FibroGen Reports Third Quarter 2024 Financial Results

November 12 2024 - 3:05PM

FibroGen, Inc. (NASDAQ: FGEN) today reported financial results for

the third quarter 2024 and provided an update on the company’s

recent developments.

“This past quarter we transformed into a lean

and more focused organization, resulting in significant cost

savings that will extend into the future. Moreover, roxadustat

continued its impressive performance, generating $96.6 million in

net sales in China during the quarter,” said Thane Wettig, Chief

Executive Officer, FibroGen. “Having implemented our cost reduction

plan, we are well positioned to advance FG-3246, with topline

results from the Phase 2 portion of the investigator-sponsored

study of FG-3246 in combination with enzalutamide at the University

of California San Francisco (UCSF) on track for the first half of

2025, and the anticipated start of our Phase 2 monotherapy trial in

the first quarter of 2025. We continue to be optimistic about our

future prospects.”

Recent Developments and Key Events of

Third Quarter 2024:

- Meaningful progress on U.S. cost

reduction plan.

- Expected to be substantially

complete by year-end 2024

- Reported topline results from the

pamrevlumab arm of PanCAN Precision Promise Phase 2/3 adaptive

platform trial for the treatment of metastatic pancreatic ductal

adenocarcinoma (mPDAC), in which the trial did not meet the primary

endpoint.

- Reported topline results from the

LAPIS Phase 3 study of pamrevlumab in patients with locally

advanced, unresectable pancreatic cancer (LAPC), in which the trial

did not meet the primary endpoint.

Upcoming

Milestones:

Roxadustat

- Expect approval decision for

roxadustat in chemotherapy-induced anemia (CIA) in China in early

2025. If approved, FibroGen will receive a $10 million milestone

payment from AstraZeneca.

FG-3246 and FG-3180 (PET Imaging

Agent)

- Topline results from the Phase 2

portion of the investigator-sponsored Phase 1b/2 study conducted by

UCSF of FG-3246 in combination with enzalutamide in patients

with mCRPC expected in 1H 2025.

- Anticipate initiation of Phase 2

monotherapy dose optimization study of FG-3246 in mCRPC in 1Q 2025.

This trial will include a sub-study of FG-3180 to enable assessment

of CD46 expression and response to FG-3246.

China:

- Third quarter FibroGen net product

revenue under U.S. GAAP from the sale of roxadustat in China was

$46.2 million compared to $29.4 million in the third quarter of

2023, an increase of 57% year over year.

- Third quarter total roxadustat net

sales in China1 by FibroGen and the distribution entity jointly

owned by FibroGen and AstraZeneca (JDE) was $96.6 million, compared

to $77.1 million in the third quarter of 2023, an increase of 25%

year over year, driven by a 34% increase in volume.

- Roxadustat continues to be the

number one brand based on value share in the anemia of CKD market

in China.

- For 2024, FibroGen’s expected full

year net product revenue under U.S. GAAP reiterated to a range

between $135 million to $150 million, representing expected full

year roxadustat net sales in China1 by FibroGen and the JDE of $330

million to $350 million.

Financial:

- Total revenue for the third quarter

of 2024 was $46.3 million, as compared to $40.1 million for the

third quarter of 2023, an increase of 15% year over year.

- Net loss for the third quarter of

2024 was $17.1 million, or $0.17 net loss per basic and diluted

share, compared to a net loss of $63.6 million, or $0.65 net loss

per basic and diluted share one year ago.

- At September 30, 2024, FibroGen

reported $160.0 million in cash, cash equivalents and accounts

receivable.

- Assuming additional repatriation of

cash from our China operations, we expect our cash, cash

equivalents and accounts receivable to be sufficient to fund our

operating plans into 2026.

Conference Call and Webcast

Details FibroGen management will host a conference call

and webcast today, Tuesday, November 12, 2024, at 5:00 PM Eastern

Time to discuss financial results and provide a business update.

Interested parties may access the conference call by dialing

1-877-300-8521 (in the U.S.) or 1-412-317-6026 (outside the U.S.).

The call will be available via webcast by clicking here or on the

“Events and Presentation” page on the FibroGen website.

About RoxadustatRoxadustat, an

oral medication, is the first in a new class of medicines

comprising HIF-PH inhibitors that promote erythropoiesis, or red

blood cell production, through increased endogenous production of

erythropoietin, improved iron absorption and mobilization, and

downregulation of hepcidin. Roxadustat is in clinical development

for chemotherapy-induced anemia (CIA) and a Supplemental New Drug

Application (sNDA) has been accepted by the China Health

Authority.

Roxadustat is approved in China, Europe, Japan,

and numerous other countries for the treatment of anemia of CKD in

adult patients on dialysis (DD) and not on dialysis (NDD). Astellas

and FibroGen are collaborating on the development and

commercialization of roxadustat for the potential treatment of

anemia in territories including Japan, Europe, Turkey, Russia, and

the Commonwealth of Independent States, the Middle East, and South

Africa. AstraZeneca and FibroGen continue to collaborate on the

development and commercialization of roxadustat in China.

About FibroGen FibroGen, Inc.

is a biopharmaceutical company focused on accelerating the

development of novel therapies at the frontiers of cancer biology.

Roxadustat (爱瑞卓®, EVRENZOTM) is currently approved in China,

Europe, Japan, and numerous other countries for the treatment of

anemia in chronic kidney disease (CKD) patients on dialysis and not

on dialysis. Roxadustat is in clinical development for

chemotherapy-induced anemia (CIA) and a Supplemental New Drug

Application (sNDA) has been accepted for review by the China Health

Authority. FG-3246 (also known as FOR46), a first-in-class

antibody-drug conjugate (ADC) targeting CD46 is in development for

the treatment of metastatic castration-resistant prostate cancer.

This program also includes the development of an associated

CD46-targeted PET imaging agent, FG-3180. In addition, FibroGen’s

research and development portfolio includes two immuno-oncology

product candidates for the treatment of solid tumors. For more

information, please visit www.fibrogen.com.

Forward-Looking Statements This

release contains forward-looking statements regarding FibroGen’s

strategy, future plans and prospects, including statements

regarding its commercial products and clinical programs and those

of its collaboration partners Fortis and UCSF. These

forward-looking statements include, but are not limited to,

statements regarding the efficacy, safety, and potential clinical

or commercial success of FibroGen products and product candidates,

statements under the caption “Upcoming Milestones”, statements

regarding the potential for cash, cash equivalents and accounts

receivable to fund FibroGen’s operating plans into 2026, and

statements about FibroGen’s plans and objectives. These

forward-looking statements are typically identified by use of terms

such as “may,” “will”, “should,” “on track,” “could,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue” and similar words, although some

forward-looking statements are expressed differently. FibroGen’s

actual results may differ materially from those indicated in these

forward-looking statements due to risks and uncertainties related

to the continued progress and timing of its various programs,

including the enrollment and results from ongoing and potential

future clinical trials, and other matters that are described in

FibroGen’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024, each as filed with the Securities

and Exchange Commission (SEC), including the risk factors set forth

therein. Investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this release, and FibroGen undertakes no obligation to update

any forward-looking statement in this press release, except as

required by law.

1 Total roxadustat net sales in China includes

sales made by the distribution entity as well as FibroGen China’s

direct sales, each to its own distributors. The distribution entity

jointly owned by AstraZeneca and FibroGen is not consolidated into

FibroGen’s financial statements.

Condensed Consolidated Balance Sheets(In

thousands)

| |

September 30, 2024 |

|

|

December 31, 2023 |

|

| |

(Unaudited) |

|

|

(1) |

|

|

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

131,003 |

|

|

$ |

113,688 |

|

|

|

Short-term investments |

|

— |

|

|

|

121,898 |

|

|

|

Accounts receivable, net |

|

29,030 |

|

|

|

12,553 |

|

|

|

Inventory |

|

23,937 |

|

|

|

41,565 |

|

|

|

Prepaid expenses and other current assets |

|

60,559 |

|

|

|

41,855 |

|

|

|

Total current assets |

|

244,529 |

|

|

|

331,559 |

|

|

| |

|

|

|

|

|

| Restricted time deposits |

|

1,658 |

|

|

|

1,658 |

|

|

| Property and equipment,

net |

|

7,603 |

|

|

|

13,126 |

|

|

| Equity method investment in

unconsolidated variable interest entity |

|

5,806 |

|

|

|

5,290 |

|

|

| Operating lease right-of-use

assets |

|

2,093 |

|

|

|

68,093 |

|

|

| Other assets |

|

2,732 |

|

|

|

3,803 |

|

|

|

Total assets |

$ |

264,421 |

|

|

$ |

423,529 |

|

|

| |

|

|

|

|

|

| Liabilities,

stockholders’ equity and non-controlling interests |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

9,238 |

|

|

$ |

17,960 |

|

|

|

Accrued and other liabilities |

|

151,141 |

|

|

|

172,891 |

|

|

|

Deferred revenue |

|

28,858 |

|

|

|

12,740 |

|

|

|

Operating lease liabilities, current |

|

1,293 |

|

|

|

14,077 |

|

|

|

Total current liabilities |

|

190,530 |

|

|

|

217,668 |

|

|

| |

|

|

|

|

|

| Product development

obligations |

|

18,199 |

|

|

|

17,763 |

|

|

| Deferred revenue, net of

current |

|

126,219 |

|

|

|

157,555 |

|

|

| Operating lease liabilities,

non-current |

|

707 |

|

|

|

66,537 |

|

|

| Senior secured term loan

facilities, non-current |

|

72,779 |

|

|

|

71,934 |

|

|

| Liability related to sale of

future revenues, non-current |

|

56,850 |

|

|

|

51,413 |

|

|

| Other long-term

liabilities |

|

837 |

|

|

|

2,858 |

|

|

|

Total liabilities |

|

466,121 |

|

|

|

585,728 |

|

|

|

|

|

|

|

|

|

| Redeemable non-controlling

interests |

|

21,480 |

|

|

|

21,480 |

|

|

| Total stockholders’ deficit

attributable to FibroGen |

|

(243,667 |

) |

|

|

(204,166 |

) |

|

| Nonredeemable non-controlling

interests |

|

20,487 |

|

|

|

20,487 |

|

|

| Total deficit |

|

(223,180 |

) |

|

|

(183,679 |

) |

|

| Total liabilities,

redeemable non-controlling interests and deficit |

$ |

264,421 |

|

|

$ |

423,529 |

|

|

(1) The condensed consolidated balance

sheet amounts at December 31, 2023 are derived from audited

financial statements.

Condensed Consolidated Statements of

Operations(In thousands, except per share data)

| |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(Unaudited) |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

License revenue |

$ |

— |

|

|

$ |

2,649 |

|

|

$ |

— |

|

|

$ |

9,649 |

|

|

Development and other revenue |

|

385 |

|

|

|

6,775 |

|

|

|

1,532 |

|

|

|

15,825 |

|

|

Product revenue, net |

|

46,210 |

|

|

|

29,390 |

|

|

|

126,391 |

|

|

|

77,439 |

|

|

Drug product revenue, net |

|

(262 |

) |

|

|

1,320 |

|

|

|

24,954 |

|

|

|

17,701 |

|

|

Total revenue |

|

46,333 |

|

|

|

40,134 |

|

|

|

152,877 |

|

|

|

120,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

5,295 |

|

|

|

4,243 |

|

|

|

36,227 |

|

|

|

13,441 |

|

|

Research and development |

|

21,708 |

|

|

|

61,194 |

|

|

|

94,206 |

|

|

|

231,158 |

|

|

Selling, general and administrative |

|

17,554 |

|

|

|

25,573 |

|

|

|

62,650 |

|

|

|

91,029 |

|

|

Restructuring charge |

|

18,554 |

|

|

|

12,606 |

|

|

|

18,554 |

|

|

|

12,606 |

|

|

Total operating costs and expenses |

|

63,111 |

|

|

|

103,616 |

|

|

|

211,637 |

|

|

|

348,234 |

|

| Loss from

operations |

|

(16,778 |

) |

|

|

(63,482 |

) |

|

|

(58,760 |

) |

|

|

(227,620 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest and other,

net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(4,994 |

) |

|

|

(5,022 |

) |

|

|

(14,774 |

) |

|

|

(10,464 |

) |

|

Interest income and other income (expenses), net |

|

3,802 |

|

|

|

4,296 |

|

|

|

5,092 |

|

|

|

7,984 |

|

|

Total interest and other, net |

|

(1,192 |

) |

|

|

(726 |

) |

|

|

(9,682 |

) |

|

|

(2,480 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income

taxes |

|

(17,970 |

) |

|

|

(64,208 |

) |

|

|

(68,442 |

) |

|

|

(230,100 |

) |

|

Benefit from income taxes |

|

12 |

|

|

|

84 |

|

|

|

(217 |

) |

|

|

(77 |

) |

|

Investment income in unconsolidated variable interest

entity |

|

898 |

|

|

|

677 |

|

|

|

2,664 |

|

|

|

2,023 |

|

| Net loss |

$ |

(17,084 |

) |

|

$ |

(63,615 |

) |

|

$ |

(65,561 |

) |

|

$ |

(228,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

$ |

(0.17 |

) |

|

$ |

(0.65 |

) |

|

$ |

(0.66 |

) |

|

$ |

(2.35 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares used to calculate net loss per share - basic and

diluted |

|

100,515 |

|

|

|

98,245 |

|

|

|

99,780 |

|

|

|

96,901 |

|

For Investor Inquiries:David DeLucia, CFAVice

President of Corporate FP&A / Investor

Relationsir@fibrogen.com

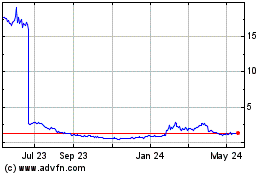

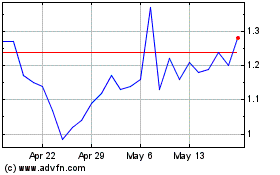

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Mar 2024 to Mar 2025