EHang Holdings Limited (“EHang” or the “Company”) (Nasdaq: EH), the

world’s leading Urban Air Mobility (“UAM”) technology platform

company, today announced its unaudited financial results for the

second quarter ended June 30, 2024.

Financial and Operational Highlights for the Second

Quarter 2024

- Sales and deliveries of

EH216 series products1 were 49 units, the

highest quarterly delivery volume in the Company’s history,

compared with 5 units in the second quarter of 2023, and 26 units

in the first quarter of 2024.

- Total revenues

reached a record high of RMB102.0 million (US$14.0 million),

representing an increase of 919.6% from RMB10.0 million in the

second quarter of 2023, and an increase of 65.3% from RMB61.7

million in the first quarter of 2024.

- Gross margin was

62.4%, representing a 2.2 percentage points increase from 60.2% in

the second quarter of 2023, and a 0.5 percentage points increase

from 61.9% in the first quarter of 2024.

- Operating loss was

RMB77.4 million (US$10.7 million), representing a slight increase

of 2.8% from RMB75.3 million in the second quarter of 2023 and an

increase of 17.6% from RMB65.8 million in the first quarter of

2024.

- Adjusted operating

loss2 (non-GAAP) was

RMB4.7 million (US$0.6 million), representing a 90.9% improvement

from RMB51.3 million in the second quarter of 2023, and a 62.9%

improvement from RMB12.6 million in the first quarter of 2024.

- Net loss was

RMB71.6 million (US$9.9 million), representing a 5.4% improvement

from RMB75.7 million in the second quarter of 2023, and a 13.0%

increase from RMB63.4 million in the first quarter of 2024.

- Adjusted net

income3 (non-GAAP) was

RMB1.2 million (US$0.2 million), compared with adjusted net loss of

RMB51.8 million in the second quarter of 2023, and adjusted net

loss of RMB10.1 million in the first quarter of 2024.

- Cash and cash equivalents,

short-term deposits, restricted short-term deposits and short-term

investments balances were RMB988.2 million (US$136.0

million) as of June 30, 2024.

- Positive cash flow from

operations continued in the second quarter of 2024. This

was the third consecutive quarter that the Company generated

positive cash flow from operations.

- Gross proceeds raised

through the at-the-market equity offering4 was RMB554.1

million (US$76.2 million) as of the date of this press release. The

proceeds from the offering bolstered the Company’s liquidity

position for driving its next stage of development and growth

strategy in the global UAM industry. With the bolstered liquidity

position, the Company will not continue selling ADSs under its

at-the-market program for the remainder of 2024. The proceeds

already raised will be used for the Company’s research and

development of next-generation technologies and products, team and

production expansion, new headquarters, commercial operations,

other working capital needs and general corporate purposes.

Business Highlights for the Second Quarter 2024 and

Recent Developments

- Secured EH216-S Production

Certificate from CAAC and Production Ramping Up

Steadily

In April 2024, EHang obtained the world’s

first-of-its-kind Production Certificate (“PC”) issued by the Civil

Aviation Administration of China (“CAAC”) for the Company’s

self-developed EH216-S passenger-carrying pilotless electric

vertical takeoff and landing (“eVTOL”) aircraft. CAAC issued the PC

to EHang following its approval of the Type Certificate (“TC”) and

the Standard Airworthiness Certificate (“AC”) for the EH216-S. The

PC allows EHang to mass produce the EH216-S at its production

facility in Yunfu, Guangdong province, China. Leveraging its

reliable production capabilities and quality management system,

EHang is steadily increasing production to meet the demands of its

expanding order book and customer delivery requirements.

- Secured RMB113 Million

Order for 50 Units of EH216-S and Purchase Plan for Additional 450

Units in Shanxi, North China, and Delivered 10 Units

In May 2024, EHang signed a memorandum of

understanding (“MoU”) with Taiyuan Xishan Ecological Tourism

Investment Construction Co., Ltd. (“Xishan Tourism”) to co-develop

a low-altitude economy industrial park in Taiyuan City, Shanxi

Province, China. The Company has received a purchase order and full

payment of RMB113 million (US$15.5 million) for 50 units of EH216-S

and has signed a purchase plan and distribution agreement with a

subsidiary of Xishan Tourism for an additional 450 units of EH216-S

in the next two years. The products are planned to be deployed for

aerial tourism, passenger transportation, and other low-altitude

use cases to facilitate adoption and operations of pilotless eVTOL

aircraft in North China. EHang has delivered the first batch of 10

units to Xishan Tourism in the second quarter of 2024, and

completed passenger-carrying flights for aerial sightseeing at the

Paddy Field Park in Taiyuan in July 2024.

- Secured Order for 30 Units

of EH216-S and Purchase Plan for Additional 270 Units in Zhejiang,

East China, and Delivered 27 Units

In June 2024, EHang signed a cooperation

agreement with the government of Wencheng County, Wenzhou City,

Zhejiang Province, China, to jointly develop UAM and supporting

public service ecosystem for the low-altitude economy. As part of

this cooperation, Wencheng County Transportation Development Group

Co., Ltd. signed a purchase agreement with EHang, and made full

payment for 30 units of EH216-S, which will be used to provide

aerial sightseeing flight services at local natural landscape.

Meanwhile, it also signed a purchase plan and distribution

agreement with prepayment for additional 270 units by the end of

2026, with the goal of expanding its business across Zhejiang

province. In the second quarter of 2024, 27 units were delivered to

the customer, and passenger-carrying flights were carried out for

aerial sightseeing tours over the renowned Tianding Lake at the

Baizhangji Fall and Feiyun Lake Scenic Resort in Wencheng.

- Partnered with KC Smart

Mobility with Purchase Plan for 30 Units of EH216-S to Advance Sale

and Tourism and Travel Operations in Hong Kong, Macau and Hubei

Province in China

In July 2024, EHang signed a purchase and

operations cooperation agreement with KC Smart Mobility Company

Limited (“KC Smart Mobility”), a subsidiary of Kwoon Chung Bus

Holdings Limited (“KCBH”) (0306.HK), Hong Kong’s largest

non-franchised bus operator, providing passenger transport services

between mainland China and Hong Kong, as well as local transport

and tourism services in Hong Kong and other locations. KC Smart

Mobility plans to purchase a total of 30 units of EH216-S from

EHang for tourism and travel operations in Hong Kong, Macau, as

well as the cities of Xiangyang and Shiyan in China’s Hubei

Province by the end of 2026. Previously, as part of the 30 units

purchase plan, the first order of five units has been placed and

delivered to Hubei for aerial sightseeing uses in the first quarter

of 2024.

- Pilotless eVTOL Air

Operator Certificate Applications Accepted by CAAC

In July 2024, CAAC formally accepted the Air

Operator Certificate (“AOC” or “OC”) applications submitted

separately by Guangdong EHang General Aviation Co., Ltd. (“EHang

General Aviation”), EHang’s wholly-owned subsidiary specializing in

UAM operation services, and Hefei Heyi Aviation Co., Ltd. (“Heyi

Aviation”), a joint venture company formed by EHang General

Aviation in Hefei. As the world's first OC project for pilotless

passenger-carrying eVTOL aircraft, it is paving the way for

creating the world's first commercial operation standard, laying a

solid foundation for EH216-S commercial operations in China.

Currently, the CAAC review team has completed the review of the

required application documents, and next will conduct operational

site review in Hefei. The Company anticipates the first OC to be

obtained within this year. In addition, EHang is supporting its

customers and partners in Guangzhou, Shenzhen, Taiyuan, and Wuxi to

actively prepare for their own OC applications, so as to accelerate

the launching of EH216-S commercial operations and low-altitude

economy demonstration projects in more cities across China.

- Formed Strategic

Partnership with China Southern Airlines General Aviation for

Collaborative eVTOL Operations

In June 2024, EHang signed a strategic MoU with

China Southern Airlines General Aviation Company Limited, a Chinese

leading general aviation service provider and a strategic emerging

business unit of China Southern Airlines Company Limited. The

partnership will center on flight operations, comprehensive

support, and other aspects of EHang’s pilotless eVTOLs to jointly

cultivate innovative solutions for low-altitude economy. The two

parties plan to establish EH216-S operation demonstration sites for

low-altitude tourism at the Zhuhai Jiuzhou Airport and the Zhuhai

Chimelong Ocean Kingdom, among other popular tourist destinations

in Zhuhai, with the aim to launch routine low-altitude flight

services and experiential activities.

- Expansion in Middle East

Market: Strategic Collaboration with MLG and ADIO in UAE, Debut

Flights in UAE and Saudi Arabia

In April 2024, EHang signed a trilateral

agreement with Multi Level Group (“MLG”), a leading fintech Company

in the Middle East and North Africa (“MENA”) region, and the Abu

Dhabi Investment Office (“ADIO”) to drive autonomous eVTOL

development in the UAE and beyond.

In May 2024, EHang successfully completed the

first passenger-carrying autonomous eVTOL flight in Abu Dhabi with

its EH216-S, as well as debut flights with the EH216-F high-rise

firefighting model and the EH216-L aerial logistics model,

following its initial delivery of the 5 units of EH216 series eVTOL

products to Wings Logistics Hub, the passenger eVTOLs (smart

mobility) and logistics tech subsidiary of Technology Holding

Company, being the technology arm of EIH Ethmar International

Holding in the first quarter of 2024.

In June 2024, EH216-S further completed its

first autonomous air taxi flight in Mecca, Saudi Arabia. Partnering

with EHang’s customer Front End Limited Company (“Front End”), a

Saudi-based enterprise specializing in advanced solutions for

various industries, this flight highlighted the transformative

potential of pilotless eVTOL aircraft for the region’s

transportation system.

- Formed Strategic

Partnership with GBT to Jointly Develop World’s First

Ultra-Fast/eXtreme Fast Charging Battery Solutions for EHang’s

eVTOL Products

In April 2024, EHang established a strategic

partnership with Guangzhou Greater Bay Technology Co., Ltd.

(“GBT”), a Chinese leading ultra-fast charging battery provider

incubated by Guangzhou Automobile Group, for the research and

development of the world’s first Ultra-Fast Charging

(“UFC”)/eXtreme Fast Charging (“XFC”) battery solutions for EHang’s

eVTOL products. EHang and GBT will jointly develop eVTOL power

cells, batteries, packs, charging piles and energy storage systems

that meet the airworthiness standards of the CAAC as well as the

“4H” standards (i.e., high energy density, high cycle life, high

instantaneous charge-discharge rate, and high safety), and further

develop fast-charging piles, stations and other infrastructures to

establish an ecosystem for future commercial operations.

Management Remarks

Mr. Huazhi Hu, EHang’s Founder, Chairman

and Chief Executive Officer, commented, “We are excited to

report another quarter of robust growth in both operational and

financial metrics. The obtainment of three certifications for the

EH216-S enables us to expedite our production and deliveries,

which, together with enhanced government initiatives for advancing

the low-altitude economy, have led to a substantial increase in

demands and orders from various domestic and international

customers that include governments and tourism operators. As a

result, we delivered a record 49 units of EH216-S during the

quarter, driving exceptional revenue growth as well as inked

hundreds-of-units purchase orders and pre-orders for EH216-S in

China. Moreover, our global expansion was also gaining momentum

with the extension of our partnership network in the Middle East

and the successful debut flights of our pilotless eVTOLs in the UAE

and Saudi Arabia in the second quarter.

With an integrated business strategy of sales

and operations, we also made great progress in fast-tracking UAM

commercial operation preparations for our customers after sales in

terms of personnel training, infrastructure development, operation

standard and certification. The CAAC has formally accepted the OC

applications submitted by EHang General Aviation and Heyi Aviation.

Besides, our customers and partners in Guangzhou, Shenzhen,

Taiyuan, and Wuxi are also actively preparing for OC applications,

with goals for accelerating the launch of commercial EH216-S

operations and low-altitude economy demonstration projects across

local cities.

We are committed to launching commercial

operations of EH216-S in the near future, which will usher in a new

phase of growth focused on intra-city mobility. At the same time,

we will meet diversified UAM demand through ongoing research,

development and testing of advanced technologies, upgraded

components and new models, such as our lift-and-cruise eVTOL

designed for inter-city mobility. We will leverage our cutting-edge

eVTOL technologies and strong low-altitude industry leadership to

provide secure, and low-carbon autonomous arial vehicles to more

customers globally.”

Mr. Conor Yang, EHang’s Chief Financial

Officer, stated, “Thanks to our industry-leading eVTOL

products, certifications and supportive government policies, we

continued delivering excellent financial results and beat our

guidance again. Notably, our second-quarter revenue surged 919.6%

year-over-year to RMB102.0 million, demonstrating strong demand for

our advanced EH216-S pilotless eVTOL vehicles and robust growth

potentials.

We are thrilled that we achieved adjusted net

income3 in the second quarter, and maintained positive operating

cash flow for the third consecutive quarter, adding strength to our

financial condition. In addition, our cash position continues to

strengthen as the Company has raised RMB554.1 million (US$76.2

million) through the at-the-market equity offering, so we will not

continue selling ADSs under the at-the-market program for the

remainder of 2024. We are confident that our capital and strategic

preparation for commercial operations along with our core strengths

position us well for sustaining this upward momentum and continuing

our expansion.”

Financial Results for the Second Quarter

2024

Revenues

Total revenues were RMB102.0 million (US$14.0

million), representing an increase of 919.6% from RMB10.0 million

in the second quarter of 2023, and an increase of 65.3% from

RMB61.7 million in the first quarter of 2024. The year-over-year

and quarter-over-quarter increases were primarily due to the

increase in the sales volume of EH216 series products.

Costs of revenues

Costs of revenues were RMB38.4 million

(US$5.3million), compared with RMB4.0 million in the second quarter

of 2023 and RMB23.5 million in the first quarter of 2024. The

year-over-year and quarter-over-quarter increases were in line with

the increase in the sales volume of EH216 series products.

Gross profit and gross

margin

Gross profit was RMB63.7 million (US$8.7

million), representing an increase of 957.3% from RMB6.0 million in

the second quarter of 2023, and an increase of 66.7% from RMB38.2

million in the first quarter of 2024. The year-over-year and

quarter-over-quarter increases were primarily due to the increase

in the sales volume of EH216 series products.

Gross margin was 62.4%, representing a 2.2

percentage points increase from 60.2% in the second quarter of

2023, and a 0.5 percentage points increase from 61.9% in the first

quarter of 2024. The year-over-year and quarter-over-quarter

increases were mainly due to changes in revenue mix.

Operating expenses

Total operating expenses were RMB143.3 million

(US$19.7 million), compared with RMB82.0 million in the second

quarter of 2023, and RMB107.7 million in the first quarter of

2024.

- Sales and marketing expenses were

RMB27.3 million (US$3.7 million), compared with RMB13.5 million in

the second quarter of 2023, and RMB20.2 million in the first

quarter of 2024. The year-over-year and quarter-over-quarter

increases were mainly attributable to increased sales-related

compensation and expansion of sales channels as well as higher

share-based compensation expenses due to modification of

outstanding share-based awards.

- General and administrative expenses

were RMB54.2 million (US$7.5 million), compared with RMB31.1

million in the second quarter of 2023, and RMB49.7 million in the

first quarter of 2024. The year-over-year increase was mainly

attributable to higher share-based compensation expenses due to

modification of outstanding share-based awards and offset by the

lower expected credit loss expenses due to the improving credit

controls in 2024. The quarter-over-quarter increase was mainly

attributable to higher share-based compensation expenses.

- Research and development expenses

were RMB61.8 million (US$8.5 million), compared with RMB37.4

million in the second quarter of 2023, and RMB37.8 million in the

first quarter of 2024. The year-over-year increase and

quarter-over-quarter increases were mainly attributable to higher

share-based compensation expenses due to modification of

outstanding share-based awards and increased expenditures on

different models of eVTOL aircraft.

Adjusted operating

expenses5 (non-GAAP)

Adjusted operating expenses were RMB70.6 million

(US$9.7 million), representing an increase of 21.6% from RMB58.0

million in the second quarter of 2023, and an increase of 29.6%

from RMB54.5 million in the first quarter of 2024. Adjusted sales

and marketing expenses, adjusted general and administrative

expenses, and adjusted research and development expenses were

RMB15.6 million (US$2.1 million), RMB22.4 million (US$3.1 million)

and RMB32.6 million (US$4.5 million) in the second quarter of 2024,

respectively.

Operating loss

Operating loss was RMB77.4 million (US$10.7

million), representing an increase of 2.8% from RMB75.3 million in

the second quarter of 2023, and an increase of 17.6% from RMB65.8

million in the first quarter of 2024.

Adjusted operating

loss6 (non-GAAP)

Adjusted operating loss was RMB4.7 million

(US$0.6 million), representing an improvement of 90.9% from RMB51.3

million in the second quarter of 2023, and an improvement of 62.9%

from RMB12.6 million in the first quarter of 2024.

Net loss

Net loss was RMB71.6 million (US$9.9 million),

representing an improvement of 5.4% from RMB75.7 million in the

second quarter of 2023, and an increase of 13.0% from RMB63.4

million in the first quarter of 2024.

Adjusted net income

(loss)7 (non-GAAP)

Adjusted net income was RMB1.2 million (US$0.2

million), compared with adjusted net loss of RMB51.8 million in the

second quarter of 2023, and adjusted net loss of RMB10.1 million in

the first quarter of 2024.

Adjusted net income attributable to EHang’s

ordinary shareholders was RMB1.2 million (US$0.2 million). Adjusted

net loss attributable to EHang’s ordinary shareholders in the

second quarter of 2023 was RMB51.6 million, and RMB10.0 million in

the first quarter of 2024.

Earnings (loss) per share and per

ADS

Basic and diluted net loss per ordinary share

were both RMB0.54 (US$0.07). Adjusted basic and diluted net

earnings per ordinary share8 (non-GAAP) were both RMB0.01

(US$0.001).

Basic and diluted net loss per ADS were both

RMB1.08 (US$0.14). Adjusted basic and diluted net earnings per ADS9

(non-GAAP) were both RMB0.02 (US$0.002).

Balance Sheets

Cash and cash equivalents, short-term deposits,

restricted short-term deposits and short-term investments balances

were RMB988.2 million (US$136.0 million) as of June 30, 2024.

Business Outlook

For the third quarter of 2024, the Company

expects the total revenues to be around RMB123 million,

representing an increase of approximately 329.8% year-over-year and

20.6% quarter-over-quarter.

The above outlook is based on information

available as of the date of this press release and reflects the

Company’s current and preliminary views regarding its business

situation and market conditions, which are subject to change.

Conference Call

EHang’s management team will host an earnings

conference call at 8:00 AM on Thursday, August 22, 2024, U.S.

Eastern Time (8:00 PM on Thursday, August 22, 2024, Beijing/Hong

Kong Time).

To join the conference call via telephone,

participants must use the following link to complete an online

registration process. Upon registering, each participant will

receive email instructions to access the conference call, including

dial-in information and a PIN number allowing access to the

conference call.

Participant Online Registration:

https://register.vevent.com/register/BI8300d14a79504787971960179ac911c3

A live and archived webcast of the conference

call will be available on the Company’s investors relations website

at http://ir.ehang.com/.

About EHang

EHang Holdings Limited (Nasdaq: EH) (“EHang”) is

the world’s leading urban air mobility (“UAM”) technology platform

company. Our mission is to enable safe, autonomous, and

eco-friendly air mobility accessible to everyone. EHang provides

customers in various industries with unmanned aerial vehicle

(“UAV”) systems and solutions: air mobility (including passenger

transportation and logistics), smart city management, and aerial

media solutions. EHang’s EH216-S has obtained the world’s first

type certificate, production certificate and standard airworthiness

certificate for passenger-carrying pilotless eVTOL aircraft issued

by the Civil Aviation Administration of China. As the forerunner of

cutting-edge UAV technologies and commercial solutions in the

global UAM industry, EHang continues to explore the boundaries of

the sky to make flying technologies benefit our life in smart

cities. For more information, please visit www.ehang.com.

Safe Harbor Statement

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. Statements that are not historical facts,

including statements about management’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to those

relating to certifications, our expectations regarding demand for,

and market acceptance of, our products and solutions and the

commercialization of UAM services, our relationships with strategic

partners, and current litigation and potential litigation involving

us. Management has based these forward-looking statements on its

current expectations, assumptions, estimates and projections. While

they believe these expectations, assumptions, estimates and

projections are reasonable, such forward-looking statements are

only predictions and involve known and unknown risks and

uncertainties, many of which are beyond management’s control. These

statements involve risks and uncertainties that may cause EHang’s

actual results, performance or achievements to differ materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements.

Non-GAAP Financial

Measures

The Company uses adjusted operating expenses,

adjusted sales and marketing expenses, adjusted general and

administrative expenses, adjusted research and development

expenses, adjusted operating loss, adjusted net income (loss),

adjusted net income (loss) attributable to ordinary shareholders,

adjusted basic and diluted earnings (loss) per ordinary share and

adjusted basic and diluted earnings (loss) per ADS (collectively,

the “Non-GAAP Financial Measures”) in evaluating its operating

results and for financial and operational decision-making purposes.

There was no income tax impact on the Company’s non-GAAP

adjustments because the non-GAAP adjustments are usually recorded

in entities located in tax-free jurisdictions, such as the Cayman

Islands.

The Company believes that the Non-GAAP Financial

Measures help identify underlying trends in its business that could

otherwise be distorted by the effects of items of (i) share-based

compensation expenses and (ii) certain non-operational expenses,

such as amortization of debt discounts, which are included in their

comparable GAAP measures. The Company believes that the Non-GAAP

Financial Measures provide useful information about its operating

results, enhance the overall understanding of its past performance

and future prospects and allow for greater visibility with respect

to key metrics used by its management members in their financial

and operational decision-making.

The Non-GAAP Financial Measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The Non-GAAP Financial Measures have limitations as analytical

tools. One of the key limitations of using the Non-GAAP Financial

Measures is that they do not reflect all items of expense that

affect the Company’s operations. Share-based compensation expenses

have been and may continue to be incurred in the business and are

not reflected in the presentation of the Non-GAAP Financial

Measures. Further, the Non-GAAP Financial Measures may differ from

the non-GAAP information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

Non-GAAP Financial Measures to the nearest U.S. GAAP measures, all

of which should be considered when evaluating the Company’s

performance.

Each of the Non-GAAP Financial Measures should

not be considered in isolation or construed as an alternative to

its comparable GAAP measure or any other measure of performance or

as an indicator of the Company’s operating performance or financial

results. Investors are encouraged to review the Company’s most

directly comparable GAAP measures in conjunction with the Non-GAAP

Financial Measures. The Non-GAAP Financial Measures presented here

may not be comparable to similarly titled measures presented by

other companies. Other companies may calculate similarly titled

measures differently, limiting their usefulness as comparative

measures to the Company’s data. The Company encourages investors

and others to review its financial information in its entirety and

not rely on a single financial measure.

For more information on the Non-GAAP Financial

Measures, please see the table captioned “Unaudited Reconciliations

of GAAP and Non-GAAP Results” set forth at the end of this press

release.

Exchange Rate

This press release contains translations of

certain RMB amounts into U.S. dollars (“USD”) at specified rates

solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to USD were made at the rate of RMB7.2672

to US$1.00, the noon buying rate in effect on June 28, 2024 in the

H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or USD amounts referred to in

this press release could have been converted into USD or RMB, as

the case may be, at any particular rate or at all.

Investor Contact:

ir@ehang.com

Media Contact: pr@ehang.com

_______________________________

1 The EH216 series products include EH216-S, the

standard model for passenger transportation, EH216-F model for

aerial firefighting, and EH216-L model for aerial logistics. 2

Adjusted operating loss is a non-GAAP financial measure, which is

defined as operating loss excluding share-based compensation

expenses. See “Non-GAAP Financial Measures” below.3 Adjusted net

income (loss) is a non-GAAP financial measure, which is defined as

net income (loss) excluding share-based compensation expenses and

certain non-operational expenses. Net loss was RMB71.6 million

(US$9.9 million) in the second quarter of 2024. See “Non-GAAP

Financial Measures” below.4 In April 2024, the Company entered into

an At Market Issuance Sales Agreement with China Renaissance

Securities (Hong Kong) Limited (the “sales agent”) relating to the

sale of ADSs for an aggregate offering price of up to US$100

million from time to time through or to the sales agent, as agent

or principal. The ADSs to be sold are registered under the

Registration Statement on Form F-3 (File No. 333-278830) filed with

the U.S. Securities and Exchange Commission on April 19, 2024.5

Adjusted operating expenses is a non-GAAP financial measure, which

is defined as operating expenses excluding share-based compensation

expenses. See “Non-GAAP Financial Measures” below.6 Adjusted

operating loss is a non-GAAP financial measure, which is defined as

operating loss excluding share-based compensation expenses. See

“Non-GAAP Financial Measures” below.7 Adjusted net income (loss) is

a non-GAAP financial measure, which is defined as net income (loss)

excluding share-based compensation expenses and certain

non-operational expenses. See “Non-GAAP Financial Measures” below.8

Adjusted basic and diluted net earnings (loss) per ordinary share

is a non-GAAP financial measure, which is defined as basic and

diluted loss per ordinary share excluding share-based compensation

expenses and certain non-operational expenses. See “Non-GAAP

Financial Measures” below.9 Adjusted basic and diluted net earnings

(loss) per ADS is a non-GAAP financial measure, which is defined as

basic and diluted loss per ADS excluding share-based compensation

expenses and certain non-operational expenses. See “Non-GAAP

Financial Measures” below.

|

EHANG HOLDINGS LIMITEDUNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS (Amounts in thousands

of Renminbi (“RMB”) and US dollars (“US$”)) |

| |

|

As of |

|

As of |

| |

|

December 31, 2023 |

|

June 30, 2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

228,250 |

|

623,436 |

|

85,788 |

|

Short-term deposits |

|

14,397 |

|

129,911 |

|

17,876 |

|

Short-term investments |

|

57,494 |

|

203,584 |

|

28,014 |

|

Restricted short-term deposits |

|

33,942 |

|

31,283 |

|

4,305 |

|

Notes receivable |

|

- |

|

33,900 |

|

4,665 |

| Accounts receivable,

net10 |

|

34,786 |

|

15,166 |

|

2,087 |

|

Inventories |

|

59,488 |

|

71,175 |

|

9,794 |

| Prepayments and other current

assets |

|

24,691 |

|

21,556 |

|

2,967 |

|

Total current assets |

|

453,048 |

|

1,130,011 |

|

155,496 |

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

| Property and equipment,

net |

|

44,623 |

|

41,989 |

|

5,778 |

| Operating lease right‑of‑use

assets, net |

|

74,528 |

|

120,783 |

|

16,620 |

|

Intangible assets, net |

|

2,426 |

|

2,382 |

|

328 |

|

Long-term loans receivable |

|

4,215 |

|

- |

|

- |

|

Long-term investments |

|

18,369 |

|

17,457 |

|

2,402 |

|

Other non-current assets |

|

1,436 |

|

2,063 |

|

284 |

|

Total non-current assets |

|

145,597 |

|

184,674 |

|

25,412 |

|

|

|

|

|

|

|

|

|

Total assets |

|

598,645 |

|

1,314,685 |

|

180,908 |

|

|

|

|

|

|

|

|

__________________________10 As of December 31,

2023 and June 30, 2024, amount due from a related party of RMB1,700

and RMB1,700 (US$234) are included in accounts receivable, net,

respectively.

|

EHANG HOLDINGS LIMITEDUNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS (CONT’D)(Amounts in

thousands of Renminbi (“RMB”) and US dollars (“US$”)) |

| |

|

As of |

|

As of |

| |

|

December 31, 2023 |

|

June 30, 2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Short-term bank loans |

|

69,798 |

|

|

|

69,435 |

|

|

|

9,555 |

|

|

Short-term debt |

|

- |

|

|

|

90,000 |

|

|

|

12,384 |

|

| Accounts payable |

|

35,101 |

|

|

|

73,965 |

|

|

|

10,178 |

|

| Contract liabilities11 |

|

37,169 |

|

|

|

138,553 |

|

|

|

19,066 |

|

| Current portion of long-term

bank loans |

|

3,538 |

|

|

|

4,000 |

|

|

|

550 |

|

| Mandatorily redeemable

non-controlling interests |

|

- |

|

|

|

40,000 |

|

|

|

5,504 |

|

| Accrued expenses and other

liabilities |

|

94,149 |

|

|

|

103,246 |

|

|

|

14,208 |

|

| Current portion of lease

liabilities |

|

5,595 |

|

|

|

10,265 |

|

|

|

1,413 |

|

| Deferred income |

|

1,549 |

|

|

|

1,559 |

|

|

|

215 |

|

| Deferred government

subsidies |

|

3,147 |

|

|

|

805 |

|

|

|

111 |

|

| Income taxes payable |

|

29 |

|

|

|

1 |

|

|

|

- |

|

| Total current

liabilities |

|

250,075 |

|

|

|

531,829 |

|

|

|

73,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Long-term bank loans |

|

9,308 |

|

|

|

14,000 |

|

|

|

1,926 |

|

| Mandatorily redeemable

non-controlling interests |

|

40,000 |

|

|

|

- |

|

|

|

- |

|

| Deferred tax liabilities |

|

292 |

|

|

|

292 |

|

|

|

40 |

|

|

Unrecognized tax benefit |

|

5,480 |

|

|

|

5,480 |

|

|

|

754 |

|

|

Lease liabilities |

|

75,308 |

|

|

|

119,094 |

|

|

|

16,388 |

|

| Deferred income |

|

1,486 |

|

|

|

718 |

|

|

|

99 |

|

| Other non-current

liabilities |

|

2,477 |

|

|

|

3,910 |

|

|

|

538 |

|

|

Total non-current liabilities |

|

134,351 |

|

|

|

143,494 |

|

|

|

19,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

384,426 |

|

|

|

675,323 |

|

|

|

92,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

|

|

|

|

|

|

| Ordinary shares |

|

80 |

|

|

|

85 |

|

|

|

12 |

|

| Additional paid-in

capital |

|

1,951,936 |

|

|

|

2,508,530 |

|

|

|

345,185 |

|

| Statutory reserves |

|

1,239 |

|

|

|

1,239 |

|

|

|

170 |

|

| Accumulated deficit |

|

(1,754,542 |

) |

|

|

(1,889,404 |

) |

|

|

(259,991 |

) |

| Accumulated other

comprehensive income |

|

15,079 |

|

|

|

18,646 |

|

|

|

2,566 |

|

| Total EHang Holdings

Limited shareholders’ equity |

|

213,792 |

|

|

|

639,096 |

|

|

|

87,942 |

|

| Non-controlling interests |

|

427 |

|

|

|

266 |

|

|

|

37 |

|

| Total shareholders’

equity |

|

214,219 |

|

|

|

639,362 |

|

|

|

87,979 |

|

|

Total liabilities and shareholders’ equity |

|

598,645 |

|

|

|

1,314,685 |

|

|

|

180,908 |

|

__________________________11 As of December 31,

2023 and June 30, 2024, amount due to a related party of RMB2,000

and RMB2,000 (US$275) are included in contract liabilities,

respectively.

|

EHANG HOLDINGS LIMITEDUNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2023 |

|

March 31,2024 |

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Total revenues |

|

10,006 |

|

|

61,727 |

|

|

102,019 |

|

14,038 |

|

|

32,207 |

|

|

163,746 |

|

22,532 |

|

| Costs of revenues |

|

(3,986 |

) |

|

(23,536 |

) |

|

(38,367 |

) |

(5,279 |

) |

|

(11,993 |

) |

|

(61,903 |

) |

(8,518 |

) |

| Gross

profit |

|

6,020 |

|

|

38,191 |

|

|

63,652 |

|

8,759 |

|

|

20,214 |

|

|

101,843 |

|

14,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(13,526 |

) |

|

(20,224 |

) |

|

(27,321 |

) |

(3,759 |

) |

|

(26,000 |

) |

|

(47,545 |

) |

(6,542 |

) |

|

General and administrative expenses |

|

(31,061 |

) |

|

(49,676 |

) |

|

(54,235 |

) |

(7,463 |

) |

|

(56,057 |

) |

|

(103,911 |

) |

(14,299 |

) |

|

Research and development expenses |

|

(37,414 |

) |

|

(37,836 |

) |

|

(61,800 |

) |

(8,504 |

) |

|

(91,489 |

) |

|

(99,636 |

) |

(13,710 |

) |

| Total operating

expenses |

|

(82,001 |

) |

|

(107,736 |

) |

|

(143,356 |

) |

(19,726 |

) |

|

(173,546 |

) |

|

(251,092 |

) |

(34,551 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income |

|

676 |

|

|

3,707 |

|

|

2,261 |

|

311 |

|

|

2,281 |

|

|

5,968 |

|

821 |

|

| Operating

loss |

|

(75,305 |

) |

|

(65,838 |

) |

|

(77,443 |

) |

(10,656 |

) |

|

(151,051 |

) |

|

(143,281 |

) |

(19,716 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and investment income |

|

966 |

|

|

2,864 |

|

|

6,763 |

|

931 |

|

|

1,949 |

|

|

9,627 |

|

1,325 |

|

|

Interest expenses |

|

(816 |

) |

|

(859 |

) |

|

(799 |

) |

(110 |

) |

|

(1,530 |

) |

|

(1,658 |

) |

(228 |

) |

|

Amortization of debt discounts |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

(12,023 |

) |

|

- |

|

- |

|

|

Foreign exchange loss |

|

(1,028 |

) |

|

(245 |

) |

|

(483 |

) |

(66 |

) |

|

(1,124 |

) |

|

(728 |

) |

(100 |

) |

|

Other non-operating income, net |

|

2,075 |

|

|

1,037 |

|

|

911 |

|

125 |

|

|

2,726 |

|

|

1,948 |

|

268 |

|

| Total other income

(expense) |

|

1,197 |

|

|

2,797 |

|

|

6,392 |

|

880 |

|

|

(10,002 |

) |

|

9,189 |

|

1,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax

and loss from equity method investment |

|

(74,108 |

) |

|

(63,041 |

) |

|

(71,051 |

) |

(9,776 |

) |

|

(161,053 |

) |

|

(134,092 |

) |

(18,451 |

) |

|

Income tax expenses |

|

(13 |

) |

|

(1 |

) |

|

(18 |

) |

(2 |

) |

|

(14 |

) |

|

(19 |

) |

(3 |

) |

| Loss before loss from

equity method investment |

|

(74,121 |

) |

|

(63,042 |

) |

|

(71,069 |

) |

(9,778 |

) |

|

(161,067 |

) |

|

(134,111 |

) |

(18,454 |

) |

|

Loss from equity method investment |

|

(1,607 |

) |

|

(347 |

) |

|

(565 |

) |

(78 |

) |

|

(1,697 |

) |

|

(912 |

) |

(125 |

) |

| Net loss |

|

(75,728 |

) |

|

(63,389 |

) |

|

(71,634 |

) |

(9,856 |

) |

|

(162,764 |

) |

|

(135,023 |

) |

(18,579 |

) |

|

EHANG HOLDINGS LIMITEDUNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (CONT’D)

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2023 |

|

March 31,2024 |

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net loss |

|

(75,728 |

) |

|

(63,389 |

) |

|

(71,634 |

) |

(9,856 |

) |

|

(162,764 |

) |

|

(135,023 |

) |

(18,579 |

) |

| Net loss attributable to

non-controlling interests |

|

165 |

|

|

64 |

|

|

97 |

|

13 |

|

|

376 |

|

|

161 |

|

22 |

|

| Net loss attributable

to ordinary shareholders |

|

(75,563 |

) |

|

(63,325 |

) |

|

(71,537 |

) |

(9,843 |

) |

|

(162,388 |

) |

|

(134,862 |

) |

(18,557 |

) |

| Net loss per ordinary

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

(0.63 |

) |

|

(0.50 |

) |

|

(0.54 |

) |

(0.07 |

) |

|

(1.37 |

) |

|

(1.04 |

) |

(0.14 |

) |

| Shares used in net

loss per ordinary share computation (in thousands of

shares): |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

120,159 |

|

|

126,704 |

|

|

131,537 |

|

131,537 |

|

|

118,286 |

|

|

129,120 |

|

129,120 |

|

| Diluted |

|

120,159 |

|

|

126,704 |

|

|

131,537 |

|

131,537 |

|

|

118,286 |

|

|

129,120 |

|

129,120 |

|

| Loss per ADS (2 ordinary

shares equal to 1 ADS)Basic and diluted |

|

(1.26 |

) |

|

(1.00 |

) |

|

(1.08 |

) |

(0.14 |

) |

|

(2.74 |

) |

|

(2.08 |

) |

(0.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments net of nil tax |

|

4,968 |

|

|

751 |

|

|

2,816 |

|

387 |

|

|

4,246 |

|

|

3,567 |

|

491 |

|

| Total other

comprehensive income, net of tax |

|

4,968 |

|

|

751 |

|

|

2,816 |

|

387 |

|

|

4,246 |

|

|

3,567 |

|

491 |

|

| Comprehensive

loss |

|

(70,760 |

) |

|

(62,638 |

) |

|

(68,818 |

) |

(9,469 |

) |

|

(158,518 |

) |

|

(131,456 |

) |

(18,088 |

) |

| Comprehensive loss

attributable to non-controlling interests |

|

165 |

|

|

64 |

|

|

97 |

|

13 |

|

|

376 |

|

|

161 |

|

22 |

|

| Comprehensive loss

attributable to ordinary shareholders |

|

(70,595 |

) |

|

(62,574 |

) |

|

(68,721 |

) |

(9,456 |

) |

|

(158,142 |

) |

|

(131,295 |

) |

(18,066 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EHANG HOLDINGS LIMITEDUNAUDITED

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”) except for per share data and per ADS data) |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2023 |

|

March 31,2024 |

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Gross profit |

|

6,020 |

|

|

38,191 |

|

|

63,652 |

|

8,759 |

|

|

20,214 |

|

|

101,843 |

|

14,014 |

|

| Plus: Share-based

compensation |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

| Adjusted gross profit |

|

6,020 |

|

|

38,191 |

|

|

63,652 |

|

8,759 |

|

|

20,214 |

|

|

101,843 |

|

14,014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

|

(13,526 |

) |

|

(20,224 |

) |

|

(27,321 |

) |

(3,759 |

) |

|

(26,000 |

) |

|

(47,545 |

) |

(6,542 |

) |

| Plus: Share-based

compensation |

|

4,656 |

|

|

8,817 |

|

|

11,725 |

|

1,613 |

|

|

9,607 |

|

|

20,542 |

|

2,827 |

|

| Adjusted sales and marketing

expenses |

|

(8,870 |

) |

|

(11,407 |

) |

|

(15,596 |

) |

(2,146 |

) |

|

(16,393 |

) |

|

(27,003 |

) |

(3,715 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and

administrative expenses |

|

(31,061 |

) |

|

(49,676 |

) |

|

(54,235 |

) |

(7,463 |

) |

|

(56,057 |

) |

|

(103,911 |

) |

(14,299 |

) |

| Plus: Share-based

compensation |

|

10,693 |

|

|

29,521 |

|

|

31,848 |

|

4,382 |

|

|

19,857 |

|

|

61,369 |

|

8,445 |

|

| Adjusted general and

administrative expenses |

|

(20,368 |

) |

|

(20,155 |

) |

|

(22,387 |

) |

(3,081 |

) |

|

(36,200 |

) |

|

(42,542 |

) |

(5,854 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development expenses |

|

(37,414 |

) |

|

(37,836 |

) |

|

(61,800 |

) |

(8,504 |

) |

|

(91,489 |

) |

|

(99,636 |

) |

(13,710 |

) |

| Plus: Share-based

compensation |

|

8,607 |

|

|

14,948 |

|

|

29,211 |

|

4,020 |

|

|

35,931 |

|

|

44,159 |

|

6,076 |

|

| Adjusted research and

development expenses |

|

(28,807 |

) |

|

(22,888 |

) |

|

(32,589 |

) |

(4,484 |

) |

|

(55,558 |

) |

|

(55,477 |

) |

(7,634 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

(82,001 |

) |

|

(107,736 |

) |

|

(143,356 |

) |

(19,726 |

) |

|

(173,546 |

) |

|

(251,092 |

) |

(34,551 |

) |

| Plus: Share-based

compensation |

|

23,956 |

|

|

53,286 |

|

|

72,784 |

|

10,015 |

|

|

65,395 |

|

|

126,070 |

|

17,348 |

|

| Adjusted operating

expenses |

|

(58,045 |

) |

|

(54,450 |

) |

|

(70,572 |

) |

(9,711 |

) |

|

(108,151 |

) |

|

(125,022 |

) |

(17,203 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

(75,305 |

) |

|

(65,838 |

) |

|

(77,443 |

) |

(10,656 |

) |

|

(151,051 |

) |

|

(143,281 |

) |

(19,716 |

) |

| Plus: Share-based

compensation |

|

23,956 |

|

|

53,286 |

|

|

72,784 |

|

10,015 |

|

|

65,395 |

|

|

126,070 |

|

17,348 |

|

| Adjusted operating loss |

|

(51,349 |

) |

|

(12,552 |

) |

|

(4,659 |

) |

(641 |

) |

|

(85,656 |

) |

|

(17,211 |

) |

(2,368 |

) |

|

EHANG HOLDINGS LIMITEDUNAUDITED

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(CONT’D) (Amounts in thousands of Renminbi

(“RMB”) and US dollars (“US$”) except for per share data and per

ADS data) |

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30,2023 |

|

March 31,2024 |

|

June 30,2024 |

|

June 30,2023 |

|

June 30,2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

US$ |

|

RMB |

|

RMB |

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net loss |

|

(75,728 |

) |

|

(63,389 |

) |

|

(71,634 |

) |

(9,856 |

) |

|

(162,764 |

) |

|

(135,023 |

) |

(18,579 |

) |

| Plus: Share-based

compensation |

|

23,956 |

|

|

53,286 |

|

|

72,784 |

|

10,015 |

|

|

65,395 |

|

|

126,070 |

|

17,348 |

|

| Plus: Amortization of debt

discounts |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

12,023 |

|

|

- |

|

- |

|

| Adjusted net (loss)

income |

|

(51,772 |

) |

|

(10,103 |

) |

|

1,150 |

|

159 |

|

|

(85,346 |

) |

|

(8,953 |

) |

(1,231 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable

to ordinary shareholders |

|

(75,563 |

) |

|

(63,325 |

) |

|

(71,537 |

) |

(9,843 |

) |

|

(162,388 |

) |

|

(134,862 |

) |

(18,557 |

) |

| Plus: Share-based

compensation |

|

23,956 |

|

|

53,286 |

|

|

72,784 |

|

10,015 |

|

|

65,395 |

|

|

126,070 |

|

17,348 |

|

| Plus: Amortization of debt

discounts |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

12,023 |

|

|

- |

|

- |

|

| Adjusted net (loss) income

attributable to ordinary shareholders |

|

(51,607 |

) |

|

(10,039 |

) |

|

1,247 |

|

172 |

|

|

(84,970 |

) |

|

(8,792 |

) |

(1,209 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in net

earnings (loss) per ordinary share computation (in thousands of

shares): |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

120,159 |

|

|

126,704 |

|

|

131,537 |

|

131,537 |

|

|

118,286 |

|

|

129,120 |

|

129,120 |

|

| Diluted |

|

120,159 |

|

|

126,704 |

|

|

134,037 |

|

134,037 |

|

|

118,286 |

|

|

129,120 |

|

129,120 |

|

| Adjusted basic and diluted net

earnings (loss) per ordinary share |

|

(0.43 |

) |

|

(0.08 |

) |

|

0.01 |

|

0.001 |

|

|

(0.72 |

) |

|

(0.07 |

) |

(0.01 |

) |

| Adjusted basic and diluted net

earnings (loss) per ADS |

|

(0.86 |

) |

|

(0.16 |

) |

|

0.02 |

|

0.002 |

|

|

(1.44 |

) |

|

(0.14 |

) |

(0.02 |

) |

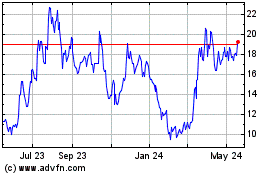

EHang (NASDAQ:EH)

Historical Stock Chart

From Nov 2024 to Dec 2024

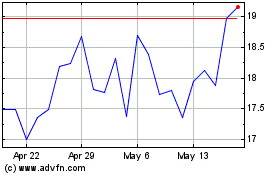

EHang (NASDAQ:EH)

Historical Stock Chart

From Dec 2023 to Dec 2024