UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2024

Commission

File Number: 001-38304

DOGNESS

(INTERNATIONAL) CORPORATION

(Registrant’s

name)

Tongsha

Industrial Estate, East District

Dongguan,

Guangdong

People’s

Republic of China 523217

+86

769-8875-3300

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXPLANATORY

NOTE

The

Registrant is filing this Report on Form 6-K to provide its proxy statement for its 2023 annual meeting of shareholders. With a record

date as of January 5, 2024, the meeting will be held on February 28, 2024, at 9:00 a.m. China Time (8:00 p.m. Eastern Time on February

27, 2024 and at the Registrant’s executive office at No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, China.

Exhibits

The

following document is filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

Dogness

(International) Corporation |

| |

|

| |

By: |

/s/

Silong Chen |

| |

Name: |

Silong

Chen |

| |

Title: |

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) and |

| |

|

Duly

Authorized Officer |

Dated:

January 12, 2024

Exhibit

99.1

DOGNESS

(INTERNATIONAL) CORPORATION

NO.

16 N. DONGKE ROAD, TONGSHA INDUSTRIAL ZONE, DONGGUAN, GUANGDONG

PEOPLE’S

REPUBLIC OF CHINA

PROXY

STATEMENT AND NOTICE OF

ANNUAL

MEETING OF SHAREHOLDERS

FOR

THE FISCAL YEAR ENDED JUNE 30, 2023

| To

the shareholders of |

January

12, 2024 |

| Dogness

(International) Corporation |

Dongguan,

China |

To

our shareholders:

It

is my pleasure to invite you to our Annual Meeting of Shareholders for the fiscal year ended June 30, 2023 on February 28, 2024, at 9:00

a.m. China Time (8:00 p.m. Eastern Time on February 27, 2024). The meeting will be held at our executive office at No. 16 N. Dongke Road,

Tongsha Industrial Zone, Dongguan, Guangdong, China. The meeting will be held as a hybrid virtual and physical meeting. Shareholders

unable to attend in person may attend by visiting http://dogness.com/shareholdermeeting/2024february which will redirect

to the meeting website.

The

matters to be acted upon at the meeting are described in the Notice of Annual Meeting of Shareholders and Proxy Statement.

YOUR

VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY

BY EMAIL, THE INTERNET OR BY MAIL. IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR

SHARES IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT

YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

| |

By

order of the Board of Directors, |

| |

|

| |

/s/

Silong Chen |

| |

Silong

Chen |

| |

Chairman |

NOTICE

OF ANNUAL MEETING

OF

SHAREHOLDERS FOR THE FISCAL YEAR ENDED JUNE 30, 2023

DOGNESS

(INTERNATIONAL) CORPORATION

| TIME: |

|

9:00

A.M., Beijing Time, on February 28, 2024

(8:00

P.M., Eastern Time, on February 27, 2024) |

| PLACE: |

|

No.

16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, China. |

| |

|

|

| |

|

The

Meeting will also be held virtually http://dogness.com/shareholdermeeting/2024february. |

ITEMS

OF BUSINESS:

| |

(1) |

The

election of five members of the Board of Directors, each to serve a one-year term expiring at the Annual Meeting of Shareholders

for the fiscal year ended June 30, 2024 or until their successors are duly elected and qualified; |

| |

|

|

| |

(2) |

The

ratification of the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for the

fiscal year ended June 30, 2023; |

| |

|

|

| |

(3) |

To

Transact any other business properly coming before the meeting. |

| WHO

MAY VOTE: |

You

may vote if you were a shareholder of record on January 5, 2024. |

| |

|

| DATE

OF MAILING: |

This

notice and the proxy statement are first being mailed to shareholders on or about January 15, 2024. |

| By

order of the Board of Directors, |

|

| |

|

| /s/

Silong Chen |

|

| Silong

Chen |

|

| Chairman |

|

ABOUT

THE ANNUAL MEETING OF SHAREHOLDERS

FOR THE FISCAL YEAR ENDED JUNE 30, 2023

What

am I voting on?

You

will be voting on the following:

| |

(1) |

The

election of five members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Shareholders for the

fiscal year ended June 30, 2024 or until their successors are duly elected and qualified; |

| |

|

|

| |

(2) |

The

ratification of the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for the

fiscal year ended June 30, 2023; |

| |

|

|

| |

(3) |

The

transaction of any other business properly coming before the meeting. |

Who

is entitled to vote?

You

may vote if you owned Class A shares or Class B shares of the Company as of the close of business on January 5, 2024. Each Class A share

is entitled to one vote, and each Class B share is entitled to ten votes on all matters subject to vote at the annual meeting. As of

January 5, 2024, we had 1,634,385 Class A shares (not including 25,000 Class A shares underlying options granted to management, and warrants

to purchase an aggregate of 35,986 Class A shares issued to the investors and the placement agent in the 2021 and 2022 offering)

and 9,069,000 Class B shares.

How

do I vote before the meeting?

If

you are a registered shareholder, meaning that you hold your shares in certificate form, you have three voting options:

| |

(1) |

By

Internet, which we encourage if you have Internet access, at the address shown on your proxy card; |

| |

|

|

| |

(2) |

By

email, by emailing your signed proxy card to akotlova@bizsolaconsulting.com; or |

| |

|

|

| |

(3) |

By

mail, by completing, signing and returning the enclosed proxy card. |

If

you hold your shares through an account with a bank or broker, your ability to vote by the Internet depends on their voting procedures.

Please follow the directions that your bank or broker provides.

May

I vote at the meeting?

If

you are a shareholder of record, you may vote in person at the meeting. If you hold your shares through an account with a bank or broker,

please follow the directions provided to you by your bank or broker. If you wish to vote in person at the meeting, please contact your

bank or broker to learn the procedures necessary to allow you to vote your shares in person. Even if you plan to attend the meeting,

we encourage you to vote your shares by proxy. You may vote by proxy through the Internet, by email, or by mail.

Can

I change my mind after I return my proxy?

You

may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may do this by (1) signing another

proxy card with a later date and returning it to us before the meeting, (2) voting again over the Internet prior to 4:00 p.m.,

Eastern Time, on February 27, 2024, (3) voting again by email prior to 4:00 p.m., Eastern Time, on February 27, 2024, or (4) voting

at the meeting if you are a registered shareholder or have followed the necessary procedures required by your bank or broker.

What

if I return my proxy card but do not provide voting instructions?

Proxies

that are signed and returned but do not contain instructions will be voted “FOR” the election of all nominees under Proposal

1, and voted in favor of Proposal 2 and Proposal 3 in accordance with the best judgment of the named proxies on any other matters properly

brought before the meeting. Unsigned proxies will not be voted or counted.

What

does it mean if I receive more than one proxy card or instruction form?

It

indicates that your shares are registered differently and are in more than one account. To ensure that all shares are voted, please either

vote each account by email or on the Internet, or sign and return all proxy cards. We encourage you to register all your accounts in

the same name and address. Those holding shares through a bank or broker should contact their bank or broker and request consolidation.

How

can I attend the meeting?

The

meeting is open to all holders of the Company’s shares as of January 5, 2024. The meeting will be held as a hybrid virtual and

physical meeting. Shareholders unable to attend in person may attend by visiting http://dogness.com/shareholdermeeting/2024february,

which will redirect to the meeting website. Whether you attend in person or virtually, the Company recommends that shareholders arrive

at least a half-hour early to facilitate an on-time beginning to the meeting.

May

shareholders ask questions at the meeting?

Yes.

Representatives of the Company will answer questions of general interest at the end of the meeting. You may also submit questions in

advance via email to info@dogness.com. Such questions will also be addressed at the end of the meeting.

How

many votes must be present to hold the meeting?

Your

shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by

internet, email or mail. In order for us to conduct our meeting, at least one-half (1/2) of the voting power of each class of our

outstanding shares (i.e., one half of the voting power of the Class A shares and one half of the voting power of the Class B shares)

as of January 5, 2024 must be present in person or by proxy. This is referred to as a quorum. Abstentions will be counted for

purposes of establishing a quorum at the meeting. In the event we do not have quorum at the time set for the meeting, we are

required to adjourn the meeting until the following week, at which time quorum will be satisfied if shares representing at least

one-third (1/3) of the total issued voting power of our company are present in person or by proxy.

How

many votes are needed to approve the Company’s proposals?

Proposal

1. The nominees receiving the highest number of “For” votes will be elected as directors. This number is called a plurality.

Shares not voted will have no impact on the election of directors. The proxy given will be voted “For” each of the nominees

for director unless a properly executed proxy card is marked “Withhold” as to a particular nominee or nominees for director.

Proposal

2. The ratification of the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for

the fiscal year ended June 30, 2023 requires that a majority of the votes cast at the meeting be voted “For” the proposal.

A properly executed proxy card marked “Abstain” with respect to this proposal will not be voted.

PROPOSAL

ONE

ELECTION

OF DIRECTORS AND DIRECTOR BIOGRAPHIES

(ITEM

1 ON THE PROXY CARD)

A

brief biography of each Director follows. Our Board of Directors, upon the recommendation of the Nominating Committee, has nominated

five Directors for election to be on the Board of Directors for a one-year term expiring at the Annual Meeting of Shareholders for the

fiscal year ended June 30, 2024. You are asked to vote for these nominees to serve as members of the Board of Directors. All candidates

for the Board have consented to serve if elected.

Qingshen

Liu

Director

Nominee (Independent)

Age

— 52

Director

since 2018

Dr.

Qingshen Liu is an associate professor in the Faculty of Animal Science at South China Agriculture University. He has many years of experience

in teaching, research, and social services and focuses on commercial animal breeding, nutrition, and biotechnology. Dr. Liu’s vast

industry involvement includes senior roles at the Chinese Association of Animal Science and Veterinary Medicine, the Guangdong Zoological

Society, the Guangdong Association of Animal Husbandry and Veterinary Medicine, the Guangdong Pet Industry Technology Innovation Alliance,

the Guangdong Vocational Education Strategic Alliance for the pet industry, and the China Native Dog Protection Association. He is also

a consultant for the China Pet Health Nutrition Association, the Dongguan Pet Industry Association, and the Guangdong Province Science

and Technology Project. He is an editor of Kennel Technology and the Guangdong Journal of Animal and Veterinary Science. Dr. Qingshen

Liu holds a Ph.D in animal nutrition and feed science from South China Agricultural University. We have nominated Dr. Liu because of

his expertise in animal science and knowledge of research, product development and education.

Zhiqiang

Shao

Director

Nominee (Independent)

Age

— 51

Director

since 2017

Mr.

Shao has been an independent director since 2017. Since May 2015, Mr. Shao has been the Vice Risk Control Officer in Paisheng Technology

Group Co., Ltd, where he is responsible for implementing the company’s corporate risk control strategy. From March 2010 through

April 2015, Mr. Shao was the Financial and Risk Control Director at Dongguan Xiangbang Credit Guarantee Ltd. From November 2006 through

February 2010, Mr. Shao was the Financial and Risk Control Manager at China Zhongkezhi Guarantee Group Co., Ltd, Dongguan Branch. From

July 1996 to October 2006, Mr. Shao worked as the Financial Manager for Huiyang Wanli Plastic Products Co., Ltd/Dongguan Wanjia Toys

Co., Ltd. In July 1996, he graduated from a three-year college in Accounting, Shanghai Lixin Institute of Accounting and Finance (formerly

Shanghai Lixin College of Accounting), and earned his Bachelor in Financial Management from South China Normal University in May 2017.

We believe Mr. Shao’s experience with accounting and risk management make him a qualified member of our Board of Directors.

Changqing

Shi

Director

Nominee (Independent)

Age

– 43

Director

since 2020

Mr.

Shi has been nominated to serve on our Board of Directors. Since September 2019, Mr. Shi has been the Deputy General Manager of Dongguan

Newspaper Culture Communication Co., Ltd. From May 2018 through August 2019, he was Executive Dean of Duowei Training Institute. From

April 2017 through April 2018, Mr. Shi was Vice Principal of Guangdong School of Science and Technology. From September 2016 through

March 2017, he was Vice Principal of Dongguan Yuehua School. From May 2014 through August 2016, Mr. Shi was the Chief Counselor of the

Dongguan Youth Leadership Program. Mr. Shi earned his B.A. from Yantai Normal University and is studying for a master’s degree

in cultural industry management from Peking University. We have nominated Mr. Shi to serve as a member of our Board of Directors due

to his media experience and corporate governance experience, which we are hopeful will benefit Dogness’ efforts to promote its

products and brand and to further Dogness’ efforts to grow as a public company. If elected, Mr. Shi will serve on the Nominating

and Corporate Governance, Compensation and Auditing Committees and will serve as the Chairman of the Nominating and Corporate Governance

Committee, while Mr. Liu will become Chairman of the Compensation Committee.

Silong

Chen

Director

Nominee and Chief Executive Officer

Age

— 43

Director

since 2017

Mr.

Chen serves as our Chief Executive Officer and Chairman of our Board of Directors. Mr. Chen founded our Chinese subsidiary in 2003 and

has more than 20 years of experience in the pet products industry. Mr. Chen created the brand Dogness in 2008. Since 2017, Mr.

Chen has served as the executive director of the Guangdong Province Economic Research Institute. We have nominated Mr. Chen to serve

as a director because of his expertise and experience in the pet supply industry.

Aihua

Cao

Director

Nominee and Chief Financial Officer

Age

—56

Director

since 2023

Ms.

Cao serves as our Chief Financial Officer. Prior to this position, Ms. Cao served as the Finance and Accounting Manager of the Company

since 2015. Ms. Cao has more than 32 years of experience in financing and accounting, and is specialized in financial system construction,

financial investment, business analysis, tax planning, and cost control. Ms. Cao received her bachelor’s degree from Hunan University

of Finance and Economics in 1991. We have chosen Dr. Chen as our Chief Financial Officer because of her knowledge and experience with

U.S. GAAP and SEC reporting and compliance requirements. We have chosen Dr. Chen to serve as a director because of her experience with

financial matters and her knowledge of our company’s operations.

Involvement

in Certain Legal Proceedings

To

the best of our knowledge, none of our directors or officers has been convicted in a criminal proceeding, excluding traffic violations

or similar misdemeanors, nor has any been a party to any judicial or administrative proceeding during the past five years that resulted

in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or

state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without

sanction or settlement. Except as set forth in our discussion in “Related Party Transactions,” our directors and officers

have not been involved in any transactions with us or any of our affiliates or associates which are required to be disclosed pursuant

to the rules and regulations of the SEC.

Board

Leadership Structure

Mr.

Silong Chen currently holds both the positions of Chief Executive Officer and Chairman of the Board. These two positions have not been

consolidated into one position; Mr. Chen simply holds both positions at this time. As a smaller public company, we believe it is in the

company’s best interest to allow the company to benefit from guidance from key members of management in a variety of capacities.

We do not have a lead independent director and do not anticipate having a lead independent director because we will encourage our independent

directors to freely voice their opinions on a relatively small company board. We believe this leadership structure is appropriate because

we are a relatively small public company.

Risk

Oversight

Our

Board of Directors plays a significant role in our risk oversight. The Board of Directors makes all relevant Company decisions. As such,

it is important for us to have our Chief Executive Officer serve on the Board as he plays a key role in the risk oversight of the Company.

As a smaller reporting company with a small board of directors, we believe it is appropriate to have the involvement and input of all

of our directors in risk oversight matters.

WE

RECOMMEND THAT YOU VOTE FOR THE ELECTION OF THE

NOMINEES

TO THE BOARD OF DIRECTORS.

PROPOSAL

TWO

RATIFICATION

OF THE APPOINTMENT OF AUDIT ALLIANCE LLP

(ITEM

2 ON THE PROXY CARD)

What

am I voting on?

A

proposal to ratify the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for the

fiscal year ended June 30, 2023. The Audit Committee of the Board of Directors has appointed Audit Alliance LLP to serve as the Company’s

fiscal year 2023 independent registered public accounting firm. Although the Company’s governing documents do not require the submission

of this matter to shareholders, the Board of Directors considers it desirable that the appointment of Audit Alliance LLP be ratified

by shareholders.

Has

the Company changed its independent registered public accounting firm during its two most recent fiscal years?

No.

Audit Alliance LLP served as the Company’s independent registered public accountant for the year ended June 30, 2022 and for the

year ended June 30, 2023.

What

services does Audit Alliance LLP provide?

Audit

services provided by Audit Alliance LLP for fiscal 2023 included the examination of the consolidated financial statements of the Company

and services related to periodic filings made with the SEC.

Will

a representative of Audit Alliance LLP be present at the meeting?

One

or more representatives of Audit Alliance LLP may be present at the meeting. The representatives will have an opportunity to make a statement

if they desire and will be available to respond to questions from shareholders.

What

if this proposal is not approved?

If

the appointment of Audit Alliance LLP is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

WE

RECOMMEND THAT YOU VOTE FOR THE RATIFICATION OF

AUDIT

ALLIANCE LLP AS THE COMPANY’S FISCAL 2023 INDEPENDENT

REGISTERED

PUBLIC ACCOUNTING FIRM.

BOARD

OF DIRECTORS AND CORPORATE GOVERNANCE INFORMATION

What

if a nominee is unwilling or unable to serve?

Each

nominee listed in the Proxy Statement has agreed to serve as a director, if reelected. If for some unforeseen reason a nominee becomes

unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board of Directors.

How

are directors compensated?

All

directors hold office until the next annual meeting of shareholders at which they are re-elected or until their successors have been

duly elected and qualified. Officers are elected by and serve at the discretion of the Board of Directors. Employee directors do not

receive any compensation for their services. Non-employee directors are entitled to receive such remuneration as our board of directors

may determine or change from time to time for serving as directors and may receive incentive option grants from our company. In addition,

each non-employee director is entitled to be repaid or prepaid all traveling, hotel and incidental expenses reasonably incurred or expected

to be incurred in attending meetings of our board of directors or committees of our board of directors or shareholder meetings or otherwise

in connection with the discharge of his or her duties as a director.

How

does the Board determine which directors are independent?

The

Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions

and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine

whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable

law, listing standards and the Company’s director independence standards. The Company believes that it maintains a majority of

independent directors who are deemed to be independent under the definition of independence provided by NASDAQ Listing Rule 5605(a)(2).

What

role does the Nominating Committee play in selecting nominees to the Board of Directors?

Two

of the primary purposes of the Board’s Nominating Committee are (i) to develop and implement policies and procedures that are intended

to ensure that the Board of Directors will be appropriately constituted and organized to meet its fiduciary obligations to the Company

and its shareholders and (ii) to identify individuals qualified to become members of the Board of Directors and to recommend to the Board

of Directors the director nominees for the annual meeting of shareholders. The Nominating Committee is also responsible for considering

candidates for membership on the Board of Directors submitted by eligible shareholders. The Nominating Committee’s charter is available

on the Company’s website at www.dogness.com under Investor Relations and in print upon request. The Nominating Committee

of the Company’s Board of Directors was the only entity or person to nominate and/or recommend any of the director nominees.

Are

the members of the Nominating Committee independent?

Yes.

All members of the Nominating Committee have been determined to be independent by the Board of Directors.

How

does the Nominating Committee identify and evaluate nominees for director?

The

Nominating Committee considers candidates for nomination to the Board of Directors from a number of sources. Current members of the Board

of Directors are considered for re-election unless they have notified the Company that they do not wish to stand for re-election. The

Nominating Committee also considers candidates recommended by current members of the Board of Directors, members of management or eligible

shareholders. From time to time the Board may engage a firm to assist in identifying potential candidates, although the Company did not

engage such a firm to identify any of the nominees for director proposed for election at the meeting. The Nominating Committee evaluates

all candidates for director, regardless of the person or firm recommending such candidate, on the basis of the length and quality of

their business experience, the applicability of such candidate’s experience to the Company and its business, the skills and perspectives

such candidate would bring to the Board of Directors and the personality or “fit” of such candidate with existing members

of the Board of Directors and management. The nominating committee does not have a specific policy in place with regard to the consideration

of diversity when identifying director nominees; however, the nominating committee does consider diversity of opinion and experience

when nominating directors.

What

are the Nominating Committee’s policies and procedures for considering director candidates recommended by shareholders?

The

Nominating Committee will consider all candidates recommended by shareholders. A shareholder wishing to recommend a candidate must submit

the following documents to the Secretary of the Company at No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, China:

| |

● |

a

recommendation that identifies the name and address of the shareholder and the person to be nominated; |

| |

|

|

| |

● |

the

written consent of the candidate to serve as a director of the Company, if elected; |

| |

|

|

| |

● |

a

description of all arrangements between the shareholders and such nominee pursuant to which the nomination is to be made; and |

| |

|

|

| |

● |

such

other information regarding the nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules

of the SEC. |

If

the candidate is to be evaluated by the Nominating Committee, the Secretary will request a detailed resume, an autobiographical statement

explaining the candidate’s interest in serving as a director of the Company, a completed statement regarding conflicts of interest,

and a waiver of liability for a background check from the candidate.

What

are the minimum qualifications required to serve on the Company’s Board of Directors?

All

members of the Board of Directors must possess the following minimum qualifications as determined by the Nominating Committee:

| |

● |

A

director must demonstrate integrity, accountability, informed judgment, financial literacy, creativity and vision; |

| |

|

|

| |

● |

A

director must be prepared to represent the best interests of all Company shareholders, and not just one particular constituency; |

| |

|

|

| |

● |

A

director must have a record of professional accomplishment in his or her chosen field; and |

| |

|

|

| |

● |

A

director must be prepared and able to participate fully in Board activities, including membership on committees. |

What

other considerations does the Nominating Committee consider?

The

Nominating Committee believes it is important to have directors from various backgrounds and professions in order to ensure that the

Board of Directors has a wealth of experiences to inform its decisions. Consistent with this philosophy, in addition to the minimum standards

set forth above, business and managerial experience and an understanding of financial statements and financial matters are very important.

How

may shareholders communicate with the members of the Board of Directors?

Shareholders

and others who are interested in communicating directly with members of the Board of Directors, including communication of concerns relating

to accounting, internal accounting controls or audit matters, or fraud or unethical behavior, may do so by writing to the directors at

the following address:

Name

of Director or Directors

c/o

Secretary

No.

16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong

People’s

Republic of China

Does

the Company have a Code of Business Ethics and Conduct?

The

Company has adopted a Code of Business Ethics and Conduct, which is applicable to all directors, officers and associates of the Company,

including the principal executive officer and the principal financial and accounting officer. The complete text of the Code of Business

Ethics and Conduct is available on the Company’s web site at www.dogness.com and is also available in print upon request.

The Company intends to post any amendments to or waivers from its Code of Business Ethics and Conduct (to the extent applicable to the

Company’s principal executive officer and principal financial and accounting officer) at this location on its web site.

How

often did the Board meet or act by consent in Fiscal 2023?

Our

Board acted by written consent or held meetings three (3) times in connection with matters related to the fiscal year ended June 30,

2023. Our Board has an Audit Committee, a Compensation Committee and a Nominating Committee. The Audit Committee acted by written consent

or held meetings three (3) times during the fiscal year ended June 30, 2023. The Compensation Committee acted by written consent or held

meetings two (2) times during the fiscal year ended June 30, 2023. The Nominating Committee acted by written consent or held meetings

two (2) times by unanimous written consent during the fiscal year ended June 30, 2023. Each incumbent director attended all of the meetings

of the Board of Directors and of the standing committees of which he or she was a member during fiscal 2023. The Board invites, but does

not require, directors to attend the annual meeting of shareholders.

What

are the committees of the Board?

During

fiscal 2023, the Board of Directors had standing Audit, Nominating, and Compensation Committees. The members of each of the Committees

as of June 30, 2023, their principal functions and the number of meetings held during the fiscal year ended June 30, 2023 are shown

below.

Compensation

Committee

The

members of the Compensation Committee were:

Qingshen

Liu, Chairman

Zhiqiang

Shao

Changqing

Shi

The

Compensation Committee acted by written consent or held meetings two (2) times during the year ended June 30, 2023. The Compensation

Committee’s charter is available on the Company’s website at www.dogness.com under Investor Relations and in print

upon request. The Compensation Committee’s principal responsibilities include:

| |

● |

Making

recommendations to the Board of Directors concerning executive management organization matters generally; |

| |

|

|

| |

● |

In

the area of compensation and benefits, making recommendations to the Board of Directors concerning employees who are also directors

of the Company, consult with the CEO on matters relating to other executive officers, and make recommendations to the Board of Directors

concerning policies and procedures relating to executive officers; |

| |

|

|

| |

● |

Making

recommendations to the Board of Directors regarding all contracts of the Company with any officer for remuneration and benefits after

termination of regular employment of such officer; |

| |

|

|

| |

● |

Making

recommendations to the Board of Directors concerning policy matters relating to employee benefits and employee benefit plans, including

incentive compensation plans and equity based plans; and |

| |

|

|

| |

● |

Administering

the Company’s formal incentive compensation programs, including equity based plans. |

The

Compensation Committee may not delegate its authority to other persons. Similarly, the Compensation Committee has not engaged a compensation

consultant to assist in the determination of executive compensation issues. While the Company’s executives will communicate with

the Compensation Committee regarding executive compensation issues, the Company’s executive officers do not participate in any

executive compensation decisions.

Audit

Committee

The

members of the Audit Committee were:

Zhiqiang

Shao, Chairman

Qingshen

Liu

Changqing

Shi

The

Audit Committee held three (3) meetings during the year ended June 30, 2023. The primary responsibility of the Audit Committee is to

assist the Board of Directors in monitoring the integrity of the Company’s financial statements and the independence of its external

auditors. The Company believes that each of the members of the Audit Committee is “independent” and that Mr. Shao qualifies

as an “audit committee financial expert” in accordance with applicable NASDAQ Capital Market listing standards. In carrying

out its responsibility, the Audit Committee undertakes to:

| |

● |

Review

and recommend to the directors the independent auditors to be selected to audit the financial statements of the Company; |

| |

|

|

| |

● |

Meet

with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the

audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the

independent auditors; |

| |

|

|

| |

● |

Review

with the independent auditors and financial and accounting personnel the adequacy and effectiveness of the accounting and financial

controls of the Company. The Audit Committee elicits recommendations for the improvement of such internal control procedures or particular

areas where new or more detailed controls or procedures are desirable. The Audit Committee emphasizes the adequacy of such internal

controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper; |

| |

|

|

| |

● |

Review

the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans

with the Company’s independent auditors; |

| |

|

|

| |

● |

Review

the financial statements contained in the annual report to shareholders with management and the independent auditors to determine

that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the shareholders; |

| |

|

|

| |

● |

Provide

sufficient opportunity for the independent auditors to meet with the members of the Audit Committee without members of management

present. Among the items discussed in these meetings are the independent auditors’ evaluation of the Company’s financial,

accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit; |

| |

|

|

| |

● |

Review

accounting and financial human resources and succession planning within the Company; |

| |

|

|

| |

● |

Submit

the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board

of Directors; and |

| |

|

|

| |

● |

Investigate

any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if,

in its judgment, that is appropriate. |

The

Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting

controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable

accounting or auditing matters.

Nominating

Committee

The

members of the Nominating Committee were:

Changqing

Shi, Chairman

Zhiqiang

Shao

Qingshen

Liu

The

Nominating Committee held two (2) meetings during the fiscal year ended June 30, 2023. All members of the Nominating Committee are independent,

as such term is defined by the NASDAQ Capital Market listing standards. The Nominating Committee undertakes to:

| |

● |

Identify

individuals qualified to become members of the Board of Directors and to make recommendations to the Board of Directors with respect

to candidates for nomination for election at the next annual meeting of shareholders or at such other times when candidates surface

and, in connection therewith, consider suggestions submitted by shareholders of the Company; |

| |

|

|

| |

● |

Determine

and make recommendations to the Board of Directors with respect to the criteria to be used for selecting new members of the Board

of Directors; |

| |

|

|

| |

● |

Oversee

the process of evaluation of the performance of the Company’s Board of Directors and committees; |

| |

|

|

| |

● |

Make

recommendations to the Board of Directors concerning the membership of committees of the Board and the chairpersons of the respective

committees; |

| |

|

|

| |

● |

Make

recommendations to the Board of Directors with respect to the remuneration paid and benefits provided to members of the Board in

connection with their service on the Board or on its committees; and |

| |

|

|

| |

● |

Evaluate

Board and committee tenure policies as well as policies covering the retirement or resignation of incumbent directors. |

The

Board of Directors has determined to provide a process by which shareholders may communicate with the Board as a whole, a Board committee

or individual director. Shareholders wishing to communicate with the Board as a whole, a Board committee or an individual member may

do so by sending a written communication addressed to the Board of Directors of the Company or to the committee or to an individual director,

c/o Secretary, Dogness (International) Corporation, No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, China. All communications

will be compiled by the Secretary of the Company and submitted to the Board of Directors or the addressee not later than the next regular

Board meeting.

MANAGEMENT

— BUSINESS HISTORY OF EXECUTIVE OFFICERS

For

information as to the business history of our Chief Executive Officer and Chairman of the Board of Directors, Mr. Silong Chen, and our

Chief Financial Officer, Aihua Cao, see the section “Proposal One: Election of Directors” elsewhere in this Proxy Statement.

EMPLOYMENT

AGREEMENTS WITH THE COMPANY’S

NAMED

EXECUTIVE OFFICERS

Our

employment agreements with our executive officers generally provide for a salary to be paid monthly. The agreements also provide that

executive officers are to work full time for our company and are entitled to all legal holidays as well as other paid leave in accordance

with PRC laws and regulations and our internal work policies. The employment agreements also provide that we will pay for all mandatory

social insurance programs for our executive officers in accordance with PRC regulations. In addition, our employment agreements with

our executive officers prevent them from rendering services for our competitors for so long as they are employed.

Other

than the salary, bonuses, equity grants and necessary social benefits required by the government, which are defined in the employment

agreements, we currently do not provide other benefits to the officers. Our executive officers are not entitled to severance payments

upon the termination of their employment agreement or following a change in control. We are not aware of any arrangement that may at

a subsequent date, result in a change of control of our company. We have not provided retirement benefits (other than a state pension

scheme in which all of our employees in China participate) or severance or change of control benefits to our named executive officers.

Under

Chinese law, we may terminate an employment agreement without penalty by providing the employee thirty days’ prior written notice

or one month’s wages in lieu of notice if the employee is incompetent or remains incompetent after training or adjustment of the

employee’s position in other limited cases. If we wish to terminate an employment agreement in the absence of cause, then we are

obligated to pay the employee one month’s salary for each year we have employed the employee. We are, however, permitted to terminate

an employee for cause without penalty to our company, where the employee has committed a crime or the employee’s actions or inactions

have resulted in a material adverse effect to us.

Silong

Chen

On

May 28, 2017, we entered a written employment agreement with Mr. Chen. Under the terms of Mr. Chen’s employment agreement, he is

entitled to base compensation of $10,000 per month. Mr. Chen received options to purchase 360,000 Class A shares for a purchase

price of $1.50 per share, which options will vest monthly at a rate of 10,000 per month for the next three years following the completion

of our initial public offering, with the first tranche vesting one month after completion of the offering. Mr. Chen’s employment

agreement has no expiration date but may be terminated immediately for cause or at any time by either party upon presentation of 30 days’

prior notice in the event he is unable to perform assigned tasks or the parties are unable to agree to changes to his employment agreement.

All of such options have vested.

Aihua

Cao

Effective

August 16, 2023, we entered a written employment agreement with Aihua Cao to serve as our Chief Financial Officer. Under the terms of

Aihua Cao’s employment agreement, she was entitled to base compensation of $3,500 per month.

Yunhao

Chen (from 2019 to August 2023)

Dr.

Chen served as our Chief Financial Officer and a director from 2019 to August 2023. Prior to joining our company, Dr. Chen served as

the CFO for a US company since 2014, where she directed and managed the company’s financial reporting and accounting functions.

With a Ph.D. in Accounting and an MBA from the University of Minnesota, and a BE degree from University of International Business and

Economics of China, Dr. Chen has also been active in the academic area. From 2007 to 2014, Dr. Chen has been a faculty member at Florida

International University and University of Miami. From 2011 till present, she has been teaching at Southern Medical University as a Visiting

Professor (Healthcare MBA). We have chosen Dr. Chen as our Chief Financial Officer because of her knowledge and experience with U.S.

GAAP and SEC reporting and compliance requirements. She holds a CPA license and has conducted analyses and research of a large amount

of formal filings of SEC registrants, with focuses on financial disclosure, capital market anomaly, business valuation, internal control

and auditing, corporate tax avoidance, and earnings-returns relation. Dr. Chen also published research results in both accounting and

finance journals such as Journal of American Tax Association, Journal of Information System, and Financial Management. We chose Dr. Chen

to serve as a director because of her experience with financial matters and her knowledge of our company’s operations. Dr. Chen

has resigned as the Company’s Chief Financial Officer effective August 1, 2023.

SUMMARY

COMPENSATION TABLE

The

following table shows the annual compensation paid by us for the year ended June 30, 2023 to Silong Chen, our principal executive officer,

and Aihua Cao, our principal financial officer. No other officer had a salary during either of the previous two years of more than $100,000.

| Name and principal position | |

Salary | | |

Bonus | | |

Option Awards | | |

All Other Compensation | | |

Total | |

Silong Chen

Chief Executive Officer | |

$ | 120,000 | | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 120,000 | |

Yunhao Chen*

Chief Financial Officer | |

$ | 150,000 | | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 150,000 | |

1.

Yunhao Chen resigned since August 1, 2023;

2.

Aihua Cao is our current Chief Financial Officer. Effective August 16, 2023, Aihua Cao started to serve as our Chief Financial Officer.

Under the terms of Aihua Cao’s employment agreement, she was entitled to base compensation of $3,500 per month.

AUDIT

COMMITTEE REPORT AND FEES PAID TO

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Who

served on the Audit Committee of the Board of Directors during fiscal year 20223

The

members of the Audit Committee as of June 30, 2023 were Zhiqiang Shao, Chairman, Qingshen Liu and Changqing Shi. Each member of the Audit

Committee is independent under the rules of the SEC and the NASDAQ Capital Market. The Board of Directors has determined that Mr. Shao,

who is an independent director, is an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation

S-K promulgated under the Exchange Act.

What

document governs the activities of the Audit Committee?

The

Audit Committee acts under a written charter, which sets forth its responsibilities and duties, as well as requirements for the Audit

Committee’s composition and meetings. The Audit Committee Charter is available on the Company’s website at dogness.com

under Investor Relations.

How

does the Audit Committee conduct its meetings?

During

fiscal 2023, the Audit Committee met with the senior members of the Company’s financial management team and the Company’s

independent registered public accounting firm. The Audit Committee’s agenda was established by the Chairman. At each meeting, the

Audit Committee reviewed and discussed various financial and regulatory issues. The Audit Committee also had private, separate sessions

from time to time with representatives of the Company’s independent registered public accounting firm, at which meetings candid

discussions of financial management, accounting and internal control issues took place.

Does

the Audit Committee review the periodic reports and other public financial disclosures of the Company?

The

Audit Committee reviews each of the Company’s quarterly and annual reports, including Management’s Discussion of Results

of Operations and Financial Condition. As part of this review, the Audit Committee discusses the reports with the Company’s management

and considers the audit and review reports prepared by the independent registered public accounting firm about the Company’s quarterly

and annual reports, as well as related matters such as the quality (and not just the acceptability) of the Company’s accounting

principles, alternative methods of accounting under generally accepted accounting principles and the preferences of the independent registered

public accounting firm in this regard, the Company’s critical accounting policies and the clarity and completeness of the Company’s

financial and other disclosures.

What

is the role of the Audit Committee in connection with the financial statements and controls of the Company?

Management

of the Company has primary responsibility for the financial statements and internal control over financial reporting. The independent

registered public accounting firm has responsibility for the audit of the Company’s financial statements and internal control over

financial reporting. The responsibility of the Audit Committee is to oversee financial and control matters, among other responsibilities

fulfilled by the Audit Committee under its charter. The Audit Committee meets regularly with the independent registered public accounting

firm, without the presence of management, to ensure candid and constructive discussions about the Company’s compliance with accounting

standards and best practices among public companies comparable in size and scope to the Company. The Audit Committee also regularly reviews

with its outside advisors material developments in the law and accounting literature that may be pertinent to the Company’s financial

reporting practices.

What

has the Audit Committee done with regard to the Company’s audited financial statements for fiscal 2023?

The

Audit Committee has:

| |

● |

reviewed

and discussed the audited financial statements with the Company’s management; and |

| |

|

|

| |

● |

discussed

with Audit Alliance LLP, the Company’s independent registered public accounting firm for fiscal 2023, the matters required

to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. |

Has

the Audit Committee considered the independence of the Company’s auditors?

The

Audit Committee has received from Audit Alliance LLP the written disclosures and the letter required by Independence Standards Board

Standard No. 1, Independence Discussions with Audit Committees, and the Audit Committee has discussed with Audit Alliance LLP about their

independence. The Audit Committee has concluded that Audit Alliance LLP are independent from the Company and its management.

Has

the Audit Committee made a recommendation regarding the audited financial statements for fiscal 2023?

Based

upon its review and the discussions with management and the Company’s independent registered public accounting firm, the Audit

Committee recommended to the Board of Directors that the audited consolidated financial statements for the Company be included in the

Company’s Annual Report on Form 20-F for fiscal 2023.

Has

the Audit Committee reviewed the fees paid to the independent registered public accounting firm during fiscal 2023?

The

Audit Committee has reviewed and discussed the fees paid to Audit Alliance LLP during fiscal 2023 for audit, audit-related, tax and other

services, which are set forth below under “Fees Paid to Independent Registered Public Accounting Firm.” The Audit Committee

has determined that the provision of non-audit services is compatible with Audit Alliance LLP’s independence.

What

is the Company’s policy regarding the retention of the Company’s auditors?

The

Audit Committee has adopted a policy regarding the retention of the independent registered public accounting firm that requires pre-approval

of all services by the Audit Committee.

Who

prepared this report?

This

report has been furnished by the members of the Audit Committee:

Zhiqiang

Shao, Chairman

Qingshen

Liu

Changqing

Shi

FEES

PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit

Fees

During

fiscal year 2023, Audit Alliance LLP’s audit fees were $160,000, and Prager Metis CPAs, LLC’s audit fees were $0.

During

fiscal year 2022, Audit Alliance LLP’s audit fees were $160,000, and Prager Metis CPAs, LLC’s audit fees were $30,000.

Audit

Related Fees

During

fiscal year 2023, Audit Alliance LLP’s audit-related fees were $4,700.

During

fiscal year 2022, Audit Alliance LLP’s audit-related fees were $2,250.

Tax

Fees

During

fiscal year 2023, Audit Alliance LLP’s tax fees were $0.

During

fiscal year 2022, Audit Alliance LLP’s tax fees were $0.

All

Other Fees

During

fiscal year 2023, Audit Alliance LLP’s other fees were $40,000, and Prager Metis CPAs, LLC’s other fess were $48,000.

During

fiscal year 2022, Audit Alliance LLP’s other fees were $0, Prager Metis CPAs, LLC’s other fees were $81,000, and Friedman

LLP’s other fees were $80,000.

Audit

Committee Pre-Approval Policies

Before

Audit Alliance LLP was engaged by the Company to render audit or non-audit services, the engagement was approved by the Company’s

audit committee. All services rendered by Audit Alliance LLP have been so approved.

Percentage

of Hours

The

percentage of hours expended on the principal accountants’ engagement to audit our consolidated financial statements for fiscal

2023 that were attributed to work performed by persons other than Audit Alliance LLP’s full-time permanent employees was

less than 50%.

BENEFICIAL

OWNERSHIP OF SHARES

The

following table sets forth information with respect to beneficial ownership of our shares as of January 5, 2024 by:

| |

● |

Each

person who is known by us to beneficially own 5% or more of our outstanding shares; |

| |

● |

Each

of our directors and named executive officers; and |

| |

● |

All

directors and named executive officers as a group. |

The

number and percentage of Common Shares beneficially owned are based on 1,634,385 Common Shares outstanding as of January 5, 2024 .

Information with respect to beneficial ownership has been furnished by each director, officer or beneficial owner of 5% or more of

our Common Shares. Beneficial ownership is determined in accordance with the rules of the SEC and generally requires that such

person have voting or investment power with respect to securities. In computing the number of Common Shares beneficially owned by a

person listed below and the percentage ownership of such person, Common Shares underlying options, warrants or convertible

securities held by each such person that are exercisable or convertible within 60 days of January 5, 2024 are deemed outstanding,

but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated in the

footnotes to this table, or as required by applicable community property laws, all persons listed have sole voting and investment

power for all Common Shares shown as beneficially owned by them. Unless otherwise indicated in the footnotes, the address for each

principal shareholder is in the care of our Company at Tongsha Industrial Estate, East District, Dongguan, Guangdong, People’s

Republic of China 523217. As of the close of business on January 5, 2024, we have approximately five (5) shareholders

of statement. This does not include shareholders who hold their shares in “street name”. A majority of our Common Shares

are held outside the United States, and none of our directors is located in the United States.

| | |

Shares Beneficially Owned (1) | | |

Percentage of Voting | |

| | |

Number | | |

Percent | | |

Power (2) | |

| Named Executive Officers and Directors: | |

| | | |

| | | |

| | |

| Silong Chen(3) | |

| 25,000 | | |

| 1.53 | % | |

| 98.26 | % |

| Zhiqiang Shao | |

| 0 | | |

| 0 | % | |

| - | |

| Changqing Shi | |

| 0 | | |

| 0 | % | |

| - | |

| Qingshen Liu | |

| 0 | | |

| 0 | % | |

| - | |

| Yunhao Chen(4) | |

| 2,500 | | |

| * | | |

| * | |

| Aihua Cao (5) | |

| 0 | | |

| 0 | % | |

| - | |

| 5% or Greater Shareholders | |

| | | |

| | | |

| | |

| Fine victory holding company Limited(3) | |

| 9,069,000 | | |

| 84.73 | % | |

| 98.23 | % |

| * |

Less

than 1% |

| |

|

| (1) |

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the Common

Shares. All shares represent Class A and Class B Common Shares and granted options to the extent such options will vest within 60

days after January 5, 2024. |

| |

|

| (2) |

Class

A Common Shares have one vote per share. Class B Common Shares have ten votes per share. |

| |

|

| (3) |

Consists

of 9,069,000 Class B Common Shares held by Fine victory holding company Limited, of which Silong Chen may be deemed to have voting

and dispositive power, 25,000 Class A Common Shares, and vested options to purchase 25,000 Class A Common Shares. Due to his ownership

of all outstanding Class B Common Shares (which have ten votes per share rather than one vote like Class A Common Shares), Mr. Silong

Chen has substantial control over Dogness. |

| |

|

| (4) |

Consists

of 50,000 options to purchase Class A Common Shares granted and vested as part of the salary on January 26, 2023. Dr. Chen has resigned

from the position as the Chief Financial Officer as of August 1, 2023 |

| |

|

| (5) |

Aihua

Cao started to serve as our Chief Financial Officer since August 16, 2023. |

GENERAL

Compensation

Committee Interlocks and Insider Participation

None

of the members of the Board of Directors who served on the Compensation Committee during the fiscal year ended June 30, 2023 were officers

or employees of the Company or any of its subsidiaries or had any relationship with the Company requiring disclosure under SEC regulations.

Shareholder

Proposals

As

a foreign private issuer, we are not required to accept shareholder proposals but welcome such proposals for the Board’s consideration

or potential inclusion at share shareholder meetings. To be considered for inclusion in next year’s Proxy Statement or considered

at next year’s annual meeting but not included in the Proxy Statement, shareholder proposals must be submitted in writing no later

than December 31, 2023. All written proposals should be submitted to: Secretary, Dogness (International) Corporation, No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong, China.

Other

Proposed Actions

If

any other items or matters properly come before the meeting, the proxies received will be voted on those items or matters in accordance

with the discretion of the proxy holders.

Solicitation

by Board; Expenses of Solicitation

Our

Board of Directors has sent you this Proxy Statement. Our directors, officers and associates may solicit proxies by telephone or in person.

We will also reimburse the expenses of brokers, nominees and fiduciaries that send proxies and proxy materials to our shareholders.

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement are available at https://dogness.com

under Investor Relations.

DOGNESS

(INTERNATIONAL) CORPORATION

Annual

Meeting of Shareholders

February

28, 2024, 9:00 AM, Beijing Time

(February

27, 2024, 8:00 PM, Eastern Time)

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF DOGNESS (INTERNATIONAL) CORPORATION

The

undersigned shareholder(s) of Dogness (International) Corporation (the “Company”), hereby appoint(s) Silong Chen or Aihua

Cao as proxy, each with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the

annual meeting of shareholders of the Company to be held on February 28, 2024, at 9:00 a.m. China Time (8:00 p.m. Eastern Time on February

27, 2024), at No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong Province, China, and to vote all

shares which the undersigned would be entitled to vote if then and there personally present, on the matters set forth below (i) as specified

by the undersigned below and (ii) in the discretion of the proxy upon such other business as may properly come before the meeting, all

as set forth in the notice of annual meeting and in the proxy statement furnished herewith.

THIS

PROXY CARD, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. IF NO DIRECTION IS MADE BUT THE CARD

IS SIGNED, THIS PROXY CARD WILL BE VOTED “FOR” THE ELECTION OF ALL NOMINEES UNDER PROPOSAL NO. 1, “FOR” PROPOSAL

NO. 2 AND NO. 3, AND IN THE DISCRETION OF THE PROXY WITH RESPECT TO SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

Continued

and to be signed on reverse side

DOGNESS

(INTERNATIONAL) CORPORATION

VOTE

BY INTERNET

www.transhare.com

Use

the Internet to transmit your voting instructions and for electronic delivery of information up until 3:00 PM, Eastern Time, on February

27, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create

an electronic voting instruction form.

ELECTRONIC

DELIVERY OF FUTURE PROXY MATERIALS

If

you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy

statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please provide

your email address below and check here to indicate you consent to receive or access proxy materials electronically in future years.

☐

Email

Address: ________________________________________

VOTE

BY EMAIL

Please

email your signed proxy card to akotlova@bizsolaconsulting.com.

VOTE

BY FAX

Please

fax your signed proxy card to 1.727. 269.5616

VOTE

BY MAIL

Mark,

sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Anna Kotlova, Transhare Corporation,

Bayside Center 1, 17755 US Highway 19 N, Suite 140, Clearwater FL 33764.

TO

VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

THIS

PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

The

Board of Directors recommend voting FOR the nominees and FOR Proposals 2 and 3.

| |

|

|

FOR |

|

|

|

WITHHOLD |

| 1. |

Resolution

THAT the following individuals be elected as Directors. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Silong

Chen |

|

☐ |

|

|

|

☐ |

| |

Aihua

Cao |

|

☐ |

|

|

|

☐ |

| |

Qingshen

Liu |

|

☐ |

|

|

|

☐ |

| |

Zhiqiang

Shao |

|

☐ |

|

|

|

☐ |

| |

Changqing

Shi |

|

☐ |

|

|

|

☐ |

| |

|

|

|

|

|

|

|

| |

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

| 2. |

Resolution

THAT the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for the fiscal year

ended June 30, 2023, be ratified. |

|

☐ |

|

☐ |

|

☐ |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

| 3. |

Such

other business as may properly come before the meeting or any adjournment thereof. |

|

☐ |

|

☐ |

|

☐ |

Please

sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full

title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full

corporate or partnership name, by authorized officer.

Date

(mm/dd/yyyy) – Please

write

date below. |

|

Signature

1 – Please keep

signature

within the box. |

|

Signature

2 – Please keep signature within the box. (Joint Owner) |

| |

|

|

|

|

Exhibit

99.2

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF DOGNESS (INTERNATIONAL) CORPORATION

The

undersigned shareholder(s) of Dogness (International) Corporation (the “Company”), hereby appoint(s) Silong Chen or Yunhao

Chen as proxy, each with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the

annual meeting of shareholders of the Company to be held on February 28, 2024, at 9:00 a.m. China Time (8:00 p.m. Eastern Time on February

27, 2024), at No. 16 N. Dongke Road, Tongsha Industrial Zone, Dongguan, Guangdong Province, China, and to vote all

shares which the undersigned would be entitled to vote if then and there personally present, on the matters set forth below (i) as specified

by the undersigned below and (ii) in the discretion of the proxy upon such other business as may properly come before the meeting, all

as set forth in the notice of annual meeting and in the proxy statement furnished herewith.

THIS

PROXY CARD, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. IF NO DIRECTION IS MADE BUT THE CARD

IS SIGNED, THIS PROXY CARD WILL BE VOTED “FOR” THE ELECTION OF ALL NOMINEES UNDER PROPOSAL NO. 1, “FOR” PROPOSAL

NO. 2 AND NO. 3, AND IN THE DISCRETION OF THE PROXY WITH RESPECT TO SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

Continued

and to be signed on reverse side

DOGNESS

(INTERNATIONAL) CORPORATION

VOTE

BY INTERNET

www.transhare.com

Use

the Internet to transmit your voting instructions and for electronic delivery of information up until 3:00 PM, Eastern Time, on February

27, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create

an electronic voting instruction form.

ELECTRONIC

DELIVERY OF FUTURE PROXY MATERIALS

If

you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy

statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please provide

your email address below and check here to indicate you consent to receive or access proxy materials electronically in future years.

☐

Email

Address: ________________________________________

VOTE

BY EMAIL

Please

email your signed proxy card to akotlova@bizsolaconsulting.com.

VOTE

BY FAX

Please

fax your signed proxy card to 1.727. 269.5616

VOTE

BY MAIL

Mark,

sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Anna Kotlova, Transhare Corporation,

Bayside Center 1, 17755 US Highway 19 N, Suite 140, Clearwater FL 33764.

TO

VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

THIS

PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

The

Board of Directors recommend voting FOR the nominees and FOR Proposals 2 and 3.

| |

|

|

FOR |

|

|

|

WITHHOLD |

| 1. |

Resolution

THAT the following individuals be elected as Directors. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Silong

Chen |

|

☐ |

|

|

|

☐ |

| |

Aihua

Cao |

|

☐ |

|

|

|

☐ |

| |

Qingshen

Liu |

|

☐ |

|

|

|

☐ |

| |

Zhiqiang

Shao |

|

☐ |

|

|

|

☐ |

| |

Changqing

Shi |

|

☐ |

|

|

|

☐ |

| |

|

|

|

|

|

|

|

| |

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

| 2. |

Resolution

THAT the appointment of Audit Alliance LLP as the Company’s independent registered public accounting firm for the fiscal year

ended June 30, 2023, be ratified. |

|

☐ |

|

☐ |

|

☐ |

| |

|

|

|

|

|

|

|

| |

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

| 3. |

Such

other business as may properly come before the meeting or any adjournment thereof. |

|

☐ |

|

☐ |

|

☐ |

Please

sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full

title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full

corporate or partnership name, by authorized officer.

Date

(mm/dd/yyyy) – Please

write

date below. |

|

Signature

1 – Please keep

signature

within the box. |

|

Signature

2 – Please keep

signature

within the box. (Joint Owner) |

| |

|

|

|

|

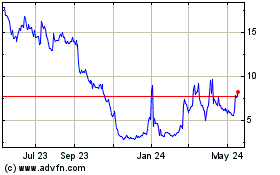

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

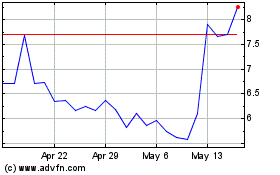

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Nov 2023 to Nov 2024