Form S-3 - Registration statement under Securities Act of 1933

July 31 2024 - 3:28PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 31, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EMCORE CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| |

New Jersey

(State or other jurisdiction of

incorporation or organization)

|

|

|

22-2746503

(I.R.S. Employer

Identification Number)

|

|

450 Clark Drive

Budd Lake, NJ 07828

(626) 293-3400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas P. Minichiello

Chief Financial Officer

EMCORE Corporation

450 Clark Drive

Budd Lake, NJ 07828

(626) 293-3400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James J. Masetti

Julie Park

Pillsbury Winthrop Shaw Pittman LLP

2550 Hanover Street

Palo Alto, CA 94304-1115

Telephone: (650) 233-4500

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective, as determined by market conditions and other factors.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☒

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☒

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 31, 2024.

PROSPECTUS

1,810,528 Shares

EMCORE CORPORATION

Common Stock

This prospectus relates to the resale from time to time by the selling stockholder identified in this prospectus of up to 1,810,528 shares of our common stock, no par value per share, issuable upon the exercise of a warrant to purchase our common stock, or the Warrant. When we refer to the selling stockholder in this prospectus, we are referring to the entity named in this prospectus as the selling stockholder and, as applicable, its permitted transferees, pledgees, assignees, distributees, donees or successors or others who later hold any of the selling stockholder’s interests. We issued the Warrant in connection with the forbearance agreement and second amendment to credit agreement, or the Forbearance Agreement, dated April 29, 2024, as more fully described in the section entitled “Prospectus Summary — The Transaction.” We will not receive any proceeds from any sale by the selling stockholder of the shares of our common stock offered by this prospectus and any prospectus supplement, but in some cases we have agreed to pay certain registration expenses. We will receive the proceeds from any exercise of the Warrant on a cash basis.

Our registration of the shares of our common stock covered by this prospectus does not mean that the selling stockholder will offer or sell any of the shares of our common stock. The selling stockholder identified in this prospectus may sell the shares of our common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholder may sell the securities in the section entitled “Plan of Distribution.”

Our common stock is listed on the Nasdaq Global Market under the symbol “EMKR.” On July 30, 2024, the last reported sale price of our common stock on the Nasdaq Global Market was $1.22 per share.

Investing in our common stock involves risks. See the section entitled “Risk Factors” on page 3 of this prospectus and “Item 1A — Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q that are incorporated by reference in this prospectus before making an investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

10

|

|

|

Neither we, the selling stockholder nor any underwriter, if any, has authorized anyone to provide any information other than that contained or incorporated by reference into this prospectus, any applicable prospectus supplement or any free writing prospectus prepared by or on behalf of us or to which we have referred you, and you should not rely on any other information. Neither we, the selling stockholder nor any underwriter, if any, takes any responsibility for, and none of the foregoing can provide any assurance as to the reliability of, any other information that others may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus and any prospectus supplement, or incorporated by reference herein or therein, is accurate only as of the dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus and any prospectus supplement for a specific offering of securities, together with additional information described in the section entitled “Where You Can Find More Information” below, before making an investment decision. If there is any inconsistency between this prospectus and the information contained in a prospectus supplement or any free writing prospectus prepared by or on behalf of us to which we have referred you, you should rely on the information in the prospectus supplement or such free writing prospectus.

Information about the selling stockholder may change over time. Any changed information given to us by the selling stockholder will be set forth in a prospectus supplement if and when necessary. Further, in some cases, the selling stockholder will also be required to provide a prospectus supplement containing specific information about the terms on which they are offering and selling shares of our common stock. If a prospectus supplement is provided and the description of the offering in the prospectus supplement varies from the information in this prospectus, you should rely on the information in the prospectus supplement.

We use various trademarks and trade names in our business, including without limitation our corporate name and logo. This prospectus and the documents incorporated by reference into this prospectus may also contain trademarks and trade names that are the property of their respective owners.

Unless the context otherwise requires, references in this prospectus to “EMCORE,” “we,” “us” and “our” refer to EMCORE Corporation and its subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before you decide to invest in our common stock, you should read carefully and in their entirety this entire prospectus, including the section entitled “Risk Factors,” and the documents we have incorporated by reference in this prospectus, along with our financial statements and accompanying notes incorporated by reference in this prospectus.

Our Company

We are a leading provider of sensors and navigation systems for the aerospace and defense market. Over the last five years, we have expanded our scale and portfolio of inertial sensor products through the acquisitions of Systron Donner Inertial, Inc. (“SDI”) in June 2019, the Space and Navigation business of L3Harris Technologies, Inc. (“S&N”) in April 2022, and the FOG and Inertial Navigation Systems business of KVH Industries, Inc. (“EMCORE Chicago”) in August 2022. Our multi-year transition from a broadband company to an inertial navigation company has now been completed following the sales of (i) our cable TV, wireless, sensing and defense optoelectronics business lines and (ii) our chips business line and indium phosphide wafer fabrication operations.

We have fully vertically-integrated manufacturing capability at our facilities in Budd Lake, NJ, Concord, CA, and Tinley Park, IL (the “Tinley Park Facility”) and Alhambra, CA. These facilities support our manufacturing strategy for Fiber Optic Gyroscope (“FOG”), Ring Laser Gyro (“RLG”), Photonic Integrated Chip (“PIC”), and Quartz Micro Electro-Mechanical System (“QMEMS”) products for inertial navigation. Our manufacturing facilities maintain ISO 9001 quality management certification, and we are AS9100 aerospace quality certified at our facilities in Alhambra, CA, Concord, CA, and Budd Lake, NJ. Our best-in-class components and systems support a broad array of inertial navigation applications.

Our operations include wafer fabrication (lithium niobate and quartz), device design and production, fiber optic module and subsystem design and manufacture, and PIC-based and QMEMS-based component design and manufacture. Many of our manufacturing operations are computer-monitored or controlled to enhance production output and statistical control. Our manufacturing processes involve extensive quality assurance systems and performance testing. We have one reporting segment, Inertial Navigation, whose product technology categories include: (a) FOG, (b) QMEMS, and (c) RLG, in each case which serves the aerospace and defense market.

Corporate Information

We were incorporated in 1986 as a New Jersey corporation. We became publicly traded in 1997 and our common stock is listed on the Nasdaq Global Market under the ticker symbol EMKR. Our headquarters and principal executive offices are located in Budd Lake, New Jersey and our main telephone number is (626) 293-3400. For specific information about our products or the markets served please visit our website at www.emcore.com. The information contained in or linked to our website is not a part of, nor incorporated by reference into, this this prospectus supplement, the accompanying prospectus or any part of any other report or filing with the SEC.

The Transaction

On April 29, 2024, we entered into the Forbearance Agreement with HCP-FVU, LLC, the selling stockholder. In consideration of the forbearance under the Forbearance Agreement, we issued the Warrant to HCP-FVU, LLC to purchase an aggregate of 1,810,528 shares of our common stock at an exercise price of $2.73 per share (which was the average closing price of the common stock for the five trading days immediately preceding the date of the issuance of the Warrant), subject to certain adjustments.

Under the terms of the Warrant, we have agreed to prepare and file the registration statement of which this prospectus forms a part to effect a registration of our common stock issuable upon the exercise of the Warrant, covering the resale of the number of common stock as may become issuable upon the exercise of the Warrant.

The Offering

Shares of common stock offered for resale by the selling stockholder

Up to 1,810,528 shares of common stock issuable upon the exercise of the Warrant.

We will not receive any proceeds from the sale of common stock by the selling stockholder. The selling stockholder may exercise the warrant in cash, on a cashless basis, or a combination thereof. If exercised in full in cash, we will receive up to an aggregate of approximately $4.9 million. We intend to use the proceeds from the exercise of the Warrant on a cash basis, if any, for general corporate and working capital purposes. There is no assurance that the selling stockholder will elect to exercise any or all of the warrant, or to exercise in cash.

Nasdaq Global Market symbol

EMKR

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors described below, as well as the risk factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as any prospectus supplement to this prospectus, and the other information contained in or incorporated by reference into this prospectus and any prospectus supplement to this prospectus before deciding to invest in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected.

Our stock price is volatile, and you may not be able to sell shares of our common stock at or above the price you paid.

The trading price of our common stock is volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control. These factors include:

•

actual or anticipated fluctuations in our operating results;

•

failure to meet or exceed financial estimates and projections;

•

issuance of new or updated research or reports by securities analysts or changed recommendations for our stock;

•

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments;

•

the timing and magnitude of our investments in the growth of our business;

•

actual or anticipated changes in regulatory oversight of our business;

•

additions or departures of key management or other personnel;

•

disputes or other developments related to our intellectual property or other proprietary rights, including litigation;

•

general economic and market conditions; and

•

issuances of significant amounts of our common stock.

In addition, the stock market has historically experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of public companies. Broad market factors may seriously affect the market price of our common stock, regardless of our actual operating performance. Moreover, in the past, following periods of volatility in the overall market and the market price of a particular company’s securities, securities class action litigation has often been instituted against the companies. This litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources.

Sales of a substantial number of shares of our common stock in the public market could cause our stock price to fall.

Sales of a substantial number of shares of our common stock in the public market or the perception that these sales might occur could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that sales may have on the prevailing market price of our common stock. In addition, the sale of substantial amounts of our common stock could adversely impact its price. As of July 25, 2024, we had outstanding 9,066,620 shares of our common stock, options to purchase 632 shares of our common stock (of which 632 were exercisable as of that date) and restricted stock units, or RSUs, representing 1,013,983 shares of our common stock (which includes an estimated number of RSUs, subject to certain employees’ continued service with us, or time-based RSUs, and RSUs that are performance based RSUs). The foregoing does not include 1,856,899 shares of our common stock, including the 1,810,528 shares that we

are registering for resale by this prospectus. In addition, as of July 25, 2024, 43,271 and 3,100 shares of common stock are available for future issuance under our 2019 Equity Stock Incentive Plan and the 2022 New Employee Inducement Plan, respectively. The sale or the availability for sale of a large number of shares of our common stock in the public market could cause the price of our common stock to decline.

We have never paid dividends on our capital stock, and we do not anticipate paying dividends in the foreseeable future.

We have never paid dividends on any of our capital stock and currently intend to retain any future earnings to fund the growth of our business. In addition, the terms of our credit agreement restrict our ability to pay dividends. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for the foreseeable future.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the Securities and Exchange Commission, or the SEC, that are incorporated herein by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that involve risks and uncertainties. These statements relate to future periods, future events or our future operating or financial plan or performance. These statements can often be identified by the use of forward-looking terminology such as “expects,” “believes,” “intends,” “anticipates,” “estimates,” “plans,” “may,” or “will,” or the negative of these terms, and other similar expressions. These forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. These risks and uncertainties could cause actual results to differ materially from those projected. We discuss many of these risks and uncertainties in greater detail in the section entitled “Risk Factors” and in the documents that are incorporated by reference into this prospectus, which address additional factors that could cause results or events to differ from those set forth in the forward-looking statements. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by federal securities laws, we undertake no obligation to update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

USE OF PROCEEDS

All of the shares of common stock being offered hereby are being sold by the selling stockholder identified in this prospectus. We will not receive any proceeds from the sale of common stock by the selling stockholder. The selling stockholder may exercise the warrant in cash, on a cashless basis, or a combination thereof. If exercised in full in cash, we will receive up to an aggregate of approximately $4.9 million. We intend to use the proceeds from the exercise of the Warrant on a cash basis, if any, for general corporate and working capital purposes. There is no assurance that the selling stockholder will elect to exercise any or all of the warrant, or to exercise in cash.

SELLING STOCKHOLDER

The selling stockholder listed in the table below may from time to time offer and sell any or all of the shares of common stock set forth below pursuant to this prospectus. When we refer to the selling stockholder in this prospectus, we refer to the person listed in the table below, and the pledgees, donees, transferees, assignees, successors and other permitted transferees that hold any of the selling stockholder’s interest in the shares of common stock after the date of this prospectus.

The following table sets forth certain information provided by or on behalf of the selling stockholder concerning shares of our common stock that may be offered from time to time by the selling stockholder pursuant to this prospectus. The selling stockholder identified below may have sold, transferred or otherwise disposed of all or a portion of its securities after the date on which it provided us with information regarding their securities. Any changed or new information given to us by the selling stockholder, including regarding the identity of, and the securities held by, the selling stockholder, will be set forth in a prospectus supplement or amendments to the registration statement of which this prospectus is a part, if and when necessary. The selling stockholder may sell all, some or none of such securities in this offering. See “Plan of Distribution.”

We have determined beneficial ownership in accordance with the rules of the SEC. To our knowledge, the selling stockholder has not held any position or office or had any other material relationship with us or our affiliates during the three years prior to the date of issuance and sale of the Notes.

|

Name of Selling Stockholder

|

|

|

Number of Shares

Beneficially

Owned Prior to

Offering(1)

|

|

|

Number of

Shares Being

Offered(2)

|

|

|

Shares Beneficially

Owned After Offering

|

|

| |

Number(3)

|

|

|

Percent

|

|

|

HCP-FVU, LLC(4)

|

|

|

|

|

1,810,528 |

|

|

|

|

|

1,810,528 |

|

|

|

|

|

0 |

|

|

|

|

|

— |

|

|

(1)

The number of shares being offered includes shares that will become issuable upon the exercise of the Warrant.

(2)

The table assumes that we will become obligated to issue the maximum number of shares upon the exercise of the Warrant and the selling stockholder will sell all of its shares offered pursuant to this prospectus. We are unable to determine the number of shares that will actually be sold pursuant to this prospectus.

(3)

The number of shares beneficially owned after the offering assumes that the full amount of the Warrant has been exercised. Information with respect to shares owned beneficially after the offering assumes the sale of all of the shares offered and that no other purchases or sales of our securities by the selling stockholder have occurred or will occur.

(4)

The address of the selling stockholder is HCP FVU LLC, c/o Hale Capital Partners, 17 State St., Suite 3230, New York, NY 10004 Attention: Martin Hale.

PLAN OF DISTRIBUTION

The selling stockholder, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from the selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of its shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholder may use any one or more of the following methods when disposing of shares or interests therein:

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

short sales;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

broker-dealers may agree with the selling stockholder to sell a specified number of such shares at a stipulated price per share;

•

a combination of any such methods of sale; and

•

any other method permitted by applicable law.

The selling stockholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholder to include the pledgee, transferee or other successors in interest as selling stockholder under this prospectus. The selling stockholder also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholder may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholder from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholder reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents.

The selling stockholder also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that they meet the criteria and conform to the requirements of that rule.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholder, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus. In order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholder that the anti-manipulation rules of Regulation M under the Exchange Act, as amended, may apply to sales of shares in the market and to the activities of the selling stockholder and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholder for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholder may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the selling stockholder against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

We have agreed with the selling stockholder to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (i) the fifth anniversary of the effective date of such registration statement, (ii) such time as all of the shares of common stock covered by the registration statement have been sold publicly or (iii) such time as all of the shares of common stock covered by the registration statement may be sold by the selling stockholder pursuant to Rule 144 without volume limitations and without the requirement that there be adequate current public information with regards to us.

LEGAL MATTERS

The validity of the shares of common stock offered by this prospectus will be passed upon for us by Connell Foley LLP, Roseland, New Jersey.

EXPERTS

The consolidated financial statements of EMCORE Corporation (the Company) as of September 30, 2023 and 2022, and for each of the years then ended, have been incorporated by reference herein and in the registration statement in reliance upon the reports of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report covering the September 30, 2023 consolidated financial statements contains an explanatory paragraph that states that the Company’s recurring losses from operations raise substantial doubt about the entity’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty. The audit report on the effectiveness of internal control over financial reporting as of September 30, 2023, expresses an opinion that the Company did not maintain effective internal control over financial reporting as of September 30, 2023 because of the effect of a material weakness on the achievement of the objectives of the control criteria and contains an explanatory paragraph that states that a material weakness related to ineffective controls over new or novel transactions as a result of ineffective communication has been identified and included in management’s assessment.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-3 with the SEC under the Securities Act. This prospectus is part of the registration statement but the registration statement includes and incorporates by reference additional information and exhibits. We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding companies, such as ours, that file documents electronically with the SEC. The address of that website is http://www.sec.gov. The information on the SEC’s website is not part of this prospectus, and any references to this website or any other website are inactive textual references only.

The SEC permits us to “incorporate by reference” the information contained in documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to be part of this prospectus and you should read it with the same care that you read this prospectus. Later information that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus, and will be considered to be a part of this prospectus from the date those documents are filed. We have filed with the SEC, and incorporate by reference in this prospectus:

•

•

•

our Current Reports on Form 8-K filed with the SEC on October 12, 2023, January 11, 2024 (as amended on January 31, 2024), February 8, 2024, February 21, 2024, March 20, 2024, March 25, 2024, April 23, 2024, May 2, 2024, May 8, 2024, May 16, 2024, May 23, 2024, June 21, 2024, July 10, 2024 and July 31, 2024; and

•

the description of our common stock set forth in Exhibit 4.2 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023.

We also incorporate by reference all additional documents that we file with the SEC under the terms of Section 13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the filing date of the registration statement of which this prospectus is a part, as well as between the date of this prospectus and the termination of any offering of common stock offered by this prospectus. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance with SEC rules.

You may request a copy of any or all of the documents incorporated by reference but not delivered with this prospectus, at no cost, by writing or telephoning us at the following address and number: EMCORE Corporation, 450 Clark Dr., Budd Lake, NJ 07828 and (626) 293-3400. We will not, however, send exhibits to those documents, unless the exhibits are specifically incorporated by reference in those documents.

We make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. You may also obtain a free copy of these reports in the Investor Relations section of our website, www.emcore.com.

PART II

Information Not Required In Prospectus

Item 14. Other Expenses of Issuance and Distribution.

The following is a statement of estimated expenses in connection with the issuance and distribution of the securities being registered. All of the amounts are estimated except the SEC registration fee.

| |

SEC registration fee

|

|

|

|

$ |

315.34 |

|

|

| |

Legal fees and expenses

|

|

|

|

|

20,000.00 |

|

|

| |

Accounting fees and expenses

|

|

|

|

|

30,000.00 |

|

|

| |

Printing and miscellaneous fees and expenses

|

|

|

|

|

9,684.66 |

|

|

| |

|

|

|

|

$ |

60,000.00 |

|

|

Item 15. Indemnification of Directors and Officers.

Section 14A:3-5 of the New Jersey Business Corporation Act provides that a corporation may indemnify a corporate agent made a party to a proceeding (other than a proceeding by or in the right of the corporation) by reason of the fact that such person was a corporate agent, against expenses and liabilities in connection with any proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal proceeding (other than a proceeding by or in the right of the corporation) has no reasonable cause to believe his or her conduct was unlawful.

The Registrant’s Restated Certificate of Incorporation, as amended, and By-Laws, as amended, include provisions (i) to reduce the personal liability of the Registrant’s directors for monetary damage resulting from breaches of their fiduciary duty, and (ii) to permit the Registrant to indemnify its directors and officers to the fullest extent permitted by New Jersey law. The Registrant has obtained directors’ and officers’ liability insurance that insures such persons against the costs of defense, settlement, or payment of a judgment under certain circumstances. The Registrant has also entered into indemnification agreements with each of its executive officers and directors. The form of such indemnification agreement is attached as Exhibit 10.2 to the Registrant’s Quarterly Report on Form 10-Q, filed with the SEC on August 6, 2020.

Item 16. Exhibits.

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Budd Lake, State of New Jersey, on July 31, 2024.

EMCORE CORPORATION

By:

/s/ Matthew Vargas

Matthew Vargas

Interim Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Matthew Vargas and Thomas P. Minichiello, and each of them, his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this Registration Statement, and any registration statement relating to the offering covered by this Registration Statement and filed pursuant to Rule 462(b) under the Securities Act of 1933, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys in fact and agents or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ Matthew Vargas

Matthew Vargas

|

|

|

Interim Chief Executive Officer (Principal

Executive Officer) and Director

|

|

|

July 31, 2024

|

|

| |

/s/ Thomas P. Minichiello

Thomas P. Minichiello

|

|

|

Chief Financial Officer

(Principal Financial Officer and Accounting Officer)

|

|

|

July 31, 2024

|

|

| |

/s/ Cletus C. Glasener

Cletus C. Glasener

|

|

|

Chair of the Board and Director

|

|

|

July 31, 2024

|

|

| |

/s/ Bruce E. Grooms

Bruce E. Grooms

|

|

|

Director

|

|

|

July 31, 2024

|

|

| |

/s/ David Rogers

David Rogers

|

|

|

Director

|

|

|

July 31, 2024

|

|

| |

/s/ Jeffrey J. Roncka

Jeffrey J. Roncka

|

|

|

Director

|

|

|

July 31, 2024

|

|

Exhibit 5.1

Connell Foley LLP

56 Livingston Avenue

Roseland , NJ 07068

P 973.535.0500 F 973.535.9217

July 31 , 2024

EMCORE Corporation

450 Clark Dr.,

Budd Lake, NJ 07828

Re: Registration

of Securities of EMCORE Corporation

Ladies and Gentlemen:

We have acted as

special New Jersey counsel for EMCORE Corporation, a New Jersey corporation (the “Company”), in connection with the filing of

the Registration Statement on Form S-3 (the “Registration Statement”) with the Securities and Exchange Commission (the

“SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration under the

Securities Act and the proposed issuance and sale from time to time pursuant to Rule 415 under the Securities Act of up to 1,810,528

shares of common stock, no par value (the “Common Stock”) issuable upon the exercise of a warrant to purchase the Common Stock

(the “Warrant”). Common Stock shall include any additional amounts of such common stock the offer and sale of which are registered

pursuant to a registration statement filed pursuant to Rule 462(b) under the Securities Act in connection with one or more offerings

contemplated by such Registration Statement. Such Registration Statement, as amended, and including any registration statement related

thereto and filed pursuant to Rule 462(b) under the Act, is herein referred to as the “Registration Statement.”

In rendering this

opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of the following documents, each

of which is dated the date hereof unless otherwise indicated:

| (i) | Registration Statement; |

| (ii) | Prospectus relating to the offer and sale of the Common Stock (the “Prospectus”); |

| (iii) | Restated Certificate of Incorporation of the Company dated April 4, 2008, as amended through March 25,

2024 (the “Certificate of Incorporation”); |

| (iv) | By-Laws of the Company, as amended through February 20, 2024 (the “By-Laws”); |

www.connellfoley.com

EMCORE Corporation

July 31, 2024

Page2

| (v) | Certificate dated July 26, 2024, issued by the State Treasurer, State of New Jersey, as to the Company’s

good standing in State of New Jersey (the “Good Standing Certificate”); and |

| (vi) | Minutes of meetings and/or written consents of the Board of Directors of the Company as provided to us

by the Company, and such other documents, corporate records, certificates of corporate officers and public officials and such other instruments

as we have deemed necessary or advisable for the purpose of rendering this opinion (the “Resolutions”). |

In such examination, we have

assumed, with your consent and without independent investigation, that: (a) each document submitted to us for review is authentic,

accurate, and complete, each such document that is a copy conforms to an authentic original, and all signatures on each such document

are genuine; and (b) each certificate issued by a governmental official, office, or agency concerning an entity’s status, including,

but not limited to, certificates of corporate status, is accurate, complete, and authentic.

We have been furnished with,

and with your consent have relied upon, a certificate of an officer of the Company with respect to certain factual matters (the “Factual

Certificate”). As to matters of fact material to the opinions set forth herein, we have relied upon the accuracy of the matters addressed

in the Factual Certificate. We have assumed, without independent investigation, that such statements and representations are true, correct

and complete, in all material respects and we have no actual knowledge that such matters of fact are untrue.

Where our opinion relates

to our “knowledge”, such knowledge is based upon our examination of the records, documents, reports, instruments and certificates

enumerated and described herein, or that we otherwise deemed necessary to examine for purposes of rendering this opinion, and the actual

knowledge of attorneys in this firm who are currently involved in substantive legal representation of the Company and its subsidiaries.

Based upon and subject to

the foregoing, and assuming that (i) the Registration Statement and any supplements and amendments thereto (including post-effective

amendments) will have become effective and will comply with all applicable laws; (ii) the Registration Statement will be effective

and will comply with all applicable laws at the time the Common Stock is offered or issued as contemplated by the Registration Statement;

(iii) a prospectus supplement will have been prepared and filed with the SEC describing the Common Stock offered thereby and will

comply with all applicable laws; (iv) all Common Stock will be issued and sold in compliance with all applicable federal and state

securities laws and in the manner stated in the Registration Statement and the appropriate prospectus supplement; and (v) none of

the terms of any Common Stock to be established subsequent to the date hereof, nor the issuance and delivery of such Common Stock, nor

the compliance by the Company with the terms of such Common Stock will violate any applicable law or will result in a violation of any

provision of any instrument or agreement then binding upon the Company or any restriction imposed by any court or

governmental body having jurisdiction over the Company, we are of opinion as follows:

EMCORE Corporation

July 31, 2024

Page 3

| 1. | Based solely upon our review of the Good Standing Certificate,

the Company is a corporation validly existing under the laws of the State of New Jersey. The Company has the corporate power to own or

lease its properties and conduct its business in all material respects as described in the Registration Statement and the Prospectus. |

| 2. | The registration, offer and sale by the Company of the Common

Stock and the transactions contemplated by the Registration Statement do not conflict with or result in any breach of, or constitute

a default under the Certificate of Incorporation or Bylaws of the Company. |

| 3. | With respect to any of the Common Stock, assuming that any Common Stock issued by the Company

pursuant to the exercise of the Warrant, will not exceed the maximum authorized number of shares of Common Stock under the

Certificate of Incorporation, minus that number of shares of Common Stock that may have been issued and are outstanding, or are

reserved for issuance for other purposes, at such time, has been duly authorized and when issued against the full payment specified

therefor, which must have a value not less than the par value thereof, such Common Stock will be validly issued, fully paid and

non-assessable. |

Notwithstanding anything

contained herein which may be construed to the contrary, this opinion is based, as to matters of law, solely on the laws of the

State of New Jersey. We express no opinion relating to: (a) the laws or regulations of any jurisdiction other than the State of

New Jersey (including, but not limited to, the federal laws of the United States); or (b) the application of, or compliance

with, any foreign, federal or state law or regulation with respect to the power, authority or competence of any party, other than

the Company, to the Indenture.

This opinion is rendered as

of the date hereof, and we express no opinion as to any event, fact, circumstance, or development subsequent to the date of this opinion.

We undertake no, and hereby disclaim any, obligation to advise you of any change in any matter set forth in this opinion that may result

from any change of law or fact that may arise after the date of this opinion. Our opinion is limited to the matters stated herein, and

no opinion is to be implied or inferred beyond the matters stated herein.

EMCORE Corporation

July 31, 2024

Page 4

We are furnishing this opinion

to the Company solely in connection with the Registration Statement. We hereby consent to the filing of this opinion as Exhibit 5.1

to the Registration Statement and to the reference to us under the caption “Legal Matters” in the prospectus included in the

Registration Statement. In giving this consent, we do not hereby admit that we are acting within the category of persons whose consent is required under Section 7

of the Securities Act or the rules or regulations of the SEC promulgated thereunder.

| |

Very truly yours, |

| |

/s/ Connell Foley LLP |

| |

Connell Foley LLP |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the use of our reports dated December 27, 2023,

with respect to the consolidated financial statements of EMCORE Corporation, and the effectiveness of internal control over financial

reporting, included herein by reference and to the reference to our firm under the heading “Experts” in the prospectus.

/s/ KPMG LLP

Irvine, California

July 31, 2024

Exhibit 107

Calculation of Filing Fee Table

S-3

(Form Type)

EMCORE Corporation

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| |

Security

Type |

Security Class Title |

Fee Calculation or Carry Forward Rule |

Amount

Registered(1) |

Proposed Maximum Offering Price Per Unit(1) |

Maximum Aggregate Offering Price |

Fee

Rate |

Amount of Registration Fee |

| Fees to be Paid |

Equity |

Common Stock, no par value per share |

457(a) |

1,810,528(2) |

$1.18 |

$2,136,424 |

0.00014760 |

$315.34 |

| |

Total Offering Amounts |

|

$2,136,424 |

|

$315.34 |

| |

Total Fee Offsets |

|

|

|

— |

| |

Net Fee Due |

|

|

|

$315.34 |

| (1) | Estimated pursuant to Rule 457(c) under the Securities Act of 1933 solely for the purpose of calculating the registration

fee, based upon the average of the high and low prices for the registrant’s common stock, as reported on the Nasdaq Global Market

on July 26, 2024. |

| (2) | Represents the number of shares of the registrant’s common stock that may be issued upon the exercise of warrant to purchase

the registrant’s common stock. |

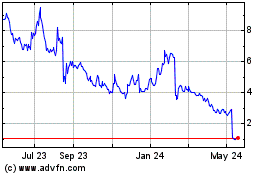

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

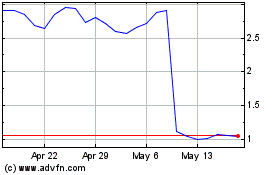

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Dec 2023 to Dec 2024