false000081158900008115892023-10-252023-10-25

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

Form 8-K

__________________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| | | | | | | | |

| Date of Report (Date of earliest event reported): | | October 25, 2023 |

First Bancorp

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | | |

| North Carolina | | 0-15572 | | 56-1421916 |

| (State or Other Jurisdiction | | (Commission | | (I.R.S. Employer |

| of Incorporation) | | File Number) | | Identification Number) |

| | | | | | | | | | | | | | |

| | | | | |

| 300 SW Broad Street, | | | |

| Southern Pines, | NC | | | 28387 |

| (Address of Principal Executive Offices) | | | (Zip Code) |

(910) 246-2500

____________________

(Registrant’s telephone number, including area code)

Not Applicable

___________________

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading symbol Name of each exchange on which registered:

Common Stock, No Par Value FBNC The Nasdaq Global Select Market

First Bancorp

INDEX

| | | | | |

| | Page |

| | |

| Item 2.02 – Results of Operations and Financial Condition | 3 | |

| |

| Item 9.01 – Financial Statements and Exhibits | 3 | |

| | |

| Signatures | 3 | |

| | |

| 4 | |

Item 2.02 - Results of Operations and Financial Condition

On October 25, 2023, First Bancorp (the “Registrant” or “Company”) issued an earnings release to announce its financial results for the three month period ended September 30, 2023. The earnings release contains forward-looking statements regarding the Company and includes cautionary language identifying important factors that could cause actual results to differ materially from those anticipated. The earnings release is furnished as Exhibit 99.1. Consequently, it is not deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Such materials may only be incorporated by reference into another filing under the Exchange Act or Securities Act of 1933 if such subsequent filing specifically references this Form 8-K.

Item 9.01 – Financial Statements and Exhibits

(d) Exhibits

Disclosures About Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, which statements are inherently subject to risks and uncertainties. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often characterized by the use of qualifying words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” or other statements concerning opinions or judgments of the Company and its management about future events. Factors that could influence the accuracy of such forward-looking statements include, but are not limited to, the financial success or changing strategies of the Company’s customers, the Company’s level of success in integrating acquisitions, actions of government regulators, the level of market interest rates, and general economic conditions. For additional information about the factors that could affect the matters discussed in this paragraph, see the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements. The Company is also not responsible for changes made to the press release by wire services, internet services or other media.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | First Bancorp |

| | | | | | | |

| | | October 25, 2023 | |

By: | |

/s/ Richard H. Moore |

| | | | | | | Richard H. Moore |

| | | | | | | Chief Executive Officer |

News Release

| | | | | | | | | | | |

| For Immediate Release: | | | For More Information, Contact: |

| October 25, 2023 | | | Elaine Pozarycki |

| | | 984-900-2457 |

First Bancorp Reports Third Quarter Results

SOUTHERN PINES, N.C. - First Bancorp (the "Company") (NASDAQ - FBNC), the parent company of First Bank, announced today net income of $29.9 million, or $0.73 per diluted common share, for the three months ended September 30, 2023 compared to $29.4 million, or $0.71 per diluted common share, for the three months ended June 30, 2023 ("linked quarter") and $37.9 million, or $1.06 per diluted common share, recorded in the third quarter of 2022. For the nine months ended September 30, 2023, the Company recorded net income of $74.5 million, or $1.81 per diluted common share, compared to $108.5 million, or $3.04 per diluted common share, for the nine months ended September 30, 2022.

On January 1, 2023, the Company completed its acquisition of GrandSouth Bancorporation ("GrandSouth"). Comparisons for the financial periods presented are impacted by the GrandSouth acquisition which contributed $1.02 billion in loans and $1.05 billion in deposits. The results for the nine months ended September 30, 2023 include merger expenses totaling $13.5 million and an initial loan loss provision of $12.2 million for acquired loans.

Richard H. Moore, CEO and Chairman of the Company, stated, “Our Company has demonstrated once again that our deposit base is very stable, comparatively low cost, diversified and growing. We are a relationship-driven bank and it has paid off in this market. When you consider our deposit base, our low loan-to-deposit ratio, strong credit quality, and almost no large office building credit exposure, we are confident about our ability to stay well-positioned for the remainder of the year and into next year.”

Third Quarter 2023 Highlights

•Loans totaled $8.0 billion at September 30, 2023, with growth for the quarter of $129.4 million, an annualized growth rate of 6.5%.

•Total market deposits (exclusive of brokered deposits) grew $66.7 million for the quarter, an annualized growth rate of 2.6%.

•Noninterest-bearing demand accounts remained strong at 34% of total deposits at quarter end.

•Total loan yield increased to 5.32%, up 83 basis points from the third quarter of 2022, with accretion on purchased loans contributing 16 basis points to loan yield.

•While deposit rates increased during the quarter, total cost of funds remained low at 1.46% for the quarter ended September 30, 2023.

•The on-balance sheet liquidity ratio was 14.4% at September 30, 2023. Available off-balance sheet sources totaled $2.2 billion at quarter end, resulting in a total liquidity ratio of 30.2%.

•Credit quality continued to be strong with a nonperforming assets ("NPA") to total assets ratio of 0.32% as of September 30, 2023, down from 0.39% for the comparable period of 2022.

•Capital remained strong with a total common equity tier 1 ratio of 12.93% (estimated) and a total risk-based capital ratio of 15.26% (estimated) as of September 30, 2023.

Net Interest Income and Net Interest Margin

Net interest income for the third quarter of 2023 was $84.7 million compared to $85.3 million recorded in the third quarter of 2022, a nominal decrease of 0.7%. Net interest income for the current quarter decreased 2.6% from the $87.0 million reported for the linked quarter. Average interest-earning assets for the third quarter of 2023 increased 13.7% from the comparable period of the prior year, with growth primarily in loans resulting from both organic growth and the GrandSouth acquisition.

Despite the higher level of earning assets, the market-driven increases in rates on liabilities, which have occurred at a more rapid pace than increased yields on assets, resulted in the reduction in net interest income and net interest margin ("NIM") as compared to the prior periods.

The Company’s tax-equivalent NIM (calculated by dividing tax-equivalent net interest income by average earning assets) declined year-over-year with the third quarter of 2023 reporting a tax-equivalent NIM of 2.97% compared to 3.40% for the third quarter of 2022. The lower NIM was due to rising market interest rates driving higher cost of funds which outpaced the increase in loan yields over the same period. While loan yields rose from 4.49% for the third quarter of 2022 to 5.32% for the current period, the total cost of funds increased from 0.12% for the third quarter of 2022 to 1.46% for the quarter ended September 30, 2023. There has been some deceleration of the pace of increase of the Company's cost of funds; however, it is anticipated there may continue to be some compression in the NIM given the percentage of fixed rate loans in the Company's loan portfolio.

| | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| YIELD INFORMATION | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| | | | | | |

| Yield on loans | | 5.32% | | 5.26% | | 4.49% |

| Yield on securities | | 1.75% | | 1.77% | | 1.71% |

| Yield on other earning assets | | 4.58% | | 4.60% | | 2.27% |

| Yield on total interest-earning assets | | 4.31% | | 4.25% | | 3.49% |

| | | | | | |

| Rate on interest-bearing deposits | | 1.95% | | 1.68% | | 0.13% |

| Rate on other interest-bearing liabilities | | 5.88% | | 5.68% | | 3.99% |

| Rate on total interest-bearing liabilities | | 2.20% | | 1.96% | | 0.21% |

| Total cost of funds | | 1.46% | | 1.29% | | 0.12% |

| | | | | | |

| Net interest margin (1) | | 2.95% | | 3.05% | | 3.38% |

| Net interest margin - tax-equivalent (2) | | 2.97% | | 3.08% | | 3.40% |

| Average prime rate | | 8.43% | | 8.16% | | 5.35% |

| | | | | | |

| (1) Calculated by dividing annualized net interest income by average earning assets for the period. | |

(2) Calculated by dividing annualized tax-equivalent net interest income by average earning assets for the period. The tax-equivalent amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed assuming a 23% tax rate and is reduced by the related nondeductible portion of interest expense. |

Included in interest income for the third quarter of 2023 was total loan discount accretion of $3.2 million compared to $2.6 million for the third quarter of 2022, with the increase being primarily related to the GrandSouth acquisition. Loan discount accretion had an 11 basis points positive impact on the Company's NIM in the third quarter of 2023 compared to accretion contributing 10 basis points to NIM for the prior year quarter.

The following table presents the impact to net interest income of the purchase accounting adjustments for each period.

| | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

NET INTEREST INCOME PURCHASE ACCOUNTING ADJUSTMENTS ($ in thousands) | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| | | | | | |

| Interest income - increased by accretion of loan discount on acquired loans | | $ | 2,766 | | | 3,159 | | | 1,519 | |

| Interest income - increased by accretion of loan discount on retained portions of SBA loans | | 437 | | | 426 | | | 1,032 | |

| Total interest income impact | | 3,203 | | | 3,585 | | | 2,551 | |

| Interest expense - (increased) reduced by (discount accretion) premium amortization of deposits | | (709) | | | (878) | | | 121 | |

| Interest expense - increased by discount accretion of borrowings | | (215) | | | (212) | | | (64) | |

| Total net interest expense impact | | (924) | | | (1,090) | | | 57 | |

| Total impact on net interest income | | $ | 2,279 | | | 2,495 | | | 2,608 | |

Provision for Credit Losses and Credit Quality

For the three months ended September 30, 2023 and September 30, 2022, the Company recorded $1.2 million and $5.1 million in provision for loan losses, respectively. The provision for the current quarter was driven by the loan growth experienced during the quarter, combined with updated prepayment speed estimates which are a key assumption in the CECL model. The higher interest rate environment has resulted in slower prepayment speed estimates, thus increasing the projected allowance for credit losses ("ACL") required. Loss driver assumptions were also updated with the lower loss rate estimates resulting in offsetting reductions to the ACL reserve estimate.

During the third quarter of 2023, the Company recorded a $1.2 million reversal of the provision for unfunded commitments, compared to a provision for unfunded commitments of $0.3 million for the third quarter of 2022. The current quarter's reversal related primarily to a reduction in the amount of available lines of credit and the updated loss driver assumptions reducing the loss rate estimates. The reserve for unfunded commitments totaled $11.8 million at September 30, 2023 and is included in the line item "Other Liabilities".

The combination of the above provisions for credit losses and unfunded commitments resulted in an income statement impact of $0 for the third quarter of 2023 as compared to $5.4 million for the third quarter of 2022.

Asset quality remained strong with annualized net loan charge-offs of 0.11% for the third quarter of 2023. Total NPAs amounted to $38.8 million at September 30, 2023, or 0.32% of total assets, down from $40.7 million, or 0.39% of total assets, at September 30, 2022. Nonaccrual loans declined $3.0 million from the linked quarter, with the higher number and volume of modifications to borrowers experiencing financial distress accounting for the increase in total NPAs during the current quarter.

The following table presents the summary of NPAs and asset quality ratios for each period.

| | | | | | | | | | | | | | | | | | | | |

ASSET QUALITY DATA ($ in thousands) | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| | | | | | |

| Nonperforming assets | | | | | | |

| Nonaccrual loans | | $ | 26,884 | | | 29,876 | | | 28,669 | |

| Modifications to borrowers in financial distress | | 10,723 | | | 4,862 | | | — | |

Troubled debt restructurings - accruing (1) | | — | | | — | | | 11,355 | |

| Total nonperforming loans | | 37,607 | | | 34,738 | | | 40,024 | |

| Foreclosed real estate | | 1,235 | | | 1,077 | | | 658 | |

| Total nonperforming assets | | $ | 38,842 | | | 35,815 | | | 40,682 | |

| | | | | | |

| Asset Quality Ratios | | | | | | |

| Quarterly net charge-offs to average loans - annualized | | 0.11 | % | | 0.04 | % | | 0.04 | % |

| Nonperforming loans to total loans | | 0.47 | % | | 0.44 | % | | 0.61 | % |

| Nonperforming assets to total assets | | 0.32 | % | | 0.30 | % | | 0.39 | % |

| Allowance for credit losses to total loans | | 1.35 | % | | 1.38 | % | | 1.33 | % |

| | | | | | |

| (1) The Company implemented ASU 2022-02 effective January 1, 2023 eliminating TDR accounting. | |

Noninterest Income

Total noninterest income for the third quarter of 2023 was $15.2 million, a 10.3% decrease from the $16.9 million recorded for the third quarter of 2022 and a 6.6% increase from the linked quarter. The primary factors driving fluctuations among the periods presented were as follows:

•The increase in "Service charges on deposit accounts" between periods was primarily driven by the higher number of customer accounts resulting from the GrandSouth acquisition and organic growth.

•The year-over-year decline in "Other service charges, commissions and fees" was related to the lower interchange fees beginning during the third quarter of 2022 as a result of the Durbin Amendment limitations becoming applicable to the Company.

•SBA loan sale gains were up from the linked quarter of 2023 and the comparable quarter of 2022, while year to date results for 2023 continued to lag 2022 due primarily to slower loan originations earlier in the current year combined with lower premiums available on SBA loan sales given the current market conditions.

•Other gains for the third quarter and year to date period of 2022 included death benefits realized on bank-owned life insurance policies. There were no large or unusual transactions in 2023 giving rise to large gains or losses.

Noninterest Expenses

Noninterest expenses amounted to $62.2 million for the third quarter of 2023 compared to $61.6 million for the linked quarter and $48.7 million for the third quarter of 2022.

The 27.8% increase in total noninterest expenses from the prior year period was primarily driven by increased compensation expense of $7.4 million, or 25.8%, and other facilities-related and support costs associated with the acquisition of eight GrandSouth branch locations and related branch and support personnel. Intangible amortization increased $1.1 million (119.7%) from the third quarter of 2022 to the third quarter of 2023 as a direct result of the core deposit intangibles added with the GrandSouth acquisition. Other operating expenses increased $5.5 million (39.7%) from the third quarter of 2022 driven by: (1) increases in data processing and software expense for the additional transaction and account volumes and investments in new software systems; (2) FDIC insurance increases related to the deposits acquired from GrandSouth and the general FDIC rate increase effective January 1, 2023; and (3) higher check fraud and other non-credit losses experienced to date in 2023.

Balance Sheet

Total assets at September 30, 2023 amounted to $12.0 billion, down $55.0 million from the linked quarter and growing 13.9% from a year earlier. The decrease from the linked quarter was primarily related to lower cash and borrowing balances from normal balance sheet fluctuations. Increases in loans during the quarter were essentially offset by lower balances of investment securities. The growth from a year earlier was driven by the acquisition of GrandSouth, combined with organic loan and deposit growth during the period.

Quarterly average balances for key balance sheet accounts are presented below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

AVERAGE BALANCES ($ in thousands) | | September 30, 2023 | | December 31, 2022 | | September 30, 2022 | | Change

3Q23 vs 3Q22 |

| | | | | | | | |

| Total assets | | $ | 12,005,778 | | | 10,579,187 | | | 10,567,133 | | | 13.6 | % |

| Investment securities, at amortized cost | | 3,180,845 | | | 3,325,652 | | | 3,378,383 | | | (5.8) | % |

| Loans | | 7,939,783 | | | 6,576,415 | | | 6,389,996 | | | 24.3 | % |

| Earning assets | | 11,405,306 | | | 10,161,108 | | | 10,028,388 | | | 13.7 | % |

| Deposits | | 10,180,046 | | | 9,275,909 | | | 9,299,278 | | | 9.5 | % |

| Interest-bearing liabilities | | 7,071,407 | | | 5,779,958 | | | 5,661,339 | | | 24.9 | % |

| Shareholders’ equity | | 1,303,249 | | | 1,003,031 | | | 1,087,763 | | | 19.8 | % |

Total investment securities were $2.6 billion at September 30, 2023, a decrease of $121.7 million from the linked quarter and $246.5 million from September 30, 2022. The investment securities portfolio continues to decline as cash flows from amortizing investments are utilized to fund loan growth and fluctuations in deposits. The unrealized loss on available for sale securities totaled $521.7 million at September 30, 2023, representing an increase of $81.5 million from the linked quarter and $77.6 million from year end. The Company has the intent to hold, and will not be required to sell, investments with unrealized losses until maturity or recovery of the amortized cost as market conditions change.

Total loans amounted to $8.0 billion at September 30, 2023, an increase of $129.4 million from the linked quarter and $1.5 billion, or 23.0%, from September 30, 2022. Excluding the GrandSouth acquisition, organic loan growth was $341.8 million for 2023 year to date, representing an annualized growth rate of 5.9%.

As presented below, our total loan portfolio mix has remained consistent. There were no notable concentrations in geographies or industries, including in office or hospitality categories. The Company's exposure to non-owner occupied office loans represented approximately 5.8% of the total portfolio at September 30, 2023, and the average size of these loans was $1.4 million. Non-owner occupied office loans are generally in non-metro markets and the top 10 loans in this category represent less than 2% of the total loan portfolio.

The following table presents the balance and portfolio percentage by loan category for each period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| ($ in thousands) | | Amount | | Percentage | | Amount | | Percentage | | Amount | | Percentage |

| | | | | | | | | | | | |

| Commercial and industrial | | $ | 893,910 | | | 11 | % | | 888,391 | | | 11 | % | | 617,538 | | | 10 | % |

| Construction, development & other land loans | | 1,008,289 | | | 13 | % | | 1,109,769 | | | 14 | % | | 919,236 | | | 14 | % |

| Commercial real estate - owner occupied | | 1,252,259 | | | 16 | % | | 1,222,189 | | | 16 | % | | 1,038,877 | | | 16 | % |

| Commercial real estate - non-owner occupied | | 2,509,317 | | | 31 | % | | 2,423,262 | | | 31 | % | | 2,095,283 | | | 32 | % |

| Multi-family real estate | | 405,161 | | | 5 | % | | 392,120 | | | 5 | % | | 339,065 | | | 5 | % |

| Residential 1-4 family real estate | | 1,560,140 | | | 19 | % | | 1,461,068 | | | 18 | % | | 1,132,552 | | | 17 | % |

| Home equity loans/lines of credit | | 331,108 | | | 4 | % | | 334,566 | | | 4 | % | | 323,218 | | | 5 | % |

| Consumer loans | | 67,169 | | | 1 | % | | 67,077 | | | 1 | % | | 60,651 | | | 1 | % |

| Loans, gross | | 8,027,353 | | | 100 | % | | 7,898,442 | | | 100 | % | | 6,526,420 | | | 100 | % |

| Unamortized net deferred loan fees | | (316) | | | | | (813) | | | | | (1,134) | | | |

| Total loans | | $ | 8,027,037 | | | | | 7,897,629 | | | | | 6,525,286 | | | |

Total deposits amounted to $10.2 billion at September 30, 2023, an increase of $1.0 billion, or 10.9%, from September 30, 2022, primarily driven by the GrandSouth acquisition. Organic market deposit growth (excluding the acquired deposits and brokered deposits) was $66.7 million for the third quarter of 2023 and $220.7 million since year end. Quarterly organic market growth represents an annualized growth rate of 3.0%.

The Company has a diversified and granular deposit base which has remained stable with continued growth in core deposits, primarily noninterest-bearing checking accounts and money market accounts. At quarter end, noninterest-bearing deposits accounted for 34% of total deposits, down slightly from 36% in the linked quarter. As of September 30, 2023, the estimated insured deposits totaled $6.4 billion or 63.0% of total deposits. In addition, there were collateralized deposits at that date of $804.6 million such that approximately 70.9% of our total deposits were insured or collateralized at the current quarter end.

Our deposit mix has remained consistent historically and has not significantly changed with the addition of GrandSouth as presented in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| ($ in thousands) | | Amount | | Percentage | | Amount | | Percentage | | Amount | | Percentage |

| | | | | | | | | | | | |

| Noninterest-bearing checking accounts | | $ | 3,503,050 | | | 34 | % | | 3,639,930 | | | 36 | % | | 3,748,207 | | | 41 | % |

| Interest-bearing checking accounts | | 1,458,855 | | | 14 | % | | 1,454,489 | | | 14 | % | | 1,551,450 | | | 17 | % |

| Money market accounts | | 3,635,523 | | | 36 | % | | 3,411,072 | | | 34 | % | | 2,432,926 | | | 26 | % |

| Savings accounts | | 638,912 | | | 6 | % | | 658,473 | | | 6 | % | | 751,895 | | | 8 | % |

| Other time deposits | | 626,870 | | | 6 | % | | 638,751 | | | 6 | % | | 485,738 | | | 5 | % |

| Time deposits >$250,000 | | 359,704 | | | 4 | % | | 353,473 | | | 4 | % | | 259,055 | | | 3 | % |

| Total market deposits | | 10,222,914 | | | 100 | % | | 10,156,188 | | | 100 | % | | 9,229,271 | | | 100 | % |

| Brokered deposits | | 12,489 | | | — | % | | 12,381 | | | — | % | | — | | | — | % |

| Total deposits | | $ | 10,235,403 | | | 100 | % | | 10,168,569 | | | 100 | % | | 9,229,271 | | | 100 | % |

Capital

The Company remains well-capitalized by all regulatory standards, with an estimated total risk-based capital ratio at September 30, 2023 of 15.26%, up from the linked quarter ratio of 15.09% and the 14.84% ratio reported at September 30, 2022.

The Company has elected to exclude accumulated other comprehensive income ("AOCI") related primarily to available for sale securities from common equity tier 1 capital. AOCI is included in the Company’s tangible common equity to tangible assets ratio ("TCE") which was 6.49% at September 30, 2023, a decrease of 30 basis points from the linked quarter and an increase of 51 basis points from the prior year period. The decrease in TCE for the current quarter was driven by changes in AOCI, partially offset by earnings. As discussed above, the AOCI balance deteriorated relative to the increase in unrealized loss on available for sale securities as of September 30, 2023.

| | | | | | | | | | | | | | | | | | | | |

| CAPITAL RATIOS | | September 30, 2023 (estimated) | | June 30, 2023 | | September 30, 2022 |

| | | | | | |

| Tangible common equity to tangible assets (non-GAAP) | | 6.49% | | 6.79% | | 5.98% |

| Common equity tier I capital ratio | | 12.93% | | 12.75% | | 12.76% |

| Tier I leverage ratio | | 10.72% | | 10.47% | | 10.21% |

| Tier I risk-based capital ratio | | 13.71% | | 13.54% | | 13.59% |

| Total risk-based capital ratio | | 15.26% | | 15.09% | | 14.84% |

Liquidity

Liquidity is evaluated as both on-balance sheet (primarily cash and cash-equivalents, unpledged securities, and other marketable assets) and off-balance sheet (readily available lines of credit or other funding sources). The Company continues to manage liquidity sources, including unused lines of credit, at levels believed to be adequate to meet its operating needs for the foreseeable future.

The Company's on-balance sheet liquidity ratio (net liquid assets as a percent of net liabilities) at September 30, 2023 was 14.4%. In addition, the Company had approximately $2.2 billion in available lines of credit at that date resulting in a total liquidity ratio of 30.2%. The increase of $462,000 in available lines during the third quarter of 2023 was a result of additional loan collateral being transferred to the FHLB to enhance the levels of off-balance sheet liquidity availability to meet demands, as necessary.

First Bancorp is a bank holding company headquartered in Southern Pines, North Carolina, with total assets of $12.0 billion. Its principal activity is the ownership and operation of First Bank, a state-chartered community bank that operates 118 branches in North Carolina and South Carolina. First Bank also provides SBA loans to customers through its nationwide network of lenders - for more information on First Bank’s SBA lending capabilities, please visit www.firstbanksba.com. First Bancorp’s common stock is traded on The NASDAQ Global Select Market under the symbol “FBNC.”

Please visit our website at www.LocalFirstBank.com.

Caution about Forward-Looking Statements: This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, which statements are inherently subject to risks and uncertainties. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often characterized by the use of qualifying words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” or other words or phrases concerning opinions or judgments of the Company and its management about future events. Factors that could influence the accuracy of such forward-looking statements include, but are not limited to, the financial success or changing strategies of the Company’s customers, the Company’s level of success in integrating acquisitions, actions of government regulators, the level of market interest rates, and general economic conditions. For additional information about the factors that could affect the matters discussed in this paragraph, see the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K available at www.sec.gov. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements. The Company is also not responsible for changes made to this press release by wire services, internet services or other media.

| | |

First Bancorp and Subsidiaries

Financial Summary |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED INCOME STATEMENT ($ in thousands, except per share data) |

| | For the Three Months Ended | | For the Nine Months Ended |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Interest income | | | | | | | | | | |

| Interest and fees on loans | | $ | 106,514 | | | 102,963 | | | 72,239 | | | 308,857 | | | 201,518 | |

| Interest on investment securities | | 14,054 | | | 14,183 | | | 14,565 | | | 42,783 | | | 43,312 | |

| Other interest income | | 3,283 | | | 4,015 | | | 1,486 | | | 10,546 | | | 3,016 | |

| Total interest income | | 123,851 | | | 121,161 | | | 88,290 | | | 362,186 | | | 247,846 | |

| Interest expense | | | | | | | | | | |

| Interest on deposits | | 32,641 | | | 27,328 | | | 1,848 | | | 78,887 | | | 5,204 | |

| Interest on borrowings | | 6,508 | | | 6,848 | | | 1,108 | | | 19,125 | | | 2,160 | |

| Total interest expense | | 39,149 | | | 34,176 | | | 2,956 | | | 98,012 | | | 7,364 | |

| Net interest income | | 84,702 | | | 86,985 | | | 85,334 | | | 264,174 | | | 240,482 | |

| Provision for loan losses | | 1,200 | | | 3,700 | | | 5,100 | | | 16,351 | | | 8,600 | |

| (Reversal of) provision for unfunded commitments | | (1,200) | | | (1,339) | | | 300 | | | (1,487) | | | (1,200) | |

| Total provision for credit losses | | — | | | 2,361 | | | 5,400 | | | 14,864 | | | 7,400 | |

| Net interest income after provision for credit losses | | 84,702 | | | 84,624 | | | 79,934 | | | 249,310 | | | 233,082 | |

| Noninterest income | | | | | | | | | | |

| Service charges on deposit accounts | | 4,661 | | | 4,114 | | | 4,166 | | | 13,012 | | | 11,407 | |

| Other service charges, commissions, and fees | | 5,450 | | | 5,650 | | | 6,312 | | | 16,677 | | | 21,200 | |

| Fees from presold mortgage loans | | 325 | | | 557 | | | 376 | | | 1,288 | | | 1,951 | |

| Commissions from sales of financial products | | 1,207 | | | 1,413 | | | 1,391 | | | 3,926 | | | 3,487 | |

| SBA consulting fees | | 478 | | | 409 | | | 479 | | | 1,408 | | | 1,963 | |

| SBA loan sale gains | | 1,101 | | | 696 | | | 479 | | | 2,052 | | | 4,581 | |

| Bank-owned life insurance income | | 1,104 | | | 1,066 | | | 962 | | | 3,216 | | | 2,880 | |

| | | | | | | | | | |

| Other gains, net | | 851 | | | 330 | | | 2,747 | | | 1,369 | | | 5,958 | |

| Total noninterest income | | 15,177 | | | 14,235 | | | 16,912 | | | 42,948 | | | 53,427 | |

| Noninterest expenses | | | | | | | | | | |

| Salaries expense | | 29,394 | | | 28,676 | | | 24,416 | | | 87,391 | | | 71,669 | |

| Employee benefit expense | | 6,539 | | | 6,165 | | | 4,156 | | | 19,097 | | | 16,044 | |

| Occupancy and equipment related expense | | 5,003 | | | 4,972 | | | 4,847 | | | 15,042 | | | 14,171 | |

| Merger and acquisition expenses | | — | | | 1,334 | | | 548 | | | 13,506 | | | 4,769 | |

| Intangibles amortization expense | | 1,953 | | | 2,049 | | | 889 | | | 6,147 | | | 2,859 | |

| Other operating expenses | | 19,335 | | | 18,397 | | | 13,844 | | | 56,809 | | | 40,051 | |

| Total noninterest expenses | | 62,224 | | | 61,593 | | | 48,700 | | | 197,992 | | | 149,563 | |

| Income before income taxes | | 37,655 | | | 37,266 | | | 48,146 | | | 94,266 | | | 136,946 | |

| Income tax expense | | 7,762 | | | 7,863 | | | 10,197 | | | 19,809 | | | 28,443 | |

| Net income | | $ | 29,893 | | | 29,403 | | | 37,949 | | | 74,457 | | | 108,503 | |

| | | | | | | | | | |

| Earnings per common share - diluted | | $ | 0.73 | | | 0.71 | | | 1.06 | | | 1.81 | | | 3.04 | |

| | |

First Bancorp and Subsidiaries

Financial Summary |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED BALANCE SHEETS ($ in thousands) |

| | At September 30, 2023 | | At June 30, 2023 | | At December 31, 2022 | | At September 30, 2022 |

| Assets | | | | | | | | |

| Cash and due from banks | | $ | 95,257 | | | 101,215 | | | 101,133 | | | 83,050 | |

| Interest-bearing deposits with banks | | 178,332 | | | 259,460 | | | 169,185 | | | 186,465 | |

| Total cash and cash equivalents | | 273,589 | | | 360,675 | | | 270,318 | | | 269,515 | |

| | | | | | | | |

| Investment securities | | 2,635,866 | | | 2,757,607 | | | 2,856,193 | | | 2,882,408 | |

| Presold mortgages and SBA loans held for sale | | 8,060 | | | 4,953 | | | 1,282 | | | 3,710 | |

| | | | | | | | |

| Loans | | 8,027,037 | | | 7,897,629 | | | 6,665,145 | | | 6,525,286 | |

| Allowance for credit losses on loans | | (108,198) | | | (109,230) | | | (90,967) | | | (86,587) | |

| Net loans | | 7,918,839 | | | 7,788,399 | | | 6,574,178 | | | 6,438,699 | |

| | | | | | | | |

| Premises and equipment | | 151,981 | | | 152,443 | | | 134,187 | | | 134,288 | |

| Operating right-of-use lease assets | | 17,604 | | | 18,375 | | | 18,733 | | | 19,230 | |

| Intangible assets | | 513,629 | | | 515,847 | | | 376,938 | | | 378,150 | |

| Bank-owned life insurance | | 182,764 | | | 181,659 | | | 164,592 | | | 164,793 | |

| Other assets | | 275,628 | | | 253,040 | | | 228,628 | | | 225,069 | |

| Total assets | | $ | 11,977,960 | | | 12,032,998 | | | 10,625,049 | | | 10,515,862 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Deposits: | | | | | | | | |

| Noninterest-bearing checking accounts | | $ | 3,503,050 | | | 3,639,930 | | | 3,566,003 | | | 3,748,207 | |

| Interest-bearing deposit accounts | | 6,732,353 | | | 6,528,639 | | | 5,661,526 | | | 5,481,064 | |

| Total deposits | | 10,235,403 | | | 10,168,569 | | | 9,227,529 | | | 9,229,271 | |

| | | | | | | | |

| Borrowings | | 401,843 | | | 481,658 | | | 287,507 | | | 226,476 | |

| Operating lease liabilities | | 18,348 | | | 19,109 | | | 19,391 | | | 19,847 | |

| Other liabilities | | 64,683 | | | 66,020 | | | 59,026 | | | 55,771 | |

| Total liabilities | | 10,720,277 | | | 10,735,356 | | | 9,593,453 | | | 9,531,365 | |

| | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Common stock | | 962,644 | | | 960,851 | | | 725,153 | | | 724,694 | |

| Retained earnings | | 695,791 | | | 674,933 | | | 648,418 | | | 617,839 | |

| Stock in rabbi trust assumed in acquisition | | (1,375) | | | (1,365) | | | (1,585) | | | (1,585) | |

| Rabbi trust obligation | | 1,375 | | | 1,365 | | | 1,585 | | | 1,585 | |

| Accumulated other comprehensive loss | | (400,752) | | | (338,142) | | | (341,975) | | | (358,036) | |

| Total shareholders’ equity | | 1,257,683 | | | 1,297,642 | | | 1,031,596 | | | 984,497 | |

| Total liabilities and shareholders’ equity | | $ | 11,977,960 | | | 12,032,998 | | | 10,625,049 | | | 10,515,862 | |

| | |

First Bancorp and Subsidiaries

Financial Summary |

TREND INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 | | | |

| | | | | | | | | | | | | |

PERFORMANCE RATIOS (annualized) | | | | | | | | | | | | | |

| Return on average assets (1) | | 0.99 | % | | 0.98 | % | | 0.51 | % | | 1.44 | % | | 1.42 | % | | | |

| Return on average common equity (2) | | 9.10 | % | | 8.97 | % | | 4.83 | % | | 15.20 | % | | 13.84 | % | | | |

| Return on average tangible common equity (3) | | 15.05 | % | | 14.79 | % | | 8.16 | % | | 20.96 | % | | 21.25 | % | | | |

| | | | | | | | | | | | | |

| COMMON SHARE DATA | | | | | | | | | | | | | |

| Cash dividends declared - common | | $ | 0.22 | | | 0.22 | | | 0.22 | | | 0.22 | | | 0.22 | | | | |

| Stated book value - common | | $ | 30.61 | | | 31.59 | | | 31.72 | | | 28.89 | | | 27.57 | | | | |

| Tangible book value - common (non-GAAP) | | $ | 18.11 | | | 19.03 | | | 19.08 | | | 18.34 | | | 16.98 | | | | |

| Common shares outstanding at end of period | | 41,085,498 | | | 41,082,678 | | | 40,986,990 | | | 35,704,154 | | | 35,711,754 | | | | |

| Weighted average shares outstanding - diluted | | 41,199,058 | | | 41,129,100 | | | 41,112,692 | | | 35,614,972 | | | 35,703,446 | | | | |

| | | | | | | | | | | | | |

| CAPITAL INFORMATION (estimates for current quarter) | | | | | | | | | | | | | |

| Tangible common equity to tangible assets | | 6.49 | % | | 6.79 | % | | 6.60 | % | | 6.39 | % | | 5.98 | % | | | |

| Common equity tier I capital ratio | | 12.93 | % | | 12.75 | % | | 12.53 | % | | 13.02 | % | | 12.76 | % | | | |

| Total risk-based capital ratio | | 15.26 | % | | 15.09 | % | | 14.88 | % | | 15.09 | % | | 14.84 | % | | | |

| | | | | | | | | | | | | |

| (1) Calculated by dividing annualized net income by average assets. | | | |

| (2) Calculated by dividing annualized net income by average common equity. | | | |

| (3) Calculated by dividing annualized net income by average tangible common equity. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

INCOME STATEMENT ($ in thousands except per share data) | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| | | | | | | | | | |

| Net interest income - tax-equivalent (1) | | $ | 85,442 | | | 87,684 | | | 93,186 | | | 85,094 | | | 86,026 | |

| Taxable equivalent adjustment (1) | | 740 | | | 699 | | | 700 | | | 722 | | | 692 | |

| Net interest income | | 84,702 | | | 86,985 | | | 92,486 | | | 84,372 | | | 85,334 | |

| Provision for loan losses | | 1,200 | | | 3,700 | | | 11,451 | | | 4,000 | | | 5,100 | |

| (Reversal of) provision for unfunded commitments | | (1,200) | | | (1,339) | | | 1,051 | | | 1,000 | | | 300 | |

| Noninterest income | | 15,177 | | | 14,235 | | | 13,536 | | | 14,558 | | | 16,912 | |

| Merger and acquisition costs | | — | | | 1,334 | | | 12,182 | | | 303 | | | 548 | |

| Other noninterest expense | | 62,224 | | | 60,259 | | | 61,993 | | | 45,354 | | | 48,152 | |

| Income before income taxes | | 37,655 | | | 37,266 | | | 19,345 | | | 48,273 | | | 48,146 | |

| Income tax expense | | 7,762 | | | 7,863 | | | 4,184 | | | 9,840 | | | 10,197 | |

| Net income | | 29,893 | | | 29,403 | | | 15,161 | | | 38,433 | | | 37,949 | |

| | | | | | | | | | |

| Earnings per common share - diluted | | $ | 0.73 | | | 0.71 | | | 0.37 | | | 1.08 | | | 1.06 | |

| | | | | | | | | | |

| (1) This amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed assuming a 23% tax rate and is reduced by the related nondeductible portion of interest expense. |

v3.23.3

Cover Page

|

Oct. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity Registrant Name |

First Bancorp

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity File Number |

0-15572

|

| Entity Tax Identification Number |

56-1421916

|

| Entity Address, Address Line One |

300 SW Broad Street,

|

| Entity Address, City or Town |

Southern Pines,

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28387

|

| City Area Code |

(910)

|

| Local Phone Number |

246-2500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, No Par Value

|

| Trading Symbol |

FBNC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000811589

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

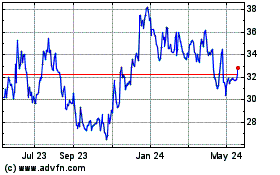

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Nov 2023 to Nov 2024