FALSE000086878000008687802024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 29, 2024

DORMAN PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Pennsylvania | 000-18914 | 23-2078856 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3400 East Walnut Street, Colmar, Pennsylvania 18915

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (215) 997-1800

| | | | | | | | |

| Not Applicable | |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | DORM | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operation and Financial Condition.

On October 31, 2024, Dorman Products, Inc. (the “Company”) issued a press release announcing its operating results for the third fiscal quarter ended September 28, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein. The Company will hold a conference call and webcast on November 1, 2024 (see information in the press release attached hereto as Exhibit 99.1 under “Conference Call and Webcast”).

Item 8.01 Other Events.

On October 29, 2024, the Company’s Board of Directors approved a new share repurchase program with an aggregate authorization to repurchase up to $500 million of the Company’s common stock (the “New Program”). The New Program is effective January 1, 2025 and will expire December 31, 2027. The Company’s existing share repurchase program will expire December 31, 2024, along with all unused amounts under that program as of that date.

Once it becomes effective, share repurchases under the New Program may be made from time to time, as the Company deems appropriate, based on factors such as market conditions, share price, share availability and other factors. There can be no assurance as to the number of shares the Company will purchase, if any, and the New Program may be modified, renewed, suspended or terminated by the Company at any time without prior notice.

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995, including forward-looking statements regarding the New Program. These statements are neither promises nor guarantees and involve risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements, including, without limitation, risks relating to the Company’s ability to implement and make appropriate, timely and beneficial decisions as to when, how and if to purchase shares under the New Program, and other risks described in the Company’s filings with the U.S. Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | DORMAN PRODUCTS, INC. |

| | | | |

Date: | October 31, 2024 | By: | /s/ David M. Hession |

| | | Name: | David M. Hession |

| | | Title: | Senior Vice President, Chief Financial Officer and Treasurer |

Dorman Products, Inc. Reports Third Quarter 2024 Results; Raises Full Year 2024 Earnings Guidance

Highlights (All comparisons are to the prior year period unless otherwise noted):

•Net sales of $503.8 million, up 3.2% compared to $488.2 million

•Diluted earnings per share (“EPS”) of $1.80, up 41% compared to $1.28

•Adjusted diluted EPS* of $1.96, up 40% compared to $1.40

•Repurchased $27 million of its shares and announced a new share repurchase authorization for up to $500 million

•Updates its full-year guidance for 2024

COLMAR, PA (October 31, 2024) – Dorman Products, Inc. (the “Company” or “Dorman”) (NASDAQ: DORM), a leading supplier in the motor vehicle aftermarket industry, today announced its financial results for the third quarter ended September 28, 2024.

Kevin Olsen, Dorman’s President and Chief Executive Officer, stated, “We delivered strong performance in the third quarter with earnings growth exceeding our expectations. Light Duty drove mid-single digit net sales growth, as our innovation strategy continues to bolster Dorman’s leading portfolio of aftermarket solutions. While net sales were down in our Heavy Duty segment and flat in our Specialty Vehicle segment, both delivered solid topline results when considering the headwinds that persisted in each sector throughout the quarter. Each of our businesses continues to execute exceptionally well against our operational excellence initiatives. These efforts are enabling streamlined workflows, quicker speeds to market, and increased profitability across the enterprise.

“With three quarters of strong financial results, coupled with our positive outlook and visibility through the balance of the year, we are updating our full-year net sales and EPS growth guidance. For 2024, we now anticipate net sales growth to be in the range of 3.5% to 4.5%. We are also increasing and narrowing our EPS guidance and now expect diluted EPS to be in the range of $6.15 to $6.25 and adjusted diluted EPS* to be in the range of $6.85 to $6.95.

“We are pleased with our results through the third quarter and look forward to delivering solid sales and earnings growth for the year. Our performance is a testament to the hard work and dedication of our Contributors, the strength of our customer relationships, and our unwavering commitment to driving innovation for our end users.”

Third Quarter Financial Results

The Company reported third-quarter 2024 net sales of $503.8 million, up 3.2% compared to net sales of $488.2 million in the third quarter of 2023.

Gross profit was $203.8 million in the third quarter of 2024, or 40.5% of net sales, compared to $183.2 million, or 37.5% of net sales, for the same quarter last year.

Selling, general and administrative (“SG&A”) expenses were $124.5 million, or 24.7% of net sales, in the third quarter of 2024 compared to $119.0 million, or 24.4% of net sales, for the same quarter last year. Adjusted SG&A expenses* were $117.9 million, or 23.4% of net sales, in the third quarter of 2024, compared to $114.1 million, or 23.4% of net sales, in the same quarter last year.

Diluted EPS was $1.80 in the third quarter of 2024, up 41% compared to diluted EPS of $1.28 in the same quarter last year. Adjusted diluted EPS* was $1.96 in the third quarter of 2024, up 40% compared to adjusted diluted EPS* of $1.40 in the same quarter last year.

During the quarter, the Company generated $44 million in cash from operating activities, invested $9 million in capital expenditures, repaid $11 million of debt and returned $27 million to shareholders through stock repurchases.

Segment results were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Sales | | Segment Profit Margin |

| ($ in millions) | Q3 2024 | | Q3 2023 | | Change | | Q3 2024 | | Q3 2023 | | Change |

| Light Duty | $ | 393.6 | | | $ | 374.7 | | | 5 | % | | 19.0 | % | | 16.1 | % | | 290 bps |

| Heavy Duty | 59.6 | | | 62.8 | | | -5 | % | | 4.5 | % | | 3.0 | % | | 150 bps |

| Specialty Vehicle | 50.6 | | | 50.6 | | | 0 | % | | 17.0 | % | | 13.5 | % | | 350 bps |

2024 Guidance

The Company updated its full-year 2024 guidance, detailed in the table below, which excludes any potential impacts from future acquisitions and divestitures, supply chain disruptions, significant inflation, interest rate changes and additional share repurchases.

| | | | | | | | |

| Updated 2024 Guidance | Prior 2024 Guidance |

| Net Sales Growth vs. 2023 | 3.5% – 4.5% | 3% – 5% |

| Diluted EPS | $6.15 – $6.25 | $5.32 – $5.52 |

| Growth vs. 2023 | 50% – 52% | 30% – 35% |

| Adjusted Diluted EPS* | $6.85 – $6.95 | $6.00 – $6.20 |

| Growth vs. 2023 | 51% – 53% | 32% – 37% |

| Tax Rate Estimate | 24% | 24% |

Share Repurchase Program

Dorman repurchased 273,653 shares of its common stock for $26.7 million at an average share price of $97.70 during the quarter ended September 28, 2024. The Company had $134.6 million remaining under its prior share repurchase authorization.

In October, the Company’s Board of Directors authorized a new share repurchase program, effective January 1, 2025, authorizing the Company to repurchase up to $500 million of its outstanding common stock by the end of 2027. Under this program, share repurchases may be made from time to time depending on market conditions, share price, share availability and other factors at the Company’s discretion. The prior share repurchase plan and any amounts that remain available for purchases under that plan will expire on December 31, 2024.

Conference Call and Webcast

The Company will hold a conference call and webcast for investors on Friday, November 1, 2024 beginning at 8:00 a.m. Eastern time. The conference call can be accessed by telephone at (888) 440-4182 within the U.S. or +1 (646) 960-0653 outside the U.S. When prompted, enter the conference ID number 1698878. A live audio webcast along with the accompanying presentation materials can be accessed on the Company’s website at Dorman Products, Inc. - Events. A replay of the session will be available on the Investor section of the Company’s website after the call.

About Dorman Products

Dorman gives professionals, enthusiasts and owners greater freedom to fix motor vehicles. For over 100 years, we have been driving new solutions, releasing tens of thousands of aftermarket replacement products engineered to save time and money and increase convenience and reliability.

Founded and headquartered in the United States, we are a pioneering global organization offering an always-evolving catalog of products, covering cars, trucks and specialty vehicles, from chassis to body, from underhood to undercarriage, and from hardware to complex electronics.

*Non-GAAP Measures

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), this earnings release also contains Non-GAAP financial measures. The reasons why we believe these measures provide useful information to investors and a reconciliation of these measures to the most directly comparable GAAP measures and other information relating to these Non-GAAP measures are included in the supplemental schedules attached.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “likely,” “probably,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “views,” “estimates” and similar expressions are used to identify these forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date such statements were made. Such forward-looking statements are based on current expectations that involve known and unknown risks, uncertainties and other factors (many of which are outside of our control). Such risks, uncertainties and other factors relate to, among other things: competition in and the evolution of the motor vehicle aftermarket industry; changes in our relationships with, or the loss of, any customers or suppliers; our ability to develop, market and sell new and existing products; our ability to anticipate and meet customer demand; our ability to purchase necessary materials from our suppliers and the impacts of any related logistics constraints; widespread public health pandemics; political and regulatory matters, such as changes in trade policy, the imposition of tariffs and climate regulation; our ability to protect our information security systems and defend against cyberattacks; our ability to protect our intellectual property and defend against any claims of infringement; and financial and economic factors, such as our level of indebtedness, fluctuations in interest rates and inflation. More information on these risks and other potential factors that could affect the Company’s business, reputation, results of operations, financial condition, and stock price is included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The Company is under no obligation to, and expressly disclaims any such obligation to, update any of the information in this document, including but not limited to any situation where any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise.

Investor Relations Contact

Alex Whitelam, VP, Investor Relations & Risk Management

awhitelam@dormanproducts.com

(445) 448-9522

Visit our website at www.dormanproducts.com. The Investor Relations section of the website contains a significant amount of information about Dorman, including financial and other information for investors. Dorman encourages investors to visit its website periodically to view new and updated information.

DORMAN PRODUCTS, INC.

Consolidated Statements of Operations

(in thousands, except per-share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| (unaudited) | 9/28/24 | | Pct.* | | 9/30/23 | | Pct. * |

| Net sales | $ | 503,773 | | | 100.0 | | | $ | 488,186 | | | 100.0 | |

| Cost of goods sold | 299,970 | | | 59.5 | | | 304,968 | | | 62.5 | |

| Gross profit | 203,803 | | | 40.5 | | | 183,218 | | | 37.5 | |

| Selling, general and administrative expenses | 124,532 | | | 24.7 | | | 119,010 | | | 24.4 | |

| Income from operations | 79,271 | | | 15.7 | | | 64,208 | | | 13.2 | |

| Interest expense, net | 9,762 | | | 1.9 | | | 12,215 | | | 2.5 | |

| Other income, net | 1,615 | | | 0.3 | | | 605 | | | 0.1 | |

| Income before income taxes | 71,124 | | | 14.1 | | | 52,598 | | | 10.8 | |

| Provision for income taxes | 15,871 | | | 3.2 | | | 12,076 | | | 2.5 | |

| Net income | $ | 55,253 | | | 11.0 | | | $ | 40,522 | | | 8.3 | |

| | | | | | | |

| Diluted earnings per share | $ | 1.80 | | | | | $ | 1.28 | | | |

| | | | | | | |

| Weighted average diluted shares outstanding | 30,739 | | | | 31,555 | | |

| | | | | | | |

| Nine Months Ended | | Nine Months Ended |

| (unaudited) | 9/28/24 | | Pct.* | | 9/30/23 | | Pct. * |

| Net sales | $ | 1,475,425 | | | 100.0 | | | $ | 1,435,492 | | | 100.0 | |

| Cost of goods sold | 890,775 | | | 60.4 | | | 944,291 | | | 65.8 | |

| Gross profit | 584,650 | | | 39.6 | | | 491,201 | | | 34.2 | |

| Selling, general and administrative expenses | 378,489 | | | 25.7 | | | 353,681 | | | 24.6 | |

| Income from operations | 206,161 | | | 14.0 | | | 137,520 | | | 9.6 | |

| Interest expense, net | 30,569 | | | 2.1 | | | 36,733 | | | 2.6 | |

| Other income, net | 1,711 | | | 0.1 | | | 1,358 | | | 0.1 | |

| Income before income taxes | 177,303 | | | 12.0 | | | 102,145 | | | 7.1 | |

| Provision for income taxes | 41,812 | | | 2.8 | | | 23,170 | | | 1.6 | |

| Net income | $ | 135,491 | | | 9.2 | | | $ | 78,975 | | | 5.5 | |

| | | | | | | |

| Diluted earnings per share | $ | 4.37 | | | | | $ | 2.50 | | | |

| | | | | | | |

| Weighted average diluted shares outstanding | 31,019 | | | | 31,540 | | |

* Percentage of sales. Data may not add due to rounding.

DORMAN PRODUCTS, INC.

Consolidated Balance Sheets

(in thousands, except share data)

| | | | | | | | | | | |

| (unaudited) | 9/28/24 | | 12/31/23 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45,127 | | | $ | 36,814 | |

Accounts receivable, less allowance for doubtful accounts of $1,647 and $3,518 | 571,051 | | | 526,867 | |

| Inventories | 665,237 | | | 637,375 | |

| Prepaids and other current assets | 34,661 | | | 32,653 | |

| Total current assets | 1,316,076 | | | 1,233,709 | |

| Property, plant and equipment, net | 165,734 | | | 160,113 | |

| Operating lease right-of-use assets | 107,176 | | | 103,476 | |

| Goodwill | 443,340 | | | 443,889 | |

| Intangible assets, net | 284,138 | | | 301,556 | |

| Other assets | 47,633 | | | 49,664 | |

| Total assets | $ | 2,364,097 | | | $ | 2,292,407 | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 205,905 | | | $ | 176,664 | |

| Accrued compensation | 27,003 | | | 23,971 | |

| Accrued customer rebates and returns | 208,274 | | | 204,495 | |

| Revolving credit facility | 61,760 | | | 92,760 | |

| Current portion of long-term debt | 18,750 | | | 15,625 | |

| Other accrued liabilities | 39,631 | | | 33,636 | |

| Total current liabilities | 561,323 | | | 547,151 | |

| Long-term debt | 455,038 | | | 467,239 | |

| Long-term operating lease liabilities | 94,294 | | | 91,262 | |

| Other long-term liabilities | 9,203 | | | 9,627 | |

| Deferred tax liabilities, net | 9,637 | | | 8,925 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

Common stock, $0.01 par value; 50,000,000 shares authorized; 30,516,759 and 31,299,770 shares issued and outstanding in 2024 and 2023, respectively | 305 | | | 313 | |

| Additional paid-in capital | 110,595 | | | 101,045 | |

| Retained earnings | 1,127,259 | | | 1,069,435 | |

| Accumulated other comprehensive loss | (3,557) | | | (2,590) | |

| Total shareholders’ equity | 1,234,602 | | | 1,168,203 | |

| Total liabilities and shareholders' equity | $ | 2,364,097 | | | $ | 2,292,407 | |

Selected Cash Flow Information (unaudited): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (in thousands) | 9/28/24 | | 9/30/23 | | 9/28/24 | | 9/30/23 |

| Cash provided by operating activities | $ | 44,293 | | | $ | 56,224 | | | $ | 159,622 | | | $ | 149,110 | |

| Depreciation, amortization and accretion | $ | 14,812 | | | $ | 13,817 | | | $ | 43,015 | | | $ | 40,786 | |

| Capital expenditures | $ | 8,555 | | | $ | 9,667 | | | $ | 31,245 | | | $ | 32,936 | |

DORMAN PRODUCTS, INC.

Non-GAAP Financial Measures

(in thousands, except per-share amounts)

Our financial results include certain financial measures not derived in accordance with generally accepted accounting principles (GAAP). Non-GAAP financial measures should not be used as a substitute for GAAP measures, or considered in isolation, for the purpose of analyzing our operating performance, financial position or cash flows. Additionally, these non-GAAP measures may not be comparable to similarly titled measures reported by other companies. However, we have presented these non-GAAP financial measures because we believe this presentation, when reconciled to the corresponding GAAP measure, provides useful information to investors by offering additional ways of viewing our results, profitability trends, and underlying growth relative to prior and future periods and to our peers. Management uses these non-GAAP financial measures in making financial, operating, and planning decisions and in evaluating our performance. Non-GAAP financial measures may reflect adjustments for charges such as fair value adjustments, amortization, transaction costs, severance, accelerated depreciation, and other similar expenses related to acquisitions as well as other items that we believe are not related to our ongoing performance.

Adjusted Net Income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (unaudited) | 9/28/24* | | 9/30/23* | | 9/28/24* | | 9/30/23* |

| Net income (GAAP) | $ | 55,253 | | | $ | 40,522 | | | $ | 135,491 | | | $ | 78,975 | |

| Pretax acquisition-related intangible assets amortization [1] | 6,173 | | | 5,485 | | | 17,138 | | | 16,336 | |

| Pretax acquisition-related transaction and other costs [2] | 396 | | | 465 | | | 1,327 | | | 14,880 | |

| Pretax executive transition services expense [3] | — | | | — | | | — | | | 1,801 | |

| Pretax fair value adjustment to contingent consideration [4] | — | | | (1,000) | | | — | | | (13,400) | |

| Pretax reduction in workforce costs [5] | 76 | | | — | | | 4,926 | | | — | |

| Tax adjustment (related to above items) [6] | (1,654) | | | (1,214) | | | (5,815) | | | (4,891) | |

| Adjusted net income (Non-GAAP) | $ | 60,244 | | | $ | 44,258 | | | $ | 153,067 | | | $ | 93,701 | |

| | | | | | | |

| Diluted earnings per share (GAAP) | $ | 1.80 | | | $ | 1.28 | | | $ | 4.37 | | | $ | 2.50 | |

| Pretax acquisition-related intangible assets amortization [1] | 0.20 | | | 0.17 | | | 0.55 | | | 0.52 | |

| Pretax acquisition-related transaction and other costs [2] | 0.01 | | | 0.01 | | | 0.04 | | | 0.47 | |

| Pretax executive transition services expense [3] | — | | | — | | | — | | | 0.06 | |

| Pretax fair value adjustment to contingent consideration [4] | — | | | (0.03) | | | — | | | (0.42) | |

| Pretax reduction in workforce costs [5] | 0.00 | | | — | | | 0.16 | | | — | |

| Tax adjustment (related to above items) [6] | (0.05) | | | (0.04) | | | (0.19) | | | (0.16) | |

| Adjusted diluted earnings per share (Non-GAAP) | $ | 1.96 | | | $ | 1.40 | | | $ | 4.93 | | | $ | 2.97 | |

| | | | | | | |

| Weighted average diluted shares outstanding | 30,739 | | 31,555 | | 31,019 | | 31,540 |

* Amounts may not add due to rounding.

See accompanying notes at the end of this supplemental schedule.

DORMAN PRODUCTS, INC.

Non-GAAP Financial Measures

(in thousands, except per-share amounts)

Adjusted Gross Profit: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| (unaudited) | 9/28/24 | | Pct.** | | 9/30/23 | | Pct.** |

| Gross profit (GAAP) | $ | 203,803 | | | 40.5 | | | $ | 183,218 | | | 37.5 | |

| Pretax acquisition-related transaction and other costs [2] | 1 | | | 0.0 | | 6 | | | 0.0 | |

| Adjusted gross profit (Non-GAAP) | $ | 203,804 | | | 40.5 | | | $ | 183,224 | | | 37.5 | |

| | | | | | | |

| Net sales | $ | 503,773 | | | | | $ | 488,186 | | | |

| | | | | | | |

| Nine Months Ended | | Nine Months Ended |

| (unaudited) | 9/28/24 | | Pct.** | | 9/30/23 | | Pct.** |

| Gross profit (GAAP) | $ | 584,650 | | | 39.6 | | | $ | 491,201 | | | 34.2 | |

| Pretax acquisition-related transaction and other costs [2] | 11 | | | 0.0 | | 11,806 | | | 0.8 | |

| Adjusted gross profit (Non-GAAP) | $ | 584,661 | | | 39.6 | | | $ | 503,007 | | | 35.0 | |

| | | | | | | |

| Net sales | $ | 1,475,425 | | | | | $ | 1,435,492 | | | |

DORMAN PRODUCTS, INC.

Non-GAAP Financial Measures

(in thousands, except per-share amounts)

Adjusted SG&A Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| (unaudited) | 9/28/24 | | Pct.** | | 9/30/23 | | Pct.** |

| SG&A expenses (GAAP) | $ | 124,532 | | | 24.7 | | | $ | 119,010 | | | 24.4 | |

| Pretax acquisition-related intangible assets amortization [1] | (6,173) | | | (1.2) | | | (5,485) | | | (1.1) | |

| Pretax acquisition-related transaction and other costs [2] | (395) | | | (0.1) | | | (459) | | | (0.1) | |

| | | | | | | |

| Pretax fair value adjustment to contingent consideration [4] | — | | | — | | | 1,000 | | | 0.2 | |

| Pretax reduction in workforce costs [5] | (76) | | | (0.0) | | | — | | | — | |

| Adjusted SG&A expenses (Non-GAAP) | $ | 117,888 | | | 23.4 | | | $ | 114,066 | | | 23.4 | |

| | | | | | | |

| Net sales | $ | 503,773 | | | | | $ | 488,186 | | | |

| | | | | | | |

| Nine Months Ended | | Nine Months Ended |

| (unaudited) | 9/28/24 | | Pct.** | | 9/30/23 | | Pct.** |

| SG&A expenses (GAAP) | $ | 378,489 | | | 25.7 | | | $ | 353,681 | | | 24.6 | |

| Pretax acquisition-related intangible assets amortization [1] | (17,138) | | | (1.2) | | | (16,336) | | | (1.1) | |

| Pretax acquisition-related transaction and other costs [2] | (1,316) | | | (0.1) | | | (3,074) | | | (0.2) | |

| Executive transition services expense [3] | — | | | — | | | (1,801) | | | (0.1) | |

| Pretax fair value adjustment to contingent consideration [4] | — | | | — | | | 13,400 | | | 0.9 | |

| Pretax reduction in workforce costs [5] | (4,926) | | | (0.3) | | | — | | | — | |

| Adjusted SG&A expenses (Non-GAAP) | $ | 355,109 | | | 24.1 | | | $ | 345,870 | | | 24.1 | |

| | | | | | | |

| Net sales | $ | 1,475,425 | | | | | $ | 1,435,492 | | | |

* *Percentage of sales. Data may not add due to rounding. [1] – Pretax acquisition-related intangible asset amortization results from allocating the purchase price of acquisitions to the acquired tangible and intangible assets of the acquired business and recognizing the cost of the intangible asset over the period of benefit. Such costs were $6.2 million pretax (or $4.6 million after tax) during the three months ended September 28, 2024 and $17.1 million pretax (or $12.9 million after tax) during the nine months ended September 28, 2024. Such costs were $5.5 million pretax (or $4.2 million after tax) during the three months ended September 30, 2023 and $16.3 million pretax (or $12.3 million after tax) during the nine months ended September 30, 2023.

[2] – Pretax acquisition-related transaction and other costs include costs incurred to complete and integrate acquisitions, accretion on contingent consideration obligations, inventory fair value adjustments and facility consolidation and start-up expenses. During both the three and nine months ended September 28, 2024, we incurred charges included in cost of goods sold for integration costs of $0.0 million pretax (or $0.0 million after tax). During the three and nine months ended September 28, 2024, we incurred charges included in selling, general and administrative expenses to complete and integrate acquisitions of $0.4 million pretax (or $0.3 million after tax) and $1.3 million pretax (or $1.0 million after tax), respectively.

During the three and nine months ended September 30, 2023, we incurred charges included in cost of goods sold for integration costs, other facility consolidation expenses and inventory fair value adjustments of $0.0 million pretax (or $0.0 million after tax) and $11.8 million pretax (or $8.9 million after tax), respectively. During the three and nine months ended September 30, 2023, we incurred charges included in selling, general and administrative expenses to complete and integrate acquisitions, accretion on contingent consideration obligations and facility consolidation and start-up expenses of $0.5 million pretax (or $0.4 million after tax) and $3.1 million pretax (or $2.4 million after tax), respectively.

DORMAN PRODUCTS, INC.

Non-GAAP Financial Measures

(in thousands, except per-share amounts)

[3] – Pretax executive transition service expenses represents an accrual for costs required to be paid under an agreement in connection with the planned transition of our Executive Chairman to Non-Executive Chairman, and other professional services rendered in connection with the execution of the agreement. The expense was $1.8 million pretax (or $1.4 million after tax) during the nine months ended September 30, 2023.

[4] – Fair value adjustments to contingent consideration represents the change to our estimates of ultimate earnout payment amounts for a previously completed acquisition based on projections of financial performance compared to the target amounts defined in the purchase agreement and totaled $1.0 million pretax (or $0.8 million after tax) and $13.4 million pretax (or $10.2 million after tax) during the three and nine months ended September 30, 2023, respectively.

[5] – Pretax reduction in workforce costs represents costs incurred in connection with our planned workforce reduction including severance and other payroll-related costs insurance continuation costs, modifications of share-based compensation awards, and other costs directly attributable to the action. During the three and nine months ended September 28, 2024, the expense was $0.1 million pretax (or $0.1 million after tax) and $4.9 million pretax (or $3.7 million after tax), respectively.

[6] – Tax adjustments represent the aggregate tax effect of all non-GAAP adjustments reflected in the table above and totaled $(1.7) million and $(5.8) million during the three and nine months ended September 28, 2024, respectively, and $(1.2) million and $(4.9) million during the three and nine months ended September 30, 2023, respectively. Such items are estimated by applying our statutory tax rate to the pretax amount, or an actual tax amount for discrete items.

DORMAN PRODUCTS, INC.

Non-GAAP Financial Measures

(in thousands, except per-share amounts)

2024 Guidance:

The Company provides the following updated guidance ranges related to their fiscal 2024 outlook:

| | | | | | | | | | | |

| Year Ending 12/31/2024 |

| (unaudited) | Low End* | | High End* |

| Diluted earnings per share (GAAP) | $ | 6.15 | | | $ | 6.25 | |

| Pretax acquisition-related intangible assets amortization | 0.73 | | | 0.73 | |

| Pretax acquisition transaction and other costs | 0.05 | | | 0.05 | |

| Pretax reduction in workforce costs | 0.15 | | | 0.15 | |

| Tax adjustment (related to above items) | (0.23) | | | (0.23) | |

| Adjusted diluted earnings per share (Non-GAAP) | $ | 6.85 | | | $ | 6.95 | |

| | | |

| Weighted average diluted shares outstanding | 31,000 | | 31,000 |

*Data may not add due to rounding.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

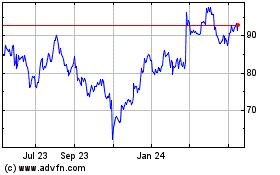

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Oct 2024 to Nov 2024

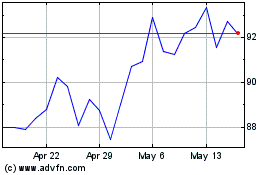

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Nov 2023 to Nov 2024