NCR Wins New Deal from SBI - Analyst Blog

April 09 2013 - 4:20AM

Zacks

NCR Corporation

(NCR) has won a deal from a new banking client. Recently, the

company secured a contract from the largest bank in India “State

Bank of India” (“SBI”) to deploy roughly 600 NCR SelfServ 32

Intelligent Cash Deposit ATMs across India.

This is one of the largest orders

made by the State Bank of India for its cash deposit ATMs in recent

times. With the implementation of the new NCR SelfServ intelligent

deposit ATMs, SBI customers can avoid the long queues at its

branches as well as avail cash deposits cash using these machines

beyond banking hours.

These ATM’s will help SBI reduce

the cost incurred during cash transactions as it will be able to

shift most of its deposit transactions from the banks to the ATM’s.

Normally, a transaction costs roughly Rs. 40 to Rs. 45, which will

come down by approximately 66.0%.

As per a latest report by RBR

Research and the ATM industry association, the global ATM space

will likely grow at a rapid rate, especially cash withdrawal

services in emerging markets. The report suggests that ATM cash

withdrawals will grow by 90.0%.

The under-penetrated markets of the

Asia-Pacific, the Middle East and Africa are deemed to see the

strongest growth. Thus, these regions appear to be apt for

companies like NCR to focus on.

NCR has been constantly inking new

deals, which are expected to be beneficial for the company going

forward. A couple of months back, NCR agreed to provide support to

eBay Inc. (EBAY) to expand its mobile payment

business, PayPal. As per the terms of this agreement, the PayPal

mobile service will be integrated into NCR's POS technology,

enabling customers to pay their bills at restaurants using a

smartphone.

However, with more players

introducing new products, competition is heating up. NCR’s broad

exposure and years of experience in the ATM space is encouraging

and could help it stay ahead of its traditional competitors

Diebold Inc. (DBD) and Wincor Nixdorf.

Currently, NCR Corp. has a Zacks

Rank #2 (Buy). Investors can also consider other technology stocks

such as Faro Tech Inc. (FARO), carrying a Zacks

Rank #1 (Strong Buy).

DIEBOLD INC (DBD): Free Stock Analysis Report

EBAY INC (EBAY): Free Stock Analysis Report

FARO TECH INC (FARO): Free Stock Analysis Report

NCR CORP-NEW (NCR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

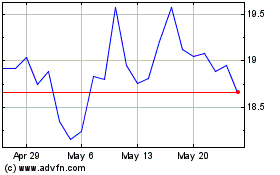

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jun 2024 to Jul 2024

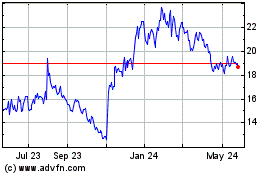

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jul 2023 to Jul 2024