Filed Pursuant to Rule 424(b)(5)

Registration No. 333-267397

PROSPECTUS SUPPLEMENT

(To Prospectus Dated September 29, 2022)

Fangdd Network Group Ltd.

3,181,044 Class A Ordinary Shares

Pre-Funded Warrants to Purchase up to 1,933,828

Class A Ordinary Shares

Up to 1,933,828 Class A Ordinary Shares Underlying

the Pre-Funded Warrants

We entered into a securities purchase agreement, dated October 10,

2024, with certain investors relating to the sale of 3,181,044 Class A ordinary shares, par value US$0.0005625 per share, of Fangdd Network

Group Ltd. offered by this prospectus supplement and the accompanying prospectus, at a negotiated price of US$0.88 per Class A ordinary

share.

We are also offering pre-funded warrants, or the Pre-Funded Warrants,

in lieu of Class A ordinary shares, to purchase up to 1,933,828 Class A ordinary shares to those investors whose purchase of shares in

this offering would result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99%

(or, at the election of the investor, 9.99%) of our issued and outstanding Class A ordinary shares immediately following the consummation

of this offering. Each Pre-Funded Warrant is exercisable for one Class A ordinary share and has an exercise price of US$0.0005625 per

share. The purchase price per Pre-Funded Warrant is US$0.8794375. Each Pre-Funded Warrant will be exercisable immediately upon issuance

and will expire when exercised in full. This offering also relates to the Class A ordinary shares issuable upon exercise of the Pre-Funded

Warrants sold in this offering.

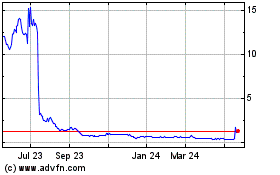

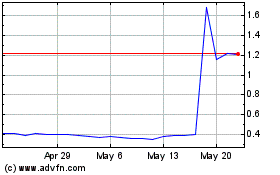

Our Class A ordinary shares

are listed on the Nasdaq Capital Market under the symbol “DUO.” On October 10, 2024, the closing price of our Class A ordinary

shares on the Nasdaq Capital Market was US$1.76 per Class A ordinary share. There is no established public trading market for the Pre-Funded

Warrants, and we do not expect a market to develop. Without an active trading market, the liquidity of the Pre-Funded Warrants will be

limited. In addition, we do not intend to apply for a listing of the Pre-Funded Warrants on any national securities exchange or other

nationally recognized trading system.

We have retained MM Global

Securities, Inc., or the Placement Agent, to act as our exclusive placement agent in connection with this offering. The Placement Agent

is not purchasing or selling any of the securities offered pursuant to this prospectus supplement and the accompanying prospectus, and

the Placement Agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount but has agreed

to use its reasonable best efforts to sell the securities offered by this prospectus supplement.

We have agreed to pay the

Placement Agent a fee based on the aggregate proceeds raised in this offering as set forth in the table below:

| |

|

Per Class A Ordinary

Share |

|

|

Per Pre-Funded

Warrant |

|

|

Total(2) |

|

| Offering price |

|

US$ |

0.88 |

|

|

US$ |

|

0.8794375 |

|

|

US$ |

4,499,999.58 |

|

| Placement Agent’s fees (1) |

|

US$ |

0.0616 |

|

|

US$ |

|

0.061560625 |

|

|

US$ |

314,999.97 |

|

| Proceeds to us (before expenses) |

|

US$ |

0.8184 |

|

|

US$ |

|

0.817876875 |

|

|

US$ |

4,184,999.61 |

|

Notes:

| (1) |

We will pay the Placement Agent a cash fee equal to seven percent (7%) of the aggregate gross proceeds raised in this offering. In addition, we have agreed to reimburse the Placement Agent for certain offering-related expenses. For additional information regarding compensation to be received by the Placement Agent, see “Plan of Distribution.” |

| (2) |

The total offering price, Placement Agent’s fees and proceeds to us (before expenses) contained in this prospectus supplement have been rounded to two decimal places for the convenience of readers. |

| (3) |

The amount of the offering proceeds to us presented in this table does not give effect to any exercise of the pre-funded warrants being issued in connection with this offering. |

Delivery of the securities being offered pursuant to this prospectus

supplement and the accompanying prospectus is expected to be made on or about October 11, 2024, subject to the satisfaction of certain

closing conditions.

We are now subject to General Instruction I.B.5 of Form F-3, which

limits the amounts that we may sell under the registration statement of which this prospectus supplement and the accompanying prospectus

form a part. The aggregate market value of our issued and outstanding Class A ordinary shares held by non-affiliates, or public float,

was approximately US$58.7 million, which was calculated based on 13,396,130 Class A ordinary shares issued and outstanding held by non-affiliates

and a per share closing price of US$4.38 as reported on the Nasdaq Capital Market on October 2, 2024. We have sold approximately US$7.5

million of securities pursuant to General Instruction I.B.5. of Form F-3 during the prior 12-calendar-month period that ends on and includes

the date of this prospectus supplement. Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell securities covered

hereby in a public primary offering with a value exceeding one-third of our public float in any 12-month period so long as our public

float remains below US$75 million.

Our share capital consists of Class A ordinary shares, Class B ordinary

shares and Class C ordinary shares. Each Class A ordinary share is entitled to one vote, each Class B ordinary share is entitled to ten

votes, and each Class C ordinary share is entitled to 10,000 votes. Each Class B ordinary share and each Class C ordinary share is convertible

into one Class A ordinary share at any time at the option of the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares or Class C ordinary shares under any circumstances. Upon any sale, transfer, assignment or disposition of Class B ordinary

shares by a holder thereof or a change of ultimate beneficial ownership of any Class B ordinary share to any person other than our founders

or any of their respective affiliates controlled by them, such Class B ordinary shares will be automatically and immediately converted

into the same number of Class A ordinary shares. Upon (i) any sale, transfer, assignment or disposition of such number of Class C ordinary

shares by a holder thereof or the direct or indirect transfer or assignment of the voting power attached to such number of Class C ordinary

shares through a voting proxy or otherwise to any person that is not an affiliate of such holder, (ii) the direct or indirect sale, transfer,

assignment or disposition of a majority of the issued and outstanding voting securities of, or the direct or indirect transfer or assignment

of the voting power attached to such voting securities through voting proxy or otherwise, or the direct or indirect sale, transfer, assignment

or disposition of all or substantially all of the assets of, a holder of Class C ordinary shares that is an entity to any person other

than an affiliate of such holder, (iii) Mr. Xi Zeng, our chairman of the board of directors and chief executive officer, ceasing to be

the ultimate beneficial owner of at least 80,698,283 Class A ordinary shares (on an as-if-converted basis) at any time, or (iv) Mr. Xi

Zeng being permanently unable to attend board meetings and manage the business affairs of our company as a result of incapacity solely

due to his then physical and/or mental condition, Class C ordinary shares held by a holder thereof will be automatically and immediately

converted into the same number of Class A ordinary shares. Except for voting and conversion rights, holders of Class A ordinary shares,

Class B ordinary shares and Class C ordinary shares shall rank pari passu with one another and shall have the same rights, preference,

privileges and restrictions. As of the date of this prospectus supplement, Mr. Xi Zeng beneficially owned one Class A ordinary shares,

28,693 Class B ordinary shares and 5,159 Class C ordinary shares, representing 0.3% of our total issued and outstanding shares and 78.8%

of the aggregate voting power of our issued and outstanding shares.

We are an “emerging

growth company” and a “foreign private issuer,” each as defined under the federal securities laws, and, as such, we

will be subject to reduced public company reporting requirements for this prospectus supplement and future filings. See “Prospectus

Supplement Summary—Implications of Being an Emerging Growth Company” and “Prospectus Supplement Summary—Implications

of Being a Foreign Private Issuer.”

Investing

in our securities involves a high degree of risk. Please carefully consider the risks and uncertainties discussed under “Risk Factors”

in this prospectus supplement beginning on page S-15, in the accompanying prospectus and in the documents incorporated by reference in

this prospectus supplement and the accompanying prospectus concerning factors you should consider before investing in our Class A ordinary

shares.

Fangdd Network Group Ltd.,

or Fangdd Cayman, is a Cayman Islands holding company with operations primarily conducted by its subsidiaries and a variable interest

entity, or the VIE, and the VIE’s subsidiaries. Investors of our Class A ordinary shares are not holding equity interest in the

VIE or its subsidiaries, but instead are holding equity interest in Fangdd Cayman. The VIE structure is used to provide investors with

exposure to foreign investment in China-based companies where PRC law prohibits direct foreign investment in the operating companies

in China. PRC laws and regulations restrict and impose conditions on foreign investment in the business involving value-added telecommunications

service (except for e-commerce, domestic conferencing, store-and-forward, and call center services), including internet real estate services.

Accordingly, these businesses are operated by the VIE and the VIE’s subsidiaries in China. Neither Fangdd Cayman nor its subsidiaries

own any equity interest or direct foreign investment in the VIE, Shenzhen Fangdd Network Technology Co., Ltd., or Fangdd Network, and

the VIE’s subsidiaries. Instead, Fangdd Cayman relies on contractual arrangements among its wholly owned PRC subsidiary, the VIE

and the VIE’s nominee shareholders, or Fangdd Network VIE Agreements, which allow Fangdd Cayman to (i) direct the activities of

the VIE and the VIE’s subsidiaries that most significantly impact the economic performance of the VIE and the VIE’s subsidiaries;

(ii) receive substantially all of the economic benefits of the VIE and the VIE’s subsidiaries; and (iii) have an exclusive option

to purchase all or part of the equity interest in the VIE when and to the extent permitted by PRC law. As a result of the Fangdd Network

VIE Agreements, Fangdd Cayman is considered the primary beneficiary of the VIE and the VIE’s subsidiaries for accounting purposes

and is able to consolidate the financial results of the VIE and VIE’s subsidiaries in the consolidated financial statements in

accordance with U.S. GAAP. For a detailed description of these contractual arrangements, see “Prospectus Summary—Contractual

Arrangements with the VIE and Its Shareholders.” As a result, investors in our Class A ordinary shares are not purchasing equity

interest in the VIE or its subsidiaries but instead are purchasing equity interest in Fangdd Cayman, a Cayman Islands holding company,

whose consolidated financial results include those of the VIE and its subsidiaries under U.S. GAAP. More specifically, investors in our

Class A ordinary shares would not hold any ownership interest, directly or indirectly, in the VIE and its subsidiaries in China and would

merely have a contractual relationship with the operating entities in China. As used in this prospectus supplement, “Fangdd Cayman”

refers to Fangdd Network Group Ltd., and “we,” “us,” “our company,” or “our” refers to

Fangdd Network Group Ltd. and its subsidiaries, and, when describing our consolidated financial information, also includes the VIE and

its subsidiaries.

Our corporate structure

is subject to risks associated with our contractual arrangements with the VIE. These contractual arrangements have not been tested in

a court of law in the PRC. If the PRC government finds that the Fangdd Network VIE Agreements do not comply with PRC laws and regulations,

or if existing regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could

be subject to severe penalties or be forced to relinquish our interests in the operations of the VIE and its subsidiaries. This would

result in the VIE and its subsidiaries being deconsolidated. The majority of our assets, including the necessary licenses to conduct

business in China, are held by the VIE. A significant part of our revenue is generated by the VIE. An event that results in the deconsolidation

of the VIE would have a material adverse effect on our operations and result in our Class A ordinary shares diminishing substantially

in value or even becoming worthless. There are substantial uncertainties about potential future actions by the PRC government that could

affect the enforceability of the Fangdd Network VIE Agreements and, consequently, significantly affect the financial performance of the

VIE and our company as a whole. For a detailed description of the risks associated with our corporate structure, see risks disclosed

under “Risk Factors—Risks Related to Our Corporate Structure” in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference.

We and the VIE face various

legal and operational risks and uncertainties related to doing business in China, including complex and evolving PRC laws and regulations.

For example, we and the VIE face risks associated with regulatory approvals on offshore offerings, the use of variable interest entities,

anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain businesses,

accept foreign investments, or list on a U.S. or other foreign exchange. These risks could result in a material adverse change in our

operations and the value of our Class A ordinary shares, significantly limit or completely hinder our ability to offer or continue to

offer securities to investors and cause such securities to significantly decline in value or become worthless. Since 2021, the PRC government

has initiated a series of regulatory actions and guidelines to regulate business operations in China, including cracking down on illegal

activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend

the scope of cybersecurity reviews and strength the administration on data cross-border transfer, regulating overseas securities offering

and listing, and expanding the efforts in anti-monopoly enforcement. Since these regulatory actions and guidelines are relatively new,

it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or

regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such

modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on

a U.S. or other foreign exchange. For a detailed description of risks relating to doing business in China, see “Risk Factors—Risks

Related to Doing Business in China” in this prospectus supplement, the accompanying prospectus and the documents incorporated by

reference.

Under our current corporate

structure, we may rely on dividend payments from our subsidiaries, to fund any cash and financing requirements we may have. As of the

date of this prospectus supplement, none of our subsidiaries have ever issued any dividends or made other distributions to us or their

respective holding companies nor have we or any of our subsidiaries ever paid dividends or made other distributions to U.S. investors.

We currently intend to retain all future earnings to finance business operations. As a result, we do not expect to pay any cash dividends

in the foreseeable future. Any limitation on the ability of our subsidiaries to distribute dividends to us or on the ability of the VIE

to make payments to us may restrict our ability to satisfy our liquidity requirements. If any of our subsidiaries incurs debt on its

own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To the extent cash in

the business is in the PRC or a PRC entity, and may need to be used to fund operations outside of the PRC, the funds may not be available

due to limitations placed by the government. For more details, see “Prospectus Summary—Cash Flows through Our Organization,”

“—Transfer of Cash through Our Organization,” “—Restrictions and Limitations on Transfer of Capital”

and “—Taxation on Dividends or Distributions.”

Pursuant to the Holding

Foreign Companies Accountable Act, or the HFCA Act, if the U.S. Securities and Exchange Commission, or the SEC, determines that a company

retains a foreign accounting firm that cannot be subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB,

for two consecutive years, the SEC will prohibit its securities from being traded on a national securities exchange or in the over-the-counter

trading market in the United States. On December 16, 2021, the PCAOB issued a report relaying to the SEC its determinations that the

board was unable to inspect or investigate completely registered public accounting firms in Mainland China and Hong Kong. In March 2022,

the SEC issued its first “Conclusive list of issuers identified under the HFCA Act” indicating that those companies were

formally subject to the delisting provisions. In May 2022, we were conclusively identified by the SEC under the HFCA Act due to the fact

that our previous auditor was located in Mainland China and could not be inspected by the PCAOB. On December 15, 2022, the PCAOB issued

a report that vacated its December 16, 2021 determination and removed Mainland China and Hong Kong from the list of jurisdictions where

it was unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it

can inspect and investigate completely audit firms in Mainland China and Hong Kong, among other jurisdictions. We have engaged our current

auditor, a Singapore-based accounting firm that is registered with the PCAOB, as our independent registered public accounting firm starting

from the fiscal year ended December 31, 2022, and our current auditor can be inspected under the PCAOB requirements. However, if the

PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in Mainland China

and Hong Kong, it may create uncertainties about the ability of our current auditor to fully cooperate with the PCAOB’s request

for audit workpapers. Such lack of inspection could cause trading in our securities to be prohibited under the HFCA Act and ultimately

result in a determination by a securities exchange to delist our securities. If our shares are prohibited from trading in the United

States, there is no certainty that we will be able to list on a non-U.S. exchange or that a market for our shares will develop outside

of the United States. Such a prohibition would substantially impair your ability to sell or purchase our Class A ordinary shares when

you wish to do so, and the risk and uncertainty associated with delisting would cause Class A ordinary shares to significantly decline

in value or become worthless. Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable to

us, or at all, which would have a material adverse impact on our business, financial condition, and prospects. For more details, see

“Risk Factors—Risks Related to Doing Business in China—Our Class A ordinary shares may be prohibited from trading in

the United States under the HFCA Act in the future if the PCAOB is unable to inspect or investigate completely auditors located in China.

The delisting of our Class A ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of

your investment.”

Neither the U.S. Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated October 11, 2024

TABLE OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT THIS PROSPECTUS

SUPPLEMENT

This document is in two

parts. The first part is this prospectus supplement, which describes the specific terms of this offering and the securities offered hereby,

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated into each by reference.

The second part is the accompanying prospectus dated September 29, 2022, included in the registration statement on Form F-3 (No. 333-267397),

including the documents incorporated by reference therein, which provides more general information, some of which may not be applicable

to this offering. This prospectus supplement is deemed to be incorporated by reference into the accompanying prospectus solely for the

purpose of this offering. When we refer only to the “prospectus,” we are referring to both parts combined.

If there is any inconsistency

between information in or incorporated by reference into the accompanying prospectus and information in or incorporated by reference

into this prospectus supplement, you should rely only on the information contained in or incorporated by reference into this prospectus

supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important

information about us, the shares being offered and other information you should know before investing. You should read this prospectus

supplement and the accompanying prospectus together with the additional information described under the headings “Where You Can

Find More Information” and “Incorporation of Documents by Reference” before investing in our Class A ordinary shares.

We have not authorized anyone

to provide you with any information other than that contained or incorporated by reference in this prospectus supplement and the accompanying

prospectus, the documents incorporated by reference herein or therein or in any related free writing prospectus prepared by us or on

our behalf to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents

incorporated by reference herein or therein and in any free writing prospectus that we have authorized for use in connection with this

offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and

prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents

incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this

offering, in their entirety before making an investment decision.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in this prospectus supplement or in the accompanying prospectus were made solely for the benefit of the parties to such

agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed

to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the

current state of our affairs.

In this prospectus supplement

and the accompanying prospectus, unless otherwise indicated or the context otherwise requires, all references to “we,” “us,”

“our,” or similar terms used in this prospectus supplement refer to Fangdd Network Group Ltd., a Cayman Islands holding company,

and its subsidiaries, and when describing our consolidated financial information, also includes the VIE and its subsidiaries.

“PRC” or “China”

refers to the People’s Republic of China, excluding, for the purpose of this prospectus supplement, Taiwan, Hong Kong and Macau,

“RMB” or “Renminbi” refers to the legal currency of China and “US$” or “U.S. dollars”

refers to the legal currency of the United States.

Unless otherwise noted, all

translations from Renminbi to U.S. dollars in this prospectus supplement were made at the exchange rate of RMB7.2672 to US$1.00, the exchange

rate in effect as of June 28, 2024, set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System.

We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi,

as the case may be, at any particular rate, or at all. On October 4, 2024, the noon buying rate set forth in the H.10 statistical release

of the Board of Governors of the Federal Reserve System was RMB7.0175 to US$1.00.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, contain

forward-looking statements. These are based on our management’s current beliefs, expectations and assumptions about future events,

conditions and results and on information currently available to us. Discussions containing these forward-looking statements may be found,

among other places, in “Information on the Company,” “Risk Factors” and “Operating and Financial Review

and Prospects” in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference including

our most recent annual report on Form 20-F, as well as any amendments thereto, filed with the SEC.

In

some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“could,” “would,” “predicts,” “potential,” “continue,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

as well as statements in the future tense or the negative or plural of those terms, and similar expressions intended to identify statements

about the future, although not all forward-looking statements contain these words. These statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different

from the information expressed or implied by these forward-looking statements.

Any

statements in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein about

our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking

statements. Within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended, or the Exchange Act, these forward-looking statements include, without limitation, statements

regarding:

| ● | our

future business development, financial condition and results of operations; |

| ● | expected

changes in our revenues, costs or expenditures; |

| ● | our

estimates regarding revenues, cash flows, capital requirements and our need for additional

financing; |

| ● | our

expectations regarding demand for and market acceptance of our services; |

| ● | competition

in our industry; |

| ● | risks

related to our corporate structure, in particular the VIE structure; and |

| ● | government

policies and regulations relating to our industry. |

The

ultimate correctness of these forward-looking statements depends upon a number of known and unknown risks and events. Many factors could

cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Consequently, you should

not place undue reliance on these forward-looking statements. In addition, we cannot assess the impact of each factor on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements.

The

forward-looking statements speak only as of the date on which they are made; and, except as required by law we undertake no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect

the occurrence of unanticipated events.

You

should refer to “Risk Factors” in this prospectus supplement, the accompanying prospectus and Item 3.D. to our most recent

annual report on Form 20-F for the fiscal year ended December 31, 2023 incorporated by reference, for a discussion of important factors

that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these

risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements

in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein will prove to

be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore, if our forward-looking statements

prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements,

you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives

and plans in any specified time frame, or at all.

You

should read this prospectus supplement, together with the accompanying prospectus and the documents we have filed with the SEC that are

incorporated by reference, completely and with the understanding that our actual future results may be materially different from what

we expect. We qualify all of our forward-looking statements by these cautionary statements.

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein may contain market

data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations,

and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity and market

size information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein is generally reliable, such information is inherently imprecise.

PROSPECTUS SUPPLEMENT

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference

into this prospectus supplement, and does not contain all of the information that you need to consider in making your investment decision.

For a more complete understanding of our business and this offering, you should carefully read this entire prospectus supplement and

the accompanying prospectus, including our historical financial statements and the notes thereto, which are incorporated herein by reference.

You should read “Risk Factors” beginning on page S-15 of this prospectus supplement, “Item 3D. Risk Factors” in

our annual report on Form 20-F for our fiscal year ended December 31, 2023, and elsewhere in this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein or therein, for more information about important risks that you should

consider before making a decision to invest in our securities.

Company Overview

We are a customer-oriented

PropTech company in China, focusing on providing real estate transaction digitalization services. We operate a real estate-focused online

marketplace for real estate transactions and related services in China. Our marketplace connects real estate sellers, agents, buyers,

and other participants as part of a vibrant ecosystem and a self-reinforcing network, enabling marketplace participants to transact real

estate assets with efficiency at lowered costs. We provide all participants with one-stop digital real estate transaction services and

seamless transaction experience through our reliable and extensive property listings, SaaS solutions, intelligent matching algorithms

and other real estate related services. In 2023, we had over 72.5 thousand active agents on our marketplace. By providing real estate

sellers with innovative and diversified digital marketing solutions as well as access to our extensive agent network, we help real estate

sellers to move their traditional offline business online and improve transaction efficiency, thereby gathering the property resources

of real estate transactions on our marketplace. In 2023, there were 765 new property projects on our marketplace.

Our primary sources of revenue

are (i) property transaction services and (ii) innovation initiatives and other value-added services. We earn base commission revenue

by charging commission fees when real estate buyers and sellers close transactions through the marketplace. Our innovation initiatives

and other value-added services include SaaS solutions and other value-added services which are provided based on our deep understanding

of marketplace participants’ problems and needs, such as asset management services aimed at optimizing returns for asset holders

and enhancing the overall operational efficiency of their asset portfolios. For our SaaS solutions, we charge marketplace participants

software subscription fees. For other value-added services such as our asset management services, we charge consulting fees, management

fees, sharing fees, and commissions.

Our revenue decreased by

73.9% from RMB942.4 million in 2021 to RMB245.9 million in 2022 due to various factors, including the continued property market downturn,

the resurgence of COVID-19 outbreaks in China and the measures we took to minimize our exposure to the systematic risk of real estate

industry in the continued downturn, such as our actions to cease business cooperation with high credit risk developers and to reduce

our business scale of new property and resale property transaction service business. Our revenue increased by 15.9% from RMB245.9 million

in 2022 to RMB285.0 million in 2023. The increase was influenced by various factors, including modest stimulation in the Chinese real

estate market spurred by a series of preferential policies, such as greater access to credit and funding for real estate developers,

mortgage interest rate cuts and lower down payments for home buyers, and relaxed restrictions on secondhand housing sales and purchases.

Our growth was also supported by strategic decisions such as discontinuing business partnerships with high credit risk developers to

mitigate losses and focusing on developers with strong credit profiles to sustain our property transaction services. We also actively

explored opportunities in other digitalization services for real estate transactions. Our revenue was RMB153.5 million and RMB140.0 million

(US$19.3 million) for the six months ended June 30, 2023 (unaudited) and 2024 (unaudited), respectively. We will continue to focus on

optimizing our revenue mix and prioritizing the value-added services and new business initiatives, including our SaaS solutions for various

platform participants and asset management services launched in 2023. We recorded a net loss of RMB1.2 billion, RMB239.6 million and

RMB93.1 million in 2021, 2022 and 2023, respectively. For the six months ended June 30, 2023 (unaudited) and 2024 (unaudited), we recorded

a net income of RMB9.4 million and RMB16.4 million (US$2.3 million), respectively.

Our Corporate Structure and Operation in

China

Fangdd Network Group Ltd.,

or Fangdd Cayman, is a Cayman Islands holding company with no material operations of its own. We conduct our operations in China primarily

through our PRC subsidiary Shenzhen Fangdd Information Technology Co., Ltd., or Shenzhen Fangdd or the WFOE, the VIE Shenzhen Fangdd

Network Technology Co., Ltd., or Fangdd Network or the VIE, and the VIE’s subsidiaries. Foreign investment in the business involving

value-added telecommunications service (except for e-commerce, domestic conferencing, store-and-forward, and call center services), including

internet real estate services, is subject to significant restrictions under current PRC laws, rules and regulations. Accordingly, these

businesses are operated by the VIE and the VIE’s subsidiaries. Investors in our Class A ordinary shares thus are not purchasing

equity interests in our operating entities in China but instead are purchasing equity interests in Fangdd Cayman, a Cayman Islands holding

company.

The following chart illustrates

our corporate structure as of the date of this prospectus supplement.

Notes:

| (1) | Shareholders of Fangdd Network are Xi Zeng, Yi Duan, Wei

Zhang, Li Zhou, Jiaorong Pan, and Ying Lu, holding 46.62%, 31.95%, 9.00%, 8.88%, 2.66%, and 0.90%, respectively, of the equity interest

in Fangdd Network. Xi Zeng is our chairman of the board of directors and chief executive officer. Yi Duan is our director. Jiaorong Pan

is our director and chief operating officer. |

| (2) | As of the date of this prospectus supplement, Fangdd Network

had 12 wholly owned subsidiaries. |

Contractual Arrangements with the VIE and

Its Shareholders

Neither we nor our subsidiaries

own any equity interest in the VIE. The equity interest in the VIE is legally held by individuals who act as nominee shareholders of

the VIE on behalf of the WFOE. A series of contractual arrangements were entered into between the WFOE, the VIE and the VIE’s shareholders,

which we refer to as the Fangdd Network VIE Agreements. The Fangdd Network VIE Agreements were originally entered into in March 2014

and subsequently amended to include registration of the Equity Interest Pledge Agreements with the relevant registration authority. Certain

Fangdd Network VIE Agreements were further amended when three nominee shareholders transferred equity interests in Fangdd Network to

other nominee shareholders in 2017 and another three nominee shareholders transferred their equity interest to the remaining nominee

shareholders in 2023. The Fangdd Network VIE Agreements allow the WFOE to (i) direct the activities of the VIE and the VIE’s subsidiaries

that most significantly impact the economic performance of the VIE and the VIE’s subsidiaries; (ii) receive substantially all of

the economic benefits of the VIE and the VIE’s subsidiaries; and (iii) have an exclusive option to purchase all or part of the

equity interests in the VIE when and to the extent permitted by PRC law. As a result of the Fangdd Network VIE Agreements, we are the

primary beneficiary of the VIE for accounting purposes and treat it as a PRC consolidated entity under U.S. GAAP. We consolidate the

financial results of the VIE in our consolidated financial statements in accordance with U.S. GAAP.

The Fangdd Network VIE Agreements

include Business Operation Agreement, Powers of Attorney, Equity Interest Pledge Agreements, Option Agreements, Operation Maintenance

Service Agreement and Technology Development and Application Service Agreement. The following is a summary of the Fangdd Network VIE

Agreements.

| ● | Business

Operation Agreement. The WFOE, the VIE and the VIE’s shareholders have entered

into a business operation agreement (including subsequent amendments, supplement and re-signing),

pursuant to which the VIE and its shareholders undertake that without the WFOE’s prior

written consent, the VIE shall not enter into any transactions that may have material effects

on the VIE’s assets, obligations, rights or business operations. Additionally, the

VIE’s shareholders undertake that without the WFOE’s prior written consent, they

shall not (i) sell, transfer, pledge or otherwise dispose of any rights associated with their

equity interests in the VIE, (ii) approve any merger or acquisition of the VIE, (iii) take

any actions that may have a material adverse effect on the VIE’s assets, businesses

and liabilities, or sell, transfer, pledge or otherwise dispose or impose other encumbrances

of any assets, businesses or income of the VIE, (iv) request the VIE to declare dividend

or make other distribution, (v) amend the VIE’s articles of association, or (vi) increase,

decrease or otherwise change the VIE’s registered capital. The WFOE may request the

VIE to transfer at any time all the intellectual property rights held by the VIE to the WFOE

or any person designated by the WFOE. The VIE and certain of its shareholders shall be jointly

and severally responsible for the performance of their obligations under this agreement. |

| ● | Powers

of Attorney. Each shareholder of the VIE has issued a power of attorney, appointing

Mr. Xi Zeng, the person designated by the WFOE, as such shareholder’s attorney-in-fact

to exercise all shareholder rights. |

| ● | Equity

Interest Pledge Agreements. Each shareholder of the VIE has entered into an equity

interest pledge agreement with the WFOE and the VIE, pursuant to which, the shareholder has

pledged all of his or her equity interests in the VIE to the WFOE to guarantee the performance

by the VIE and its shareholders of their obligations under the master agreements, which include

the technology development and application service agreement, the operation and maintenance

service agreement, the business operation agreement and the option agreements. |

| ● | Option

Agreements. The WFOE, the VIE and each of the VIE’s shareholders have entered

into an option agreement (including subsequent amendments, supplement and re-signing), pursuant

to which the VIE’s shareholder has irrevocably granted the WFOE an exclusive option,

to the extent permitted by PRC law, to purchase, or have its designated person or persons

to purchase, at its discretion all or part of the shareholder’s equity interests in

the VIE or all or part of the VIE’s assets. The purchase price shall be a nominal price

unless where PRC laws and regulations require valuation of the equity interests or the assets,

or promulgate other restrictions on the purchase price, or otherwise prohibit purchasing

the equity interests or the assets at a nominal price. |

| ● | Operation

Maintenance Service Agreement. The WFOE and the VIE have entered into an operation

maintenance service agreement, pursuant to which the WFOE has the exclusive right to provide

the VIE with operation maintenance services and marketing services. Without the WFOE’s

written consent, the VIE shall not engage any third party to provide the services covered

by this agreement. The VIE agrees to pay service fees on an annual basis and at an amount

determined by the WFOE. |

| ● | Technology

Development and Application Service Agreement. The WFOE and the VIE have entered

into a technology development and application service agreement, pursuant to which, the WFOE

has the exclusive right to provide the VIE with technology development and application services.

Without the WFOE’s written consent, the VIE shall not accept any technology development

and application services covered by this agreement from any third party. The VIE agrees to

pay service fees on an annual basis and at an amount determined by the WFOE. |

For a summary of the material

provisions of the Fangdd Network VIE Agreements, please refer to “Item 4. Information on the Company—C. Organizational Structure”

in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus and the accompanying prospectus.

The contractual arrangements

may not be as effective as direct ownership in providing us with control over Fangdd Network, and we may incur substantial costs to enforce

the terms of the arrangements. The legal environment in the PRC differs from that in other jurisdictions, such as the United States.

As a result, uncertainties in the PRC legal system could limit our ability, as a Cayman Islands holding company, to enforce these contractual

arrangements and doing so may be quite costly. There are also substantial uncertainties regarding the interpretation and application

of current and future PRC laws, regulations and rules on the status of the rights of our Cayman Islands holding company with respect

to its contractual arrangements with the VIE and its shareholders. It is uncertain whether any new PRC laws, rules or regulations related

to VIE structures will be adopted or if adopted, what effect they may have on our corporate structure. If, as a result of such contractual

arrangements, we or Fangdd Network is found to be in violation of any existing or future PRC laws or regulations, or such contractual

arrangement is determined as illegal and invalid by the PRC court, arbitral tribunal or regulatory authorities, the relevant PRC regulatory

authorities would have broad discretion to take action in dealing with such violations or failures. For a detailed description of the

risks associated with our corporate structure, please refer to risks disclosed under “Item 3.D. Key Information—Risk Factors—Risks

Related to Our Corporate Structure” in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus

and the accompanying prospectus.

Change in Registrant’s Certifying

Accountant

KPMG Huazhen LLP, or KPMG,

was previously the principal accountants for us. On July 25, 2022, KPMG was dismissed. On July 29, 2022, Audit Alliance LLP, or Audit

Alliance, was engaged as our principal accountants. The decision to change accountants was approved by our audit committee of the board

of directors.

During the two fiscal years

ended December 31, 2021, and the subsequent interim period through July 25, 2022, there were no: (1) disagreements with KPMG on any matter

of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved

to their satisfaction would have caused them to make reference in connection with their opinion to the subject matter of the disagreement,

or (2) reportable events, except that KPMG advised us of the following material weakness:

As of December 31, 2020

and 2021, we did not maintain effective internal control over financial reporting due to one material weakness identified relating to

the lack of sufficient financial reporting and accounting personnel with appropriate understanding of U.S. GAAP to implement formal period-end

financial reporting policies and procedures, to address complex U.S. GAAP technical accounting issues, and to prepare and review our

consolidated financial statements and related disclosures in accordance with U.S. GAAP and financial reporting requirements set forth

by the U.S. Securities and Exchange Commission.

The audit reports of KPMG

on our consolidated financial statements as of and for the years ended December 31, 2021 and 2020 did not contain any adverse opinion

or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles, except as follows:

KPMG’s report on our

consolidated financial statements as of and for the years ended December 31, 2021 and 2020, contained a separate paragraph stating

that “the Company has suffered recurring losses from operations and a significant decline in revenue during the year ended December 31,

2021, that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters

are also described in Note 2(b). The consolidated financial statements do not include any adjustments that might result from the outcome

of this uncertainty.”

A letter from KPMG was filed

as Exhibit 16.1 to the registration statement on Form F-3 (No. 333-267397) of which this prospectus supplement and the accompanying prospectus

form a part.

During our two most recent

fiscal years and through the subsequent interim period on or prior to July 25, 2022, neither we nor anyone on our behalf has consulted

with Audit Alliance on either (a) the application of accounting principles to a specified transaction, either completed or proposed,

or the type of audit opinion that might be rendered on our financial statements, and neither a written report nor oral advice was provided

to us by Audit Alliance that Audit Alliance concluded was an important factor considered by us in reaching a decision as to any accounting,

auditing or financial reporting issue, or (b) any matter that was the subject of a disagreement, as that term is defined in Item 16F(a)(1)(iv)

of Form 20-F (and the related instructions thereto) or a reportable event as set forth in Item 16F(a)(1)(v) of Form 20-F.

The Holding Foreign Companies Accountable

Act

Pursuant to the Holding

Foreign Companies Accountable Act, or the HFCA Act, if the SEC determines that a company retains a foreign accounting firm that cannot

be subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC will prohibit

its securities from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On

December 16, 2021, the PCAOB issued a report relaying to the SEC its determinations that the board was unable to inspect or investigate

completely registered public accounting firms in Mainland China and Hong Kong. In March 2022, the SEC issued its first “Conclusive

list of issuers identified under the HFCA Act” indicating that those companies were formally subject to the delisting provisions.

In May 2022, we were conclusively identified by the SEC under the HFCA Act due to the fact that our previous auditor was located in Mainland

China and could not be inspected by the PCAOB. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination

and removed Mainland China and Hong Kong from the list of jurisdictions where it was unable to inspect or investigate completely registered

public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in Mainland

China and Hong Kong, among other jurisdictions.

We have engaged our current

auditor, a Singapore-based accounting firm that is registered with the PCAOB, as our independent registered public accounting firm starting

from the fiscal year ended December 31, 2022, and our current auditor can be inspected under the PCAOB requirements. However, if the

PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in Mainland China

and Hong Kong, it may create uncertainties about the ability of our current auditor to fully cooperate with the PCAOB’s request

for audit workpapers. Such lack of inspection could cause trading in our securities to be prohibited under the HFCA Act and ultimately

result in a determination by a securities exchange to delist our securities. If our Class A ordinary shares are prohibited from trading

in the United States, there is no certainty that we will be able to list on a non-U.S. exchange or that a market for our shares will

develop outside of the United States. Such a prohibition would substantially impair your ability to sell or purchase our Class A ordinary

shares when you wish to do so, and the risk and uncertainty associated with delisting would cause our Class A ordinary shares to significantly

decline in value or become worthless. Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable

to us, or at all, which would have a material adverse impact on our business, financial condition, and prospects. For more details, see

“Risk Factors—Risks Related to Doing Business in China—Our Class A ordinary shares may be prohibited from trading in

the United States under the HFCA Act in the future if the PCAOB is unable to inspect or investigate completely auditors located in China.

The delisting of our Class A ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of

your investment.”

Permissions Required from the PRC Authorities

for Our Operations and Issuance of Securities to Foreign Investors

We conduct our business

primarily through our PRC subsidiaries, the VIE and the VIE’s subsidiaries in China. Our operations in China are governed by PRC

laws and regulations. As of the date of this prospectus supplement, our PRC subsidiaries, the VIE and the VIE’s subsidiaries have

obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our

subsidiaries and the consolidated affiliated entities in China, including, among others, the Value-Added Telecommunication Business Operating

License and the Certificate of Filing of Real Estate Brokerage Business. Given the uncertainties of interpretation and implementation

of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional

licenses, permits, filings or approvals for the functions and services of our platform in the future. For more detailed information,

see “Item 3. Key Information—D. Risk Factors—Risks related to Our Business and Industry—If we fail to obtain

or keep licenses, permits or approvals applicable to the various real estate services provided by us, we may incur significant financial

penalties and other government sanctions” in our most recent annual report on Form 20-F, which is incorporated by reference in

this prospectus supplement and the accompanying prospectus.

The PRC government has recently

indicated an intent to exert more oversight and control over offerings that are conducted overseas by and/or foreign investments in China-based

issuers. For example, on February 17, 2023, the CSRC promulgated a set of new regulations, including the Trial Administrative Measures

of Overseas Securities Offerings and Listings by Domestic Companies, or the Trial Measures, which came into effect on March 31, 2023,

and five supporting guidelines, which came into effect on February 17, 2023. Subsequently, the CSRC promulgated two additional supporting

guidelines on May 16, 2023 and May 7, 2024, respectively. The Trial Measures refine the regulatory system by subjecting both direct and

indirect overseas offering and listing activities to the CSRC filing-based administration. Requirements for filing entities, time points

and procedures are specified. Where a PRC domestic company indirectly offers and lists securities in overseas markets, the issuer shall

designate a major domestic operating entity to file with the CSRC. Companies, like us, that are already listed overseas as of March 31,

2023 are not required to make an immediate filing with the CSRC until a subsequent offering, in which case a filing should be made with

the CSRC within three business days after the offering is completed. Failure to complete the filing required by the Trial Measures may

result in a warning and a fine between RMB1 million and RMB10 million as for the domestic entity. Additionally, on December 28, 2021,

the Cyberspace Administration of China, or the CAC, together with another twelve regulatory authorities jointly issued the Cybersecurity

Review Measures, which came into effect on February 15, 2022. The Cybersecurity Review Measures require that, the purchase of cyber products

and services by critical information infrastructure operator and the data processing activities engaged in by network platform operators,

which affects or may affect national security, shall be subject to cybersecurity review. Further, an online platform operator that possesses

personal data of more than one million users shall declare to the Office of Cybersecurity Review for cybersecurity review before listing

in a foreign country. For more detailed information, see “Risk Factors—Risks related to Doing Business in China—The

approval of and the filing with the CSRC, CAC or other PRC governmental authorities may be required in connection with our offshore offerings

under PRC law and if required, we cannot predict whether or how soon we will be able to obtain such approval or complete such filing.”

On October 1, 2024, we conducted a registered offering through which

we sold and issued a total of 1,612,902 Class A ordinary shares on October 2, 2024. Subsequently, on October 7, 2024, we conducted another

registered offering through which we sold and issued a total of 2,464,000 Class A ordinary shares and pre-funded warrants to purchase

up to 661,232 Class A ordinary shares on the same day. We submitted a filing to the CSRC for these two offerings on October 10, 2024,

the date within three business days after the two offerings in China. Other than the filing mentioned above, under current PRC laws, regulations

and regulatory rules, as of the date of this prospectus supplement, we, our PRC subsidiaries, the VIE and the VIE’s subsidiaries,

(i) are not required to obtain permissions or approvals from the CSRC, except that a filing should be made with the CSRC within three

business days after the offering is completed, and (ii) are not required to go through cybersecurity review by the CAC, because (a) the

ownership structures of our PRC subsidiaries and VIE were not established through acquisition of equity interests or assets of any PRC

domestic company by foreign entities as clearly defined under the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign

Investor, and (b) the Cybersecurity Review Measures do not provide any explanation or interpretation of “affect or may affect national

security,” and our offshore offering in this prospectus supplement does not belong to “listing in a foreign country”

as defined in the Cybersecurity Review Measures. In addition, we, our PRC subsidiaries, the VIE and the VIE’s subsidiaries have

not been asked to obtain or denied such permissions by any PRC authority, nor have we received any inquiry, notice, warning or sanctions

regarding our corporate structure and contractual arrangements from the CSRC, CAC or any other PRC governmental agency. However, there

are substantial uncertainties regarding the interpretation and application of current and future PRC laws. Accordingly, a PRC government

agency may take a view that is contrary to the above conclusion.

Summary of Risk Factors

Below please find a summary

of the principal risks we face, organized under relevant headings. These risks are discussed more fully in “Item 3. Key Information—D.

Risk Factors” in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus supplement and

the accompanying prospectus.

Risks Related to Our Business and Industry

| ● | We

have a history of losses and negative cash flows from operating activities, and we may not

achieve profitability in the future. |

| ● | If

our estimates relating to our allowance for doubtful accounts prove to be wrong, our financial

condition and results of operations could be adversely affected. |

| ● | We

have a limited operating history, and we may not be able to effectively implement our business

strategies. |

| ● | Our

business is susceptible to fluctuations in China’s real estate market, its overall

economic growth and government measures aimed at China’s real estate industry. |

| ● | We

may fail to compete effectively with existing and new industry players, which could significantly

reduce our market share and materially and adversely affect our business, financial condition

and results of operations. |

| ● | If

our marketplace is unable to offer comprehensive, authentic, accurate and up-to-date property

listings, our business, financial condition and results of operations could be materially

and adversely affected. |

| ● | If

we are unable to retain and attract real estate professionals or fail to continue to develop

and promote our marketplace, service offerings and features, and develop the technologies

that cater to their needs, our business and operating results would be harmed. |

| ● | Our

reliance on a limited number of property developers may materially and adversely affect us. |

| ● | Our

outstanding and future indebtedness may adversely affect our available cash flow and our

ability to operate our business. In addition, we may not be able to obtain additional capital

when desired, on favorable terms or at all. |

| ● | Potential

strategic investments, acquisitions or new business initiatives may disrupt our ability to

manage our business effectively. |

Risks Related to Our Corporate Structure

| ● | If

the PRC government deems that our contractual arrangements with the VIE do not comply with

PRC regulatory restrictions on foreign investment in the relevant industries, or if these

regulations or the interpretation of existing regulations change in the future, we could

be subject to severe penalties or be forced to relinquish our interests in those operations. |

| ● | We

rely on contractual arrangements with the VIE and its shareholders to exercise control over

our business, which may not be as effective as direct ownership in providing operational

control. |

| ● | The

shareholders of the VIE may have potential conflicts of interest with us, which may materially

and adversely affect our business and financial condition. |

| ● | Any

failure by the VIE or its shareholders to perform their obligations under our contractual

arrangements with them would have a material and adverse effect on our business. |

| ● | Our

contractual arrangements with the VIE may be subject to scrutiny by the PRC tax authorities

and they may determine that we or the VIE owe additional taxes, which could negatively affect

our financial condition and the value of your investment. |

Risks Related to Doing Business in China

| ● | The

PRC government’s significant oversight over our business operation could result in

a material adverse change in our operations and the value of our ADSs (previously representing

our Class A ordinary shares). |

| ● | The

approval of and the filing with the CSRC, CAC or other PRC governmental authorities may be

required in connection with our future offshore offerings under PRC law and if required,

we cannot predict whether or how soon we will be able to obtain such approval or complete

such filing. |

| ● | Changes

in PRC government policies or political or social conditions could have a material adverse

effect on the overall economic growth in China, which could adversely affect our business,

financial condition and results of operations. |

| ● | The

Chinese economy differs from the economies of most developed countries in many respects,

including a higher level of government involvement, the ongoing development of a market-oriented

economy, a higher level of control over foreign exchange, and a less efficient allocation

of resources. |

| ● | The

PRC legal system contains uncertainties, which could limit the legal protections available

to you and us. |

| ● | The

PCAOB had historically been unable to inspect our former auditor in relation to their audit

work. |

Risks Related to Our Securities

| ● | We

may be unable to comply with the applicable continued listing requirements of Nasdaq. |

| ● | The

market price movement of the ADSs (previously representing our Class A ordinary shares) may

be volatile. |

| ● | The

sale or availability for sale of substantial amounts of the ADSs (previously representing

our Class A ordinary shares) or ordinary shares could adversely affect their market price. |

| ● | Our

triple-class voting structure will limit your ability to influence corporate matters and

could discourage others from pursuing any change of control transactions that holders of

our Class A ordinary shares and ADSs (previously representing our Class A ordinary shares)

may view as beneficial. |

| ● | If

securities or industry analysts cease to publish research or reports about our business,

or if they adversely change their recommendations regarding the ADSs (previously representing

our Class A ordinary shares), the market price for the ADSs (previously representing our

Class A ordinary shares) and trading volume could decline. |

| ● | Because

we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation

of the ADSs (previously representing our Class A ordinary shares) for return on your investment. |

Cash Flows Through Our Organization

Under our current corporate

structure, we may rely on dividend payments from our subsidiaries, to fund any cash and financing requirements we may have. As of the

date of this prospectus supplement, none of our subsidiaries have ever issued any dividends or made other distributions to us or their

respective holding companies nor have we or any of our subsidiaries ever paid dividends or made other distributions to U.S. investors.

We currently intend to retain all future earnings to finance business operations. As a result, we do not expect to pay any cash dividends

in the foreseeable future. Any limitation on the ability of our subsidiaries to distribute dividends to us or on the ability of the VIE

to make payments to us may restrict our ability to satisfy our liquidity requirements. If any of our subsidiaries incurs debt on its

own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To the extent cash in

the business is in the PRC or a PRC entity, and may need to be used to fund operations outside of the PRC, the funds may not be available

due to limitations placed by the government.

Transfer of Cash Through Our Organization

Fangdd Network Group Ltd.

is a Cayman Islands holding company with no material operations of its own. We currently conduct our operations primarily through Fangdd

Network, the VIE, and its subsidiaries. As of December 31, 2023 and June 30, 2024 (unaudited), we had RMB121.7 million and RMB125.4 million

(US$17.3 million) in cash and cash equivalents, respectively, RMB22.2 million and RMB17.0 million (US$2.3 million) in restricted cash,

respectively, and RMB15.3 million and RMB11.8 million (US$1.6 million) in short-term investments, respectively, that consisted of investments

in wealth management products which were redeemable by us at any time. Although we consolidate the results of the VIE and its subsidiaries,

we only have access to the assets or earnings of the VIE and its subsidiaries through our contractual arrangements with the VIE and its

shareholders. The cash flows that have occurred between our holding company, its subsidiaries and the VIE are summarized as follows:

| | |

For the Year Ended

December 31, | | |

For the Six Months Ended

June 30, | |

| | |

2021 | | |

2022 | | |

2023 | | |

2023 | | |

2024 | |

| | |

(in US$ millions) | |

| Cash received by Fangdd Network Group Ltd. as equity investment | |

| — | | |

| 0.5 | | |

| 27.3 | | |

| 20.1 | | |

| — | |

| Cash paid by Fangdd Network Group Ltd. to Fangdd Network Holding Ltd. (Hong Kong) to invest in WFOE, Shenzhen Fangdd Information Technology Co., Ltd(1) | |

| 21.5 | | |

| — | | |

| — | | |

| — | | |

| — | |

| Cash paid by Fangdd Network Holding Ltd. (Hong Kong) to contribute to the payment to WFOE as paid-in capital | |

| 12.8 | | |

| — | | |

| — | | |

| — | | |

| — | |

| Cash paid by WFOE to VIE, Shenzhen Fangdd Network Technology Co., Ltd., through bank entrusted loan(2) | |

| 69.0 | | |

| 5.7 | | |

| — | | |

| — | | |

| — | |

| Cash received by WOFE, Shenzhen Fangdd Information Technology Co., Ltd from Parent company | |

| — | | |

| — | | |

| 20.1 | | |

| 19.7 | | |

| — | |

Notes:

| (1) | Part of Fangdd Network Holding Ltd (Hong Kong)’s cash

used to invest in Shenzhen Fangdd Information Technology Co., Ltd. was from its bank balance of previous years’ equity financing

before 2016; |

| | |

| (2) | Part of Shenzhen Fangdd Information Technology Co., Ltd.’s

cash used to loan to the VIE was from its bank balance of previous years’ equity financing before 2016. |

Pursuant to the operation maintenance service agreement, Shenzhen Fangdd

has the exclusive right to provide Fangdd Network, the VIE, with operation maintenance services and marketing services. Fangdd Network

agrees to pay service fees on an annual basis and at an amount determined by Shenzhen Fangdd after taking into account factors such as

the labor cost, facility cost and marketing expenses incurred by Shenzhen Fangdd in providing the services. Pursuant to the technology

development and application service agreement, Shenzhen Fangdd has the exclusive right to provide Fangdd Network with technology development

and application services. Fangdd Network agrees to pay service fees on an annual basis and at an amount determined by Shenzhen Fangdd

after taking into account multiple factors, such as the labor and time consumed for the provision of the service, the type and complexity

of the services provided, the difficulties in providing the service, the commercial value of services provided and the market price of

comparable services. Since Fangdd Network has incurred and accumulated losses historically, there was no service fee payable by Fangdd

Network to Shenzhen Fangdd.

Impact of Taxation on Dividends or Distributions

Fangdd Network Group Ltd.

is incorporated in the Cayman Islands and conducts business in China through its PRC subsidiaries and the VIE. Neither our subsidiaries

nor the consolidated VIE has declared or paid any dividend or distribution to us. We have never declared or paid any dividend on our

ordinary shares and we have no current intention to pay dividends to shareholders. We currently intend to retain all future earnings

to finance our operations and to expand our business. Under the current laws of the Cayman Islands, Fangdd Network Group Ltd. is not

subject to taxes based upon profits, income or capital gains. Upon payments of dividends to our shareholders, no Cayman Islands withholding

tax will be imposed.

For purposes of illustration,

the following discussion reflects the hypothetical taxes that might be required to be paid in Mainland China and Hong Kong, assuming

that: (i) we have taxable earnings, and (ii) we determine to pay a dividend in the future:

| Hypothetical pre-tax earnings(1) | |

| 100.00 | |

| Tax on earnings at statutory rate of 25% at Shenzhen Fangdd level | |

| (25.00 | ) |

| Amount to be distributed as dividend from Shenzhen Fangdd to Hong Kong subsidiary(2) | |

| 75.00 | |

| Withholding tax at tax treaty rate of 5% | |

| (3.75 | ) |

| Amount to be distributed as dividend at Hong Kong subsidiary level and net distribution to Fangdd Network

Group Ltd. | |

| 71.25 | |

Notes:

| (1) | For purposes of this example, the tax calculation

has been simplified. The hypothetical book pre-tax earnings amount is assumed to equal Chinese

taxable income. |

| (2) | China’s Enterprise Income Tax Law imposes

a withholding income tax of 10% on dividends distributed by a foreign invested enterprise

to its immediate holding company outside of Mainland China. A lower withholding income tax

rate of 5% is applied if the foreign invested enterprise’s immediate holding company

is registered in Hong Kong or other jurisdictions that have a tax treaty arrangement with

Mainland China, subject to a qualification review at the time of the distribution. There

is no incremental tax at Hong Kong subsidiary level for any dividend distribution to Fangdd

Network Group Ltd. If a 10% withholding income tax rate is imposed, the withholding tax will

be 7.5 and the amount to be distributed as dividend at Hong Kong subsidiary level and net

distribution to Fangdd Network Group Ltd. will be 67.5. |

Restrictions and Limitations on Transfer

of Capital

We face various restrictions

and limitations on foreign exchange, our ability to transfer cash between entities, across borders and to U.S. investors, and our ability

to distribute earnings from our businesses, including our subsidiaries and/or the consolidated VIE, to the parent company and U.S. investors

as well as the ability to settle amounts owed under the Fangdd Network VIE Agreements.

Our offshore holding company

is permitted under PRC laws and regulations to provide funding to our PRC subsidiaries only through loans or capital contributions, subject

to the approval of government authorities and limits on the amount of capital contributions and loans. This may delay or prevent us from

using the proceeds from this offering to make loans or capital contribution to our PRC subsidiaries. See “Item 3. Key Information—D.

Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans and direct investment by offshore holding companies

to PRC entities may delay or prevent us from making loans or additional capital contributions to our PRC operating subsidiaries”

in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus supplement and accompanying prospectus.

Under our current corporate

structure, Fangdd Cayman’s ability to pay dividends depends upon dividends paid by its Hong Kong subsidiary, which in turn depends

on dividends paid by its PRC subsidiaries, which further depend on payments from the VIE under the Fangdd Network VIE Agreements.

| ● | Although we consolidate the results

of the VIE and its subsidiaries, we only have access to the assets or earnings of the VIE

and its subsidiaries through the Fangdd Network VIE Agreements. If the PRC authorities determine

that the contractual arrangements constituting part of the VIE structure do not comply with

PRC regulations, or if current regulations change or are interpreted differently in the future,

our ability to settle amounts owed by the VIE under the VIE agreements may be seriously hindered. |