Valuevision Media Inc - Current report filing (8-K)

August 28 2008 - 5:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

August 25, 2008

|

ValueVision Media, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Minnesota

|

0-20243

|

41-1673770

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

6740 Shady Oak Road, Eden Prairie, Minnesota

|

|

55344-3433

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

952-943-6000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

a) Compensatory Arrangements of Certain Officers

Chief Executive Officer

Effective August 25, 2008, we have entered into a letter agreement with Mr. John Buck relating to the compensatory terms of his services to us as chief executive officer. The appointment of Mr. Buck was disclosed in a report on Form 8-K filed August 26, 2008. The terms of Mr. Buck’s agreement include the following:

Annualized base salary: $300,000, subject to annual review by the board of directors.

Bonus for Special Board Service: $250,000, payable upon the commencement of employment.

Annual cash incentive: Mr. Buck will participate in our annual cash incentive plan. He will have a target bonus opportunity equal to 75% of his base salary, based on performance goals set by our compensation committee. Mr. Buck’s incentive payment for our 2008 fiscal year will be pro-rated based on his hire date.

Long Term Incentive: Mr. Buck will be granted options to purchase an aggregate of 1,000,000 shares of our common stock in the following manner: (i) an option to purchase 500,000 shares of common stock at an exercise price per share of $2.36 (the closing price of our common stock on his start date); (ii) an option to purchase 250,000 shares of common stock at an exercise price of $6.00 per share; and (iii) an option to purchase 250,000 shares of common stock at an exercise price of $7.00 per share. The options are exercisable for a period of ten years from the date of grant. Each of the options shall vest 50% on the earlier of (i) the first anniversary of the date of grant or (ii) the appointment of Keith R. Stewart as the Company’s chief executive officer. The remaining options shall vest in equal monthly installments over two years, commencing on the last day of the first full month after the vesting of the first 50% of the options. In the event of a change of control at any time, or in the event of Mr. Buck’s termination by the Company without cause, or his voluntary termination of employment for good reason during the first year, the unvested portion of the options shall immediately vest.

Mr. Buck will continue to serve as the chairman of our board of directors, subject to the board’s discretion to change the appointment at any time. We have agreed to nominate him for election to the board at each annual shareholders meeting arising during the period he continues to serve as our chief executive officer. Mr. Buck has agreed to waive any future director and chairman compensation he would otherwise be entitled while he serves as our chief executive officer.

The preceding description of Mr. Buck’s compensation is only a summary. The complete terms of his employment are set forth in his offer letter, which is included as Exhibit 10.1 to this current report, and the Form of Option Agreement, which is included as Exhibit 10.2, each of which is incorporated by reference into this Item 5.02.

Item 9.01 Financial Statements and Exhibits.

Exhibits

10.1 Offer letter from the registrant to John D. Buck dated August 25, 2008

10.2 Form of Option Agreement

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ValueVision Media, Inc.

|

|

|

|

|

|

|

|

August 27, 2008

|

|

By:

|

|

/s/ Nathan E. Fagre

|

|

|

|

|

|

|

|

|

|

|

|

Name: Nathan E. Fagre

|

|

|

|

|

|

Title: SVP and General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Offer letter from the registrant to John D. Buck dated August 25, 2008

|

|

10.2

|

|

Form of Option Agreement

|

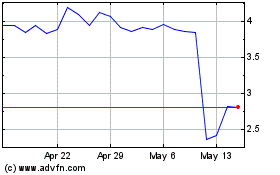

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

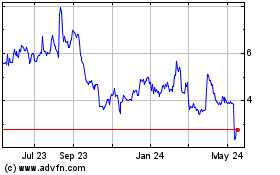

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024