Eagle Bancorp, Inc. Announces 68% Increase in Earnings for the First Nine Months of 2005 With Assets Exceeding $647 Million

October 17 2005 - 7:00AM

PR Newswire (US)

BETHESDA, Md., Oct. 17 /PRNewswire-FirstCall/ -- Eagle Bancorp,

Inc. (NASDAQ:EGBN), the parent company of EagleBank, today

announced net income of $5.5 million for the nine months ended

September 30, 2005, compared to $3.3 million for the first nine

months of 2004, an increase of 68%. On a per-share basis, the

Company earned $0.77 per basic share and $0.73 per diluted share

for 2005, as compared to $0.46 per basic share and $0.44 cents per

diluted share for 2004. (Logo:

http://www.newscom.com/cgi-bin/prnh/20050927/EAGLEBANKLOGO ) For

the third quarter of 2005, the Company earned $2.3 million, as

compared to $1.0 million for the third quarter of 2004, a 127%

increase. On a per-share basis, the Company earned $0.32 per basic

share and $0.30 per diluted share for the third quarter of 2005, as

compared to $0.14 per share for both basic and fully diluted shares

for the same period in 2004. "Our growth in assets, loans and

deposits continues and was coupled with favorable financial

performance for Eagle Bancorp for the first nine months and third

quarter of 2005," noted Leonard L. Abel, Chairman of Eagle Bancorp

and Ronald D. Paul, President and CEO of Eagle Bancorp. "We are

quite pleased with our balance sheet growth, and a continuing

favorable net interest margin result. Furthermore, non-interest

revenue has shown increases and productivity, as measured by the

efficiency ratio, has improved in 2005 over 2004. We are committed

to a balanced approach to managing the Company, which includes

focusing on solid asset quality and making investment in

infrastructure to support a growing organization," added Abel and

Paul. For the nine months ended September 30, 2005, the Company

reported an annualized return on average assets (ROAA) of 1.23% as

compared to 0.92% for the first nine months of 2004; while the

annualized return on average equity (ROAE) was 12.07%, as compared

to 7.91% for the same period in 2004. Several factors contributed

to the favorable financial results. Both loan and deposit activity

were strong in the period, and together with an improved net

interest margin, resulted in the Company's net interest income

increasing to $20.9 million from $14.0 million for the first nine

months of 2005 over 2004, a 49% gain and to $7.5 million from $5.0

million for the third quarter of 2005 as compared to the same

period in 2004, also a 49% gain. The Bank's asset/liability

management position has allowed it to benefit from the increase in

market interest rates in the January to September period. For the

first nine months of 2005, the net interest margin was 5.01% as

compared to 4.27% for the first nine months in 2004. Non-interest

income for the first nine months of 2005 was $3.2 million compared

to $2.6 million in the first nine months of 2004, a 22% increase.

This increase in non-interest income was due primarily to increased

amounts of gains on the sale of SBA loans and related service fees,

where EagleBank is the leading community bank lender in its

marketplace and to higher net investment gains. For the three

months ended September 30, 2005, noninterest income increased 78%

to $1.2 million from $697 thousand in the same period in 2004. The

primary reason for the increase was $269 thousand of net investment

gains in the third quarter of 2005, as compared to a $60 thousand

net investment loss for the same period in 2004. Other increases in

the third quarter were due to increases in gains on the sale of SBA

loans and related service fees. Non-interest expenses were $14.1

million for the first nine months of 2005, as compared to $11.1

million for 2004, a 27% increase. The primary reasons for this

increase were increases in personnel and related benefit cost

increases, higher incentive compensation, increased occupancy cost,

due in part to new banking offices, and higher marketing, data

processing and professional fees associated with a larger

organization. In spite of higher levels of noninterest expenses,

the very strong growth in revenue allowed the efficiency ratio to

improve for the first nine months of 2005 to 58.52% from 66.74% for

the same period in 2004. For the three months ended September 30,

2005, noninterest expenses increased 19% to $4.7 million from $4.0

million for the same period in 2004. This increase was attributed

to the same factors mentioned above for the nine month period.

Asset quality remained favorable in the period. The Company

recorded net charge-offs of just $53 thousand for the first nine

months of 2005 (.02% of average loans outstanding), as compared to

net recoveries of $39 thousand for the first nine months of 2004.

The ratio of non-performing loans to total loans was .04% at

September 30, 2005, as compared to .71% at September 30, 2004. The

provision for loan loss was $1.3 million for the first nine months

in 2005 as compared to $457 thousand for 2004; the increase due

substantially to growth in the loan portfolio over the past twelve

months. At September 30, 2005, the allowance for credit losses

represented 1.09% of loans outstanding, as compared to 1.15% at

September 30, 2004. For the three months ended September 30, 2005,

the provision for loan losses was $424 thousand as compared to $227

for the third quarter in 2004. At September 30, 2005, total assets

were $647 million compared to $508 million at September 30, 2004, a

27% increase. Total deposits amounted to $546 million at September

30, 2005, a 33% increase over deposits of $411 million at September

30, 2004, while total loans increased to $504 million at September

30, 2005, from $364 million at September 30, 2004, a 38% increase.

Eagle Bancorp paid a dividend of $.07 per share for the third

quarter of 2005. The quarterly dividend commenced in the first

quarter of 2005. Eagle Bancorp is the holding company for EagleBank

and its subsidiary, Eagle Land Title, LLC. EagleBank commenced

operations in 1998. The Bank is headquartered in Bethesda,

Maryland, and conducts full service commercial banking services

thru eight offices, located in Montgomery County, Maryland and

Washington, D.C. A lease has been executed for a new community bank

office in Chevy Chase, Maryland which is expected to be opened in

the second quarter of 2006. The Company focuses on building

relationships with businesses, professionals and individuals in its

marketplace. Forward looking Statements: This press release

contains forward looking statements within the meaning of the

Securities and Exchange Act of 1934, as amended, including

statements of goals, intentions, and expectations as to future

trends, plans, events or results of Company operations and policies

and regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as "may," "will," "anticipates," "believes," "expects," "plans,"

"estimates," "potential," "continue," "should," and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company's market,

interest rates and interest rate policy, competitive factors and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward- looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. Readers are cautioned against placing

undue reliance on any such forward-looking statements. The

Company's past results are not necessarily indicative of future

performance.

http://www.newscom.com/cgi-bin/prnh/20050927/EAGLEBANKLOGO

http://photoarchive.ap.org/ DATASOURCE: Eagle Bancorp, Inc.

CONTACT: Ronald D. Paul of Eagle Bancorp, Inc., +1-301-986-1800 Web

site: http://www.eaglebankmd.com/

Copyright

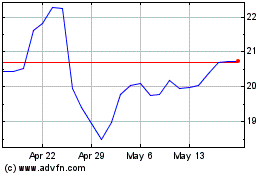

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jun 2024 to Jul 2024

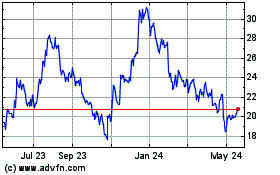

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jul 2023 to Jul 2024