ShopNBC (NASDAQ: VVTV)

-- Net sales increased 11% to $132 million

-- Positive adjusted EBITDA of $0.6 million vs. ($5.6) million

-- Gross Profit increased 19% to $47 million

-- E-commerce sales penetration increased 680 bps to 40.5%

ShopNBC (NASDAQ: VVTV), the premium lifestyle brand in

multi-media retailing, today announced financial results for its

fiscal third quarter ended October 30, 2010. The company will host

a conference call and webcast to review its results today at 11:00

a.m. ET. Details provided below.

SUMMARY RESULTS AND KEY OPERATING METRICS

($ Millions, except average price points)

Q3 YTD

For the three months ending For the nine months ending

------------------------------ -----------------------------

10/30/2010 10/31/2009 Change 10/30/2010 10/31/2009 Change

--------- --------- -------- --------- --------- -------

Net Sales $ 132.3 $ 119.4 10.8% $ 383.4 $ 372.6 2.9%

EBITDA $ 0.6 $ (5.6) N/A $ (5.7) $ (18.2) 68.8%

as adjusted

Net Loss $ (5.8) $ (12.9) 55.0% $ (24.5) $ (33.2) 26.2%

Homes 76,768 73,063 5.1% 76,032 73,097 4.0%

(Average 000s)

Net Shipped 1,317 1,186 11.0% 3,590 3,084 16.4%

Units (000s)

Average $ 93 $ 95 -2.5% $ 99 $ 114 -13.3%

Price

Return Rate % 20.8% 21.9% -110 bps 20.2% 21.8% -160 bps

Gross Margin % 35.6% 33.2% 240 bps 36.5% 33.1% 340 bps

Internet Net 40.5% 33.7% 680 bps 39.8% 31.5% 830 bps

Sales %

New 562,510 486,474 15.6% N/A N/A

Customers

12 month

rolling

Active 1,110,187 959,508 15.7% N/A N/A

Customers

12 month

rolling

"Our experienced multi-channel team achieved another consecutive

quarter of improved performance," said Keith Stewart, CEO of

ShopNBC. "Sales growth of 11%, gross margin improvements, and lower

transactional costs contributed to a $0.6 million adjusted EBITDA

profit in the third quarter. New and active customers in the

quarter continued to engage, interact and shop across our multiple

channels with e-commerce sales penetration of 40.5%, up 680 basis

points compared to last year. This overall progress is a validation

of our continued focus and efforts to turn the company around while

executing on new strategies for growth."

Mr. Stewart added: "Going forward, we will continue to focus on

customer-centric strategies that will help us build on our existing

base. We intend to improve operating processes and gain added

efficiencies through disciplined execution and lower transactional

costs. Lastly, as the year comes to a close, we anticipate entering

into negotiations with several of our cable and satellite

affiliates -- representing approximately 25% of our household

footprint -- to further reduce distribution costs and improve our

channel positioning."

"We are committed to delivering long-term sustained growth. As

part of these efforts, we are launching a proactive investor

relations outreach program and have recently retained a New

York-based IR firm to assist us in that effort."

Third Quarter 2010 Results

Third quarter revenues rose 11% to $132.3 million vs. Q3 2009.

The company continued to make progress in its strategy to drive

transaction volumes through the reduction of its net average

selling price, which decreased 2.5% to $93 vs. $95 in the year-ago

quarter while net shipped units increased by 11%. E-commerce sales,

which carry lower transaction costs, grew to 40.5% of total company

sales in the quarter, from 33.7% in Q3 2009.

Customer trends continued to improve with new and active

customers increasing 15.6% and 15.7%, respectively, on a 12-month

rolling basis vs. Q2 2009. Return rates for the quarter declined to

20.8% vs. 21.9% in Q3 2009, reflecting improvements in overall

customer satisfaction and the benefit of strategic pricing

changes.

Gross profit increased 19% to $47.1 million and gross profit

margin improved 240 bps to 35.6% vs. 33.2% last year, largely

driven by merchandise margin rate improvements across several key

categories.

Adjusted EBITDA was positive $0.6 million compared to an

adjusted EBITDA loss of $5.6 million in the year-ago period, driven

by increased sales, improved gross margin and lower operating

expenses.

Operating expenses in the third quarter decreased approximately

1% to $50.8 million, due to lower transactional costs and the

impact of prior-year itemized non-recurring expenses.

Net loss for the third quarter was reduced to ($5.8) million

compared to a net loss of ($12.9) million for the same quarter last

year.

Liquidity and Capital Resources

The Q3 quarter-end cash and cash equivalents balance was $20.6

million, including $5.0 million of restricted cash. The cash and

cash equivalents balance declined $2.3 million from the second

quarter, driven by working capital use in the quarter. On a

year-to-date basis, cash and cash equivalents have decreased $1.4

million.

Additionally, the company recently announced that it entered

into a $25 million term loan with a lending group led by Crystal

Financial LLC. The loan has a 5-year maturity, bears a variable

interest rate, which will initially be set at 11%, and will be used

to finance general working capital needs. The loan replaces a

previous $20 million revolving credit facility, and is secured

primarily by the company's inventory and accounts receivable.

Conference Call / Webcast Information

Conference Call Dial-In: 1-800-369-2063 (pass code: 7467622;

keypad: SHOPNBC)

Webcast URL: https://e-meetings.verizonbusiness.com conference

number 8656218, pass code: SHOPNBC. An archived version of the

webcast will be available for 30 days.

Call Replay: 1-800-867-1929 with pass code 81810, available for

30 days.

About ShopNBC

ShopNBC is a multi-media retailer operating with a premium

lifestyle brand. Over 1 million customers benefit from ShopNBC as

an authority and destination in the categories of home,

electronics, beauty, health, fitness, fashion, jewelry and watches.

As part of the company's "ShopNBC Anywhere" initiative, customers

can interact and shop via cable and satellite TV in 76 million

homes (DISH Network channels 134 and 228; DIRECTV channel 316);

mobile devices including iPhone, BlackBerry and Droid; online at

www.ShopNBC.com; live streaming at www.ShopNBC.TV; and social

networking sites Facebook, Twitter and YouTube. ShopNBC is owned

and operated by ValueVision Media (NASDAQ: VVTV). For more

information, please visit www.ShopNBC.com/IR.

EBITDA and EBITDA, as adjusted

EBITDA represents net loss for the respective periods excluding

depreciation and amortization expense, interest income (expense)

and income taxes. The company defines Adjusted EBITDA as EBITDA

excluding non-operating gains (losses); non-cash impairment charges

and write-downs; restructuring, rebranding, and chief executive

officer transition costs; and non-cash share-based compensation

expense. The company has included the term "Adjusted EBITDA" in our

EBITDA reconciliation in order to adequately assess the operating

performance of our "core" television and internet businesses and in

order to maintain comparability to our analyst's coverage and

financial guidance, when given. Management believes that Adjusted

EBITDA allows investors to make a more meaningful comparison

between our core business operating results over different periods

of time with those of other similar companies. In addition,

management uses Adjusted EBITDA as a metric measure to evaluate

operating performance under its management and executive incentive

compensation programs. Adjusted EBITDA should not be construed as

an alternative to operating income (loss) or to cash flows from

operating activities as determined in accordance with generally

accepted accounting principles and should not be construed as a

measure of liquidity. Adjusted EBITDA may not be comparable to

similarly entitled measures reported by other companies.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and accordingly are subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable and satellite distribution for

the company's programming and the fees associated therewith; the

success of the company's e-commerce and new sales initiatives; the

success of its strategic alliances and relationships; the ability

of the company to manage its operating expenses successfully; the

ability of the Company to establish and maintain acceptable

commercial terms with third party vendors and other third parties

with whom the Company has contractual relationships; changes in

governmental or regulatory requirements; litigation or governmental

proceedings affecting the company's operations; and the ability of

the company to obtain and retain key executives and employees. More

detailed information about those factors is set forth in the

company's filings with the Securities and Exchange Commission,

including the company's annual report on Form 10-K, quarterly

reports on Form 10-Q, and current reports on Form 8-K. The company

is under no obligation (and expressly disclaims any such

obligation) to update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share data)

October 30, January 30,

2010 2010

----------- -----------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 15,674 $ 17,000

Restricted cash and investments 4,961 5,060

Accounts receivable, net 57,312 68,891

Inventories 51,997 44,077

Prepaid expenses and other 4,029 4,333

----------- -----------

Total current assets 133,973 139,361

Property and equipment, net 26,651 28,342

FCC broadcasting license 23,111 23,111

NBC Trademark License Agreement, net 1,734 4,154

Other Assets 1,386 1,246

----------- -----------

$ 186,855 $ 196,214

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 51,618 $ 58,777

Accrued liabilities 44,493 26,487

Deferred revenue 728 728

----------- -----------

Total current liabilities 96,839 85,992

Deferred revenue 607 1,153

Long Term Payable 1,937 4,841

Accrued Dividends - Series B Preferred Stock 8,903 4,681

Series B Mandatorily Redeemable Preferred Stock 12,531 11,243

$.01 par value, 4,929,266 shares authorized;

4,929,266 shares issued and outstanding

----------- -----------

Total liabilities 120,817 107,910

Commitments and Contingencies

Shareholders' equity:

Common stock, $.01 par value, 100,000,000

shares authorized; 32,796,077 and 32,672,735

shares issued and outstanding 328 327

Warrants to purchase 6,022,115 shares of

common stock 637 637

Additional paid-in capital 318,932 316,721

Accumulated deficit (253,859) (229,381)

----------- -----------

Total shareholders' equity 66,038 88,304

----------- -----------

$ 186,855 $ 196,214

=========== ===========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

For the Three Month For the Nine Month

Periods Ended Periods Ended

------------------------ ------------------------

October 30, October 31, October 30, October 31,

2010 2009 2010 2009

----------- ----------- ----------- -----------

Net sales $ 132,283 $ 119,441 $ 383,437 $ 372,588

Cost of sales 85,234 79,774 243,495 249,172

----------- ----------- ----------- -----------

Gross profit 47,049 39,667 139,942 123,416

Operating expense:

Distribution and

selling 42,752 41,774 133,815 130,898

General and

administrative 4,445 4,264 14,007 13,200

Depreciation and

amortization 2,997 3,507 10,215 10,723

Restructuring costs 412 126 838 715

Rebranding costs 39 - 39 -

CEO transition costs - 1,567 - 1,867

----------- ----------- ----------- -----------

Total operating

expense 50,645 51,238 158,914 157,403

----------- ----------- ----------- -----------

Operating loss (3,596) (11,571) (18,972) (33,987)

----------- ----------- ----------- -----------

Other income

(expense):

Interest income - 2 51 365

Interest expense (2,203) (1,350) (6,148) (3,328)

Gain on sale of

investments - - - 3,628

----------- ----------- ----------- -----------

Total other income

(expense) (2,203) (1,348) (6,097) 665

----------- ----------- ----------- -----------

Loss before income

taxes (5,799) (12,919) (25,069) (33,322)

Income tax (provision)

benefit (15) - 591 157

----------- ----------- ----------- -----------

Net loss (5,814) (12,919) (24,478) (33,165)

Excess of preferred

stock carrying value

over redemption value - - - 27,362

Accretion of

redeemable

Series A preferred

stock - - - (62)

----------- ----------- ----------- -----------

Net loss available to

common shareholders $ (5,814) $ (12,919) $ (24,478) $ (5,865)

=========== =========== =========== ===========

Net loss per common

share $ (0.18) $ (0.40) $ (0.75) $ (0.18)

=========== =========== =========== ===========

Net loss per common

share

---assuming dilution $ (0.18) $ (0.40) $ (0.75) $ (0.18)

=========== =========== =========== ===========

Weighted average

number of common

shares outstanding:

Basic 32,781,462 32,332,278 32,721,377 32,569,618

=========== =========== =========== ===========

Diluted 32,781,462 32,332,278 32,721,377 32,569,618

=========== =========== =========== ===========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Reconciliation of EBITDA, as adjusted, to Net Loss:

For the Three Month For the Nine Month

Periods Ended Periods Ended

------------------------ ------------------------

October 30, October 31, October 30, October 31,

2010 2009 2010 2009

----------- ----------- ----------- -----------

EBITDA, as adjusted

(000's) $ 578 $ (5,630) $ (5,656) $ (18,152)

Less:

Non-operating gain

on sale of

investments - - - 3,628

Restructuring

costs (412) (126) (838) (715)

CEO transition

costs - (1,567) - (1,867)

Rebranding costs (39) - (39) -

Non-cash

share-based

compensation (616) (741) (2,114) (2,530)

----------- ----------- ----------- -----------

EBITDA (as defined) (a) (489) (8,064) (8,647) (19,636)

----------- ----------- ----------- -----------

A reconciliation of

EBITDA to net loss is

as follows:

EBITDA, as defined (489) (8,064) (8,647) (19,636)

Adjustments:

Depreciation and

amortization (3,107) (3,507) (10,325) (10,723)

Interest income - 2 51 365

Interest expense (2,203) (1,350) (6,148) (3,328)

Income taxes (15) - 591 157

----------- ----------- ----------- -----------

Net loss $ (5,814) $ (12,919) $ (24,478) $ (33,165)

=========== =========== =========== ===========

(a) EBITDA as defined for this statistical presentation represents net

income (loss) for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes. The

Company defines EBITDA, as adjusted, as EBITDA excluding non-operating

gains (losses); non-cash impairment charges and writedowns, restructuring,

rebranding and CEO transition costs; and non-cash share-based compensation

expense.

Management has included the term EBITDA, as adjusted, in its EBITDA

reconciliation in order to adequately assess the operating performance of

the Company's "core" television and Internet businesses and in order to

maintain comparability to its analyst's coverage and financial guidance

when given. Management believes that EBITDA, as adjusted, allows investors

to make a more meaningful comparison between our core business operating

results over different periods of time with those of other similar

companies. In addition, management uses EBITDA, as adjusted, as a metric

measure to evaluate operating performance under its management and

executive incentive compensation programs. EBITDA, as adjusted, should not

be construed as an alternative to operating income (loss) or to cash flows

from operating activities as determined in accordance with GAAP and should

not be construed as a measure of liquidity. EBITDA, as adjusted, may not

be comparable to similarly entitled measures reported by other companies.

Contact Information: Investor/Media Relations Anthony Giombetti

agiombetti@shopnbc.com 612-308-1190 Investor Relations Norberto Aja

& David Collins vvtv@jcir.com 212-835-8500

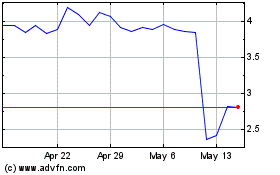

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

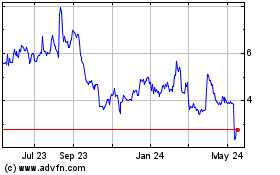

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024