- Amended Statement of Beneficial Ownership (SC 13D/A)

December 06 2010 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1 )*

(Name of Issuer)

Common Stock, $.01 par value

(Title of Class of Securities)

(CUSIP Number)

Keith R. Stewart

6740 Shady Oak Road

Eden Prairie, MN 55344

952-943-6000

With copy to:

Nathan E. Fagre

6740 Shady Oak Road

Eden Prairie, MN 55344

952-943-6000

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

o

Note:

Schedules filed

in paper format shall include a signed original and five copies of

the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

1.

|

|

NAMES OF REPORTING PERSONS. I.R.S. Identification Nos. of above persons (entities only).

Keith R. Stewart

|

|

|

|

|

|

|

|

|

|

2.

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

o

|

|

|

|

|

|

3.

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4.

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

PF

|

|

|

|

|

|

5.

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6.

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

United States

|

|

|

|

|

|

|

|

7.

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

2,464,488

|

|

|

|

|

|

|

SHARES

|

8.

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

-0-

|

|

|

|

|

|

|

EACH

|

9.

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

2,464,488

|

|

|

|

|

|

|

WITH:

|

10.

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

|

11.

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

(see explanation in Item 5)

|

|

|

|

|

|

12.

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13.

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

7.39%

1

|

|

|

|

|

|

14.

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

IN

|

1.

Percentage of beneficial ownership is calculated under applicable SEC regulations based upon 32,772,735 shares of common stock outstanding as of September 7, 2010.

Item 1.

SECURITY AND ISSUER

This Amendment No. 1 to Schedule 13D (the “Amendment”) amends and restates, where indicated,

the statement on Schedule 13D relating to the Common Stock, par value $0.01 per share (“Common

Stock”) of the Issuer filed by Keith R. Stewart (the “Reporting Person”) with the Securities and

Exchange Commission (the “SEC”) on July 27, 2009 (the “Initial Schedule 13D”).

Item 2.

IDENTITY AND BACKGROUND

|

(a)

|

|

This Amendment is being filed by the Reporting Person.

|

|

|

|

(b)

|

|

The principal residence or office of the Reporting Person is 6740 Shady Oak Road, Eden

Prairie, MN 55344.

|

|

|

|

(c)

|

|

The Reporting Person is the Chief Executive Officer and a director of the Issuer.

|

|

|

|

(d)-(e)

|

|

During the last five years, the Reporting Person has not been convicted in a criminal

proceeding, been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction as a result of which such individual was or is subject to a judgment, decree, or final

order enjoining future violations of, or prohibiting, or mandating activity subject to, federal or

state securities laws or finding any violation with respect to such laws.

|

Item 3.

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

Not applicable.

Item 4.

PURPOSE OF TRANSACTION

The Reporting Person acquired the securities referenced in Item 5 for investment purposes. The

Reporting Person may, from time to time, acquire additional shares of the Company’s common stock

in the open market, in connection with issuances by the Company or sales by other shareholders in

transactions registered under the Securities Act of 1933, as amended, in privately negotiated

transactions or otherwise and/or retain and/or sell or otherwise dispose of all or a portion of

his shares in the open market, through transactions registered under the Securities Act or through

privately negotiated transactions. Any actions the Reporting Person might undertake will be

dependent upon the Reporting Person’s review of numerous factors, including, among other things,

the price levels of the Company’s common stock; general market and economic conditions; the

relative attractiveness of alternative business and investment opportunities; and other future

developments.

Except as set forth above, the Reporting Person has no present plans or intentions which would

result in or relate to any of the transactions described in subparagraphs (a) through (j) of Item

4 of Schedule 13D.

Item 5.

INTEREST IN SECURITIES OF THE ISSUER

|

(a)

|

|

The Reporting Person beneficially owns 2,464,488 shares, (including options to purchase

166,666 shares pursuant to the exercise of options which vest within 60 days) representing

approximately 7.39% of the outstanding shares of Common Stock of the Issuer. The calculation

of the foregoing percentage is based on a total of 32,772,735 shares of Common Stock of the

Issuer outstanding as of September 7, 2010.

|

|

|

|

(b)

|

|

The Reporting Person has sole voting and dispositive power with respect to the 2,464,488

shares of Common Stock (including 166,666 shares issuable upon exercise of the options to

purchase Common Stock) of the Issuer.

|

|

|

|

(c)

|

|

TRANSACTIONS WITHIN THE LAST 60 DAYS OR SINCE THE LAST FILING.

|

|

|

|

|

|

On November 18, 2010, the Company granted an option to the Reporting Person to purchase

500,000 shares of the Company’s common stock under the Company’s 2004 Omnibus Stock Plan

(the “Option

|

|

|

|

Grant”), pursuant to his Employment Agreement signed when the Reporting

Person was promoted to Chief Executive Officer, and subsequently amended and restated

with a date of February 19, 2010. Although initially it was proposed that the Option

Grant was to be issued upon Mr. Stewart’s promotion to Chief Executive Officer, at Mr.

Stewart’s request the Board of Directors agreed to defer the grant until the Company

recorded a positive EBITDA quarter, or certain other events. The Company recently

reported positive EBITDA results in the third quarter of fiscal year 2010 and issued the

Option Grant. The vesting schedule of the Option Grant is as follows: 166,666 shares of

the Option Grant vested on November 18, 2010; 166,666 shares of the Option Grant will

vest on January 26, 2011 and the remaining shares of the Option Grant will vest on

January 26, 2012.

|

|

|

|

The Reporting Person is also voluntarily disclosing vesting conditions of all of his

shares obtainable upon exercise of stock options previously granted to him by the

Company. These previous grants of stock options, although currently not exercisable

within 60 days, will vest over time as follows: (i) August 27, 2008 grant of 250,000

shares of common stock of which 125,000 shares have vested and 62,500 shares will vest on

August 25, 2011 and the remaining 62,500 shares will vest on

August 25, 2012; (ii) August 27, 2008 grant

of 125,000 shares of common stock of which 62,500 shares have vested and 31,250 shares

will vest on August 25, 2011 and the remaining 31,250 shares will vest on August 25,

2012; and (iii) August 27, 2008 grant of 125,000 shares of common stock of which 62,500 shares have

vested and 31,250 shares will vest on August 25, 2011 and the remaining 31,250 shares

will vest on August 25, 2012.

|

|

|

|

(d)

|

|

Not applicable.

|

|

|

|

(e)

|

|

Not applicable.

|

Item 6.

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

None.

Item 7.

MATERIAL TO BE FILED AS EXHIBITS

None.

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the

information set forth in this statement is true, complete and correct.

Dated: December 6, 2010

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Keith R. Stewart

|

|

|

|

Keith R. Stewart

|

|

|

|

|

|

|

|

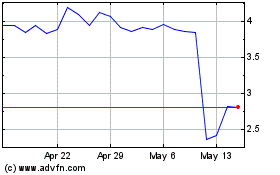

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

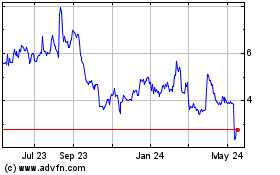

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024