ShopNBC (NASDAQ: VVTV), a 24-hour TV shopping network, today

announced financial results for its second fiscal quarter ended

August 2, 2008.

Second Quarter Results

Second quarter revenues were $142 million, a 26% decrease from

the same period last year. EBITDA, as adjusted, was ($10.7) million

compared with $1.8 million in the year-ago period. Net Loss for the

second quarter was ($15.7) million compared with a net loss of

($5.4) million for the same quarter last year.

"Revenues in the second quarter were very disappointing," said

John Buck, ShopNBC's CEO. "The Board fully recognizes these

performance issues, and we are taking decisive action to address

these trends."

Leadership Changes

As announced in a separate press release the Company issued

earlier today, ShopNBC's Board of Directors concluded it was

necessary to make organizational leadership changes that are

effective immediately. The Board appointed John D. Buck to serve as

Chief Executive Officer replacing Rene Aiu, who joined the Company

as President and CEO in March 2008 and is leaving ShopNBC and its

Board. Mr. Buck is currently Executive Chairman and was previously

ShopNBC's Interim CEO from November 2007 to March 2008. The Company

also announced the departures of Glenn Leidahl, COO, Terry Curtis,

SVP of Customer Analytics and Sales Planning, and John Gunder, SVP

of Media & On-air Sales, who were named to their positions in

April 2008.

The Board also appointed Keith R. Stewart, with 20 years of

executive retail experience, as President and Chief Operating

Officer of the Company. Buck commented, "Keith has excellent

leadership skills, a deep understanding of retail operations

domestically and internationally and, importantly, nearly 15 years

of experience in home shopping as an executive at QVC. He possesses

a strong understanding of multi-channel retailing and has a proven

history of delivering growth and profitability spanning markets in

the United States and Germany."

Second Quarter Highlights

The Company noted that in the second quarter:

-- ShopNBC.com launched several live Webcasts to aggressively reach new

customers and drive incremental sales by capitalizing on its strong niche

categories, such as watches and coins.

-- It appointed Kris Kulesza, a retail executive with 23 years of

experience and nearly a decade in home shopping, as Senior Vice President

and Chief Merchant; and Jeff Lewis, a customer service executive with 25

years of leadership experience in retail and direct marketing, as Vice

President of Customer Experience.

-- It continued disciplined control of operating expenses, which were

down year-over-year by 11% in the quarter, driven by headcount and other

fixed overhead reductions.

-- It maintained a strong balance sheet with over $80 million in cash and

securities.

-- It recently signed an extended carriage agreement with one of the top

five cable providers and continues to work on preserving its cable

distribution base while lowering distribution costs.

Business Outlook

"ShopNBC has undergone significant changes this past year," said

Buck. "We greatly appreciate the support and patience of our

shareholders. Despite these challenging times, ShopNBC made

progress in the second quarter in its cable negotiations,

diversifying its merchandise mix with newness, and continued

success of our e-commerce business. ShopNBC is a great company with

strong underlying assets supported by a talented and dedicated

employee base and excellent growth potential.

"We are encouraged by these signs of progress. I look forward to

working with Keith and the rest of our talented management team to

improve performance that will enable us to deliver long-term

shareholder value. Given the changes being implemented at the

Company, we have decided not to provide guidance at this time."

Conference Call Information

The Company has re-scheduled its conference call for 11 a.m. EDT

/ 10 a.m. CDT on Monday, August 25, 2008, to discuss the results

for the fiscal second quarter. To participate, please dial

1-800-857-9866 (pass code SHOPNBC) five to ten minutes prior to the

start time. A replay of the call will be available for 30 days. To

access the replay, please dial 1-866-455-0459 (pass code SHOPNBC).

You may also participate via live audio stream by logging on to

https://e-meetings.verizonbusiness.com. To access the audio stream,

please use conference number 6203440 (pass code SHOPNBC). A

rebroadcast of the audio stream will be available using the same

access information for 30 days after the initial broadcast.

EBITDA and EBITDA, as adjusted

The Company defines EBITDA as net income (loss) from continuing

operations for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes.

The Company defines EBITDA, as adjusted, as EBITDA excluding

non-recurring non-operating gains (losses) and equity in income of

Ralph Lauren Media, LLC; non-recurring restructuring and CEO

transition costs; and non-cash share-based payment expense.

Management has included the term EBITDA, as adjusted, in order to

adequately assess the operating performance of the Company's "core"

television and Internet businesses and in order to maintain

comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to

make a more meaningful comparison between our core business

operating results over different periods of time with those of

other similar small cap, higher growth companies. In addition,

management uses EBITDA, as adjusted, as a metric measure to

evaluate operating performance under its management and executive

incentive compensation programs. EBITDA, as adjusted, should not be

construed as an alternative to operating income (loss) or to cash

flows from operating activities as determined in accordance with

GAAP and should not be construed as a measure of liquidity. EBITDA,

as adjusted, may not be comparable to similarly entitled measures

reported by other companies.

About ShopNBC

ShopNBC is a direct-to-consumer, multi-media shopping

destination for little luxuries and fashion must-haves. The

shopping network reaches 70 million homes in the United States via

cable affiliates and satellite: DISH Network channel 228 and

DIRECTV channel 316. www.ShopNBC.com is recognized as a top

e-commerce site. ShopNBC is owned and operated by ValueVision Media

(NASDAQ: VVTV). For more information, please visit

www.ShopNBC.com.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and are accordingly subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable distribution for the Company's

programming and the fees associated therewith; the success of the

Company's e-commerce and rebranding initiatives; the performance of

its equity investments; the success of its strategic alliances and

relationships; the ability of the Company to manage its operating

expenses successfully; risks associated with acquisitions; changes

in governmental or regulatory requirements; litigation or

governmental proceedings affecting the Company's operations; and

the ability of the Company to obtain and retain key executives and

employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

The Company is under no obligation (and expressly disclaims any

such obligation to) update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

VALUE VISION MEDIA, INC.

Key Performance Metrics*

(Unaudited)

Q2 YTD

For the three months ending For the six months ending

------------------------- -------------------------

8/2/2008 8/4/2007 % 8/2/2008 8/4/2007 %

-------- -------- ----- -------- -------- -----

Program Distribution

Cable FTEs 42,988 41,446 4% 42,673 40,901 4%

Satellite FTEs 28,676 27,486 4% 28,528 27,292 5%

-------- -------- ----- -------- -------- -----

Total FTEs (Average

000s) 71,664 68,932 4% 71,201 68,193 4%

Net Sales per FTE

(Annualized) $ 7.92 $ 10.85 -27% $ 8.32 $ 10.92 -24%

Product Mix

Jewelry 39% 40% 41% 40%

Apparel, Fashion

Accessories,

Health & Beauty 9% 8% 10% 8%

Computers &

Electronics 18% 23% 17% 23%

Watches, Coins &

Collectibles 26% 17% 23% 16%

Home & All Other 8% 12% 9% 13%

Shipped Units (000s) 870 1,132 -23% 1,874 2,281 -18%

Average Price Point -

shipped units $ 224 $ 233 -4% $ 226 $ 229 -1%

-------- -------- ----- -------- -------- -----

*Includes ShopNBC TV and ShopNBC.com only.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

For the Three Month For the Six Month

Periods Ended Periods Ended

---------------------- ----------------------

August 2, August 4, August 2, August 4,

2008 2007 2008 2007

---------- ---------- ---------- ----------

Net sales $ 141,927 $ 190,613 $ 298,215 $ 378,722

Cost of sales 94,046 123,291 200,378 245,287

(exclusive of

depreciation and

amortization shown

below)

Operating expense:

Distribution and

selling 53,827 60,033 110,910 120,493

General and

administrative 5,682 6,210 12,017 13,705

Depreciation and

amortization 4,246 5,261 8,565 10,847

Restructuring costs - 2,043 330 2,043

CEO transition costs 553 - 830 -

---------- ---------- ---------- ----------

Total operating

expense 64,308 73,547 132,652 147,088

---------- ---------- ---------- ----------

Operating loss (16,427) (6,225) (34,815) (13,653)

---------- ---------- ---------- ----------

Other income (loss):

Other loss - (119) - (119)

Interest income 761 1,575 1,586 2,815

---------- ---------- ---------- ----------

Total other income 761 1,456 1,586 2,696

---------- ---------- ---------- ----------

Loss before income taxes

and equity in net income

of affiliates (15,666) (4,769) (33,229) (10,957)

Gain on sale of RLM

investment - - - 40,240

Equity in income of

affiliates - - - 609

Income tax provision (18) (640) (33) (921)

---------- ---------- ---------- ----------

Net income (loss) (15,684) (5,409) (33,262) 28,971

Accretion of redeemable

preferred stock (73) (73) (146) (145)

---------- ---------- ---------- ----------

Net income (loss)

available to

common shareholders $ (15,757) $ (5,482) $ (33,408) $ 28,826

========== ========== ========== ==========

Net income (loss) per

common share $ (0.47) $ (0.15) $ (0.99) $ 0.67

========== ========== ========== ==========

Net income (loss) per

common share

---assuming dilution $ (0.47) $ (0.15) $ (0.99) $ 0.68

========== ========== ========== ==========

Weighted average number of

common shares outstanding:

Basic 33,574,131 37,366,541 33,576,015 42,822,333

========== ========== ========== ==========

Diluted 33,574,131 37,366,541 33,576,015 42,846,686

========== ========== ========== ==========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share data)

August 2, February 2,

2008 2008

----------- -----------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 48,829 $ 25,605

Short-term investments 10,892 33,473

Accounts receivable, net 55,730 109,489

Inventories 55,634 79,444

Prepaid expenses and other 5,646 4,172

----------- -----------

Total current assets 176,731 252,183

Long term investments 20,487 26,306

Property and equipment, net 34,694 36,627

FCC broadcasting license 31,943 31,943

NBC Trademark License Agreement, net 8,994 10,608

Cable distribution and marketing agreement, net 502 872

Other assets 615 541

----------- -----------

$ 273,966 $ 359,080

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 36,543 $ 73,093

Accrued liabilities 34,598 44,609

Deferred revenue 692 648

----------- -----------

Total current liabilities 71,833 118,350

Deferred revenue 2,132 2,322

Series A Redeemable Convertible Preferred Stock,

$.01 par value, 5,339,500 shares authorized;

5,339,500 shares issued and outstanding 44,045 43,898

Shareholders' equity:

Common stock, $.01 par value, 100,000,000

shares authorized; 33,590,834 and 34,070,422

shares issued and outstanding 336 341

Warrants to purchase 2,036,858 shares of

common stock 12,041 12,041

Additional paid-in capital 272,745 274,172

Accumulated other comprehensive losses (6,314) (2,454)

Accumulated deficit (122,852) (89,590)

----------- -----------

Total shareholders' equity 155,956 194,510

----------- -----------

$ 273,966 $ 359,080

=========== ===========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Reconciliation of EBITDA, as adjusted, to Net Income (Loss):

Six-Month Six-Month

Second Second Period Period

Quarter Quarter Ended Ended

2-Aug-08 4-Aug-07 2-Aug-08 4-Aug-07

--------- --------- --------- ---------

EBITDA, as adjusted (000's) $ (10,666) $ 1,764 $ (23,059) $ 515

Less:

Non-operating gains (losses)

and equity in income of RLM - (119) - 40,730

Restructuring costs - (2,043) (330) (2,043)

CEO transition costs (553) - (830) -

Non-cash share-based

compensation (962) (685) (2,031) (1,278)

--------- --------- --------- ---------

EBITDA (as defined) (a) (12,181) (1,083) (26,250) 37,924

--------- --------- --------- ---------

A reconciliation of EBITDA to

net income (loss) is as

follows:

EBITDA, as defined (12,181) (1,083) (26,250) 37,924

Adjustments:

Depreciation and amortization (4,246) (5,261) (8,565) (10,847)

Interest income 761 1,575 1,586 2,815

Income taxes (18) (640) (33) (921)

--------- --------- --------- ---------

Net income (loss) $ (15,684) $ (5,409) $ (33,262) $ 28,971

========= ========= ========= =========

(a) EBITDA as defined for this statistical presentation represents net

income (loss) from continuing operations for the respective periods

excluding depreciation and amortization expense, interest income (expense)

and income taxes. The Company defines EBITDA, as adjusted, as EBITDA

excluding non-recurring non-operating gains (losses) and equity in income

of Ralph Lauren Media, LLC; non-recurring restructuring and CEO transition

costs; and non-cash share-based compensation expense.

Management has included the term EBITDA, as adjusted, in its EBITDA

reconciliation in order to adequately assess the operating performance of

the Company's "core" television and Internet businesses and in order to

maintain comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to make a

more meaningful comparison between our core business operating results over

different periods of time with those of other similar small cap, higher

growth companies. In addition, management uses EBITDA, as adjusted, as a

metric measure to evaluate operating performance under its management and

executive incentive compensation programs. EBITDA, as adjusted, should not

be construed as an alternative to operating income (loss) or to cash flows

from operating activities as determined in accordance with GAAP and should

not be construed as a measure of liquidity. EBITDA, as adjusted, may not

be comparable to similarly entitled measures reported by other companies.

CONTACT: Frank Elsenbast Chief Financial Officer

952-943-6262

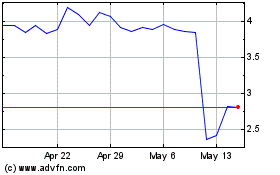

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

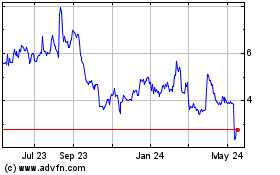

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024