EHang Holdings Limited (“EHang” or the “Company”) (Nasdaq: EH), the

world’s leading autonomous aerial vehicle (“AAV”) technology

platform company, today announced its unaudited financial results

for the second quarter ended June 30, 2023.

Financial and Operational Highlights for the Second

Quarter 2023

- Total revenues were RMB10.0 million (US$1.4

million), compared with RMB22.2 million in the first quarter of

2023, as some deliveries have been extended to be post type

certification (“TC”) of EH216-S per customers’ requests in light

that the TC process is approaching the end.

- Gross margin was 60.2%, representing a

continued high gross margin level with a slight decrease of 3.7

percentage points compared to 63.9% in the first quarter of 2023,

mainly due to the changes in revenue mix.

- Operating loss was RMB75.3 million (US$10.4

million), compared with RMB75.7 million in the first quarter of

2023.

- Adjusted operating loss1

(non-GAAP) was RMB51.3 million (US$7.1 million),

compared with RMB34.3 million in the first quarter of 2023.

- Net loss was RMB75.7 million (US$10.4

million), compared with RMB87.0 million in the first quarter of

2023.

- Adjusted net loss2

(non-GAAP) was RMB51.8 million (US$7.1 million),

compared with RMB33.6 million in the first quarter of 2023.

- Cash, cash equivalents and restricted short-term

deposits balances were RMB160.7 million (US$22.2 million)

as of June 30, 2023, and increased to RMB320.6 million (US$44.9

million) as of July 31, 2023 after the closing of the US$23 million

strategic PIPE investment.

- Sales and deliveries of EH216 series

AAVs3 were 5 units, compared with 11

units in the first quarter of 2023.

Business Highlights for the Second

Quarter 2023 and Recent Developments

- All Planned Tests for EH216-S Type Certification

Completed 100%

The Company has achieved a significant milestone for EH216-S TC

by successfully completing all of the planned tests and flights in

the last phase of demonstration and verification of compliance, and

also completed the definitive TC Flight Test by the Civil Aviation

Administration of China (“CAAC”), with unwavering endeavors

throughout past 31 months since the CAAC officially accepted the

Company’s TC application in January 2021. After finishing the

remaining procedures, the Company expects to obtain the type

certificate of EH216-S Unmanned Aerial Vehicle (“UAV”) System from

the CAAC soon.

- Delivered 5 Units of EH216-S AAVs to Joint Venture

with Shenzhen-listed Xiyu Tourism

In the second quarter of 2023, EHang established a joint venture

with Xiyu Tourism (300859.SZ), a Shenzhen-listed leading tourism

company in China and delivered 5 units of EH216-S AAVs to the joint

venture. The customer aims to develop low-altitude tourism and

sightseeing projects with EHang AAVs in the Heavenly Lake of

Tianshan, a national 5A-class tourist attraction, and other scenic

areas in Northwestern China. The partnership consists of plans to

operate a minimum of 120 units of EH216-S or EHang’s comparable

passenger-carrying AAVs within the next five years.

- Strategic UAM Operational Partnership with Shenzhen

Bao’an District

In July 2023, EHang reached a Memorandum of Understanding

(“MOU”) with the Bao’an District Government of Shenzhen

municipality on a strategic partnership for urban air mobility

(“UAM”) operations after the certification of EH216-S. Both parties

will jointly develop UAM use cases, systems, and routes to build

Shenzhen as a national low-altitude economy development

demonstration city. EHang plans to establish a UAM Operation

Demonstration Center at the OH Bay in Shenzhen and launch aerial

tourism and sightseeing experience services with EH216-S AAVs.

- Continued Trial Operations of EH216-S in

China

Under the CAAC’s guidance and the Company’s 100 Air Mobility

Route Initiative, EHang, along with its customers and partners,

have developed a total of 20 trial operation sites across 18 cities

in China during the two years prior to the end of July 2023. More

than 9,300 safety-ensured operational trial flights for

low-altitude tourism and aerial sightseeing have been conducted by

EH216-S at these sites, which paves the way for future commercial

operations following the certification.

- Extended Flight Footprints in Asia and

Europe

In April 2023, EHang was inducted as a member of Japan’s

Public-Private Committee for Advanced Air Mobility. In June 2023,

EHang extended its flight footprints to Okinawa with EH216-S,

making the 7th Japanese city that it has flown. It also

demonstrated Japan’s first island-hopping flights by an unmanned

electric vertical take-off and landing aircraft (“eVTOL”).

As part of the Israel National Drone Initiative and supported by

Dronery and Cando Drones, test flights were conducted for EH216-S

and EH216-L in Caesarea and Tel Aviv, Israel in June and August

2023 successively.

In July 2023, test flights to transport blood bags in Belgium

using EH216-S were conducted with the supports of Helicus,

DronePort and Blood Services of the Belgian Red Cross. This marked

the Europe’s first unmanned flight for medical transportation by an

unmanned large-payload eVTOL.

As of the end of July 2023, the flight footprints of EH216

series AAVs have extended to 14 countries across Asia, Europe and

Americas, with a total of more than 39,000 demo and trial

flights.

- US$23 Million Strategic PIPE

Investment to Strengthen Liquidity

In July 2023, EHang secured a new round of US$23 million of

equity investment through a private placement from several

strategic investors led by Mr. Lee Soo Man (“Mr. Lee”), a renowned

K-Pop music mogul. Additionally, EHang and Mr. Lee will collaborate

to drive the development of UAM business in Asian Pacific regions

by leveraging each other’s complementary strengths. The gross

proceeds from the placement will be allocated by EHang for working

capital and general corporate purposes, enabling acceleration of

strategic plans for technology advancement, business development,

and post-certification commercial operations.

CEO Remarks

Mr. Huazhi Hu, EHang’s Founder, Chairman and Chief Executive

Officer, commented, “We’ve made remarkable progress in our pursuit

of long-term growth. Notably, we are thrilled to announce that we

have successfully completed all the planned tests for EH216-S type

certification. This achievement marks a significant unprecedented

milestone in the global emerging eVTOL industry, underscoring our

unwavering dedication and pioneering advantages. Additionally, this

sets the stage for us to secure the type certificate soon and

proceed with our endeavors to initiate commercial operations.”

“We’ve also witnessed positive policy developments for the

industry recently. Specifically in June, China issued regulations

governing UAVs, the first of this kind in the nation, which could

propel growth of the sector and provide a clear guidance for UAV

flight operations in China, including for our passenger-carrying

eVTOL. Furthermore, our global initiatives to expand orders and

collaborations have continued to gain traction. This includes

conducting additional demonstration and tests flights and exploring

various business opportunities at home and abroad. Our strategic

partnership with Shenzhen Bao’an Government will stand out as a

pivotal step after we obtain the type certificate. For our

execution of the post-certification commercial plans, we have

further strengthened our liquidity position with a new round of

US$23 million investments from long-term strategic investors in

July 2023. As a trailblazer in the sector, we are committed to

continuously enhancing our products and technologies to offer a

secure, efficient, and sustainable aerial experience for our

customers and partners. In doing so, we are well-positioned to

seize the abundant market opportunities that lie ahead.”

Financial Results for the Second Quarter

2023

Revenues

Total revenues were RMB10.0 million (US$1.4 million), compared

with RMB22.2 million in the first quarter of 2023, as some

deliveries have been extended to be post TC of EH216-S per

customers’ requests in light that the TC process is approaching the

end.

Costs of revenues

Costs of revenues were RMB4.0 million (US$0.6 million), compared

with RMB8.0 million in the first quarter of 2023.

Gross profit and gross margin

Gross profit was RMB6.0 million (US$0.8 million), compared with

RMB14.2 million in the first quarter of 2023.

Gross margin was 60.2%, down 3.7 percentage points from 63.9% in

the first quarter of 2023. The decrease in gross margin was mainly

due to changes in revenue mix.

Operating expenses

Total operating expenses were RMB82.0 million

(US$11.3 million), representing a decrease of 10.4% compared with

RMB91.5 million in the first quarter of 2023.

- Sales and marketing expenses were RMB13.5 million (US$1.9

million), compared with RMB12.4 million in the first quarter of

2023. The increase was mainly due to increased marketing and

promotion activities to enhance brand awareness and higher employee

compensation.

- General and administrative expenses were RMB31.1 million

(US$4.3 million), compared with RMB25.0 million in the first

quarter of 2023. The increase was mainly attributed to additional

provisions for several long-aging accounts receivable on certain

customers in the second quarter of 2023.

- Research and development expenses were RMB37.4 million (US$5.1

million), compared with RMB54.1 million in the first quarter of

2023. The decrease was mainly due to lower share-based compensation

expenses for a certain portion of share-based awards vested in the

first quarter of 2023, partially offset by the continued focus on

EH216-S type certification and increased expenditures on the

conforming aircraft and compliance tests in the final demonstration

and verification phase of the type certification.

Adjusted operating expenses4

(non-GAAP)

Adjusted operating expenses were RMB58.1 million (US$8.0

million), compared with RMB50.1 million in the first quarter of

2023. Adjusted sales and marketing expenses, adjusted general and

administration expenses, and adjusted research and development

expenses were RMB8.9 million (US$1.2 million), RMB20.4 million

(US$2.8 million) and RMB28.8 million (US$4.0 million) in the second

quarter of 2023, respectively. The changes in adjusted operating

expenses were primarily due to the same reasons discussed under the

heading “Operating expenses” above.

Operating loss

Operating loss was RMB75.3 million (US$10.4 million), compared

with RMB75.7 million in the first quarter of 2023.

Adjusted operating loss

(non-GAAP)5

Adjusted operating loss was RMB51.3 million (US$7.1 million),

compared with RMB34.3 million in the first quarter of 2023.

Other income

Other income was RMB1.2 million (US$0.2 million), compared with

RMB11.2 million of other expenses in the first quarter of 2023.

This was primarily due to the non-cash expenses of amortization of

debt discounts incurred in the first quarter of 2023, which relates

to the interim funding recognized as short-term debt provided by an

investor in the private placement entered in December 2022. The

Company accounted for a significant portion of the funds as

short-term debt and the remaining portion as warrants under

additional paid-in capital. In addition, the Company has repaid the

interim funding of short-term debt in full and, with the warrants

exercised, the Company concurrently received US$10 million as

purchase price of Class A ordinary shares.

Net loss

Net loss was RMB75.7 million (US$10.4 million), compared with

RMB87.0 million in the first quarter of 2023.

Adjusted net loss

(non-GAAP)6

Adjusted net loss was RMB51.8 million (US$7.1million), compared

with RMB33.6 million in the first quarter of 2023.

Adjusted net loss attributable to EHang’s ordinary shareholders

was RMB51.6 million (US$7.1million), compared with RMB33.4 million

in the first quarter of 2023.

Loss per share and per ADS

Basic and diluted net loss per ordinary share were both RMB0.63

(US$0.09). Adjusted basic and diluted net loss per ordinary share7

(non-GAAP) were both RMB0.43 (US$0.06).

Basic and diluted net loss per ADS were both RMB1.26 (US$0.18).

Adjusted basic and diluted net loss per ADS8 (non-GAAP) were both

RMB0.86 (US$0.12).

Balance Sheets

- Cash, cash equivalents and restricted short-term deposits

balances were RMB160.7 million (US$22.2 million) as of June 30,

2023. In July 2023, the Company completed and closed the private

investment of US$23 million from long-term strategic investors to

support the needs of working capital and general corporate

purposes, enabling acceleration of strategic plans for technology

advancement, business development, and post-certification

commercial operations.

Liquidity

The Company has been incurring losses from operations since

inception. For the six months ended June 30, 2023, the Company had

net loss of RMB162.8 million (US$22.4 million). As of December 31,

2022 and June 30, 2023, accumulated deficit amounted to RMB1,450.4

million and RMB1,615.2 million (US$222.7 million),

respectively.

The Company’s liquidity and continuous operation depend on its

ability to enhance its operating cash flows and financial position,

which is currently largely dependent on when the Company will

obtain the type certificate of EH216-S to launch commercial sales

of EH216-S AAVs, and the Company’s capability to raise additional

funds through debt financings or equity offerings. The Company

expects to obtain the type certificate soon as it has already

completed all the planned tests in the final phase of Demonstration

and Verification of Compliance for EH216-S type certification as of

the date of this earnings release. In July 2023, the Company has

also secured a round of US$23 million of equity investment through

private placement from several strategic investors. The gross

proceeds from the placement has strengthened the Company’s

liquidity status. Therefore, we believe that our current cash and

cash equivalents and our anticipated cash flows from operations

will be sufficient to meet our anticipated working capital

requirements and material cash requirements for at least the next

12 months. However, we may need additional cash resources in the

future if we experience changes in business conditions or other

developments, or if we pursue opportunities for investment,

acquisition, capital expenditure or similar actions.

Management Transition

The Company also announced today that Mr. Richard Jian Liu

tendered his resignation from his position as the Chief Financial

Officer (“CFO”) of the Company for personal reasons, which

resignation will become effective on August 31, 2023 and will serve

as a senior advisor to the Company effective on September 1, 2023.

In addition, the Board has appointed Mr. Conor Chia-hung Yang,

currently a director of the Company, as the new Chief Financial

Officer while keeping his directorship, effective on September 1,

2023. Mr. Liu’s resignation did not result from any dispute or

disagreement with the Board or the Company.

Mr. Huazhi Hu, EHang’s Founder, Chairman and Chief Executive

Officer, commented, “On behalf of the Board and the management

team, I would like to thank Richard for his wholehearted dedication

and tremendous contributions to EHang’s growth during his 8-year

tenure with the Company. As a founding member, his foresight and

leadership have been instrumental in leading the Company in going

public and navigating the capital markets as the pioneer in the

global eVTOL/UAM industry. We would also like to warmly welcome

Conor to join our management team, who has more than 30 years of

professional experience in financial management, investor

relations, capital markets and corporate governance at many listed

companies, and served as a director in our Board for more than 3

years since our listing on Nasdaq, demonstrating his deep

understanding and confidence in the Company. We look forward to

continuing working with Conor in his new capacities to take EHang

into a new stage with bright prospect.”

Mr. Liu said, “I would like to sincerely thank the Board, Huazhi

and the investment communities for all your trust and supports in

the past 8 years. I have witnessed and experienced the Company’s

development and every milestone from an innovative startup into an

industry leading listed company and believe the Company has built a

solid foundation for its sustainable long-term growth.”

Mr. Yang said, “I feel privileged to join the management team of

EHang, a trailblazer in global UAM industry, and take over CFO’s

responsibilities at this pivotal and exhilarating stage. Leveraging

my extensive finance experience and my enthusiasm for the UAM

sector, I am dedicated to forging strong collaborations with our

talented team to drive financial excellence and maximize value for

the Company’s stakeholders.”

Prior to this appointment as CFO, Mr. Yang has served as an

independent director, the chair of Audit Committee, and a member of

Compensation Committee of the Board of EHang since December 2019.

From 2007 to 2023, Mr. Yang served in several chief financial

officer positions, including Tuniu Corporation (Nasdaq: TOUR),

E-Commerce China Dangdang Inc., and AirMedia Group Inc. Mr. Yang

was the chief executive officer of Rock Mobile Corporation from

2004 to 2007, and the chief financial officer of the Asia Pacific

region for CellStar Asia Corporation from 1999 to 2004. Prior to

that, Mr. Yang was a senior banker at Goldman Sachs (Asia) L.L.C.,

Lehman Brothers Asia Limited and Morgan Stanley Asia Limited from

1992 to 1999. Mr. Yang currently also serves as an independent

director of I-Mab, iQIYI, Inc., Tongcheng Travel Holdings Limited,

UP Fintech Holding Ltd and Smart Share Global Limited. Mr. Yang

received his master’s degree in business administration from the

University of California, Los Angeles (UCLA).

Board Change

The Company also announced today that it has appointed Mr. Wing

Kee Lau (“Mr. Lau”) as a new independent director to the Board,

effective on August 16, 2023. Mr. Lau was also concurrently

appointed as the chair of Audit Committee, and a member of

Compensation Committee, to succeed Mr. Yang’s prior roles in the

Board. The Board has reviewed and determined that Mr. Lau meets all

the “independence” requirements under Rule 10A-3 of the United

States Exchange Act of 1934 and Listing Rule 5605 of the Nasdaq

Stock Market Rules and qualifies as an audit committee financial

expert as defined in the instructions to Item 16A of the Form

20-F.

Following this appointment, the Board will be comprised of six

members, including four independent non-executive directors and two

executive directors.

Mr. Huazhi Hu, EHang’s Founder, Chairman and Chief Executive

Officer, commented, “On behalf of the Board and the management

team, I would like to express our warm welcome to Mr. Lau to join

us. I am confident that his extensive background of over 30 years

in financial management and accounting will enrich us with a wealth

of valuable experience and expertise, further fortifying our

dedication to robust governance and strategic oversight.”

Mr. Lau said, “I am honored to join the Company’s Board, Audit

Committee and Compensation Committee. I look forward to

collaborating closely with my fellow Board members and the

management team to uphold the principles of sound financial

stewardship and contribute to the Company’s continued success.”

Mr. Lau has been serving as the chief financial officer of

RoboSense Technology Co., Ltd. since August 2022. From 2000 to

2022, Mr. Lau served in several chief financial officer and senior

financial positions at listed or industry-leading companies,

including Perfect World Co., Ltd. (SHE: 002624), Ogilvy &

Mather Advertising Ltd. Beijing Branch, Tarena International Inc.

(Nasdaq: TEDU), Beijing Media Corporation Ltd. (HKEX: 01000), and

Square Panda Inc. Prior to that, Mr. Lau was a senior manager at

PricewaterhouseCoopers (“PwC”) Shanghai and Beijing from 1994 to

2000, and a senior accountant at PwC Hong Kong from 1990 to 1994.

Mr. Lau currently also serves as an independent director at

Genetron Holding Ltd. since June 2020. Mr. Lau received his

bachelor’s degree in business administration (finance) from Hong

Kong Baptist University in 1990, and an EMBA degree from Cheung

Kong Graduate School of Business in 2011. Mr. Lau is a member of

the Association of Chartered Certified Accountants, and a member of

the Hong Kong Institution of Certified Public Accountants.

Business Outlook

The Company continues to receive increasing inquiries, demands,

and orders from customers for AAV uses in aerial tourism, urban

transportation, emergency rescue, and smart city management, which

are driven by its first-mover advantages, favorable policies in the

UAM sector, and expected upcoming commercialization. The Company’s

EH216-S order pipeline in China has reached more than 100 units and

continues growing. Most of these orders are conditional upon the

Company’s completion of the type certification.

The above outlook is based on information available as of the

date of this press release and reflects the Company’s current and

preliminary expectations regarding its business situation and

market conditions. The outlook is subject to changes, especially

uncertainties and situations related to EH216-S certification,

political and economic landscape, etc.

Conference Call

EHang’s management team will host an earnings conference call at

8:00 AM on Thursday, August 17, 2023, U.S. Eastern Time (8:00 PM on

Thursday, August 17, 2023, Beijing/Hong Kong Time).

To join the conference call via telephone, participants must use

the following link to complete an online registration process. Upon

registering, each participant will receive email instructions to

access the conference call, including dial-in information and a PIN

number allowing access to the conference call.

Participant Online Registration:

https://register.vevent.com/register/BId28c5673b2f747f68e3a7042f02cf7f1

A live and archived webcast of the conference call will be

available on the Company’s investors relations website at

http://ir.ehang.com/.

About EHang

EHang (Nasdaq: EH) is the world’s leading autonomous aerial

vehicle (“AAV”) technology platform company. EHang’s mission is to

make safe, autonomous, and eco-friendly air mobility accessible to

everyone. EHang provides customers in various industries with AAV

products and commercial solutions: urban air mobility (including

passenger transportation and logistics), smart city management, and

aerial media solutions. As the forerunner of cutting-edge AAV

technologies and commercial solutions in the global Urban Air

Mobility (“UAM”) industry, EHang continues to explore the

boundaries of the sky to make flying technologies benefit our life

in smart cities. For more information, please visit

www.ehang.com.

Safe Harbor Statement

This press release contains statements that may constitute

“forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. Statements that are not historical facts,

including statements about management’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to those

relating to EH216-S type certification, our expectations regarding

demand for, and market acceptance of, our AAV products and

solutions and the commercialization of UAM services, our

relationships with strategic partners, and current litigation and

potential litigation involving us. Management has based these

forward-looking statements on its current expectations,

assumptions, estimates and projections. While they believe these

expectations, assumptions, estimates and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond management’s control. These statements involve

risks and uncertainties that may cause EHang’s actual results,

performance or achievements to differ materially from any future

results, performance or achievements expressed or implied by these

forward-looking statements.

Non-GAAP Financial

Measures

The Company uses adjusted gross profit, adjusted operating

expenses, adjusted sales and marketing expenses, adjusted general

and administration expenses, adjusted research and development

expenses, adjusted operating loss, adjusted net loss, adjusted net

loss attributable to ordinary shareholders, adjusted basic and

diluted loss per ordinary share and adjusted basic and diluted loss

per ADS (collectively, the “Non-GAAP Financial Measures”) in

evaluating its operating results and for financial and operational

decision-making purposes. There was no income tax impact on the

Company’s non-GAAP adjustments because the non-GAAP adjustments are

usually recorded in entities located in tax-free jurisdictions,

such as the Cayman Islands.

The Company believes that the Non-GAAP Financial Measures help

identify underlying trends in its business that could otherwise be

distorted by the effects of items of (i) share-based compensation

expenses and (ii) certain non-operational expenses, such as

provisions for legal proceedings and amortization of debt

discounts, which are included in their comparable GAAP measures.

The Company believes that the Non-GAAP Financial Measures provide

useful information about its operating results, enhance the overall

understanding of its past performance and future prospects and

allow for greater visibility with respect to key metrics used by

its management members in their financial and operational

decision-making.

The Non-GAAP Financial Measures are not defined under U.S. GAAP

and are not presented in accordance with U.S. GAAP. The Non-GAAP

Financial Measures have limitations as analytical tools. One of the

key limitations of using the Non-GAAP Financial Measures is that

they do not reflect all items of expense that affect the Company’s

operations. Share-based compensation expenses have been and may

continue to be incurred in the business and are not reflected in

the presentation of the Non-GAAP Financial Measures. Further, the

Non-GAAP Financial Measures may differ from the non-GAAP

information used by other companies, including peer companies, and

therefore their comparability may be limited. The Company

compensates for these limitations by reconciling the Non-GAAP

Financial Measures to the nearest U.S. GAAP measures, all of which

should be considered when evaluating the Company’s performance.

Each of the Non-GAAP Financial Measures should not be considered

in isolation or construed as an alternative to its comparable GAAP

measure or any other measure of performance or as an indicator of

the Company’s operating performance or financial results. Investors

are encouraged to review the Company’s most directly comparable

GAAP measures in conjunction with the Non-GAAP Financial Measures.

The Non-GAAP Financial Measures presented here may not be

comparable to similarly titled measures presented by other

companies. Other companies may calculate similarly titled measures

differently, limiting their usefulness as comparative measures to

the Company’s data. The Company encourages investors and others to

review its financial information in its entirety and not rely on a

single financial measure.

For more information on the Non-GAAP Financial Measures, please

see the table captioned “Unaudited Reconciliations of GAAP and

Non-GAAP Results” set forth at the end of this press release.

Exchange Rate

This press release contains translations of certain RMB amounts

into U.S. dollars (“USD”) at specified rates solely for the

convenience of the reader. Unless otherwise stated, all

translations from RMB to USD were made at the rate of RMB7.2513 to

US$1.00, the noon buying rate in effect on June 30, 2023 in the

H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or USD amounts referred to in

this press release could have been converted into USD or RMB, as

the case may be, at any particular rate or at all.

Investor Contact: ir@ehang.com

Media Contact: pr@ehang.com

________________________________

1 Adjusted operating loss is a non-GAAP financial measure, which

is defined as operating loss excluding share-based compensation

expenses. See “Non-GAAP Financial Measures” below.2 Adjusted net

loss is a non-GAAP financial measure, which is defined as net loss

excluding share-based compensation expenses and certain

non-operational expenses. See “Non-GAAP Financial Measures” below.3

The EH216 series AAVs include EH216-S, the standard model for

passenger transportation, EH216-F model for aerial firefighting,

and EH216-L model for aerial logistics. 4 Adjusted operating

expenses is a non-GAAP financial measure, which is defined as

operating expenses excluding share-based compensation expenses. See

“Non-GAAP Financial Measures” below.5 Adjusted operating loss is a

non-GAAP financial measure, which is defined as operating loss

excluding share-based compensation expenses. See “Non-GAAP

Financial Measures” below.6 Adjusted net loss is a non-GAAP

financial measure, which is defined as net loss excluding

share-based compensation expenses and certain non-operational

expenses, which include amortization of debt discounts. See

“Non-GAAP Financial Measures” below.7 Adjusted basic and diluted

net loss per ordinary share is a non-GAAP financial measure, which

is defined as basic and diluted loss per ordinary share excluding

share-based compensation expenses and certain non-operational

expenses, which include amortization of debt discounts. See

“Non-GAAP Financial Measures” below.8 Adjusted basic and diluted

net loss per ADS is a non-GAAP financial measure, which is defined

as basic and diluted loss per ADS excluding share-based

compensation expenses and certain non-operational expenses, which

include amortization of debt discounts. See “Non-GAAP Financial

Measures” below.

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”)) |

| |

| |

As of |

|

As of |

| |

December 31, 2022 |

|

June 30, 2023 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

249,310 |

|

127,067 |

|

17,523 |

|

Restricted short-term deposits |

- |

|

33,617 |

|

4,636 |

| Accounts receivable, net9 |

20,298 |

|

16,403 |

|

2,262 |

|

Inventories |

72,364 |

|

70,528 |

|

9,726 |

| Prepayments and other current

assets9 |

45,183 |

|

48,175 |

|

6,644 |

|

Total current assets |

387,155 |

|

295,790 |

|

40,791 |

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

| Property and equipment,

net |

47,060 |

|

43,802 |

|

6,041 |

| Operating lease right‑of‑use

assets, net |

73,482 |

|

73,525 |

|

10,140 |

|

Intangible assets, net |

1,959 |

|

2,139 |

|

295 |

|

Long-term loans receivable |

9,980 |

|

8,000 |

|

1,103 |

|

Long-term investments10 |

9,839 |

|

14,142 |

|

1,950 |

|

Other non-current assets |

1,392 |

|

1,562 |

|

215 |

|

Total non-current assets |

143,712 |

|

143,170 |

|

19,744 |

|

|

|

|

|

|

|

|

Total assets |

530,867 |

|

438,960 |

|

60,535 |

|

|

|

|

|

|

|

___________________________________

9 On January 1, 2023, the Company adopted ASU 2016-13, Financial

Instruments — Credit Losses (Topic 326), using the modified

retrospective method and have no material impact on the

consolidated financial statements.10 The Company established a

joint venture with Xiyu Tourism, a third party, in the second

quarter of 2023 and accounted as an equity method investment.

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(CONT’D) |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”)) |

| |

| |

As of |

|

As of |

| |

December 31, 2022 |

|

June 30, 2023 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

Short-term bank loans |

49,794 |

|

59,338 |

|

8,183 |

|

| Short-term debt11 |

57,838 |

|

- |

|

- |

|

| Accounts payable |

35,456 |

|

33,613 |

|

4,635 |

|

| Contract liabilities |

19,321 |

|

22,251 |

|

3,069 |

|

| Current portion of long-term

bank loans |

13,154 |

|

1,538 |

|

212 |

|

| Accrued expenses and other

liabilities |

97,763 |

|

93,931 |

|

12,953 |

|

| Current portion of lease

liabilities |

5,520 |

|

6,596 |

|

910 |

|

| Deferred income |

1,495 |

|

1,551 |

|

214 |

|

| Deferred government

subsidies |

1,993 |

|

2,270 |

|

313 |

|

| Income taxes payable |

7 |

|

2 |

|

- |

|

| Total current

liabilities |

282,341 |

|

221,090 |

|

30,489 |

|

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

| Long-term bank loans |

3,846 |

|

3,077 |

|

424 |

|

| Mandatorily redeemable

non-controlling interests |

40,000 |

|

40,000 |

|

5,516 |

|

| Deferred tax liabilities |

292 |

|

292 |

|

40 |

|

|

Unrecognized tax benefit |

5,480 |

|

5,480 |

|

756 |

|

|

Lease liabilities |

69,913 |

|

70,864 |

|

9,773 |

|

| Deferred income |

2,928 |

|

2,269 |

|

313 |

|

| Other non-current

liabilities |

1,389 |

|

1,973 |

|

272 |

|

|

Total non-current liabilities |

123,848 |

|

123,955 |

|

17,094 |

|

|

|

|

|

|

|

|

|

Total liabilities |

406,189 |

|

345,045 |

|

47,583 |

|

| |

|

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

|

|

Ordinary shares |

|

75 |

|

|

77 |

|

|

11 |

|

| Additional paid-in

capital12 |

|

1,558,356 |

|

|

1,687,880 |

|

|

232,769 |

|

| Statutory reserves |

|

1,191 |

|

|

1,191 |

|

|

164 |

|

| Accumulated deficit9 13 |

|

(1,450,374 |

) |

|

(1,615,182 |

) |

|

(222,744 |

) |

| Accumulated other

comprehensive income |

|

15,010 |

|

|

19,256 |

|

|

2,656 |

|

| Total EHang Holdings

Limited shareholders’ equity |

|

124,258 |

|

|

93,222 |

|

|

12,856 |

|

| Non-controlling interests |

|

420 |

|

|

693 |

|

|

96 |

|

| Total shareholders’

equity |

|

124,678 |

|

|

93,915 |

|

|

12,952 |

|

|

Total liabilities and shareholders’ equity |

|

530,867 |

|

|

438,960 |

|

|

60,535 |

|

___________________________________

11 In December 2022, the Company received interim funding from

an investor who has subscribed for certain number of Class A

ordinary shares of the Company in a private placement. The funds

amounted to US$10 million in total and were made available for use

by the Company pending the closing of the private placement. We

accounted for a significant portion of the funds as short-term debt

and the remaining portion as additional paid-in capital. The

closing of the private placement has occurred by the end of first

quarter of 2023. The Company has repaid the interim funding in full

and concurrently received US$10 million as purchase price of

3,466,204 Class A ordinary shares.12 Additional paid-in capital

reflected the impacts from transactions with non-controlling

shareholder. Please refer to the annual report for more details. 13

Accumulated deficit reflected the impacts from adoption of ASU

2016-13, Financial Instruments — Credit Losses (Topic 326) since

January 1, 2023 and transactions with non-controlling shareholder.

Please refer to the annual report for more details.

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2022 |

|

March 31,2023 |

|

June 30,2023 |

|

June 30,2022 |

|

June 30,2023 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Total revenues |

|

14,618 |

|

|

22,201 |

|

|

10,006 |

|

1,380 |

|

|

20,408 |

|

|

32,207 |

|

4,442 |

|

| Costs of revenues |

|

(4,805 |

) |

|

(8,007 |

) |

|

(3,986 |

) |

(550 |

) |

|

(6,979 |

) |

|

(11,993 |

) |

(1,654 |

) |

| Gross

profit |

|

9,813 |

|

|

14,194 |

|

|

6,020 |

|

830 |

|

|

13,429 |

|

|

20,214 |

|

2,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(12,243 |

) |

|

(12,474 |

) |

|

(13,526 |

) |

(1,865 |

) |

|

(24,940 |

) |

|

(26,000 |

) |

(3,586 |

) |

| General and administrative

expenses |

|

(39,563 |

) |

|

(24,996 |

) |

|

(31,061 |

) |

(4,284 |

) |

|

(63,073 |

) |

|

(56,057 |

) |

(7,731 |

) |

| Research and development

expenses |

|

(34,727 |

) |

|

(54,075 |

) |

|

(37,414 |

) |

(5,160 |

) |

|

(66,728 |

) |

|

(91,489 |

) |

(12,617 |

) |

| Total operating

expenses |

|

(86,533 |

) |

|

(91,545 |

) |

|

(82,001 |

) |

(11,309 |

) |

|

(154,741 |

) |

|

(173,546 |

) |

(23,934 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other operating income |

|

2,424 |

|

|

1,605 |

|

|

676 |

|

93 |

|

|

3,202 |

|

|

2,281 |

|

315 |

|

| Operating

loss |

|

(74,296 |

) |

|

(75,746 |

) |

|

(75,305 |

) |

(10,386 |

) |

|

(138,110 |

) |

|

(151,051 |

) |

(20,831 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and investment

income |

|

1,139 |

|

|

983 |

|

|

966 |

|

133 |

|

|

2,509 |

|

|

1,949 |

|

269 |

|

| Interest expenses |

|

(440 |

) |

|

(714 |

) |

|

(816 |

) |

(113 |

) |

|

(915 |

) |

|

(1,530 |

) |

(211 |

) |

| Amortization of debt

discounts |

|

- |

|

|

(12,023 |

) |

|

- |

|

- |

|

|

- |

|

|

(12,023 |

) |

(1,658 |

) |

| Foreign exchange loss |

|

(1,018 |

) |

|

(96 |

) |

|

(1,028 |

) |

(142 |

) |

|

(1,441 |

) |

|

(1,124 |

) |

(155 |

) |

| Other non-operating income

(expenses), net |

|

721 |

|

|

651 |

|

|

2,075 |

|

286 |

|

|

(4,768 |

) |

|

2,726 |

|

375 |

|

| Total other income

(expense) |

|

402 |

|

|

(11,199 |

) |

|

1,197 |

|

164 |

|

|

(4,615 |

) |

|

(10,002 |

) |

(1,380 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax

and income (loss) from equity method investment |

|

(73,894 |

) |

|

(86,945 |

) |

|

(74,108 |

) |

(10,222 |

) |

|

(142,725 |

) |

|

(161,053 |

) |

(22,211 |

) |

| Income tax (expenses)

benefits |

|

(1 |

) |

|

(1 |

) |

|

(13 |

) |

(2 |

) |

|

1 |

|

|

(14 |

) |

(2 |

) |

| Loss before income

(loss) from equity method investment |

|

(73,895 |

) |

|

(86,946 |

) |

|

(74,121 |

) |

(10,224 |

) |

|

(142,724 |

) |

|

(161,067 |

) |

(22,213 |

) |

| Income (loss) from equity

method investment |

|

30 |

|

|

(90 |

) |

|

(1,607 |

) |

(222 |

) |

|

43 |

|

|

(1,697 |

) |

(234 |

) |

| Net loss |

|

(73,865 |

) |

|

(87,036 |

) |

|

(75,728 |

) |

(10,446 |

) |

|

(142,681 |

) |

|

(162,764 |

) |

(22,447 |

) |

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS (CONT’D) |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2022 |

|

March 31,2023 |

|

June 30,2023 |

|

June 30,2022 |

|

June 30,2023 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net loss |

|

(73,865 |

) |

|

(87,036 |

) |

|

(75,728 |

) |

(10,446 |

) |

|

(142,681 |

) |

|

(162,764 |

) |

(22,447 |

) |

| Net loss attributable to

non-controlling interests |

|

312 |

|

|

211 |

|

|

165 |

|

23 |

|

|

467 |

|

|

376 |

|

52 |

|

| Net loss attributable

to ordinary shareholders |

|

(73,553 |

) |

|

(86,825 |

) |

|

(75,563 |

) |

(10,423 |

) |

|

(142,214 |

) |

|

(162,388 |

) |

(22,395 |

) |

| Net loss per ordinary

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

(0.64 |

) |

|

(0.74 |

) |

|

(0.63 |

) |

(0.09 |

) |

|

(1.24 |

) |

|

(1.37 |

) |

(0.19 |

) |

| Shares used in net

loss per ordinary share computation (in thousands of

shares): |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

114,410 |

|

|

117,549 |

|

|

120,159 |

|

120,159 |

|

|

114,385 |

|

|

118,286 |

|

118,286 |

|

| Loss per ADS (2 ordinary

shares equal to 1 ADS)Basic and diluted |

|

(1.28 |

) |

|

(1.48 |

) |

|

(1.26 |

) |

(0.18 |

) |

|

(2.48 |

) |

|

(2.74 |

) |

(0.38 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments net of nil tax |

|

12,444 |

|

|

(722 |

) |

|

4,968 |

|

685 |

|

|

11,330 |

|

|

4,246 |

|

586 |

|

| Total other

comprehensive income (loss), net of tax |

|

12,444 |

|

|

(722 |

) |

|

4,968 |

|

685 |

|

|

11,330 |

|

|

4,246 |

|

586 |

|

| Comprehensive

loss |

|

(61,421 |

) |

|

(87,758 |

) |

|

(70,760 |

) |

(9,761 |

) |

|

(131,351 |

) |

|

(158,518 |

) |

(21,861 |

) |

| Comprehensive loss

attributable to non-controlling interests |

|

312 |

|

|

211 |

|

|

165 |

|

23 |

|

|

467 |

|

|

376 |

|

52 |

|

| Comprehensive loss

attributable to ordinary shareholders |

|

(61,109 |

) |

|

(87,547 |

) |

|

(70,595 |

) |

(9,738 |

) |

|

(130,884 |

) |

|

(158,142 |

) |

(21,809 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP

RESULTS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2022 |

|

March 31,2023 |

|

June 30,2023 |

|

June 30,2022 |

|

June 30,2023 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Gross profit |

|

9,813 |

|

|

14,194 |

|

|

6,020 |

|

830 |

|

|

13,429 |

|

|

20,214 |

|

2,788 |

|

| Plus: Share-based

compensation |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

| Adjusted gross profit |

|

9,813 |

|

|

14,194 |

|

|

6,020 |

|

830 |

|

|

13,429 |

|

|

20,214 |

|

2,788 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

|

(12,243 |

) |

|

(12,474 |

) |

|

(13,526 |

) |

(1,865 |

) |

|

(24,940 |

) |

|

(26,000 |

) |

(3,586 |

) |

| Plus: Share-based

compensation |

|

4,545 |

|

|

4,951 |

|

|

4,656 |

|

642 |

|

|

8,897 |

|

|

9,607 |

|

1,325 |

|

| Adjusted sales and marketing

expenses |

|

(7,698 |

) |

|

(7,523 |

) |

|

(8,870 |

) |

(1,223 |

) |

|

(16,043 |

) |

|

(16,393 |

) |

(2,261 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and

administrative expenses |

|

(39,563 |

) |

|

(24,996 |

) |

|

(31,061 |

) |

(4,284 |

) |

|

(63,073 |

) |

|

(56,057 |

) |

(7,731 |

) |

| Plus: Share-based

compensation |

|

10,726 |

|

|

9,163 |

|

|

10,693 |

|

1,475 |

|

|

20,979 |

|

|

19,857 |

|

2,738 |

|

| Adjusted general and

administrative expenses |

|

(28,837 |

) |

|

(15,833 |

) |

|

(20,368 |

) |

(2,809 |

) |

|

(42,094 |

) |

|

(36,200 |

) |

(4,993 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development expenses |

|

(34,727 |

) |

|

(54,075 |

) |

|

(37,414 |

) |

(5,160 |

) |

|

(66,728 |

) |

|

(91,489 |

) |

(12,617 |

) |

| Plus: Share-based

compensation |

|

7,834 |

|

|

27,325 |

|

|

8,607 |

|

1,187 |

|

|

15,373 |

|

|

35,931 |

|

4,955 |

|

| Adjusted research and

development expenses |

|

(26,893 |

) |

|

(26,750 |

) |

|

(28,807 |

) |

(3,973 |

) |

|

(51,355 |

) |

|

(55,558 |

) |

(7,662 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

(86,533 |

) |

|

(91,545 |

) |

|

(82,001 |

) |

(11,309 |

) |

|

(154,741 |

) |

|

(173,546 |

) |

(23,934 |

) |

| Plus: Share-based

compensation |

|

23,105 |

|

|

41,439 |

|

|

23,956 |

|

3,304 |

|

|

45,249 |

|

|

65,395 |

|

9,018 |

|

| Adjusted operating

expenses |

|

(63,428 |

) |

|

(50,106 |

) |

|

(58,045 |

) |

(8,005 |

) |

|

(109,492 |

) |

|

(108,151 |

) |

(14,916 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

(74,296 |

) |

|

(75,746 |

) |

|

(75,305 |

) |

(10,386 |

) |

|

(138,110 |

) |

|

(151,051 |

) |

(20,831 |

) |

| Plus: Share-based

compensation |

|

23,105 |

|

|

41,439 |

|

|

23,956 |

|

3,304 |

|

|

45,249 |

|

|

65,395 |

|

9,018 |

|

| Adjusted operating loss |

|

(51,191 |

) |

|

(34,307 |

) |

|

(51,349 |

) |

(7,082 |

) |

|

(92,861 |

) |

|

(85,656 |

) |

(11,813 |

) |

| |

|

EHANG HOLDINGS LIMITED |

|

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(CONT’D) |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2022 |

|

March 31,2023 |

|

June 30,2023 |

|

June 30,2022 |

|

June 30,2023 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net loss |

|

(73,865 |

) |

|

(87,036 |

) |

|

(75,728 |

) |

(10,446 |

) |

|

(142,681 |

) |

|

(162,764 |

) |

(22,447 |

) |

| Plus: Share-based

compensation |

|

23,105 |

|

|

41,439 |

|

|

23,956 |

|

3,304 |

|

|

45,249 |

|

|

65,395 |

|

9,018 |

|

| Plus: Amortization of debt

discounts |

|

- |

|

|

12,023 |

|

|

- |

|

- |

|

|

|

|

12,023 |

|

1,658 |

|

| Plus: Certain non-operational

expenses |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

5,803 |

|

|

- |

|

- |

|

| Adjusted net loss |

|

(50,760 |

) |

|

(33,574 |

) |

|

(51,772 |

) |

(7,142 |

) |

|

(91,629 |

) |

|

(85,346 |

) |

(11,771 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable

to ordinary shareholders |

|

(73,553 |

) |

|

(86,825 |

) |

|

(75,563 |

) |

(10,423 |

) |

|

(142,214 |

) |

|

(162,388 |

) |

(22,395 |

) |

| Plus: Share-based

compensation |

|

23,105 |

|

|

41,439 |

|

|

23,956 |

|

3,304 |

|

|

45,249 |

|

|

65,395 |

|

9,018 |

|

| Plus: Amortization of debt

discounts |

|

- |

|

|

12,023 |

|

|

- |

|

- |

|

|

- |

|

|

12,023 |

|

1,658 |

|

| Plus: Certain non-operational

expenses |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

5,803 |

|

|

- |

|

- |

|

| Adjusted net loss attributable

to ordinary shareholders |

|

(50,448 |

) |

|

(33,363 |

) |

|

(51,607 |

) |

(7,119 |

) |

|

(91,162 |

) |

|

(84,970 |

) |

(11,719 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted basic and diluted net

loss per ordinary share |

|

(0.44 |

) |

|

(0.28 |

) |

|

(0.43 |

) |

(0.06 |

) |

|

(0.80 |

) |

|

(0.72 |

) |

(0.10 |

) |

| Adjusted basic and diluted net

loss per ADS |

|

(0.88 |

) |

|

(0.56 |

) |

|

(0.86 |

) |

(0.12 |

) |

|

(1.60 |

) |

|

(1.44 |

) |

(0.20 |

) |

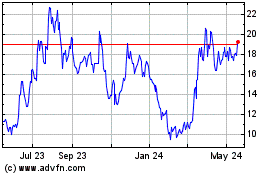

EHang (NASDAQ:EH)

Historical Stock Chart

From Jan 2025 to Feb 2025

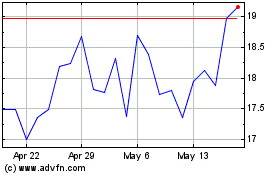

EHang (NASDAQ:EH)

Historical Stock Chart

From Feb 2024 to Feb 2025