ValueVision Urges Shareholders to Review Its Five-Year Track Record of Performance Before Voting on the Company's Future

June 12 2014 - 7:00AM

Marketwired

ValueVision Urges Shareholders to Review Its Five-Year Track Record

of Performance Before Voting on the Company's Future

MINNEAPOLIS, MN--(Marketwired - Jun 12, 2014) - ValueVision

Media, Inc. (NASDAQ: VVTV), a multichannel electronic retailer

operating as ShopHQ via TV, Internet and mobile, today provided a

clear quantitative accounting of the Company's current leadership's

track record of success across a number of crucial financial and

operating metrics. The table (below) illustrates the Company's

performance over the five full years during which key members of

the current Board and management team formulated and executed the

Company's successful strategy and return to growth.

Randy Ronning, ValueVision's Chairman of the Board of Directors,

stated, "ValueVision's record is clear and compelling. On nearly

every important measure, the Board and leadership team have made

tremendous progress, transforming a business that was seriously

challenged and near bankruptcy into a growing and vibrant Company.

Based on our record, we believe ValueVision's nominees deserve

strong shareholder support. Moreover, the Company's track record of

accomplishment should be the real focus of consideration as our

shareholders face the critical choices before them for the future

of their investment.

"Owning collectively 12.6% of the Company, ValueVision's Board

and management are deeply concerned about the future of the

Company, given the risk and uncertainty that we believe could

result should shareholders support the Clinton Group's proposed

change of Board leadership and Company direction and the proposed

immediate removal of the current senior management in light of the

Clinton Group's constant and baseless criticisms, which we believe

are not supported by the Company's performance.

"What is clear to the Board is that few if any shareholders

would support such unwarranted change and risk, if they were fully

informed regarding the breadth of progress that has been made. To

assure that performance is both clear and accessible, we have

provided the above table of performance metrics from Fiscal 2008

through Fiscal 2013.

"We believe that in reviewing the Company's record and in

considering the huge management, operational, distribution,

financial, merchandise, branding and reputational challenges the

business faced when management arrived, that shareholders will

conclude that the Clinton Group's nominees and their proposed

actions are the wrong direction for the Company. Most importantly,

such review will likely inform shareholders as to which leadership

team, strategy and direction offers the greatest experience,

potential and lowest risk for delivering further improvements in

shareholder value.

"We have come too far to risk your and our collective

investments on what we believe to be Clinton Group's and its

nominees' superficial ideas to bet the Company's future on costly,

uncertain celebrity-linked products or strategies to be executed by

an as yet undetermined CEO. Instead, imagine what the proven

ValueVision team can do over the next five years as they focus

fully on growth and business enhancements, rather than fixes,

financial restructuring and other remedial tasks. Certainly our

covering analysts also share our enthusiasm, as each of them

recommends our shares as a Buy."

Adjusted EBITDA

EBITDA represents net income (loss) for the respective periods

excluding depreciation and amortization expense, interest income

(expense) and income taxes. The Company defines Adjusted EBITDA as

EBITDA excluding debt extinguishment; non-operating gains (losses);

non-cash impairment charges and write-downs; activist shareholder

response costs; and non-cash share-based compensation expense. The

Company has included the term "Adjusted EBITDA" in our EBITDA

reconciliation in order to adequately assess the operating

performance of our television and Internet businesses and in order

to maintain comparability to our analysts' coverage and financial

guidance, when given. Management believes that the term Adjusted

EBITDA allows investors to make a more meaningful comparison

between our business operating results over different periods of

time with those of other similar companies. In addition, management

uses Adjusted EBITDA as a metric to evaluate operating performance

under the Company's management and executive incentive compensation

programs. Adjusted EBITDA should not be construed as an alternative

to operating income (loss), net income (loss) or to cash flows from

operating activities as determined in accordance with generally

accepted accounting principles and should not be construed as a

measure of liquidity. Adjusted EBITDA may not be comparable to

similarly entitled measures reported by other companies. The

Company has included a reconciliation of Adjusted EBITDA to net

income (loss), its most directly comparable GAAP financial measure,

above.

About ValueVision Media/ShopHQ (www.shophq.com/ir)

ValueVision Media, Inc. operates as ShopHQ, a multichannel

retailer that enables customers to shop and interact via TV, phone,

Internet and mobile in the merchandise categories of Home &

Consumer Electronics, Beauty, Health & Fitness, Fashion &

Accessories, and Jewelry & Watches. The ShopHQ television

network reaches over 87 million cable and satellite homes and is

also available nationwide via live streaming at www.shophq.com.

Please visit www.shophq.com/ir for more investor information.

Forward-Looking Information

This release may contain certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. Any statements contained herein that are not statements of

historical fact may be deemed forward-looking statements. These

statements are based on management's current expectations and

accordingly are subject to uncertainty and changes in

circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer preferences, spending and

debt levels; the general economic and credit environment; interest

rates; seasonal variations in consumer purchasing activities; the

ability to achieve the most effective product category mixes to

maximize sales and margin objectives; competitive pressures on

sales; pricing and gross sales margins; the level of cable and

satellite distribution for our programming and the associated fees;

our ability to establish and maintain acceptable commercial terms

with third-party vendors and other third parties with whom we have

contractual relationships, and to successfully manage key vendor

relationships; our ability to manage our operating expenses

successfully and our working capital levels; our ability to remain

compliant with our long-term credit facility covenants; our ability

to successfully transition our brand name; the market demand for

television station sales; our management and information systems

infrastructure; challenges to our data and information security;

changes in governmental or regulatory requirements; litigation or

governmental proceedings affecting our operations; significant

public events that are difficult to predict, or other significant

television-covering events causing an interruption of television

coverage or that directly compete with the viewership of our

programming; and our ability to obtain and retain key executives

and employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

You are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date of this announcement.

The Company is under no obligation (and expressly disclaims any

such obligation) to update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

Important Information

This release may be deemed to be solicitation material in

respect of the solicitation of proxies from shareholders in

connection with one or more meetings of the Company's shareholders,

including the Company's 2014 Annual Meeting of Shareholders. On May

9, 2014, the Company filed with the Securities and Exchange

Commission ("SEC") a proxy statement and a WHITE proxy card in

connection with the Company's 2014 Annual Meeting of Shareholders.

The Company, its directors and certain of its executive officers

and employees may be deemed to be participants in the solicitation

of proxies from shareholders in connection with the Company's 2014

Annual Meeting of Shareholders. Information concerning the

interests of these directors and executive officers in connection

with the matters to be voted on at the Company's 2014 Annual

Meeting of Shareholders is included in the proxy statement filed by

the Company with the SEC in connection with such meeting. In

addition, the Company files annual, quarterly and special reports,

proxy and information statements, and other information with the

SEC. The proxy statement for the 2014 Annual Meeting of

Shareholders is available, and any other relevant documents and any

other material filed with the SEC concerning the Company will be,

when filed, available, free of charge at the SEC website at

http://www.sec.gov. SHAREHOLDERS ARE URGED TO READ CAREFULLY THE

PROXY STATEMENT FILED BY THE COMPANY AND ANY OTHER RELEVANT

DOCUMENTS FILED WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION WITH RESPECT

TO PARTICIPANTS.

|

|

|

|

|

|

|

|

|

| ValueVision Media, Inc. Financial and Operational

Progress over 5 Years |

| Based on VVTV Board & Team Assembled Starting Late

2008/Early 2009 |

|

|

|

|

|

|

|

|

|

|

|

Prior Team |

Current Team's Performance |

Current Team |

|

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

Improvement |

|

Improved Financial Performance |

|

|

|

|

|

|

|

|

Revenue $M's |

$568 |

$528 |

$562 |

$558 |

$587 |

$641 |

+ $73M |

|

Gross Margin % |

32.0% |

32.9% |

35.5% |

36.6% |

36.2% |

35.9% |

+390 basis points |

|

Gross Profit, $M's |

$182 |

$173 |

$200 |

$204 |

$212 |

$230 |

+ $48M |

|

Total Operating Expenses, $M's |

$

271 |

$

215 |

$

215 |

$

221 |

$

236 |

$

230 |

- $41M |

|

Operating (Loss) Profit, $M's |

$

(89) |

$

(41) |

$

(16) |

$

(17) |

$

(23) |

$

1 |

+ $90M |

|

Adj. EBITDA, $M's |

$

(51) |

$

(19) |

$

2 |

$

1 |

$

5 |

$

18 |

+ $69M |

|

Net Loss, $M's |

$

(98) |

$

(42) |

$

(26) |

$

(48) |

$

(28) |

$

(3) |

+ $95M |

|

|

|

|

|

|

|

|

|

|

Diversification of Merchandise Assortment |

|

|

|

|

|

|

|

|

Jewelry & Watches |

56% |

55% |

52% |

53% |

52% |

43% |

- 1,300 basis points * |

|

Home & Consumer Electronics |

32% |

32% |

33% |

28% |

27% |

33% |

+ 100 basis points |

|

Fashion & Accessories |

7% |

6% |

6% |

7% |

8% |

11% |

+ 400 basis points |

|

Beauty, Health & Fitness |

5% |

7% |

9% |

12% |

13% |

13% |

+ 800 basis points |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Improved Operating Metrics |

|

|

|

|

|

|

|

|

Internet / Mobile % of Revenue |

32.0% |

33.7% |

41.2% |

44.9% |

45.7% |

46.4% |

+ 1,440 basis points |

|

Net Promoter Score # |

n/a |

n/a |

n/a |

36% |

47% |

54% |

|

|

Returns % |

31.2% |

21.0% |

19.8% |

22.6% |

21.1% |

22.3% |

- 900 basis points |

|

Average Selling Price |

$

176 |

$

108 |

$

101 |

$

104 |

$

96 |

$

81 |

- $95 |

|

Shipped Units |

3.7 |

4.5 |

5.2 |

4.9 |

5.5 |

7.2 |

+ 3.5M |

|

Transaction Costs |

$4.82 |

$3.60 |

$2.90 |

$2.91 |

$2.61 |

$2.50 |

- $2.32 |

|

|

|

|

|

|

|

|

|

|

Active Customers Past 12 Months, M's |

0.754 |

1.022 |

1.144 |

1.060 |

1.132 |

1.357 |

+ 0.60 M |

|

|

|

|

|

|

|

|

|

| * Progress on strategy to diminish reliance on Jewelry

& Watches category and to invest in growing its other

segments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted EBITDA to Net

Income/(Loss): |

|

|

|

|

|

|

|

|

|

|

|

Prior Team |

Current Team's Performance |

Current Team |

|

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

Improvement |

|

|

|

|

|

|

|

|

|

|

EBITDA, as adjusted |

$ |

(51) |

$ |

(19) |

$ |

2 |

$ |

1 |

$ |

5 |

$ |

18 |

+ $69M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCC license impairment |

|

(9) |

|

|

|

|

|

|

|

(11) |

|

- |

|

|

Writedown of Auction Rate Securities |

|

(11) |

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) on sale of investments or asset |

|

(1) |

|

4 |

|

|

|

|

|

0 |

|

- |

|

|

CEO Transition Cost |

|

(3) |

|

(2) |

|

|

|

|

|

- |

|

- |

|

|

Debt Extinguishment |

|

- |

|

- |

|

(1) |

|

(26) |

|

(1) |

|

- |

|

|

Activist Shareholder Response Costs |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(2) |

|

|

Restructuring costs and other non-recurring items |

|

(4) |

|

(2) |

|

(1) |

|

- |

|

- |

|

- |

|

|

Non-cash share-based compensation |

|

(4) |

|

(3) |

|

(3) |

|

(5) |

|

(3) |

|

(3) |

|

|

EBITDA (as defined) (a) |

|

(83) |

|

(23) |

|

(3) |

|

(30) |

|

(10) |

|

13 |

+ $96M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A reconciliation of EBITDA to net income (loss) is as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA, as defined |

|

(83) |

|

(23) |

|

(3) |

|

(30) |

|

(10) |

|

13 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

(17) |

|

(14) |

|

(13) |

|

(13) |

|

(13) |

|

(13) |

|

|

Interest income |

|

3 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Interest expense |

|

- |

|

(5) |

|

(10) |

|

(6) |

|

(4) |

|

(1) |

|

|

Income taxes |

|

(0) |

|

0 |

|

1 |

|

(0) |

|

(0) |

|

(1) |

|

|

Net income (loss) |

$ |

(98) |

$ |

(42) |

$ |

(26) |

$ |

(48) |

$ |

(28) |

$ |

(3) |

+ $95M |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Media Contact: Dawn Zaremba ShopHQ dzaremba@shophq.com (952)

943-6043 O

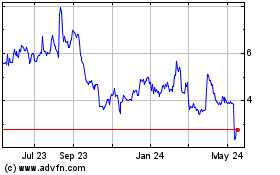

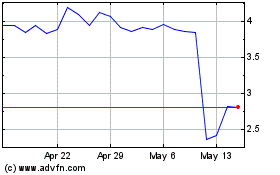

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024