EDAP TMS S.A. Reports 2003 Third Quarter Financial Results - UDS

Division Continues Record Breaking Year - VAULX-EN-VELIN, France,

Nov. 5 /PRNewswire-FirstCall/ -- EDAP TMS S.A. , a global leader in

the development, marketing and distribution of a portfolio of

minimally-invasive medical devices for the treatment of urological

diseases, today reported financial results for the third quarter

ended September 30, 2003. The Company's revenues for the third

quarter of 2003 were EUR 4.7 million compared to EUR 4.1 million in

the same quarter of 2002. Third quarter revenues included the sale

of ten lithotripsy machines. Total revenues for the nine months

ended September 30, 2003 were EUR 13.9 million compared to EUR 14.0

million in the same period of 2002, partially due to the decrease

in TUMT manufacturing revenues. The Company's gross margin, for the

third quarter of 2003 and for the nine months ended September 30,

2003, were 31% and 34%, respectively, versus 38% and 41% for the

same periods in 2002. The decrease, year over year, is partially

related to the strong Euro and the decrease sequentially is

primarily due to lower than expected revenues in the Company's HIFU

division. The Company's expenses in the third quarter of 2003 were

EUR 2.6 million and were EUR 8.6 million for the nine months ended

September 30, 2003, which was below budget. The Company's operating

loss was EUR 1.2 million in the third quarter of 2003 compared to

EUR 1.8 million in the third quarter of 2002 and was EUR 3.9

million in the nine months ended September 30, 2003 compared to EUR

3.4 million in the same period of 2002, partially due to the strong

Euro. As of September 30, 2003, the Company had EUR 12.0 million in

cash and cash equivalents, or EUR 1.53 per diluted share, which

reflects the Company's continued focus on cash management. Net book

value is EUR 23.7 million, or EUR 3.03 per diluted share. Philippe

Chauveau, EDAP TMS's Chairman and CEO, commented, "While the

overall third quarter results are in line with expectations, the

results by division show a different situation. HIFU division: "The

results of the Company's HIFU division did not meet expectations in

terms of either revenues or number of treatments performed. The

third quarter included several challenges, including continuing

weakness in Italy and delayed orders elsewhere. Per the conditions

placed on the HIFU division by the board of directors, the board

met on October 21, 2003 to review the milestones expected from this

business in order to give directives and determine changes so as to

retain the overall goals of the Company. "However, even with these

challenges, we continue to be optimistic about the future of HIFU

as we see increases in recognition and acceptance of HIFU in Europe

at both the patient and physician level. Additionally, there were

positive events that occurred during the quarter that have yet to

positively impact the income statement of the HIFU division. UDS

division: "The UDS division continued its record breaking year with

a very strong third quarter which included the sale of ten

lithotripsy machines, bringing the nine months number of machines

sold to 27. The backlog of machines as of September 30, 2003 was

seven units. The quarter continued to see an impact on revenues

related to the strong Euro which, through the end of the third

quarter, had a cumulative effect of EUR 1.0 million, however the

division has been able to offset this impact, as compared to 2003

expectation, with an increase in expected units sold. Finally, for

the UDS division, we continue to execute on our goal of leveraging

our distribution platform by adding new product distribution on

behalf of other companies. We anticipate announcing specifics of

these new products during the fourth quarter. "Regarding the

overall business, we had expected to be able to make an

announcement regarding a U.S. partner during this quarter. The

search has taken longer than expected. The discussions that the

Company has had have focused on the time and money required and not

issues with the effectiveness of our technologies. "In conclusion,

the Company with a September 30, 2003 cash balance of just under

EUR 12 million, continued to successfully implement its cash

management plan with a burn rate of less than EUR 1.0 million

during the quarter. Therefore, the Company expects to retain the

necessary liquidity to reach the goal of overall profitability and

positive cash flow as planned," concluded Mr. Chauveau. EDAP TMS

S.A. is the global leader in the development, production, marketing

and distribution of a portfolio of minimally invasive medical

devices primarily for the treatment of urological diseases. The

Company currently develops and markets devices for the minimally

invasive treatment of localized prostate cancer, using High

Intensity Focused Ultrasound (HIFU), through its EDAP SA

subsidiary; it is also developing this technology for the treatment

of certain other types of tumors. EDAP TMS S.A. also produces and

commercializes medical equipment for treatment of urinary tract

stones using Extra-corporeal Shockwave Lithotripsy (ESWL), via its

TMS SA subsidiary. In addition, the Company markets in Japan and

Italy devices for the non-surgical treatment of benign Prostate

Hyperplasia (BPH) using Microwave Thermotherapy (TUMT). For more

information, in the U.S., contact EDAP Technomed Inc., the

Company's U.S. subsidiary located in Atlanta, GA, by phone at (770)

446-9950. For additional information on the Company, please see the

Company's web site at: http://www.edap-tms.com/. This press release

contains, in addition to historical information, forward-looking

statements that involve risks and uncertainties. These include

statements regarding the Company's growth and expansion plans. Such

statements are based on management's current expectations and are

subject to a number of uncertainties and risks that could cause

actual results to differ materially from those described in the

forward-looking statements. Factors that may cause such a

difference include, but are not limited to, those described in the

Company's filings with the Securities and Exchange Commission.

CONTACT: Philippe Chauveau / Blandine Confort 33.4.72.15.31.50 Ian

Vawter - EDAP Technomed Inc. 1.770.446.9950 EDAP TMS S.A. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (Amounts in

thousands of Euro's and U.S. Dollars, except per share data) Three

Months Ended: Three Months Ended: September September September

September 30, 30, 30, 30, 2003 2002 2003 2002 Euros Euros $US $US

Net sales of medical equipment 2,129 1,748 2,404 1,718 Net sales of

spare parts, supplies and Services 2,349 2,361 2,652 2,320 NET

SALES 4,478 4,109 5,056 4,038 Other revenues 241 30 271 29 TOTAL

REVENUES 4,719 4,139 5,327 4,067 Cost of sales (3,308) (2,565)

(3,734) (2,520) GROSS PROFIT 1,411 1,574 1,593 1,547 Research &

development expenses (792) (753) (894) (740) S, G & A expenses

(1,846) (1,880) (2,084) (1,847) Non-recurring operating expenses --

(745) -- (732) Total operating expenses (2,638) (3,378) (2,978)

(3,319) OPERATING PROFIT (LOSS) (1,227) (1,804) (1,385) (1,772)

Interest (expense) income, net 35 369 40 362 Currency exchange

gains (loss), net 60 (137) 67 (134) Other income (loss), net (3)

(27) (3) (27) INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST

(1,135) (1,599) (1,281) (1,571) Income tax (expense) credit 14 39

16 38 NET INCOME (LOSS) (1,121) (1,560) (1,265) (1,533) Earning per

share - Basic (0.14) (0.20) (0.16) (0.20) Average number of shares

used in computation of EPS 7,781,731 7,781,731 7,781,731 7,781,731

Earning per share - Diluted (0.14) (0.20) (0.16) (0.20) Average

number of shares used in computation of EPS 7,821,195 7,821,195

7,821,195 7,821,195 NOTE: Translated for convenience of the reader

to U.S. dollars at the 2003 average three months noon buying rate

of 1 Euro = 1.1289 USD, and 2002 average three months noon buying

rate of 1 Euro = 0.9827 USD. EDAP TMS S.A. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) (Amounts in thousands of

Euro's and U.S. Dollars, except per share data) Nine Months Ended:

Nine Months Ended: September September September September 30, 30,

30, 30, 2003 2002 2003 2002 Euros Euros $US $US Net sales of

medical equipment 6,516 6,587 7,294 6,122 Net sales of spare parts,

supplies and Services 7,004 7,224 7,839 6,714 NET SALES 13,520

13,811 15,133 12,836 Other revenues 338 149 378 138 TOTAL REVENUES

13,858 13,960 15,511 12,974 Cost of sales (9,245) (8,230) (10,348)

(7,649) GROSS PROFIT 4,613 5,730 5,163 5,325 Research &

development expenses (2,344) (2,176) (2,623) (2,023) S, G & A

expenses (6,207) (6,165) (6,947) (5,730) Non-recurring operating

expenses -- (745) -- (692) Total operating expenses (8,551) (9,086)

(9,570) (8,445) OPERATING PROFIT (LOSS) (3,938) (3,356) (4,407)

(3,120) Interest (expense) income, net 42 549 47 510 Currency

exchange gains (loss), net (656) (599) (734) (557) Other income

(loss), net (164) 2,008 (184) 1,866 INCOME (LOSS) BEFORE TAXES AND

MINORITY INTEREST (4,716) (1,398) (5,278) (1,301) Income tax

(expense) credit 78 (170) 87 (158) NET INCOME (LOSS) (4,638)

(1,568) (5,191) (1,459) Earning per share - Basic (0.60) (0.20)

(0.67) (0.19) Average number of shares used in computation of EPS

7,781,731 7,768,383 7,781,731 7,768,383 Earning per share - Diluted

(0.59) (0.20) (0.66) (0.19) Average number of shares used in

computation of EPS 7,821,195 7,833,620 7,821,195 7,833,620 NOTE:

Translated for convenience of the reader to U.S. dollars at the

2003 average nine months noon buying rate of 1 Euro = 1.1193 USD,

and 2002 average nine months noon buying rate of 1 Euro = 0.9294

USD. EDAP TMS S.A. CONSOLIDATED BALANCE SHEETS HIGHLIGHTS

(UNAUDITED) (Amounts in thousands of Euro's and U.S. Dollars) Sept.

30, June 30, Sept. 30, June 30, 2003 2003 2003 2003 Euros Euros $US

$US Cash, cash equivalents 11,963 12,769 13,937 14,687 and short

term investments Total current assets 28,551 29,508 33,262 33,940

Total current liabilities 9,363 9,301 10,908 10,698 Shareholders'

Equity 23,663 24,722 27,567 28,435 NOTE: Translated for convenience

of the reader to U.S. dollars at the noon buying rate of 1 Euro =

1.165 USD, on September 30, 2003 and at the noon buying rate of 1

Euro = 1.1502 USD, on June 30, 2003. EDAP TMS S.A. CONDENSED

STATEMENTS OF OPERATIONS BY DIVISION NINE MONTHS ENDED SEPTEMBER

30, 2003 (Amounts in thousands of Euro's) EDAP TMS EDAP Consoli-

Total S.A. S.A. TMS da- After HIFU UDS HQ tion Consoli- Division

Division Impact dation Net sales of medical devices 1,148 6,499

(1,131) 6,516 Net sales of spare parts, supplies & services

1,270 6,229 (495) 7,004 Other revenues 32 304 2 338 TOTAL REVENUES

2,450 13,032 2 (1,626) 13,858 GROSS PROFIT 806 33% 3,982 31% 2

(177) 4,613 34% Research & Development (1,172) (177) (1,349)

Total SG&A plus depreciation (2,849) (3,319) (1,034) (7,202)

OPERATING PROFIT (LOSS) (3,215) 486 (1,032) (177) (3,938)

DATASOURCE: EDAP TMS S.A. CONTACT: Philippe Chauveau or Blandine

Confort, both for EDAP TMS S.A., +33-4-72-15-31-50, or Ian Vawter

of EDAP Technomed Inc., +1-770-446-9950 Web site:

http://www.edaptechnomed.com/

Copyright

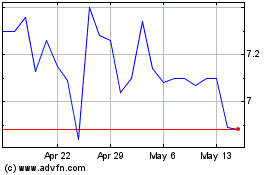

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Jun 2024 to Jul 2024

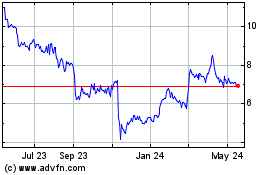

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Jul 2023 to Jul 2024