Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

January 11 2024 - 4:21PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| |

|

| Washington, D.C. 20549 |

|

| _______________ |

|

| |

|

| SCHEDULE 13D/A |

| |

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a) |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 9) |

| |

|

Freshpet, Inc. |

| (Name of Issuer) |

| |

|

Common Stock, par

value $0.001 per share |

| (Title of Class of Securities) |

| |

|

358039105 |

| (CUSIP Number) |

| |

|

Eleazer Klein, Esq.

Adriana Schwartz, Esq. |

| 919 Third Avenue |

| New York, New York 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

January 9, 2024* |

| (Date of Event which Requires |

| Filing of this Schedule) |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. [ ]

NOTE: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

* JANA Partners Management, LP was previously a relying adviser of JANA

Partners LLC, and from and after the effectiveness of its application for investment advisor registration, will replace JANA Partners

LLC as the reporting person on all filings with respect to securities held in various accounts under its management and control. Accordingly,

JANA Partners Management, LP is the reporting person on this filing and JANA Partners LLC is no longer a reporting person on this filing.

The prior filings on Schedule 13D were made under the CIK of JANA Partners LLC (CIK 0001159159).

(Continued on following pages)

(Page 1 of 6 Pages)

--------------------------

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 358039105 | SCHEDULE 13D/A | Page 2 of 6 Pages |

| 1 |

NAME OF REPORTING PERSON

JANA PARTNERS MANAGEMENT, LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

2,383,150 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

2,383,150 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

2,383,150 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

4.9% |

| 14 |

TYPE OF REPORTING PERSON

IA, PN |

| |

|

|

|

|

| CUSIP No. 358039105 | SCHEDULE 13D/A | Page 3 of 6 Pages |

This Amendment No. 9

(“Amendment No. 9”) amends and supplements the statement on Schedule 13D filed by JANA Partners LLC on September

22, 2022 (the “Original Schedule 13D”), as amended by Amendment No. 1 filed on December 9, 2022 (“Amendment No. 1”),

Amendment No. 2 filed on December 15, 2022 (“Amendment No. 2”), Amendment No. 3 filed on May 24, 2023

(“Amendment No. 3”), Amendment No. 4 filed on May 25, 2023 (“Amendment No. 4”), Amendment

No. 5 filed on May 30, 2023 (“Amendment No. 5”), Amendment No. 6 filed on June 1, 2023 (“Amendment

No. 6”), Amendment No. 7 filed on August 9, 2023 (“Amendment No. 7”) and Amendment No. 8

filed on August 23, 2023 (“Amendment No. 8” and together with the Original Schedule 13D, Amendment No. 1,

Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7 and

this Amendment No. 9, the “Schedule 13D”) as specifically set forth herein. Capitalized terms used herein and

not otherwise defined in this Amendment No. 9 have the meanings set forth in the Schedule 13D.

| Item 2. |

IDENTITY AND BACKGROUND: |

| |

|

|

Item 2 is hereby amended and restated in its entirety as follows:

(a) This statement is filed

by JANA Partners Management, LP, a Delaware limited partnership (“JANA” or the “Reporting Person”).

JANA is a private money management firm which holds Shares of the Issuer in various accounts under its management and control. JANA Partners

Management GP, LLC (the “GP”) is the general partner of JANA. The senior managing member of the GP and indirect control

person of JANA is Barry Rosenstein (the “Principal”).

(b) The principal business

address of JANA, the GP and the Principal is 767 Fifth Avenue, 8th Floor, New York, New York 10153.

(c) The principal business

of JANA and the Principal is investing for accounts under their management. The principal business of the GP is acting as the

general partner of JANA.

(d) None of the Reporting Person,

the GP or the Principal has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors).

(e) None of the Reporting

Person, the GP or the Principal has, during the last five years, been a party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

(f) JANA is a limited

partnership organized in Delaware. The Principal is a citizen of the United States of America. The GP is a limited liability company

organized in Delaware. |

| CUSIP No. 358039105 | SCHEDULE 13D/A | Page 4 of 6 Pages |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION: |

| |

|

| Item 3 is hereby amended and restated in its entirety as follows: |

The 2,383,150 Shares

reported herein by JANA were acquired at an aggregate purchase price of approximately $105 million. Such Shares were acquired

with investment funds in accounts managed by JANA and margin borrowings described in the following sentence. Such Shares are held by

the investment funds managed by JANA in commingled margin accounts, which may extend margin credit to JANA from time to time,

subject to applicable federal margin regulations, stock exchange rules and credit policies. In such instances, the positions held in

the margin accounts are pledged as collateral security for the repayment of debit balances in the account. The margin accounts bear

interest at a rate based upon the broker’s call rate from time to time in effect. Because other securities are held in the

margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Shares reported herein.

| Item 5. |

INTEREST IN SECURITIES OF THE COMPANY: |

| |

|

| Items 5(a)-(c) and (e) are hereby amended and restated in their entirety as follows: |

(a) The aggregate percentage

of Shares reported to be beneficially owned by the Reporting Person is based upon 48,241,898 Shares outstanding as of November 2, 2023,

as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, filed with the SEC

on November 6, 2023.

As of the close of

business on the date hereof, JANA may be deemed to beneficially own 2,383,150 Shares, representing approximately 4.9% of the

Shares outstanding.

(b) JANA has sole voting and dispositive

power over the 2,383,150 Shares, which power is exercised by the Principal.

(c) Information concerning transactions

in the Shares effected by the Reporting Person during the past sixty (60) days is set forth in Exhibit O hereto and is incorporated

herein by reference. All of the transactions in Shares listed in Exhibit O were effected in the open market through various brokerage

entities.

(e) January 10, 2024.

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS: |

| |

|

| Item 7 is hereby amended and supplemented by the addition of the following: |

| Exhibit O: |

Transactions in the Shares of the Issuer During the Past Sixty (60) Days. |

| |

|

|

| CUSIP No. 358039105 | SCHEDULE 13D/A | Page 5 of 6 Pages |

SIGNATURES

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 11, 2024

| |

JANA PARTNERS MANAGEMENT, LP |

| |

|

|

| |

|

|

| |

By: |

/s/ Jennifer Fanjiang |

| |

Name: |

Jennifer Fanjiang |

| |

Title: |

Partner, Chief Legal Officer and Chief Compliance Officer |

| |

|

| CUSIP No. 358039105 | SCHEDULE 13D/A | Page 6 of 6 Pages |

EXHIBIT O

Transactions in the Shares of the Issuer During

the Past Sixty (60) Days

The following table sets forth

all transactions in the Shares effected by the Reporting Person during the past sixty (60) days. All such transactions were effected in

the open market through brokers and the price per share includes commissions. Where a price range is provided in the column Price Range

($), the price reported in that row’s Price Per Share ($) column is a weighted average price. These Shares were purchased/sold in

multiple transactions at prices between the price ranges indicated in the Price Range ($) column. The Reporting Person will undertake

to provide to the staff of the SEC, upon request, full information regarding the number of Shares purchased/sold at each separate price.

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| 11/14/2023 |

(22,690) |

69.81 |

|

| 11/15/2023 |

(6,332) |

69.92 |

69.73 – 70.32 |

| 11/17/2023 |

(68,632) |

69.95 |

69.89 – 70.25 |

| 11/20/2023 |

(38,200) |

69.93 |

69.78 – 70.15 |

| 11/22/2023 |

(4,772) |

69.78 |

|

| 11/24/2023 |

(18,093) |

70.00 |

|

| 11/28/2023 |

(41,281) |

70.02 |

|

| 11/30/2023 |

34,375 |

70.29 |

|

| 12/8/2023 |

(100,000) |

76.24 |

76.24 – 76.27 |

| 1/2/2024 |

(126,276) |

87.31 |

87.17 – 87.35 |

| 1/3/2024 |

(24,371) |

84.04 |

|

| 1/4/2024 |

(14,053) |

82.65 |

|

| 1/9/2024 |

(123,766) |

84.77 |

84.58 – 84.97 |

| 1/10/2024 |

(122,338) |

85.77 |

85.73 – 85.90 |

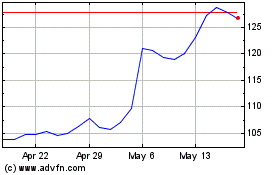

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Apr 2024 to May 2024

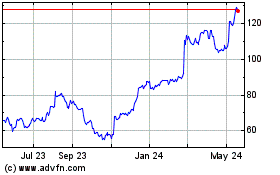

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From May 2023 to May 2024