ShopNBC (NASDAQ: VVTV), a 24-hour TV shopping network, today

announced financial results for its third fiscal quarter ended

November 1, 2008.

Third Quarter Results

Third quarter revenues were $124.8 million, a 32% decrease from

the same period last year. EBITDA, as adjusted, was ($13.3) million

compared to approximately $1 million in the year-ago period. Net

loss for the third quarter was ($20.8) million compared to a net

loss of ($5.7) million for the same quarter last year.

"Revenues in the third quarter were disappointing," said John

Buck, ShopNBC's Chairman and CEO. "While certainly it's been a

tough economy with consumer confidence at historic lows, we take

full responsibility for our sales performance. We are in a

transition period at the Company and working hard to improve the

fundamentals of this business for long-term sustained growth. The

Board and management recognize the challenges facing this business,

and we are taking decisive action by working on three strategic

initiatives on parallel paths to increase shareholder value."

The Company stated these initiatives include:

-- Sharp focus on the Company's balance sheet through tight control of

expenses and working capital resulting in a cash and securities balance

which stands at $81 million, an improvement of approximately $2 million

over the previous quarter.

-- Executing key operational efficiencies and initiatives to improve the

fundamentals of ShopNBC's multi-channel, electronic retailing business

model.

-- Actively exploring strategic alternatives to enhance shareholder value

by a Special Committee of Independent Directors of the Company's Board. An

update for this initiative will be provided on tomorrow's investor call by

Special Committee Chairman George Vandeman.

Third Quarter Highlights

-- The Company continued control of operating expenses, which decreased year-

over-year by 12% in the quarter.

-- Increased gross margins from 33.7% in Q2 to 34.5% in the third quarter

while return rates decreased from 31.5% in Q2 to 29.2%, respectively. The

Company will continue to work with its vendors to improve gross margins.

-- Realigned merchandising, broadcast operations, sales and product

planning, calendar and events, and e-commerce teams for improved

operational efficiencies and customer centricity.

-- Continued to aggressively negotiate with its cable and satellite

providers in the quarter. The Company's priority is to achieve a

significant reduction in its distribution costs next year.

Business Outlook

"In this difficult retail environment, we are highly focused on

managing the business thoughtfully yet decisively by protecting our

balance sheet for the long term," said Buck. "At the same time, we

are working on improving the fundamentals of our business and

exploring a full range of strategic alternatives. Given the changes

being implemented at the Company and the volatile economic

conditions, we will not be providing guidance at this time."

Conference Call Information

The Company has scheduled its conference call for 11 a.m. EST /

10 a.m. CST on Wednesday, November 19, 2008, to discuss the results

for the fiscal third quarter. To participate in the conference

call, please dial 1-888-455-9646 (pass code: SHOPNBC) five to ten

minutes prior to the call time. If you are unable to participate

live in the conference call, a replay will be available for 30

days. To access the replay, please dial 1-866-470-4775 with pass

code 7467622 (keypad: SHOPNBC).

You also may participate via live audio stream by logging on to

https://e-meetings.verizonbusiness.com. To access the audio stream,

please use conference number 1742627 with pass code: SHOPNBC. A

rebroadcast of the audio stream will be available using the same

access information for 30 days after the initial broadcast.

EBITDA and EBITDA, as adjusted

The Company defines EBITDA as net income (loss) from continuing

operations for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes.

The Company defines EBITDA, as adjusted, as EBITDA excluding

non-recurring non-operating gains (losses) and equity in income of

Ralph Lauren Media, LLC; non-recurring restructuring and CEO

transition costs; and non-cash share-based payment expense.

Management has included the term EBITDA, as adjusted, in order to

adequately assess the operating performance of the Company's "core"

television and Internet businesses and in order to maintain

comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to

make a more meaningful comparison between our core business

operating results over different periods of time with those of

other similar small cap, higher growth companies. In addition,

management uses EBITDA, as adjusted, as a metric measure to

evaluate operating performance under its management and executive

incentive compensation programs. EBITDA, as adjusted, should not be

construed as an alternative to operating income (loss) or to cash

flows from operating activities as determined in accordance with

GAAP and should not be construed as a measure of liquidity. EBITDA,

as adjusted, may not be comparable to similarly entitled measures

reported by other companies.

About ShopNBC

ShopNBC is a multi-channel electronic retailer operating with a

premium lifestyle brand. The shopping network reaches 70 million

homes in the United States via cable affiliates and satellite: DISH

Network channel 228 and DIRECTV channel 316. www.ShopNBC.com is

recognized as a top e-commerce site. ShopNBC is owned and operated

by ValueVision Media (NASDAQ: VVTV). For more information, please

visit www.ShopNBC.com.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and are accordingly subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable distribution for the Company's

programming and the fees associated therewith; the success of the

Company's e-commerce and rebranding initiatives; the performance of

its equity investments; the success of its strategic alliances and

relationships; the ability of the Company to manage its operating

expenses successfully; risks associated with acquisitions; changes

in governmental or regulatory requirements; litigation or

governmental proceedings affecting the Company's operations; and

the ability of the Company to obtain and retain key executives and

employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

The Company is under no obligation (and expressly disclaims any

such obligation) to update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

VALUEVISION MEDIA, INC.

Key Performance Metrics*

(Unaudited)

Q3 YTD

For the three months ending For the nine months ending

---------- ---------- --- ---------- ---------- ---

11/1/2008 11/3/2007 % 11/1/2008 11/3/2007 %

---------- ---------- --- ---------- ---------- ---

Program Distribution

Cable FTEs 43,326 41,726 4% 42,886 41,156 4%

Satellite FTEs 28,846 27,687 4% 28,632 27,421 4%

---------- ---------- --- ---------- ---------- ---

Total FTEs

(Average 000s) 72,172 69,413 4% 71,518 68,577 4%

Net Sales per FTE

(Annualized) $ 6.92 $ 10.46 -34% $ 7.85 $ 10.77 -27%

Product Mix

Jewelry 33% 38% 39% 39%

Apparel, Fashion

Accessories and

Health & Beauty 12% 10% 10% 9%

Computers &

Electronics 25% 25% 20% 24%

Watches, Coins

& Collectibles 21% 16% 23% 16%

Home & All Other 9% 11% 8% 12%

Shipped Units

(000s) 782 1,069 -27% 2,655 3,350 -21%

Average Price Point

- shipped units $ 212 $ 240 -12% $ 223 $ 233 -4%

---------- ---------- --- ---------- ---------- ---

*Includes ShopNBC TV and ShopNBC.com only.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Consolidated Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

For the Three Month For the Nine Month

Periods Ended Periods Ended

---------- ---------- ---------- ----------

November November November November

1, 3, 1, 3,

2008 2007 2008 2007

---------- ---------- ---------- ----------

Net sales $ 124,769 $ 184,821 $ 422,984 $ 563,543

Cost of sales 81,694 119,837 282,072 365,124

(exclusive of

depreciation

and amortization shown

below)

Operating expense:

Distribution and selling 51,743 59,126 162,653 179,619

General and

administrative 5,582 5,423 17,599 19,128

Depreciation and

amortization 4,246 4,734 12,811 15,581

Restructuring costs 175 1,061 505 3,104

CEO transition costs 1,883 2,096 2,713 2,096

---------- ---------- ---------- ----------

Total operating expense 63,629 72,440 196,281 219,528

---------- ---------- ---------- ----------

Operating loss (20,554) (7,456) (55,369) (21,109)

---------- ---------- ---------- ----------

Other income (loss):

Other loss (969) - (969) (119)

Interest income 745 1,728 2,331 4,543

---------- ---------- ---------- ----------

Total other income (224) 1,728 1,362 4,424

---------- ---------- ---------- ----------

Loss before income taxes

and equity in net income

of affiliates (20,778) (5,728) (54,007) (16,685)

Gain on sale of RLM

investment - - - 40,240

Equity in income of

affiliates - - - 609

Income tax provision - - (33) (921)

---------- ---------- ---------- ----------

Net income (loss) (20,778) (5,728) (54,040) 23,243

Accretion of redeemable

preferred stock (73) (73) (219) (218)

---------- ---------- ---------- ----------

Net income (loss)

available to common

shareholders $ (20,851) $ (5,801) $ (54,259) $ 23,025

========== ========== ========== ==========

Net income (loss) per

common share $ (0.62) $ (0.16) $ (1.62) $ 0.54

========== ========== ========== ==========

Net income (loss) per

common share

---assuming dilution $ (0.62) $ (0.16) $ (1.62) $ 0.54

========== ========== ========== ==========

Weighted average number of

common shares outstanding:

Basic 33,590,834 36,330,800 33,580,955 42,438,322

========== ========== ========== ==========

Diluted 33,590,834 36,330,800 33,580,955 42,458,720

========== ========== ========== ==========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands except share and per share data)

November 1, February 2,

2008 2008

------------ ------------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 56,444 $ 25,605

Short-term investments 4,975 33,473

Accounts receivable, net 43,178 109,489

Inventories 70,513 79,444

Prepaid expenses and other 5,198 4,172

------------ ------------

Total current assets 180,308 252,183

Long term investments 20,487 26,306

Property and equipment, net 33,532 36,627

FCC broadcasting license 31,943 31,943

NBC Trademark License Agreement, net 8,188 10,608

Cable distribution and marketing agreement, net 329 872

Other assets 567 541

------------ ------------

$ 275,354 $ 359,080

============ ============

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 58,391 $ 73,093

Accrued liabilities 34,073 44,609

Deferred revenue 705 648

------------ ------------

Total current liabilities 93,169 118,350

Deferred revenue 1,997 2,322

Series A Redeemable Convertible Preferred

Stock, $.01 par value, 5,339,500 shares

authorized; 5,339,500 shares issued and

outstanding 44,117 43,898

Shareholders' equity:

Common stock, $.01 par value, 100,000,000

shares authorized; 33,590,834 and

34,070,422 shares issued and outstanding 336 341

Warrants to purchase 2,036,858 shares of

common stock 12,041 12,041

Additional paid-in capital 273,638 274,172

Accumulated other comprehensive losses (6,314) (2,454)

Accumulated deficit (143,630) (89,590)

------------ ------------

Total shareholders' equity 136,071 194,510

------------ ------------

$ 275,354 $ 359,080

============ ============

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Reconciliation of EBITDA, as adjusted, to Net Income (Loss):

Nine-Month Nine-Month

Third Third Period Period

Quarter Quarter Ended Ended

1-Nov-08 3-Nov-07 1-Nov-08 3-Nov-07

---------- ---------- ---------- ----------

EBITDA, as adjusted (000s) $ (13,283) $ 947 $ (36,343) $ 1,461

Less:

Non-operating gains

(losses) and equity

in income of RLM (969) - (969) 40,730

Restructuring costs (175) (1,061) (505) (3,104)

CEO transition costs (1,883) (2,096) (2,713) (2,096)

Non-cash share-based

compensation (967) (512) (2,997) (1,789)

---------- ---------- ---------- ----------

EBITDA (as defined) (a) (17,277) (2,722) (43,527) 35,202

---------- ---------- ---------- ----------

A reconciliation of EBITDA

to net income (loss) is as

follows:

EBITDA, as defined (17,277) (2,722) (43,527) 35,202

Adjustments:

Depreciation and

amortization (4,246) (4,734) (12,811) (15,581)

Interest income 745 1,728 2,331 4,543

Income taxes - - (33) (921)

---------- ---------- ---------- ----------

Net income (loss) $ (20,778) $ (5,728) $ (54,040) $ 23,243

========== ========== ========== ==========

(a) EBITDA as defined for this statistical presentation

represents net income (loss) from continuing operations for the

respective periods excluding depreciation and amortization expense,

interest income (expense) and income taxes. The Company defines

EBITDA, as adjusted, as EBITDA excluding non-recurring

non-operating gains (losses) and equity in income of Ralph Lauren

Media, LLC; non-recurring restructuring and CEO transition costs;

and non-cash share-based compensation expense.

Management has included the term EBITDA, as adjusted, in its

EBITDA reconciliation in order to adequately assess the operating

performance of the Company's "core" television and Internet

businesses and in order to maintain comparability to its analyst's

coverage and financial guidance. Management believes that EBITDA,

as adjusted, allows investors to make a more meaningful comparison

between our core business operating results over different periods

of time with those of other similar small cap, higher growth

companies. In addition, management uses EBITDA, as adjusted, as a

metric measure to evaluate operating performance under its

management and executive incentive compensation programs. EBITDA,

as adjusted, should not be construed as an alternative to operating

income (loss) or to cash flows from operating activities as

determined in accordance with GAAP and should not be construed as a

measure of liquidity. EBITDA, as adjusted, may not be comparable to

similarly entitled measures reported by other companies.

Contacts: Frank Elsenbast Chief Financial Officer 952-943-6262

Anthony Giombetti Media Relations 612-308-1190

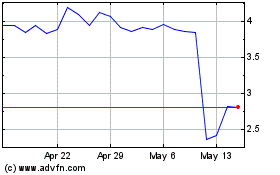

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

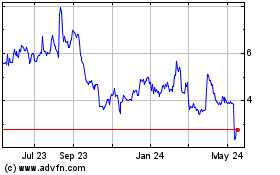

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024