ordinary

shareholders of Dada per share for the period should not be

considered in isolation from or as an alternative to income/(loss)

from operations, operating margin, net income/(loss), net margin,

net income/(loss) attributable to ordinary shareholders of Dada and

net income/(loss) attributable to ordinary shareholders of Dada per

share, or other financial measures prepared in accordance with U.S.

GAAP.

The Company compensates for these limitations by

reconciling the non-GAAP financial measures to the nearest U.S.

GAAP performance measures, which should be considered when

evaluating the Company’s performance. For reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

financial measures, please see the section of the accompanying

tables titled, “Reconciliations of GAAP and Non-GAAP Results.”

Forward-Looking Statements

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. Among other things, quotations in this

announcement, contain forward-looking statements. Dada may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about Dada’s beliefs, plans

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Dada’s strategies; Dada’s future business

development, financial condition and results of operations; Dada’s

ability to maintain its relationship with major strategic

investors; its ability to provide efficient on-demand delivery

services and offer quality on-demand retail experience; its ability

to maintain and enhance the recognition and reputation of its

brands; general economic and business conditions globally and in

China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in Dada’s filings with the SEC. All information provided

in this press release is as of the date of this press release, and

Dada does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

About Dada

Dada is a leading platform of local on-demand

retail and delivery in China. It operates JDDJ, one of China’s

largest local on-demand retail platforms for retailers and brand

owners, and Dada Now, a leading local on-demand delivery platform

open to merchants and individual senders across various industries

and product categories. The Company’s two platforms are

inter-connected and mutually beneficial. The Dada Now platform

enables improved delivery experience for participants on the JDDJ

platform through its readily accessible fulfillment solutions and

strong on-demand delivery infrastructure. Meanwhile, the vast

volume of on-demand delivery orders from the JDDJ platform

increases order volume and density for the Dada Now platform.

For more information, please visit https://ir.imdada.cn/.

For investor inquiries, please contact:

Dada Nexus LimitedMs. Caroline DongE-mail: ir@imdada.cn

Christensen

In ChinaMr. Rene VanguestainePhone: +86-178-1749 0483E-mail:

rene.vanguestaine@christensencomms.com

In USMs. Linda BergkampPhone: +1-480-614-3004

E-mail: linda.bergkamp@christensencomms.com

For media inquiries, please

contact:

Dada Nexus Limited E-mail: PR@imdada.cn

Appendix I

|

DADA NEXUS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(Amounts in thousands, except share data and otherwise

noted) |

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

As of December 31, |

|

|

|

|

2021 |

|

2022 |

|

|

|

|

RMB |

|

RMB |

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

512,830 |

|

1,233,974 |

|

|

Restricted cash |

|

58,020 |

|

433,895 |

|

|

Short-term investments |

|

1,193,909 |

|

2,702,524 |

|

|

Accounts receivable |

|

352,324 |

|

313,502 |

|

|

Inventories, net |

|

6,344 |

|

8,826 |

|

|

Amount due from related parties |

|

840,667 |

|

1,060,987 |

|

|

Prepayments and other current assets |

|

479,017 |

|

606,502 |

|

|

Total current assets |

|

3,443,111 |

|

6,360,210 |

|

|

Non-current assets |

|

|

|

|

|

|

Property and equipment, net |

|

37,555 |

|

16,849 |

|

|

Goodwill |

|

957,605 |

|

957,605 |

|

|

Intangible assets, net |

|

332,317 |

|

1,665,320 |

|

|

Operating lease right-of-use assets |

|

76,811 |

|

37,592 |

|

|

Non-current time deposits |

|

400,000 |

|

— |

|

|

Other non-current assets |

|

33,181 |

|

8,223 |

|

|

Total non-current assets |

|

1,837,469 |

|

2,685,589 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

5,280,580 |

|

9,045,799 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Short-term loan |

|

100,000 |

|

100,000 |

|

|

Accounts payable |

|

9,800 |

|

9,791 |

|

|

Payable to riders and drivers |

|

580,983 |

|

794,320 |

|

|

Amount due to related parties |

|

71,760 |

|

147,003 |

|

|

Accrued expenses and other current liabilities |

|

620,406 |

|

931,943 |

|

|

Operating lease liabilities |

|

35,759 |

|

24,460 |

|

|

Total current liabilities |

|

1,418,708 |

|

2,007,517 |

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Deferred tax liabilities |

|

27,000 |

|

21,988 |

|

|

Non-current operating lease liabilities |

|

46,243 |

|

16,574 |

|

|

Total non-current liabilities |

|

73,243 |

|

38,562 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

1,491,951 |

|

2,046,079 |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Ordinary shares (US$0.0001 par value, 2,000,000,000 and

2,000,000,000 shares authorized, 955,876,116 and 1,079,881,662

shares issued, 927,776,552 and 1,021,923,242 shares outstanding as

of December 31, 2021 and 2022, respectively) |

|

633 |

|

630 |

|

|

Additional paid-in capital |

|

15,714,015 |

|

20,599,607 |

|

|

Accumulated deficit |

|

(11,816,229) |

|

(13,824,234) |

|

|

Accumulated other comprehensive income/(loss) |

|

(109,790) |

|

223,717 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

3,788,629 |

|

6,999,720 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

5,280,580 |

|

9,045,799 |

|

DADA NEXUS

LIMITEDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE LOSS(Amounts in

thousands, except share and per share data and otherwise

noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended December 31, |

|

|

For the year ended December 31, |

|

|

|

|

2021 |

|

2022 |

|

|

2021 |

|

2022 |

|

|

|

|

RMB |

|

RMB |

|

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

2,032,126 |

|

|

2,681,036 |

|

|

|

6,866,262 |

|

|

9,367,595 |

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

Operations and support |

|

(1,371,896 |

) |

|

(1,574,603 |

) |

|

|

(5,139,102 |

) |

|

(5,743,010 |

) |

|

|

Selling and marketing |

|

(1,032,697 |

) |

|

(1,293,509 |

) |

|

|

(3,427,909 |

) |

|

(4,747,926 |

) |

|

|

General and administrative |

|

(99,018 |

) |

|

(101,009 |

) |

|

|

(400,397 |

) |

|

(408,771 |

) |

|

|

Research and development |

|

(169,439 |

) |

|

(125,665 |

) |

|

|

(573,949 |

) |

|

(630,911 |

) |

|

|

Other operating expenses |

|

(15,227 |

) |

|

(20,113 |

) |

|

|

(60,326 |

) |

|

(77,423 |

) |

|

|

Total costs and expenses |

|

(2,688,277 |

) |

|

(3,114,899 |

) |

|

|

(9,601,683 |

) |

|

(11,608,041 |

) |

|

|

Other operating income |

|

50,483 |

|

|

34,237 |

|

|

|

156,714 |

|

|

120,921 |

|

|

|

Loss from operations |

|

(605,668 |

) |

|

(399,626 |

) |

|

|

(2,578,707 |

) |

|

(2,119,525 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income/(expenses) |

|

|

|

|

|

|

|

|

|

|

|

Interest expenses |

|

(1,482 |

) |

|

(5,477 |

) |

|

|

(13,806 |

) |

|

(10,946 |

) |

|

|

Others, net |

|

21,564 |

|

|

33,268 |

|

|

|

109,828 |

|

|

117,625 |

|

|

|

Total other income |

|

20,082 |

|

|

27,791 |

|

|

|

96,022 |

|

|

106,679 |

|

|

|

Loss before income tax benefits |

|

(585,586 |

) |

|

(371,835 |

) |

|

|

(2,482,685 |

) |

|

(2,012,846 |

) |

|

|

Income tax benefits |

|

7,799 |

|

|

1,253 |

|

|

|

11,558 |

|

|

4,841 |

|

|

|

Net loss |

|

(577,787 |

) |

|

(370,582 |

) |

|

|

(2,471,127 |

) |

|

(2,008,005 |

) |

|

|

Accretion of convertibleredeemable preferred shares |

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

Net loss attributable to ordinary shareholders of

Dada |

|

(577,787 |

) |

|

(370,582 |

) |

|

|

(2,471,127 |

) |

|

(2,008,005 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.61 |

) |

|

(0.36 |

) |

|

|

(2.60 |

) |

|

(1.98 |

) |

|

|

Diluted |

|

(0.61 |

) |

|

(0.36 |

) |

|

|

(2.60 |

) |

|

(1.98 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating net loss per

share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

942,581,485 |

|

|

1,021,484,524 |

|

|

|

950,697,557 |

|

|

1,015,265,686 |

|

|

|

Diluted |

|

942,581,485 |

|

|

1,021,484,524 |

|

|

|

950,697,557 |

|

|

1,015,265,686 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

(577,787 |

) |

|

(370,582 |

) |

|

|

(2,471,127 |

) |

|

(2,008,005 |

) |

|

| Other comprehensive

income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(14,274 |

) |

|

(36,054 |

) |

|

|

(39,487 |

) |

|

333,507 |

|

|

|

Total comprehensive loss |

|

(592,061 |

) |

|

(406,636 |

) |

|

|

(2,510,614 |

) |

|

(1,674,498 |

) |

|

DADA NEXUS

LIMITEDReconciliations of GAAP and Non-GAAP

Results(Amounts in thousands, except share and per

share data and otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

For the three months ended December 31, |

|

|

For the year ended December 31, |

|

|

|

|

2021 |

|

2022 |

|

|

2021 |

|

2022 |

|

|

|

|

RMB |

|

RMB |

|

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(605,668 |

) |

|

(399,626 |

) |

|

|

(2,578,707 |

) |

|

(2,119,525 |

) |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

57,606 |

|

|

55,838 |

|

|

|

207,943 |

|

|

218,730 |

|

|

|

Intangible assets amortization |

|

42,619 |

|

|

136,755 |

|

|

|

171,883 |

|

|

468,058 |

|

|

| Non-GAAP loss from

operations |

|

(505,443 |

) |

|

(207,033 |

) |

|

|

(2,198,881 |

) |

|

(1,432,737 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

(577,787 |

) |

|

(370,582 |

) |

|

|

(2,471,127 |

) |

|

(2,008,005 |

) |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

57,606 |

|

|

55,838 |

|

|

|

207,943 |

|

|

218,730 |

|

|

|

Intangible assets amortization |

|

42,619 |

|

|

136,755 |

|

|

|

171,883 |

|

|

468,058 |

|

|

|

Income tax benefit |

|

(7,799 |

) |

|

(1,253 |

) |

|

|

(11,558 |

) |

|

(5,012 |

) |

|

| Non-GAAP net

loss |

|

(485,361 |

) |

|

(179,242 |

) |

|

|

(2,102,859 |

) |

|

(1,326,229 |

) |

|

|

Accretion of convertible redeemable preferred shares |

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

Non-GAAP net loss attributable to ordinary shareholders of

Dada |

|

(485,361 |

) |

|

(179,242 |

) |

|

|

(2,102,859 |

) |

|

(1,326,229 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net loss per

share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.51 |

) |

|

(0.18 |

) |

|

|

(2.21 |

) |

|

(1.31 |

) |

|

|

Diluted |

|

(0.51 |

) |

|

(0.18 |

) |

|

|

(2.21 |

) |

|

(1.31 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating net loss per

share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

942,581,485 |

|

|

1,021,484,524 |

|

|

|

950,697,557 |

|

|

1,015,265,686 |

|

|

|

Diluted |

|

942,581,485 |

|

|

1,021,484,524 |

|

|

|

950,697,557 |

|

|

1,015,265,686 |

|

|

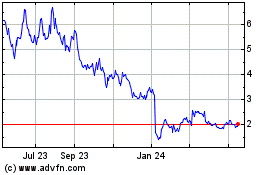

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Jan 2025 to Feb 2025

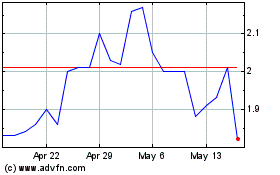

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Feb 2024 to Feb 2025