0001822359FALSE00018223592025-02-272025-02-270001822359dei:FormerAddressMember2025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 27, 2025

___________________________________

DOCGO INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-39618 | | 85-2515483 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

685 Third Avenue, 9th Floor, New York, New York | | 10017 |

(Address of principal executive offices) | | (Zip Code) |

| | | | |

(844) 443-6246 |

(Registrant's telephone number, including area code) |

| | | | |

35 West 35th Street, Floor 6, New York, New York 10001 |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | DCGO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2025, DocGo Inc. (the “Company”) issued a press release announcing the Company’s earnings results for the quarter and year ended December 31, 2024 (the “Press Release”). The Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

As previously announced, the Company will also hold a conference call and webcast at 5:00 p.m. Eastern Time on February 27, 2025 to discuss its earnings results for the quarter and year ended December 31, 2024 (the “Conference Call”).

During the Conference Call, the Company’s management intends to report adjusted gross margin, which is a financial measure that is not calculated or presented in accordance with generally accepted accounting principles (“GAAP”). Information regarding adjusted gross margin and reconciliation to the most directly comparable financial measure calculated and presented in accordance with GAAP are included in Exhibit 99.2 to this Report.

The information in this Report and Exhibits 99.1 and 99.2 is being furnished and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| DOCGO INC. |

| |

By: | /s/ Norman Rosenberg |

Name: | Norman Rosenberg |

Title: | Chief Financial Officer and Treasurer |

Date: February 27, 2025

Exhibit 99.1

DocGo Announces Fourth Quarter and Full-Year 2024 Results

Company Surpasses 700,000 Total Patient Lives Assigned for Care Gap Closure Programs and Expands Contracts With Payer Partners on Both Coasts

Management to Host Conference Call and Webcast Today at 5:00 PM Eastern Time

NEW YORK, NY, February 27, 2025 – DocGo Inc. (Nasdaq: DCGO) (“DocGo” or the “Company”), a leading provider of technology-enabled mobile health services, today announced financial and operating results for the quarter and full-year ended December 31, 2024.

Full-Year 2024 Financial Highlights

•Full-year 2024 revenue was $616.6 million, compared to $624.2 million for the full-year 2023.

•GAAP gross margin (which includes non-cash depreciation expenses) for the full-year 2024 was 32.1%, compared to 28.7% for the full-year 2023.

•Adjusted gross margin1 for the full-year 2024 was 34.6%, compared to 31.3% for the full-year 2023.

•Full-year net income for 2024 was $13.4 million, compared to 2023 full year net income of $10.0 million.

•Full-year 2024 adjusted EBITDA1 was $60.3 million, compared to $54.0 million for the full-year 2023.

•Full-year 2024 Mobile Health Services revenue was $423.1 million, compared to $442.8 million for the full-year 2023.

•Full-year 2024 Transportation Services revenue was $193.5 million, compared to $181.5 million for the full-year 2023.

Fourth Quarter 2024 Financial Highlights

•Total revenue for the fourth quarter of 2024 was $120.8 million, compared to $199.2 million in the fourth quarter of 2023. The decline was due primarily to the wind-down of migrant-related programs.

•GAAP gross margin (which includes non-cash depreciation expenses) for the fourth quarter of 2024 was 30.8%, compared to 31.2% in the fourth quarter of 2023.

•Adjusted gross margin1 for the fourth quarter of 2024 was 33.5%, compared to 33.5% in the fourth quarter of 2023.

•Net loss for the fourth quarter of 2024 was $7.6 million, compared to net income of $8.0 million in the fourth quarter of 2023.

•Adjusted EBITDA1 was $1.1 million for the fourth quarter of 2024, compared to $22.6 million for the fourth quarter of 2023.

•Mobile Health Services revenue for the fourth quarter of 2024 was $71.8 million, compared to $150.4 million for the fourth quarter of 2023. The decline was due primarily to the wind-down of migrant-related programs.

•Transportation Services revenue in the fourth quarter of 2024 was $49.1 million, compared to $48.8 million for the fourth quarter of 2023.

•As of December 31, 2024, the Company held total cash and cash equivalents, including restricted cash, of approximately $107.3 million, compared to $108.5 million as of September 30, 2024.

Results Compared to the Company’s Most Recent Guidance

•Subsequent to the Company’s November 7th earnings call, the Company was informed by New York City Health and Hospitals (“NYC HH”) that they were now planning to accelerate the wind down of their migrant program, affecting both the scope and scale of those projects. In addition, subsequently, the HPD migrant sites in Upstate NY closed weeks earlier than had been anticipated. These two factors resulted in a negative impact of approximately $9.0 million on Q4 revenue and $5.3 million on Q4 adjusted EBITDA1.

•The Company witnessed a significant increase in activity in its payer vertical. In anticipation of an expansion of these services, the Company increased levels of investment late in the fourth quarter in several areas, including personnel and related expenses. This increased investment reduced fourth quarter adjusted EBITDA1 by approximately $1.5 million.

•At year-end, the Company increased loss reserves for both ongoing and as-yet-reported claims across several of its self-insured lines, including auto, worker’s compensation and health. The aggregate increase in costs reduced fourth quarter adjusted EBITDA1 by approximately $3.2 million.

•Based upon the above unanticipated items, actual adjusted EBITDA1 in Q4 of 2024 was approximately $10 million lower than the Company’s implied guidance range from early November.

2025 Guidance

•Full-year 2025 revenue is expected to be $410-$450 million, unchanged from the previous estimate.

•Full-year 2025 adjusted EBITDA margin2 is now expected to be approximately 5%, down from the previous estimate of 8%-10%. The revision is largely due to increased investment to support the growth of the Company’s care gap closure programs, add expanded mobile health offerings, and transitioning operations from migrant revenue to core mobile health revenue.

Select Corporate Highlights for the Fourth Quarter of 2024 and Recent Weeks

•Surpassed 700,000 patients assigned by its insurance partners for care gap closure programs.

•Signed a two-year contract with a major hospital system in Fort Worth, TX to provide medical transportation services.

•Signed a contract in Mississippi with a major hospital system to provide adult and pediatric remote cardiac monitoring services for approximately 3,000 patients.

•Signed a two-year transportation contract renewal with a major Tennessee healthcare system and announced expansion of services to the Chattanooga region.

•Acquired PTI Health to expand the Company’s portfolio of clinical offerings with mobile phlebotomy services.

•Signed deals with two Veterans Affairs (VA) contractors for the Company to facilitate medical screenings and additional services for Veterans.

•Brought on Dr. David Shulkin – former Secretary of the VA – to help guide the Company’s efforts and drive growth in the population health vertical.

•Made significant investments in the Company’s tech stack to streamline patient intake and reduce booking friction, resulting in a 9% reduction in average booking time compared to the previous quarter.

Lee Bienstock, Chief Executive Officer of DocGo, commented, “We continue to experience strong demand for our care gap closure programs in our payer and provider vertical, and are investing heavily to support this growth. We are expanding our training initiatives, broadening our scope of services and continuing to aggressively build out our footprint while maintaining the highest level of quality. Our number of patient lives assigned has increased to more than 700,000, up from just 2,000 a little over a year ago. Perhaps, most impressively, is that our Net Promoter Score (NPS) in the fourth quarter was 86 for our care gap closure programs. To put that in perspective, in healthcare, above 30 is deemed good, and above 70 is deemed world class. Our patients and customers are delighted with these programs, and we see a substantial opportunity to accelerate our growth in this market via both organic and inorganic means in the coming quarters.” Bienstock continued, “Additionally, we have had a recent flurry of activity in our government population health pipeline which we are confident will translate into second half revenues. This includes both subcontracted, healthcare specific work with major government contractors and new direct opportunities with government entities. We believe the investments we made during the fourth quarter and continue to make will drive our transition from migrant-related revenues to core mobile health revenue.”

Norm Rosenberg, Chief Financial Officer of DocGo, also commented, “While our adjusted EBITDA came in lower than our previous expectations, that was driven in part by higher SG&A to support the growth and buildout of our payer and provider vertical, which included investments in our people, our tech stack and in quality initiatives to ensure we deliver a world-class product. We anticipate that these investments will continue into 2025. We continue to believe that beyond 2025, our business model can achieve double digit adjusted EBITDA margins, as we have demonstrated in the recent past.” Rosenberg added, “We continued to make progress with our cash collections during the fourth quarter and subsequent to year end. As of year-end, we had approximately $150 million in

migrant-related project receivables which we expect to largely be collected by the end of the second quarter, supporting further substantial increases in our cash position.”

1.Adjusted gross margin and adjusted EBITDA are non-GAAP financial measures. See “Non-GAAP Financial Measures” below for additional information on these non-GAAP financial measures and reconciliations to the most comparable GAAP measures.

2.Adjusted EBITDA margin is a non-GAAP financial measure. We have not reconciled adjusted EBITDA margin outlook to the most comparable GAAP outlook because it is not possible to do so without unreasonable efforts due to the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management’s control and which could be significant. Because such items cannot be reasonably predicted with the level of precision required, we are unable to provide an outlook for the comparable GAAP measure (net margin). Forward-looking estimates of adjusted EBITDA margin are made in a manner consistent with the relevant definitions and assumptions noted herein.

Conference Call and Webcast Details

Thursday, February 27, 2025 at 5:00 PM ET

1-800-717-1738 - Investors Dial

1-646-307-1865 - Int’l Investors Dial

Conference ID: 41220

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1706503&tp_key=ffa80ce9b1

The webcast can also be accessed under Events on the Investors section of the Company’s website, https://ir.docgo.com/.

About DocGo

DocGo is leading the proactive healthcare revolution with an innovative care delivery platform that includes mobile health services, remote patient monitoring and ambulance services. DocGo is helping to reshape the traditional four-wall healthcare system by providing high quality, highly accessible care to patients where and when they need it. DocGo’s proprietary technology and relationships with a dedicated field staff of certified health professionals elevate the quality of patient care and drive business efficiencies for municipalities, hospital networks and health insurance providers. With Mobile Health, DocGo empowers the full promise and potential of telehealth by facilitating healthcare treatment, in tandem with a remote advanced practice provider, in the comfort of a patient’s home or workplace. Together with DocGo’s integrated Ambulnz medical transport services, DocGo is bridging the gap between physical and virtual care. For more information, please visit www.docgo.com. To get an inside look on how the proactive healthcare revolution is helping transform healthcare by reducing costs, increasing efficiency and improving outcomes, visit www.proactivecarenow.com.

Forward-Looking Statements

This earnings release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, the plans, strategies, outcomes, and prospects, both business and financial, of the Company, including our expectations around second half revenues and the growth and buildout of our payer and provider vertical; new direct opportunities with government entities; cash collections; the provision of services under its existing contracts, including the winding down of migrant-related services; the expansion of the Company’s programs with insurance partners, hospital systems, municipalities and other strategic partners, including care gap closure programs and government population health programs, and investments related to such programs; and the Company’s cash balances. These statements are based on the beliefs and assumptions of the Company’s management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions, outcomes, results or expectations. Accordingly, you should not place undue reliance on such statements. All statements other than statements of historical fact are forward-looking, including, but not limited, to statements regarding the Company’s future actions, business strategies or models, plans, goals, future events, future revenues,

future margins, current and future revenue guidance, future growth or performance, financing needs, business trends, results of operations, objectives and intentions with respect to future operations, services and products, and new and existing contracts or partnerships. In some cases, these statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “might,” “will,” “should,” “could,” “can,” “would,” “design,” “potential,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends” or the negative of these terms or similar expressions.

Forward-looking statements are inherently subject to substantial risks, uncertainties and assumptions, many of which are beyond the Company’s control, and which may cause the Company’s actual results or outcomes, or the timing of results or outcomes, to differ materially from those contained in the Company’s forward-looking statements, including, but not limited to the following: impacts related to the wind down of migrant-related services and associated cash collections; the Company’s ability to expand its programs with insurance partners, hospital systems, municipalities, other government entities and other strategic partners; the Company’s ability to successfully implement its business strategy, including delivering value to shareholders via buybacks, funding new strategic relationships and potentially repaying its line of credit; the Company’s ability to grow demand for its care gap closure programs; the Company’s ability to maintain sufficient cash balances; the Company’s ability to maintain its contractual relationships with its healthcare provider partners and clients; the Company’s ability to compete effectively in a highly competitive industry; the Company’s reliance on government contracts; the Company’s ability to effectively manage its growth; the Company’s financial performance and future prospects; the Company’s ability to deliver on its business strategies or models, plans and goals; the Company’s ability to expand geographically; the Company’s M&A activity; the Company’s ability to retain its workforce and management personnel and successfully manage leadership transitions; the Company’s ability to collect on customer receivables; risks associated with the Company’s share repurchase program; expected impacts of macroeconomic factors, including inflationary pressures, general economic slowdown or a recession, rising interest rates, foreign exchange rate volatility, changes in monetary pressure, financial institution instability or the prospect of a shutdown of the U.S. federal government; potential changes in federal, state or local government policies regarding immigration and asylum seekers; expected impacts of geopolitical instability; the Company’s competitive position and opportunities, including its ability to realize the benefits from its operating model; the Company’s ability to improve gross margins; the Company’s ability to implement and deliver on cost-containment measures and ongoing cost rationalization initiatives; legislative and regulatory actions; the impact of legal proceedings and compliance risk; volatility of the Company’s stock price; the impact on the Company’s business and reputation in the event of information technology system failures, network disruptions, cyber incidents or losses or unauthorized access to, or release of, confidential information; and the ability of the Company to comply with laws and regulations regarding data privacy and protection and other risk factors included in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this earnings release. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results or outcomes could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this earnings release are based on events or circumstances as of the date on which the statements are made. The Company undertakes no obligation to update any forward-looking statements made in this earnings release to reflect events or circumstances after the date of this earnings release or to reflect new information or the occurrence of unanticipated events, except as and to the extent required by law. The Company’s forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

| | | | | | | | |

DocGo Inc. and Subsidiaries

CONSOLIDATED BALANCE SHEETS |

| December 31, |

| 2024 | 2023 |

| ASSETS | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 89,241,695 | | $ | 59,286,147 | |

| Accounts receivable, net of allowance for credit loss of $5,873,942 and $6,276,454 as of December 31, 2024 and December 31, 2023, respectively | 210,899,926 | | 262,083,462 | |

| Prepaid expenses and other current assets | 4,344,642 | | 17,499,953 | |

| Total current assets | 304,486,263 | | 338,869,562 | |

| Property and equipment, net | 14,881,411 | | 16,835,484 | |

| Intangibles, net | 25,728,813 | | 37,682,928 | |

| Goodwill | 47,432,550 | | 47,539,929 | |

| Restricted cash | 18,095,612 | | 12,931,839 | |

| Operating lease right-of-use assets | 11,958,698 | | 9,580,535 | |

| Finance lease right-of-use assets | 15,337,299 | | 12,003,919 | |

| Investments | 5,547,979 | | 553,573 | |

| Deferred tax assets | 8,422,034 | | 11,888,539 | |

| Other assets | 3,730,473 | | 2,565,649 | |

| Total assets | $ | 455,621,132 | | $ | 490,451,957 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | |

| Current liabilities: | | |

| Accounts payable | $ | 28,356,430 | | $ | 19,827,258 | |

| Accrued liabilities | 49,896,796 | | 91,340,609 | |

| Line of credit | 30,000,000 | | 25,000,000 | |

| Notes payable, current | 12,515 | | 28,131 | |

| Due to seller | 28,656 | | 7,823,009 | |

| Contingent consideration | 4,973,152 | | 19,792,982 | |

| Operating lease liability, current | 3,844,561 | | 2,773,020 | |

| Finance lease liability, current | 4,694,467 | | 3,534,073 | |

| Total current liabilities | 121,806,577 | | 170,119,082 | |

| | |

| Notes payable, non-current | 5,215 | | 41,586 | |

| Operating lease liability, non-current | 8,599,072 | | 7,223,941 | |

| Finance lease liability, non-current | 10,031,138 | | 7,896,392 | |

| Total liabilities | 140,442,002 | | 185,281,001 | |

| Commitments and contingencies | | |

| Stockholders’ equity: | | |

| Common stock ($0.0001 par value; 500,000,000 shares authorized as of December 31, 2024 and December 31, 2023; 101,910,883 and 104,055,168 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively) | 10,191 | | 10,406 | |

| Additional paid-in-capital | 321,087,583 | | 320,693,866 | |

| Accumulated deficit | (1,402,167) | | (21,394,310) | |

| Accumulated other comprehensive income | 1,221,869 | | 1,484,905 | |

| Total stockholders’ equity attributable to DocGo Inc. and Subsidiaries | 320,917,476 | | 300,794,867 | |

| Noncontrolling interests | (5,738,346) | | 4,376,089 | |

| Total stockholders’ equity | 315,179,130 | | 305,170,956 | |

| Total liabilities and stockholders’ equity | $ | 455,621,132 | | $ | 490,451,957 | |

| | | | | | | | | | | |

DocGo Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

| Year Ended

December 31, |

| 2024 | 2023 | 2022 |

| | | |

| Revenues, net | $ | 616,555,132 | | $ | 624,288,642 | | $ | 440,515,746 | |

| Expenses: | | | |

Cost of revenues (exclusive of depreciation and amortization, which is

shown separately below) | 402,980,557 | | 428,906,225 | | 285,794,520 | |

| Operating expenses: | | | |

| General and administrative | 138,758,758 | | 137,152,512 | | 103,403,416 | |

| Depreciation and amortization | 15,884,898 | | 16,431,892 | | 10,565,578 | |

| Legal and regulatory | 17,146,891 | | 13,082,569 | | 8,780,590 | |

| Technology and development | 11,589,402 | | 10,858,724 | | 5,384,853 | |

| Sales, advertising and marketing | 1,505,900 | | 2,801,740 | | 4,755,161 | |

| Total expenses | 587,866,406 | | 609,233,662 | | 418,684,118 | |

| Income from operations | 28,688,726 | | 15,054,980 | | 21,831,628 | |

| Other (expense) income: | | | |

| Interest (expense) income, net | (1,929,207) | | 1,684,399 | | 762,685 | |

| Gain on remeasurement of warrant liabilities | — | | — | | 1,127,388 | |

| Change in fair value of contingent liability | 9,392,133 | | 1,437,525 | | — | |

| Finite-lived intangible asset impairment | (8,306,591) | | — | | — | |

| Goodwill impairment | — | | — | | (2,921,958) | |

| (Loss) gain on equity method investments | (316,044) | | (343,336) | | 8,919 | |

| (Loss) gain on remeasurement of operating and finance leases | (32,363) | | (866) | | 1,388,273 | |

| Gain on bargain purchase | — | | — | | 1,593,612 | |

| Gain (loss) on disposal of fixed assets | 23,682 | | (852,544) | | (21,173) | |

| Other income (expense) | 228,666 | | (686,865) | | (987,482) | |

| Total other (expense) income | (939,724) | | 1,238,313 | | 950,264 | |

| Net income before income tax expense | 27,749,002 | | 16,293,293 | | 22,781,892 | |

| (Provision for) benefit from income taxes | (14,388,422) | | (6,244,965) | | 7,961,321 | |

| Net income | 13,360,580 | | 10,048,328 | | 30,743,213 | |

| Net (loss) income attributable to noncontrolling interests | (6,631,563) | | 3,189,873 | | (3,841,285) | |

| Net income attributable to stockholders of DocGo Inc. and Subsidiaries | 19,992,143 | | 6,858,455 | | 34,584,498 | |

| Other comprehensive income | | | |

| Foreign currency translation adjustment | (263,036) | | 743,699 | | 773,707 | |

| Total comprehensive income | $ | 19,729,107 | | $ | 7,602,154 | | $ | 35,358,205 | |

Net income per share attributable to DocGo Inc. and Subsidiaries -

Basic | $ | 0.20 | | $ | 0.07 | | $ | 0.34 | |

| Weighted-average shares outstanding - Basic | 102,395,141 | 103,511,299 | 101,228,369 |

Net income per share attributable to DocGo Inc. and Subsidiaries -

Diluted | $ | 0.18 | | $ | 0.06 | | $ | 0.34 | |

| Weighted-average shares outstanding - Diluted | 109,422,840 | 105,617,817 | 102,975,831 |

| | | | | | | | | | | |

DocGo Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| Year Ended

December 31, |

| 2024 | 2023 | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 13,360,580 | | $ | 10,048,328 | | $ | 30,743,213 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| | | |

| Depreciation of property and equipment | 5,606,818 | | 4,829,780 | | 4,114,346 | |

| Amortization of intangible assets | 5,660,818 | | 5,249,358 | | 3,214,814 | |

| Amortization of finance lease right-of-use assets | 4,617,262 | | 6,352,754 | | 3,236,418 | |

| (Gain) loss on disposal of assets | (23,682) | | 852,544 | | 21,173 | |

| Deferred income tax | 3,466,505 | | (1,981,519) | | (9,957,967) | |

| Loss (gain) on equity method investments | 316,044 | | 343,336 | | (8,919) | |

| Bad debt expense | 5,235,560 | | 3,601,520 | | 3,815,187 | |

| Stock-based compensation | 13,634,086 | | 20,969,174 | | 8,054,571 | |

| Loss (gain) on remeasurement of operating and finance leases | 32,363 | | 866 | | (1,388,273) | |

| Loss on liquidation of business | — | | 70,284 | | — | |

| Gain on remeasurement of warrant liabilities | — | | — | | (1,127,388) | |

| Gain on bargain purchase | — | | — | | (1,593,612) | |

| Finite-lived intangible asset impairment | 8,306,591 | | — | | — | |

| Goodwill impairment | — | | — | | 2,921,958 | |

| Change in fair value of contingent consideration | (9,392,133) | | (1,437,525) | | — | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 41,272,218 | | (160,524,934) | | (8,415,793) | |

| Asset held for sale | — | | — | | 190,312 | |

| Prepaid expenses and other current assets | 13,007,231 | | (10,843,890) | | (4,181,035) | |

| Other assets | (1,384,824) | | 1,059,605 | | 1,557,655 | |

| Accounts payable | 8,562,006 | | (1,780,403) | | 3,637,305 | |

| Accrued liabilities | (41,940,373) | | 58,968,844 | | (5,964,064) | |

| Net cash provided by (used in) operating activities | 70,337,070 | | (64,221,878) | | 28,869,901 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Acquisition of property and equipment | (3,834,146) | | (7,584,561) | | (3,198,234) | |

| Acquisition of intangibles | (2,002,103) | | (2,541,661) | | (2,299,558) | |

| Acquisition of businesses | — | | (20,203,464) | | (32,953,179) | |

| Equity method investments | (310,450) | | (298,932) | | — | |

| Investment in equity securities | (5,000,000) | | — | | — | |

| Proceeds from disposal of property and equipment | 274,427 | | 747,088 | | 3,000 | |

| Net cash used in investing activities | (10,872,272) | | (29,881,530) | | (38,447,971) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from revolving credit line | 45,000,000 | | 25,000,000 | | — | |

| Repayments of revolving credit line | (40,000,000) | | — | | (25,881) | |

| Repayments of notes payable | (51,987) | | (25,926) | | (925,151) | |

| Due to seller | (3,118,595) | | (13,590,382) | | (2,535,521) | |

| Acquisition of noncontrolling interest | (1,848,000) | | — | | — | |

| Earnout payments on contingent liabilities | (3,608,553) | | (5,266,681) | | — | |

| Dividends paid to noncontrolling interest | (1,294,422) | | — | | — | |

| | | | | | | | | | | |

| Noncontrolling interest contributions | — | | — | | 2,063,000 | |

| Proceeds from exercise of stock options | 26,330 | | 1,581,183 | | 1,980,585 | |

| Payments for taxes related to shares withheld for employee taxes | (1,168,877) | | (2,308,954) | | — | |

| Common stock repurchased | (13,756,271) | | — | | (3,731,712) | |

| Equity costs | — | | — | | (19,570) | |

| Payments on obligations under finance lease | (4,334,463) | | (4,270,553) | | (2,985,568) | |

| Net cash (used in) provided by financing activities | (24,154,838) | | 1,118,687 | | (6,179,818) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (190,639) | | 1,093,633 | | 761,232 | |

| | | |

| Net increase (decrease) in cash and restricted cash | 35,119,321 | | (91,891,088) | | (14,996,656) | |

| Cash and restricted cash at beginning of period | 72,217,986 | | 164,109,074 | | 179,105,730 | |

| Cash and restricted cash at end of period | $ | 107,337,307 | | $ | 72,217,986 | | $ | 164,109,074 | |

| | | |

| | | |

| Year Ended

December 31, |

| 2024 | 2023 | 2022 |

| Supplemental disclosure of cash and non-cash transactions: | | | |

| Cash paid for interest | $ | 2,142,288 | | $ | 250,100 | | $ | 197,005 | |

| Cash paid for interest on finance lease liabilities | $ | 769,041 | | $ | 600,239 | | $ | 559,596 | |

| Cash paid for income taxes | $ | 7,249,331 | | $ | 4,251,658 | | $ | 1,505,235 | |

| Right-of-use assets obtained in exchange for lease liabilities | $ | 13,973,620 | | $ | 7,621,538 | | $ | 5,035,201 | |

| Remeasurement of finance lease right-of-use asset due to lease modification | $ | 300,000 | | $— | $ | — | |

| Fixed assets acquired in exchange for notes payable | $ | — | | $— | $ | 923,377 | |

| | | |

| Supplemental non-cash investing and financing activities: | | | |

| Acquisition of remaining FMC NA through due to seller and issuance of stock | $ | — | | $ | 7,000,000 | | $ | — | |

| Acquisition of CRMS through issuance of stock | $ | — | | $ | 1,000,000 | | $ | — | |

| CRMS True-up Payment through issuance of stock | $ | 1,814,345 | | $— | $ | — | |

| Receivable exchanged for trade credits | $ | — | | $ | 1,500,000 | | $ | — | |

| Pre-acquisition receivables written off through due to seller | $ | 4,675,758 | | $— | $ | — | |

| | | |

| Reconciliation of cash and restricted cash | | | |

| Cash | $ | 89,241,695 | | $ | 59,286,147 | | $ | 157,335,323 | |

| Restricted cash | 18,095,612 | | 12,931,839 | | 6,773,751 | |

| Total cash and restricted cash shown in statement of cash flows | $ | 107,337,307 | | $ | 72,217,986 | | $ | 164,109,074 | |

| | | | | | | | |

DocGo Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME |

| Three Months Ended

December 31, |

| 2024 | 2023 |

| | |

| Revenues, net | $ | 120,833,073 | | $ | 199,246,269 | |

| | | | | | | | |

| Expenses: | | |

Cost of revenues (exclusive of depreciation and amortization, which is

shown separately below) | 80,334,624 | | 132,559,805 | |

| Operating expenses: | | |

| General and administrative | 35,041,780 | | 43,514,996 | |

| Depreciation and amortization | 3,322,925 | | 4,615,235 | |

| Legal and regulatory | 5,524,453 | | 3,493,572 | |

| Technology and development | 3,685,650 | | 3,185,455 | |

| Sales, advertising and marketing | 396,828 | | 203,548 | |

| Total expenses | 128,306,260 | | 187,572,611 | |

| (Loss) income from operations | (7,473,187) | | 11,673,658 | |

| Other income: | | |

| Interest (expense) income, net | (541,464) | | 6,979 | |

| Change in fair value of contingent liability | 9,762,845 | | 1,277,551 | |

| Finite-lived intangible asset impairment | (8,306,591) | | — | |

| Loss on equity method investments | (86,121) | | (41,974) | |

| Loss on remeasurement of operating and finance leases | (311) | | (5,700) | |

| Loss on disposal of fixed assets | (13,035) | | (689,092) | |

| Other income (expense) | 82,608 | | (25,040) | |

| Total other income | 897,931 | | 522,724 | |

| Net (loss) income before income tax expense | (6,575,256) | | 12,196,382 | |

| Provision for income taxes | (1,071,670) | | (4,203,122) | |

| Net (loss) income | (7,646,926) | | 7,993,260 | |

| Net (loss) income attributable to noncontrolling interests | (4,384,116) | | 422,789 | |

| Net (loss) income attributable to stockholders of DocGo Inc. and Subsidiaries | (3,262,810) | | 7,570,471 | |

| Other comprehensive income | | |

| Foreign currency translation adjustment | (1,091,649) | | 676,734 | |

| Total comprehensive (loss) income | $ | (4,354,459) | | $ | 8,247,205 | |

| | | | | | | | |

DocGo Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| Three Months Ended

December 31, |

| 2024 | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net (loss) income | $ | (7,646,926) | | $ | 7,993,260 | |

Adjustments to reconcile net income to net cash provided by

(used in) operating activities: | | |

| | |

| Depreciation of property and equipment | 1,323,878 | | 132,063 | |

| Amortization of intangible assets | 776,481 | | 953,400 | |

| Amortization of finance lease right-of-use assets | 1,222,566 | | 3,529,772 | |

| Loss on disposal of assets | 13,035 | | 689,092 | |

| Deferred income tax | 8,709,292 | | (3,030,755) | |

| Loss on equity method investments | 86,121 | | 41,974 | |

| Bad debt expense | 1,378,086 | | 3,912,961 | |

| Stock-based compensation | 3,878,631 | | 5,807,327 | |

| Loss on remeasurement of operating and finance leases | 311 | | 5,700 | |

| Finite-lived intangible asset impairment | 8,306,591 | | — | |

| Change in fair value of contingent consideration | (9,762,845) | | (1,277,551) | |

| Changes in operating assets and liabilities: | | |

| | | | | | | | |

| Accounts receivable | 21,434,711 | | (57,040,937) | |

| Prepaid expenses and other current assets | 674,104 | | (10,507,797) | |

| Other assets | (297,911) | | 362,621 | |

| Accounts payable | (6,764,153) | | 10,860,517 | |

| Accrued liabilities | (10,444,857) | | 31,649,586 | |

| Net cash provided by (used in) operating activities | 12,887,115 | | (5,918,767) | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | |

| Acquisition of property and equipment | (893,303) | | (3,223,754) | |

| Acquisition of intangibles | 226,130 | | (62,853) | |

| Equity method investments | — | | (148,422) | |

| Investment in equity securities | (5,000,000) | | — | |

| Proceeds from disposal of property and equipment | 95,892 | | 472,878 | |

| Net cash used in investing activities | (5,571,281) | | (2,962,151) | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | |

| Proceeds from revolving credit line | — | | 25,000,000 | |

| Repayments of revolving credit line | — | | — | |

| Repayments of notes payable | (29,980) | | 503,657 | |

| Due to seller | (109,619) | | (5,172,446) | |

| Earnout payments on contingent liabilities | (2,008,524) | | (5,266,681) | |

| Dividends paid to noncontrolling interest | (1,044,422) | | — | |

| Proceeds from exercise of stock options | 25,646 | | 31,885 | |

| Payments for taxes related to shares withheld for employee taxes | (794,566) | | (141,972) | |

| Common stock repurchased | (2,678,073) | | — | |

| Payments on obligations under finance lease | (1,216,409) | | (1,977,223) | |

| Net cash (used in) provided by financing activities | (7,855,947) | | 12,977,220 | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | (701,078) | | 865,746 | |

| | |

| Net (decrease) increase in cash and restricted cash | (1,241,191) | | 4,962,048 | |

| Cash and restricted cash at beginning of period | 108,578,498 | | 67,255,938 | |

| Cash and restricted cash at end of period | $ | 107,337,307 | | $ | 72,217,986 | |

Non-GAAP Financial Measures

The following information provides definitions and reconciliation of non-GAAP financial measures used by the Company to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (“GAAP”). The Company has provided this non-GAAP financial information, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in this earnings release that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this earnings release. The non-GAAP financial measures used by the Company may differ from similarly titled measures used by other companies.

Adjusted Gross Margin

Adjusted gross profit and adjusted gross margin are considered non-GAAP financial measures under SEC rules because they exclude certain amounts included in gross profit and gross margin calculated in accordance with GAAP. Adjusted gross profit is total revenue minus cost of revenue, excluding depreciation and amortization (which are shown separately), and adjusted gross margin is adjusted gross profit as a percentage of total revenue.

The Company’s management believes that adjusted gross margin is useful in evaluating DocGo’s operating performance, as the calculation of this measure excludes the impact of non-cash depreciation and amortization charges. The Company’s management believes that by using adjusted gross margin in conjunction with GAAP gross

margin, investors will get a more complete view of what management considers to be the Company’s core operating performance and allow for comparison of this measure when compared to those of prior periods. While many companies use adjusted gross margin as a performance measure, not all companies use identical calculations for determining adjusted gross margin. As such, DocGo’s presentation of adjusted gross margin might not be comparable to similarly titled measures of other companies.

Adjusted EBITDA

Adjusted EBITDA is considered a non-GAAP financial measure under SEC rules because it excludes certain amounts included in net income (loss) calculated in accordance with GAAP. Specifically, adjusted EBITDA is arrived at by taking reported GAAP net income and adding back the following items: net interest expense (income), provision for (benefit from) income taxes, depreciation and amortization, other (income) expense, non-cash equity-based compensation and certain other non-recurring expenses consisting of certain one-time legal settlements and certain one-time expenses incurred in connection with acquisitions and other corporate activities, beyond those that are typically incurred.

The Company’s management believes that its adjusted EBITDA measure is useful in evaluating DocGo’s operating performance, as the calculation of this measure generally eliminates the effect of financing and income taxes and the accounting effects of capital spending and acquisitions, as well as other items of a non-recurring and/or non-cash nature. Adjusted EBITDA is not intended to be a measure of GAAP cash flow, as this measure does not consider certain cash-based expenses, such as payments for taxes or debt service.

Management believes that using adjusted EBITDA in conjunction with GAAP measures such as net income assists investors in getting a more complete picture of the Company’s financial results and operations, affording them with a more complete view of what management considers to be the Company’s core operating performance as well as offering the ability to assess such performance as compared with that of prior periods and management’s public guidance. While many companies use adjusted EBITDA as a performance measure, not all companies use identical calculations for determining adjusted EBITDA. As such, DocGo’s presentation of adjusted EBITDA might not be comparable to similarly titled measures of other companies.

Adjusted EBITDA Margin

Adjusted EBITDA margin is considered a non-GAAP measure under SEC rules. It is calculated by dividing adjusted EBITDA by revenues. Management believes using adjusted EBITDA margin in conjunction with GAAP measures, such as gross margin and/or net margin, is useful to investors because it assists investors in getting a more complete view of what management considers the Company’s core operating performance, as expressed in marginal terms. While many companies use adjusted EBITDA margin as a performance measure, not all companies use identical calculations for determining adjusted EBITDA margin. As such, DocGo’s presentation of adjusted EBITDA margin might not be comparable to similarly titled measures of other companies.

Reconciliation of Non-GAAP Measures

The table below reflects the reconciliation of GAAP gross margin and adjusted gross margin for the three and twelve months ended December 31, 2024 compared to the same periods in 2023:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | December 31, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenue | $ | 120,833,073 | | $ | 199,246,269 | | | $ | 616,555,132 | | $ | 624,288,642 | |

| Cost of revenue (exclusive of depreciation and amortization, which are shown separately below) | (80,334,624) | | (132,559,805) | | | (402,980,557) | | (428,906,225) | |

| Depreciation and amortization | (3,322,925) | | (4,615,235) | | | (15,884,898) | | (16,431,892) | |

| GAAP gross profit | $ | 37,175,524 | | $ | 62,071,229 | | | $ | 197,689,677 | | $ | 178,950,525 | |

| | | | | |

| Depreciation and amortization | 3,322,925 | | 4,615,235 | | | 15,884,898 | | 16,431,892 | |

| | | | | | | | | | | | | | | | | |

| Adjusted gross profit | $ | 40,498,449 | | $ | 66,686,464 | | | $ | 213,574,575 | | $ | 195,382,417 | |

| | | | | |

| GAAP gross margin | 30.8 | % | 31.2 | % | | 32.1 | % | 28.7 | % |

| Adjusted gross margin | 33.5 | % | 33.5 | % | | 34.6 | % | 31.3 | % |

The table below reflects the reconciliation of net income (loss) to adjusted EBITDA for the three and twelve months ended December 31, 2024 compared to the same periods in 2023 (in millions):

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

|

| 2024 | 2023 | | 2024 | 2023 |

| Net income (GAAP) | $ | (7.6) | | $ | 8.0 | | | $ | 13.4 | | $ | 10.0 | |

| (+) Net interest expense (income) | 0.5 | | — | | | 1.9 | | (1.7) | |

| (+) Income tax | 1.1 | | 4.2 | | | 14.4 | | 6.2 | |

| (+) Depreciation & amortization | 3.3 | | 4.6 | | | 15.9 | | 16.4 | |

| (+) Other (income) expense | (1.4) | | (0.5) | | | (1.0) | | 0.5 | |

| EBITDA | $ | (4.1) | | $ | 16.3 | | | $ | 44.6 | | $ | 31.4 | |

| | | | | |

| (+) Non-cash stock compensation | 3.8 | | 5.8 | | | 13.6 | | 21.0 | |

| (+) Non-recurring expense | 1.4 | | 0.5 | | | 2.1 | | 1.6 | |

| | | | | |

| Adjusted EBITDA | $ | 1.1 | | $ | 22.6 | | | $ | 60.3 | | $ | 54.0 | |

| | | | |

| Total revenue | $ | 121.5 | | $ | 199.2 | | | $ | 616.6 | | $ | 624.3 | |

| Pretax income margin | -5.3 | % | 6.1 | % | | 4.5 | % | 2.6 | % |

| Net margin | -6.3 | % | 4.0 | % | | 2.2 | % | 1.6 | % |

| Adjusted EBITDA margin | 0.9 | % | 11.3 | % | | 9.8 | % | 8.6 | % |

Contacts

Investors:

Mike Cole

DocGo

949-444-1341

mike.cole@docgo.com

ir@docgo.com

Exhibit 99.2

Non-GAAP Financial Information

The following information provides the definition of adjusted gross margin as presented by DocGo Inc. (the “Company”), which is a financial measure that is not calculated or presented in accordance with generally accepted accounting principles (“GAAP”), and reconciliation to the most directly comparable financial measure calculated and presented in accordance with GAAP. The Company has provided adjusted gross margin as supplemental information and in addition to the financial measure presented by the Company that is calculated and presented in accordance with GAAP. This non-GAAP financial measure should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measure presented by the Company.

Adjusted Gross Margin

Adjusted gross profit and adjusted gross margin are considered non-GAAP financial measures under Securities and Exchange Commission rules because they exclude certain amounts included in gross profit and gross margin calculated in accordance with GAAP. Adjusted gross profit is total revenue minus cost of revenue, excluding depreciation and amortization (which are shown separately), and adjusted gross margin is adjusted gross profit as a percentage of total revenue.

The Company’s management believes that adjusted gross margin is useful in evaluating the Company’s operating performance, as the calculation of this measure excludes the impact of non-cash depreciation and amortization charges. The Company’s management believes that by using adjusted gross margin in conjunction with GAAP gross margin, investors will get a more complete view of what management considers to be the Company’s core operating performance and allow for comparison of this measure when compared to those of prior periods. While many companies use adjusted gross margin as a performance measure, not all companies use identical calculations for determining adjusted gross margin. As such, the Company’s presentation of adjusted gross margin might not be comparable to similarly titled measures of other companies.

Reconciliation

The table below reflects the reconciliation of GAAP gross margin and adjusted gross margin for the quarter and year ended December 31, 2024 compared to the same periods in 2023 on a consolidated basis, as well as for the Company’s Mobile Health Services and Transportation Services segments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Q4 | | Year Ended December 31, |

| DocGo Inc. Consolidated | 2024 | 2023 | | 2024 | 2023 |

| Revenue | $ 120,833,073 | $ 199,246,269 | | $ 616,555,132 | $ 624,288,642 |

Cost of revenue (exclusive of depreciation and amortization, which are shown separately below) | (80,334,624) | (132,559,805) | | (402,980,557) | (428,906,225) |

| Depreciation and amortization | (3,322,925) | (4,615,235) | | (15,884,898) | (16,431,892) |

| GAAP gross profit | 37,175,524 | 62,071,229 | | 197,689,677 | 178,950,525 |

| | | | | |

| Depreciation and amortization | 3,322,925 | 4,615,235 | | 15,884,898 | 16,431,892 |

| Adjusted gross profit | 40,498,449 | 66,686,464 | | 213,574,575 | 195,382,417 |

| | | | | |

| GAAP gross margin | 30.8% | 31.2% | | 32.1% | 28.7% |

| Adjusted gross margin | 33.5% | 33.5% | | 34.6% | 31.3% |

| | | | | |

| Mobile Health Services | | | | | |

| Revenue | $ 71,779,119 | $ 150,441,703 | | $ 423,126,040 | $ 442,793,537 |

Cost of revenue (exclusive of depreciation and amortization, which are shown separately below) | (46,028,526) | (102,027,740) | | (269,256,412) | (306,169,041) |

| Depreciation and amortization | (1,213,828) | (1,115,160) | | (4,770,367) | (4,226,657) |

| GAAP gross profit | 24,536,765 | 47,298,803 | | 149,099,261 | 132,397,839 |

| | | | | |

| Depreciation and amortization | 1,213,828 | 1,115,160 | | 4,770,367 | 4,226,657 |

| Adjusted gross profit | 25,750,593 | 48,413,963 | | 153,869,628 | 136,624,496 |

| | | | | |

| GAAP gross margin | 34.2% | 31.4% | | 35.2% | 29.9% |

| Adjusted gross margin | 35.9% | 32.2% | | 36.4% | 30.9% |

| | | | | |

| Transportation Services | | | | | |

| Revenue | $ 49,053,954 | $ 48,804,566 | | $ 193,429,093 | $ 181,495,104 |

Cost of revenue (exclusive of depreciation and amortization, which are shown separately below) | (34,306,098) | (30,532,066) | | (133,724,145) | (122,736,484) |

| Depreciation & amortization | (2,048,266) | (3,256,531) | | (8,305,049) | (9,393,895) |

| GAAP gross profit | 12,699,590 | 15,015,969 | | 51,399,899 | 49,364,725 |

| | | | | |

| Depreciation and amortization | 2,048,266 | 3,256,531 | | 8,305,049 | 9,393,895 |

| Adjusted gross profit | 14,747,856 | 18,272,500 | | 59,704,948 | 58,758,620 |

| | | | | |

| GAAP gross margin | 25.9% | 30.8% | | 26.6% | 27.2% |

| Adjusted gross margin | 30.1% | 37.4% | | 30.9% | 32.4% |

Cover

|

Feb. 27, 2025 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

DOCGO INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39618

|

| Entity Tax Identification Number |

85-2515483

|

| Entity Address, Address Line One |

685 Third Avenue

|

| Entity Address, Address Line Two |

9th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

844

|

| Local Phone Number |

443-6246

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

DCGO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001822359

|

| Amendment Flag |

false

|

| Former Address |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

35 West 35th Street

|

| Entity Address, Address Line Two |

Floor 6

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

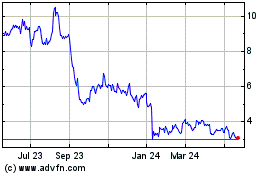

DocGo (NASDAQ:DCGO)

Historical Stock Chart

From Feb 2025 to Mar 2025

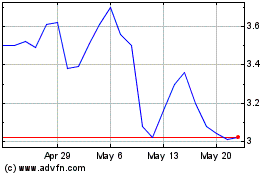

DocGo (NASDAQ:DCGO)

Historical Stock Chart

From Mar 2024 to Mar 2025