Fluent, Inc. (NASDAQ: FLNT), a partner monetization and customer

acquisition solutions leader, today reported financial results for

the third quarter and nine months ended September

30, 2024.

Don Patrick, Fluent’s Chief Executive Officer,

commented, "During the third quarter we continued to

accelerate our shift in focus and revenue mix to Fluent’s Commerce

Media Solutions, previously referred to as our Syndicated

Performance Marketplaces. This strategic shift represents a

significant opportunity for our business, as a growing number of

media owners and advertisers are turning to commerce media to

maximize the impact of their digital advertising initiatives.

Mr. Patrick continued, “Commerce media enhances customer

monetization by using first party data to interact with customers

across the entire purchasing experience, and according to BCG

estimates, experts are predicting commerce media will account for

over 25% of digital media spending by 2026. Fluent is uniquely

positioned to address this shifting demand with a comprehensive

suite of solutions that address the numerous high volume verticals

including ticketing, retail, quick-service restaurants, and

more. Since its launch in early 2023, revenue generated from

Commerce Media Solutions has grown year over year at a triple digit

pace, with $10.4 million in revenue generated for the current

quarter at 33% gross profit (exclusive of depreciation and

amortization) margin and 33.7% media margin as a percentage of

revenue, and a current annual revenue run rate of over $50

million1. This growth is supported by 14 years of deep industry

experience with our owned and operated marketplaces where we have

driven successful customer acquisition for our media partners and

advertisers and built a robust database of first-party customer

data that is a key differentiator for us in the market."

Mr. Patrick concluded, "We are intently focused on improving our

operational performance to deliver enhanced value for our

shareholders, and with our visibility today, we are targeting

double digit consolidated revenue growth and enhanced

profitability in 2025. We’re encouraged by the opportunities we’re

seeing in the marketplace and while Fluent has faced some difficult

headwinds during this fiscal year, we continue to believe that we

are positioning the Company for long-term growth and value

generation as we drive a strategic shift to the high-growth

commerce media market."

Third Quarter Financial Highlights

- Revenue of $64.5 million, a decrease of 3%,

compared to $66.2 million in Q3 2023

- Owned and Operated revenue decreased 18% to $43.5 million

compared to $53.1 million in Q3 2023 as the company executed its

shift in focus and revenue mix to higher margin Commerce Media

Solutions. Commerce Media Solutions revenue increased 341% to

$10.4 million compared to $2.3 million in Q3 2023.

- Net loss of $7.9 million, or $0.48 per share,

compared to a net loss of $33.6 million, or

$2.43 per share, for Q3 2023.

- Gross profit (exclusive of depreciation

and amortization) of $15.7 million, a decrease of 3%

over Q3 2023 and representing 24% of

revenue. The Company’s growing Commerce Media Solutions

business reported gross profit (exclusive of depreciation and

amortization) of $3.4 million, representing 33% of revenue, for Q3

2024 up from 11% of revenue in Q3 2023.

- Media margin of $18.2 million, a decrease

of 6% over Q3 2023 and

representing 28.1% of revenue. The Company’s growing

Commerce Media Solutions business reported media margins of 33.7%

for Q3 2024 up from 11.3% in Q3 2023.

- Adjusted EBITDA of

negative $0.1 million, an improvement of $1.7 million

over Q3 2023 and representing (0.1%) of

revenue.

- Adjusted net loss of $3.7 million, or

$0.22 per share, compared to an adjusted net loss

of $4.1 million, or $0.30 per share,

for Q3 2023.

Nine Months Ended September 30, 2024 Financial

Highlights

- Revenue of $189.2 million, a

decrease of 16%, compared to $225.6 million for the

nine months ended September 30, 2023.

- Owned and Operated revenue decreased 30% to $130.2 million

compared to $185.8 million for the first nine months of last year

as the company executed its shift in focus and revenue mix to

higher margin Commerce Media Solutions.

- Commerce Media Solutions revenue increased 580% to $24.0

million compared to $3.5 million in the first nine months of last

year.

- Net loss of $25.8 million,

or $1.75 per share, compared to a net loss

of $61.3 million, or $4.46 per share, for the nine

months ended September 30, 2023.

- Gross profit (exclusive of depreciation

and amortization) of $46.9 million, a decrease

of 19% over the nine months ended September 30,

2023 and representing 25% of revenue. The

Company’s growing Commerce Media Solutions business reported gross

profit (exclusive of depreciation and amortization) of $7.5

million, representing 31% of revenue, for the nine months ended

September 30, 2024 up from negative 12% of revenue, for the nine

months ended last year.

- Media margin of $56.0 million, a decrease

of 17% over the nine months ended September 30,

2023 and representing 29.6% of revenue. The

Company’s growing Commerce Media Solutions business reported media

margins of 32.1% for first nine months of 2024 up from negative

11.9% in the first nine months of last year.

- Adjusted EBITDA

of negative $3.9 million, a decrease

of $8.2 million over the nine months ended September

30, 2023 and representing (2.1%) of revenue.

- Adjusted net loss of $15.2 million, or $1.03 per

share, compared to an adjusted net loss of $6.8 million,

or $0.49 per share, for the nine months

ended September 30, 2023.

Media margin, adjusted EBITDA, and adjusted net income

(loss) are non-GAAP financial measures, as defined and reconciled

below.

Business Outlook & Goals

- Establish Fluent’s Commerce Media Solutions business as a

leader in the performance marketing sector among both media

partners and advertisers to capitalize on the growing demand for

this advertising channel across numerous high volume market

verticals.

- Drive double digit revenue growth, improved gross margins,

and improved net income and adjusted EBITDA as compared to

2024 in 2025 supported by the growth of Fluent’s Commerce

Media Solutions.

- Leverage 14-year leadership position at the forefront of

customer acquisition and robust database of first-party user data

to differentiate Fluent from its competitors in the commerce media

space.

- Seasonality, the ongoing shift to commerce media, and

expense discipline is expected to support low-single digit adjusted

EBITDA margin as a percentage of revenue in the fourth quarter of

2024, driving enhanced profitability and improved value for

stakeholders.

The Company cannot provide a reconciliation of adjusted EBITDA

to expected net income or net loss for the fourth quarter of 2024

due to the unknown effect, timing, and potential significance of

certain operating costs and expenses, share-based compensation

expense, and the provision for (or benefit from) income taxes.

____________________

(1) Annual Revenue Run Rate is an operational

metric that represents the annualized revenue of the Company’s

media partnerships at current monetization levels, as of the end of

the reporting period. The Company calculates Annual Revenue Run

Rate as follows:

- Media partners within Commerce Media Solutions with an active

contract are assessed and assigned an annual media volume estimate

based on the active term of the contract and the monetization rate

at the end of the reporting period. The Company considers a media

partner contract to be active when the contractual term commences

(the "start date") until its right to serve the partner’s commerce

traffic ends. Even if the contract with the customer is executed

before the start date, the contract will not count toward Annual

Revenue Run Rate until the media partner’s right to receive the

benefit of the services has commenced.

- As Annual Revenue Run Rate includes only contracts that are

active at the end of the reporting period, it does not reflect

assumptions or estimates regarding new business. For contracts

expiring within the 12-months after the period-end calculation

date, Annual Revenue Run Rate does reflect expectations of

renewal.

- The Company’s Commerce Media Solutions platform provides the

technology to effectively monetize the partner’s media by placing

relevant ads at a contracted moment of consumer engagement.

Although from inception to date, improvements in the platform’s

AI-powered technology have consistently driven increased rates of

monetization, for the purpose of Annual Revenue Run Rate, the

Company assumes a consistent monetization level to that as measured

on each media partner at the end of the reporting period.

The way the Company measures Annual Run Rate may not be

comparable to similarly titled measures presented by other

companies and should not be viewed as a projection of future

revenue.

Conference Call

Fluent, Inc. will host a conference call on Thursday,

November 14, 2024, at 4:30 PM ET to discuss its

2024 third quarter financial results. The conference call can

be accessed by phone after registering online at

https://register.vevent.com/register/BI864a66719cf74bf5b6122e36d27dac25. The

call will also be webcast simultaneously on the Fluent website at

https://investors.fluentco.com/. Following the completion of the

earnings call, a recorded replay of the webcast will be available

for those unable to participate. To listen to the telephone replay,

please connect

via https://edge.media-server.com/mmc/p/j8zkwa2m. The

replay will be available for one year, via the Fluent

website https://investors.fluentco.com/.

About Fluent, Inc.

Fluent, Inc. (NASDAQ: FLNT) has been a leader in performance

marketing since 2010, offering customer acquisition and partner

monetization solutions that exceed client expectations. Leveraging

untapped channels and diverse ad inventory across partner

ecosystems and owned sites, Fluent connects brands with consumers

at the most optimal moment, ensuring impactful engagement when it

matters most. Constantly innovating and optimizing for performance,

Fluent unlocks additional revenue streams for partners and empowers

advertisers to acquire their most valuable customers at scale. For

more insights visit https://www.fluentco.com/.

Safe Harbor Statement Under the Private Securities

Litigation Reform Act of 1995

The matters contained in this press release may be considered to

be "forward-looking statements" within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934.

Those statements include statements regarding the intent, belief or

current expectations or anticipations of Fluent and members of our

management team. Factors currently known to management that could

cause actual results to differ materially from those in

forward-looking statements include the following:

- Compliance with a significant number of governmental laws and

regulations, including those regarding telemarketing, text

messaging, privacy and data;

- The financial impact of compliance changes to our business,

including changes to our employment opportunities marketplace and

programmatic advertising businesses, and whether and when our

competitors will implement similar changes;

- The outcome of litigation, regulatory investigations, or other

legal proceedings in which we may become involved in the

future;

- Failure to safeguard the personal information and other data

contained in our database;

- Unfavorable publicity and negative public perception about the

digital marketing industry;

- Failure to adequately protect intellectual property rights or

allegations of infringement of intellectual property rights;

- Unfavorable global economic conditions, including as a result

of health concerns, terrorist attacks or civil unrest;

- Dependence on our key personnel and ability to attract or

retain employees;

- Dependence on and liability related to actions of third-party

service providers;

- A decline in the supply or increase in the price of media

available;

- Ability to compete in an industry characterized by

rapidly-evolving standards and internet media and advertising

technology;

- Failure to compete effectively against other online marketing

and advertising companies or respond to user demands;

- Competition for web traffic and dependence on third-party

publishers, internet search providers, and social media platforms

for a significant portion of visitors to our websites;

- Dependence on emails, text messages, and telephone calls, among

other channels, to reach users for marketing purposes;

- Credit risk from certain clients;

- Limitations on our third-party publishers’ ability to collect

and use data derived from user activities;

- Ability to remain competitive with the shift to mobile

applications;

- Failure to detect click-through or other fraud on

advertisements;

- Fluctuation in fulfillment costs;

- Dependence on the gaming industry;

- Failure to meet our clients’ performance metrics or changing

needs;

- Our need to raise capital, the uncertainty of which raises

substantial doubt about our ability to continue as a going

concern;

- Pricing pressure by certain clients and the ability of our

marketplace to respond through allocating traffic to higher paying

clients;

- Potential limitations on the use of the revolving credit line

under our credit agreement to fund operating expenses based on the

amount and character of accounts receivable at any given time and

our ability to meet our financial forecast, the potential for which

raises substantial doubt about our ability to continue as a going

concern;

- Compliance with the covenants of our credit agreement in light

of current business conditions, the uncertainty of which raises

substantial doubt about our ability to continue as a going

concern;

- Potential for failures in our internal control over

financial reporting;

- Ability to maintain listing of our securities on Nasdaq or any

stock exchange and potential impact on our stock price, liquidity,

and ability to obtain financing; and

- Management of the growth of our operations, including

international expansion and the integration of acquired business

units or personnel.

These and additional factors to be considered are set forth

under "Risk Factors" in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 and in our other filings

with the Securities and Exchange Commission. Fluent undertakes no

obligation to update or revise forward-looking statements to

reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results or expectations.

|

FLUENT, INC.CONSOLIDATED BALANCE

SHEETS(Amounts in thousands, except share and per

share data)(unaudited) |

|

|

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

ASSETS: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

6,587 |

|

|

$ |

15,804 |

|

| Accounts receivable, net of

allowance for credit losses of $497 and $231, respectively |

|

|

52,635 |

|

|

|

56,531 |

|

| Prepaid expenses and other

current assets |

|

|

7,060 |

|

|

|

6,071 |

|

|

Total current assets |

|

|

66,282 |

|

|

|

78,406 |

|

| Restricted cash |

|

|

1,255 |

|

|

|

— |

|

| Property and equipment,

net |

|

|

362 |

|

|

|

591 |

|

| Operating lease right-of-use

assets |

|

|

2,016 |

|

|

|

3,395 |

|

| Intangible assets, net |

|

|

22,666 |

|

|

|

26,809 |

|

| Goodwill |

|

|

— |

|

|

|

1,261 |

|

| Other non-current assets |

|

|

3,364 |

|

|

|

1,405 |

|

| Total

assets |

|

$ |

95,945 |

|

|

$ |

111,867 |

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

7,902 |

|

|

$ |

10,954 |

|

| Accrued expenses and other

current liabilities |

|

|

27,273 |

|

|

|

30,534 |

|

| Deferred revenue |

|

|

428 |

|

|

|

430 |

|

| Current portion of long-term

debt |

|

|

32,582 |

|

|

|

5,000 |

|

| Current portion of operating

lease liability |

|

|

2,222 |

|

|

|

2,296 |

|

|

Total current liabilities |

|

|

70,407 |

|

|

|

49,214 |

|

| Long-term debt, net |

|

|

500 |

|

|

|

25,488 |

|

| Convertible Notes, at fair

value with related parties |

|

|

4,860 |

|

|

|

— |

|

| Operating lease liability,

net |

|

|

152 |

|

|

|

1,699 |

|

| Other non-current

liabilities |

|

|

47 |

|

|

|

1,062 |

|

| Total

liabilities |

|

|

75,966 |

|

|

|

77,463 |

|

| Contingencies |

|

|

|

|

|

|

|

|

| Shareholders' equity: |

|

|

|

|

|

|

|

|

| Preferred stock — $0.0001 par

value, 10,000,000 Shares authorized; Shares outstanding — 0 shares

for both periods |

|

|

— |

|

|

|

— |

|

| Common stock — $0.0005 par

value, 200,000,000 Shares authorized; Shares issued — 17,645,368

and 14,384,936, respectively; and Shares outstanding — 16,876,773

and 13,616,341, respectively |

|

|

46 |

|

|

|

43 |

|

| Treasury stock, at cost —

768,595 and 768,595 Shares, respectively |

|

|

(11,407 |

) |

|

|

(11,407 |

) |

| Additional paid-in

capital |

|

|

438,705 |

|

|

|

427,286 |

|

| Accumulated deficit |

|

|

(407,365 |

) |

|

|

(381,518 |

) |

| Total shareholders'

equity |

|

|

19,979 |

|

|

|

34,404 |

|

| Total liabilities and

shareholders' equity |

|

$ |

95,945 |

|

|

$ |

111,867 |

|

|

FLUENT, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(Amounts in thousands, except share and

per share data)(unaudited) |

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

64,516 |

|

|

$ |

66,239 |

|

|

$ |

189,216 |

|

|

$ |

225,638 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization) |

|

|

48,861 |

|

|

|

50,148 |

|

|

|

142,318 |

|

|

|

167,960 |

|

|

Sales and marketing |

|

|

3,983 |

|

|

|

4,426 |

|

|

|

13,400 |

|

|

|

13,454 |

|

|

Product development |

|

|

4,124 |

|

|

|

4,511 |

|

|

|

13,681 |

|

|

|

14,064 |

|

|

General and administrative |

|

|

9,067 |

|

|

|

8,725 |

|

|

|

28,288 |

|

|

|

24,991 |

|

|

Depreciation and amortization |

|

|

2,369 |

|

|

|

2,658 |

|

|

|

7,507 |

|

|

|

8,112 |

|

|

Goodwill and intangible assets impairment |

|

|

— |

|

|

|

29,705 |

|

|

|

2,241 |

|

|

|

55,405 |

|

| Total costs and

expenses |

|

|

68,404 |

|

|

|

100,173 |

|

|

|

207,435 |

|

|

|

283,986 |

|

| Loss from

operations |

|

|

(3,888 |

) |

|

|

(33,934 |

) |

|

|

(18,219 |

) |

|

|

(58,348 |

) |

|

Interest expense, net |

|

|

(1,281 |

) |

|

|

(936 |

) |

|

|

(3,711 |

) |

|

|

(2,420 |

) |

|

Fair value adjustment of Convertible Notes, with related

parties |

|

|

(2,810 |

) |

|

|

— |

|

|

|

(2,810 |

) |

|

|

— |

|

|

Loss on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(1,009 |

) |

|

|

— |

|

| Loss before income

taxes |

|

|

(7,979 |

) |

|

|

(34,870 |

) |

|

|

(25,749 |

) |

|

|

(60,768 |

) |

|

Income tax (expense) benefit |

|

|

35 |

|

|

|

1,243 |

|

|

|

(98 |

) |

|

|

(551 |

) |

| Net loss |

|

|

(7,944 |

) |

|

|

(33,627 |

) |

|

|

(25,847 |

) |

|

|

(61,319 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.48 |

) |

|

$ |

(2.43 |

) |

|

$ |

(1.75 |

) |

|

$ |

(4.46 |

) |

|

Diluted |

|

$ |

(0.48 |

) |

|

$ |

(2.43 |

) |

|

$ |

(1.75 |

) |

|

$ |

(4.46 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,452,273 |

|

|

|

13,813,423 |

|

|

|

14,783,253 |

|

|

|

13,751,910 |

|

|

Diluted |

|

|

16,452,273 |

|

|

|

13,813,423 |

|

|

|

14,783,253 |

|

|

|

13,751,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLUENT, INC.CONSOLIDATED STATEMENTS OF

CASH FLOWS(Amounts in

thousands)(unaudited) |

|

|

| |

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(25,847 |

) |

|

$ |

(61,319 |

) |

| Adjustments to

reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

7,507 |

|

|

|

8,112 |

|

| Non-cash loan amortization

expense |

|

|

1,202 |

|

|

|

330 |

|

| Non-cash gain on contingent

consideration |

|

|

(250 |

) |

|

|

— |

|

| Non-cash loss on early

extinguishment of debt |

|

|

1,009 |

|

|

|

— |

|

| Share-based compensation

expense |

|

|

1,490 |

|

|

|

2,958 |

|

| Fair value adjustment of

Convertible Notes, with related parties |

|

|

2,810 |

|

|

|

— |

|

| Goodwill impairment |

|

|

1,261 |

|

|

|

55,405 |

|

| Impairment of intangible

assets |

|

|

980 |

|

|

|

— |

|

| Allowance for credit

losses |

|

|

412 |

|

|

|

(51 |

) |

| Changes in assets and

liabilities, net of business acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

3,359 |

|

|

|

14,700 |

|

| Prepaid expenses and other

current assets |

|

|

(1,542 |

) |

|

|

(4,563 |

) |

| Other non-current assets |

|

|

280 |

|

|

|

228 |

|

| Operating lease assets and

liabilities, net |

|

|

(242 |

) |

|

|

(248 |

) |

| Accounts payable |

|

|

(3,052 |

) |

|

|

5,651 |

|

| Accrued expenses and other

current liabilities |

|

|

(510 |

) |

|

|

(10,869 |

) |

| Deferred revenue |

|

|

185 |

|

|

|

(522 |

) |

| Other |

|

|

(1,015 |

) |

|

|

(117 |

) |

| Net cash (used in)

provided by operating activities |

|

|

(11,963 |

) |

|

|

9,695 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Capitalized costs included in

intangible assets |

|

|

(4,727 |

) |

|

|

(4,093 |

) |

| Business acquisitions, net of

cash acquired |

|

|

— |

|

|

|

(1,250 |

) |

| Acquisition of property and

equipment |

|

|

(1 |

) |

|

|

(25 |

) |

| Net cash used in

investing activities |

|

|

(4,728 |

) |

|

|

(5,368 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of

long-term debt, net of debt financing costs |

|

|

54,617 |

|

|

|

— |

|

| Repayments of long-term

debt |

|

|

(56,214 |

) |

|

|

(8,750 |

) |

| Exercise of stock options |

|

|

— |

|

|

|

— |

|

| Debt financing costs |

|

|

(1,625 |

) |

|

|

(375 |

) |

| Proceeds from issuance of

warrants |

|

|

9,900 |

|

|

|

— |

|

| Proceeds from exercise of

warrants |

|

|

1 |

|

|

|

— |

|

| Proceeds from Convertible

Notes, with related parties |

|

|

2,050 |

|

|

|

— |

|

| Taxes paid related to net

share settlement of vesting of restricted stock units |

|

|

— |

|

|

|

(236 |

) |

| Net cash (used in)

provided by financing activities |

|

|

8,729 |

|

|

|

(9,361 |

) |

| Net decrease in cash,

cash equivalents, and restricted cash |

|

|

(7,962 |

) |

|

|

(5,034 |

) |

| Cash, cash equivalents, and

restricted cash at beginning of period |

|

|

15,804 |

|

|

|

25,547 |

|

| Cash, cash equivalents, and

restricted cash at end of period |

|

$ |

7,842 |

|

|

$ |

20,513 |

|

| |

Definitions, Reconciliations and Uses of Non-GAAP

Financial Measures

The following non-GAAP measures are used in this release:

Media margin is defined as that

portion of gross profit (exclusive of depreciation and

amortization) reflecting the variable costs paid for media and

related expenses and excluding non-media cost of revenue. Gross

profit (exclusive of depreciation and amortization) represents

revenue minus cost of revenue (exclusive of depreciation and

amortization). Media margin is also presented as percentage of

revenue.

Adjusted EBITDA is defined as net

income (loss), excluding (1) income taxes, (2) interest

expense, net, (3) depreciation and amortization, (4) share-based

compensation expense, (5) loss on early extinguishment of

debt, (6) accrued compensation expense for Put/Call

Consideration, (7) goodwill impairment, (8) impairment of

intangible assets, (9) loss (gain) on disposal of property and

equipment, (10) fair value adjustment of convertible notes,

(11) acquisition-related costs, (12) restructuring and other

severance costs, and (13) certain litigation and other related

costs.

Adjusted net income (loss) is

defined as net income (loss), excluding (1) share-based

compensation expense, (2) loss on early extinguishment of

debt, (3) accrued compensation expense for Put/Call

Consideration, (4) goodwill impairment, (5) impairment of

intangible assets, (6) loss (gain) on disposal of property and

equipment, (7) fair value adjustment of convertible notes, (8)

acquisition-related costs, (9) restructuring and other

severance costs, and (10) certain litigation and other related

costs. Adjusted net income (loss) is also presented on a per

share (basic and diluted) basis.

Below is a reconciliation of media margin from gross profit

(exclusive of depreciation and amortization), which we believe is

the most directly comparable GAAP measure, for the Company.

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

(In thousands, except percentages) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

64,516 |

|

|

$ |

66,239 |

|

|

$ |

189,216 |

|

|

$ |

225,638 |

|

|

Less: Cost of revenue (exclusive of depreciation and

amortization) |

|

|

48,861 |

|

|

|

50,148 |

|

|

|

142,318 |

|

|

|

167,960 |

|

| Gross profit

(exclusive of depreciation and amortization) |

|

$ |

15,655 |

|

|

$ |

16,091 |

|

|

$ |

46,898 |

|

|

$ |

57,678 |

|

| Gross profit (exclusive of

depreciation and amortization) % of revenue |

|

|

24 |

% |

|

|

24 |

% |

|

|

25 |

% |

|

|

26 |

% |

|

Non-media cost of revenue(1) |

|

|

2,505 |

|

|

|

3,229 |

|

|

|

9,066 |

|

|

|

9,510 |

|

| Media

margin |

|

$ |

18,160 |

|

|

$ |

19,320 |

|

|

$ |

55,964 |

|

|

$ |

67,188 |

|

| Media margin % of revenue |

|

|

28.1 |

% |

|

|

29.2 |

% |

|

|

29.6 |

% |

|

|

29.8 |

% |

(1) Represents the portion of cost of revenue (exclusive of

depreciation and amortization) not attributable to variable costs

paid for media and related expenses.

Below is a reconciliation of media margin from gross profit

(exclusive of depreciation and amortization), which we believe

is the most directly comparable GAAP measure, for Commerce Media

Solutions.

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

| (In thousands, except

percentages) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

10,363 |

|

|

$ |

2,348 |

|

|

$ |

24,032 |

|

|

$ |

3,534 |

|

| Less: Cost of revenue

(exclusive of depreciation and amortization) |

|

|

6,931 |

|

|

|

2,098 |

|

|

|

16,487 |

|

|

|

3,974 |

|

| Gross profit

(exclusive of depreciation and amortization) |

|

$ |

3,432 |

|

|

$ |

250 |

|

|

$ |

7,545 |

|

|

$ |

(440 |

) |

| Gross profit

(exclusive of depreciation and amortization) % of

revenue |

|

|

33 |

% |

|

|

11 |

% |

|

|

31 |

% |

|

|

(12 |

%) |

| Non-media cost of

revenue(1) |

|

|

56 |

|

|

|

16 |

|

|

|

161 |

|

|

|

19 |

|

| Media

margin |

|

$ |

3,488 |

|

|

$ |

266 |

|

|

$ |

7,706 |

|

|

$ |

(421 |

) |

| Media margin % of

revenue |

|

|

33.7 |

% |

|

|

11.3 |

% |

|

|

32.1 |

% |

|

|

(11.9 |

%) |

(1) Represents the portion of cost of revenue (exclusive of

depreciation and amortization) not attributable to variable costs

paid for media and related expenses.

Below is a reconciliation of adjusted EBITDA from net

loss for the three and nine months ended September 30,

2024 and 2023, respectively, which we believe is the most directly

comparable GAAP measure.

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

(In thousands) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

|

$ |

(7,944 |

) |

|

$ |

(33,627 |

) |

|

$ |

(25,847 |

) |

|

$ |

(61,319 |

) |

| Income tax expense

(benefit) |

|

|

(35 |

) |

|

|

(1,243 |

) |

|

|

98 |

|

|

|

551 |

|

| Interest expense, net |

|

|

1,281 |

|

|

|

936 |

|

|

|

3,711 |

|

|

|

2,420 |

|

| Depreciation and

amortization |

|

|

2,369 |

|

|

|

2,658 |

|

|

|

7,507 |

|

|

|

8,112 |

|

| Share-based compensation

expense |

|

|

460 |

|

|

|

961 |

|

|

|

1,490 |

|

|

|

2,958 |

|

| Loss on early extinguishment

of debt |

|

|

— |

|

|

|

— |

|

|

|

1,009 |

|

|

|

— |

|

| Goodwill impairment |

|

|

— |

|

|

|

29,705 |

|

|

|

1,261 |

|

|

|

55,405 |

|

| Impairment of intangible

assets |

|

|

— |

|

|

|

— |

|

|

|

980 |

|

|

|

— |

|

| Fair value adjustment of

Convertible Notes, with related parties |

|

|

2,810 |

|

|

|

— |

|

|

|

2,810 |

|

|

|

— |

|

| Acquisition-related

costs(1) |

|

|

443 |

|

|

|

516 |

|

|

|

1,250 |

|

|

|

1,701 |

|

| Restructuring and other

severance costs |

|

|

545 |

|

|

|

(24 |

) |

|

|

1,821 |

|

|

|

456 |

|

| Certain litigation and other

related costs |

|

|

— |

|

|

|

(1,624 |

) |

|

|

— |

|

|

|

(5,982 |

) |

| Adjusted

EBITDA |

|

$ |

(71 |

) |

|

$ |

(1,742 |

) |

|

$ |

(3,910 |

) |

|

$ |

4,302 |

|

(1) Balance includes compensation expense related to

non-competition agreements and earn-out expense incurred as a

result of business combinations. The earn-out expense

was $30 and ($21) for the three months

ended September 30, 2024 and 2023, respectively, and

$167 and $89 for the nine months ended September 30,

2024 and 2023, respectively.

Below is a reconciliation of adjusted net loss and adjusted

net loss per share from net loss for the nine

months ended September 30, 2024 and 2023, respectively, which we

believe is the most directly comparable GAAP measure.

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| (In thousands, except share

and per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss |

|

$ |

(7,944 |

) |

|

$ |

(33,627 |

) |

|

$ |

(25,847 |

) |

|

$ |

(61,319 |

) |

| Share-based compensation

expense |

|

|

460 |

|

|

|

961 |

|

|

|

1,490 |

|

|

|

2,958 |

|

| Loss on early extinguishment

of debt |

|

|

— |

|

|

|

— |

|

|

|

1,009 |

|

|

|

— |

|

| Goodwill impairment |

|

|

— |

|

|

|

29,705 |

|

|

|

1,261 |

|

|

|

55,405 |

|

| Impairment of intangible

assets |

|

|

— |

|

|

|

— |

|

|

|

980 |

|

|

|

— |

|

| Fair value adjustment of

Convertible Notes, with related parties |

|

|

2,810 |

|

|

|

— |

|

|

|

2,810 |

|

|

|

— |

|

| Acquisition-related

costs(1) |

|

|

443 |

|

|

|

516 |

|

|

|

1,250 |

|

|

|

1,701 |

|

| Restructuring and other

severance costs |

|

|

545 |

|

|

|

(24 |

) |

|

|

1,821 |

|

|

|

456 |

|

| Certain litigation and other

related costs |

|

|

— |

|

|

|

(1,624 |

) |

|

|

— |

|

|

|

(5,982 |

) |

| Adjusted net

loss |

|

$ |

(3,686 |

) |

|

$ |

(4,093 |

) |

|

$ |

(15,226 |

) |

|

$ |

(6,781 |

) |

| Adjusted net loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.22 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.03 |

) |

|

$ |

(0.49 |

) |

|

Diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.03 |

) |

|

$ |

(0.49 |

) |

| Weighted average

number of shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,452,273 |

|

|

|

13,813,423 |

|

|

|

14,783,253 |

|

|

|

13,751,910 |

|

|

Diluted |

|

|

16,452,273 |

|

|

|

13,813,423 |

|

|

|

14,783,253 |

|

|

|

13,751,910 |

|

(1) Balance includes compensation expense related to

non-competition agreements and earn-out expense incurred as a

result of business combinations. The earn-out expense

was $30 and ($21) for the three months

ended September 30, 2024 and 2023, respectively, and

$167 and $89 for the nine months ended September 30,

2024 and 2023, respectively.

We present media margin, media margin as a percentage of

revenue, adjusted EBITDA, adjusted net income (loss), and

adjusted net income (loss) per share as supplemental measures of

our financial and operating performance because we believe they

provide useful information to investors. More specifically:

Media margin, as defined above, is a

measure of the efficiency of the Company’s operating model. We use

media margin and the related measure of media margin as a

percentage of revenue as primary metrics to measure the financial

return on our media and related costs, specifically to measure the

degree by which the revenue generated from our digital marketing

services exceeds the cost to attract the consumers to whom offers

are made through our services. Media margin is used extensively by

our management to manage our operating performance, including

evaluating operational performance against budgeted media margin

and understanding the efficiency of our media and related

expenditures. We also use media margin for performance evaluations

and compensation decisions regarding certain personnel.

Adjusted EBITDA, as defined above, is

another primary metric by which we evaluate the operating

performance of our business, on which certain operating

expenditures and internal budgets are based and by which, in

addition to media margin and other factors, our senior management

is compensated. The first three adjustments represent the

conventional definition of EBITDA, and the remaining adjustments

are items recognized and recorded under U.S. GAAP in particular

periods but might be viewed as not necessarily coinciding with the

underlying business operations for the periods in which they are so

recognized and recorded. These adjustments include certain

litigation and other related costs associated with legal matters

outside the ordinary course of business. We consider items one-time

in nature if they are non-recurring, infrequent or unusual and have

not occurred in the past two years or are not expected to recur in

the next two years, in accordance with SEC rules. There were no

adjustments for one-time items in the periods presented in this

Quarterly Report on Form 10-Q.

Adjusted net income (loss), as

defined above, and the related measure of adjusted net income

(loss) per share excludes certain items that are recognized

and recorded under U.S. GAAP in particular periods but might be

viewed as not necessarily coinciding with the underlying business

operations for the periods in which they are so recognized and

recorded. We believe adjusted net income (loss) affords

investors a different view of the overall financial

performance of the Company than adjusted EBITDA and the U.S.

GAAP measure of net income (loss).

Media margin, adjusted EBITDA, adjusted net income (loss), and

adjusted net income (loss) per share are non-GAAP financial

measures with certain limitations regarding their usefulness.

They do not reflect our financial results in accordance with

U.S. GAAP, as they do not include the impact of certain expenses

that are reflected in our condensed consolidated statements of

operations. Accordingly, these metrics are not indicative of our

overall results or indicators of past or future financial

performance. Further, they are not financial measures of

profitability and are neither intended to be used as a proxy

for the profitability of our business nor to imply

profitability. The way we measure media margin, adjusted

EBITDA, and adjusted net income (loss) may not be comparable to

similarly titled measures presented by other companies and may not

be identical to corresponding measures used in our various

agreements.

Contact Information: Investor

RelationsFluent, Inc.InvestorRelations@fluentco.com

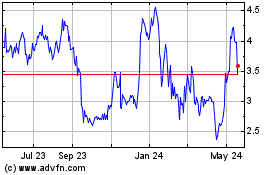

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From Jan 2025 to Feb 2025

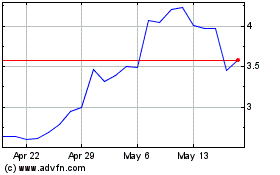

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From Feb 2024 to Feb 2025