Barring an expected slowdown in loan growth, U.S. banks appear well

placed to perform steadily through the remainder of 2012 on

uninterrupted expense control and a contraction in provisions for

credit losses. At least the progress seen in the first half of the

year gives us this indication.

Marked recovery of the bond and equity markets and consequent

revenue growth pushed the first quarter results a bit higher than

expected, but the second quarter failed to impress with respect to

top-line growth due to a decelerating economy. A combination of

factors -- subdued federal spending, ongoing European crisis and

tax law uncertainty following the presidential election -- kept

revenue and trading income under pressure. However, core dynamics

showed strength throughout the first half.

Moreover, U.S. banks are actively responding to every legal and

regulatory pressure, indicating the fact that they are well

positioned to encounter impending challenges. In addition, taking

advantage of the growing demand for loans from large- and

medium-sized businesses, U.S. banks have been easing their lending

standards in order to boost loan growth.

However, the potency of the sector is not expected to return to its

pre-recession peak anytime soon. The economic intricacies, both

domestic and overseas, may even result in further disappointments

in the upcoming quarters.

A decelerating growth rate of the U.S. gross domestic product (GDP)

(annualized growth came in at 1.5% in the second quarter of 2012,

slowing sharply from 2% in the first quarter and 4.1% in the fourth

quarter of 2011) and slowing demand from businesses related to

real-estate will continue to restrict revenue growth.

Also, as the sector is undergoing a radical structural change, it

will witness continuous headwinds related to business expansion and

investor confidence. But entering the new capital regime will

ensure stability and security in the industry over the long

term.

Looking back, the government undertook several steps, including

capital injections and debt guarantees, to rescue the U.S. banks

from the effects of the financial crisis in 2008 and 2009. The

banks are also working hard since then to address problem credit,

primarily in residential and commercial real estate. Though

financial support from the government and banks’ efforts ultimately

transformed into stability, the sector has a long way to go before

bouncing back to its pre-recession glory.

Along with increasing earnings, a major recovery in the asset

markets, improving balance sheets and declining credit costs

promise growth for the U.S. banking sector, though at a

slower-than-normal pace. The dampening factors -- issues related to

the mortgage liabilities, asset-quality troubles, weak loan growth

and the impact of tighter regulations and policy changes -- are

expected to remain tied to the fate of the U.S. banks in the

upcoming quarters.

Profitability Remains Challenged

Though reduced loss provisioning has helped the industry witness

strong earnings growth over the last couple of years, we don’t

expect a significant pickup in the upcoming earnings from provision

reductions, as the difference between loss provisions and

charge-offs is gradually decreasing.

Banks will definitely try to look at other areas -- interest

income, non-interest income and operating costs -- to keep the

earnings growth intact, but there is no significant opportunity

that can boost top-line growth in the upcoming quarters.

Interest income will remain under pressure due to low interest

rates and sluggish loan growth. After accelerating for 10 straight

months, loan growth slowed in July 2012 and is expected to continue

falling in the coming months due to a feeble macro economy. Though

banks will try to cut interest expenses and take additional risks

to improve net interest margins, the flattening of the yield curve

will mar these efforts.

Ultimately, banks will be forced to face lower margins. In fact, if

the banks shift assets to longer maturities to keep net interest

margin strong, this could backfire once interest rates start

rising.

On the other hand, attempts to boost revenues through non-interest

sources -- introducing prepaid cards, imposing new fees, increasing

minimum balance requirements on deposit accounts and encouraging

customers to use credit cards -- could be hampered by ongoing

regulatory actions, a volatile global economy and soaring overhead.

So, non-interest income will be able to marginally contribute to

total revenue.

Lower revenue will finally force these banks to cut costs in order

to stay afloat. As a result, banks will continue cutting jobs and

reducing the size of operations by selling non-core assets. So, any

cost-cutting measure will act as a defense.

Balance Sheet Recovery to Take Time

Since last year, banks have been trying to address asset-quality

troubles through the disposition of nonperforming assets. Also,

non-core asset shedding has become an industry trend as banks have

no other alternative but to keep capital ratios above regulatory

requirements.

This non-core asset-selling, along with elevated charge-offs and

weak demand, will likely keep loan growth under pressure in the

near to mid-term. Moreover, heightened regulatory restrictions and

soaring delinquency rates will act as headwinds. However, banks

will experience steady deposit growth due to the lack of low-risk

investment opportunities following the global economic turmoil and

volatility in equity markets.

So we don’t expect a significant strength in balance sheets to

return anytime soon.

Regulatory Threats Lingering

Following the latest recession, the regulatory environment has

become tougher and costlier for U.S. banks. In the last several

quarters, banks had to face a number of regulatory requirements

under several laws, including Dodd-Frank legislation, the Durbin

Amendment and the Volcker Rule.

Many other regulatory requirements are expected to hinder growth in

the upcoming quarters as regulators focus on global alignment.

Though the aim is to meaningfully change the business models of

banks to make them self-sufficient over the longer term, the cost

of compliance will drag down profitability in the near- to

mid-term.

While the implementation of the Basel III requirements will boost

minimum capital standards, there will be a short-term negative

impact on the financials of U.S. banks as they will have to adjust

their liquidity management processes. But a greater capital cushion

for the larger banks will add to their ability to withstand

internal and external shocks in the long run. However, banks will

get the time to strengthen their capital position as the Basel III

requirements will be gradually introduced during the 2013 to 2019

period.

Macroeconomic Headwinds

There are several macroeconomic factors that may weigh on the

profitability of the U.S. banks. The most crucial among these is

the uncertain outlook for the U.S. economy.

Though improved economic data such as steady consumer spending and

relatively lower unemployment point towards optimism, the economy

has witnessed a lot less momentum in the first half of 2012 than

was anticipated. Concerns have crept up in the slothful stock

market, exacerbated by ongoing concerns related to the European

debt crisis.

Though the U.S. commercial banks appear to have significant direct

and indirect exposure to Europe, the potential costs are expected

to be manageable. However, if the crisis deepens, there will be

significant impact on worldwide capital markets, and the U.S. will

not be left unscathed. Consequently, U.S. banks would then face

increased challenges.

On the other hand, the extremely low interest-rate environment is

another manifestation of this uncertain macro backdrop. Concerns

about European finances and soft U.S. growth prospects have made

treasury instruments the choice of safe asset class. As a result,

yields on benchmark treasury bonds have hovered at low levels.

Bank Failures Continue

While the financials of a few large banks are stabilizing on the

back of economic stability and increasing dependence on noninterest

revenue sources, the industry is still on shaky ground. The sector

presents a picture similar to that of 2011, with nagging issues

like depressed home prices, still-high loan defaults and

unemployment levels troubling such institutions.

The lingering economic uncertainty and its effects also weigh on

many banks. The need to absorb bad loans offered during the credit

explosion has made these banks susceptible to severe problems.

Furthermore, government efforts have not succeeded in restoring

lending activity at the banks. Banks are also trying to boost

lending activity by easing lending standards, but sufficient loan

growth is not expected anytime soon given the weak real-estate

market. Lower lending will continue to hurt margins, though

the low interest rate environment should be beneficial to banks

with a liability-sensitive balance sheet.

Increasing loan losses on commercial real estate could trigger many

more bank failures in the upcoming years. However, considering the

moderate pace of bank failures, the 2012 number is not expected to

exceed the 2011 tally. From 2012 through 2016, bank failures are

estimated to cost the Federal Deposit Insurance Corporation (FDIC)

about $12 billion.

Eventually, the strong banks will continue to take advantage of

strategic opportunities, with the big fish eating the little

ones.

Conclusion

Clearly, the banking system is still not out of the woods, as there

are several nagging issues that need to be addressed. Banks will

also have to stay away from risky activities for immediate

benefit.

Given the progress in the industry so far, it seems that banks may

encounter several disappointments ahead before gaining investors’

confidence. In fact, the negatives could offset the positive

developments to a great extent.

OPPORTUNITIES

The regulatory requirement of focusing on banking institutions

toward higher-quality capital will help banks absorb big losses.

Though this would somewhat limit the profitability of banks, a

proper implementation would bring stability to the overall sector

and hopefully keep bank failures in check.

Specific banks that we like with a Zacks #1 Rank (short-term Strong

Buy rating) include

Enterprise Financial Services

Corp. (EFSC),

Heartland Financial USA

Inc. (HTLF),

Taylor Capital Group Inc.

(TAYC),

Access National Corp. (ANCX),

Community Trust Bancorp Inc. (CTBI),

First

Bancorp (FBP),

BofI Holding Inc. (BOFI),

North Valley Bancorp (NOVB),

Premierwest

Bancorp (PWRT),

Eagle Bancorp, Inc.

(EGBN),

Horizon Bancorp. (HBNC) and

United

Financial Bancorp, Inc. (UBNK).

There are currently a number of stocks in the U.S. banking universe

with a Zacks #2 Rank (short-term Buy rating). These include

Huntington Bancshares Incorporated (HBAN),

Old National Bancorp. (ONB),

Regions

Financial Corp. (RF),

Fidelity Southern

Corporation (LION),

TriCo Bancshares

(TCBK),

Central Pacific Financial Corp. (CPF),

Bank of Hawaii Corporation (BOH),

Community Bank System Inc. (CBU),

First

Commonwealth Financial Corp. (FCF),

Signature

Bank (SBNY),

Washington Trust Bancorp

Inc. (WASH),

BOK Financial Corporation

(BOKF),

Texas Capital BancShares Inc. (TCBI),

Fifth Third Bancorp (FITB),

KeyCorp (KEY),

M&T Bank

Corporation (MTB) and

U.S. Bancorp (USB).

WEAKNESSES

The financial system is going through massive deleveraging, and

banks in particular have lower leverage. The implication for banks

is that profitability metrics (like returns on equity and return on

assets) will be under pressure.

There are currently four stocks with a Zacks #5 Rank (short-term

Strong Sell rating). These are

Seacoast Banking Corp. of

Florida (SBCF),

Washington Banking Co.

(WBCO),

Hudson Valley Holding Corp. (HVB) and

International Bancshares Corporation (IBOC).

ACCESS NATL CP (ANCX): Free Stock Analysis Report

BOFI HLDG INC (BOFI): Free Stock Analysis Report

COMMUN TRUST BC (CTBI): Free Stock Analysis Report

ENTERPRISE FINL (EFSC): Free Stock Analysis Report

EAGLE BCP INC (EGBN): Free Stock Analysis Report

FIRST BNCRP P R (FBP): Free Stock Analysis Report

HUNTINGTON BANC (HBAN): Free Stock Analysis Report

HORIZON BNCP-IN (HBNC): Free Stock Analysis Report

HEARTLAND FINCL (HTLF): Free Stock Analysis Report

NORTH VALLEY BC (NOVB): Free Stock Analysis Report

OLD NATL BCP (ONB): Free Stock Analysis Report

TAYLOR CAP GRP (TAYC): Free Stock Analysis Report

UTD FINL BCP (UBNK): Free Stock Analysis Report

To read this article on Zacks.com click here.

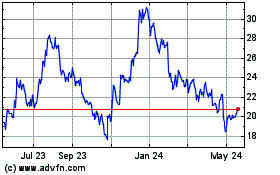

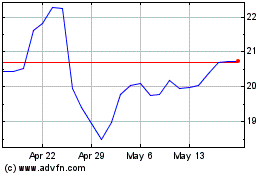

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jul 2023 to Jul 2024