First Business Financial Services, Inc. (the "Company" or "First

Business") (NASDAQ:FBIZ), the parent company of First Business

Bank, First Business Bank - Milwaukee and Alterra Bank (“Alterra”),

today reported solid fourth quarter and year-to-date 2015 earnings,

driven by the Company’s strong loan and deposit growth, as well as

enhanced performance and efficiency from strategic investments in

talent and technology.

The results underscore the value and considerable potential of

the November 2014 acquisition of Alterra as the entire Company

benefited from enhanced execution of Alterra’s relationship-based

SBA strategy across First Business’s footprint as a catalyst for

client acquisition, as well as a driver of growth in loans,

non-interest bearing deposits and non-interest income.

Highlights for the quarter ended December 31, 2015 include:

- Net income for the fourth quarter of 2015 totaled $4.1

million, an increase of 9%, compared to $3.7

million in the fourth quarter of 2014.

- Diluted earnings per common share increased

to $0.47 for the fourth quarter of 2015, compared

to $0.44 for the fourth quarter of 2014.

- Annualized return on average assets and annualized return on

average equity measured 0.93% and 10.85%, respectively, for the

fourth quarter of 2015, compared to 0.95% and 10.92%, respectively,

for the fourth quarter of 2014.

- Top line revenue, consisting of net interest income and

non-interest income, increased 20% to a record $19.8 million,

compared to $16.6 million for the fourth quarter of 2014.

- The Company's fourth quarter efficiency ratio improved to

58.75%, compared to 64.82% in the linked quarter and 61.11% for the

fourth quarter of 2014.

- Period-end loans and leases receivable net of allowance for

loan and lease losses grew for the fifteenth consecutive quarter to

a record $1.415 billion, up 12% from December 31, 2014.

- Net interest margin measured 3.63% for the fourth quarter of

2015, compared to 3.61% for the linked quarter and 3.67% for the

fourth quarter of 2014.

- Net charge-offs were $938,000 in the fourth quarter

of 2015, compared to net charge-offs of $838,000 in the

fourth quarter of 2014.

- Non-performing assets as a percent of total assets increased

to 1.34% at December 31, 2015 from 0.70% at

December 31, 2014.

- The effective tax rate for the fourth quarter of 2015 was

34.86%, compared to 31.98% in the linked quarter and 27.96% in the

fourth quarter of 2014.

“2015 represented a year of investment in both talent and

technology as we continue to develop First Business into a scalable

franchise,” said Corey Chambas, President and Chief Executive

Officer. “As evidenced by our exceptional core earnings, and our

loan and deposit growth in the fourth quarter, we’re already

starting to see a return on these investments. We also made

significant strides in expanding Alterra’s relationship-based SBA

platform across our entire footprint and we are in a great position

to continue this in 2016, as indicated by our expanding

pipeline.”

The Company earned net income of $4.1 million in the fourth

quarter of 2015, compared to $4.4 million in the third quarter

of 2015 and $3.7 million in the fourth quarter of 2014. Diluted

earnings per common share were $0.47 for the fourth quarter of

2015, compared to $0.50 for the linked quarter and $0.44 for the

fourth quarter of 2014. Per share data for all periods reflect the

previously announced two-for-one stock split in the form of a 100%

stock dividend declared and paid by the company in August 2015.

The Company's net income for the year ended December 31, 2015

was a record $16.5 million, or $1.90 per diluted common share,

compared to $14.1 million, or $1.75 per diluted common share,

earned for the year ended December 31, 2014.

During the fourth quarter of 2015, Alterra contributed $3.1

million in net interest income, including $316,000 related to the

net accretion/amortization of purchase accounting adjustments, $2.1

million in non-interest income, $2.6 million in non-interest

expense and $1.3 million in loan loss provision, netting to a total

of $1.3 million in pre-tax income to First Business's results. In

the third quarter of 2015, Alterra produced $2.9 million in net

interest income, including $385,000 related to the net

accretion/amortization of purchase accounting adjustments, $1.5

million in non-interest income, $2.6 million in non-interest

expense and $355,000 in loan loss provision, netting to a total of

$1.5 million in pre-tax income to First Business's results. During

the fourth quarter of 2014, which included two months’ contribution

from Alterra, Alterra contributed $2.0 million in net interest

income, including $392,000 related to the net

accretion/amortization of purchase accounting adjustments, $567,000

in non-interest income, $1.5 million in non-interest expense and

$337,000 in loan loss provision, netting to a total of $638,000 in

pre-tax income to First Business's results.

Results of Operations

Net interest income of $14.9 million increased 2.1%

compared to the linked quarter and 9.7% compared to the fourth

quarter of 2014. The increase from the linked quarter was primarily

due to a $48.4 million increase in average loans and leases and a

two basis point increase in net interest margin.

The net interest margin in the fourth quarter was 3.63% compared

to 3.61% in the third quarter of 2015 and 3.67% in the fourth

quarter of 2014. Fourth quarter 2015 net interest margin included

eight basis points related to the net accretion/amortization of

purchase accounting adjustments, while the linked quarter margin

and the fourth quarter 2014 margin included nine and 11 basis

points, respectively. Excluding the net accretion/amortization of

the purchase accounting adjustments, fourth quarter 2015 net

interest margin improved by three basis points from the linked

quarter, principally due to loan and lease growth and the

corresponding decrease in excess funds held at the Federal Reserve.

Management expects the net accretion/amortization to remain

volatile in future quarters but generally with a declining effect

on net interest margin. As of December 31, 2015, $954,000 and

$355,000 of purchase accounting discounts and premiums,

respectively, remain outstanding. Net interest margin may

experience occasional volatility due to non-recurring events such

as loan fees collected in lieu of interest, the collection of

interest on loans previously in non-accrual or the accumulation of

significant short-term deposit inflows.

Non-interest income of $4.9 million for the fourth quarter of

2015 increased 20.3% from the third quarter of 2015 and 66.4% from

the fourth quarter of 2014, which included only two months’

contribution from Alterra. Alterra contributed $2.1 million in

non-interest income during the fourth quarter of 2015, including

$1.5 million in gains on the sale of SBA loans, $115,000 in gains

on the sale of residential mortgage loans and $230,000 in loan

fees. Alterra’s revenue contribution reflects continued growth in

the SBA lending business, including seasonally strong volumes.

Expansion of Alterra's SBA lending expertise into First Business's

Wisconsin markets continues to be successful, with approximately

30% of the fourth quarter gain on sale of SBA loans related to

credits originated outside Alterra’s Kansas City market. Trust and

investment services income totaled $1.2 million, decreasing $34,000

compared to the linked quarter; however, business development

efforts remained strong as trust assets under management and

administration measured a record $1.021 billion at December 31,

2015, compared to $978.6 million at September 30, 2015 and $959.7

million at December 31, 2014.

Non-interest expense for the fourth quarter of 2015 was $11.7

million, a decrease of 2.5% compared to the linked quarter and an

increase of 15.4% compared to the fourth quarter of 2014. Fourth

quarter 2015 compensation expense decreased compared to the linked

quarter primarily due to a reduction to the estimate of the 2015

annual incentive bonus plan. Compared to the linked quarter,

general other non-interest expenses, specifically professional

fees, decreased in line with expectations as new technology

platforms are now largely in place. The significant increase in

non-interest expense year over year is principally due to talent

acquisition as the Company meaningfully invested in people

throughout 2015, ending the year with 242 full-time equivalent

employees, an increase of 27, or 12.6%, from December 31, 2014.

Management expects to continue investing in personnel, products and

technology to support its growth strategies and initiatives.

The Company's efficiency ratio of 58.75% for the fourth quarter

of 2015 declined from 64.82% for the linked quarter and 61.11% for

the fourth quarter of 2014. The fourth quarter of 2015 benefited

from the non-recurring reduction in incentive compensation related

to the Company’s 2015 financial performance. Management expects the

efficiency ratio to trend towards the Company’s long-term objective

of 60% in future quarters, reflecting revenue growth, operating

efficiencies and enhanced effectiveness achieved through previous

and ongoing investments.

For the full year 2015, net charge-offs as a percentage of

average loans and leases measured 0.10%, compared to 0.08% for

2014. In the fourth quarter of 2015, the Company recorded a

provision for loan and lease losses totaling $1.9 million, compared

to $287,000 in the linked quarter and $1.2 million in the fourth

quarter of 2014. Net charge-offs of $938,000 represented an

annualized 0.27% of average loans and leases for the fourth quarter

of 2015. This compares to annualized net charge-offs measuring

0.04% and 0.28% of average loans and leases in the linked quarter

and fourth quarter of 2014, respectively. The fourth quarter 2015

provision included a $653,000 charge-off related to one commercial

real estate loan that was not previously specifically reserved for,

in addition to a $621,000 increase in specific reserves on a

previously identified impaired loan related to the energy

sector.

The effective tax rate was 34.86% in the fourth quarter of 2015,

compared to 31.98% in the linked quarter and 27.96% in the fourth

quarter of 2014. The effective tax rate for the year ended December

31, 2015 was 33.65% compared to 33.38% for the year ended December

31, 2014. The third quarter of 2015 was lower primarily due to

adjustments based on the filing of the 2014 tax returns. The fourth

quarter of 2014 was lower due to the recognition of federal tax

credits related to the Company’s participation in a community

development program.

Balance Sheet and Asset Quality Strength

Period-end net loans and leases grew for the fifteenth

consecutive quarter, reaching a record $1.415 billion at December

31, 2015. Net loans and leases increased $52.8 million,

or 3.9%, from September 30, 2015 and $149.6 million, or

11.8%, from December 31, 2014. On an average basis, gross

loans and leases increased 3.6% during the fourth quarter of

2015, to $1.411 billion, compared to the linked quarter.

Growth reflects the successful execution of the Company's strategic

plan, including increased sales to existing clients, attracting new

commercial clients and capitalizing on market opportunities.

Period-end in-market deposits - consisting of all transaction

accounts, money market accounts and non-wholesale deposits -

increased to $1.090 billion, or 69.1% of total deposits, at

December 31, 2015. Period-end wholesale deposits were $487.5

million at December 31, 2015, consisting of brokered certificates

of deposit and deposits gathered through internet deposit listing

services of $413.2 million and $74.3 million, respectively. In

order to reduce interest-rate risk, the Company uses wholesale

deposits to efficiently match-fund fixed rate loans. Over time,

management expects to maintain a ratio of in-market deposits to

total deposits in line with the Company's recent historical range

of 60%-70%.

Management continues to believe asset quality is a source of

strength that differentiates the Company from many of its peers,

despite a recent increase in non-performing assets. During the

fourth quarter of 2015 total non-performing assets increased to

$24.0 million, a $12.6 million increase from $11.3 million as of

September 30, 2015, principally due to downgrading one $6.2 million

restructured relationship to non-performing. This relationship,

which was previously reported as impaired in the second and third

quarters of 2015, is directly related to the energy sector.

Management believes the remaining increase in non-performing assets

is not systemic in nature or indicative of a trend but rather due

to downgrading a small number of unrelated credits.

As of December 31, 2015, the Company’s direct exposure to the

energy sector consisted of $10.0 million in loans and leases

receivable, or 0.70% of total gross loans and leases, with an

associated reserve for loan and lease losses totaling 6.63%. Of

this population, $7.8 million was considered non-performing as of

year end. In January 2016, $1.8 million of the total non-performing

energy exposure was paid off in full.

Capital Strength

The Company's earnings continue to generate capital, and its

capital ratios exceed the highest required regulatory benchmark

levels. As of December 31, 2015, total capital to risk-weighted

assets was 11.11%, tier 1 capital to risk-weighted assets was

8.81%, tier 1 capital to average assets was 8.63% and common equity

tier 1 capital to risk-weighted assets was 8.22%. Capital ratios as

of December 31, 2015 reflect the Company's implementation of the

capital guidelines under Basel III, which became effective January

1, 2015.

Quarterly Dividend

As previously announced, during the fourth quarter of 2015 the

Company's Board of Directors declared a regular quarterly dividend

of $0.11 per share. The dividend was paid

on November 23, 2015 to shareholders of record at

the close of business on November 12, 2015. Measured

against fourth quarter 2015 diluted earnings per share

of $0.47, the dividend represents what the Company believes is

a sustainable 23% payout ratio. The Board of Directors

routinely considers dividend declarations as part of its normal

course of business.

About First Business Financial Services, Inc.

First Business Financial Services, Inc. (NASDAQ:FBIZ) is a

Wisconsin-based bank holding company focused on the unique needs of

businesses, business executives, and high net worth individuals.

First Business offers commercial banking, specialty finance, and

private wealth management solutions, and because of its niche

focus, is able to provide its clients with unmatched expertise,

accessibility, and responsiveness. For additional information,

visit www.firstbusiness.com or call 608-238-8008.

This release may include forward-looking statements as defined

in the Private Securities Litigation Reform Act of 1995, which

reflect First Business’s current views with respect to future

events and financial performance. Forward-looking statements are

not based on historical information, but rather are related to

future operations, strategies, financial results or other

developments. Forward-looking statements are based on management’s

expectations as well as certain assumptions and estimates made by,

and information available to, management at the time the statements

are made. Those statements are based on general assumptions and are

subject to various risks, uncertainties and other factors that may

cause actual results to differ materially from the views, beliefs

and projections expressed in such statements. Such statements are

subject to risks and uncertainties, including among other

things:

- Competitive pressures among depository and other financial

institutions nationally and in our market areas may increase

significantly.

- Adverse changes in the economy or business conditions, either

nationally or in our market areas, could increase credit-related

losses and expenses and/or limit growth.

- Increases in defaults by borrowers and other delinquencies

could result in increases in our provision for losses on loans and

related expenses.

- Our inability to manage growth effectively, including the

successful expansion of our customer support, administrative

infrastructure and internal management systems, could adversely

affect our results of operations and prospects.

- Fluctuations in interest rates and market prices could reduce

our net interest margin and asset valuations and increase our

expenses.

- The consequences of continued bank acquisitions and mergers in

our market areas, resulting in fewer but much larger and

financially stronger competitors, could increase competition for

financial services to our detriment.

- Changes in legislative or regulatory requirements applicable to

us and our subsidiaries could increase costs, limit certain

operations and adversely affect results of operations.

- Changes in tax requirements, including tax rate changes, new

tax laws and revised tax law interpretations may increase our tax

expense or adversely affect our customers' businesses.

- System failure or breaches of our network security, including

with respect to our internet banking activities, could subject us

to increased operating costs and other liabilities.

For further information about the factors that could affect the

Company’s future results, please see the Company’s 2014 annual

report on Form 10-K, quarterly reports on Form 10-Q and other

filings with the Securities and Exchange Commission.

SELECTED FINANCIAL CONDITION DATA

|

(Unaudited) |

|

As of |

| (in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

113,564 |

|

|

$ |

122,671 |

|

|

$ |

88,848 |

|

|

$ |

141,887 |

|

|

$ |

103,237 |

|

| Securities available-for-sale, at

fair value |

|

140,548 |

|

|

143,729 |

|

|

146,342 |

|

|

142,951 |

|

|

144,698 |

|

| Securities held-to-maturity, at

amortized cost |

|

37,282 |

|

|

38,364 |

|

|

39,428 |

|

|

40,599 |

|

|

41,563 |

|

| Loans held for sale |

|

2,702 |

|

|

2,910 |

|

|

1,274 |

|

|

2,396 |

|

|

1,340 |

|

| Loans and leases receivable |

|

1,430,965 |

|

|

1,377,172 |

|

|

1,349,290 |

|

|

1,294,540 |

|

|

1,279,427 |

|

| Allowance for loan and lease

losses |

|

(16,316 |

) |

|

(15,359 |

) |

|

(15,199 |

) |

|

(14,694 |

) |

|

(14,329 |

) |

| Loans and leases, net |

|

1,414,649 |

|

|

1,361,813 |

|

|

1,334,091 |

|

|

1,279,846 |

|

|

1,265,098 |

|

| Premises and equipment, net |

|

3,954 |

|

|

3,889 |

|

|

3,998 |

|

|

3,883 |

|

|

3,943 |

|

| Foreclosed properties |

|

1,677 |

|

|

1,632 |

|

|

1,854 |

|

|

1,566 |

|

|

1,693 |

|

| Cash surrender value of bank-owned

life insurance |

|

28,298 |

|

|

28,029 |

|

|

27,785 |

|

|

27,548 |

|

|

27,314 |

|

| Investment in Federal Home Loan

Bank and Federal Reserve Bank stock, at cost |

|

2,843 |

|

|

2,843 |

|

|

2,891 |

|

|

2,798 |

|

|

2,340 |

|

| Goodwill and other intangible

assets |

|

12,493 |

|

|

12,244 |

|

|

12,133 |

|

|

12,011 |

|

|

11,944 |

|

| Accrued interest receivable and

other assets |

|

25,626 |

|

|

26,029 |

|

|

24,920 |

|

|

25,192 |

|

|

26,217 |

|

| Total assets |

|

$ |

1,783,636 |

|

|

$ |

1,744,153 |

|

|

$ |

1,683,564 |

|

|

$ |

1,680,677 |

|

|

$ |

1,629,387 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

| In-market deposits |

|

$ |

1,089,748 |

|

|

$ |

1,062,753 |

|

|

$ |

1,026,588 |

|

|

$ |

1,054,828 |

|

|

$ |

1,010,928 |

|

| Wholesale deposits |

|

487,483 |

|

|

476,617 |

|

|

444,480 |

|

|

430,973 |

|

|

427,340 |

|

| Total deposits |

|

1,577,231 |

|

|

1,539,370 |

|

|

1,471,068 |

|

|

1,485,801 |

|

|

1,438,268 |

|

| Federal Home Loan Bank and other

borrowings |

|

35,226 |

|

|

36,354 |

|

|

47,401 |

|

|

34,448 |

|

|

33,994 |

|

| Junior subordinated notes |

|

10,315 |

|

|

10,315 |

|

|

10,315 |

|

|

10,315 |

|

|

10,315 |

|

| Accrued interest payable and other

liabilities |

|

10,032 |

|

|

10,147 |

|

|

10,493 |

|

|

8,424 |

|

|

9,062 |

|

| Total liabilities |

|

1,632,804 |

|

|

1,596,186 |

|

|

1,539,277 |

|

|

1,538,988 |

|

|

1,491,639 |

|

| Total stockholders’ equity |

|

150,832 |

|

|

147,967 |

|

|

144,287 |

|

|

141,689 |

|

|

137,748 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

1,783,636 |

|

|

$ |

1,744,153 |

|

|

$ |

1,683,564 |

|

|

$ |

1,680,677 |

|

|

$ |

1,629,387 |

|

STATEMENTS OF INCOME

|

(Unaudited) |

|

As of and for the Three Months

Ended |

|

As of and for the Year Ended |

|

(Dollars in thousands, except per share

amounts) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

|

December 31, 2015 |

|

December 31, 2014 |

| Total interest

income |

|

$ |

18,600 |

|

|

$ |

18,135 |

|

|

$ |

17,520 |

|

|

$ |

18,216 |

|

|

$ |

16,863 |

|

|

$ |

72,471 |

|

|

$ |

57,701 |

|

| Total interest

expense |

|

3,688 |

|

|

3,525 |

|

|

3,332 |

|

|

3,286 |

|

|

3,268 |

|

|

13,831 |

|

|

11,571 |

|

| Net interest income |

|

14,912 |

|

|

14,610 |

|

|

14,188 |

|

|

14,930 |

|

|

13,595 |

|

|

58,640 |

|

|

46,130 |

|

| Provision for loan and

lease losses |

|

1,895 |

|

|

287 |

|

|

520 |

|

|

684 |

|

|

1,236 |

|

|

3,386 |

|

|

1,236 |

|

| Net interest income after provision

for loan and lease losses |

|

13,017 |

|

|

14,323 |

|

|

13,668 |

|

|

14,246 |

|

|

12,359 |

|

|

55,254 |

|

|

44,894 |

|

| Trust and investment

services fee income |

|

1,217 |

|

|

1,251 |

|

|

1,279 |

|

|

1,207 |

|

|

1,119 |

|

|

4,954 |

|

|

4,434 |

|

| Gain on sale of SBA

loans |

|

1,725 |

|

|

927 |

|

|

842 |

|

|

505 |

|

|

318 |

|

|

3,999 |

|

|

318 |

|

| Gain on sale of

residential mortgage loans |

|

115 |

|

|

244 |

|

|

222 |

|

|

148 |

|

|

74 |

|

|

729 |

|

|

74 |

|

| Service charges on

deposits |

|

718 |

|

|

705 |

|

|

693 |

|

|

696 |

|

|

682 |

|

|

2,812 |

|

|

2,469 |

|

| Loan fees |

|

700 |

|

|

486 |

|

|

499 |

|

|

502 |

|

|

421 |

|

|

2,187 |

|

|

1,577 |

|

| Other |

|

460 |

|

|

489 |

|

|

591 |

|

|

790 |

|

|

351 |

|

|

2,330 |

|

|

1,231 |

|

| Total non-interest income |

|

4,935 |

|

|

4,102 |

|

|

4,126 |

|

|

3,848 |

|

|

2,965 |

|

|

17,011 |

|

|

10,103 |

|

| Compensation |

|

6,945 |

|

|

7,320 |

|

|

6,924 |

|

|

7,354 |

|

|

6,486 |

|

|

28,543 |

|

|

21,477 |

|

| Occupancy |

|

501 |

|

|

486 |

|

|

486 |

|

|

500 |

|

|

428 |

|

|

1,973 |

|

|

1,391 |

|

| Professional fees |

|

1,121 |

|

|

1,268 |

|

|

1,482 |

|

|

911 |

|

|

638 |

|

|

4,782 |

|

|

2,415 |

|

| Data processing |

|

606 |

|

|

587 |

|

|

655 |

|

|

530 |

|

|

483 |

|

|

2,378 |

|

|

1,710 |

|

| Marketing |

|

549 |

|

|

693 |

|

|

701 |

|

|

642 |

|

|

542 |

|

|

2,585 |

|

|

1,662 |

|

| Equipment |

|

316 |

|

|

308 |

|

|

298 |

|

|

308 |

|

|

250 |

|

|

1,230 |

|

|

650 |

|

| FDIC Insurance |

|

227 |

|

|

260 |

|

|

220 |

|

|

213 |

|

|

216 |

|

|

920 |

|

|

758 |

|

| Net collateral

liquidation costs |

|

70 |

|

|

22 |

|

|

78 |

|

|

302 |

|

|

44 |

|

|

472 |

|

|

320 |

|

| Net loss (gain) on

foreclosed properties |

|

7 |

|

|

(163 |

) |

|

1 |

|

|

(16 |

) |

|

(5 |

) |

|

(171 |

) |

|

(10 |

) |

| Merger-related

costs |

|

— |

|

|

— |

|

|

33 |

|

|

78 |

|

|

566 |

|

|

111 |

|

|

990 |

|

| Other |

|

1,342 |

|

|

1,203 |

|

|

1,096 |

|

|

910 |

|

|

479 |

|

|

4,551 |

|

|

2,412 |

|

| Total non-interest expense |

|

11,684 |

|

|

11,984 |

|

|

11,974 |

|

|

11,732 |

|

|

10,127 |

|

|

47,374 |

|

|

33,775 |

|

| Income before tax

expense |

|

6,268 |

|

|

6,441 |

|

|

5,820 |

|

|

6,362 |

|

|

5,197 |

|

|

24,891 |

|

|

21,222 |

|

| Income tax expense |

|

2,185 |

|

|

2,060 |

|

|

1,962 |

|

|

2,170 |

|

|

1,453 |

|

|

8,377 |

|

|

7,083 |

|

| Net income |

|

$ |

4,083 |

|

|

$ |

4,381 |

|

|

$ |

3,858 |

|

|

$ |

4,192 |

|

|

$ |

3,744 |

|

|

$ |

16,514 |

|

|

$ |

14,139 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings |

|

$ |

0.47 |

|

|

$ |

0.50 |

|

|

$ |

0.45 |

|

|

$ |

0.48 |

|

|

$ |

0.44 |

|

|

$ |

1.90 |

|

|

$ |

1.76 |

|

| Diluted earnings |

|

0.47 |

|

|

0.50 |

|

|

0.45 |

|

|

0.48 |

|

|

0.44 |

|

|

1.90 |

|

|

1.75 |

|

| Dividends declared |

|

0.11 |

|

|

0.11 |

|

|

0.11 |

|

|

0.11 |

|

|

0.105 |

|

|

0.44 |

|

|

0.42 |

|

| Book value |

|

17.34 |

|

|

17.01 |

|

|

16.64 |

|

|

16.34 |

|

|

15.88 |

|

|

17.34 |

|

|

15.88 |

|

| Tangible book

value |

|

15.90 |

|

|

15.60 |

|

|

15.24 |

|

|

14.95 |

|

|

14.51 |

|

|

15.90 |

|

|

14.51 |

|

| Weighted-average common

shares outstanding(1) |

|

8,558,810 |

|

|

8,546,563 |

|

|

8,523,418 |

|

|

8,525,127 |

|

|

8,282,999 |

|

|

8,549,176 |

|

|

7,869,956 |

|

| Weighted-average

diluted common shares outstanding(1) |

|

8,558,810 |

|

|

8,546,563 |

|

|

8,523,418 |

|

|

8,529,658 |

|

|

8,297,508 |

|

|

8,550,322 |

|

|

7,906,767 |

|

(1) Excluding participating securities

NET INTEREST INCOME ANALYSIS

|

(Unaudited) |

|

For the Three Months Ended |

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

December 31, 2014 |

| |

|

Averagebalance |

|

Interest |

|

Averageyield/rate(4) |

|

Average balance |

|

Interest |

|

Averageyield/rate(4) |

|

Averagebalance |

|

Interest |

|

Averageyield/rate(4) |

|

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate

and other mortgage loans(1) |

|

$ |

896,198 |

|

|

$ |

10,471 |

|

|

4.67 |

% |

|

$ |

856,488 |

|

|

$ |

9,994 |

|

|

4.67 |

% |

|

$ |

745,411 |

|

|

$ |

9,162 |

|

|

4.92 |

% |

| Commercial and

industrial loans(1) |

|

461,295 |

|

|

6,695 |

|

|

5.81 |

% |

|

454,184 |

|

|

6,741 |

|

|

5.94 |

% |

|

381,202 |

|

|

6,192 |

|

|

6.50 |

% |

| Direct financing

leases(1) |

|

30,227 |

|

|

341 |

|

|

4.51 |

% |

|

28,352 |

|

|

328 |

|

|

4.63 |

% |

|

33,698 |

|

|

403 |

|

|

4.78 |

% |

| Consumer and other

loans(1) |

|

23,349 |

|

|

300 |

|

|

5.14 |

% |

|

23,647 |

|

|

260 |

|

|

4.40 |

% |

|

17,631 |

|

|

196 |

|

|

4.45 |

% |

| Total loans and leases

receivable(1) |

|

1,411,069 |

|

|

17,807 |

|

|

5.05 |

% |

|

1,362,671 |

|

|

17,323 |

|

|

5.09 |

% |

|

1,177,942 |

|

|

15,953 |

|

|

5.42 |

% |

| Mortgage-related

securities(2) |

|

148,576 |

|

|

594 |

|

|

1.60 |

% |

|

152,763 |

|

|

602 |

|

|

1.57 |

% |

|

158,091 |

|

|

686 |

|

|

1.74 |

% |

| Other investment

securities(3) |

|

31,089 |

|

|

122 |

|

|

1.57 |

% |

|

30,431 |

|

|

120 |

|

|

1.58 |

% |

|

28,166 |

|

|

113 |

|

|

1.60 |

% |

| FHLB and FRB stock |

|

2,841 |

|

|

21 |

|

|

3.07 |

% |

|

3,175 |

|

|

22 |

|

|

2.69 |

% |

|

2,004 |

|

|

10 |

|

|

1.96 |

% |

| Short-term

investments |

|

50,850 |

|

|

56 |

|

|

0.44 |

% |

|

67,716 |

|

|

68 |

|

|

0.41 |

% |

|

116,283 |

|

|

101 |

|

|

0.35 |

% |

| Total interest-earning assets |

|

1,644,425 |

|

|

18,600 |

|

|

4.52 |

% |

|

1,616,756 |

|

|

18,135 |

|

|

4.49 |

% |

|

1,482,486 |

|

|

16,863 |

|

|

4.55 |

% |

| Non-interest-earning

assets |

|

104,396 |

|

|

|

|

|

|

100,863 |

|

|

|

|

|

|

92,439 |

|

|

|

|

|

| Total assets |

|

$ |

1,748,821 |

|

|

|

|

|

|

$ |

1,717,619 |

|

|

|

|

|

|

$ |

1,574,925 |

|

|

|

|

|

|

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction

accounts |

|

$ |

150,234 |

|

|

92 |

|

|

0.24 |

% |

|

$ |

138,489 |

|

|

84 |

|

|

0.24 |

% |

|

$ |

90,836 |

|

|

48 |

|

|

0.21 |

% |

| Money market |

|

593,749 |

|

|

808 |

|

|

0.54 |

% |

|

587,063 |

|

|

829 |

|

|

0.56 |

% |

|

575,266 |

|

|

768 |

|

|

0.53 |

% |

| Certificates of

deposit |

|

87,110 |

|

|

182 |

|

|

0.84 |

% |

|

102,477 |

|

|

204 |

|

|

0.80 |

% |

|

98,111 |

|

|

186 |

|

|

0.76 |

% |

| Wholesale deposits |

|

482,258 |

|

|

1,848 |

|

|

1.53 |

% |

|

466,516 |

|

|

1,668 |

|

|

1.43 |

% |

|

432,361 |

|

|

1,557 |

|

|

1.44 |

% |

| Total interest-bearing

deposits |

|

1,313,351 |

|

|

2,930 |

|

|

0.89 |

% |

|

1,294,545 |

|

|

2,785 |

|

|

0.86 |

% |

|

1,196,574 |

|

|

2,559 |

|

|

0.86 |

% |

| FHLB advances |

|

9,467 |

|

|

25 |

|

|

1.08 |

% |

|

17,503 |

|

|

30 |

|

|

0.67 |

% |

|

6,242 |

|

|

16 |

|

|

1.09 |

% |

| Other borrowings |

|

26,979 |

|

|

453 |

|

|

6.72 |

% |

|

25,154 |

|

|

430 |

|

|

6.84 |

% |

|

23,748 |

|

|

412 |

|

|

6.94 |

% |

| Junior subordinated

notes |

|

10,315 |

|

|

280 |

|

|

10.86 |

% |

|

10,315 |

|

|

280 |

|

|

10.86 |

% |

|

10,315 |

|

|

281 |

|

|

10.86 |

% |

| Total interest-bearing

liabilities |

|

1,360,112 |

|

|

3,688 |

|

|

1.08 |

% |

|

1,347,517 |

|

|

3,525 |

|

|

1.05 |

% |

|

1,236,879 |

|

|

3,268 |

|

|

1.06 |

% |

| Non-interest-bearing

demand deposit accounts |

|

227,965 |

|

|

|

|

|

|

213,712 |

|

|

|

|

|

|

191,438 |

|

|

|

|

|

| Other

non-interest-bearing liabilities |

|

10,260 |

|

|

|

|

|

|

9,520 |

|

|

|

|

|

|

9,436 |

|

|

|

|

|

| Total liabilities |

|

1,598,337 |

|

|

|

|

|

|

1,570,749 |

|

|

|

|

|

|

1,437,753 |

|

|

|

|

|

| Stockholders’

equity |

|

150,484 |

|

|

|

|

|

|

146,870 |

|

|

|

|

|

|

137,172 |

|

|

|

|

|

| Total liabilities and stockholders’

equity |

|

$ |

1,748,821 |

|

|

|

|

|

|

$ |

1,717,619 |

|

|

|

|

|

|

$ |

1,574,925 |

|

|

|

|

|

| Net interest

income |

|

|

|

$ |

14,912 |

|

|

|

|

|

|

$ |

14,610 |

|

|

|

|

|

|

$ |

13,595 |

|

|

|

| Interest rate

spread |

|

|

|

|

|

3.44 |

% |

|

|

|

|

|

3.44 |

% |

|

|

|

|

|

3.49 |

% |

| Net interest-earning

assets |

|

$ |

284,313 |

|

|

|

|

|

|

$ |

269,239 |

|

|

|

|

|

|

$ |

245,607 |

|

|

|

|

|

| Net interest

margin |

|

|

|

|

|

3.63 |

% |

|

|

|

|

|

3.61 |

% |

|

|

|

|

|

3.67 |

% |

(1) The average balances of loans and leases include

non-performing loans and leases. Interest income related to

non-performing loans and leases is recognized when collected.(2)

Includes amortized cost basis of assets available for sale and held

to maturity.(3) Yields on tax-exempt municipal obligations are not

presented on a tax-equivalent basis in this table. (4)

Represents annualized yields/rates.

NET INTEREST INCOME ANALYSIS (CONTINUED)

|

(Unaudited) |

|

For the Year Ended December 31, |

| (Dollars in

thousands) |

|

2015 |

|

2014 |

| |

|

Average balance |

|

Interest |

|

Averageyield/rate(4) |

|

Average balance |

|

Interest |

|

Averageyield/rate(4) |

|

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate

and other mortgage loans(1) |

|

$ |

848,213 |

|

|

$ |

40,006 |

|

|

4.72 |

% |

|

$ |

665,213 |

|

|

$ |

32,066 |

|

|

4.82 |

% |

| Commercial and

industrial loans(1) |

|

445,659 |

|

|

26,668 |

|

|

5.98 |

% |

|

332,591 |

|

|

19,962 |

|

|

6.00 |

% |

| Direct financing

leases(1) |

|

30,228 |

|

|

1,394 |

|

|

4.61 |

% |

|

29,395 |

|

|

1,367 |

|

|

4.65 |

% |

| Consumer and other

loans(1) |

|

23,996 |

|

|

1,067 |

|

|

4.45 |

% |

|

16,862 |

|

|

652 |

|

|

3.87 |

% |

| Total loans and leases

receivable(1) |

|

1,348,096 |

|

|

69,135 |

|

|

5.13 |

% |

|

1,044,061 |

|

|

54,047 |

|

|

5.18 |

% |

| Mortgage-related

securities(2) |

|

153,182 |

|

|

2,490 |

|

|

1.63 |

% |

|

156,144 |

|

|

2,894 |

|

|

1.85 |

% |

| Other investment

securities(3) |

|

29,686 |

|

|

472 |

|

|

1.59 |

% |

|

28,458 |

|

|

448 |

|

|

1.57 |

% |

| FHLB and FRB stock |

|

2,886 |

|

|

81 |

|

|

2.82 |

% |

|

1,512 |

|

|

14 |

|

|

0.94 |

% |

| Short-term

investments |

|

69,264 |

|

|

293 |

|

|

0.42 |

% |

|

67,281 |

|

|

298 |

|

|

0.44 |

% |

| Total interest-earning assets |

|

1,603,114 |

|

|

72,471 |

|

|

4.52 |

% |

|

1,297,456 |

|

|

57,701 |

|

|

4.45 |

% |

| Non-interest-earning

assets |

|

98,781 |

|

|

|

|

|

|

67,507 |

|

|

|

|

|

| Total assets |

|

$ |

1,701,895 |

|

|

|

|

|

|

$ |

1,364,963 |

|

|

|

|

|

|

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction

accounts |

|

$ |

125,558 |

|

|

297 |

|

|

0.24 |

% |

|

$ |

83,508 |

|

|

185 |

|

|

0.22 |

% |

| Money market |

|

602,842 |

|

|

3,331 |

|

|

0.55 |

% |

|

493,322 |

|

|

2,553 |

|

|

0.52 |

% |

| Certificates of

deposit |

|

106,177 |

|

|

825 |

|

|

0.78 |

% |

|

60,284 |

|

|

536 |

|

|

0.89 |

% |

| Wholesale deposits |

|

450,460 |

|

|

6,424 |

|

|

1.43 |

% |

|

416,202 |

|

|

6,196 |

|

|

1.49 |

% |

| Total interest-bearing

deposits |

|

1,285,037 |

|

|

10,877 |

|

|

0.85 |

% |

|

1,053,316 |

|

|

9,470 |

|

|

0.90 |

% |

| FHLB advances |

|

14,779 |

|

|

110 |

|

|

0.75 |

% |

|

5,017 |

|

|

22 |

|

|

0.45 |

% |

| Other borrowings |

|

25,460 |

|

|

1,732 |

|

|

6.80 |

% |

|

13,688 |

|

|

967 |

|

|

7.06 |

% |

| Junior subordinated

notes |

|

10,315 |

|

|

1,112 |

|

|

10.78 |

% |

|

10,315 |

|

|

1,112 |

|

|

10.78 |

% |

| Total interest-bearing

liabilities |

|

1,335,591 |

|

|

13,831 |

|

|

1.04 |

% |

|

1,082,336 |

|

|

11,571 |

|

|

1.07 |

% |

| Non-interest-bearing

demand deposit accounts |

|

211,945 |

|

|

|

|

|

|

154,687 |

|

|

|

|

|

| Other

non-interest-bearing liabilities |

|

9,049 |

|

|

|

|

|

|

7,918 |

|

|

|

|

|

| Total liabilities |

|

1,556,585 |

|

|

|

|

|

|

1,244,941 |

|

|

|

|

|

| Stockholders’

equity |

|

145,310 |

|

|

|

|

|

|

120,022 |

|

|

|

|

|

| Total liabilities and stockholders’

equity |

|

$ |

1,701,895 |

|

|

|

|

|

|

$ |

1,364,963 |

|

|

|

|

|

| Net interest

income |

|

|

|

$ |

58,640 |

|

|

|

|

|

|

$ |

46,130 |

|

|

|

| Interest rate

spread |

|

|

|

|

|

3.48 |

% |

|

|

|

|

|

3.38 |

% |

| Net interest-earning

assets |

|

$ |

267,523 |

|

|

|

|

|

|

$ |

215,120 |

|

|

|

|

|

| Net interest

margin |

|

|

|

|

|

3.66 |

% |

|

|

|

|

|

3.56 |

% |

(1) The average balances of loans and leases include

non-performing loans and leases. Interest income related to

non-performing loans and leases is recognized when collected.(2)

Includes amortized cost basis of assets available for sale and held

to maturity.(3) Yields on tax-exempt municipal obligations are not

presented on a tax-equivalent basis in this table. (4)

Represents annualized yields/rates.

SELECTED FINANCIAL TRENDS

PERFORMANCE RATIOS

| |

|

For the Three Months Ended |

|

For the Year Ended |

|

(Unaudited) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

|

December 31, 2015 |

|

December 31, 2014 |

| Return on average

assets (annualized) |

|

0.93 |

% |

|

1.02 |

% |

|

0.93 |

% |

|

1.00 |

% |

|

0.95 |

% |

|

0.97 |

% |

|

1.04 |

% |

| Return on average

equity (annualized) |

|

10.85 |

% |

|

11.93 |

% |

|

10.73 |

% |

|

11.98 |

% |

|

10.92 |

% |

|

11.36 |

% |

|

11.78 |

% |

| Efficiency ratio |

|

58.75 |

% |

|

64.82 |

% |

|

65.28 |

% |

|

62.47 |

% |

|

61.11 |

% |

|

62.75 |

% |

|

60.06 |

% |

| Interest rate

spread |

|

3.44 |

% |

|

3.44 |

% |

|

3.44 |

% |

|

3.63 |

% |

|

3.49 |

% |

|

3.48 |

% |

|

3.38 |

% |

| Net interest

margin |

|

3.63 |

% |

|

3.61 |

% |

|

3.61 |

% |

|

3.79 |

% |

|

3.67 |

% |

|

3.66 |

% |

|

3.56 |

% |

| Average

interest-earning assets to average interest-bearing

liabilities |

|

120.90 |

% |

|

119.98 |

% |

|

120.18 |

% |

|

119.02 |

% |

|

119.86 |

% |

|

120.03 |

% |

|

119.88 |

% |

ASSET QUALITY RATIOS

|

(Unaudited) |

|

As of |

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

| Non-performing loans

and leases |

|

$ |

22,298 |

|

|

$ |

9,707 |

|

|

$ |

15,198 |

|

|

$ |

9,352 |

|

|

$ |

9,792 |

|

| Foreclosed properties,

net |

|

1,677 |

|

|

1,632 |

|

|

1,854 |

|

|

1,566 |

|

|

1,693 |

|

| Total non-performing assets |

|

23,975 |

|

|

11,339 |

|

|

17,052 |

|

|

10,918 |

|

|

11,485 |

|

| Performing troubled

debt restructurings |

|

2,117 |

|

|

7,852 |

|

|

1,944 |

|

|

1,972 |

|

|

2,003 |

|

| Total impaired assets |

|

$ |

26,092 |

|

|

$ |

19,191 |

|

|

$ |

18,996 |

|

|

$ |

12,890 |

|

|

$ |

13,488 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-performing loans

and leases as a percent of total gross loans and leases |

|

1.55 |

% |

|

0.70 |

% |

|

1.12 |

% |

|

0.72 |

% |

|

0.76 |

% |

| Non-performing assets

as a percent of total gross loans and leases plus foreclosed

properties |

|

1.67 |

% |

|

0.82 |

% |

|

1.26 |

% |

|

0.84 |

% |

|

0.89 |

% |

| Non-performing assets

as a percent of total assets |

|

1.34 |

% |

|

0.65 |

% |

|

1.01 |

% |

|

0.65 |

% |

|

0.70 |

% |

| Allowance for loan and

lease losses as a percent of total gross loans and leases |

|

1.14 |

% |

|

1.11 |

% |

|

1.12 |

% |

|

1.13 |

% |

|

1.12 |

% |

| Allowance for loan and

lease losses as a percent of non-performing loans |

|

73.18 |

% |

|

158.22 |

% |

|

100.01 |

% |

|

157.12 |

% |

|

146.33 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Criticized assets: |

|

|

|

|

|

|

|

|

|

|

| Special mention |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Substandard |

|

27,178 |

|

|

11,144 |

|

|

10,633 |

|

|

22,626 |

|

|

25,493 |

|

| Doubtful |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Foreclosed properties, net |

|

1,677 |

|

|

1,632 |

|

|

1,854 |

|

|

1,566 |

|

|

1,693 |

|

| Total criticized assets |

|

$ |

28,855 |

|

|

$ |

12,776 |

|

|

$ |

12,487 |

|

|

$ |

24,192 |

|

|

$ |

27,186 |

|

| Criticized assets to

total assets |

|

1.62 |

% |

|

0.73 |

% |

|

0.74 |

% |

|

1.44 |

% |

|

1.67 |

% |

NET CHARGE-OFFS (RECOVERIES)

|

(Unaudited) |

|

For the Three Months Ended |

|

For the Year Ended |

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

|

December 31, 2015 |

|

December 31, 2014 |

| Charge-offs |

|

$ |

967 |

|

|

$ |

138 |

|

|

$ |

84 |

|

|

$ |

324 |

|

|

$ |

1,231 |

|

|

$ |

1,513 |

|

|

$ |

1,233 |

|

| Recoveries |

|

(29 |

) |

|

(11 |

) |

|

(69 |

) |

|

(5 |

) |

|

(393 |

) |

|

(114 |

) |

|

(425 |

) |

| Net charge-offs |

|

$ |

938 |

|

|

$ |

127 |

|

|

$ |

15 |

|

|

$ |

319 |

|

|

$ |

838 |

|

|

$ |

1,399 |

|

|

$ |

808 |

|

| Net charge-offs as a

percent of average gross loans and leases (annualized) |

|

0.27 |

% |

|

0.04 |

% |

|

— |

% |

|

0.10 |

% |

|

0.28 |

% |

|

0.10 |

% |

|

0.08 |

% |

CAPITAL RATIOS

| |

|

As of and for the Three Months

Ended |

|

(Unaudited) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

| Total capital to

risk-weighted assets |

|

11.11 |

% |

|

11.29 |

% |

|

11.11 |

% |

|

11.40 |

% |

|

12.13 |

% |

| Tier I capital to

risk-weighted assets |

|

8.81 |

% |

|

8.95 |

% |

|

8.78 |

% |

|

8.98 |

% |

|

9.52 |

% |

| Common equity tier I

capital to risk-weighted assets |

|

8.22 |

% |

|

8.34 |

% |

|

8.16 |

% |

|

8.34 |

% |

|

N/A |

|

| Tier I capital to

average assets |

|

8.63 |

% |

|

8.59 |

% |

|

8.66 |

% |

|

8.42 |

% |

|

8.71 |

% |

| Tangible common equity

to tangible assets |

|

7.81 |

% |

|

7.84 |

% |

|

7.91 |

% |

|

7.77 |

% |

|

7.78 |

% |

SELECTED OTHER INFORMATION

| (Unaudited) |

|

As of |

| (in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

| Trust assets under management |

|

$ |

817,926 |

|

|

$ |

791,150 |

|

|

$ |

800,615 |

|

|

$ |

814,226 |

|

|

$ |

773,192 |

|

| Trust assets under

administration |

|

203,181 |

|

|

187,495 |

|

|

197,343 |

|

|

195,148 |

|

|

186,505 |

|

| Total trust assets |

|

$ |

1,021,107 |

|

|

$ |

978,645 |

|

|

$ |

997,958 |

|

|

$ |

1,009,374 |

|

|

$ |

959,697 |

|

NON-GAAP RECONCILIATIONS

Certain financial information provided in this release is

determined by methods other than in accordance with generally

accepted accounting principles (United States) (“GAAP”).

Although the Company believes that these non-GAAP financial

measures provide a greater understanding of its business, these

measures are not necessarily comparable to similar measures that

may be presented by other companies.

TANGIBLE BOOK VALUE

“Tangible book value per share” is a non-GAAP measure

representing tangible common equity divided by total common shares

outstanding. “Tangible common equity” itself is a non-GAAP

measure representing common stockholders’ equity reduced by

intangible assets, if any. The Company’s management believes

that this measure is important to many investors in the marketplace

who are interested in period-to-period changes in book value per

common share exclusive of changes in intangible assets. The

information provided below reconciles tangible book value per share

and tangible common equity to their most comparable GAAP

measures.

|

(Unaudited) |

|

As of |

| (Dollars in

thousands, except per share amounts) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

| Common stockholders’

equity |

|

$ |

150,832 |

|

|

$ |

147,967 |

|

|

$ |

144,287 |

|

|

$ |

141,689 |

|

|

$ |

137,748 |

|

| Goodwill and other

intangible assets |

|

(12,493 |

) |

|

(12,244 |

) |

|

(12,133 |

) |

|

(12,011 |

) |

|

(11,944 |

) |

| Tangible common

equity |

|

$ |

138,339 |

|

|

$ |

135,723 |

|

|

$ |

132,154 |

|

|

$ |

129,678 |

|

|

$ |

125,804 |

|

| Common shares

outstanding |

|

8,699,410 |

|

|

8,698,755 |

|

|

8,669,836 |

|

|

8,672,322 |

|

|

8,671,854 |

|

| Book value per

share |

|

$ |

17.34 |

|

|

$ |

17.01 |

|

|

$ |

16.64 |

|

|

$ |

16.34 |

|

|

$ |

15.88 |

|

| Tangible book value per

share |

|

15.90 |

|

|

15.60 |

|

|

15.24 |

|

|

14.95 |

|

|

14.51 |

|

TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS

‘‘Tangible common equity to tangible assets’’ is defined as the

ratio of common stockholders’ equity reduced by intangible assets,

if any, divided by total assets reduced by intangible assets, if

any. The Company’s management believes that this measure is

important to many investors in the marketplace who are interested

in the relative changes from period to period in common equity and

total assets, each exclusive of changes in intangible assets.

The information below reconciles tangible common equity and

tangible assets to their most comparable GAAP measures.

|

(Unaudited) |

|

As of |

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

| Common stockholders’

equity |

|

$ |

150,832 |

|

|

$ |

147,967 |

|

|

$ |

144,287 |

|

|

$ |

141,689 |

|

|

$ |

137,748 |

|

| Goodwill and other

intangible assets |

|

(12,493 |

) |

|

(12,244 |

) |

|

(12,133 |

) |

|

(12,011 |

) |

|

(11,944 |

) |

| Tangible common

equity |

|

$ |

138,339 |

|

|

$ |

135,723 |

|

|

$ |

132,154 |

|

|

$ |

129,678 |

|

|

$ |

125,804 |

|

| Total assets |

|

$ |

1,783,636 |

|

|

$ |

1,744,153 |

|

|

$ |

1,683,564 |

|

|

$ |

1,680,677 |

|

|

$ |

1,629,387 |

|

| Goodwill and other

intangible assets |

|

(12,493 |

) |

|

(12,244 |

) |

|

(12,133 |

) |

|

(12,011 |

) |

|

(11,944 |

) |

| Tangible assets |

|

$ |

1,771,143 |

|

|

$ |

1,731,909 |

|

|

$ |

1,671,431 |

|

|

$ |

1,668,666 |

|

|

$ |

1,617,443 |

|

| Tangible common equity

to tangible assets |

|

7.81 |

% |

|

7.84 |

% |

|

7.91 |

% |

|

7.77 |

% |

|

7.78 |

% |

EFFICIENCY RATIO

“Efficiency ratio” is a non-GAAP measure representing

non-interest expense excluding the effects of losses or gains on

foreclosed properties, other discrete items that are unrelated to

the Company’s primary business activities and amortization of other

intangible assets, if any, divided by operating revenue, which is

equal to net interest income plus non-interest income less realized

gains or losses on securities, if any. In the judgment of the

Company’s management, the adjustments made to non-interest expense

and operating revenue allow investors and analysts to better assess

the Company’s operating expenses in relation to its core operating

revenue by removing the volatility that is associated with certain

one-time items and other discrete items that are unrelated to its

business. The information provided below reconciles the

efficiency ratio to its most comparable GAAP measure.

|

(Unaudited) |

|

For the Three Months Ended |

|

For the Year Ended |

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

June 30, 2015 |

|

March 31, 2015 |

|

December 31, 2014 |

|

December 31, 2015 |

|

December 31, 2014 |

| Total non-interest

expense |

|

$ |

11,684 |

|

|

$ |

11,984 |

|

|

$ |

11,974 |

|

|

$ |

11,732 |

|

|

$ |

10,127 |

|

|

$ |

47,374 |

|

|

$ |

33,775 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss (gain) on foreclosed

properties |

|

7 |

|

|

(163 |

) |

|

1 |

|

|

(16 |

) |

|

(5 |

) |

|

(171 |

) |

|

(10 |

) |

| Amortization of other intangible

assets |

|

17 |

|

|

18 |

|

|

18 |

|

|

18 |

|

|

12 |

|

|

71 |

|

|

12 |

|

| Total operating

expense |

|

$ |

11,660 |

|

|

$ |

12,129 |

|

|

$ |

11,955 |

|

|

$ |

11,730 |

|

|

$ |

10,120 |

|

|

$ |

47,474 |

|

|

$ |

33,773 |

|

| Net interest

income |

|

$ |

14,912 |

|

|

$ |

14,610 |

|

|

$ |

14,188 |

|

|

$ |

14,930 |

|

|

$ |

13,595 |

|

|

$ |

58,640 |

|

|

$ |

46,130 |

|

| Total non-interest

income |

|

4,935 |

|

|

4,102 |

|

|

4,126 |

|

|

3,848 |

|

|

2,965 |

|

|

17,011 |

|

|

10,103 |

|

| Total operating

revenue |

|

$ |

19,847 |

|

|

$ |

18,712 |

|

|

$ |

18,314 |

|

|

$ |

18,778 |

|

|

$ |

16,560 |

|

|

$ |

75,651 |

|

|

$ |

56,233 |

|

| Efficiency ratio |

|

58.75 |

% |

|

64.82 |

% |

|

65.28 |

% |

|

62.47 |

% |

|

61.11 |

% |

|

62.75 |

% |

|

60.06 |

% |

CONTACT: First Business Financial Services, Inc.

Edward G. Sloane, Jr.

Chief Financial Officer

608-232-5970

esloane@firstbusiness.com

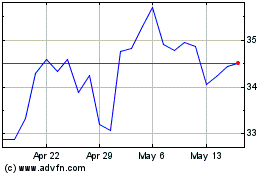

First Business Financial... (NASDAQ:FBIZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

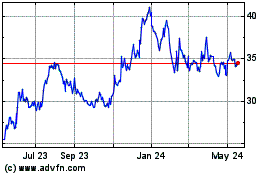

First Business Financial... (NASDAQ:FBIZ)

Historical Stock Chart

From Jul 2023 to Jul 2024