Edesa Biotech’s Founder Makes Strategic Investment in the Company

October 31 2024 - 7:15AM

Edesa Biotech, Inc. (Nasdaq:EDSA), a clinical-stage

biopharmaceutical company focused on developing host-directed

therapeutics for immuno-inflammatory diseases, today announced that

the company has entered into a purchase agreement with an entity

affiliated with Par Nijhawan, MD, Edesa’s Chief Executive Officer

and Founder, to invest up to $5.0 million in the company, including

an immediate investment of approximately $1.5 million.

The entity will purchase shares of the company’s Series A-1

Convertible Preferred Shares, as amended (the “Series A-1 Preferred

Shares”), having a stated value of $10,000 per share, and warrants

(the “Warrants”) to purchase the company’s common shares in a

transaction structured as an at-the-market issuance under Nasdaq

rules. The Series A-1 Preferred Shares will be convertible into the

company’s common shares at a conversion price of $3.445. The

Warrants will be exercisable for a number of common shares equal to

75% of the common shares initially issuable upon the conversion of

the Series A-1 Preferred Shares.

Commenting on today’s announcement, Dr. Nijhawan said “I am

pleased to demonstrate my strong belief in Edesa’s future growth

opportunities and my continuing commitment to lead the company’s

strategic initiatives. I believe Edesa has a strong development

pipeline, and I am confident that we can continue to build on our

operational and clinical success.”

Subject to certain exceptions and adjustments for share splits,

each Series A-1 Preferred Share is convertible into a number of

Edesa’s common shares calculated by dividing (i) the sum of the

stated value of the Series A-1 Shares being converted plus a return

equal to 10% of such stated value per annum by (ii) the conversion

price. The Warrants will have an exercise price of $3.445 per

share, will be exercisable immediately upon issuance and will

expire five years from the date of issuance. Under applicable

Canadian securities laws, purchases of Series A-1 Preferred Shares

under the purchase agreement in an aggregate amount greater than

$2.0 million will be subject to the prior approval of the company’s

shareholders, excluding Dr. Nijhawan. The company also announced

that in connection with the transactions contemplated by the

purchase agreement, the $10 million revolving credit agreement

previously entered into with the purchaser has been terminated. The

company did not draw any funds from the facility.

The securities described above have not been and will not be

registered under the Securities Act of 1933, as amended, and may

not be offered or sold in the United States absent registration or

an applicable exemption from registration requirements.

About Edesa Biotech, Inc.

Edesa Biotech, Inc. (Nasdaq: EDSA) is a clinical-stage

biopharmaceutical company developing innovative ways to treat

inflammatory and immune-related diseases. Its clinical pipeline is

focused on two therapeutic areas: Medical Dermatology and

Respiratory. In Medical Dermatology, Edesa is developing EB06, an

anti-CXCL10 monoclonal antibody candidate, as therapy for vitiligo,

a common autoimmune disorder that causes skin to lose its color in

patches. Its medical dermatology assets also include EB01 (1.0%

daniluromer cream), a Phase 3-ready asset developed for use as a

potential therapy for moderate-to-severe chronic Allergic Contact

Dermatitis (ACD), a common occupational skin condition. The

company’s most advanced Respiratory drug candidate is EB05

(paridiprubart), which is being evaluated in a U.S.

government-funded platform study as a treatment for Acute

Respiratory Distress Syndrome (ARDS), a life-threatening form of

respiratory failure. The EB05 program has been the recipient of two

funding awards from the Government of Canada to support the further

development of this asset. In addition to EB05, Edesa is preparing

an investigational new drug application (IND) in the United States

for EB07 (paridiprubart) to conduct a future Phase 2 study in

patients with pulmonary fibrosis. Sign up for news alerts. Connect

with us on X and LinkedIn.

Edesa Forward-Looking StatementsThis press

release may contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may be identified by the use of words

such as "anticipate," "believe," "plan," "estimate," "expect,"

"intend," "may," "will," "would," "could," "should," "might,"

"potential," or "continue" and variations or similar expressions,

including statements related to: the company’s belief that Dr.

Nijhawan’s investment is strategic and demonstrates a strong belief

in Edesa’s future growth opportunities and a continuing commitment

to lead the company’s strategic initiatives; the company’s belief

that it has a strong development pipeline; the company’s confident

belief that it can continue to build on its operational and

clinical success; and the company's timing and plans regarding its

clinical studies in general. Readers should not unduly rely on

these forward-looking statements, which are not a guarantee of

future performance. There can be no assurance that forward-looking

statements will prove to be accurate, as all such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause actual results or future events to differ

materially from the forward-looking statements. Such risks include:

the ability of Edesa to obtain regulatory approval for or

successfully commercialize any of its product candidates, the risk

that access to sufficient capital to fund Edesa's operations may

not be available or may be available on terms that are not

commercially favorable to Edesa, the risk that Edesa's product

candidates may not be effective against the diseases tested in its

clinical trials, the risk that Edesa fails to comply with the terms

of license agreements with third parties and as a result loses the

right to use key intellectual property in its business, Edesa's

ability to protect its intellectual property, the timing and

success of submission, acceptance and approval of regulatory

filings, and the impacts of public health crises. Many of these

factors that will determine actual results are beyond the company's

ability to control or predict. For a discussion of further risks

and uncertainties related to Edesa's business, please refer to

Edesa's public company reports filed with the U.S. Securities and

Exchange Commission and the British Columbia Securities Commission.

All forward-looking statements are made as of the date hereof and

are subject to change. Except as required by law, Edesa assumes no

obligation to update such statements.

Contact:

Gary Koppenjan

Edesa Biotech, Inc.

(289) 800-9600

investors@edesabiotech.com

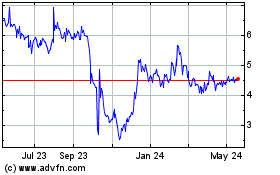

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Nov 2024 to Dec 2024

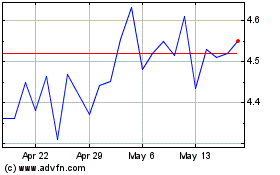

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Dec 2023 to Dec 2024