--Q2 Net Sales, Gross Margin and Adjusted

EBITDA - All Above Expectations--

Funko, Inc. (Nasdaq: FNKO), a leading pop culture lifestyle

brand, today reported its consolidated financial results for the

second quarter ended June 30, 2024.

Second Quarter Financial Results Summary: 2024 vs

2023

- Net sales were $247.7 million compared with $240.0 million

- Gross profit was $104.0 million, equal to gross margin of

42.0%. This compares with $70.0 million, equal to gross margin of

29.2%, which included $2.4 million of non-recurring charges

- SG&A expenses were $77.9 million, which included a

non-recurring net benefit of $1.5 million, compared with $85.6

million, which included non-recurring charges of $0.8 million.

Details related to the non-recurring charges can be found in

footnotes 4 and 5 of the attached reconciliations

- Net income was $5.4 million, or $0.10 per diluted share,

compared with net loss of $75.9 million, or $1.54 per share

- Adjusted net income* was $5.6 million, or $0.10 per diluted

share*, compared with adjusted net loss of $22.3 million, or $0.43

per share

- Adjusted EBITDA* was $27.9 million versus negative adjusted

EBITDA* of $7.6 million

“For the 2024 second quarter, net sales, gross margin and

adjusted EBITDA were all above our expectations,” said Cynthia

Williams, Funko’s recently named Chief Executive Officer. “Our

performance was primarily driven by strong demand for our core

collectible products in Europe and other international markets,

Pop! Yourself and Bitty Pop!, as well as solid growth in our

direct-to-consumer business. Higher than anticipated margins on

sales in the value channel and resulting inventory reserve relief

were key contributors to our better-than-expected gross margin of

42%.

“Turning to our balance sheet, we lowered our inventory levels

to $109.0 million at June 30, 2024 from $112.3 million at March 31,

2024 and reduced our debt by $22.5 million to $223.9 million at

June 30, 2024 from $246.4 million at March 31, 2024.

“Having joined Funko two months ago, I look forward to leading

Funko through the next stage of our growth. I am enthused by our

fans and excited about our business, products and opportunities.

The team is actively working on developing our plans for 2025 and

beyond. We are taking a fan-centric approach, which revolves around

delighting our core fans, attracting and serving new fans, selling

where the fans are and improving the fan experience. These four

fundamental principles are core to our growth because great

products keep our fans coming back, there are new fans we can

reach, especially by selling to them directly or in venues they

frequent, and keeping fans at the center of all we do breeds

loyalty and long-term value. We expect to provide further details

on these plans in the coming quarters.”

Leadership Update

The company also announced today the appointment of Yves Le

Pendeven as Chief Financial Officer. Since joining Funko five years

ago, Le Pendeven has held several roles as a senior finance

executive, most recently serving as Acting Chief Financial Officer

and before that as Deputy Chief Financial Officer.

Second Quarter 2024 Net Sales by Category and

Geography

The tables below show the breakdown of net sales on a brand

category and geographical basis (in thousands):

Three Months Ended June

30,

Period Over Period

Change

2024

2023

Dollar

Percentage

Net sales by brand category:

Core Collectible

$

186,738

$

175,473

$

11,265

6.4

%

Loungefly

41,483

47,922

(6,439

)

(13.4

)%

Other

19,436

16,633

2,803

16.9

%

Total net sales

$

247,657

$

240,028

$

7,629

3.2

%

Three Months Ended June

30,

Period Over Period

Change

2024

2023

Dollar

Percentage

Net sales by geography (shipped

to):

United States

$

163,021

$

171,068

$

(8,047

)

(4.7

)%

Europe

60,382

49,966

10,416

20.8

%

Other International

24,254

18,994

5,260

27.7

%

Total net sales

$

247,657

$

240,028

$

7,629

3.2

%

Balance Sheet Highlights - At June 30, 2024 vs December 31,

2023

- Total cash and cash equivalents were $41.6 million at June 30,

2024 compared with $36.5 million at December 31, 2023

- Inventory was $109.0 million at June 30, 2024 down from $119.5

million at December 31, 2023

- Total debt was $223.9 million at June 30, 2024 versus $273.6

million at December 31, 2023. Total debt includes the amount

outstanding under the company's term loan facility, net of

unamortized discounts, revolving line of credit and equipment

finance loan

Outlook for 2024

The company reiterated its 2024 full-year outlook, which

assumes, among other things, a strong holiday season, and provided

guidance for its 2024 third quarter, which reflects, in part, a

pull forward of an estimated $9 million in net sales and $2.5

million of adjusted EBITDA into its 2024 second quarter from the

2024 third quarter, as follows:

Current Outlook

2024 Full Year

Net Sales

$1.047 billion to $1.103 billion

Adjusted EBITDA*

$65 million to $85 million

2024 Third Quarter

Net sales

$282 million to $297 million

Gross margin %

38% to 39%

SG&A expense, in dollars

$90 million to $95 million

Adjusted net income*

$0.5 million to $3 million

Adjusted net income per diluted share*

$0.01 to $0.06

Adjusted EBITDA*

$21 million to $25 million

*Adjusted net income (loss), adjusted net income (loss) per

diluted share and adjusted EBITDA are non-GAAP financial measures.

For a reconciliation of historical adjusted net income (loss),

adjusted net income (loss) per share, and adjusted EBITDA, to the

most directly comparable U.S. GAAP financial measures, please refer

to the “Use of Non-GAAP Financial Measures” section of this press

release. A reconciliation of adjusted net income (loss), adjusted

net income (loss) per share and adjusted EBITDA outlook to the

corresponding GAAP measure on a forward-looking basis cannot be

provided without unreasonable efforts, as we are unable to provide

reconciling information with respect to certain items. However, for

the third quarter of 2024 the company expects equity-based

compensation of approximately $4 million, depreciation and

amortization of approximately $16 million and interest expense of

approximately $4 million. For the full year 2024, the company

expects equity-based compensation of approximately $15 million,

depreciation and amortization of approximately $63 million and

interest expense of approximately $20 million, each of which is a

reconciling item to net loss. See "Use of Non-GAAP Financial

Measures" and the attached reconciliations for more

information.

Conference Call and Webcast

The company will host a conference call at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time) today, August 8, 2024, to further

discuss its second quarter results and business update. A live

webcast and a replay of the event will be available on the Investor

Relations section on the Company’s website at investor.funko.com.

The replay of the webcast will be available for one year.

Use of Non-GAAP Financial Measures

This release contains references to non-GAAP financial measures,

including adjusted net income (loss), including per share amounts,

adjusted EBITDA, adjusted EBITDA margin and adjusted net income

(loss) margin, which are financial measures that are not prepared

in conformity with United States generally accepted accounting

principles (U.S. GAAP). Management uses these measures internally

for evaluating its operating performance, for planning purposes,

including the preparation of our annual operating budget and

financials projections, and to assess incentive compensation for

our employees, and to evaluate our capacity to expand our business.

In addition, our senior secured credit facilities use adjusted

EBITDA to measure our compliance with covenants, such as senior

leverage ratio. The company's management believes that the

presentation of non-GAAP financial measures provides useful

supplementary information regarding operational performance because

it enhances an investor's overall understanding of the financial

results for the company's core business. Additionally, it provides

a basis for the comparison of the financial results for the

company's core business between current, past and future periods as

they remove the impact of items not directly resulting from our

core operations. The company also believes that including adjusted

EBITDA and the other non-GAAP financial measures presented in this

release is appropriate to provide additional information to

investors and help to compare against other companies in our

industry. Non-GAAP financial measures have limitations as

analytical tools and should be considered only as a supplement to,

and not as a substitute for or as a superior measure to, financial

measures prepared in accordance with U.S. GAAP. We caution

investors that amounts presented in accordance with our definitions

of adjusted net income (loss), including per share amounts,

adjusted EBITDA and adjusted EBITDA margin may not be comparable to

similar measures disclosed by our competitors, because not all

companies and analysts calculate these measures in the same

manner.

Detailed reconciliations of non-GAAP financial measures to the

most directly comparable GAAP financial measures are included in

the financial tables following this release.

About Funko

Headquartered in Everett, Washington, Funko is a leading pop

culture lifestyle brand. Funko designs, sources and distributes

licensed pop culture products across multiple categories, including

vinyl figures, action toys, plush, apparel, housewares and

accessories for consumers who seek tangible ways to connect with

their favorite pop culture brands and characters. Learn more at

www.funko.com, and follow us on X (Twitter) (@OriginalFunko) and

Instagram (@OriginalFunko).

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding our

anticipated financial results, including without limitation,

equity-based compensation and financial position. These

forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: our ability to execute our business strategy; our

ability to manage our inventories and growth; our ability to

maintain and realize the full value of our license agreements;

impacts from economic downturns; changes in the retail industry and

markets for our consumer products; our ability to maintain our

relationships with retail customers and distributors; our ability

to compete effectively; fluctuations in our gross margin; our

dependence on content development and creation by third parties;

the ongoing level of popularity of our products with consumers; our

ability to develop and introduce products in a timely and

cost-effective manner; our ability to obtain, maintain and protect

our intellectual property rights or those of our licensors;

potential violations of the intellectual property rights of others;

risks associated with counterfeit versions of our products; our

ability to attract and retain qualified employees and maintain our

corporate culture; our use of third-party manufacturing; risks

associated with climate change; increased attention to

sustainability and environmental, social and governance

initiatives; geographic concentration of our operations; risks

associated with our international operations; changes in effective

tax rates or tax law; our dependence on vendors and outsourcers;

risks relating to government regulation; risks relating to

litigation, including products liability claims and securities

class action litigation; any failure to successfully integrate or

realize the anticipated benefits of acquisitions or investments;

future development and acceptance of blockchain networks; risks

associated with receiving payments in digital assets; risk

resulting from our e-commerce business and social media presence;

our ability to successfully operate our information systems and

implement new technology; risks relating to our indebtedness,

including our ability to comply with financial and negative

covenants under our Credit Agreement, as amended; our ability to

secure additional financing on favorable terms or at all; the

potential for our or our third-party providers’ electronic data or

the electronic data of our customers to be compromised; the

influence of our significant stockholder, TCG, and the possibility

that TCG’s interests may conflict with the interests of our other

stockholders; risks relating to our organizational structure;

volatility in the price of our Class A common stock; and risks

associated with our internal control over financial reporting.

These and other important factors discussed under the caption “Risk

Factors” in our quarterly report on Form 10-Q for the quarter ended

June 30, 2024 and our other filings with the Securities and

Exchange Commission could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management’s estimates as of the date of this press release. While

we may elect to update such forward-looking statements at some

point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

Funko, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Net sales

$

247,657

$

240,028

$

463,356

$

491,906

Cost of sales (exclusive of depreciation

and amortization)

143,609

170,019

273,036

372,322

Selling, general, and administrative

expenses

77,897

85,632

163,492

185,693

Depreciation and amortization

15,419

14,893

30,998

28,869

Total operating expenses

236,925

270,544

467,526

586,884

Income (loss) from operations

10,732

(30,516

)

(4,170

)

(94,978

)

Interest expense, net

5,081

7,264

11,392

12,950

Loss on debt extinguishment

—

—

—

494

Gain on tax receivable agreement liability

adjustment

—

(99,620

)

—

(99,620

)

Other (income) expense, net

(557

)

(401

)

996

421

Income (loss) before income taxes

6,208

62,241

(16,558

)

(9,223

)

Income tax expense

789

138,103

1,689

127,783

Net income (loss)

5,419

(75,862

)

(18,247

)

(137,006

)

Less: net income (loss) attributable to

non-controlling interests

304

(2,864

)

(699

)

(8,697

)

Net income (loss) attributable to Funko,

Inc.

$

5,115

$

(72,998

)

$

(17,548

)

$

(128,309

)

Earnings (loss) per share of Class A

common stock:

Basic

$

0.10

$

(1.54

)

$

(0.34

)

$

(2.71

)

Diluted

$

0.10

$

(1.54

)

$

(0.34

)

$

(2.71

)

Weighted average shares of Class A common

stock outstanding:

Basic

52,107

47,428

51,406

47,338

Diluted

52,605

47,428

51,406

47,338

Funko, Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

June 30, 2024

December 31,

2023

(In thousands, except per

share data)

Assets

Current assets:

Cash and cash equivalents

$

41,551

$

36,453

Accounts receivable, net

122,174

130,831

Inventories

108,999

119,458

Prepaid expenses and other current

assets

30,003

56,134

Total current assets

302,727

342,876

Property and equipment, net

80,768

91,335

Operating lease right-of-use assets,

net

55,510

61,499

Goodwill

133,684

133,795

Intangible assets, net

159,460

167,388

Other assets

5,601

7,752

Total assets

$

737,750

$

804,645

Liabilities and Stockholders’

Equity

Current liabilities:

Line of credit

$

90,000

$

120,500

Current portion of long-term debt

22,315

22,072

Current portion of operating lease

liabilities

16,631

17,486

Accounts payable

62,724

52,919

Accrued royalties

52,050

54,375

Accrued expenses and other current

liabilities

85,329

91,480

Total current liabilities

329,049

358,832

Long-term debt

111,606

130,986

Operating lease liabilities

64,820

71,309

Other long-term liabilities

5,029

5,478

Commitments and Contingencies

Stockholders’ equity:

Class A common stock, par value $0.0001

per share, 200,000 shares authorized; 52,488 and 50,549 shares

issued and outstanding as of June 30, 2024 and December 31, 2023,

respectively

5

5

Class B common stock, par value $0.0001

per share, 50,000 shares authorized; 1,433 and 2,277 shares issued

and outstanding as of June 30, 2024 and December 31, 2023,

respectively

—

—

Additional paid-in-capital

335,808

326,180

Accumulated other comprehensive loss

(658

)

(180

)

Accumulated deficit

(111,612

)

(94,064

)

Total stockholders’ equity attributable to

Funko, Inc.

223,543

231,941

Non-controlling interests

3,703

6,099

Total stockholders’ equity

227,246

238,040

Total liabilities and stockholders’

equity

$

737,750

$

804,645

Funko, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Six Months Ended June

30,

2024

2023

(In thousands)

Operating Activities

Net income (loss)

$

(18,247

)

$

(137,006

)

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

30,998

27,851

Equity-based compensation

7,100

8,437

Loss on debt extinguishment

—

494

Gain on tax receivable agreement liability

adjustment

—

(99,620

)

Deferred tax expense

—

123,206

Other, net

641

(2,517

)

Changes in operating assets and

liabilities, net of amounts acquired:

Accounts receivable, net

8,385

33,405

Inventories

10,102

61,640

Prepaid expenses and other assets

27,267

237

Accounts payable

10,528

13,400

Accrued royalties

(2,325

)

(15,807

)

Accrued expenses and other liabilities

(14,054

)

(25,756

)

Net cash provided by (used in)

operating activities

60,395

(12,036

)

Investing Activities

Purchases of property and equipment

(13,261

)

(22,712

)

Acquisitions of businesses and related

intangible assets, net of cash acquired

—

(5,274

)

Sale of Funko Games inventory and certain

intellectual property

6,754

—

Other

518

420

Net cash used in investing

activities

(5,989

)

(27,566

)

Financing Activities

Borrowings on line of credit

—

71,000

Payments on line of credit

(30,500

)

—

Payments of long-term debt

(19,644

)

(11,258

)

Other, net

859

(2,773

)

Net cash (used in) provided by

financing activities

(49,285

)

56,969

Effect of exchange rates on cash and cash

equivalents

(23

)

260

Net change in cash and cash

equivalents

5,098

17,627

Cash and cash equivalents at beginning of

period

36,453

19,200

Cash and cash equivalents at end of

period

$

41,551

$

36,827

The following tables reconcile the Non-GAAP Financial Measures

to the most directly comparable U.S. GAAP financial performance

measure, which is net income (loss), for the periods presented:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Net income (loss) attributable to Funko,

Inc.

$

5,115

$

(72,998

)

$

(17,548

)

$

(128,309

)

Reallocation of net income (loss)

attributable to non-controlling interests from the assumed exchange

of common units of FAH, LLC for Class A common stock (1)

304

(2,864

)

(699

)

(8,697

)

Equity-based compensation (2)

3,276

4,795

7,100

8,437

Loss on extinguishment of debt (3)

—

—

—

494

Acquisition transaction costs and other

expenses (4)

(1,605

)

444

1,579

1,454

Certain severance, relocation and related

costs (5)

101

346

1,967

2,081

Foreign currency transaction (gain) loss

(6)

(563

)

(401

)

1,013

421

Inventory write-down (7)

—

—

—

30,084

Tax receivable agreement liability

adjustments (8)

—

(99,620

)

—

(99,620

)

One-time disposal costs for unfinished

inventory held at offshore factories (9)

—

2,404

—

2,404

Income tax expense (10)

(1,065

)

145,551

2,914

143,650

Adjusted net income (loss)

$

5,563

$

(22,343

)

$

(3,674

)

$

(47,601

)

Adjusted net income (loss) margin (11)

2.2

%

(9.3

)%

(0.8

)%

(9.7

)%

Weighted-average shares of Class A common

stock outstanding-basic

52,107

47,428

51,406

47,338

Equity-based compensation awards and

common units of FAH, LLC that are convertible into Class A common

stock

2,473

4,481

2,350

4,423

Adjusted weighted-average shares of Class

A stock outstanding - diluted

54,580

51,909

53,756

51,761

Adjusted earnings (loss) per diluted

share

$

0.10

$

(0.43

)

$

(0.07

)

$

(0.92

)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(amounts in thousands)

Net income (loss)

$

5,419

$

(75,862

)

$

(18,247

)

$

(137,006

)

Interest expense, net

5,081

7,264

11,392

12,950

Income tax expense

789

138,103

1,689

127,783

Depreciation and amortization

15,419

14,893

30,998

28,869

EBITDA

$

26,708

$

84,398

$

25,832

$

32,596

Adjustments:

Equity-based compensation (2)

3,276

4,795

7,100

8,437

Loss on extinguishment of debt (3)

—

—

—

494

Acquisition transaction costs and other

expenses (4)

(1,605

)

444

1,579

1,454

Certain severance, relocation and related

costs (5)

101

346

1,967

2,081

Foreign currency transaction (gain) loss

(6)

(563

)

(401

)

1,013

421

Inventory write-down (7)

—

—

—

30,084

Tax receivable agreement liability

adjustments (8)

—

(99,620

)

—

(99,620

)

One-time disposal costs for unfinished

inventory held at offshore factories (9)

—

2,404

—

2,404

Adjusted EBITDA

$

27,917

$

(7,634

)

$

37,491

$

(21,649

)

Adjusted EBITDA margin (12)

11.3

%

(3.2

)%

8.1

%

(4.4

)%

(1)

Represents the reallocation of net income

(loss) attributable to non-controlling interests from the assumed

exchange of common units of FAH, LLC for Class A common stock in

periods in which income (loss) was attributable to non-controlling

interests.

(2)

Represents non-cash charges related to

equity-based compensation programs, which vary from period to

period depending on the timing of awards.

(3)

Represents write-off of unamortized debt

financing fees for the six months ended June 30, 2023.

(4)

For the three and six months ended June

30, 2024, includes one-time legal settlement gain and contract

settlement agreements of related services to and fair market value

adjustments of certain assets held for sale. For the three months

ended June 30, 2023 includes one-time bank monitoring fees. For the

six months ended June 30, 2023, includes acquisition-related costs

related to investment banking and due diligence fees.

(5)

For the three and six months ended June

30, 2024, includes charges related severance and benefit costs

related to certain management departures. For the three months

ended June 30, 2023, includes charges to remove leasehold

improvements and return multiple Washington-based warehouses. For

the six months ended June 30, 2023, includes charges related to

severance and benefit costs for a reduction-in-force.

(6)

Represents both unrealized and realized

foreign currency gains and losses on transactions denominated other

than in U.S. dollars, including derivative gains and losses on

foreign currency forward exchange contracts.

(7)

For the six months ended June 30, 2023,

represents a one-time inventory write-down charge, outside normal

business operations, to improve U.S. warehouse operational

efficiency.

(8)

Represents reduction of the tax receivable

agreement liability as a result of recognizing a full valuation

allowance of the Company’s deferred tax assets and anticipated

inability to realize future tax benefits.

(9)

For the three and six months ended June

30, 2023, represents one-time disposal costs related to unfinished

inventory held at offshore factories.

(10)

Represents the income tax expense effect

of the above adjustments, except for the tax liability receivable

adjustment. This adjustment uses an effective tax rate of 25% for

all periods presented. For the three and six months ended June 30,

2023, this also includes $123.2 million recognized valuation

allowance on the Company’s deferred tax assets.

(11)

Adjusted net income (loss) margin is

calculated as adjusted net loss as a percentage of net sales.

(12)

Adjusted EBITDA margin is calculated as

adjusted EBITDA as a percentage of net sales.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808710966/en/

Investor Relations: investorrelations@funko.com

Media: pr@funko.com

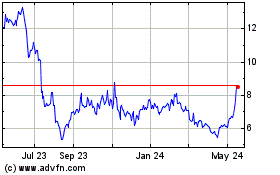

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Dec 2024 to Jan 2025

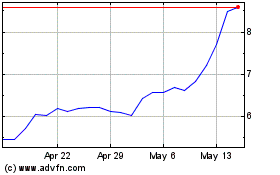

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Jan 2024 to Jan 2025