Edify Acquisition Corp. to Liquidate

March 06 2024 - 8:56PM

Edify Acquisition Corp. (NASDAQ: EAC) (the “Company”)

announced that the Company and Unique Logistics International, Inc.

(“UNQL”) have mutually agreed to terminate the previously announced

business combination agreement between the Company and UNQL, and

pursuant to its Amended and Restated Certificate of Incorporation,

the Company intends to dissolve and liquidate promptly after March

12, 2024. The Company will redeem all of the outstanding public

shares of common stock (the “Public Shares”) at an expected

per-share redemption price of approximately $10.61.

As of the close of business on March 12, 2024, the Public Shares

will be deemed cancelled and will represent only the right to

receive the expected per-share redemption price.

In order to provide for the disbursement of funds from the trust

account, the Company has instructed the trustee of the trust

account to take all necessary actions to liquidate the securities

held in the trust account. The proceeds of the trust account will

be held in a non-interest bearing account while awaiting

disbursement to the holders of the Public Shares. Record holders

will receive their pro rata portion of the proceeds of the trust

account by delivering their Public Shares to Continental Stock

Transfer & Trust Company, the Company’s transfer agent.

Beneficial owners of Public Shares held in “street name,” however,

will not need to take any action in order to receive the expected

per-share redemption price.

The Company expects that NASDAQ will file a Form 25 with the SEC

to delist the Company’s securities. The Company thereafter expects

to file a Form 15 with the SEC to terminate the registration of its

securities under the Securities Exchange Act of 1934, as

amended.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Certain of these

forward-looking statements can be identified by the use of words

such as “believes,” “expects,” “intends,” “plans,” “estimates,”

“assumes,” “may,” “should,” “will,” “seeks,” or other similar

expressions. Such statements may include, but are not limited to,

statements regarding the Company’s intention to redeem all of its

outstanding Public Shares, the Company’s cash position or cash held

in the Company’s trust account, the expected per-share redemption

price, or the timing when the Company’s Public Shares will cease

trading on NASDAQ. These statements are based on current

expectations on the date of this press release and involve a number

of risks and uncertainties that may cause actual results to differ

significantly. The Company does not assume any obligation to update

or revise any such forward-looking statements, whether as the

result of new developments or otherwise. Readers are cautioned not

to put undue reliance on forward-looking statements.

ContactsMorris BeydaChief Financial Officer

mbeyda@edifyacq.com

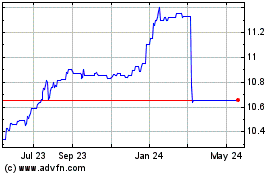

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Jan 2024 to Jan 2025