First Bank (Nasdaq Global Market: FRBA) and OceanFirst Bank, N.A.

(“OceanFirst Bank”), the banking subsidiary of OceanFirst Financial

Corp. (“OceanFirst”) (NASDAQ: OCFC), announced the completion of

their previously disclosed agreement, through which First Bank has

acquired two New Jersey branch locations from OceanFirst Bank. As

part of the acquisition, which was completed at the close of

business on December 3, 2021, First Bank also acquired

approximately $101 million of associated deposits and $11 million

of select performing loans.

Located in Flemington and Monroe, the two

branches enhance First Bank’s existing Central New Jersey footprint

and further strengthen its presence along the New York City to

Philadelphia corridor.

“We are very pleased to welcome our newest

customers and employees to First Bank as we continue to grow our

presence in Central New Jersey,” said Patrick L. Ryan, First Bank

President and Chief Executive Officer. “With added scale and

additional relationship-based low-cost core funding, we see

excellent opportunities for long-term value creation through this

latest transaction. I want to thank our entire First Bank team,

including our newest colleagues in Flemington and Monroe, for

providing a seamless transition for all of our newly acquired

customers.”

The $23 million reduction in deposit balances

between the original announcement date and closing date can be

categorized as follows: approximately $15 million in deposit

balances from accounts intentionally removed from the acquisition

list, $6 million in account balances that fluctuated lower over the

period, and $2 million from accounts that were closed. Accounts

were intentionally removed to minimize post-closing run-off.

Conversion of the branches began Friday,

December 3, 2021, and continued through the weekend, with both

locations reopening on Monday, December 6, 2021 as First Bank

branches.

About First Bank

First Bank is a New Jersey state-chartered bank

with 18 full-service branches in Cinnaminson, Cranbury, Delanco,

Denville, Ewing, Flemington (2), Hamilton, Lawrence, Monroe,

Pennington, Randolph, Somerset and Williamstown, New Jersey; and

Doylestown, Trevose, Warminster and West Chester, Pennsylvania.

With $2.4 billion in assets as of September 30, 2021, First Bank

offers a full range of deposit and loan products to individuals and

businesses throughout the New York City to Philadelphia corridor.

First Bank's common stock is listed on the NASDAQ Global Market

under the symbol “FRBA.”

About OceanFirst

OceanFirst Financial’s subsidiary, OceanFirst

Bank N.A., founded in 1902, is a $11.8 billion regional bank

providing financial services throughout New Jersey and in the major

metropolitan markets of Philadelphia, New York, Baltimore,

Washington D.C. and Boston. OceanFirst Bank delivers

commercial and residential financing, treasury management, trust

and asset management, and deposit services and is one of the

largest and oldest community-based financial institutions

headquartered in New Jersey. To learn more about OceanFirst, go to

www.oceanfirst.com.

Forward Looking Statements

This press release contains certain

forward-looking statements, either express or implied, within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include information regarding First

Bank’s and OceanFirst Financial’s future financial performance,

business and growth strategy, projected plans and objectives, and

related transactions, integration of acquired businesses, ability

to recognize anticipated operational efficiencies, and other

projections based on macroeconomic and industry trends, which are

inherently unreliable due to the multiple factors that impact

economic trends, and any such variations may be material. Such

forward-looking statements are based on various facts and derived

utilizing important assumptions, current expectations, estimates

and projections about First Bank and OceanFirst Financial, any of

which may change over time and some of which may be beyond First

Bank’s or OceanFirst Financial’s control. Statements preceded by,

followed by or that otherwise include the words “believes,”

“expects,” “anticipates,” “intends,” “projects,” “estimates,”

“plans” and similar expressions or future or conditional verbs such

as “will,” “should,” “would,” “may” and “could” are generally

forward-looking in nature and not historical facts, although not

all forward-looking statements include the foregoing. Further,

certain factors that could affect future results and cause actual

results to differ materially from those expressed in the

forward-looking statements include, but are not limited to: the

ability to successfully implement a growth strategy, including

identifying acquisition targets and consummating suitable

acquisitions; continuing to sustain internal growth rates; provide

competitive products and services that appeal to customers and

target markets; difficult market conditions and unfavorable

economic trends in the United States generally, and particularly in

the market areas in which First Bank or OceanFirst Financial

operates and in which their loans are concentrated, including the

effects of declines in housing market values; the impact of disease

pandemics, including COVID-19, on operations and customers and

employees; an increase in unemployment levels and slowdowns in

economic growth; levels of nonperforming assets and the costs

associated with resolving any problem loans including litigation

and other costs; changes in market interest rates may increase

funding costs and reduce earning asset yields thus reducing margin;

the impact of changes in interest rates and the credit quality and

strength of underlying collateral and the effect of such changes on

the market value of investment securities portfolios; the extensive

federal and state regulation, supervision and examination governing

almost every aspect of First Bank's and OceanFirst Financial’s

operations including changes in regulations affecting financial

institutions, and expenses associated with complying with such

regulations; uncertainties in tax estimates and valuations,

including due to changes in state and federal tax law; the ability

to comply with applicable capital and liquidity requirements,

including the ability to generate liquidity internally or raise

capital on favorable terms, including continued access to the debt

and equity capital markets; possible changes in trade, monetary and

fiscal policies, laws and regulations and other activities of

governments, agencies, and similar organizations. For discussion of

these and other risks that may cause actual results to differ from

expectations, please refer to “Forward-Looking Statements” and

“Risk Factors” in the Annual Reports on Form 10-K filed by First

Bank and OceanFirst Financial Corp. and any updates to those risk

factors set forth in proxy statements, subsequent Quarterly Reports

on Form 10-Q or Current Reports on Form 8-K. If one or more events

related to these or other risks or uncertainties materialize, or if

underlying assumptions prove to be incorrect, actual results may

differ materially from those anticipated. Accordingly, you should

not place undue reliance on any such forward-looking statements.

Any forward-looking statement speaks only as of the date on which

it is made, and First Bank and OceanFirst Financial do not

undertake any obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise. All forward-looking statements,

expressed or implied, included in this communication are expressly

qualified in their entirety by this cautionary statement. This

cautionary statement should also be considered in connection with

any subsequent written or oral forward-looking statements that

First Bank or OceanFirst Financial, or persons acting on First

Bank’s or OceanFirst Financial’s behalf, may issue.

FIRST BANK CONTACT:Patrick L. Ryan, President

and CEO(609) 643-0168, patrick.ryan@firstbanknj.com

OCEANFIRST BANK CONTACT:Michael J. Fitzpatrick,

Chief Financial Officer(732) 240-4500, ext.

7506, mfitzpatrick@oceanfirst.com

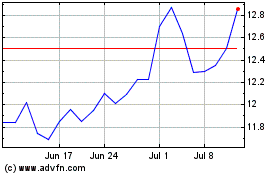

First Bank (NASDAQ:FRBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

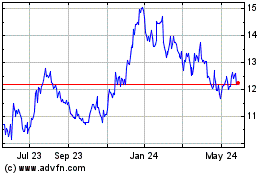

First Bank (NASDAQ:FRBA)

Historical Stock Chart

From Feb 2024 to Feb 2025