Kroll Bond Rating Agency Affirms First Bank Investment Grade Rating

August 28 2020 - 1:00PM

First Bank (Nasdaq Global Market: FRBA) today announced that the

Kroll Bond Rating Agency (KBRA), a Nationally Recognized

Statistical Rating Organization (NRSRO) registered with the U.S.

Securities and Exchange Commission (SEC), has affirmed the Bank’s

credit ratings and stable outlook. The announcement was made by

Patrick L. Ryan, President and Chief Executive Officer.

The Bank’s favorable ratings and a stable

outlook were maintained with a Deposit rating of BBB+, Senior

Unsecured Debt rating of BBB+, Subordinated Debt rating of BBB,

Short-Term Deposit rating of K2 and a Short-Term Debt rating of K2.

KBRA’s report and additional details on their rating scale can be

found at their website at www.krollbondratings.com. According to

KBRA’s report, “the Bank’s ratings are supported by a seasoned

management team and their successful execution of strategy in

recent years – utilizing M&A and organic growth to build scale

within footprint. This has resulted in enhanced operating leverage

and relatively stable pre-tax, pre-provision earnings in recent

periods despite the challenging interest rate environment. FRBA’s

ratings also reflect a relatively favorable credit position

entering the COVID-19 pandemic – with minimal credit losses in

recent years. The negligible net charge off activity is, in part,

due to the prolonged benign credit environment, though also due to

conservative underwriting criteria. Moreover, the Bank is well

situated from a loss absorption standpoint – with a comparatively

higher level of loan loss reserves (1.68% to total loans, including

existing marks from acquired portfolios and excluding PPP) and a

TCE ratio of 10% (excluding PPP) as of 2Q20.”

Mr. Ryan stated: “We are very pleased with the

results of the KBRA annual ratings review, which validates our

strategic vision of growth and improving profitability while

maintaining a safe and sound operating environment. We believe that

our favorable credit ratings helped to facilitate our recent

successful subordinated debt offering, will continue to provide us

with additional capital markets flexibility and provide current and

future customers additional comfort on our sound operating

environment.”

About Kroll Bond Rating

Agency

KBRA was established in 2010 in an effort to

restore trust in credit ratings by creating new standards for

assessing risk and by offering accurate and transparent ratings.

KBRA is registered with the SEC as a NRSRO and is recognized by the

National Association of Insurance Commission as a Credit Rating

Provider. KBRA is a full-service rating agency whose mission is to

set a standard of excellence and integrity.

About First Bank

First Bank is a New Jersey state-chartered bank

with 18 full-service branches in Cinnaminson, Cranbury, Delanco,

Denville, Ewing, Flemington, Hamilton, Hamilton Square, Lawrence,

Mercerville, Pennington, Randolph, Somerset and Williamstown, New

Jersey; and Doylestown, Trevose, Warminster and West Chester,

Pennsylvania. With $2.3 billion in assets as of June 30, 2020,

First Bank offers a full range of deposit and loan products to

individuals and businesses throughout the New York City to

Philadelphia corridor. First Bank's common stock is listed on the

Nasdaq Global Market under the symbol “FRBA”.

Forward Looking Statements

This press release contains certain

forward-looking statements, either express or implied, within the

meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include information

regarding First Bank’s future financial performance, business and

growth strategy, projected plans and objectives, and related

transactions, integration of acquired businesses, ability to

recognize anticipated operational efficiencies, and other

projections based on macroeconomic and industry trends, which are

inherently unreliable due to the multiple factors that impact

economic trends, and any such variations may be material.

Such forward-looking statements are based on various facts and

derived utilizing important assumptions, current expectations,

estimates and projections about First Bank, any of which may change

over time and some of which may be beyond First Bank’s control.

Statements preceded by, followed by or that otherwise include the

words “believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. Further, certain factors that could affect our future

results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not

limited to: whether First Bank can: successfully implement its

growth strategy, including identifying acquisition targets and

consummating suitable acquisitions; continue to sustain its

internal growth rate; provide competitive products and services

that appeal to its customers and target markets; difficult market

conditions and unfavorable economic trends in the United States

generally, and particularly in the market areas in which First Bank

operates and in which its loans are concentrated, including the

effects of declines in housing markets; the impact of disease

pandemics, such as the novel strain of coronavirus disease

(COVID-19), on First Bank, its operations and its customers and

employees; an increase in unemployment levels and slowdowns in

economic growth; First Bank's level of nonperforming assets and the

costs associated with resolving any problem loans including

litigation and other costs; changes in market interest rates may

increase funding costs and reduce earning asset yields thus

reducing margin; the impact of changes in interest rates and the

credit quality and strength of underlying collateral and the effect

of such changes on the market value of First Bank's investment

securities portfolio; the extensive federal and state regulation,

supervision and examination governing almost every aspect of First

Bank's operations including changes in regulations affecting

financial institutions, including the Dodd-Frank Wall Street Reform

and Consumer Protection Act and the rules and regulations being

issued in accordance with this statute and potential expenses

associated with complying with such regulations; uncertainties in

tax estimates and valuations, including due to changes in state and

federal tax law; First Bank's ability to comply with applicable

capital and liquidity requirements, including First Bank’s ability

to generate liquidity internally or raise capital on favorable

terms, including continued access to the debt and equity capital

markets; possible changes in trade, monetary and fiscal policies,

laws and regulations and other activities of governments, agencies,

and similar organizations. For discussion of these and other risks

that may cause actual results to differ from expectations, please

refer to “Forward-Looking Statements” and “Risk Factors” in First

Bank’s Annual Report on Form 10-K and any updates to those risk

factors set forth in First Bank’s joint proxy statement, subsequent

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If

one or more events related to these or other risks or uncertainties

materialize, or if First Bank’s underlying assumptions prove to be

incorrect, actual results may differ materially from what First

Bank anticipates. Accordingly, you should not place undue reliance

on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and First

Bank does not undertake any obligation to publicly update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. All forward-looking

statements, expressed or implied, included in this communication

are expressly qualified in their entirety by this cautionary

statement. This cautionary statement should also be considered in

connection with any subsequent written or oral forward-looking

statements that First Bank or persons acting on First Bank’s behalf

may issue.

CONTACT: Patrick L. Ryan,

President and CEO(609) 643-0168, patrick.ryan@firstbanknj.com

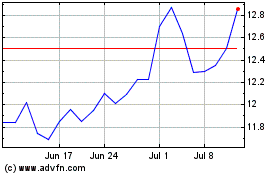

First Bank (NASDAQ:FRBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

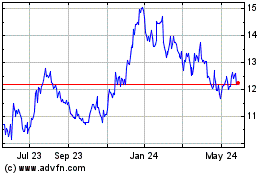

First Bank (NASDAQ:FRBA)

Historical Stock Chart

From Feb 2024 to Feb 2025