false

0001563568

0001563568

2024-05-20

2024-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 20, 2024

ENVIROTECH VEHICLES, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-38078

|

|

46-0774222

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

1425 Ohlendorf Road

Osceola, AR

|

|

72370

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(870) 970-3355

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

☐

|

Pre -commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

☐

|

Pre -commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.00001 par value

|

EVTV

|

NASDAQ Stock Market LLC.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On May 20, 2024, Envirotech Vehicles, Inc. issued a press release (the “Press Release”) announcing its financial results for the first quarter ended March 31, 2024. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section. Furthermore, such information, including Exhibit 99.1, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENVIROTECH VEHICLES, INC.

|

|

| |

|

|

|

|

Date: May 20, 2024

|

By:

|

/s/ Franklin Lim

|

|

| |

|

Franklin Lim

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Envirotech Vehicles Announces First Quarter 2024 Financial Results

OSCEOLA, AR / May 20, 2024 / Envirotech Vehicles, Inc. (NASDAQ:EVTV), a provider of purpose-built zero-emission electric vehicles (the "Company" or “Envirotech Vehicles”), today announced its results for the three months ended March 31, 2024.

First Quarter 2024 Financial Results

Sales were $810,490 for the three months ended March 31, 2024, compared to $523,199 for the three months ended March 31, 2023. The sales increase was primarily related to additional units sold in 2024 versus the same period in 2023. This reflects an increase of approximately 55% over the same quarter in 2023.

Net loss in the first quarter of 2024 was $4,532,363, or ($0.29) per basic and diluted share, compared to a net loss of $2,267,908 or ($0.15) per basic and diluted share in the first quarter of 2023. Adjusted net loss in the first quarter of 2024 was $1,144,053, or ($0.07) per basic and diluted share, compared to adjusted net loss of $2,180,764 or ($0.14) per basic and diluted share in the first quarter of 2023.

Adjusted EBITDA was ($1,098,698) for the first quarter of 2024 versus adjusted EBITDA of ($2,183,933) for the same period in 2023, reflecting an increase of $1,085,235 in 2024 compared to the same period in 2023.

As of March 31, 2024, the Company had cash and cash equivalents, of $1,049,357 and working capital of approximately $8,148,204.

Phil Oldridge, CEO and Chairman of the Company’s Board of Directors, stated that, “we continue to work on expanding our business while maintaining vigilance over spending as a part of our principled operating philosophy.”

“On the manufacturing front, we started to make progress on refurbishing our Osceola, Arkansas facility during the first quarter,” continued Mr. Oldridge. “The Company has also started the leasehold improvements to the Clark facility in the Philippines.”

“Looking ahead, we are excited to see the 2023 round of funding by the EPA to spur school bus electrification in the U.S., and we were awarded as a beneficiary in 2024 for 25 all electric EVT school buses. More broadly, we remain excited about our previously announced partnership with Plug’d. We delivered units in Q1 2024 and have partnered with them for leasing to fleet and government customers. We continue to see an increase in demand for our vehicles from companies that can take delivery of our products in the short term as opposed to simply generating backlogs of orders without firm delivery dates. At Envirotech Vehicles, we believe that this continued growing interest in and demand for our vehicles provides a positive outlook through 2024 and beyond,” concluded Mr. Oldridge.

About Envirotech Vehicles

Envirotech Vehicles is a provider of purpose-built zero-emission electric vehicles focused on reducing the total cost of vehicle ownership and helping fleet operators unlock the benefits of green technology. We serve commercial and last-mile fleets, school districts, public and private transportation service companies and colleges and universities to meet the increasing demand for heavy-duty electric vehicles. Our vehicles address the challenges of traditional fuel price cost instability and local, state and federal environmental regulatory compliance. For more information visit www.evtvusa.com.

Cautionary Statement Regarding Forward-Looking Statements

Statements made in this press release that relate to future plans, events, financial results, prospects or performance are forward-looking statements. While they are based on the current expectations and beliefs of management, such forward-looking statements are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from the expectations expressed in this press release, including the risks and uncertainties disclosed in reports filed by Envirotech Vehicles with the Securities and Exchange Commission, all of which are available online at www.sec.gov. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including statements containing the words "planned," "expected," "believes," "strategy," "opportunity," "anticipated," "outlook," "designed," and similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, Envirotech Vehicles undertakes no obligation to update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

Envirotech Vehicles, Inc.

Franklin Lim, CFO

Telephone: (870) 970-3355

Email: franklin.l@evtvusa.com

SOURCE: Envirotech Vehicles, Inc

Non-GAAP Financial Measures

This press release contains financial measures that do not comply with U.S. generally accepted accounting principles (“GAAP”), such as adjusted net loss and adjusted EBITDA. These measures are intended to supplement, not replace, the Company’s presentation of its financial results in accordance with GAAP. The Company believes that the non-GAAP financial measures presented are commonly used by financial analysts and others in the industries in which the Company operates, and thus further provide useful information to investors. The Company’s definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies. The principal limitation of these non-GAAP measures is that they exclude important cash and non-cash items required by GAAP to be recorded in the Company's financial statements. The Company urges investors to review the following reconciliation of these non-GAAP measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate the Company's financial performance.

The Company has presented these non-GAAP financial measures as it believes that the presentation of its financial results that exclude (1) stock-based compensation costs and (2) unrealized loss on financial instruments at fair value are useful and assist in comparing the Company’s current operating results with past periods and with the operational performance of other companies in its industry. As described in further detail below, the Company has determined that these expenses are not normal, recurring cash operating expenses necessary to operate its business. Presented below is the Company’s rationale for why providing financial measures for its business with such expenses excluded or adjusted is useful to investors as a supplement to the U.S. GAAP measures.

| |

●

|

Stock-based compensation costs – non-cash costs that primarily relate to equity awarded to employees, directors and certain outside consultants for services rendered;

|

| |

●

|

Unrealized loss on financial instruments at fair value – non-cash charge associated with changes in fair value of the Company’s financial instruments that do not affect the Company’s day-to-day operations.

|

ENVIROTECH VEHICLES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

| |

|

For the Three Months Ended

|

|

|

Variance

|

|

| |

|

March 31,

|

|

|

March 31,

|

|

|

|

|

|

| |

|

2024

|

|

|

2023

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings calculation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(4,532,363 |

) |

|

$ |

(2,267,908 |

) |

|

|

(2,264,455 |

) |

|

Stock-based compensation

|

|

|

1,818,383 |

|

|

|

87,144 |

|

|

|

1,731,239 |

|

|

Unrealized loss on financial instruments fair value

|

|

|

1,569,927 |

|

|

|

- |

|

|

|

1,569,711 |

|

|

Adjusted net loss

|

|

$ |

(1,144,053 |

) |

|

$ |

(2,180,764 |

) |

|

|

1,036,711 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per share calculation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share

|

|

$ |

(.29 |

) |

|

$ |

(.15 |

) |

|

$ |

(.14 |

) |

|

Stock-based compensation per share

|

|

|

0.12 |

|

|

|

0.01 |

|

|

|

.11 |

|

|

Unrealized loss on financial instruments fair value per share

|

|

|

0.10 |

|

|

|

- |

|

|

|

.10 |

|

|

Adjusted net loss per share

|

|

$ |

(.07 |

) |

|

$ |

(.14 |

) |

|

$ |

.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income taxes, depreciation, and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

(4,532,363 |

) |

|

$ |

(2,267,908 |

) |

|

$ |

(2,264,455 |

) |

|

Net interest income

|

|

|

6,143 |

|

|

|

(32,153 |

) |

|

|

38,296 |

|

|

Depreciation expense

|

|

|

39,212 |

|

|

|

28,948 |

|

|

|

10,228 |

|

|

Earnings before income taxes, depreciation, and amortization

|

|

$ |

(4,487,008 |

) |

|

$ |

(2,271,077 |

) |

|

$ |

(2,215,931 |

) |

|

Stock based compensation

|

|

$ |

1,818,383 |

|

|

$ |

87,144 |

|

|

$ |

1,731,239 |

|

|

Unrealized loss on financial instruments fair value

|

|

|

1,569,927 |

|

|

|

- |

|

|

|

1,569,235 |

|

|

Adjusted earnings before income taxes, depreciation, and amortization

|

|

$ |

(1,098,698 |

) |

|

$ |

(2,183,933 |

) |

|

$ |

1,085,235 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$ |

810,490 |

|

|

$ |

523,199 |

|

|

$ |

287,291 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 20, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ENVIROTECH VEHICLES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 20, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38078

|

| Entity, Tax Identification Number |

46-0774222

|

| Entity, Address, Address Line One |

1425 Ohlendorf Road

|

| Entity, Address, City or Town |

Osceola

|

| Entity, Address, State or Province |

AR

|

| Entity, Address, Postal Zip Code |

72370

|

| City Area Code |

870

|

| Local Phone Number |

970-3355

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

EVTV

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001563568

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

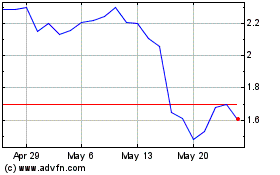

Envirotech Vehicles (NASDAQ:EVTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Envirotech Vehicles (NASDAQ:EVTV)

Historical Stock Chart

From Jan 2024 to Jan 2025