Second quarter Net Revenue grows 7.3%,

Organic Revenue increases 7.8%

Updated 2024 guidance reflects sale of

majority stake in Insomnia Cookies

Krispy Kreme, Inc. (NASDAQ: DNUT) (“Krispy Kreme”, “KKI”, or the

“Company”) today reported financial results for the quarter ended

June 30, 2024.

Second Quarter Highlights (vs Q2

2023)

- Net revenue grew 7.3% to $438.8 million

- Organic revenue grew 7.8% to $440.2 million

- GAAP net loss of $4.9 million ($5.5 million net loss

attributable to KKI)

- Adjusted EBITDA grew 12.1% to $54.7 million, Adjusted EBITDA

margin up 60 basis points year-over-year

- GAAP operating cash flow of $33.2 million

- Global Points of Access (“POA”) increased 2,981, or 23.2%, to

15,853

“Krispy Kreme had another strong quarter as our fresh doughnuts

are becoming even easier to purchase and more available globally,”

said Josh Charlesworth, CEO. “Our innovative specialty doughnut

collections continue to resonate with consumers and drove increased

Delivered Fresh Daily (“DFD”) and digital sales in the

quarter.”

“Our points of access also grew, and we’re excited about

upcoming launches in Germany, Brazil, and our recent announcements

of entries into Spain and Morocco,” continued Charlesworth. “In the

U.S., our profitable nationwide expansion is accelerating as we

grow with existing customers and add new national partners. This

includes the nationwide rollout to McDonald’s, starting this fall

in the Midwest with Chicago.”

“The recent sale of a majority stake in Insomnia Cookies allows

us to focus on our core strategy of producing, selling, and

distributing fresh doughnuts daily whilst also further improving

our financial profile,” he said.

Financial Highlights

Quarter Ended

$ in millions, except per share data

June 30, 2024

July 2, 2023

Change

GAAP:

Net revenue

$

438.8

$

408.9

7.3

%

Operating income

$

6.9

$

5.6

21.5

%

Operating income margin

1.6

%

1.4

%

20 bps

Net (loss)/income

$

(4.9

)

$

0.1

nm

Net (loss)/income attributable to

KKI

$

(5.5

)

$

0.2

nm

Diluted (loss)/income per share

$

(0.03

)

$

0.00

$

(0.03

)

Non-GAAP(1):

Organic revenue

$

440.2

$

408.2

7.8

%

Adjusted net income, diluted

$

9.1

$

11.4

(20.1

)%

Adjusted EBITDA

$

54.7

$

48.8

12.1

%

Adjusted EBITDA margin

12.5

%

11.9

%

60 bps

Adjusted diluted EPS

$

0.05

$

0.07

$

(0.02

)

Notes:

(1)

Non-GAAP figures – please

refer to Reconciliation of Non-GAAP Financial Measures.

Key Operating Metrics

Quarter Ended

$ in millions

June 30, 2024

July 2, 2023

Change

Global Points of Access

15,853

12,872

23.2

%

Sales per Hub (U.S.) TTM

$

5.0

$

4.7

6.4

%

Sales per Hub (International)

TTM

$

10.1

$

9.9

2.0

%

Digital Sales as a Percent of Retail

Sales

22.2

%

18.8

%

340 bps

Second Quarter 2024 Consolidated

Results (vs Q2 2023)

Krispy Kreme’s second quarter results represent continued

execution of its omni-channel strategy, with net revenue growth of

7.3% to $438.8 million, compared to $408.9 million last year. GAAP

net loss was $4.9 million compared to prior year net income of $0.1

million. GAAP diluted loss per share was $(0.03), a decline of

$(0.03) from the same quarter last year.

Total company organic revenue grew 7.8%, fueled by a 23.2%

increase in POA, a digital sales increase of 22%, and an increase

in DFD sales of 18%, driven by the success of global brand

activations including the Dolly Parton Southern Sweets collection,

and Kit Kat, among others.

Adjusted EBITDA in the quarter grew 12.1% to $54.7 million, with

Adjusted EBITDA margins improving 60 bps to 12.5%, benefiting from

the optimization of the Company’s Hub and Spoke strategy and

SG&A leverage driven by cost controls and lower compensation

costs. Adjusted Net Income, diluted declined 20.1% to $9.1 million

in the quarter. Adjusted Diluted EPS declined to $0.05 from $0.07

in the same quarter last year, primarily driven by increased

depreciation and amortization linked to the strategy of making

fresh doughnuts more available and Insomnia Cookies’ continued

expansion.

Second Quarter 2024 Segment Results (vs

Q2 2023)

U.S.: In the U.S. segment, net revenue grew $21.9

million, or 8.2%, with organic revenue growth of 8.4%. Revenue

growth was driven by innovative specialty doughnut collections

which continued to resonate with consumers, resulting in a 24%

increase in Delivered Fresh Daily sales and a 26% increase in

digital sales. Sales per hub in the U.S. increased 6.4% to $5.0

million, with DFD average sales per door per week increasing 4% to

$657.

U.S. Adjusted EBITDA increased 16.3% to $32.7 million with

Adjusted EBITDA margin expansion of 80 basis points to 11.3%,

driven by the impact of labor and waste optimization and

productivity benefits from the Company’s Hub and Spoke model,

partially offset by increased promotional activity and McDonald’s

start up costs.

International: In the International segment, net revenue

grew $4.7 million, or 3.9%. International organic revenue grew

5.0%, driven by record POA growth of 1,515, or 39%, and successful

marketing activations.

International Adjusted EBITDA decreased 12.3% to $21.7 million

with adjusted EBITDA margin declining approximately 320 basis

points to 17.3%, primarily linked to softer transaction volumes in

the U.K.

Market Development: In the Market Development segment net

revenue and organic revenue increased $3.4 million, or 16.1%,

driven by greater equipment sales than in the prior year.

Market Development Adjusted EBITDA grew 22.7% to $12.9 million.

Adjusted EBITDA margins expanded 280 basis points to 53.1%, driven

by greater flow through from product sales.

Balance Sheet and Capital

Expenditures

During the second quarter of 2024, strong Adjusted EBITDA

translated to GAAP Operating Cash Flow of $33.3 million. The

Company invested $31.7 million in capital expenditures, driven

primarily by the investments in the Hub and Spoke model for the

U.S. expansion of the DFD network. This drove positive Free Cash

Flow of $1.6 million in the quarter.

Subsequent to the quarter, the Company received $127.4 million

following the sale of a majority stake in Insomnia Cookies and have

received an additional $45 million following the refinancing of

intercompany debt.

2024 Financial Guidance

Krispy Kreme provides the following guidance update for the full

year 2024 (vs FY2023) solely to reflect the recent sale of a

majority ownership stake in Insomnia Cookies, which closed on July

17, 2024.

- Net Revenue of $1,650 to $1,685 million

- Organic Revenue growth of +5% to +7%

- Adjusted EBITDA of $215 to $220 million

- Adjusted Diluted EPS of $0.24 to $0.28

- Income Tax rate between 28% and 30%

- Capital Expenditures of 7% to 8% of net revenue

- Interest Expense, net of $55 million to $60 million

The Company expects net leverage to trend towards 3.5x by year

end, as we make progress towards our 2026 goal of approximately

2.0x to 2.5x net leverage.

Definitions

The following definitions apply to terms used throughout this

press release:

- Global Points of Access: Reflects all locations at which

fresh doughnuts or cookies can be purchased. We define global

points of access to include all Hot Light Theater Shops, Fresh

Shops, Carts and Food Trucks, DFD Doors and Cookie Shops, at both

Company-owned and franchise locations as of the end of the

respective reporting period. We monitor global points of access as

a metric that informs the growth of our omni-channel presence over

time and believe this metric is useful to investors to understand

our footprint in each of our segments.

- Hubs: Reflects locations where fresh doughnuts are

produced and processed for sale at any point of access. We define

Hubs to include self-sustaining Hot Light Theater Shops and

Doughnut Factories, at both Company-owned and franchise locations

as of the end of the respective reporting period.

- Sales Per Hub: Sales per Hub equals Fresh Revenues from

Hubs with Spokes, divided by the average number of Hubs with Spokes

at the end of the five most recent quarters.

- Fresh Revenues from Hubs with Spokes: Fresh Revenues

include product sales generated from our Doughnut Shop business

(including digital), as well as DFD sales, but excluding sales from

Branded Sweet Treats. It also excludes all Insomnia Cookies

revenues as the measure is focused on the Krispy Kreme business.

Fresh Revenues from Hubs with Spokes equals the Fresh Revenues

derived from those Hubs currently producing product for other

shops, Carts and Food Trucks, and/or DFD doors, but excluding Fresh

Revenues derived from those Hubs not currently producing product

for other shops, Carts and Food Trucks, and/or DFD doors.

- Free Cash Flow: Defined as cash provided by operating

activities less purchases of property and equipment.

Conference Call

Krispy Kreme will host a public conference call at 8:30 AM

Eastern Time today to discuss its results for the second quarter of

2024. The conference call can be accessed by dialing 1 (800)

715-9871 and entering the conference ID 5985470. International

participants can access the call via the corresponding number

listed HERE and entering the conference ID 5985470. To listen to

the live audio webcast and Q&A, visit the Krispy Kreme investor

relations website at investors.krispykreme.com. A replay and

transcript of the webcast will be available on the website within

24 hours after the call. Krispy Kreme’s earnings press release and

related materials will also be available on the investor relations

section of the Company’s website.

About Krispy Kreme

Headquartered in Charlotte, N.C., Krispy Kreme is one of the

most beloved and well-known sweet treat brands in the world. Our

iconic Original Glazed® doughnut is universally recognized for its

hot-off-the-line, melt-in-your-mouth experience. Krispy Kreme

operates in 40 countries through its unique network of fresh

doughnut shops, partnerships with leading retailers, and a rapidly

growing digital business with more than 15,500 fresh points of

access. Our purpose of touching and enhancing lives through the joy

that is Krispy Kreme guides how we operate every day and is

reflected in the love we have for our people, our communities and

the planet. Connect with Krispy Kreme Doughnuts at

www.KrispyKreme.com, or on one of its many social media channels,

including www.Facebook.com/KrispyKreme and

www.Twitter.com/KrispyKreme.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties. The words “continue,” “towards,”

“expect,” “outlook,” “guidance,” “explore,” or similar words, or

the negative of these words, identify forward-looking statements.

Such forward-looking statements are based on certain assumptions

and estimates that we consider reasonable but are subject to

various risks and uncertainties and assumptions relating to our

operations, financial results, financial conditions, business,

prospects, growth strategy and liquidity. Accordingly, there are,

or will be, important factors that could cause our actual results

to differ materially from those indicated in these statements. The

inclusion of this forward-looking information should not be

regarded as a representation by us that the future plans, estimates

or expectations contemplated by us will be achieved. Our actual

results could differ materially from the forward-looking statements

included herein. Factors that could cause actual results to differ

from those expressed in forward-looking statements include, without

limitation, the risks and uncertainties described under the

headings “Cautionary Note Regarding Forward-Looking Statements” and

“Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023, filed by us with the Securities and Exchange

Commission (“SEC”) and described in the other filings we make from

time to time with the SEC. We believe that these factors include,

but are not limited to, the impact of pandemics, changes in

consumer preferences, the impact of inflation, and our ability to

execute on our omni-channel business strategy. These

forward-looking statements are made only as of the date of this

document, and we do not undertake any obligation, other than as may

be required by applicable law, to update or revise any

forward-looking or cautionary statement to reflect changes in

assumptions, the occurrence of events, unanticipated or otherwise,

or changes in future operating results over time or otherwise.

Non-GAAP Measures

This press release includes certain non-GAAP financial measures

including organic revenue growth, Adjusted EBITDA, Adjusted Net

Income, Diluted, Adjusted Diluted EPS, Net Debt, Fresh Revenue from

Hubs with Spokes and Sales per Hub, which differ from results using

U.S. Generally Accepted Accounting Principles (“GAAP”). These

non-GAAP financial measures are not universally consistent

calculations, limiting their usefulness as comparative measures.

Other companies may calculate similarly titled financial measures

differently than we do or may not calculate them at all.

Additionally, these non-GAAP financial measures are not

measurements of financial performance under GAAP. In order to

facilitate a clear understanding of our consolidated historical

operating results, you should examine our non-GAAP financial

measures in conjunction with our historical consolidated financial

statements and notes thereto filed with the SEC.

To the extent that the Company provides guidance, it does so

only on a non-GAAP basis. The Company does not provide

reconciliations of such forward-looking non-GAAP measures to GAAP

due to the inability to predict the amount and timing of impacts

outside of the Company’s control on certain items, such as net

income and other charges reflected in our reconciliation of

historic numbers, the amount of which, based on historical

experience, could be significant.

Krispy Kreme, Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share amounts)

Quarter Ended

Two Quarters Ended

June 30, 2024 (13

weeks)

July 2, 2023 (13

weeks)

June 30, 2024 (26

weeks)

July 2, 2023 (26

weeks)

Net revenues

Product sales

$

429,411

$

400,348

$

862,923

$

811,022

Royalties and other revenues

9,398

8,534

18,584

16,810

Total net revenues

438,809

408,882

881,507

827,832

Product and distribution costs

107,846

111,106

214,861

228,939

Operating expenses

212,504

189,165

417,699

380,573

Selling, general and administrative

expense

64,466

62,582

136,040

124,050

Marketing expenses

12,416

9,770

24,531

19,623

Pre-opening costs

967

1,104

2,072

1,868

Other (income)/expenses, net

(849

)

314

(649

)

(4,949

)

Depreciation and amortization expense

34,600

29,196

68,186

57,135

Operating income

6,859

5,645

18,767

20,593

Interest expense, net

14,452

12,063

28,188

24,051

Other non-operating expense, net

949

1,061

1,522

2,060

Loss before income taxes

(8,542

)

(7,479

)

(10,943

)

(5,518

)

Income tax (benefit)/expense

(3,611

)

(7,563

)

651

(7,246

)

Net (loss)/income

(4,931

)

84

(11,594

)

1,728

Net income/(loss) attributable to

noncontrolling interest

560

(139

)

2,431

1,806

Net (loss)/income attributable to

Krispy Kreme, Inc.

$

(5,491

)

$

223

$

(14,025

)

$

(78

)

Net (loss)/income per share:

Common stock — Basic

$

(0.03

)

$

0.00

$

(0.08

)

$

0.00

Common stock — Diluted

$

(0.03

)

$

0.00

$

(0.08

)

$

0.00

Weighted average shares

outstanding:

Basic

169,095

168,184

168,890

168,162

Diluted

169,095

170,659

168,890

168,162

Krispy Kreme, Inc.

Condensed Consolidated Balance

Sheets

(in thousands, except per

share data)

As of

(Unaudited) June 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

28,625

$

38,185

Restricted cash

483

429

Accounts receivable, net

57,348

59,362

Inventories

39,461

34,716

Taxes receivable

18,143

15,526

Prepaid expense and other current

assets

24,110

25,363

Total current assets

168,170

173,581

Property and equipment, net

551,406

538,220

Goodwill

1,096,249

1,101,939

Other intangible assets, net

927,714

946,349

Operating lease right of use asset,

net

456,124

456,964

Other assets

23,823

23,539

Total assets

$

3,223,486

$

3,240,592

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

59,827

$

54,631

Current operating lease liabilities

54,937

50,365

Accounts payable

135,197

156,488

Accrued liabilities

114,269

134,005

Structured payables

129,344

130,104

Total current liabilities

493,574

525,593

Long-term debt, less current portion

894,979

836,615

Noncurrent operating lease liabilities

453,338

454,583

Deferred income taxes, net

115,800

123,925

Other long-term obligations and deferred

credits

36,538

36,093

Total liabilities

1,994,229

1,976,809

Commitments and contingencies

Shareholders’ equity:

Common stock, $0.01 par value; 300,000

shares authorized as of both June 30, 2024 and December 31, 2023;

169,357 and 168,628 shares issued and outstanding as of June 30,

2024 and December 31, 2023, respectively

1,694

1,686

Additional paid-in capital

1,453,944

1,443,591

Shareholder note receivable

(2,865

)

(3,850

)

Accumulated other comprehensive

(loss)/income, net of income tax

(12,594

)

7,246

Retained deficit

(304,840

)

(278,990

)

Total shareholders’ equity attributable

to Krispy Kreme, Inc.

1,135,339

1,169,683

Noncontrolling interest

93,918

94,100

Total shareholders’ equity

1,229,257

1,263,783

Total liabilities and shareholders’

equity

$

3,223,486

$

3,240,592

Krispy Kreme, Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Two Quarters Ended

June 30, 2024 (26

weeks)

July 2, 2023 (26

weeks)

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net (loss)/income

$

(11,594

)

$

1,728

Adjustments to reconcile net (loss)/income

to net cash provided by operating activities:

Depreciation and amortization expense

68,186

57,135

Deferred and other income taxes

(5,338

)

(11,743

)

Loss on extinguishment of debt

—

472

Impairment and lease termination

charges

448

7,808

Gain on disposal of property and

equipment

(3

)

(151

)

Gain on sale-leaseback

—

(9,646

)

Share-based compensation

14,634

10,369

Change in accounts and notes receivable

allowances

327

372

Inventory write-off

1,038

10,244

Settlement of interest rate swap

derivatives

—

7,657

Amortization related to settlement of

interest rate swap derivatives

(5,910

)

(4,379

)

Other

858

996

Change in operating assets and

liabilities, excluding foreign currency translation adjustments

(47,121

)

(24,609

)

Net cash provided by operating

activities

15,525

46,253

CASH FLOWS USED FOR INVESTING

ACTIVITIES:

Purchase of property and equipment

(60,735

)

(54,290

)

Proceeds from sale-leaseback

—

10,025

Purchase of equity method investment

(3,506

)

—

Disbursement for loan receivable

(1,086

)

—

Other investing activities

166

163

Net cash used for investing

activities

(65,161

)

(44,102

)

CASH FLOWS FROM/(USED FOR) FINANCING

ACTIVITIES:

Proceeds from the issuance of debt

365,000

989,198

Repayment of long-term debt and lease

obligations

(306,797

)

(916,580

)

Payment of financing costs

—

(5,000

)

Proceeds from structured payables

190,162

73,939

Payments on structured payables

(190,811

)

(126,920

)

Capital contribution by shareholders, net

of loans issued

919

631

Distribution to shareholders

(11,807

)

(11,771

)

Payments for repurchase and retirement of

common stock

(4,275

)

(147

)

Distribution to noncontrolling

interest

(2,146

)

(11,246

)

Net cash provided by/(used for)

financing activities

40,245

(7,896

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(115

)

(3,011

)

Net decrease in cash, cash equivalents and

restricted cash

(9,506

)

(8,756

)

Cash, cash equivalents and restricted cash

at beginning of period

38,614

35,730

Cash, cash equivalents and restricted

cash at end of period

$

29,108

$

26,974

Net cash provided by operating

activities

$

15,525

$

46,253

Less: Purchase of property and

equipment

(60,735

)

(54,290

)

Free cash flow

$

(45,210

)

$

(8,037

)

Krispy Kreme, Inc. Reconciliation of

Non-GAAP Financial Measures (Unaudited) (in thousands,

except per share amounts)

We define “Adjusted EBITDA” as earnings before interest expense,

net, income tax expense, and depreciation and amortization, with

further adjustments for share-based compensation, certain strategic

initiatives, acquisition and integration expenses, and other

certain non-recurring, infrequent or non-core income and expense

items. Adjusted EBITDA is a principal metric that management uses

to monitor and evaluate operating performance and provides a

consistent benchmark for comparison across reporting periods.

We define “Adjusted Net Income, Diluted” as net loss

attributable to common shareholders, adjusted for interest expense,

share-based compensation, certain strategic initiatives,

acquisition and integration expenses, amortization of

acquisition-related intangibles, the tax impact of adjustments, and

other certain non-recurring, infrequent or non-core income and

expense items. “Adjusted EPS” is Adjusted Net Income, Diluted

converted to a per share amount.

Adjusted EBITDA, Adjusted Net Income, Diluted, and Adjusted EPS

have certain limitations, including adjustments for income and

expense items that are required by GAAP. In evaluating these

non-GAAP measures, you should be aware that in the future we will

incur expenses that are the same as or similar to some of the

adjustments in this presentation, such as share-based compensation.

Our presentation of Adjusted EBITDA, Adjusted Net Income, Diluted,

and Adjusted EPS should not be construed to imply that our future

results will be unaffected by any such adjustments. Management

compensates for these limitations by relying on our GAAP results in

addition to using Adjusted EBITDA, Adjusted Net Income, Diluted,

and Adjusted EPS supplementally.

Quarter Ended

Two Quarters Ended

(in thousands)

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Net (loss)/income

$

(4,931

)

$

84

$

(11,594

)

$

1,728

Interest expense, net

14,452

12,063

28,188

24,051

Income tax (benefit)/expense

(3,611

)

(7,563

)

651

(7,246

)

Depreciation and amortization expense

34,600

29,196

68,186

57,135

Share-based compensation

7,648

4,824

14,634

10,369

Employer payroll taxes related to

share-based compensation

207

189

250

214

Other non-operating expense, net (1)

949

1,061

1,522

2,060

Strategic initiatives (2)

4,187

4,477

9,008

17,946

Acquisition and integration expenses

(3)

851

339

1,099

430

New market penetration expenses (4)

572

241

1,038

335

Shop closure expenses, net (5)

628

1,484

767

805

Restructuring and severance expenses

(6)

132

1,667

138

2,247

Gain on sale-leaseback

—

15

—

(9,646

)

Other (7)

(958

)

737

(973

)

3,314

Adjusted EBITDA

$

54,726

$

48,814

$

112,914

$

103,742

Quarter Ended

Two Quarters Ended

(in thousands)

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Segment Adjusted EBITDA:

U.S.

$

32,668

$

28,085

$

75,284

$

66,620

International

21,655

24,702

42,191

43,684

Market Development

12,875

10,495

24,775

22,046

Corporate

(12,472

)

(14,468

)

(29,336

)

(28,608

)

Total Adjusted EBITDA

$

54,726

$

48,814

$

112,914

$

103,742

Quarter Ended

Two Quarters Ended

(in thousands, except per share

amounts)

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Net (loss)/income

$

(4,931

)

$

84

$

(11,594

)

$

1,728

Share-based compensation

7,648

4,824

14,634

10,369

Employer payroll taxes related to

share-based compensation

207

189

250

214

Other non-operating expense, net (1)

949

1,061

1,522

2,060

Strategic initiatives (2)

4,187

4,477

9,008

17,946

Acquisition and integration expenses

(3)

851

339

1,099

430

New market penetration expenses (4)

572

241

1,038

335

Shop closure expenses (5)

628

1,484

767

805

Restructuring and severance expenses

(6)

132

1,667

138

2,247

Gain on sale-leaseback

—

15

—

(9,646

)

Other (7)

(958

)

737

(973

)

3,314

Amortization of acquisition related

intangibles (8)

7,397

7,368

14,817

14,641

Loss on extinguishment of 2019 Facility

(9)

—

—

—

472

Tax impact of adjustments (10)

(6,777

)

(9,464

)

(7,001

)

(14,120

)

Tax specific adjustments (11)

(226

)

(1,758

)

(815

)

(2,315

)

Net (income)/loss attributable to

noncontrolling interest

(560

)

139

(2,431

)

(1,806

)

Adjusted net income attributable to

common shareholders - Basic

$

9,119

$

11,403

$

20,459

$

26,674

Additional income attributed to

noncontrolling interest due to subsidiary potential common

shares

(11

)

(4

)

(30

)

(7

)

Adjusted net income attributable to

common shareholders - Diluted

$

9,108

$

11,399

$

20,429

$

26,667

Basic weighted average common shares

outstanding

169,095

168,184

168,890

168,162

Dilutive effect of outstanding common

stock options, RSUs, and PSUs

2,397

2,475

2,442

2,163

Diluted weighted average common shares

outstanding

171,492

170,659

171,332

170,325

Adjusted net income per share

attributable to common shareholders:

Basic

$

0.05

$

0.07

$

0.12

$

0.16

Diluted

$

0.05

$

0.07

$

0.12

$

0.16

(1)

Primarily foreign translation

gains and losses in each period.

(2)

The quarter and two quarters

ended June 30, 2024 consist primarily of costs associated with

global transformation, exploring strategic alternatives for the

Insomnia Cookies business, and preparing for the McDonald’s U.S.

expansion (with these three specific initiatives aggregating to

approximately $3.9 million and $8.5 million for the quarter and two

quarters ended June 30, 2024, respectively). The quarter and two

quarters ended July 2, 2023 consists primarily of costs associated

with the decision to exit the Branded Sweet Treats business,

including property, plant and equipment impairments, inventory

write-offs, employee severance, and other related costs.

(3)

Consists of acquisition and

integration-related costs in connection with the Company’s business

and franchise acquisitions, including legal, due diligence, and

advisory fees incurred in connection with acquisition and

integration-related activities for the applicable period.

(4)

Consists of start-up costs

associated with entry into new countries for which the Company’s

brands have not previously operated, including Brazil, Spain, and

the Insomnia Cookies brand entering Canada and the U.K.

(5)

Includes lease termination costs,

impairment charges, and loss on disposal of property, plant and

equipment.

(6)

The quarter and two quarters

ended June 30, 2024 and July 2, 2023 consist primarily of costs

associated with restructuring of the global executive team.

(7)

The quarter and two quarters

ended June 30, 2024 consist primarily of a gain from insurance

proceeds received related to a shop in the U.S. that was destroyed

and subsequently rebuilt. The quarter and two quarters ended July

2, 2023 consist primarily of legal and other regulatory expenses

incurred outside the ordinary course of business.

(8)

Consists of amortization related

to acquired intangible assets as reflected within depreciation and

amortization in the Condensed Consolidated Statements of

Operations.

(9)

Includes interest expenses

related to unamortized debt issuance costs from the 2019 Facility

associated with extinguished lenders as a result of the March 2023

debt refinancing.

(10)

Tax impact of adjustments

calculated applying the applicable statutory rates. The quarter and

two quarters ended June 30, 2024 and July 2, 2023 also include the

impact of disallowed executive compensation expense.

(11)

The quarter and two quarters

ended June 30, 2024 consist of the recognition of previously

unrecognized tax benefits unrelated to ongoing operations, a

discrete tax benefit unrelated to ongoing operations, and the

effect of various tax law changes on existing temporary

differences. The quarter and two quarters ended July 2, 2023

consist of the recognition of a previously unrecognized tax benefit

unrelated to ongoing operations, the effect of tax law changes on

existing temporary differences, and a discrete tax benefit

unrelated to ongoing operations.

Krispy Kreme, Inc.

Segment Reporting

(Unaudited)

(in thousands, except

percentages or otherwise stated)

Quarter Ended

Two Quarters Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Net revenues:

U.S.

$

289,304

$

267,417

$

585,239

$

548,761

International

125,269

120,588

250,019

232,576

Market Development

24,236

20,877

46,249

46,495

Total net revenues

$

438,809

$

408,882

$

881,507

$

827,832

Q2 2024 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in second quarter of

fiscal 2024

$

289,304

$

125,269

$

24,236

$

438,809

Total net revenues in second quarter of

fiscal 2023

267,417

120,588

20,877

408,882

Total Net Revenues Growth

21,887

4,681

3,359

29,927

Total Net Revenues Growth %

8.2

%

3.9

%

16.1

%

7.3

%

Less: Impact of shop optimization program

closures

(147

)

—

—

(147

)

Less: Impact of Branded Sweet Treats

exit

(486

)

—

—

(486

)

Adjusted net revenues in second quarter of

fiscal 2023

266,784

120,588

20,877

408,249

Adjusted net revenue growth

22,520

4,681

3,359

30,560

Impact of foreign currency translation

—

1,404

—

1,404

Organic Revenue Growth

$

22,520

$

6,085

$

3,359

$

31,964

Organic Revenue Growth %

8.4

%

5.0

%

16.1

%

7.8

%

Q2 2024 Organic Revenue - YTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in first two quarters

of fiscal 2024

$

585,239

$

250,019

$

46,249

$

881,507

Total net revenues in first two quarters

of fiscal 2023

548,761

232,576

46,495

827,832

Total Net Revenues Growth

36,478

17,443

(246

)

53,675

Total Net Revenues Growth %

6.6

%

7.5

%

-0.5

%

6.5

%

Less: Impact of shop optimization program

closures

(463

)

—

—

(463

)

Less: Impact of Branded Sweet Treats

exit

(5,853

)

—

—

(5,853

)

Adjusted net revenues in first two

quarters of fiscal 2023

542,445

232,576

46,495

821,516

Adjusted net revenue growth

42,794

17,443

(246

)

59,991

Impact of foreign currency translation

—

(432

)

—

(432

)

Organic Revenue Growth

$

42,794

$

17,011

$

(246

)

$

59,559

Organic Revenue Growth %

7.9

%

7.3

%

-0.5

%

7.2

%

Q2 2023 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in second quarter of

fiscal 2023

$

267,417

$

120,588

$

20,877

$

408,882

Total net revenues in second quarter of

fiscal 2022

244,665

110,558

20,022

375,245

Total Net Revenues Growth

22,752

10,030

855

33,637

Total Net Revenues Growth %

9.3

%

9.1

%

4.3

%

9.0

%

Less: Impact of shop optimization program

closures

(3,330

)

—

—

(3,330

)

Less: Impact of Branded Sweet Treats

exit

(6,701

)

—

—

(6,701

)

Adjusted net revenues in second quarter of

fiscal 2022

234,634

110,558

20,022

365,214

Adjusted net revenue growth

32,783

10,030

855

43,668

Impact of acquisitions

(3,023

)

—

877

(2,146

)

Impact of foreign currency translation

—

15

—

15

Organic Revenue Growth

$

29,760

$

10,045

$

1,732

$

41,537

Organic Revenue Growth %

12.7

%

9.1

%

8.7

%

11.4

%

Q2 2023 Organic Revenue - YTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in first two quarters

of fiscal 2023

$

548,761

$

232,576

$

46,495

$

827,832

Total net revenues in first two quarters

of fiscal 2022

492,584

215,051

40,142

747,777

Total Net Revenues Growth

56,177

17,525

6,353

80,055

Total Net Revenues Growth %

11.4

%

8.1

%

15.8

%

10.7

%

Less: Impact of shop optimization program

closures

(6,517

)

—

—

(6,517

)

Less: Impact of Branded Sweet Treats

exit

(6,701

)

—

—

(6,701

)

Adjusted net revenues in first two

quarters of fiscal 2022

479,366

215,051

40,142

734,559

Adjusted net revenue growth

69,395

17,525

6,353

93,273

Impact of acquisitions

(6,103

)

—

1,770

(4,333

)

Impact of foreign currency translation

—

5,794

—

5,794

Organic Revenue Growth

$

63,292

$

23,319

$

8,123

$

94,734

Organic Revenue Growth %

13.2

%

10.8

%

20.2

%

12.9

%

Trailing Four

Quarters Ended

Fiscal Year Ended

(in thousands, unless otherwise

stated)

June 30, 2024

December 31,

2023

January 1, 2023

U.S.:

Revenues

$

1,141,422

$

1,104,944

$

1,010,250

Non-Fresh Revenues (1)

(3,760

)

(9,416

)

(38,380

)

Fresh Revenues from Insomnia Cookies and

Hubs without Spokes (2)

(400,618

)

(399,061

)

(404,430

)

Sales from Hubs with Spokes

737,044

696,467

567,440

Sales per Hub (millions)

5.0

4.9

4.5

International:

Sales from Hubs with Spokes (3)

$

507,074

$

489,631

$

435,651

Sales per Hub (millions) (4)

10.1

10.0

9.7

(1)

Includes the exited Branded Sweet

Treats business revenues.

(2)

Includes Insomnia Cookies

revenues and Fresh Revenues generated by Hubs without Spokes.

(3)

Total International net revenues

is equal to Fresh Revenues from Hubs with Spokes for that business

segment.

(4)

International sales per Hub

comparative data has been restated in constant currency based on

current exchange rates.

Krispy Kreme, Inc.

Global Points of Access

(Unaudited)

Global Points of

Access

Quarter Ended

Fiscal Year

Ended

June 30, 2024

July 2, 2023

December 31,

2023

U.S.:

Hot Light Theater Shops

229

228

229

Fresh Shops

70

66

70

Cookie Bakeries

286

244

267

DFD Doors (2)

7,497

6,320

6,808

Total

8,082

6,858

7,374

International:

Hot Light Theater Shops

46

44

44

Fresh Shops

502

466

483

Carts, Food Trucks, and Other (1)

18

16

16

DFD Doors

4,871

3,396

3,977

Total

5,437

3,922

4,520

Market Development:

Hot Light Theater Shops

117

111

116

Fresh Shops

1,033

873

968

Carts, Food Trucks, and Other (1)

30

28

30

DFD Doors

1,154

1,080

1,139

Total

2,334

2,092

2,253

Total Global Points of Access (as

defined)

15,853

12,872

14,147

Total Hot Light Theater Shops

392

383

389

Total Fresh Shops

1,605

1,405

1,521

Total Cookie Bakeries

286

244

267

Total Shops

2,283

2,032

2,177

Total Carts, Food Trucks, and

Other

48

44

46

Total DFD Doors

13,522

10,796

11,924

Total Global Points of Access (as

defined)

15,853

12,872

14,147

(1)

Carts and Food Trucks are

non-producing, mobile (typically on wheels) facilities without

walls or a door where product is received from a Hot Light Theater

Shop or Doughnut Factory. Other includes a vending machine. Points

of Access in this category are primarily found in international

locations in airports, train stations, etc.

(2)

Includes over 160 McDonald’s

shops located in Louisville and Lexington, Kentucky and the

surrounding area as of June 30, 2024.

Krispy Kreme, Inc.

Global Hubs

(Unaudited)

Hubs

Quarter Ended

Fiscal Year

Ended

June 30, 2024

July 2, 2023

December 31,

2023

U.S.:

Hot Light Theater Shops (1)

222

221

220

Doughnut Factories

5

4

4

Total

227

225

224

Hubs with Spokes

151

143

149

Hubs without Spokes

76

82

75

International:

Hot Light Theater Shops (1)

37

35

36

Doughnut Factories

14

14

14

Total

51

49

50

Hubs with Spokes

51

49

50

Market Development:

Hot Light Theater Shops (1)

115

108

112

Doughnut Factories

26

23

23

Total

141

131

135

Total Hubs

419

405

409

(1)

Includes only Hot Light Theater

Shops and excludes Mini Theaters. A Mini Theater is a Spoke

location that produces some doughnuts for itself and also receives

doughnuts from another producing location.

Krispy Kreme, Inc.

Net Debt and Leverage

(Unaudited)

(in thousands, except leverage

ratio)

June 30, 2024

December 31,

2023

Current portion of long-term debt

$

59,827

$

54,631

Long-term debt, less current portion

894,979

836,615

Total long-term debt, including debt

issuance costs

954,806

891,246

Add back: Debt issuance costs

3,847

4,371

Total long-term debt, excluding debt

issuance costs

958,653

895,617

Less: Cash and cash equivalents

(28,625

)

(38,185

)

Net debt

$

930,028

$

857,432

Adjusted EBITDA - trailing four

quarters

220,796

211,624

Net leverage ratio

4.2 x

4.1 x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807359325/en/

Investor Relations

ir@krispykreme.com

Financial Media Edelman

Smithfield for Krispy Kreme, Inc. Ashley Firlan & Ashna Vasa

KrispyKremeIR@edelman.com

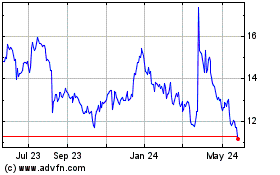

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Nov 2024 to Dec 2024

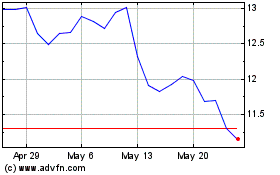

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Dec 2023 to Dec 2024