GD Culture Group Limited Announces At-The-Market Equity Offering Program

February 10 2025 - 7:00AM

GD Culture Group Limited (“GDC” or the “Company”) (Nasdaq: GDC),

and its subsidiary, AI Catalysis Corp. (“AI Catalysis”), today

announced that it has entered into an At-the-Market (“ATM”)

issuance sales agreement (the “Agreement”) with Univest Securities,

LLC (“Univest” or the “Sales Agent”) under which the Company may,

from time to time, issue and sell shares of its common stock, par

value $0.0001 per share (the “Shares”), having an aggregate

offering price of up to $10.0 million through the Sales Agent or

any of its sub-agent(s) or other designees, acting as sales agent.

Sales of the Shares, if any, will be made at or

related to then prevailing market prices and, as a result, prices

may vary. The volume and timing of sales under the ATM program will

be determined at the Company’s discretion. The Company expects to

use any proceeds from the ATM program for general working capital

and corporate purposes.

Pursuant to the Agreement, the Sales Agent may

sell the Shares, if any, only by methods deemed to be an

“at-the-market” offering as defined in Rule 415 promulgated under

the United States Securities Act of 1933, as amended (the

“Securities Act”), including, without limitation, sales made

directly through the Nasdaq Capital Market or any other trading

market on which the Company’s common stock is listed or quoted or

to or through a market maker. In addition, subject to the terms and

conditions of the Agreement, with the Company’s prior written

consent, the Sales Agent may also sell Shares by any other method

permitted by law, or as may be required by the rules and

regulations of the Nasdaq Stock Market, LLC or such other trading

market on which the Company’s common stock is listed or quoted,

including, but not limited to, in negotiated transactions. The

Sales Agent will use commercially reasonable efforts consistent

with its normal trading and sales practices to sell the Shares in

accordance with the terms of the Sales Agreement and any applicable

Transaction Notice. The Company cannot provide any assurances that

the Sales Agent will sell any Shares pursuant to the Agreement.

The Shares have been registered and the offering

is being made pursuant to a shelf registration statement on Form

F-3 (File No. 333-279141) previously filed on May 6, 2024 and

declared effective by the U.S. Securities and Exchange Commission

(“SEC”) on August 20, 2024. A final prospectus supplement and

accompanying prospectus describing the terms of the proposed

offering will be filed with the SEC and will be available on the

SEC’s website located at http://www.sec.gov. Electronic copies

of the final prospectus supplement and the accompanying prospectus

may be obtained, when available, by contacting Univest Securities,

LLC at info@univest.us, or by calling +1 (212) 343-8888.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor will there be

any sales of such securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction.

Copies of the prospectus supplement relating to the registered

direct offering, together with the accompanying base prospectus,

can be obtained at the SEC’s website at www.sec.gov.

About GD Culture Group

Limited

GD Culture Group Limited (the “Company”)

(Nasdaq: GDC), is a Nevada company currently conducting business

mainly through its subsidiaries, AI Catalysis Corp. (“AI

Catalysis”) and Shanghai Xianzhui Technology Co, Ltd. The company

plans to enter into the livestreaming market with focus on

e-commerce through its wholly owned U.S. subsidiary, AI Catalysis,

a Nevada corporation incorporated in May 2023. The Company’s main

businesses include AI-driven digital human technology,

live-streaming e-commerce business. For more information, please

visit the Company's website

at https://www.gdculturegroup.com/.

Forward-Looking Statements

This announcement contains forward-looking

statements within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact in this announcement are

forward-looking statements. These forward-looking statements

involve known and unknown risks and uncertainties and are based on

current expectations and projections about future events and

financial trends that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs. Investors can identify these forward-looking statements by

words or phrases such as "may," "will," "expect," "anticipate,"

"aim," "estimate," "intend," "plan," "believe," "potential,"

"continue," "is/are likely to" or other similar expressions. The

Company undertakes no obligation to update forward-looking

statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in

these forward-looking statements are reasonable, it cannot assure

you that such expectations will turn out to be correct, and the

Company cautions investors that actual results may differ

materially from the anticipated results.For investor and media

inquiries, please contact:

GD Culture Group Limited Investor Relations DepartmentEmail:

ir@gdculturegroup.com

Ascent Investor Relations LLCTina XiaoPhone:

+1-646-932-7242Email: investors@ascent-ir.com

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Jan 2025 to Feb 2025

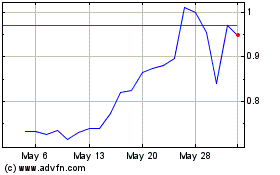

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Feb 2024 to Feb 2025