ShopNBC (NASDAQ: VVTV), the premium lifestyle brand in electronic

retailing, today announced financial results for its second fiscal

quarter ended August 1, 2009. ShopNBC is available anywhere: cable

and satellite TV, mobile devices (iPhone and iPod Touch), online at

www.ShopNBC.com, and streamed live at www.ShopNBC.TV.

Second Quarter Results

Second quarter revenues were $119.3 million, a 16% decrease from

the same period last year, driven primarily by the intended

reduction of the company's average selling price. EBITDA, as

adjusted, was a loss of ($5.7) million compared to an EBITDA, as

adjusted, loss of ($10.7) million in the year-ago period. Net loss

for the second quarter was ($8.2) million compared to a net loss of

($15.7) million for the same quarter last year.

Second Quarter Highlights

The company noted several key improvements in the quarter:

Leadership. The Board of Directors unanimously appointed TV

shopping and retail veteran Randy Ronning as Chairman of the Board,

and selected direct response veteran Edwin Garrubbo as a Director.

The company also strengthened its senior management team during the

quarter with the appointment of industry veteran Carol Steinberg as

Senior Vice President of E-Commerce.

Suzanne Somers. Renowned TV personality, successful

entrepreneur, and national best-selling author of 19 books joined

the ShopNBC network. Launching September 18, 2009, Suzanne Somers

will bring the full range of her product line and loyal fan base to

ShopNBC's on-air, online and print platforms, which will span the

categories of home, jewelry, fashion & accessories, food,

vitamin supplements, and beauty & personal care.

Customers. Customer trends continued to improve with new and

active customers up by 59% and 32%, respectively, in the second

quarter vs. the same period last year. Return and cancel rates

decreased by double digits vs. last year's same period, reflecting

improvements in delivery time, customer service, product quality,

and lower price points. Customer service inquiries decreased 18% in

the quarter.

Merchandising. Gross profit margin increased to 34.8% vs. 31.5%

in the previous quarter. Improved margins were driven by a higher

percentage of merchandise sold at full margin and a leaner mix of

electronics. The company intends to improve gross margins

throughout the second half of the year, as the company increases

its number of higher margin reorders and expands its merchandise

assortment in higher margin categories.

-- Net average selling price was lowered to $112 during the quarter vs.

$194 in the year-ago quarter.

-- A record 106 new vendors were added to ShopNBC's new and existing

merchandise categories of home, fashion, beauty and jewelry. The company

launched a record 60 new show titles, product categories and brands in the

quarter, such as Intelligent Nutrients organic beauty, Thomas Kinkade

paintings, cosmeceutical pioneer Janson Beckett, Encanto footwear, and a

new show series "Discovering Gourmet Foods." Additionally, a record 32 new

guest experts were added to the network's talent ranks, including TV

shopping veteran Dave King, gem expert Paul Deasy, and fashion expert

Khaliah Ali, to mention a few.

-- Successful sales events and key items wins: "Founders Day" with sales

of $7.5 million; "Must Watch" with sales of $5 million, which included a

finale at midnight with $500,000 in sales in 20 minutes of 1,200 Invicta

Reserve Men's Lupah Watches; "Mid-Year Clearance" with sales of $14 million

and over 1,000 sell-outs; a Toshiba 17" Notebook Package w/HP All-in-One

Printer with sales of $2.1 million; and an Invicta Men's Subaqua Noma III

Swiss Quartz Chronograph Watch with sales of $1.9 million.

-- Net units in the quarter increased a record 40% as lower price points

and new merchandise drove increased customer activity. Net unit successes

include a record 10,200 Grand Suites 600TC Embroidered Egyptian Cotton

Sheet Sets in June; a new record of 14,400 Grand Suites 800TC Egyptian

Cotton Solid Sateen Sheet Sets in July; 6,500 Sterling Silver 8-9mm Colored

Freshwater Cultured Pearl Earrings; and 5,900 TomTom ONE-S 3rd Edition

portable GPS car navigation systems.

Monetized Illiquid Auction Rate Securities. ShopNBC monetized

its portfolio of illiquid auction rate securities for $19.4 million

in cash. The company's auction rate securities portfolio had a

carrying value of $15.7 million and the sale resulted in a

non-operating gain of $3.7 million.

Cash and Securities Balance. Second quarter cash and securities

balance ended at $36.3 million, including $8.5 million of

restricted cash. This cash and securities balance is a decrease of

$18.1 million vs. the prior quarter driven by the EBITDA loss of

($5.7) million and $13.5 million of working capital spend. The

company did not repurchase any shares in the quarter.

Operating Expenses. Operating expenses decreased $12 million

year-over-year or 19% in the quarter. This decrease was driven by

broad-based reductions in the company's cost structure, including

lower cable and satellite fees, lower headcount vs. the prior-year

period, reduced online marketing spend, and a significant decline

in transactional costs in the areas of order capture, customer

service and fulfillment.

ShopNBC.com. The company's Internet business is attracting new

and returning customers at an increasing rate as online product

assortment expands. Year-to-date conversion is up 36%. Use of live

chat for sales assistance and enhanced email retention programs

allowed for stronger visitor engagement, customer education, and

overall site penetration. Going forward, the company will optimize

ShopNBC.com with the next phase of its mobile strategy, expand its

social networking initiatives, and improve its natural search

presence in key merchandise categories.

"The second quarter was another solid foundation building period

for the company in its turnaround," said Keith Stewart, ShopNBC's

President and CEO. "We have the right leadership team in place. We

are buying the right merchandise and building up our reorder

business. With improved inventory levels, higher margins and lower

price points, positive business metrics continued to take form. The

customer is responding to our new merchandise strategy and to our

new expert guests, all of which can be seen in the positive trends

in new and active customer counts."

Added Stewart: "These are the critical building blocks being

laid, and they are very good signs for this business. I am highly

encouraged about the progress made during the first half of the

year. Year-to-date EBITDA, as adjusted, is $10.5 million better

than last year. These steps are a necessary precursor to improved

sales and profits."

Conference Call Information

The company has scheduled its conference call for 11 a.m. EDT /

10 a.m. CDT on Wednesday, August 19, 2009, to discuss the results

for the fiscal second quarter. To participate in the conference

call, please dial 1-800-369-2172 (pass code: SHOPNBC) five to ten

minutes prior to the call time. If you are unable to participate

live in the conference call, a replay will be available for 30

days. To access the replay, please dial 1-800-297-0782 with pass

code 7467622 (keypad: SHOPNBC).

You also may participate via live audio stream by logging on to

https://e-meetings.verizonbusiness.com. To access the audio stream,

please use conference number 8457395 with pass code: SHOPNBC. A

rebroadcast of the audio stream will be available using the same

access information for 30 days after the initial broadcast.

EBITDA and EBITDA, as adjusted

The Company defines EBITDA as net income (loss) from continuing

operations for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes.

The Company defines EBITDA, as adjusted, as EBITDA excluding

non-recurring non-operating gains (losses); non-cash impairment

charges and writedowns, restructuring and CEO transition costs; and

non-cash share-based compensation expense. Management has included

the term EBITDA, as adjusted, in order to adequately assess the

operating performance of the Company's "core" television and

Internet businesses and in order to maintain comparability to its

analyst's coverage and financial guidance. Management believes that

EBITDA, as adjusted, allows investors to make a more meaningful

comparison between our core business operating results over

different periods of time with those of other similar small cap,

higher growth companies. In addition, management uses EBITDA, as

adjusted, as a metric measure to evaluate operating performance

under its management and executive incentive compensation programs.

EBITDA, as adjusted, should not be construed as an alternative to

operating income (loss) or to cash flows from operating activities

as determined in accordance with GAAP and should not be construed

as a measure of liquidity. EBITDA, as adjusted, may not be

comparable to similarly entitled measures reported by other

companies.

About ShopNBC

ShopNBC is a multi-channel electronic retailer operating with a

premium lifestyle brand. The shopping network reaches 73 million

homes in the United States via cable affiliates and satellite: DISH

Network channel 134 and 228; DIRECTV channel 316. www.ShopNBC.com

is recognized as a top e-commerce site. ShopNBC is owned and

operated by ValueVision Media (NASDAQ: VVTV). For more information,

please visit www.ShopNBC.com/ir.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and accordingly are subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable distribution for the Company's

programming and the fees associated therewith; the success of the

Company's e-commerce and rebranding initiatives; the performance of

its equity investments; the success of its strategic alliances and

relationships; the ability of the Company to manage its operating

expenses successfully; risks associated with acquisitions; changes

in governmental or regulatory requirements; litigation or

governmental proceedings affecting the Company's operations; and

the ability of the Company to obtain and retain key executives and

employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

The Company is under no obligation (and expressly disclaims any

such obligation) to update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

VALUE VISION MEDIA, INC.

Key Performance Metrics*

(Unaudited)

Q2 YTD

For the three months ending For the six months ending

8/1/2009 8/2/2008 % 8/1/2009 8/2/2008 %

------- ------- --------- ------- ------- ---------

Program

Distribution

Cable FTEs 43,885 42,988 2% 43,836 42,673 3%

Satellite FTEs 29,524 28,676 3% 29,348 28,528 3%

------- ------- --------- ------- ------- ---------

Total FTEs

(Average 000s) 73,410 71,664 2% 73,183 71,201 3%

Net Sales per FTE

(Annualized) $ 6.50 $ 7.92 -18% $ 6.92 $ 8.32 -17%

Customer Counts

Year-to-Date

New 102,421 64,436 59% 215,448 135,027 60%

Active 351,057 265,323 32% 557,456 431,643 29%

Product Mix

Jewelry 28% 39% 24% 41%

Apparel,

Fashion

Accessories,

Health &

Beauty 12% 9% 11% 10%

Computers &

Electronics 16% 18% 23% 17%

Watches, Coins

& Collectibles 33% 26% 33% 23%

Home & All

Other 11% 8% 9% 9%

Net Units (000s) 980 701 40% 1,832 1,475 24%

Average Price

Point - net

units $ 112 $ 194 -42% $ 127 $ 195 -35%

Return Rate 21.8% 31.5% -9.7 ppt 21.7% 34.0% -12.3 ppt

------- ------- --------- ------- ------- ---------

*Includes ShopNBC TV and ShopNBC.com only.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

For the Three Month For the Six Month

Periods Ended Periods Ended

---------------------- ----------------------

August 1, August 2, August 1, August 2,

2009 2008 2009 2008

---------- ---------- ---------- ----------

Net sales $ 119,345 $ 141,927 $ 253,147 $ 298,215

Cost of sales 77,785 94,046 169,398 200,378

(exclusive of

depreciation

and amortization shown

below)

Operating expense:

Distribution and selling 43,885 53,827 89,124 110,910

General and

administrative 4,309 5,682 8,936 12,017

Depreciation and

amortization 3,427 4,246 7,216 8,565

Restructuring costs 485 - 589 330

CEO transition costs 223 553 300 830

---------- ---------- ---------- ----------

Total operating expense 52,329 64,308 106,165 132,652

---------- ---------- ---------- ----------

Operating loss (10,769) (16,427) (22,416) (34,815)

---------- ---------- ---------- ----------

Other income (expense):

Interest income 146 761 363 1,586

Interest expense (Series

B Preferred Stock) (1,235) - (1,978) -

Gain on sale of

investments 3,628 - 3,628 -

---------- ---------- ---------- ----------

Total other income

(expense) 2,539 761 2,013 1,586

---------- ---------- ---------- ----------

Loss before income taxes (8,230) (15,666) (20,403) (33,229)

Income tax (provision)

benefit (5) (18) 157 (33)

---------- ---------- ---------- ----------

Net loss (8,235) (15,684) (20,246) (33,262)

Excess of preferred stock

carrying value

over redemption value - - 27,362 -

Accretion of redeemable

Series A preferred stock - (73) (62) (146)

---------- ---------- ---------- ----------

Net income (loss)

available to

common shareholders $ (8,235) $ (15,757) $ 7,054 $ (33,408)

========== ========== ========== ==========

Net income (loss) per

common share $ (0.26) $ (0.47) $ 0.22 $ (0.99)

========== ========== ========== ==========

Net income (loss) per

common share

---assuming dilution $ (0.26) $ (0.47) $ 0.21 $ (0.99)

========== ========== ========== ==========

Weighted average number of

common shares outstanding:

Basic 32,272,841 33,574,131 32,688,289 33,576,015

========== ========== ========== ==========

Diluted 32,272,841 33,574,131 33,391,279 33,576,015

========== ========== ========== ==========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share data)

August 1, January 31,

2009 2009

----------- -----------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 27,869 $ 53,845

Restricted cash 8,461 1,589

Accounts receivable, net 56,770 51,310

Inventories 48,834 51,057

Prepaid expenses and other 4,942 3,668

----------- -----------

Total current assets 146,876 161,469

Long term investments - 15,728

Property and equipment, net 29,998 31,723

FCC broadcasting license 23,111 23,111

NBC Trademark License Agreement, net 5,768 7,381

Other Assets 491 2,088

----------- -----------

$ 206,244 $ 241,500

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 46,232 $ 64,615

Accrued liabilities 36,785 30,657

Deferred revenue 725 716

----------- -----------

Total current liabilities 83,742 95,988

Deferred revenue 1,510 1,849

Accrued Dividends (Series B Preferred Stock) 2,067 -

Series B Mandatorily Redeemable Preferred Stock 11,013 -

$.01 par value, 4,929,266 shares authorized;

4,929,266

shares issued and outstanding

Commitments and Contingencies

Series A Redeemable Convertible Preferred Stock,

$.01 par value, 5,339,500 shares authorized; - 44,191

Shareholders' equity:

Common stock, $.01 par value, 100,000,000

shares authorized;

32,317,620 and 33,690,266 shares issued and

outstanding 323 337

Warrants to purchase 6,029,487 shares of

common stock 671 138

Additional paid-in capital 314,547 286,380

Accumulated deficit (207,629) (187,383)

----------- -----------

Total shareholders' equity 107,912 99,472

----------- -----------

$ 206,244 $ 241,500

=========== ===========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Reconciliation of EBITDA, as adjusted, to Net Loss:

Six-Month Six-Month

Second Second Period Period

Quarter Quarter Ended Ended

1-Aug-09 2-Aug-08 1-Aug-09 2-Aug-08

--------- --------- --------- ---------

EBITDA, as adjusted (000's) $ (5,733) $ (10,666) $ (12,521) $ (23,059)

Less:

Gain on sale of

investments 3,628 - 3,628 -

Restructuring costs (485) - (589) (330)

CEO transition costs (223) (553) (300) (830)

Non-cash share-based

compensation (901) (962) (1,790) (2,031)

--------- --------- --------- ---------

EBITDA (as defined) (a) (3,714) (12,181) (11,572) (26,250)

--------- --------- --------- ---------

A reconciliation of EBITDA to

net loss is as follows:

EBITDA, as defined (3,714) (12,181) (11,572) (26,250)

Adjustments:

Depreciation and amortization (3,427) (4,246) (7,216) (8,565)

Interest income 146 761 363 1,586

Interest expense (1,235) - (1,978) -

Income taxes (5) (18) 157 (33)

--------- --------- --------- ---------

Net loss $ (8,235) $ (15,684) $ (20,246) $ (33,262)

========= ========= ========= =========

(a) EBITDA as defined for this statistical presentation represents net

income (loss) from continuing operations for the respective periods

excluding depreciation and amortization expense, interest income (expense)

and income taxes. The Company defines EBITDA, as adjusted, as EBITDA

excluding non-recurring non-operating gains (losses); non-cash impairment

charges and writedowns, restructuring and CEO transition costs; and

non-cash share-based compensation expense.

Management has included the term EBITDA, as adjusted, in its EBITDA

reconciliation in order to adequately assess the operating performance of

the Company's "core" television and Internet businesses and in order to

maintain comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to make a

more meaningful comparison between our core business operating results

over different periods of time with those of other similar small cap,

higher growth companies. In addition, management uses EBITDA, as adjusted,

as a metric measure to evaluate operating performance under its management

and executive incentive compensation programs. EBITDA, as adjusted,

should not be construed as an alternative to operating income (loss) or to

cash flows from operating activities as determined in accordance with GAAP

and should not be construed as a measure of liquidity. EBITDA, as

adjusted, may not be comparable to similarly entitled measures reported by

other companies.

Contacts: Frank Elsenbast Chief Financial Officer 952-943-6262

Anthony Giombetti Media Relations 612-308-1190

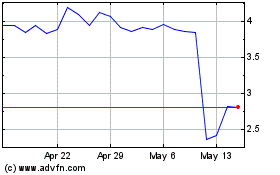

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

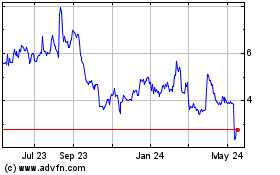

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024