As

filed with the United States Securities and Exchange Commission on

June 9, 2010

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ValueVision Media, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Minnesota

|

|

41-1673770

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

6740 Shady Oak Road

Eden Prairie, Minnesota 55344-3433

(952) 943-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nathan E. Fagre

Senior Vice President, General Counsel and Secretary

ValueVision Media, Inc.

6740 Shady Oak Road

Eden Prairie, Minnesota 55344-3433

(952) 943-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Peter J. Ekberg

Jonathan R. Zimmerman

Faegre & Benson LLP

2200 Wells Fargo Center

90 South Seventh Street

Minneapolis, Minnesota 55402-3901

(612) 766-1600

Approximate date of commencement of proposed sale to the public:

From time to time after the

effective date of this Registration Statement, as determined by market conditions.

If the only securities being registered on this form are being offered pursuant to dividend or

interest reinvestment plans, please check the following box:

o

If any of the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, please check the following

box:

þ

If this Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities

Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post

effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities

Act, check the following box.

o

If this form is a post-effective amendment to a registration statement filed pursuant to

General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

þ

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

|

|

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed Maximum

|

|

|

Proposed Maximum

|

|

|

|

|

|

|

Title of Each Class of Securities to

|

|

|

Amount to be

|

|

|

Offering Price

|

|

|

Aggregate

|

|

|

Amount of

|

|

|

|

be Registered

|

|

|

Registered

|

|

|

per Share (1)

|

|

|

Offering Price

|

|

|

Registration Fee

|

|

|

|

Common Stock, par value $0.01 per share

|

|

|

|

6,452,194

|

|

|

|

$

|

2.00

|

|

|

|

$

|

12,904,388

|

|

|

|

$

|

920

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Estimated solely for the purpose of calculating the

registration fee. The estimate is made pursuant to Rule 457(c)

of the Securities Act of 1933 based on $2.00, which represents the

average of the high and low sales prices of the Registrant’s

common stock on June 4, 2010 as reported on the Nasdaq Global

Market.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be

necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in

accordance with

Section 8(a)

of the Securities Act of 1933 or until this Registration Statement

shall become effective on such date as the Commission, acting pursuant to said Section

8(a)

, may

determine.

The information in this prospectus is not complete and may be changed. The

selling shareholder may not sell these securities until the registration

statement filed with the Securities and Exchange Commission becomes effective.

This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or

sale is not permitted.

SUBJECT

TO COMPLETION, DATED JUNE 9, 2010

PROSPECTUS

VALUEVISION MEDIA, INC.

6,452,194 Shares

Common Stock

This prospectus relates to 6,452,194 shares of common stock of ValueVision Media, Inc., which

may be offered for sale from time to time by the selling shareholder named under “Selling

Shareholder,” which is affiliated with members of our board of directors.

All of the proceeds from the sale of the shares covered by this prospectus will be received by

the selling shareholder. We will not receive any proceeds from the sale of these shares.

Our common stock trades on the

Nasdaq Global Market under the ticker symbol “VVTV.” On

June 4,

2010, the closing price of our common stock was $1.79 per share.

The selling shareholder or its pledgees, donees, transferees, assignees or

successors-in-interest may offer and sell or otherwise dispose of the shares of common stock

described in this prospectus from time to time through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices.

The selling shareholder will bear all commissions and discounts, if any, attributable to the sales

of shares. We will bear all other costs, expenses and fees in connection with the registration of

the shares. See “Plan of Distribution” beginning on page 12 for more information about how the

selling shareholder may sell or dispose of the shares of common stock offered hereby.

Investing in these securities involves a high degree of risk. See “Risk Factors” on page 2 of

this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities, or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2010

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

When we refer to “we,” “us” or the “company,” we mean ValueVision Media, Inc. and its

subsidiaries unless the context indicates otherwise.

You should rely only on the information provided in this prospectus, any prospectus supplement

and any free-writing prospectus, including the information incorporated herein or therein by

reference. Neither we nor the selling shareholder have authorized anyone to provide you with

different information. You should not assume that the information in this prospectus, any

prospectus supplement and any free-writing prospectus, is accurate at any date other than the date

indicated on the cover page of such documents.

The distribution of this prospectus, any prospectus supplement and any free-writing prospectus

and the offering of the securities in certain jurisdictions may be restricted by law. Persons into

whose possession this prospectus, any prospectus supplement and any free-writing prospectus come

should inform themselves about and observe any such restrictions. This prospectus, any prospectus

supplement and any free-writing prospectus does not constitute, and may not be used in connection

with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is

not authorized or in which the person making such offer or solicitation is not qualified to do so

or to any person to whom it is unlawful to make such offer or solicitation.

This prospectus, any prospectus supplement and any free-writing prospectus may include

trademarks, service marks and trade names owned by us or other companies. All trademarks, service

marks and trade names included in this prospectus, any prospectus supplement and any free-writing

prospectus are the property of their respective owners.

i

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We file annual, quarterly and current reports, proxy statements and other information with the

SEC. Our SEC filings are available over the Internet at the SEC’s web site at www.sec.gov. You

may also read and copy any document we file with the SEC at their Public Reference Room located at

100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. We maintain a web site at

www.valuevisionmedia.com. The information on our web site is not incorporated by reference in this

prospectus, any prospectus supplement and any free-writing prospectus, and you should not consider

it a part of this prospectus, any prospectus supplement and any free-writing prospectus.

The SEC allows us to “incorporate by reference” the information we file with them, which means

that we can disclose important information to you by referring you to separate documents. The

information incorporated by reference is considered to be part of this prospectus, any prospectus

supplement and any free-writing prospectus, and later information filed with the SEC will update

and supersede this information. We incorporate by reference the documents listed below that we have

previously filed with the SEC as well as all documents filed by us with the SEC pursuant to

Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 or the “Exchange Act,”

subsequent to the date of this prospectus (together with all filings we make under the Exchange Act

following the date of the initial filing of our initial registration statement but prior to the

effectiveness of such registration statement) and prior to the termination date of this offering

(other than information deemed furnished and not filed in accordance with SEC rules):

|

|

•

|

|

Annual Report on Form 10-K for the year ended January 30, 2010;

|

|

|

|

|

•

|

|

Current Reports on Form 8-K filed on February 3,

February 23, May 19, 2010 (but

only with respect to Item 8.01) and June 9, 2010; and

|

|

|

|

|

•

|

|

The description of our common stock contained in the Registration Statement on Form

8-A filed with the SEC on May 22, 1992, as the same may be amended from time to time.

|

Copies of these filings are available at no cost on our website, www.valuevisionmedia.com.

You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is

specifically incorporated by reference into that filing) at no cost, by writing to or telephoning

us at the following address:

Corporate Secretary

ValueVision Media, Inc.

6740 Shady Oak Road

Eden Prairie, Minnesota 55344

(952) 943-6000

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, may contain statements

that constitute “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, and Section 21E of the Securities Exchange Act of 1934. All statements other than

statements of historical fact, including statements regarding guidance, industry prospects or

future results of operations or financial position made in this report are forward-looking.

We often use words such as “may,” “will,” “could,” “estimates”, “continue,” “anticipates,”

“believes,” “expects,” “intends” and similar expressions to identify forward-looking statements.

These statements are based on management’s current expectations based on information currently

available to us and accordingly are subject to uncertainty and changes in circumstances. Actual

results may vary materially from the expectations contained herein. Factors that could cause or

contribute to such differences include, but are not limited to, those described in the “Risk

Factors” section of our annual report on Form 10-K for the year ended January 30, 2010 and other

filings we have made with the SEC. These include, without limitation:

|

|

•

|

|

macroeconomic issues, including, but not limited to, the current global

financial crisis and the credit environment;

|

|

|

|

|

•

|

|

risks relating to decreased consumer spending and increased consumer debt

levels;

|

|

|

|

|

•

|

|

the impact of increasing interest rates;

|

|

|

|

|

•

|

|

risks relating to seasonal variations in consumer purchasing activities;

|

|

|

|

|

•

|

|

risks relating to changes in the mix of products sold by us;

|

|

|

|

|

•

|

|

competitive pressures on our sales, as well as pricing and sales margins;

|

|

|

|

|

•

|

|

the level of cable and satellite distribution for our programming and the

associated fees;

|

|

|

|

|

•

|

|

our ability to continue to manage our cash, cash equivalents and investments to

meet our liquidity needs;

|

|

|

|

|

•

|

|

our ability to manage our operating expenses successfully;

|

|

|

|

|

•

|

|

our management and information systems infrastructure;

|

|

|

|

|

•

|

|

changes in governmental or regulatory requirements;

|

|

|

|

|

•

|

|

litigation or governmental proceedings affecting our operations;

|

|

|

|

|

•

|

|

significant public events that are difficult to predict, such as widespread

weather catastrophes or other significant television-covering events causing an

interruption of television coverage or that directly compete with the viewership of

our programming; and

|

|

|

|

|

•

|

|

our ability to obtain and retain key executives and employees.

|

Investors are cautioned that all forward-looking statements involve risk and uncertainty. The facts

and circumstances that exist when any forward-looking statements are made and on which those

forward-looking statements are based may significantly change in the future, thereby rendering the

forward-looking statements obsolete. We are under no obligation (and expressly disclaim any

obligation) to update or alter our forward-looking statements whether as a result of new

information, future events or otherwise.

iii

SUMMARY

The following summary contains basic information about us and this offering. It does not

contain all of the information that you should consider in making your investment decision. You

should read and consider carefully all of the information in this prospectus, including the

information set forth under “Risk Factors,” as well as the more detailed financial information,

including the consolidated financial statements and related notes thereto, appearing elsewhere or

incorporated by reference in this prospectus, before making an investment decision. Unless the

context indicates otherwise, all references in this prospectus to “ValueVision,” the “Company,”

“our,” “us” and “we” refer to ValueVision Media, Inc. and its subsidiaries as a combined entity.

The Company

We are an integrated multi-channel retailer that markets, sells and distributes our products

directly to consumers through various forms of electronic media. Our operating strategy

incorporates distribution from television, internet and mobile devices. Our principal electronic

media activity is our television home shopping business, which uses on-air spokespersons to market

brand name and private label consumer products at competitive prices. Our live 24-hour per day

television home shopping programming is distributed primarily through cable and satellite

affiliation agreements and the purchase of month-to-month full- and part-time lease agreements of

cable and broadcast television time. In addition, we distribute our programming through a

company-owned full power television station in Boston, Massachusetts and through leased carriage on

full power television stations in Pittsburgh, Pennsylvania and Seattle, Washington. We also market

a broad array of merchandise through our internet retailing websites, www.ShopNBC.com and

www.ShopNBC.TV. We are not including the information contained on our internet retailing websites

as a part of, or incorporating it by reference into, this prospectus.

We have an exclusive license from NBC Universal, Inc. (“NBCU”), for the worldwide use of an

NBC-branded name and the peacock image through May 2011. Pursuant to the license, we operate our

television home shopping network under the ShopNBC brand name and operate our internet website

under the ShopNBC.com and ShopNBC.TV brand name.We are in the process of selecting a new name and logo for our television, websites, mobile and other media channels, and will implement a systematic rebranding strategy during the remainder of the fiscal year.

ValueVision Media, Inc. is a Minnesota corporation with principal and executive offices

located at 6740 Shady Oak Road, Eden Prairie, Minnesota 55344-3433. Our telephone number is (952)

943-6000.

OFFERING

|

|

|

|

|

Issuer

|

|

ValueVision Media, Inc.

|

|

|

|

|

|

Selling Shareholder

|

|

NBC Universal, Inc.

|

|

|

|

|

|

Common stock offered by the selling shareholder

|

|

6,452,194

|

|

|

|

|

|

Use of Proceeds

|

|

The proceeds from the sale

|

|

|

|

of the securities covered

|

|

|

|

by this prospectus will be

|

|

|

|

received by the selling

|

|

|

|

shareholder. We will not

|

|

|

|

receive any of the

|

|

|

|

proceeds from any sale of

|

|

|

|

the shares of common stock

|

|

|

|

offered by this

|

|

|

|

prospectus. See "Use of

|

|

|

|

Proceeds."

|

|

|

|

|

|

Listing of common stock

|

|

Our common stock is listed

|

|

|

|

on the Nasdaq Global

|

|

|

|

Market under the symbol

|

|

|

|

"VVTV."

|

1

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully

consider the risks described below, as well as the other information included or incorporated by

reference in this prospectus before making an investment decision. Our business, financial

condition or results of operations could be materially adversely affected by any of these risks.

The market or trading price of our common stock could decline due to any of these risks, and you

may lose all or part of your investment. In addition, please read “Forward-Looking Statements”

where we describe additional uncertainties associated with our business and the forward-looking

statements included or incorporated by reference in this prospectus. The risks below should be

considered along with the other information included or incorporated by reference into this

prospectus. Please note that additional risks not presently known to us or that we currently deem

immaterial may also impair our business and operations.

Risks Relating to Our Business and Operations

We launched a new business strategy after unsuccessful efforts to sell our company in fiscal 2008.

Beginning in the fall of 2008, the board of directors, with the assistance of financial and

legal advisors, pursued a strategy to find a purchaser of the company or a new strategic partner.

This effort ended in January 2009 without a transaction taking place. At this time, Keith Stewart

was promoted to chief executive officer of our company, and under his leadership, we are currently

focused on executing a new strategy for ShopNBC that is designed to grow EBITDA levels and increase

revenues. In support of this strategy, we are pursuing the following actions: (i) growing new and

active customers while improving household penetration, (ii) reducing our operating expenses to

reverse our operating losses, (iii) continue renegotiating cable and satellite carriage contracts

where we have cost savings opportunities, (iv) broadening and optimizing our mix of product

categories offered on television and the internet in order to appeal to a broader population of

potential customers, (v) lowering the average selling price of our products in order to increase

the size and purchase frequency of our customer base, (vi) growing our internet business by

providing broader and internet-only merchandise offering, and (vii) improving the shopping

experience and our customer service in order to retain and attract more customers. There can be no

guarantee that we will be able to successfully implement this new strategy on a timeline that would

lead to a successful turnaround of operating results before we exhaust available cash and other

liquidity resources.

We have a history of losses and a high fixed cost operating base and may not be able to achieve or

maintain profitable operations in the future.

We experienced operating losses of approximately $41.2 million, $88.5 million and $23.1

million in the years ended January 30, 2010 (“fiscal 2009”), January 31, 2009 (“fiscal 2008”) and

February 2, 2008 (“fiscal 2007”), respectively. We reported a net loss of $42.0 in fiscal 2009 and

a net loss in fiscal 2008 of $97.8 million. While we reported net income of $22.5 million in fiscal

2007, this was due to the $40.2 million pre-tax gain we recorded on the sale of our equity interest

in Ralph Lauren Media, LLC, operator of the polo.com website. There is no assurance that we will be

able to achieve or maintain profitable operations in future fiscal years.

Our television home shopping business operates with a high fixed cost base, primarily driven

by fixed fees under distribution agreements with cable and satellite system operators to carry our

programming. In order to operate on a profitable basis, we must reach and maintain sufficient

annual sales revenues to cover our high fixed cost base and/or negotiate a reduction in this cost

structure. If our sales levels are not sufficient to cover our operating expenses, our ability to

reduce operating expenses in the near term will be limited by the fixed cost base. In that case,

our earnings, cash balance and growth prospects could be materially and adversely affected.

If we do not reverse our current trend of operating losses, we could reduce our operating cash resources to the point where we will not have sufficient liquidity to meet the ongoing cash commitments and obligations to continue operating our business.

We have limited unrestricted cash to fund our business, $20.9 million as of May 1, 2010 (with an additional $4.9 million of cash that is restricted and used to secure letters of credit and similar arrangements), and have a history of operating losses. We expect to use our cash to fund any further operating losses, to finance our working capital requirements and to make necessary capital expenditures in order to operate our business.

We also have significant future commitments for our cash, primarily payments for our cable and satellite program

distribution obligations and redemption of our Series B preferred stock. If our vendors or service providers were

to demand a shift from our current payment terms to upfront prepayments or require cash reserves, this will have a

significant adverse impact on our available cash balance and our ability to meet the ongoing commitments and obligations

of our business. If we are not able to attain profitability and generate positive cash flows from operations or obtain

cash from other sources in addition to our $20 million secured bank line of credit facility, we may not have sufficient

liquidity to continue operating. In addition, our credit agreement with our secured lender requires compliance with

various operating and financial covenants. If we are unable to comply with those covenants, our access to our secured

bank line of credit may be limited. For example, in order to borrow more than $8 million under the credit agreement,

we must satisfy certain EBITDA thresholds or fixed charge ratios on certain dates. While we are currently in

compliance, because borrowings were not in excess of $8 million, we currently believe that borrowings in excess

of $8 million would result in a covenant violation at the quarter ended January 29, 2011. This effectively will

limit our borrowing capacity to $8 million at January 29, 2011 unless these covenants are amended prior to or at that time. In addition, the lender has the right to terminate the revolving credit facility in the event a material adverse effect (as defined in the agreement) is met. Based on our current projections for fiscal 2010, we believe that our existing cash balances, our credit line, our ability to raise additional financing and

the ability to structure transactions in a manner reflective of capital availability will be sufficient

to maintain liquidity to fund our normal business operations through fiscal 2010. However, there can be

no assurance that we will meet our projections for 2010 or that, if required, the Company would be able to

raise additional capital or reduce spending sufficiently to maintain the necessary liquidity. Our shareholders

agreement with GE Capital Equity Investments, Inc. (“GE Equity”) and NBCU require their consent in order for the

Company to issue new equity securities above certain thresholds, and there can be no assurance that we would receive

such consent if we made a request. If we did issue additional equity, it would be dilutive to our existing shareholders.

If we sought to and were successful in incurring indebtedness from sources other than our existing line of credit

arrangement to raise additional capital, there would be additional interest expense associated with such funding,

which expense could be substantial.

2

The failure to secure suitable placement for our television programming and the expansion of

digital cable systems could adversely affect our ability to attract and retain television viewers

and could result in a decrease in revenue.

We are dependent upon our ability to compete for television viewers. Effectively competing for

television viewers is dependent on our ability to secure placement of our television programming

within a suitable programming tier at a desirable channel position. The majority of cable operators

now offer cable programming on a digital basis. While the growth of digital cable systems may over

time make it possible for our programming to be more widely distributed, there are several risks as

well. The primary risks associated with the growth of digital cable are demonstrated by the

following:

|

|

•

|

|

we could experience a reduction in the growth rate or an absolute decline in

sales per digital tier subscriber because of the increased number of channels

offered on digital systems competing for the same number of viewers and the higher

channel location we typically are assigned in digital tiers;

|

|

|

|

|

•

|

|

more competitors may enter the marketplace as additional channel capacity is

added; and

|

|

|

|

|

•

|

|

more programming options being available to the viewing public in the form of

new television networks and time-shifted viewing (

e.g.

, personal video recorders,

video-on-demand, interactive television and streaming video over broadband internet

connections).

|

Failure to adapt to these risks will result in lower revenue and may harm our results of

operations. In addition, failure to anticipate and adapt to technological changes in a

cost-effective manner that meets customer demands and evolving industry standards will also reduce

our revenue, harm our results of operations and financial condition and have a negative impact on

our business.

We may not be able to continue to expand or could lose some of our programming distribution if we

cannot negotiate profitable distribution agreements or because of the ongoing shift from analog to

digital programming.

We are seeking to continue to materially reduce the costs associated with our cable and

satellite distribution agreements. However, while we were able to achieve significant reductions in

such costs during fiscal 2009 without a loss in households, there can be no assurance that we will

achieve comparable cost reductions in the future or that we will be able to maintain or grow our

households on financial terms that are profitable to us. It is possible that we would reduce our

programming distribution in certain systems if we are unable to obtain appropriate financial terms.

Failure to successfully renew agreements covering a material portion of our existing cable and

satellite households on acceptable financial and other terms could adversely affect our future

growth, sales revenues and earnings unless we are able to arrange for alternative means of broadly

distributing our television programming.

NBCU and GE Equity have the ability to exert significant influence over us and have the right to

disapprove of certain actions by us.

As a result of their equity ownership in our company, NBCU and GE Equity together are

currently our

3

largest shareholder and have the ability to exert significant influence over actions requiring

shareholder approval, including the election of directors, adoption of equity-based compensation

plans and approval of mergers or other significant corporate events. Through the provisions in the

shareholder agreement and certificate of designation for the preferred stock, NBCU and GE Equity

also have the right to block us from taking certain actions. While we have registered for sale all

of the outstanding shares of common stock owned by NBCU, NBCU may decide not to sell all of the

shares registered in this registration statement. The interests of NBCU and GE Equity may differ

from the interests of our other shareholders, and they may block us from taking actions that might

otherwise be in the interests of our other shareholders.

Our directors, executive officers and principal shareholders will continue to have substantial

control over us and could delay or prevent a change in corporate control.

Our directors, executive officers and holders of more than 5% of our common stock, together

with their affiliates, beneficially own, in the aggregate, over 40% of our outstanding common stock

and would beneficially own over 20% of our common stock even if NBCU sold all of the shares offered

hereby to unaffiliated holders of less than 5% of our common stock. As a result, these

shareholders, acting together, would have the ability to control the outcome of matters submitted

to our shareholders for approval, including the election of directors and any merger, consolidation

or sale of all or substantially all of our assets. In addition, these shareholders, acting

together, would have the ability to control the management and affairs of our company.

Accordingly, this concentration of ownership might harm the market price of our common stock by:

|

|

•

|

|

delaying, deferring or preventing a change in corporate control;

|

|

|

|

|

•

|

|

impeding a merger, consolidation, takeover or other business combination

involving us; or

|

|

|

|

|

•

|

|

discouraging a potential acquirer from making a tender offer or otherwise

attempting to obtain control of us.

|

Expiration of the NBCU branding license would require us to pursue a new branding strategy that may

not be successful.

We have branded our television home shopping network and internet site as ShopNBC and

ShopNBC.com, respectively, under an exclusive, worldwide licensing agreement with NBCU for the use

of NBC trademarks, service marks and domain names that continues until May 2011. We do not have the

right to automatic renewal at the end of the license term, and consequently may choose or be

required to pursue a new branding strategy in the next 12 months which may not be as successful as

the NBC brand with current or potential customers. NBCU also has the right to terminate the license

prior to the end of the license term in certain circumstances, including without limitation in the

event of a breach by us of the terms of the license agreement or upon certain changes of control.

Competition in the general merchandise retailing industry and particularly the live home shopping

and e-commerce sectors could limit our growth and reduce our profitability.

As a general merchandise retailer, we compete for consumer expenditures with other forms of

retail businesses, including other television home shopping and e-commerce retailers, infomercial

companies, other types of consumer retail businesses, including traditional “brick and mortar”

department stores, discount stores, warehouse stores, specialty stores, catalog and mail order

retailers and other direct sellers. In the competitive television home shopping sector, we compete

with QVC Network, Inc., HSN, Inc. and Jewelry Television, as well as a number of smaller “niche”

home shopping competitors. QVC Network, Inc and HSN, Inc. both are substantially larger than we are

in terms of annual revenues and customers, their programming is more broadly available to U.S.

households than is our programming and in many markets they have more favorable channel locations

than we have. The internet retailing industry is also highly competitive, with numerous e-commerce

websites competing in every product category we carry, in addition to the websites operated by the

other television home shopping companies. This competition in the internet retailing sector makes

it more challenging and expensive for us to attract new customers, retain existing customers and

maintain desired gross margin levels.

We may not be able to maintain our satellite services in certain situations, beyond our control,

which may cause our programming to go off the air for a period of time and cause us to incur

substantial additional costs.

Our programming is presently distributed to cable systems, full power television stations and

satellite dish operators via a leased communications satellite transponder. Satellite service may

be interrupted due to a variety of

4

circumstances beyond our control, such as satellite transponder failure, satellite fuel

depletion, governmental action, preemption by the satellite service provider, solar activity and

service failure. The agreement provides us with preemptable back-up service if satellite

transmission is interrupted. Our satellite service provider recently advised us and its other

customers that our current satellite had experienced an anomaly and that its customers would be

transitioned to a backup satellite for continued service. However, there can be no assurance that

there will be no interruption in service in connection with this transition or that, if the

transition is successful, we will be able to arrange an additional preemptable back-up service. In

the event of a serious transmission interruption where back-up service is not available, we may

need to enter into new arrangements, resulting in substantial additional costs and the inability to

broadcast our signal for some period of time.

The FCC could limit must-carry rights, which would impact distribution of our television home

shopping programming and might impair the value of our Boston FCC license.

The Federal Communications Commission, known as the FCC, issued a public notice on May 4, 2007

stating that it was updating the public record for a petition for reconsideration filed in 1993 and

still pending before the FCC. The petition challenges the FCC’s prior determination to grant the

same mandatory cable carriage (or “must-carry”) rights for TV broadcast stations carrying home

shopping programming that the FCC’s rules accord to other TV stations. The time period for comments

and reply comments regarding the reconsideration closed in August 2007, and we submitted comments

supporting the continuation of must-carry rights for home shopping stations. If the FCC decides to

change its prior determination and withdraw must-carry rights for home shopping stations as a

result of this updating of the public record, we could lose our current carriage distribution on

cable systems in three markets: Boston, Pittsburgh and Seattle, which currently constitute

approximately 3.2 million full-time equivalent households, or FTE’s, receiving our programming. We

own the Boston television station and have carriage contracts with the Pittsburg and Seattle

television stations. In addition, if must-carry rights for home shopping stations are withdrawn, it

may not be possible to replace these FTE’s on commercially reasonable terms and the carrying value

of our Boston FCC license ($23.1 million) may become further impaired.

We may be subject to product liability claims for on-air misrepresentations or if people or

properties are harmed by products sold by us.

Products sold by us and representations related to these products may expose us to potential

liability from claims by purchasers of such products, subject to our rights, in certain instances,

to seek indemnification against this liability from the suppliers or manufacturers of the products.

In addition to potential claims of personal injury, wrongful death or damage to personal property,

the live unscripted nature of our television broadcasting may subject us to claims of

misrepresentation by our customers, the Federal Trade Commission and state attorneys general. We

maintain, and have generally required the manufacturers and vendors of these products to carry,

product liability and errors and omissions insurance. There can be no assurance that we will

maintain this coverage or obtain additional coverage on acceptable terms, or that this insurance

will provide adequate coverage against all potential claims or even be available with respect to

any particular claim. There also can be no assurance that our suppliers will continue to maintain

this insurance or that this coverage will be adequate or available with respect to any particular

claims. Product liability claims could result in a material adverse impact on our financial

performance.

Our ValuePay installment payment program could lead to significant unplanned credit losses if our

credit loss rate was to materially deteriorate.

We utilize an installment payment program called ValuePay that entitles customers to purchase

merchandise and generally pay for the merchandise in two or more equal monthly installments. As of

January 30, 2010 we had approximately $62.5 million due from customers under the ValuePay

installment program. We maintain allowances for doubtful accounts for estimated losses resulting

from the inability of our customers to make required payments. There is no guarantee that we will

continue to experience the same credit loss rate that we have in the past or that losses will not

be within current provisions. A significant increase in our credit losses above what we have been

experiencing could result in a material adverse impact on our financial performance.

Failure to comply with existing laws, rules and regulations, or to obtain and maintain required

licenses and rights, could subject us to additional liabilities.

We market and provide a broad range of merchandise through multiple channels. As a result, we

are subject to a wide variety of statutes, rules, regulations, policies and procedures in various

jurisdictions which are subject to change at any time, including laws regarding consumer

protection, privacy, the regulation of retailers generally, the importation, sale and promotion of

merchandise and the operation of warehouse facilities, as well as laws and

5

regulations applicable to the internet and businesses engaged in e-commerce. Our failure to

comply with these laws and regulations could result in fines and proceedings against us by

governmental agencies and consumers, which could adversely affect our business, financial condition

and results of operations. Moreover, unfavorable changes in the laws, rules and regulations

applicable to us could decrease demand for merchandise offered by us, increase costs and subject us

to additional liabilities. Finally, certain of these regulations impact our marketing efforts.

We may be subject to claims by consumers and state and federal authorities for security breaches

involving customer information, which could materially harm our reputation and business.

In order to operate our business we take orders for our products from customers. This requires

us to obtain personal information from these customers including credit card numbers. Although we

take reasonable and appropriate security measures to protect customer information, there is still

the risk that external or internal security breaches could occur. In addition, new tools and

discoveries by third parties in computer or communications technology or software or other

developments may facilitate or result in a future compromise or breach of our computer systems.

Such compromises or breaches could result in significant liability or costs to us from consumer

lawsuits for monetary redress, state and federal authorities for fines and penalties, and could

also lead to interruptions in our operations and negative publicity causing damage to our

reputation and limiting customers’ willingness to purchase products from us. Recently, a major

discount retailer and a credit reporting agency experienced theft of credit card numbers of

millions of consumers resulting in multi-million dollar fines and consumer settlement costs, FTC

audit requirements, and significant internal administrative costs.

The unanticipated loss of several of our larger vendors could impact our sales on a temporary

basis.

It is possible that one or more of our larger vendors could experience financial difficulties,

including bankruptcy, or otherwise could determine to cease doing business with us. While we have

periodically experienced the loss of a major vendor, if a number of our current larger vendors

ceased doing business with us, this could materially and adversely impact our sales and

profitability on a short term basis.

Many of our key functions are concentrated in a single location, and a natural disaster could

seriously impact our ability to operate.

Our television broadcast studios, internet operations, IT systems, merchandising team,

inventory control systems, executive offices and finance/accounting functions, among others, are

centralized in our adjacent offices at 6740 and 6690, Shady Oak Road in Eden Prairie, Minnesota. In

addition, our only fulfillment and distribution facility is centralized at a location in Bowling

Green, Kentucky. A natural disaster, such as a tornado, could seriously disrupt our ability to

continue or resume normal operations for some period of time. While we have certain business

continuity plans in place, no assurances can be given as to how quickly we would be able to resume

operations and how long it may take to return to normal operations. We could incur substantial

financial losses above and beyond what may be covered by applicable insurance policies, and may

experience a loss of customers, vendors and employees during the recovery period.

We could be subject to additional sales tax collection obligations and claims for uncollected

amounts.

A number of states have adopted new legislation that would require the collection of state

and/or local taxes on transactions originating on the internet or by other out-of-state retailers,

such as home shopping, infomercial and catalog companies. In some cases these new laws seek to

establish grounds for asserting “nexus” by the out-of-state retailer in the applicable state, and

are being challenged by internet and other retailers under federal constitutional grounds. However,

if this trend continues and the laws are upheld after legal challenges, we could be required to

collect additional state and local taxes which could negatively impact sales as well as creating an

additional administrative burden which could be costly to the business. In addition, the state of

North Carolina is seeking to assert claims for uncollected state sales taxes going back a number of

years against out-of-state retailers, including our company. The retailers subject to these claims

by North Carolina include major national internet-based retailers and catalog companies. We intend

to vigorously contest these efforts by North Carolina.

We place a significant reliance on technology and information management tools to run our existing

businesses, the failure of which could adversely impact our operations.

Our businesses are dependent, in part, on the use of sophisticated technology, some of which

is provided to us by third parties. These technologies include, but are not necessarily limited to,

satellite based transmission of our programming, use of the internet in relation to our on-line

business, new digital technology used to manage and supplement our television broadcast operations

and a network of complex computer hardware and software to

6

manage an ever increasing need for information and information management tools. The failure

of any of these technologies, or our inability to have this technology supported, updated, expanded

or integrated into other technologies, could adversely impact our operations. Although we have,

when possible, developed alternative sources of technology and built redundancy into our computer

networks and tools, there can be no assurance that these efforts to date would protect us against

all potential issues or disaster occurrences related to the loss of any such technologies or their

use.

Risks Relating to Our Common Stock and This Offering

Future sales of our common stock by our existing shareholders could cause our stock price to decline.

If our shareholders sell substantial amounts of our common stock in the public market, the

market price of our common stock could decrease significantly. The perception in the public market

that our shareholders might sell shares of our common stock could also depress the market price of

our common stock. A decline in the price of shares of our common stock might impede our ability to

raise capital through the issuance of additional shares of our common stock or other equity

securities.

We do not intend to declare dividends on our stock after this offering.

Pursuant to the shareholders agreement we have with GE Equity and NBCU, we are prohibited from

paying dividends on our common stock without GE Equity’s prior written consent. We currently

intend to retain all future earnings for the operation and expansion of our business and,

therefore, do not anticipate declaring or paying cash dividends on our common stock in the

foreseeable future. Any payment of cash dividends on our common stock will be subject to

restrictions on payment of dividends contained in the terms of our outstanding Series B Preferred

Stock held by GE Equity, and is otherwise at the discretion of our board of directors and will

depend upon our results of operations, earnings, capital requirements, financial condition, future

prospects, contractual restrictions and other factors deemed relevant by our board of directors.

Therefore, you should not expect to receive dividend income from shares of our common stock.

If securities or industry analysts do not publish research or reports about our business, or if

they adversely change their recommendations regarding our common stock, the market price for our

common stock and trading volume could decline.

The trading market for our common stock will be influenced by research or reports that

industry or securities analysts publish about us or our business. If one or more analysts who

cover us downgrade our common stock, the market price for our common stock would likely decline.

If one or more of these analysts cease coverage of us or fail to regularly publish reports on us,

we could lose visibility in the financial markets, which, in turn, could cause the market price or

trading volume for our common stock to decline.

Certain provisions of Minnesota law may make a takeover of our company more difficult,

depriving shareholders of opportunities to sell shares at above-market prices.

Certain provisions of Minnesota law may have the effect of discouraging attempts to acquire us

without the approval of our board of directors. Section 302A.671 of the Minnesota statutes, with

certain exceptions, requires approval of any acquisition of the beneficial ownership of 20% or more

of our voting stock then outstanding by a majority vote of our shareholders prior to its

consummation. In general, shares acquired in the absence of such approval are denied voting rights

and are redeemable by us at their then-fair market value within 30 days after the acquiring person

failed to give a timely information statement to us or the date the shareholders voted not to grant

voting rights to the acquiring person’s shares. Section 302A.673 of the Minnesota statutes

generally prohibits any business combination by us, or any of our subsidiaries, with an interested

shareholder, which includes any shareholder that purchases 10% or more of our voting shares within

four years following such interested shareholder’s share acquisition date, unless the business

combination is approved by a committee of all of the disinterested members of our board of

directors before the interested shareholder’s share acquisition date. Consequently, our common

shareholders may lose opportunities to sell their stock for a price in excess of the prevailing

market price due to these protective measures.

7

USE OF PROCEEDS

The proceeds from the sale of the common stock covered by this prospectus will be received by

the selling shareholder. We will not receive any proceeds from the sale by the selling shareholder

of the shares of common stock offered by this prospectus.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our shares of common stock. We currently

intend to retain all future earnings for the operation and expansion of our business and do not

anticipate paying cash dividends on our shares of common stock in the foreseeable future. Pursuant

to the shareholders agreement we have with GE Equity and NBCU, we are prohibited from paying

dividends on our common stock without GE Equity’s prior written consent. Any payment of cash

dividends on our common stock will be subject to restrictions on payment of dividends contained in

the terms of our outstanding Series B Preferred Stock held by GE Equity, and is otherwise at the

discretion of our board of directors and will depend upon our results of operations, earnings,

capital requirements, financial condition, future prospects, contractual restrictions and other

factors deemed relevant by our board of directors.

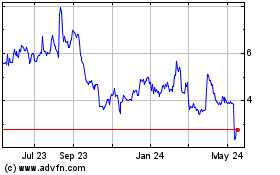

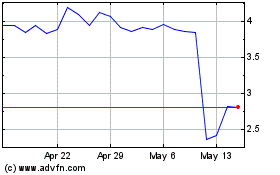

MARKET PRICE OF COMMON STOCK

Shares of our common stock are traded on the Nasdaq Global Market under the symbol “VVTV.”

The following table shows the high and low sales prices of our common stock on the Nasdaq Global

Market for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Price Stock

|

|

|

|

|

High

|

|

|

Low

|

|

|

Fiscal 2010:

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

4.77

|

|

|

$

|

2.96

|

|

|

Second Quarter (through June 4, 2010)

|

|

$

|

3.09

|

|

|

$

|

1.60

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2009:

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.83

|

|

|

$

|

0.18

|

|

|

Second Quarter

|

|

$

|

3.22

|

|

|

$

|

0.50

|

|

|

Third Quarter

|

|

$

|

4.15

|

|

|

$

|

2.61

|

|

|

Fourth Quarter

|

|

$

|

5.27

|

|

|

$

|

3.00

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2008:

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

7.20

|

|

|

$

|

4.38

|

|

|

Second Quarter

|

|

$

|

5.55

|

|

|

$

|

2.90

|

|

|

Third Quarter

|

|

$

|

3.19

|

|

|

$

|

0.51

|

|

|

Fourth Quarter

|

|

$

|

0.91

|

|

|

$

|

0.23

|

|

On

June 4, 2010, the last reported sale price for shares of our common stock on the Nasdaq

Global Market was $1.79 per share.

LIQUIDITY AND CAPITAL RESOURCES UPDATE

Our principal source of liquidity is our available cash and cash equivalents of $20.9 million as of May 1, 2010 and $20 million of additional borrowing capacity relating to our revolving asset-backed bank line of credit with PNC Bank, National Association, as amended on June 8, 2010. If we are not able to attain profitability and generate positive cash flows from operations or obtain cash from other sources in addition to

our $20 million secured bank line of credit facility, we may not have sufficient liquidity to continue operating.

In addition, our credit agreement with our secured lender requires compliance with various operating and financial

covenants. If we are unable to comply with those covenants, our access to our secured bank line of credit may be

limited. For example, in order to borrow more than $8 million under the credit agreement, we must satisfy

certain EBITDA thresholds or fixed charge ratios on certain dates. While we are currently in compliance, because

borrowings were not in excess of $8 million, we currently believe that borrowings in excess of $8 million would

result in a covenant violation at the quarter ended January 29, 2011. This effectively will limit our

borrowing capacity to $8 million at January 29, 2011 unless these covenants are amended prior to or at

that time. In addition, the lender has the right to terminate the revolving credit facility in the event

a material adverse effect (as defined in the agreement) is met. We also have the ability to increase our

short-term liquidity and cash resources by reducing the percentage of our sales offered to customers using

our ValuePay installment program and by decreasing the length of time we extend credit to our customers using

the ValuePay program. Based on our current projections for fiscal 2010, we believe that our existing cash

balances, our credit line, our ability to raise additional financing and the ability to structure transactions

in a manner reflective of capital availability will be sufficient to maintain liquidity to fund our normal business

operations through fiscal 2010. However, there can be no assurance that we will meet our projections for 2010 or that, if required, we would be able to raise additional capital or reduce spending sufficiently to maintain the necessary

liquidity.

8

SELLING SHAREHOLDER

We are registering 6,452,194 shares of our common stock for resale by the selling shareholder

identified below. The shares are being registered to permit public secondary trading of the

shares, and the selling shareholder may offer the shares for resale from time to time. The selling

shareholder acquired the shares pursuant to our strategic alliance with GE Equity and NBCU. As

part of this strategic alliance, we entered into an amended and restated registration rights

agreement on February 25, 2009 with GE Equity and NBCU that provides GE Equity, NBCU and their

affiliates and any transferees and assigns, an aggregate of four demand registrations and unlimited

piggy-back registration rights. We have prepared this prospectus pursuant to a notice submitted to

us by NBCU under the demand registration provisions in the amended and restated registration rights

agreement.

The following table presents the number of outstanding shares of our common stock owned by the

selling shareholder as of June 1, 2010. The percentage of common stock owned by the selling

shareholder is calculated based on 32,686,735 shares outstanding on

June 1, 2010. The table also

presents the maximum number of shares proposed to be sold by the selling shareholder and the number

of shares they will own after the sales.

The selling shareholder named below in the table has sole voting and investment power with

respect to the shares of common stock set forth opposite the selling shareholder’s name.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

|

|

|

|

|

|

Number of

|

|

Number of

|

|

|

|

|

|

Shares of

|

|

Shares of

|

|

Shares of

|

|

|

|

Common Stock

|

|

Common Stock to

|

|

Common Stock

|

|

|

|

Owned Prior

|

|

be Sold Pursuant

|

|

Owned After

|

|

|

|

to Offering

|

|

to this Prospectus

|

|

Offering

|

|

Name of Selling Shareholder

|

|

Number

|

|

Percent

|

|

Number

|

|

Percent

|

|

Number

|

|

Percent

|

|

NBC Universal, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 Rockefeller Plaza

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York,

New York 10122 (1)

|

|

|

6,474,309

|

|

|

|

19.8

|

|

|

|

6,452,194

|

|

|

|

19.7

|

|

|

|

22,115

|

|

|

|

*

|

|

|

|

|

|

|

*

|

|

less than 1%

|

|

|

|

(1)

|

|

Information with respect to NBCU is provided in reliance upon information provided by NBCU.

Common stock shown for NBCU includes 6,452,194 shares of common stock and 22,115 shares of common

stock issuable upon exercise of certain warrants for which NBCU has sole dispositive power.

|

Strategic Alliance with GE Equity and NBC Universal

In March 1999, we entered into a strategic alliance with GE Equity and NBCU pursuant to which

we issued Series A Redeemable Convertible Preferred Stock and common stock warrants, and entered

into a shareholder agreement, a registration rights agreement, a distribution and marketing

agreement and, the following year, a trademark license agreement. On February 25, 2009, we entered

into an exchange agreement with the same parties, pursuant to which GE Equity exchanged all

outstanding shares of our Series A Preferred Stock for (i) 4,929,266 shares of our Series B

Redeemable Preferred Stock, (ii) warrants to purchase up to 6,000,000 shares of our common stock at

an exercise price of $0.75 per share and (iii) a cash payment in the amount of $3.4 million.

Immediately after the exchange, the aggregate equity ownership of GE Equity and NBCU in our company

was as follows: (i) 6,452,194 shares of common stock, (ii) warrants to purchase up to 6,029,487

shares of common stock and (iii) 4,929,266 shares of Series B Preferred Stock. In connection with

the exchange, the parties also amended and restated both the shareholder agreement and the

registration rights agreement. The outstanding agreements with GE Equity and NBCU are described in

more detail below.

Series B Preferred Stock

On February 25, 2009, we issued 4,929,266 shares of Series B Preferred Stock to GE Equity. The

shares of Series B Preferred Stock are redeemable at any time by us for the initial redemption

amount of $40.9 million, plus accrued dividends. The Series B Preferred Stock accrues cumulative

dividends at a base annual rate of 12%, subject to adjustment. All payments on the Series B

Preferred Stock will be applied first to any accrued but unpaid dividends, and then to redeem

shares.

30% of the Series B Preferred Stock (including accrued but unpaid dividends) is required to be

redeemed on February 25, 2013, and the remainder on February 25, 2014. In addition, the Series B

Preferred Stock includes a cash sweep mechanism that may require accelerated redemptions if we

generate excess cash above agreed upon

9

thresholds. Specifically, our excess cash balance at the end of each fiscal year, and at the

end of any fiscal quarter during which we sell our auction rate securities or dispose of assets or

incur indebtedness above agreed upon thresholds, must be used to redeem the Series B Preferred

Stock and pay accrued and unpaid dividends thereon. Excess cash balance is defined as our company’s

cash and cash equivalents and marketable securities, adjusted to (i) exclude auction rate

securities, (ii) exclude cash pledged to vendors to secure purchase price of inventory, (iii)

account for variations that are due to our management of payables, and (iv) provide us a cash

cushion of at least $20 million. Any redemptions as a result of this cash sweep mechanism will

reduce the amounts required to be redeemed on February 25, 2013 and February 25, 2014. The Series B

Preferred Stock (including accrued but unpaid dividends) is also required to be redeemed, at the

option of the holders, upon a change in control.

The Series B Preferred Stock is not convertible into common stock or any other security, but

initially will vote with the common stock on a one-for-one basis on general corporate matters other

than the election of directors. In addition, the holders of the Series B Preferred Stock have

certain class voting rights, including the right to elect the GE Equity director-designees

described below.

Amended and Restated Shareholder Agreement

On February 25, 2009, we entered into an amended and restated shareholder agreement with GE

Equity and NBCU, which provides for certain corporate governance and standstill matters. The

amended and restated shareholder agreement provides that GE Equity is entitled to designate

nominees for three out of nine members of our board of directors so long as the aggregate

beneficial ownership of GE Equity and NBCU (and their affiliates) is at least equal to 50% of their

beneficial ownership as of February 25, 2009 (i.e. beneficial ownership of approximately 8.75

million common shares), and two out of nine members so long as their aggregate beneficial ownership

is at least 10% of the “adjusted outstanding shares of common stock,” as defined in the amended and

restated shareholder agreement. In addition, the amended and restated shareholder agreement

provides that GE Equity may designate any of its director-designees to be an observer of the Audit,

Human Resources and Compensation, and Corporate Governance and Nominating Committees.

The amended and restated shareholder agreement requires the consent of GE Equity prior to our

entering into any material agreements with any of CBS, Fox, Disney, Time Warner or Viacom, provided

that this restriction will no longer apply when either (i) our trademark license agreement with

NBCU (described below) has terminated or (ii) GE Equity is no longer entitled to designate at least

two director nominees. In addition, the amended and restated shareholder agreement requires the

consent of GE Equity prior to our exceeding certain thresholds relating to the issuance of

securities, the payment of dividends, the repurchase of common stock, acquisitions (including

investments and joint ventures) or dispositions, and the incurrence of debt; provided, that these

restrictions will no longer apply when both (i) GE Equity is no longer entitled to designate three

director nominees and (ii) GE Equity and NBCU no longer hold any Series B Preferred Stock. We are

also prohibited from taking any action that would cause any ownership interest by us in TV

broadcast stations from being attributable to GE Equity, NBCU or their affiliates.

The shareholder agreement provides that during the standstill period (as defined in the

shareholder agreement), subject to certain limited exceptions, GE Equity and NBCU are prohibited

from: (i) any asset/business purchases from us in excess of 10% of the total fair market value of

our assets; (ii) increasing their beneficial ownership above 39.9% of our shares; (iii) making or

in any way participating in any solicitation of proxies; (iv) depositing any securities of our

company in a voting trust; (v) forming, joining or in any way becoming a member of a “13D Group”

with respect to any voting securities of our company; (vi) arranging any financing for, or

providing any financing commitment specifically for, the purchase of any voting securities of our

company; (vii) otherwise acting, whether alone or in concert with others, to seek to propose to us

any tender or exchange offer, merger, business combination, restructuring, liquidation,

recapitalization or similar transaction involving us, or nominating any person as a director of our

company who is not nominated by the then incumbent directors, or proposing any matter to be voted

upon by our shareholders. If, during the standstill period, any inquiry has been made regarding a

“takeover transaction” or “change in control,” each as defined in the shareholder agreement, that

has not been rejected by the board of directors, or the board pursues such a transaction, or

engages in negotiations or provides information to a third party and the board has not resolved to

terminate such discussions, then GE Equity or NBCU may propose to us a tender offer or business

combination proposal.

In addition, unless GE Equity and NBCU beneficially own less than 5% or more than 90% of the

adjusted outstanding shares of common stock, GE Equity and NBCU shall not sell, transfer or

otherwise dispose of any securities of our company except for transfers: (i) to certain affiliates

who agree to be bound by the provisions of the

10

shareholder agreement, (ii) that have been consented to by us, (iii) pursuant to a third-party

tender offer, (iv) pursuant to a merger, consolidation or reorganization to which we are a party,

(v) in an underwritten public offering pursuant to an effective registration statement, (vi)

pursuant to Rule 144 of the Securities Act of 1933, or (vii) in a private sale or pursuant to Rule

144A of the Securities Act of 1933; provided, that in the case of any transfer pursuant to clause

(v), (vi) or (vii), the transfer does not result in, to the knowledge of the transferor after

reasonable inquiry, any other person acquiring, after giving effect to such transfer, beneficial

ownership, individually or in the aggregate with that person’s affiliates, of more than 10% (or

16.2%, adjusted for repurchases of common stock by our company, in the case of a transfer by NBCU)

of the adjusted outstanding shares of the common stock.

The standstill period will terminate on the earliest to occur of (i) the ten-year anniversary

of the amended and restated shareholder agreement, (ii) our entering into an agreement that would

result in a “change in control” (subject to reinstatement), (iii) an actual “change in control”

(subject to reinstatement), (iv) a third-party tender offer (subject to reinstatement), or (v) six

months after GE Equity and NBCU can no longer designate any nominees to the board of directors.

Following the expiration of the standstill period pursuant to clause (i) or (v) above (indefinitely

in the case of clause (i) and two years in the case of clause (v)), GE Equity and NBCU’s beneficial

ownership position may not exceed 39.9% of our diluted outstanding stock, except pursuant to

issuance or exercise of any warrants or pursuant to a 100% tender offer for our company.

Registration Rights Agreement

On February 25, 2009, we entered into an amended and restated registration rights agreement

providing GE Equity, NBCU and their affiliates and any transferees and assigns, an aggregate of

four demand registrations and unlimited piggy-back registration rights.

NBCU Trademark License Agreement

On November 16, 2000, we entered into a trademark license agreement with NBCU, pursuant to

which NBCU granted us an exclusive, worldwide license for a term of ten years to use certain NBC

trademarks, service marks and domain names to rebrand our business and corporate name and website.

We subsequently selected the names ShopNBC and ShopNBC.com.

Under the license agreement we have agreed, among other things, to (i) certain restrictions on

using trademarks, service marks, domain names, logos or other source indicators owned or controlled

by NBCU, (ii) the loss of our rights under the license with respect to specific territories outside

of the United States in the event we fail to achieve and maintain certain performance targets in

such territories, (iii) not own, operate, acquire or expand our business to include certain

businesses without NBCU’s prior consent, (iv) comply with NBCU’s privacy policies and standards and

practices, and (v) not own, operate, acquire or expand our business such that one-third or more of

our revenues or our aggregate value is attributable to certain services (not including retailing

services similar to our existing e-commerce operations) provided over the internet. The license

agreement also grants to NBCU the right to terminate the license agreement at any time upon certain

changes of control of our company, in certain situations upon the failure by NBCU to own a certain

minimum percentage of our outstanding capital stock on a fully diluted basis, and certain other

situations. On March 28, 2007, we and NBCU agreed to extend the term of the license by six months,

such that the license would continue through May 15, 2011, and to provide that certain changes of

control involving a financial buyer would not provide the basis for an early termination of the

license by NBCU. We are in the process of selecting a new name and logo for our television, websites, mobile and other media channels, and will implement a systematic rebranding strategy during the remainder of the fiscal year.

11

PLAN OF DISTRIBUTION

The selling shareholder may, from time to time, sell any or all of its shares of common stock

on the Nasdaq Global Market, any other stock exchange or automated interdealer quotation system on

which the securities are listed or otherwise, in the over-the-counter market or in private

transactions through one or more underwriters, broker-dealers or agents, or in any other legal